2026 ROUTE Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: ROUTE's Market Position and Investment Value

Router Protocol (ROUTE), as a chain abstraction protocol empowering developers to build intent-based cross-chain solutions, has been facilitating seamless transfers and messaging in decentralized environments since its launch in 2024. As of 2026, ROUTE maintains a market capitalization of approximately $873,851, with a circulating supply of around 648.74 million tokens, and the price hovering near $0.001347. This asset, recognized as an infrastructure layer for cross-chain interoperability, is playing an increasingly important role in enabling multi-chain applications and bridging blockchain ecosystems.

This article will comprehensively analyze ROUTE's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. ROUTE Price History Review and Market Status

ROUTE Historical Price Evolution Trajectory

- 2024: Router Protocol token launched on Gate.com in July with an initial price of $0.04, experiencing significant volatility throughout the year

- 2024: In November, ROUTE reached a notable price level of $0.08108, representing a substantial appreciation from its launch price

- 2026: Following broader market trends, the price declined from previous levels to $0.0013 in early February

ROUTE Current Market Situation

As of February 4, 2026, ROUTE is trading at $0.001347, showing a modest increase of 0.37% over the past 24 hours. The token has experienced a price range between $0.00132 and $0.001417 in the last 24 hours. Over the past week, ROUTE has declined by 4.2%, while the 30-day performance shows a decrease of 9.22%.

The current market capitalization stands at approximately $873,851, with a circulating supply of 648,739,153 ROUTE tokens, representing 66.06% of the maximum supply of 982,072,351 tokens. The 24-hour trading volume amounts to $27,894, indicating moderate trading activity. The fully diluted market cap reaches approximately $1,322,851.

Router Protocol currently ranks #2605 in the cryptocurrency market, with a market dominance of 0.000049%. The token is available for trading on 4 exchanges and has approximately 3,633 holders. The market sentiment index registers at 17, corresponding to an extreme fear level in the crypto market.

Click to view current ROUTE market price

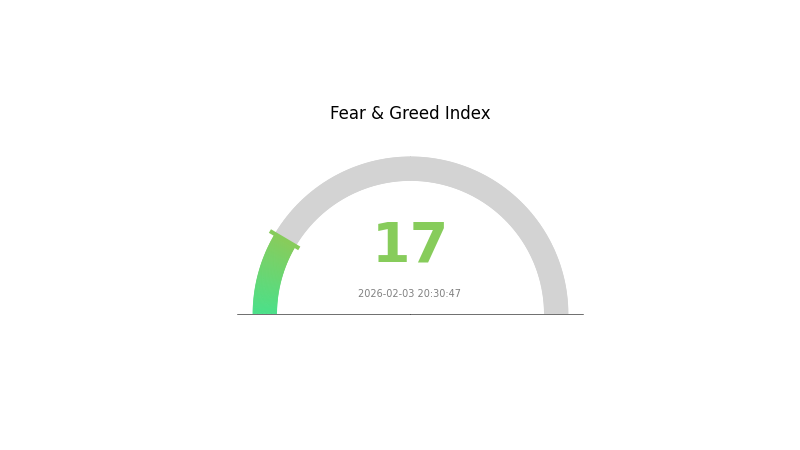

ROUTE Market Sentiment Index

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 17, signaling heightened investor anxiety and pessimism. This level typically indicates panic selling and depressed asset valuations. Market participants are displaying significant risk aversion, creating potential buying opportunities for contrarian investors. Such extreme readings often precede market reversals. Traders should exercise caution while monitoring for capitulation signals that may indicate a near-term bottom.

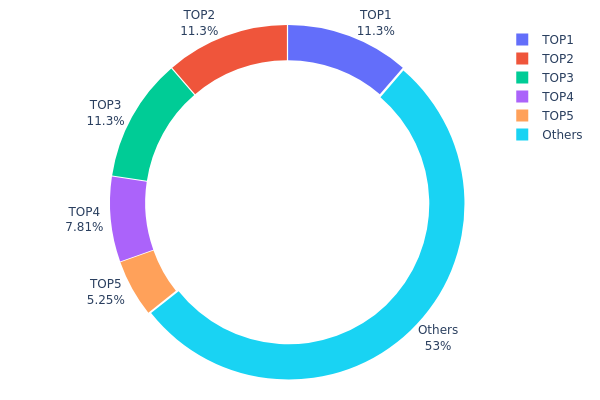

ROUTE Holding Distribution

The holding distribution chart illustrates the allocation of ROUTE tokens across different wallet addresses, providing insights into the degree of decentralization and concentration of token ownership. By examining how tokens are distributed among top holders versus the broader community, this metric helps assess potential risks related to market manipulation and price volatility.

Based on the current data, ROUTE demonstrates a relatively concentrated holding structure. The top three addresses each hold exactly 111,111.07K tokens, accounting for 11.31% individually, which collectively represents 33.93% of the total supply. The fourth and fifth largest holders possess 7.80% and 5.25% respectively. When combined, the top five addresses control approximately 46.98% of the circulating supply, while the remaining 53.02% is distributed among other holders. This concentration level indicates that nearly half of ROUTE's supply is controlled by a small number of addresses, which could pose risks to market stability.

This concentration pattern may amplify price volatility, as large holders possess significant influence over market dynamics through their trading decisions. The presence of three addresses with identical holdings suggests possible coordination or strategic allocation, which warrants closer monitoring. While the majority stake (53.02%) remains with the broader community, the substantial control held by top addresses could facilitate coordinated price movements or create selling pressure during market downturns. From a decentralization perspective, this distribution structure falls between highly centralized and truly decentralized models, suggesting that ROUTE's on-chain structure maintains moderate stability while carrying elevated concentration risks that investors should consider when evaluating market exposure.

Click to view current ROUTE Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa96d...3e5ec4 | 111111.07K | 11.31% |

| 2 | 0x94dc...f1d1b5 | 111111.07K | 11.31% |

| 3 | 0xcc94...319e69 | 111111.07K | 11.31% |

| 4 | 0x58ed...a36a51 | 76652.88K | 7.80% |

| 5 | 0x27fd...618d46 | 51566.48K | 5.25% |

| - | Others | 520519.80K | 53.02% |

II. Core Factors Influencing ROUTE's Future Price Trends

Supply Mechanism

- Deflationary Model: ROUTE adopts a deflationary token economy where circulating supply decreases over time, creating built-in scarcity mechanisms that affect long-term value proposition.

- Historical Pattern: During previous supply reduction phases, prices typically experienced upward momentum due to enhanced scarcity dynamics, though past performance does not guarantee future results.

- Current Impact: The ongoing deflationary pressure may continue to influence supply-demand dynamics, potentially supporting price appreciation as circulating tokens become progressively scarcer.

Technology Development and Ecosystem Building

- Router Protocol Upgrades: Router Protocol continues to refine its cross-chain infrastructure, enabling efficient asset and information flow across multiple blockchain networks. Protocol enhancements substantially improve interoperability capabilities within the decentralized ecosystem.

- Multi-Chain Asset Circulation: The protocol's technical iterations focus on seamless cross-chain functionality, allowing users to transfer assets and data between different blockchain environments with reduced friction and enhanced security.

- Ecosystem Applications: The expanding Router Protocol ecosystem supports various decentralized applications that leverage cross-chain capabilities, potentially driving broader adoption and utility for the ROUTE token across interconnected blockchain networks.

III. 2026-2031 ROUTE Price Forecast

2026 Outlook

- Conservative forecast: $0.00107

- Neutral forecast: $0.00136

- Optimistic forecast: $0.00172 (requires favorable market conditions)

2027-2029 Mid-term Outlook

- Market stage expectation: The token may enter a gradual growth phase, with potential expansion in adoption and ecosystem development driving upward momentum.

- Price range forecast:

- 2027: $0.00111 - $0.00226, with an average around $0.00154

- 2028: $0.00169 - $0.0027, with an average around $0.0019

- 2029: $0.0014 - $0.00297, with an average around $0.0023

- Key catalysts: Increased platform utility, broader market recovery, and potential technological upgrades could serve as primary drivers for price appreciation during this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00161 - $0.00298 (assuming steady ecosystem growth and market stability)

- Optimistic scenario: $0.00263 - $0.003 (assuming accelerated adoption and favorable regulatory environment)

- Transformative scenario: Approaching $0.003 (under conditions of significant ecosystem expansion and mainstream integration)

- Feb 4, 2026: ROUTE is positioned in its early forecast stage with conservative estimates suggesting potential for gradual appreciation through the end of the decade.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00172 | 0.00136 | 0.00107 | 0 |

| 2027 | 0.00226 | 0.00154 | 0.00111 | 14 |

| 2028 | 0.0027 | 0.0019 | 0.00169 | 41 |

| 2029 | 0.00297 | 0.0023 | 0.0014 | 70 |

| 2030 | 0.00298 | 0.00263 | 0.00161 | 95 |

| 2031 | 0.003 | 0.0028 | 0.00266 | 108 |

IV. ROUTE Professional Investment Strategies and Risk Management

ROUTE Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Investors who believe in cross-chain infrastructure development and chain abstraction technology, with risk tolerance for emerging blockchain protocols

- Operational Recommendations:

- Consider accumulating positions during periods of market weakness, given the current price near historical lows

- Monitor the development progress of Router Protocol's chain abstraction products and cross-chain messaging capabilities

- Implement a diversified crypto portfolio where ROUTE represents a portion of infrastructure holdings rather than a concentrated position

- Storage Solution: Utilize Gate Web3 Wallet for secure storage, supporting ERC20 tokens with multi-signature capabilities

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the current 24-hour trading volume of approximately 27,894 USDT to identify potential breakout or breakdown signals

- Support and Resistance Levels: Track the 24-hour range between 0.00132 and 0.001417 USDT to establish short-term trading boundaries

- Swing Trading Key Points:

- Consider the current low liquidity environment with limited exchange listings (4 exchanges), which may result in higher volatility

- Set strict stop-loss orders given the significant distance from all-time high and recent price decline trends

ROUTE Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: Maximum 1-2% portfolio allocation given high volatility and early-stage project status

- Aggressive Investors: 3-5% portfolio allocation for those seeking exposure to cross-chain infrastructure

- Professional Investors: Up to 5-8% allocation with active monitoring and rebalancing strategies

(II) Risk Hedging Strategies

- Correlation Hedging: Balance ROUTE exposure with positions in established layer-1 protocols that Router Protocol aims to connect

- Position Sizing: Utilize dollar-cost averaging to mitigate timing risk in this volatile asset

(III) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet, which supports ERC20 tokens including ROUTE with user-friendly interface and security features

- Hardware Wallet Option: Consider transferring significant holdings to compatible hardware wallet solutions for long-term storage

- Security Precautions: Never share private keys, enable two-factor authentication, verify contract addresses (0x60f67e1015b3f069dd4358a78c38f83fe3a667a9 on Ethereum), and regularly update wallet software

V. ROUTE Potential Risks and Challenges

ROUTE Market Risks

- High Volatility: ROUTE has experienced a 94.67% decline over the past year, indicating significant price instability and potential for continued volatility

- Limited Liquidity: With trading available on only 4 exchanges and 24-hour volume of approximately 27,894 USDT, liquidity constraints may impact entry and exit strategies

- Market Capitalization Concerns: Current market cap of approximately 873,851 USDT represents a relatively small project size, increasing susceptibility to market manipulation and dramatic price swings

ROUTE Regulatory Risks

- Cross-chain Protocol Oversight: As regulatory frameworks evolve, cross-chain bridging solutions may face increased scrutiny regarding security standards and compliance requirements

- Jurisdictional Uncertainty: The decentralized nature of Router Protocol's operations may encounter varying regulatory approaches across different jurisdictions

- Securities Classification Risk: Token utility and distribution models in emerging blockchain infrastructure projects may face classification challenges under evolving securities regulations

ROUTE Technical Risks

- Smart Contract Vulnerabilities: Cross-chain messaging and transfer protocols inherently involve complex smart contract interactions that may contain undiscovered vulnerabilities

- Bridge Security Concerns: Cross-chain bridge protocols have historically been targets for exploits, posing security risks to the Router Protocol ecosystem

- Competition Risk: The chain abstraction and cross-chain infrastructure space features numerous competing projects, potentially impacting Router Protocol's market adoption

- Integration Dependencies: The protocol's success depends on successful integrations with multiple blockchain networks, creating technical dependencies and potential points of failure

VI. Conclusion and Action Recommendations

ROUTE Investment Value Assessment

Router Protocol presents an ambitious vision in the chain abstraction and cross-chain infrastructure space, aiming to enable seamless cross-chain transfers and messaging in a decentralized environment. The current valuation near historical lows may present opportunity for those who believe in the long-term potential of cross-chain technology. However, significant challenges remain, including limited liquidity (4 exchange listings), substantial price decline (94.67% over one year), and intense competition in the cross-chain bridge sector. The circulating supply represents approximately 66.06% of maximum supply, indicating moderate token distribution. The project's focus on intent-based products and security borrowing from Ethereum demonstrates technical innovation, but execution risk and market adoption uncertainties warrant careful consideration.

ROUTE Investment Recommendations

✅ Beginners: Approach ROUTE with extreme caution. If interested in cross-chain infrastructure exposure, limit allocation to less than 1% of total crypto portfolio. Focus on understanding the technology and market dynamics before committing significant capital. Consider starting with small test positions to gain familiarity.

✅ Experienced Investors: May consider ROUTE as a speculative position within a diversified blockchain infrastructure portfolio, limiting exposure to 2-5% based on risk tolerance. Implement disciplined entry strategies such as dollar-cost averaging, and maintain strict stop-loss parameters. Monitor project development milestones and ecosystem adoption metrics closely.

✅ Institutional Investors: Conduct comprehensive due diligence on Router Protocol's technical architecture, team credentials, partnership ecosystem, and competitive positioning. If investment thesis aligns, consider position sizing up to 3-5% of crypto infrastructure allocation with robust risk management protocols, including regular rebalancing and hedging strategies.

ROUTE Trading Participation Methods

- Spot Trading on Gate.com: Access ROUTE/USDT trading pairs with competitive fees and liquidity aggregation features

- Gate Web3 Wallet Integration: Store and manage ROUTE tokens directly through Gate Web3 Wallet, supporting ERC20 standard with secure key management

- Portfolio Tracking: Utilize Gate.com's portfolio management tools to monitor ROUTE price movements, set price alerts, and track historical performance data

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ROUTE token and what are its uses and value?

ROUTE is a native token of a decentralized trading platform built on blockchain technology. It facilitates transactions and services within the DeFi ecosystem, enhancing efficiency and functionality. ROUTE's value derives from its utility in enabling decentralized finance operations and supporting platform services.

What are the main factors affecting ROUTE price?

ROUTE price is primarily influenced by trading volume, market demand, network adoption, liquidity depth, and overall crypto market sentiment. Exchange listing announcements and protocol updates also significantly impact its valuation.

How to conduct price prediction for ROUTE tokens? What are the analysis methods?

Use technical analysis with moving averages and trend lines to identify price patterns. Apply fundamental analysis by evaluating project development, adoption metrics, and market demand. Monitor trading volume and on-chain activity for market sentiment insights.

What is the historical price trend of ROUTE tokens?

ROUTE tokens have experienced recent declines, dropping 0.20% over 24 hours, 1.98% over 7 days, and 9.20% over 14 days. The token shows moderate downward pressure in short-term trading activity.

What are the risks to note when investing in ROUTE tokens?

ROUTE token investments involve market volatility risk, regulatory compliance uncertainty, and liquidity constraints. Smart contract vulnerabilities, issuer credit risk, and tax implications across jurisdictions require careful due diligence. Monitor exchange depth, verify audit reports, and maintain compliant transaction records.

What is the future development prospects and price expectations for ROUTE token?

ROUTE token shows promising potential with growing ecosystem adoption. As the network expands and transaction volume increases, price appreciation is expected through enhanced utility and community growth driving long-term value creation.

What distinguishes ROUTE from other cryptocurrencies?

ROUTE is a cross-chain liquidity protocol enabling low-cost, near-instant asset swaps across multiple blockchains. Unlike other cryptocurrencies, it focuses on decentralized exchange infrastructure, providing seamless interoperability and efficient trading mechanisms rather than serving as a standalone digital currency.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

What Is a Cryptocurrency Node and How to Run One

Best Hardware Wallets for Cryptocurrency Storage

Comprehensive Guide to NFT Minting: Create and Sell NFTs for Free

Play-to-Earn Games: Leading GameFi Projects

What is an airdrop in crypto assets?