2026 老子 Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: Market Position and Investment Value of 老子

老子 (老子), as a trending meme token on BNB Chain, has been gaining attention since its launch in early 2026. As of February 2, 2026, 老子 has achieved a market capitalization of approximately $1.56 million, with a circulating supply of 1 billion tokens and a current trading price around $0.001563. This meme asset, characterized by its community-driven nature and presence on BNB Chain, is demonstrating notable market activity within the decentralized finance ecosystem.

This article provides a comprehensive analysis of 老子's potential price trajectory from 2026 to 2031, examining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to offer investors professional price forecasts and practical investment strategies.

I. 老子 Price History Review and Market Status

老子 Historical Price Evolution Trajectory

- January 2026: Token launch phase, price started from deployment level and reached a peak of 0.015 USDT on January 11

- January 2026: Market correction period, price declined to a historical low of 0.00132 USDT on January 21

- Late January to Early February 2026: Recovery phase, price experienced fluctuations with a notable 30-day increase

老子 Current Market Status

As of February 2, 2026, 老子 is trading at 0.001563 USDT, representing a decline of 4.15% over the past 24 hours. The token has demonstrated mixed short-term performance, with a modest 0.44% increase in the past hour and a 2.76% gain over the past week.

The project, described as a trending meme on BNB Chain, maintains a market capitalization of approximately 1,563,000 USDT. With a circulating supply of 1,000,000,000 tokens and a maximum supply matching this figure, the token has achieved full circulation with a market cap to fully diluted valuation ratio of 100%.

The 24-hour trading range spans from 0.00148 to 0.001896 USDT, with total trading volume reaching 315,578.254648 USDT. The token is listed on 6 exchanges and has attracted 6,510 holders. Built on the BEP-20 standard, the contract address is verified on BSC (0x1a5f9d77ca46646cd4937fd8d093f460b66f4444).

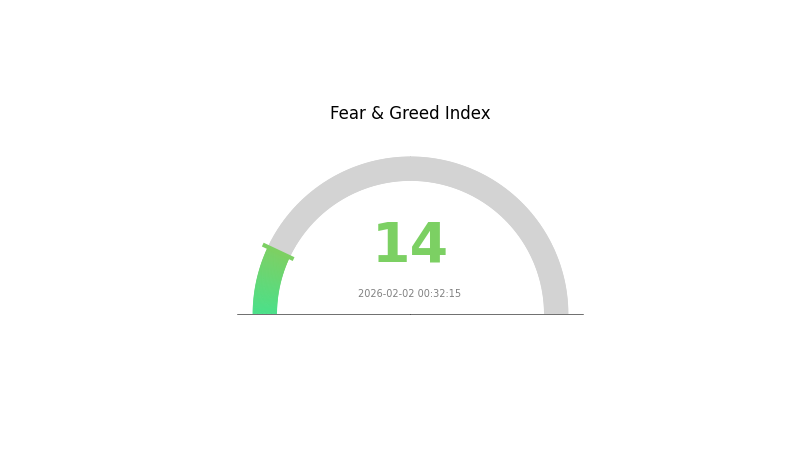

Market sentiment indicators show an extreme fear level with a VIX reading of 14, suggesting heightened caution among participants. The token's market dominance stands at 0.000056%, placing it at rank 2203 in the overall cryptocurrency market landscape.

Click to view current 老子 market price

Crypto Market Sentiment Index

02-02-2026 Fear & Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear & Greed Index plummeting to 14. This exceptionally low reading signals intense market pessimism and risk aversion among investors. When sentiment reaches such extreme levels, it often presents contrarian opportunities for long-term investors, as panic-driven selloffs typically create attractive entry points. However, exercise caution and conduct thorough research before making investment decisions. Monitor market developments closely on Gate.com to stay informed of price movements and sentiment shifts.

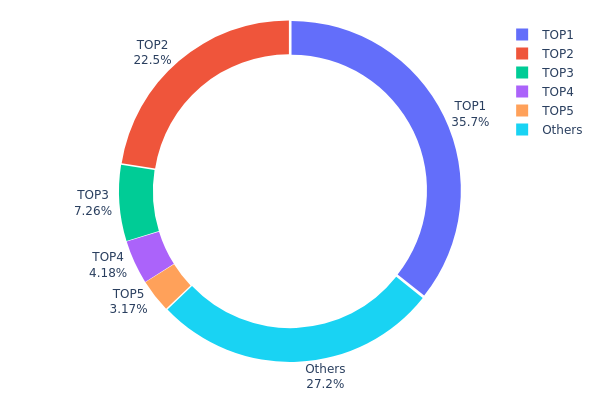

老子 持仓分布

Address holding distribution reflects the concentration of token ownership across different wallet addresses on the blockchain. By analyzing the proportion of tokens held by top addresses, we can assess the degree of centralization and evaluate potential risks related to market manipulation or price volatility.

Based on current data, 老子 exhibits significant holding concentration characteristics. The top address holds 356,716.65K tokens, accounting for 35.67% of the total supply, while the second-largest holder controls 225,030.63K tokens (22.50%). Combined, the top two addresses control 58.17% of the circulating supply. The top five addresses collectively hold approximately 72.76% of all tokens, with only 27.24% distributed among other addresses. This distribution pattern indicates a highly centralized ownership structure, which deviates considerably from the decentralized principles typically associated with cryptocurrency projects.

Such concentrated holding distribution poses notable implications for market dynamics. High concentration levels increase the potential for price manipulation, as large holders possess sufficient market power to influence price movements through coordinated buying or selling activities. Additionally, if major holders decide to liquidate their positions, it could trigger substantial selling pressure, leading to sharp price corrections and heightened volatility. From a structural perspective, this concentration pattern suggests weak on-chain decentralization, which may undermine investor confidence and limit broader market participation. The current holding structure reflects an immature distribution phase, where token ownership remains heavily skewed toward a small number of addresses rather than being widely dispersed across the community.

Click to view current 老子 Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x73d8...4946db | 356716.65K | 35.67% |

| 2 | 0x0d07...b492fe | 225030.63K | 22.50% |

| 3 | 0xc784...6b784e | 72598.27K | 7.25% |

| 4 | 0xafdf...50692b | 41789.00K | 4.17% |

| 5 | 0xdd3c...999e0c | 31718.08K | 3.17% |

| - | Others | 272147.38K | 27.24% |

II. Core Factors Influencing LAOZI's Future Price

Market Sentiment and Community Engagement

- Viral Spread Mechanism: LAOZI's value is primarily driven by meme culture propagation and community sentiment rather than fundamental utility. The token originated from a viral social media post and relies heavily on sustained attention from KOLs (Key Opinion Leaders) on platforms like X (formerly Twitter) and Telegram.

- Historical Pattern: During its early phase in mid-January 2026, LAOZI experienced rapid price surges driven by FOMO (Fear of Missing Out) sentiment, with market capitalization reaching approximately $12 million before experiencing corrections.

- Current Impact: The token's price trajectory remains highly dependent on continued community activity and the broader BSC (BNB Smart Chain) meme token trend. Without sustained viral events or narrative momentum, price volatility may increase with limited upside potential.

External Platform Support and Ecosystem Factors

- Exchange Listings: LAOZI's liquidity and exposure are influenced by listings on centralized exchanges. Currently, LAOZI/USDT spot trading is available on XT.com, providing competitive trading fees and user-friendly interfaces for retail participants.

- BSC Ecosystem Advantages: As a BEP-20 token operating on BSC, LAOZI benefits from low transaction fees and fast execution speeds, which facilitate retail trading activity and reduce friction for meme token speculation.

- Cultural Differentiation: The token distinguishes itself in the competitive Chinese-language meme coin sector through its integration of Sichuan dialect elements and cultural references to the ancient philosopher Laozi, creating a unique positioning among Asian traders and meme enthusiasts.

Broader Cryptocurrency Market Conditions

- Market Cycle Influence: In a potentially bullish overall crypto market environment in 2026, LAOZI may possess rebound potential if broader risk appetite remains elevated. Conversely, during market downturns, meme tokens typically face amplified selling pressure.

- Liquidity Constraints: Low liquidity amplifies both potential gains and losses. Trading volume plays a crucial role in determining whether momentum can be sustained, as price movements are primarily driven by trading behavior rather than fundamentals.

- Competitive Landscape: The rapid evolution of Chinese-themed meme tokens creates continuous competitive pressure, with new projects potentially diverting attention and capital away from existing tokens like LAOZI.

Risk Factors and Limitations

- Lack of Utility: LAOZI does not provide DeFi functionality or real-world applications. Its value proposition is limited to speculative trading and cultural participation, making it highly susceptible to sentiment shifts.

- Price Volatility: Typical of meme tokens, LAOZI exhibits pronounced price fluctuations, with rapid appreciation often followed by significant corrections. This volatility pattern reflects its speculative nature.

- Dependency on External Catalysts: The token's value growth relies excessively on external factors such as sector hype, platform support, and exchange listings, rather than intrinsic development or utility expansion. This creates sustainability challenges for long-term price appreciation.

III. LAO Price Forecast

Given the absence of specific price prediction data in the provided materials, and without reliable historical performance metrics or fundamental indicators for LAO, we are unable to provide concrete price forecasts for the requested timeframe. Market participants should note that any price projection would require comprehensive data including historical volatility patterns, tokenomics structure, trading volume trends, and broader market correlation metrics.

Investors interested in LAO should conduct independent research and consult multiple data sources before making investment decisions. Price movements in cryptocurrency markets remain highly unpredictable and subject to numerous external factors including regulatory developments, technological upgrades, and overall market sentiment shifts.

For real-time market data and trading opportunities, users may explore Gate.com's platform which offers comprehensive charting tools and market analysis features to assist in informed decision-making.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|

IV. 老子 Professional Investment Strategy and Risk Management

老子 Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors with high risk tolerance and understanding of meme token volatility

- Operational Recommendations:

- Consider dollar-cost averaging to mitigate entry point risk given the token's high volatility (30-day change of 1888.78%)

- Monitor BNB Chain ecosystem developments as 老子 operates as a trending meme on this network

- Storage Solution: Use Gate Web3 Wallet for secure storage with BEP-20 token support

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume ($315,578) relative to market cap ($1.56M) to identify liquidity trends

- Price Range Monitoring: Track movements within the 24-hour range ($0.00148 - $0.001896) for short-term opportunities

- Swing Trading Considerations:

- Set stop-loss orders given the -4.15% 24-hour decline and historical low of $0.00132

- Consider profit-taking strategies near resistance levels, particularly the ATH of $0.015

老子 Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio

- Aggressive Investors: 2-5% of crypto portfolio

- Professional Investors: Up to 10% with active monitoring

(II) Risk Hedging Approaches

- Position Sizing: Limit exposure due to meme token nature and concentration risk (6,510 holders)

- Diversification: Balance 老子 holdings with established cryptocurrencies and different blockchain ecosystems

(III) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet with BEP-20 compatibility

- Multi-signature Option: Consider multi-sig arrangements for larger holdings

- Security Precautions: Verify BSC contract address (0x1a5f9d77ca46646cd4937fd8d093f460b66f4444) before transactions and avoid phishing sites

V. 老子 Potential Risks and Challenges

老子 Market Risks

- Extreme Volatility: The 1888.78% 30-day surge indicates high speculation risk and potential for sharp corrections

- Liquidity Concerns: With a market cap of $1.56M and daily volume of $315,578, liquidity may be limited during market stress

- Meme Token Dynamics: As a trending meme on BNB Chain, value is heavily influenced by social sentiment rather than fundamental utility

老子 Regulatory Risks

- Meme Token Classification: Regulatory bodies may scrutinize meme tokens differently than utility tokens, potentially affecting trading availability

- BNB Chain Regulations: Changes in regulatory treatment of BNB Chain or BSC-based tokens could impact 老子's accessibility

- Cross-border Compliance: Varying international regulations on speculative digital assets may limit geographic availability

老子 Technical Risks

- Smart Contract Vulnerability: As a BEP-20 token, risks associated with contract bugs or exploits exist despite BSC's established infrastructure

- Network Dependency: Full reliance on BNB Chain means any network issues directly impact 老子 functionality

- Limited Track Record: Token published on January 9, 2026, providing minimal historical data for technical analysis

VI. Conclusion and Action Recommendations

老子 Investment Value Assessment

As a trending meme token on BNB Chain with a fully diluted market cap of $1.56M and 100% circulating supply, 老子 represents a speculative opportunity rather than a long-term value investment. The extraordinary 30-day gain of 1888.78% demonstrates significant market interest, but also signals elevated risk. With 6,510 holders and limited trading history since early January 2026, the token's sustainability depends heavily on community engagement and broader meme token market trends. The current price of $0.001563 sits significantly below the ATH of $0.015, suggesting either recovery potential or warning of declining momentum.

老子 Investment Recommendations

✅ Beginners: Avoid or allocate only minimal amounts (under 1% of portfolio) for learning purposes; prioritize understanding meme token risks before investing ✅ Experienced Investors: Consider small speculative positions (1-3%) with strict stop-losses; actively monitor BNB Chain meme trends and social sentiment ✅ Institutional Investors: Generally unsuitable due to high volatility, limited liquidity, and speculative nature; if considering, use derivatives for hedged exposure

老子 Trading Participation Methods

- Spot Trading: Available on Gate.com and 5 other exchanges; verify liquidity depth before large orders

- DeFi Integration: Interact directly through BNB Chain DeFi platforms using Gate Web3 Wallet with appropriate slippage settings

- Portfolio Tracking: Monitor position through Gate.com's portfolio tools to track the 0.000056% market dominance and relative performance

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of Laozi?

The current price of Laozi is approximately 0.001597 USD. Real-time price data is continuously updated to ensure accuracy as of February 2, 2026.

How to predict the future price trend of Laozi?

Financial analysts use technical analysis, fundamental analysis, and sentiment analysis to predict Laozi's future price. Key factors include market trends, trading volume, and investor sentiment. Predictions are based on current market data and historical patterns.

What are the main factors affecting Laozi price predictions?

Laozi price is primarily influenced by market sentiment, trading volume, overall market trends, and technological developments. Investor confidence and macroeconomic factors also play significant roles in price movements.

What is the price difference between Laozi and other similar products/assets?

Laozi is currently priced at US$0.001562 with a 24-hour trading volume of US$1,227,291. It has declined 43.13% over the past 7 days with a circulating supply of 1 billion tokens, positioning it competitively within the market segment.

What risks should I pay attention to when investing in Laozi for price prediction trading?

Laozi price prediction trading involves market volatility risks, regulatory changes, and smart contract vulnerabilities. Diversify your portfolio and stay updated with market dynamics to manage exposure effectively.

Can AI Companions (AIC) Reach $0.2729 in Price Prediction?

What is BNB?

Factors That Could Cause BNB's Price to Drop

BNB Price Analysis: Historical Highs and Future Trends

Where to Buy BNB: A Comprehensive Guide

What specific applications does AIC have on the BNB Smart Chain?

Top 4 Coins with the Highest Mining Profitability

2026 BIGPUMP Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

2026 SPEC Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Rafał Zaorski: Who Is He? Background, Career, and Net Worth

Is Smoking Chicken Fish (SCF) a good investment?: A Comprehensive Analysis of Market Trends, Risk Factors, and Long-term Profitability Potential