2026 RING Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: RING's Market Position and Investment Value

DarwiniaRing (RING) serves as the native asset of the Darwinia Network, a cross-chain bridge network connecting Polkadot parachain ecosystems with external heterogeneous chains. Since its launch, RING has been utilized for on-chain transaction fees, contract execution costs, and cross-chain services while enabling staking participation for governance. As of February 2026, RING maintains a market capitalization of approximately $863,677, with a circulating supply of around 1.71 billion tokens and a current price hovering near $0.0005063. This asset, designed to facilitate cross-chain infrastructure and multi-chain applications, plays an increasingly important role in areas such as NFT auction markets, stablecoin bridging, and asset exchange.

This article will comprehensively analyze RING's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. RING Price History Review and Market Status

RING Historical Price Evolution Trajectory

- 2021: RING reached a notable price level of $0.30361 on March 14, with significant market attention during the broader cryptocurrency bull market period

- 2026: The token experienced substantial price pressure, declining to $0.00049197 on February 2, reflecting broader market challenges and volatility

RING Current Market Situation

As of February 4, 2026, RING is trading at $0.0005063, representing a modest recovery from its recent low point. The token has experienced notable price movements across different timeframes, with a 0.22% increase over the past hour, while facing downward pressure of 2.52% over the last 24 hours.

The 24-hour trading range shows RING fluctuating between $0.0004925 and $0.0005203, with a total trading volume of approximately $12,787.23. The market capitalization stands at around $863,677, with a circulating supply of 1.71 billion RING tokens out of a maximum supply of approximately 2.1 billion tokens, representing a circulation ratio of 81.24%.

The broader trend indicates challenges across extended timeframes, with price declines of 24.16% over the past week, 31.75% over the past month, and 71.17% over the past year. The current market dominance remains at 0.000039%, with the token holding the 2,625th position in overall cryptocurrency rankings.

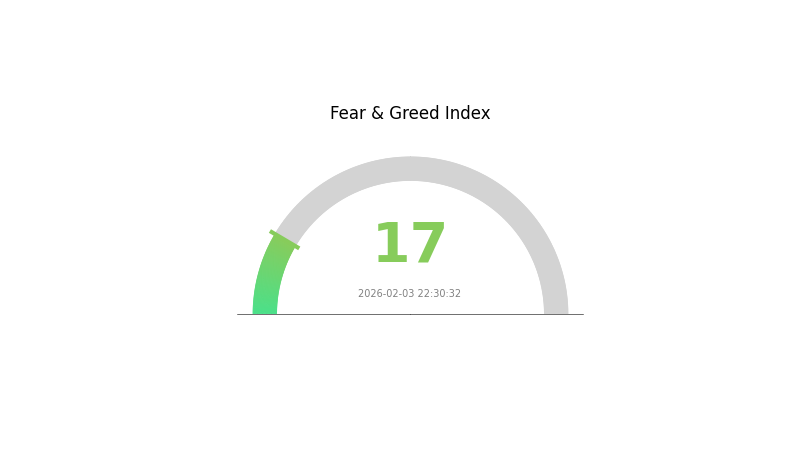

The current market sentiment indicator reflects a Fear Index reading of 17, categorized as "Extreme Fear," suggesting cautious investor sentiment in the broader cryptocurrency market environment.

Click to view current RING market price

RING Market Sentiment Indicator

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The market is currently experiencing extreme fear with an index reading of 17. This exceptionally low sentiment level indicates significant pessimism and risk aversion among investors. When fear reaches such extreme levels, it historically presents contrarian opportunities for long-term investors, as panic selling often creates undervalued assets. However, exercise caution and conduct thorough due diligence before making investment decisions. Monitor market developments closely and consider dollar-cost averaging strategies to mitigate volatility risks during this period of heightened uncertainty.

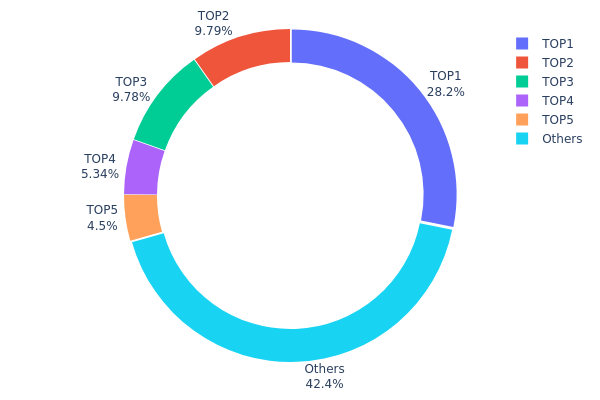

RING Token Holding Distribution

The token holding distribution chart illustrates the allocation of RING tokens across different wallet addresses, serving as a crucial metric for evaluating the degree of decentralization and potential concentration risks within the network. As of February 4, 2026, the top five addresses collectively hold 435,244.84K RING tokens, accounting for 57.55% of the total supply, while the remaining 42.45% is distributed among other addresses.

The current holding structure reveals a moderate to high concentration level. The largest holder (0xa3a7...d60eec) possesses 28.16% of the total supply, representing a significant but not absolute dominant position. The second and third largest holders maintain relatively balanced positions at 9.79% and 9.77% respectively, followed by two additional major holders controlling 5.34% and 4.49%. This concentration pattern suggests that while RING has achieved a certain level of distribution beyond a single dominant entity, the cumulative influence of top holders remains substantial.

Such a holding structure presents both opportunities and challenges for market stability. The moderate concentration among top five addresses could lead to increased price volatility, as large-scale movements from any major holder may trigger significant market reactions. However, the fact that over 42% of tokens are distributed among smaller holders indicates a growing community base, which can provide a stabilizing effect during market fluctuations. The relatively balanced distribution among the top three holders also reduces the risk of single-point manipulation, though coordinated actions among major stakeholders could still impact market dynamics.

Click to view the current RING Token Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa3a7...d60eec | 212929.56K | 28.16% |

| 2 | 0x649f...d82d88 | 74013.57K | 9.79% |

| 3 | 0xa325...dea101 | 73924.30K | 9.77% |

| 4 | 0x0079...3ed38b | 40377.41K | 5.34% |

| 5 | 0x043d...295d7e | 34000.00K | 4.49% |

| - | Others | 320761.99K | 42.45% |

II. Core Factors Influencing RING's Future Price

Supply and Demand Dynamics

- Market Mechanism: RING's price trajectory is shaped by the fundamental interplay between supply availability and market demand. When demand increases relative to available supply, upward price pressure typically emerges, while oversupply conditions may create downward momentum.

- Historical Patterns: Past market cycles have demonstrated that shifts in supply-demand equilibrium can generate significant price volatility, though specific historical data requires further analysis to establish clear correlations.

- Current Outlook: The balance between circulating supply and active market participation continues to serve as a primary determinant for near-term price movements.

Technological Advancements

- Innovation Impact: Technological developments within the RING ecosystem may influence investor confidence and utility perception. Enhanced functionality or protocol improvements could potentially attract increased participation from both developers and users.

- Ecosystem Evolution: The maturation of technical infrastructure and integration capabilities may affect RING's competitive positioning within the broader digital asset landscape.

Market Trends and Sentiment

- Industry Momentum: Broader cryptocurrency market trends often create ripple effects across individual assets. Positive sentiment in the digital asset sector may provide tailwind support, while sector-wide corrections can exert downward pressure regardless of project-specific fundamentals.

- Trading Activity: Market liquidity and trading volume patterns influence price discovery mechanisms and can affect volatility levels during key market events.

Regulatory Environment

- Policy Developments: Evolving regulatory frameworks across major jurisdictions continue to shape market conditions for digital assets. Clarity or uncertainty in regulatory treatment can materially impact investor behavior and institutional participation.

- Compliance Landscape: Adherence to emerging regulatory standards may affect RING's accessibility across different markets and trading venues.

Economic Factors

- Macroeconomic Conditions: Broader economic indicators, including monetary policy shifts and inflation dynamics, can influence risk appetite for digital assets. Changes in traditional financial market conditions often correlate with cryptocurrency sector performance.

- Global Economic Outlook: International economic developments and geopolitical considerations may create headwinds or tailwinds for digital asset adoption and valuation trends.

III. 2026-2031 RING Price Forecast

2026 Outlook

- Conservative estimate: $0.00038 - $0.00051

- Neutral estimate: Around $0.00051

- Optimistic estimate: Up to $0.00055 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: Gradual recovery and consolidation phase with moderate volatility

- Price range forecast:

- 2027: $0.00028 - $0.0006

- 2028: $0.00032 - $0.00067

- 2029: $0.00039 - $0.00069

- Key catalysts: Ecosystem development, increased adoption, and broader cryptocurrency market trends

2030-2031 Long-term Outlook

- Baseline scenario: $0.00048 - $0.00065 (assuming steady ecosystem growth)

- Optimistic scenario: $0.00062 - $0.00078 (with accelerated adoption and positive regulatory environment)

- Transformative scenario: Up to $0.00113 (under exceptional market conditions and significant technological breakthroughs)

- 2026-02-04: RING showing stable positioning with projected average of $0.00051

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00055 | 0.00051 | 0.00038 | 0 |

| 2027 | 0.0006 | 0.00053 | 0.00028 | 3 |

| 2028 | 0.00067 | 0.00056 | 0.00032 | 11 |

| 2029 | 0.00069 | 0.00062 | 0.00039 | 21 |

| 2030 | 0.0009 | 0.00065 | 0.00048 | 28 |

| 2031 | 0.00113 | 0.00078 | 0.00062 | 53 |

IV. RING Professional Investment Strategy and Risk Management

RING Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in cross-chain infrastructure development and can tolerate significant volatility

- Operational Recommendations:

- Consider accumulating positions during market downturns, as RING has declined over 71% in the past year

- Monitor Darwinia Network's ecosystem development and cross-chain bridging adoption metrics

- Store RING securely using Gate Web3 Wallet for long-term custody with proper backup procedures

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Current 24-hour range shows support near $0.0004925 and resistance around $0.0005203

- Volume Analysis: Monitor the current 24-hour trading volume of approximately $12,787 to gauge market interest and liquidity

- Swing Trading Considerations:

- RING exhibits notable short-term volatility, with 7-day decline of 24.16% and 30-day decline of 31.75%

- Set strict stop-loss orders due to relatively low liquidity with a market cap under $900,000

RING Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio allocation given the high-risk profile

- Aggressive Investors: 2-3% maximum allocation considering extreme volatility

- Professional Investors: Up to 5% with active risk management and hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance RING exposure with established cross-chain projects and stablecoins

- Position Sizing: Use dollar-cost averaging to mitigate timing risk given the steep price declines

(3) Secure Storage Solutions

- Hot Wallet Recommended: Gate Web3 Wallet for active trading and staking participation

- Cold Storage Option: Hardware wallet solutions for long-term holdings exceeding your trading allocation

- Security Precautions: Enable two-factor authentication, verify contract addresses (0x9469d013805bffb7d3debe5e7839237e535ec483 on Ethereum), and never share private keys

V. RING Potential Risks and Challenges

RING Market Risks

- Extreme Volatility: RING has experienced a 71.17% decline over the past year, indicating substantial downside risk

- Low Liquidity: With a market cap of approximately $863,677 and daily volume around $12,787, large trades may face significant slippage

- Distance from Historical Peak: Trading at $0.0005063 compared to an all-time high of $0.30361 in March 2021, representing over 99% decline

RING Regulatory Risks

- Cross-chain Protocol Scrutiny: Regulatory bodies may impose restrictions on bridge protocols and cross-chain asset transfers

- Jurisdictional Complexity: Operating across multiple blockchain ecosystems may create compliance challenges in various jurisdictions

- Token Classification Uncertainty: Evolving regulatory frameworks may impact RING's classification as a utility token for gas fees and governance

RING Technical Risks

- Bridge Security Vulnerabilities: Cross-chain bridges have historically been targets for exploits, which could impact RING's utility and value

- EVM Compatibility Dependencies: Technical issues with EVM integration or Substrate framework updates could affect network functionality

- Competition from Alternative Solutions: Numerous cross-chain projects compete in the bridging space, potentially limiting Darwinia's market share

VI. Conclusion and Action Recommendations

RING Investment Value Assessment

RING presents as a high-risk, speculative investment opportunity within the cross-chain infrastructure sector. The token's utility as gas for transactions, contract execution, and cross-chain services within the Darwinia Network provides fundamental use cases. However, the significant price decline of over 71% in the past year, low market capitalization under $900,000, and limited liquidity present considerable concerns. The project's focus on NFT markets, stablecoin bridging, and asset exchange infrastructure may offer long-term potential if the ecosystem gains traction, but near-term risks remain elevated. With a circulating supply of approximately 1.7 billion tokens (81.24% of max supply), dilution pressure appears limited.

RING Investment Recommendations

✅ Beginners: Avoid RING until gaining substantial experience with cryptocurrency markets. If considering exposure, limit to less than 0.5% of total crypto portfolio and only invest amounts you can afford to lose completely

✅ Experienced Investors: Consider small speculative positions (1-2% of portfolio) with strict stop-loss orders. Monitor Darwinia ecosystem developments, cross-chain transaction volumes, and partnership announcements before adding to positions

✅ Institutional Investors: Conduct thorough due diligence on Darwinia Network's technical infrastructure, team credentials, and competitive positioning. Consider pilot allocations with rigorous risk management frameworks and regular portfolio rebalancing

RING Trading Participation Methods

- Spot Trading on Gate.com: Access RING trading pairs with various cryptocurrencies for direct exposure

- Staking Participation: Stake RING tokens to gain governance influence and potential rewards within the Darwinia Network ecosystem

- Portfolio Integration: Include RING as part of a diversified cross-chain infrastructure investment thesis alongside other interoperability projects

Cryptocurrency investment carries extreme risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is RING token? What are its uses?

RING is the native token of Ring Network, a decentralized blockchain platform. It facilitates digital asset trading, payment settlements, and financial services within the ecosystem, providing users with efficient and secure transactions.

What is the historical price performance of RING token?

RING token has shown volatility in recent periods, with 24-hour price range between $0.001653 and $0.00183. The token's market performance reflects typical crypto market dynamics. Current valuation depends on trading volume and market conditions as of February 2026.

What are the main factors affecting RING price?

RING price is primarily influenced by market demand and supply dynamics, ecosystem development progress, token utility adoption, and overall cryptocurrency market sentiment. Network activity and technological updates also impact price movements.

How will RING price perform in 2024-2025?

Based on technical analysis, RING showed bullish potential with predictions reaching up to $13.39. Market sentiment remained positive driven by increasing trading volume and network adoption. However, price movements were influenced by broader crypto market dynamics and project developments during this period.

What are the differences between RING and other Layer 2 tokens?

RING's Layer 2 solution focuses on specific use cases with distinct architecture and incentive mechanisms, differing from competing L2 tokens in security model, throughput, and ecosystem focus. It enables lower transaction costs while maintaining Ethereum compatibility, offering unique scalability approach compared to alternatives.

What are the risks of investing in RING tokens?

RING token investments carry market volatility risk, technological failure risk, and regulatory uncertainty. Token value may decline significantly if the project fails to deliver. Cryptocurrency markets are inherently speculative and unpredictable.

What are the circulating supply and total supply of RING?

Darwinia Network (RING) has a circulating supply of 1.78 billion tokens and a total supply of 2.1 billion tokens, with a circulation rate of 84.77%.

Darwinia Network未来的发展计划对RING价格有什么影响?

Darwinia Network的发展计划将增强网络功能和采用率,预计推动RING价格上升。生态扩展、跨链集成优化、及开发者生态完善将吸引更多投资者,带动价格持续增长。

Top Layer 2 projects worth following in 2025: From Arbitrum to zkSync

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

What is Layer 2 in crypto assets? Understand the scaling solution for Ethereum

How Layer 2 Changes the Crypto Assets Experience: Speed, Cost, and Mass Adoption

Pepe Unchained (PEPU): Building the New Era of Meme Coins on Layer 2

Understanding NGMI and WAGMI: Key Terms in the Cryptocurrency Industry

2026 SMURFCAT Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2026 BST Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

2026 FIR Price Prediction: Expert Analysis and Market Forecast for the Coming Year

How to Get Started with Bitcoin Mining