2026 POLK Price Prediction: Expert Analysis and Market Forecast for Polkastarter's Token Future

Introduction: POLK's Market Position and Investment Value

Polkamarkets (POLK), as a DeFi-powered prediction market platform built for cross-chain information exchange and trading, has been operating since its launch in 2021. As of 2026, POLK holds a market capitalization of approximately $365,000, with a circulating supply of 100 million tokens, and the price maintains around $0.00365. This asset, positioned as a decentralized and interoperable platform based on Polkadot technology, enables users to take positions on real-world event outcomes within the prediction market ecosystem.

This article will comprehensively analyze POLK's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment factors to provide investors with professional price forecasts and practical investment strategies.

I. POLK Price History Review and Current Market Status

POLK Historical Price Evolution Trajectory

- 2021: POLK launched on March 16, reaching an all-time high of $4.18 during the initial market enthusiasm for Polkadot-based prediction market platforms

- 2021-2025: The token experienced a significant downward trend as the broader crypto market entered a bearish cycle, with price declining substantially from its peak

- 2026: POLK reached its all-time low of $0.00343311 on February 6, representing a decline of over 99% from its historical high

POLK Current Market Situation

As of February 6, 2026, POLK is trading at $0.00365, showing a slight recovery of 0.22% over the past hour. However, the token has experienced notable declines across multiple timeframes: down 8.38% in 24 hours, down 40.25% over the past week, and down 50.98% over the past month. The yearly performance shows a substantial decrease of 68.28%.

The token's market capitalization stands at $365,000, with a fully diluted valuation matching this figure at $365,000, indicating that 100% of the maximum supply of 100 million POLK tokens is currently in circulation. The 24-hour trading volume registers at approximately $16,059.84, reflecting relatively low market activity. POLK's market dominance is minimal at 0.000015%, and it ranks #3,299 among cryptocurrencies.

The current price represents a dramatic 99.91% decline from the all-time high of $4.18 recorded on March 16, 2021, while sitting just 6.35% above the all-time low of $0.00343311 reached earlier today. The token is held by 8,814 addresses according to available data.

Polkamarkets operates as a DeFi-powered prediction market built for cross-chain information exchange and trading, where users can take positions on real-world event outcomes through this decentralized and interoperable platform.

Click to view current POLK market price

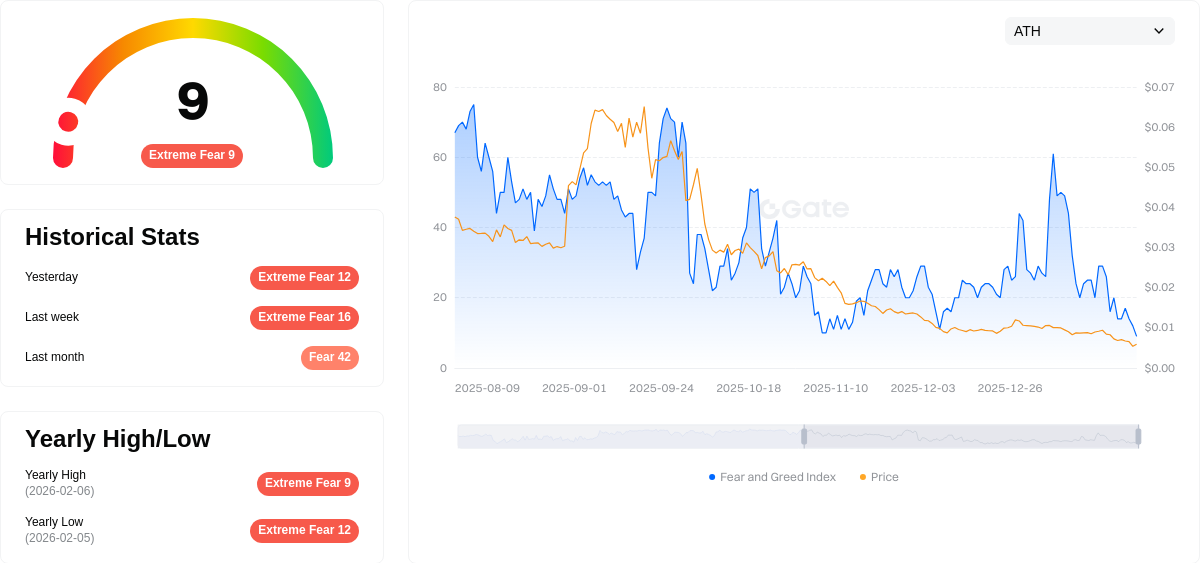

POLK Market Sentiment Index

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index at just 9 points. This indicates widespread panic and pessimism among investors, reflecting significant market uncertainty and potential downward pressure on digital assets. Such extreme fear levels historically present contrarian opportunities for long-term investors, as panic-driven sell-offs often create attractive entry points. However, caution remains essential during volatile periods. Market participants should closely monitor regulatory developments and macroeconomic factors while considering their risk tolerance before making investment decisions.

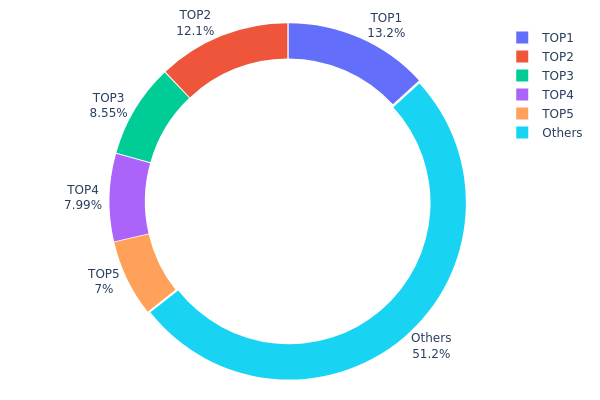

POLK Token Holding Distribution

The token holding distribution chart reveals the concentration level of POLK tokens across different wallet addresses, serving as a critical indicator of decentralization and potential market manipulation risks. By analyzing the distribution pattern among top holders and comparing it with the broader holder base, investors can assess the health of the token's ecosystem and evaluate whether whale addresses possess excessive control over circulating supply.

According to the current on-chain data, POLK exhibits a moderately concentrated holding structure. The top five addresses collectively control 48.8% of the total supply, with the largest holder possessing 13.18% (13,187.92K tokens), followed by the second-largest at 12.09% (12,097.11K tokens). The third through fifth positions hold 8.54%, 7.99%, and 7.00% respectively, demonstrating a relatively gradual decline in concentration. The remaining 51.2% of tokens are distributed among other addresses, suggesting a degree of decentralization beyond the major holders.

This concentration level presents both stabilizing and concerning factors for market participants. While the distribution among top holders shows no single dominant whale controlling over 15% of supply, the cumulative holdings of the top five addresses approaching nearly half of total supply could potentially influence price discovery mechanisms. Large holders may coordinate selling pressure during market downturns or accumulate tokens to suppress volatility, creating asymmetric risks for retail participants. However, the substantial 51.2% held by other addresses provides a counterbalancing force, indicating that community participation remains meaningful and the token has achieved reasonable circulation beyond early investors or project teams.

Click to view current POLK holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x53c6...0a87ce | 13187.92K | 13.18% |

| 2 | 0x34b8...30cd43 | 12097.11K | 12.09% |

| 3 | 0x0d07...b492fe | 8546.62K | 8.54% |

| 4 | 0xdb6f...82019a | 7990.21K | 7.99% |

| 5 | 0x4bb7...71e25e | 7000.13K | 7.00% |

| - | Others | 51178.01K | 51.2% |

II. Core Factors Influencing POLK's Future Price

Supply Mechanism

- Fixed Supply Model: POLK operates with a total supply of 100,000,000 tokens, all of which are currently in circulation. This fixed-supply structure creates scarcity dynamics that may influence long-term value appreciation.

- Historical Pattern: Since reaching its peak of $4.18 in March 2021, POLK experienced significant price fluctuation, with its lowest point at $0.00561973 recorded in April 2025. These movements reflect broader market sentiment cycles and adoption trends affecting the token's valuation.

- Current Impact: With full token circulation achieved and no additional supply planned, price movements are primarily driven by demand-side factors including platform adoption, trading volume, and overall market conditions for DeFi prediction market protocols.

Institutional and Major Holder Dynamics

- Holder Distribution: As of late 2025, POLK maintains an active holder base of 8,785 participants, indicating a relatively distributed ownership structure within the prediction market ecosystem.

- Platform Utility: The token's value proposition centers on its functional roles within Polkamarkets, including market creation requirements, oracle staking for event resolution, and liquidity mining rewards for platform participants.

- Ecosystem Integration: POLK benefits from its strategic positioning within the Polkadot ecosystem, leveraging cross-chain capabilities and interoperability features that may attract users seeking multi-chain prediction market solutions.

Macroeconomic Environment

- DeFi Market Conditions: POLK's performance remains closely tied to broader decentralized finance trends, as prediction markets represent a specialized segment within the DeFi landscape. Market sentiment toward DeFi protocols influences investor interest and platform participation.

- Risk Appetite Indicators: As with many utility tokens, POLK pricing reflects overall cryptocurrency market risk appetite, responding to shifts in investor confidence across digital asset classes.

- Regulatory Landscape: Evolving frameworks around prediction markets and DeFi protocols may shape the operating environment for platforms like Polkamarkets, potentially affecting token utility and adoption trajectories.

Technical Development and Ecosystem Building

- Cross-Chain Compatibility: Originally deployed on Ethereum mainnet, Polkamarkets has expanded to support Polygon, Moonbeam, and Moonriver networks. This multi-chain approach enhances accessibility and may drive broader user adoption across different blockchain communities.

- Decentralized Oracle System: The platform employs a decentralized resolution mechanism where oracles stake POLK tokens to determine event outcomes and resolve disputes, ensuring transparent and fair market resolution without centralized control.

- Platform Applications: Users engage with the ecosystem through prediction activities, liquidity provision opportunities, and participation in decentralized event outcome markets. The protocol's smart contract infrastructure enables transparent trading and fee distribution mechanisms that support ongoing platform operations.

III. 2026-2031 POLK Price Prediction

2026 Outlook

- Conservative Estimate: $0.00314 - $0.00365

- Neutral Estimate: $0.00365

- Optimistic Estimate: $0.0046 (contingent on favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market Stage Expectation: The token may enter a gradual growth phase, characterized by moderate price appreciation as the project matures and expands its ecosystem.

- Price Range Predictions:

- 2027: $0.00235 - $0.00544

- 2028: $0.00273 - $0.00651

- 2029: $0.0035 - $0.00694

- Key Catalysts: Potential drivers include technological developments within the Polkadot ecosystem, increasing network activity, strategic partnerships, and broader cryptocurrency market trends.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00529 - $0.00718 (assuming steady project development and stable market conditions)

- Optimistic Scenario: $0.00629 - $0.00718 in 2030, potentially stabilizing around $0.00478 - $0.007 by 2031 (driven by successful ecosystem expansion and sustained user growth)

- Transformative Scenario: Prices could approach the upper range of projections if POLK achieves significant mainstream adoption and benefits from a broader bull market cycle

- 2026-02-06: POLK is positioned at the beginning of this forecast period, with anticipated cumulative growth of approximately 72% by 2030 and 84% by 2031 relative to 2026 baseline levels

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0046 | 0.00365 | 0.00314 | 0 |

| 2027 | 0.00544 | 0.00412 | 0.00235 | 13 |

| 2028 | 0.00651 | 0.00478 | 0.00273 | 31 |

| 2029 | 0.00694 | 0.00565 | 0.0035 | 54 |

| 2030 | 0.00718 | 0.00629 | 0.00529 | 72 |

| 2031 | 0.007 | 0.00674 | 0.00478 | 84 |

IV. POLK Professional Investment Strategy and Risk Management

POLK Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term potential of decentralized prediction markets and are comfortable with high volatility

- Operational Recommendations:

- Consider dollar-cost averaging to mitigate entry timing risk given POLK's high price volatility

- Monitor the development and adoption of the Polkamarkets platform, including trading volume on prediction markets

- Storage Solution: Use Gate Web3 Wallet for secure storage of POLK tokens with multi-signature protection

(II) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Given POLK's 40.25% decline over 7 days and 50.98% over 30 days, watch for potential support levels and reversal signals

- Volume Analysis: Monitor the current 24-hour trading volume of $16,059.84 for signs of accumulation or distribution

- Swing Trading Points:

- Be aware of the significant price gap between the 24-hour high ($0.003993) and low ($0.003434), representing approximately 16% intraday volatility

- Consider the token's proximity to its all-time low of $0.00343311 recorded on February 6, 2026, when evaluating risk-reward ratios

POLK Risk Management Framework

(I) Asset Allocation Principles

- Conservative investors: 0.5-1% of crypto portfolio allocation

- Aggressive investors: 2-3% of crypto portfolio allocation

- Professional investors: 3-5% with active monitoring and stop-loss protocols

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance POLK exposure with established cryptocurrencies and stablecoin positions

- Stop-Loss Implementation: Given recent price decline trends, consider setting stop-losses 10-15% below entry points

(III) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet provides secure, non-custodial storage for POLK tokens with user-controlled private keys

- Hardware Wallet Option: For larger holdings, consider transferring to hardware wallets compatible with Ethereum-based tokens

- Security Precautions: Never share private keys or seed phrases; enable two-factor authentication; verify contract addresses before transactions (0xd478161c952357f05f0292b56012cd8457f1cfbf)

V. POLK Potential Risks and Challenges

POLK Market Risks

- Extreme Volatility: POLK has experienced a 68.28% decline over the past year and currently trades near its all-time low, indicating substantial downside risk

- Limited Liquidity: With only $16,059.84 in 24-hour trading volume and trading on a single exchange, liquidity constraints may impact execution prices

- Market Capitalization Decline: The current market cap of $365,000 represents minimal market presence (0.000015% dominance), suggesting vulnerability to market shocks

POLK Regulatory Risks

- Prediction Market Scrutiny: Decentralized prediction markets may face regulatory challenges in jurisdictions where betting or forecasting platforms require licensing

- Cross-border Compliance: As prediction markets operate globally, varying regulatory approaches across jurisdictions may impact platform accessibility

- Token Classification Uncertainty: Evolving regulatory frameworks for DeFi tokens may affect POLK's legal status in different markets

POLK Technical Risks

- Smart Contract Vulnerabilities: As an Ethereum-based token, POLK depends on the security of its smart contract implementation

- Platform Dependency: POLK's value is closely tied to the success and adoption of the Polkamarkets platform; platform failures or low user adoption directly impact token utility

- Blockchain Network Risks: Reliance on Ethereum network exposes POLK to potential network congestion, high gas fees, or technical issues affecting the underlying infrastructure

VI. Conclusion and Action Recommendations

POLK Investment Value Assessment

Polkamarkets (POLK) represents a speculative opportunity in the decentralized prediction market sector, built on the vision of cross-chain information exchange. However, the token faces significant headwinds, including a 68.28% decline over the past year, trading near all-time lows, and minimal market capitalization of $365,000. The limited liquidity and single-exchange listing present substantial risk factors.

Long-term value proposition depends heavily on the successful adoption of the Polkamarkets platform and growth in prediction market activity. The fully circulating supply of 100 million tokens eliminates inflation risk, but the token's utility is directly tied to platform usage. Short-term risks include continued price pressure, liquidity constraints, and broader market volatility.

POLK Investment Recommendations

✅ Beginners: Exercise extreme caution. If interested in exposure to prediction markets, consider starting with a very small position (less than 0.5% of crypto portfolio) and focus on understanding the platform's functionality before increasing allocation

✅ Experienced Investors: Suitable only for those with high risk tolerance and understanding of DeFi prediction markets. Consider waiting for signs of platform growth, increased trading volume, or price stabilization before establishing positions

✅ Institutional Investors: POLK's limited liquidity and small market capitalization make it unsuitable for most institutional strategies. Conduct thorough due diligence on platform metrics, user adoption, and team execution before considering allocation

POLK Trading Participation Methods

- Spot Trading: Purchase POLK on Gate.com through spot markets with limit orders to manage execution prices given limited liquidity

- Dollar-Cost Averaging: Spread purchases over time to mitigate timing risk and take advantage of price volatility

- Platform Participation: Acquire POLK tokens to participate in Polkamarkets prediction markets, potentially earning returns through accurate event predictions

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for POLK tokens in 2024-2025?

Based on 2024 analysis, POLK could reach around 14 USD by year-end under bullish conditions, or decline to approximately 7 USD under bearish pressure. Detailed 2025 predictions require further market analysis.

What are the main factors affecting POLK price?

POLK price is influenced by market demand, trading volume, project development progress, and overall cryptocurrency market performance. Fixed circulating supply makes supply-demand dynamics crucial. Platform activity, technical innovation, and ecosystem adoption directly impact price movements.

POLK token's all-time high and lowest prices are respectively?

POLK's all-time high price is $3.16, and its all-time low price is $0.00562. The token has experienced significant price fluctuations since its inception.

What are the development prospects of the Polkastarter project? Will it affect the POLK price?

Polkastarter has strong development prospects with backing from renowned investors and active community engagement. As the project expands its IDO platform and ecosystem partnerships, POLK token price is expected to appreciate correspondingly with increased adoption and transaction volume growth.

What advantages does POLK have compared to other Polkadot ecosystem tokens?

POLK excels with superior cross-chain interoperability and decentralized architecture, ensuring enhanced security and network stability. Its multi-chain ecosystem integration provides greater scalability and liquidity advantages within the Polkadot network.

What are the circulating supply and total supply of POLK tokens?

POLK has a circulating supply of 100.00M tokens. The total supply information is not currently available. Current market cap is $660.82K.

What are the main risks of investing in POLK tokens?

POLK token investments face significant market volatility risk. Historical price peaked at $4.18 but has declined substantially. Cryptocurrency markets are highly unpredictable, and project developments remain uncertain. Investors should carefully assess their risk tolerance before participation.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Digital Nomads & Web3: Traveling and Working Around the World

Top 8 NEAR Wallets

Comprehensive Guide to Understanding and Managing FUD in Cryptocurrency Markets

Bitcoin Pizza Day Explained: The Story of the First BTC Transaction

Are NFTs obsolete? A comprehensive look at NFT applications