2026 RWAINC Price Prediction: Expert Analysis and Market Forecast for Revolutionary AI Innovation Inc.

Introduction: RWAINC's Market Position and Investment Value

RWA Inc. (RWAINC), positioned as the first comprehensive Real-World Asset (RWA) ecosystem bridging traditional finance and blockchain technology, has been making significant progress since its launch in 2024. As of February 4, 2026, RWAINC maintains a market capitalization of approximately $816,323, with a circulating supply of around 332.79 million tokens, and the price hovering around $0.002453. This asset, recognized as a utility token powering an innovative RWA ecosystem, is playing an increasingly important role in the tokenization of real-world assets.

This article will comprehensively analyze RWAINC's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. RWAINC Price History Review and Market Status

RWAINC Historical Price Evolution Trajectory

- 2024: RWAINC reached a peak price of $0.14542 in December, marking a significant milestone for the token following its launch in November 2024.

- 2025-2026: The token experienced substantial volatility, with prices declining considerably from previous levels.

- 2026: In early February, RWAINC recorded its lowest price point at $0.002409, representing a significant correction from its historical peak.

RWAINC Current Market Situation

As of February 04, 2026, RWAINC is trading at $0.002453, demonstrating recent price fluctuations across multiple timeframes. Over the past hour, the token has declined by 4.56%, while the 24-hour performance shows an 11.61% decrease. The 7-day trend indicates a 23.95% decline, and the 30-day period reflects a 36.37% reduction. On an annual basis, RWAINC has experienced a 93.83% decline from previous levels.

The token's 24-hour trading range spans from $0.002419 to $0.002778, with a total trading volume of $17,829.17. RWAINC maintains a market capitalization of $816,323.77, with a circulating supply of 332,785,884 tokens out of a maximum supply of 1,000,000,000 tokens, representing a circulation ratio of approximately 33.28%. The fully diluted market cap stands at $2,453,000.

RWAINC is deployed on the Base blockchain network, with the contract address 0xe2b1dc2d4a3b4e59fdf0c47b71a7a86391a8b35a. The token currently ranks #2657 in market capitalization, holding a 0.000090% market dominance. The holder base consists of 73,054 addresses.

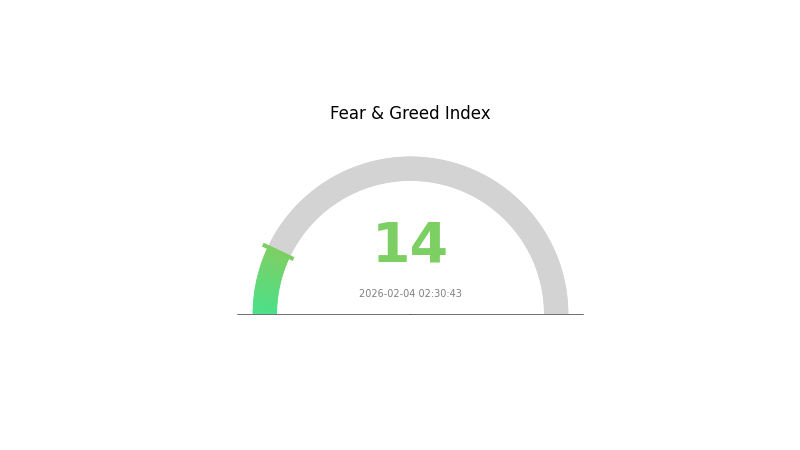

The current market sentiment index registers at 1, corresponding to an "Extreme Fear" classification, with a VIX reading of 14, suggesting heightened market caution among participants.

Click to view the current RWAINC market price

RWAINC Market Sentiment Indicator

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 14, indicating heightened anxiety among investors. This sentiment typically emerges during significant market downturns or negative macroeconomic events. When fear reaches such extreme levels, contrarian investors often view it as a potential buying opportunity, as the market may be oversold. However, caution is advised as continued bearish pressure could drive prices further down. Monitor market developments closely and consider your risk tolerance before making investment decisions during this period of intense market uncertainty.

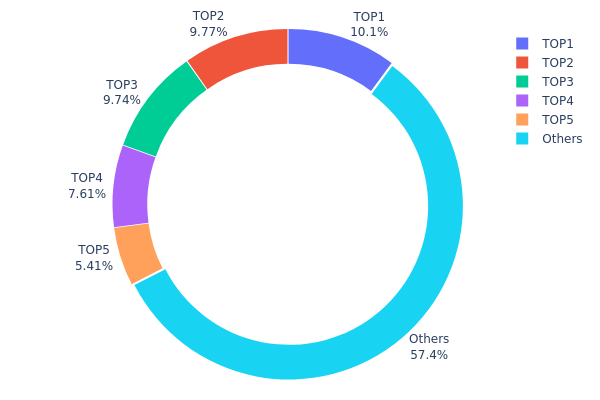

RWAINC Holding Distribution

The holding distribution chart reflects the allocation of token holdings across different on-chain addresses, serving as a critical indicator for assessing the degree of decentralization and potential concentration risks within a cryptocurrency's ecosystem. By examining the proportion of tokens held by top addresses versus smaller holders, analysts can evaluate whether a token's supply is widely distributed or controlled by a limited number of entities, which directly impacts market stability and manipulation susceptibility.

Based on the current data, RWAINC exhibits moderate concentration characteristics. The top five addresses collectively hold approximately 42.61% of the total supply, with the largest single address controlling 10.11% (100,000K tokens). The second and third largest holders possess 9.76% and 9.73% respectively, indicating a relatively balanced distribution among major stakeholders. Meanwhile, the remaining addresses outside the top five account for 57.39% of the supply, suggesting that over half of RWAINC's tokens are distributed across a broader holder base. This distribution pattern indicates neither extreme concentration nor complete decentralization, positioning RWAINC within a moderate risk zone regarding centralization concerns.

From a market structure perspective, this holding distribution presents both advantages and vulnerabilities. The presence of several large holders with similar stakes creates a multi-polar structure that may prevent single-entity manipulation while maintaining sufficient liquidity for major transactions. However, the combined holdings of the top five addresses approaching 43% introduces potential price volatility risks, as coordinated selling pressure from these entities could significantly impact market prices. The substantial portion held by smaller addresses (57.39%) provides a foundation for organic trading activity and community participation, which contributes to on-chain structural stability and reduces the likelihood of complete market control by whale addresses.

Click to view current RWAINC Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0ac6...2ca401 | 100000.00K | 10.11% |

| 2 | 0xef66...a0e71e | 96574.39K | 9.76% |

| 3 | 0x886d...c0b9af | 96317.42K | 9.73% |

| 4 | 0x260d...50f23c | 75247.48K | 7.60% |

| 5 | 0x4e3a...a31b60 | 53535.51K | 5.41% |

| - | Others | 567245.76K | 57.39% |

II. Core Factors Influencing RWAINC's Future Price

Supply Mechanism

- Tokenization-Driven Supply Model: RWAINC operates on a real-world asset (RWA) tokenization framework, where token supply correlates with underlying asset backing. The tokenization process aims to enhance liquidity and transparency in asset management.

- Historical Patterns: RWA tokens have demonstrated resilience during inflationary periods due to their asset-backed nature, which provides inherent value support compared to purely speculative cryptocurrencies.

- Current Impact: As the RWA market continues its early-stage expansion with current valuations exceeding $17 billion, the supply dynamics remain influenced by institutional adoption rates and regulatory frameworks governing asset tokenization.

Institutional and Major Holder Dynamics

- Institutional Holdings: The RWA sector is experiencing exponential growth driven by institutional adoption, with industry projections suggesting potential market expansion to $30 trillion by 2030. Institutional interest remains concentrated in sectors like private credit, commodities, and equities.

- Corporate Adoption: Technology advancement and institutional participation continue to drive RWA market development, with U.S. Treasury-backed tokens representing nearly 50% of the current RWA market, indicating growing institutional confidence.

- National Policies: Digital assets, including RWA tokens, are increasingly subject to traditional market macro variables, including interest rate policies, inflation trends, policy uncertainty, and global liquidity environments.

Macroeconomic Environment

- Monetary Policy Impact: Central bank interest rates and inflation policies significantly influence RWA token investment attractiveness. Changes in monetary policy direction may alter institutional allocation strategies toward tokenized assets.

- Inflation Hedge Characteristics: Real asset-backed RWA tokens possess anti-inflation properties, with demand potentially increasing during inflationary periods as investors seek value preservation through tangible asset exposure.

- Geopolitical Factors: Global economic conditions and geopolitical developments affect RWA market sentiment and capital flows. The convergence of digital assets with traditional financial markets means RWA tokens face similar macro-level risk exposures.

Technology Development and Ecosystem Building

- Blockchain Technology Integration: RWAINC benefits from technological progress in blockchain infrastructure, enabling improved asset management efficiency through reduced transaction and management costs, enhanced liquidity, and better pricing efficiency.

- Tokenization Infrastructure: The development of tokenization frameworks aims to stimulate practical blockchain applications and innovation in the financial system, facilitating broader adoption of real-world asset digitization.

- Ecosystem Applications: The RWA ecosystem is expanding from blockchain-native applications toward broader financial markets, with projections indicating tokenized real-world asset scales could exceed $18 trillion by 2033, representing significant compound annual growth from 2025 onwards.

III. 2026-2031 RWAINC Price Prediction

2026 Outlook

- Conservative prediction: $0.00161 - $0.00241

- Neutral prediction: $0.00241 (average estimate)

- Optimistic prediction: $0.00303 (requires favorable market conditions)

Based on the forecast data, RWAINC may experience a slight decline of approximately 1% during 2026, with prices potentially ranging between $0.00161 and $0.00303. The average price is expected to stabilize around $0.00241.

2027-2029 Outlook

- Market stage expectation: Recovery and gradual growth phase

- Price range predictions:

- 2027: $0.00204 - $0.00383 (10% growth anticipated)

- 2028: $0.00206 - $0.00445 (33% growth anticipated)

- 2029: $0.00286 - $0.00437 (57% growth anticipated)

- Key catalysts: Broader crypto market recovery, potential technology upgrades, and increased adoption rates

The mid-term period shows promising growth potential, with projections indicating steady price appreciation from 2027 through 2029. The average price could climb from $0.00272 in 2027 to $0.00386 by 2029.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00300 - $0.00486 (assuming steady market development)

- Optimistic scenario: $0.00363 - $0.00583 (assuming accelerated adoption and favorable regulatory environment)

- Transformative scenario: Above $0.00583 (requires significant market breakthroughs and widespread institutional adoption)

Long-term projections suggest continued upward momentum, with 2030 potentially seeing a 67% increase and 2031 reaching up to 82% growth. The average price in 2031 could reach approximately $0.00449, with the high estimate at $0.00583. However, investors should note that cryptocurrency markets remain highly volatile, and actual performance may vary significantly from these projections based on market conditions, regulatory changes, and technological developments.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00303 | 0.00241 | 0.00161 | -1 |

| 2027 | 0.00383 | 0.00272 | 0.00204 | 10 |

| 2028 | 0.00445 | 0.00327 | 0.00206 | 33 |

| 2029 | 0.00437 | 0.00386 | 0.00286 | 57 |

| 2030 | 0.00486 | 0.00412 | 0.003 | 67 |

| 2031 | 0.00583 | 0.00449 | 0.00363 | 82 |

IV. RWAINC Professional Investment Strategies and Risk Management

RWAINC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to the tokenized real-world asset (RWA) sector with a long-term investment horizon

- Operational recommendations:

- Consider accumulating positions during periods of significant price corrections, as RWAINC has experienced substantial volatility with a 93.83% decline over the past year

- Monitor the development progress of RWA Inc.'s ecosystem and its positioning within the projected $16-26 trillion tokenized RWA market by 2030

- Storage solution: Utilize Gate Web3 Wallet for secure storage of RWAINC tokens, which are deployed on the BASE blockchain

(2) Active Trading Strategy

- Technical analysis tools:

- Volume analysis: Monitor the current 24-hour trading volume of $17,829.17 to identify potential liquidity patterns and trading opportunities

- Support and resistance levels: Track the recent low of $0.002409 as a key support level and the 24-hour high of $0.002778 as near-term resistance

- Swing trading considerations:

- The token has shown significant short-term volatility with a 4.56% decline in 1 hour and 11.61% decline in 24 hours, presenting potential opportunities for experienced traders

- Consider the limited exchange availability (currently trading on 1 exchange) when planning entry and exit strategies

RWAINC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of cryptocurrency portfolio allocation

- Aggressive investors: 3-5% of cryptocurrency portfolio allocation

- Professional investors: Up to 7-10% with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Portfolio diversification: Balance RWAINC holdings with established cryptocurrencies and other RWA-related tokens to mitigate sector-specific risks

- Position sizing: Given the token's high volatility and significant year-to-date decline, implement strict position limits and stop-loss orders

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for active trading and ecosystem participation

- Security considerations: Verify contract address (0xe2b1dc2d4a3b4e59fdf0c47b71a7a86391a8b35a on BASE blockchain) before any transactions to avoid scam tokens

- Best practices: Never share private keys, enable two-factor authentication, and regularly update wallet software

V. RWAINC Potential Risks and Challenges

RWAINC Market Risks

- High volatility: The token has experienced a 93.83% decline over the past year, indicating substantial price instability and market uncertainty

- Limited liquidity: With only one exchange listing and 24-hour trading volume of approximately $17,829, liquidity constraints may impact execution of larger trades

- Market capitalization: Current market cap of approximately $816,324 represents a relatively small position in the cryptocurrency market with 0.000090% market dominance, suggesting higher susceptibility to market movements

RWAINC Regulatory Risks

- RWA sector regulations: As real-world asset tokenization develops, evolving regulatory frameworks may impact the project's operations and token utility

- Compliance requirements: The bridging of traditional finance and blockchain may subject the project to increased regulatory scrutiny across multiple jurisdictions

- Token classification: Potential regulatory changes regarding the classification of utility tokens could affect RWAINC's legal status and tradability

RWAINC Technical Risks

- Smart contract vulnerabilities: As with any blockchain-based token, potential security vulnerabilities in smart contracts could pose risks to token holders

- Blockchain dependency: The token operates on the BASE blockchain, creating dependency on the underlying network's performance and security

- Ecosystem development: The project's success relies on successful execution of its comprehensive RWA ecosystem, which faces technical implementation challenges

VI. Conclusion and Action Recommendations

RWAINC Investment Value Assessment

RWAINC represents a high-risk, high-potential opportunity in the emerging tokenized real-world asset sector. While the project positions itself to capture a portion of the projected $16-26 trillion RWA market by 2030, current market conditions reflect significant challenges, including a 93.83% year-over-year decline and limited trading infrastructure. The token's utility within the RWA Inc. ecosystem and focus on regulatory compliance may offer long-term value, but investors should recognize the substantial near-term risks and volatility. The current low price point of $0.002453, compared to its previous level of $0.14542, indicates either a potential entry opportunity or continued market skepticism that requires careful evaluation.

RWAINC Investment Recommendations

✅ Beginners: Avoid or allocate only minimal speculative capital (less than 1% of cryptocurrency portfolio). Focus on understanding RWA fundamentals and market dynamics before considering investment

✅ Experienced investors: Consider small position sizing (2-3% of cryptocurrency portfolio) with strict risk management. Monitor ecosystem development milestones and market sentiment indicators closely

✅ Institutional investors: Conduct comprehensive due diligence on regulatory compliance, team credentials, and technical infrastructure before allocation. Consider phased entry strategy with emphasis on risk-adjusted returns

RWAINC Trading Participation Methods

- Spot trading: Purchase RWAINC through available exchange platforms, with Gate.com offering trading access to the token

- Dollar-cost averaging: Implement systematic purchase strategy to mitigate timing risk in volatile market conditions

- Portfolio integration: Incorporate RWAINC as part of a diversified RWA sector allocation, balanced with other blockchain assets and traditional investments

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is RWAINC? What are its uses and application scenarios?

RWAINC is a global end-to-end real-world asset tokenization and trading ecosystem. It provides asset tokenization services, token issuance platforms, staking solutions, and an RWA exchange, enabling seamless investment in real-world assets through digital tokens.

What is the current price of RWAINC? What are its all-time high and all-time low prices?

RWAINC's current price fluctuates in real-time. Its all-time high reached $0.1436, while the all-time low stands at $0.0026. Recent performance shows +9.23% growth over the past 7 days.

RWAINC price prediction: How will the price trend develop in the next one month, half year, and one year?

RWAINC is projected to reach approximately $0.041098 within the next month, based on a 5% annual growth rate estimate. Long-term predictions for six months and one year require additional market data and analysis for more accurate forecasting.

What are the main factors affecting RWAINC price?

RWAINC price is primarily driven by supply and demand dynamics, market sentiment, and adoption rates. Trading volume, regulatory developments, and broader cryptocurrency market trends also significantly influence its valuation.

What are the advantages and disadvantages of RWAINC compared to similar tokens?

RWAINC enhances asset liquidity and reduces transaction costs, supporting financial globalization. Disadvantages include market volatility and regulatory uncertainty risks.

What are the risks of investing in RWAINC? How should I mitigate them?

RWAINC investments face market volatility, regulatory changes, and asset quality risks. Mitigate by conducting thorough project due diligence, verifying security audits from reputable firms, monitoring asset fundamentals, diversifying across asset types, understanding tax implications, and maintaining proper trading records for compliance.

Detailed Analysis of the Top 10 RWA Cryptocurrencies in 2025

Benefits of RWAs in Crypto

How to Earn with The RWA DePin Protocol in 2025

Detailed Analysis of RWA in Crypto Assets

Rexas Finance: A Blockchain-Powered Real-World Asset Tokenization Ecosystem

SIX Token (SIX): Core Logic, Use Cases and 2025 Roadmap Analysis

Promising Cryptocurrencies: Leading AI Tokens for Investment

Top Cold Wallets for Cryptocurrency: Rankings

What Is a Cryptocurrency Airdrop? Where to Find Opportunities and How to Profit in the Current Landscape

Comprehensive Guide to Phil Konieczny's Cryptocurrency Investment Strategy and Philosophy

What is Raydium: A Complete Overview of the DEX on Solana Blockchain