2026 RITE Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: RITE's Market Position and Investment Value

Ritestream (RITE), positioned as a Web3 ecosystem platform for creating, monetizing, and consuming film and television content, has been advancing its mission to democratize the creator economy since its launch in 2022. As of 2026, RITE maintains a market capitalization of approximately $380,628, with a circulating supply of around 860 million tokens, and the price is trading at approximately $0.0004426. This asset, recognized as a bridge between traditional entertainment and blockchain technology, is playing an increasingly important role in enabling creators and communities to generate revenue through NFT-based content monetization.

This article will comprehensively analyze RITE's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. RITE Price History Review and Current Market Status

RITE Historical Price Evolution Trajectory

- 2024: RITE reached a notable price level of $0.081853 on January 30, representing a significant milestone in its early trading history. However, the token experienced substantial volatility, with prices declining sharply to $0.00016697 on January 12, marking its lowest recorded level.

- 2025-2026: The token entered a prolonged downward trend, with the price declining approximately 94.73% over the course of one year, reflecting challenging market conditions and reduced trading momentum.

RITE Current Market Status

As of February 06, 2026, RITE is trading at $0.0004426, reflecting a modest hourly increase of 0.32% but experiencing a slight 24-hour decline of 0.36%. The token has demonstrated some recovery over the past week, posting a 4% gain, though it remains under pressure on a monthly basis with a 1.35% decrease.

The current circulating supply stands at approximately 859.98 million RITE tokens, representing 86% of the maximum supply of 1 billion tokens. The market capitalization is positioned at $380,628, with a fully diluted market cap of $442,600. Trading volume over the past 24 hours reached $14,523, indicating moderate liquidity levels.

The 24-hour trading range has been relatively narrow, with prices fluctuating between $0.0004373 and $0.0004512. With approximately 9,106 token holders, RITE maintains a modest community base within the Web3 entertainment ecosystem.

The token's market dominance remains minimal at 0.000018%, positioning it within the broader landscape of emerging blockchain-based entertainment platforms.

Click to view current RITE market price

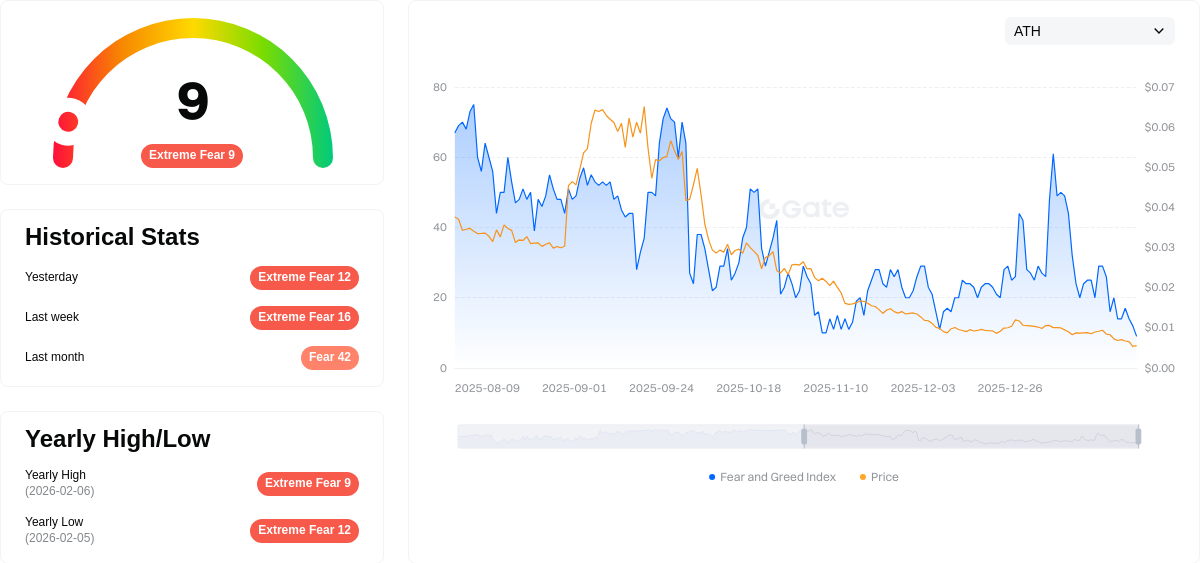

RITE Market Sentiment Index

2026-02-06 Fear & Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear & Greed Index standing at 9. This exceptionally low reading indicates significant market pessimism and widespread investor anxiety. During periods of extreme fear, markets often present contrarian opportunities for long-term investors, as assets may become oversold. However, cautious risk management remains essential. Monitor market developments closely and consider your investment horizon before making decisions. Historical patterns suggest extreme fear can precede market recoveries, but timing such reversals is challenging.

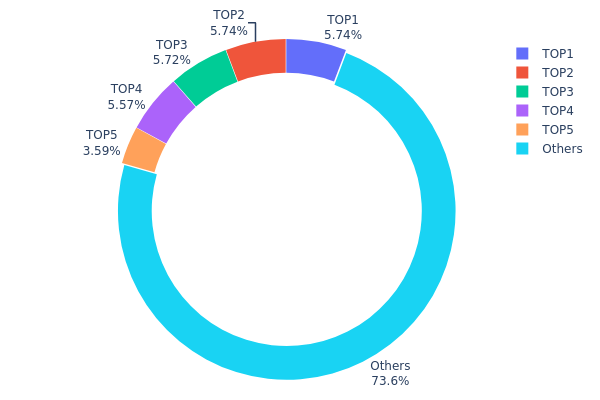

RITE Holding Distribution

The holding distribution chart reveals the concentration of token ownership across different wallet addresses, serving as a crucial metric for evaluating decentralization and potential market manipulation risks. According to the latest data, RITE exhibits a moderately concentrated holding structure. The top five addresses collectively hold 262,589.70K tokens, representing 26.34% of the total supply. Among these, the largest holder (0x4982...6e89cb) possesses 57,427.10K tokens (5.74%), followed closely by the second-largest holder with 57,410.54K tokens (5.74%). The remaining addresses outside the top five collectively account for 73.66% of the supply, indicating a relatively dispersed ownership base among smaller holders.

This holding pattern suggests a balanced distribution structure with no single entity dominating the market. While the top five addresses maintain significant positions, none individually controls more than 6% of the total supply, which mitigates concerns about excessive centralization or coordinated market manipulation. The substantial 73.66% held by other addresses demonstrates healthy participation from the broader community, potentially reducing volatility triggered by large-scale sell-offs from whale accounts. However, the combined 26.34% concentration among top holders still warrants monitoring, as coordinated actions could impact short-term price movements.

From a market structure perspective, RITE's current distribution reflects moderate decentralization that supports both stability and liquidity. The absence of extreme concentration reduces the risk of single-entity price manipulation while maintaining sufficient whale participation to provide market depth. This equilibrium typically correlates with more predictable price action and reduced susceptibility to pump-and-dump schemes, though investors should remain vigilant regarding potential shifts in this distribution pattern over time.

Click to view current RITE Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4982...6e89cb | 57427.10K | 5.74% |

| 2 | 0x387d...4af45b | 57410.54K | 5.74% |

| 3 | 0x0529...c553b7 | 57176.49K | 5.71% |

| 4 | 0x0d07...b492fe | 55722.72K | 5.57% |

| 5 | 0x5f93...1cabfd | 35852.85K | 3.58% |

| - | Others | 736410.29K | 73.66% |

II. Core Factors Influencing RITE's Future Price

Supply Mechanism

- Token Supply Structure: RITE has a total supply of 1,000,000,000 tokens, with a circulating supply of 859,982,700 RITE. The remaining tokens are yet to enter circulation, which may create potential selling pressure as they are gradually released into the market.

- Supply Impact Analysis: As the circulating supply approaches the total supply cap, the rate of new token introduction may influence price dynamics through basic supply-demand mechanics.

Market Demand and Adoption

- Market Positioning: RITE operates within the decentralized content economy sector, where its value proposition centers on enabling users to participate directly in financial decisions through expanded DeFi applications.

- Adoption Metrics: The project emphasizes community participation and global consensus mechanisms, allowing members to influence platform decisions. The extent of actual user adoption and engagement remains a key variable in determining long-term price sustainability.

- Growth Projections: Some market analyses suggest potential growth trajectories, though these remain speculative and dependent on actual adoption rates and market conditions.

Macroeconomic Environment

- Broader Economic Factors: RITE's price outlook is influenced by general economic conditions, including institutional participation patterns and wider economic trends affecting cryptocurrency markets.

- Market Sentiment: Overall cryptocurrency market sentiment and risk appetite among investors play significant roles in determining demand for tokens like RITE.

Technology Development and Ecosystem Building

- Decentralized Financial System: Ritestream Token aims to expand DeFi system applications, enabling users to participate directly in financial decision-making processes. This approach seeks to provide users with greater asset freedom and enhanced security.

- Community Governance: The platform emphasizes global consensus mechanisms, allowing community members to participate in and influence platform decisions. The effectiveness of this governance model may impact long-term project sustainability.

- Application Scenarios: The token's utility and application scenarios may expand as the cryptocurrency market develops and the project progresses, though specific ecosystem applications and partnerships require further observation.

Investment Considerations

- Market Position Assessment: Investors should comprehensively consider multiple factors when evaluating RITE, including overall cryptocurrency market trends, project fundamentals, current market capitalization levels, and whether the current price represents an appropriate entry point.

- Risk Management: Given the volatile nature of cryptocurrency markets, investors should monitor project developments, adjust investment strategies based on fundamental changes, and exercise caution if valuations appear disconnected from underlying fundamentals.

III. 2026-2031 RITE Price Prediction

2026 Outlook

- Conservative Prediction: $0.00042

- Neutral Prediction: $0.00044

- Optimistic Prediction: $0.00047 (requires favorable market conditions)

2027-2029 Outlook

- Market Stage Expectation: The token may enter a gradual growth phase as ecosystem development progresses and market awareness increases

- Price Range Prediction:

- 2027: $0.00041 - $0.00058

- 2028: $0.00050 - $0.00062

- 2029: $0.00034 - $0.00064

- Key Catalysts: Potential adoption growth, technological developments within the ecosystem, and broader market sentiment improvements could serve as primary drivers

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00050 - $0.00061 (assuming steady ecosystem development and stable market conditions)

- Optimistic Scenario: $0.00065 - $0.00069 (assuming accelerated adoption and positive regulatory environment)

- Transformative Scenario: Potential price expansion beyond current projections (requires breakthrough partnerships or significant protocol upgrades)

- 2026-02-06: RITE trading at early-stage valuation levels (current market positioning phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00047 | 0.00044 | 0.00042 | 0 |

| 2027 | 0.00058 | 0.00046 | 0.00041 | 3 |

| 2028 | 0.00062 | 0.00052 | 0.0005 | 17 |

| 2029 | 0.00064 | 0.00057 | 0.00034 | 28 |

| 2030 | 0.00069 | 0.00061 | 0.0005 | 36 |

| 2031 | 0.00067 | 0.00065 | 0.00037 | 45 |

IV. RITE Professional Investment Strategy and Risk Management

RITE Investment Methodology

(I) Long-term Holding Strategy

- Target investors: Long-term believers in Web3 entertainment economy and NFT ecosystem development

- Operational recommendations:

- Consider establishing positions when RITE's price fluctuates near technical support levels, with reference to the 30-day price trend showing relative stability

- Set a holding period of at least 12-24 months to benefit from potential ecosystem development of the Ritestream platform

- Use Gate Web3 Wallet for secure storage, supporting BSC chain assets and facilitating interaction with the Ritestream ecosystem

(II) Active Trading Strategy

- Technical analysis tools:

- Moving averages: Monitor 7-day and 30-day moving averages; current 7-day gain of 4% suggests short-term positive momentum

- Volume analysis: Daily trading volume of approximately $14,523 indicates relatively low liquidity, requiring caution with position sizing

- Swing trading considerations:

- Given the 24-hour price range of $0.0004373-$0.0004512, set tight stop-loss orders due to relatively narrow trading bands

- Monitor hourly price movements, as 1-hour changes of 0.32% may present short-term trading opportunities

RITE Risk Management Framework

(I) Asset Allocation Principles

- Conservative investors: 0.5-1% of crypto portfolio

- Aggressive investors: 2-3% of crypto portfolio

- Professional investors: Up to 5% based on comprehensive ecosystem assessment

(II) Risk Hedging Approaches

- Portfolio diversification: Balance RITE holdings with established cryptocurrencies and stablecoins

- Position scaling: Implement dollar-cost averaging strategy given the token's volatility profile

(III) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet, supporting BSC chain and providing convenient access for trading

- Cold storage approach: For long-term holdings exceeding $1,000, consider hardware wallet solutions

- Security precautions: Never share private keys, enable two-factor authentication, and regularly verify contract addresses (0x0808bf94d57c905f1236212654268ef82e1e594e on BSC)

V. RITE Potential Risks and Challenges

RITE Market Risks

- High volatility: The token experienced a decline of approximately 94.73% from its peak, demonstrating significant price volatility

- Low liquidity: Daily trading volume of approximately $14,523 and market cap of around $380,628 may result in slippage during large transactions

- Market concentration: Currently available on only 1 exchange, creating dependency and potential accessibility limitations

RITE Regulatory Risks

- NFT classification uncertainty: Evolving global regulatory frameworks for NFTs and entertainment-related tokens may impact the Ritestream ecosystem

- Cross-border content distribution: Film and TV content distribution across jurisdictions may face varying regulatory requirements

- Securities law considerations: Depending on token utility and revenue-sharing mechanisms, regulatory classification uncertainties may arise

RITE Technical Risks

- Smart contract vulnerabilities: BSC-based token (contract: 0x0808bf94d57c905f1236212654268ef82e1e594e) requires ongoing security audits

- Platform execution risk: Success depends on Ritestream's ability to deliver on four key pillars: content publishing platform, consumer application, NFT marketplace, and B2B distribution platform

- Adoption challenges: The Web3 entertainment model requires significant user base growth, currently with approximately 9,106 holders

VI. Conclusion and Action Recommendations

RITE Investment Value Assessment

RITE represents an experimental position in the Web3 entertainment and NFT content creation space. While the project addresses democratization of creator economy through its four-pillar ecosystem, investors should note the substantial decline from historical highs and current low trading volumes. The token's long-term value proposition depends on successful execution of the Ritestream platform and broader adoption of blockchain-based content monetization models. Short-term risks include high volatility, limited liquidity, and uncertainties surrounding Web3 entertainment sector development.

RITE Investment Recommendations

✅ Beginners: Limit exposure to less than 1% of crypto portfolio; prioritize education about Web3 entertainment models before investing ✅ Experienced investors: Consider small speculative positions (1-3%) if aligned with thesis on NFT-based content ecosystems; implement strict stop-loss orders ✅ Institutional investors: Conduct comprehensive due diligence on Ritestream platform development milestones; assess position sizing based on entertainment sector allocation strategy

RITE Trading Participation Methods

- Spot trading: Available on Gate.com with RITE/USDT trading pair

- Wallet storage: Transfer to Gate Web3 Wallet for secure holding and potential ecosystem participation

- DCA strategy: Implement dollar-cost averaging with small periodic purchases to mitigate volatility impact

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of RITE token? What are the main factors affecting its price?

RITE token currently trades at approximately 0.0001519 OMR. Its price is primarily influenced by market demand, trading volume, and overall cryptocurrency market trends.

How to conduct RITE price prediction? What analysis methods and tools can be used?

Use technical analysis methods like RSI (Relative Strength Index) and candlestick charts for RITE price prediction. When RSI is between 60-80, it indicates a buy opportunity. Analyze trading volume trends and market sentiment. Professional prediction tools provide real-time forecasts and historical data analysis to help identify price movement patterns.

What is the future price trend of RITE? What are expert price expectations for 2024 and 2025?

RITE is projected to trade around $0.0009169 in 2024-2025 period, with market cap of $739,223.91 and circulating supply of 806 million tokens. Expert analysts anticipate price fluctuations driven by market dynamics and ecosystem adoption growth.

What advantages does RITE have compared to similar tokens, and how does this impact its long-term price potential?

RITE offers superior transaction speed and lower fees than competitors, providing significant market advantages. Its innovative technology and transparent governance model enhance investor confidence and support strong long-term price appreciation potential.

What are the risks of investing in RITE? What are the main drivers of price fluctuations?

RITE investment faces market volatility and liquidity risks. Price fluctuations are primarily driven by interest rate changes, inflation expectations, and macroeconomic policy shifts. Monitor economic indicators and market sentiment for better trading decisions.

What is RITE's technology development roadmap? How do new feature releases affect the price?

RITE's roadmap emphasizes continuous innovation and ecosystem expansion. New feature releases typically boost short-term price momentum as market participants recognize increased utility and adoption potential. Long-term price appreciation depends on sustained technological advancement and growing transaction volume.

Treasure NFT Marketplace: A 2025 Guide for Web3 Gamers and Investors

What are the new trends in the NFT market in 2025?

NFT Treasure Hunting: Top Strategies for Web3 Collectors in 2025

How to Create and Sell NFTs: A Step-by-Step Guide for Beginners

The technical principles and application scenarios of 2025 NFTs

How to Create an NFT in 2025: A Step-by-Step Guide

Everything You Need to Know About Bull Flag Patterns

What is CBDC (Central Bank Digital Currency)? An Easy-to-Understand Comparison with Cryptocurrency

What is Elliott Wave and How to Apply It?

Comprehensive Guide to Recessions, Depressions, and Economic Downturns

What is Stellar & How Does it Work