2026 SBR Price Prediction: Expert Analysis and Market Outlook for the Next Bull Run

Introduction: SBR's Market Position and Investment Value

Saber (SBR), as a governance token for the leading cross-chain stablecoin exchange on Solana, has been facilitating asset transfers and providing liquidity infrastructure since its launch in 2021. As of 2026, SBR maintains a market capitalization of approximately $1.18 million, with a circulating supply of around 2.25 billion tokens, and the price hovering around $0.0005243. This asset, known as a "cross-chain liquidity protocol governance token," is playing an increasingly significant role in stablecoin trading and cross-chain asset mobility within the Solana ecosystem.

This article will comprehensively analyze SBR's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. SBR Price History Review and Market Status

SBR Historical Price Evolution Trajectory

- 2021: Saber launched as a cross-chain stablecoin exchange on Solana. The token reached a price peak of $0.960362 on September 10, with significant trading activity during the initial launch period.

- 2022-2025: The token experienced sustained downward pressure across multiple market cycles, with price declining gradually from previous levels.

- 2026: As of February 2, the price touched $0.00052206, representing a contraction from historical levels.

SBR Current Market Status

As of February 3, 2026, SBR is trading at $0.0005243. Over the past 24 hours, the token has experienced a price decline of 2.1%, with the 24-hour trading range spanning between $0.0005209 and $0.0005391. The 24-hour trading volume stands at approximately $12,385.95.

From a broader timeframe perspective, SBR has shown downward momentum across multiple periods: a 7.77% decline over the past week, a 35.98% decrease over the past month, and a 67.97% decline over the past year.

The token's market capitalization currently stands at approximately $1.18 million, with a fully diluted valuation of approximately $1.59 million. The circulating supply represents 2.25 billion SBR tokens, accounting for 22.45% of the maximum supply of 10 billion tokens. The market capitalization to fully diluted valuation ratio is 22.45%.

SBR maintains a market dominance of 0.000057%. The token is available for trading on 2 exchanges, with Gate.com being one of the platforms supporting SBR trading. The token holder count stands at approximately 39,910 addresses.

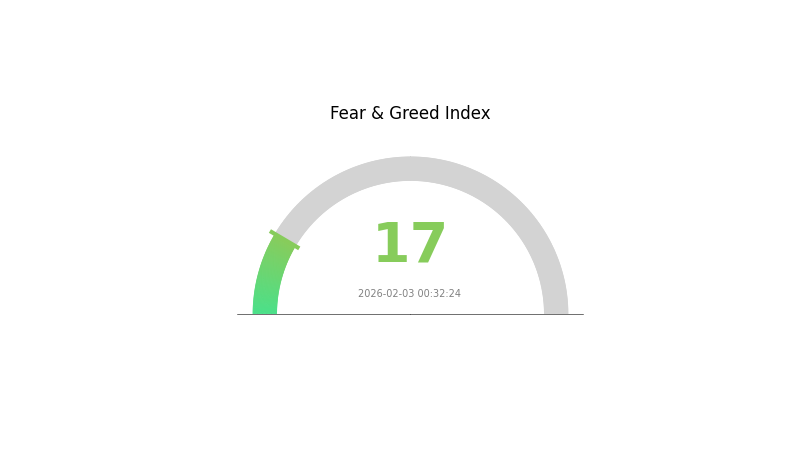

The current market sentiment indicator shows a Crypto Fear & Greed Index of 17, reflecting "Extreme Fear" conditions in the broader cryptocurrency market.

Click to view current SBR market price

SBR Market Sentiment Index

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with the Fear and Greed Index at 17. This exceptionally low reading indicates severe market pessimism and heightened investor anxiety. During such periods, panic selling often intensifies as participants rush to exit positions. However, extreme fear historically presents contrarian opportunities for long-term investors, as oversold conditions may precede market recoveries. Risk-averse traders should exercise caution, while those with higher risk tolerance might consider strategic accumulation at depressed price levels. Monitor key support levels closely and maintain proper risk management protocols.

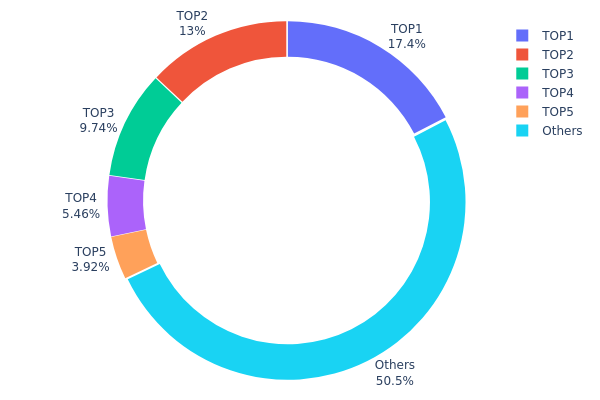

SBR Holding Distribution

The holding distribution chart illustrates how SBR tokens are allocated across different wallet addresses on the blockchain, providing critical insights into the concentration of token ownership and the overall decentralization level of the project. By analyzing the percentage of total supply held by top addresses versus smaller holders, this metric helps assess potential risks related to market manipulation and liquidity dynamics.

Based on current data, the top 5 addresses collectively control approximately 49.53% of the total SBR supply, with the largest single address holding 17.38% (561.15M tokens). The second and third largest addresses hold 13.03% and 9.74% respectively, while the remaining addresses outside the top 5 account for 50.47% of the supply. This distribution pattern suggests a moderate level of concentration, where nearly half of the circulating supply resides in a relatively small number of wallets. While not reaching the threshold of extreme centralization seen in some projects, this concentration level warrants careful monitoring as it indicates that a limited number of entities possess significant influence over market dynamics.

The current holding structure presents both opportunities and risks for market participants. The concentration of tokens in top addresses could indicate strong institutional participation or strategic reserves held by the project team and early investors, which may provide stability during market downturns. However, this structure also introduces potential volatility risks, as large holders possess the capacity to significantly impact price movements through substantial sell-offs or coordinated actions. The relatively balanced distribution between top holders and the broader community (50.47% in "Others") suggests a developing ecosystem with growing retail participation, though the market remains vulnerable to decisions made by major stakeholders.

Click to view current SBR Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | GESNnr...GjLjc2 | 561152.69K | 17.38% |

| 2 | EFE3j1...o4ewqR | 420647.01K | 13.03% |

| 3 | E2RvJg...qnatYy | 314360.75K | 9.74% |

| 4 | 6LY1Jz...kZzkzF | 176215.87K | 5.46% |

| 5 | u6PJ8D...ynXq2w | 126565.06K | 3.92% |

| - | Others | 1628049.55K | 50.47% |

II. Core Factors Influencing Future SBR Prices

Supply Mechanism

-

Raw Material Cost Pressure: SBR (Styrene-Butadiene Rubber) production heavily relies on butadiene and styrene as key raw materials. Butadiene accounts for over 70% of production costs, making its price volatility the primary driver of SBR pricing dynamics. Supply constraints in butadiene, coupled with escalating crude oil prices, directly translate into elevated SBR production costs.

-

Historical Patterns: Historical data demonstrates a strong positive correlation (coefficient >0.92) between butadiene prices and SBR prices. From November 2025 to January 2026, butadiene prices surged 58.8% from 6,800 yuan/ton to 10,800 yuan/ton, driving SBR production costs upward by approximately 38%. This cost transmission mechanism has consistently influenced SBR market pricing throughout industry cycles.

-

Current Impact: As of late January 2026, domestic butadiene port inventories declined 30.8% to 12.8 thousand tons, while production facility utilization rates dropped to 72%. Meanwhile, downstream rubber processing plants maintained 78% utilization rates, creating a supply-demand mismatch. Export demand acceleration and production facility maintenance further tightened butadiene availability, establishing rigid cost support for SBR prices in the near term.

Industrial Demand Dynamics

-

Tire Industry Recovery: The tire sector, consuming over 69% of global SBR output, exhibits improving order momentum. As of January 2026, domestic all-steel tire order rates reached 75-80%, while semi-steel tire orders stood at 80-85%, representing 5-8 percentage point improvements month-over-month. The EU's elimination of anti-dumping duties on Chinese PCR tires effective January 21, 2026, is projected to boost first-quarter exports to Europe by 25-30%, stimulating substantial SBR demand growth.

-

New Energy Vehicle Support: Rapid expansion of the electric vehicle market creates specialized demand for high-performance SBR. EV tires require superior low rolling resistance and durability characteristics that functionalized SBR uniquely provides. In 2024, functionalized SBR penetration in EV tire applications reached 28%, with projections indicating 50% penetration by 2027 and 70% by 2030. With domestic NEV sales reaching 9.8 million units in 2025 (up 35.6% year-over-year) and expectations exceeding 12 million units in 2026, this segment represents a significant long-term demand catalyst.

-

Industrial Application Diversification: Beyond tires, SBR finds expanding applications in adhesives, footwear, conveyor belts, and polymer-modified asphalt. The adhesive segment is projected to achieve the highest CAGR of 4.52% through 2030, driven by infrastructure development across Asia-Pacific markets and evolving material performance requirements.

Macroeconomic Environment

-

Monetary Policy Influence: The Federal Reserve's December 2025 decision to reduce rates by 25 basis points improved sentiment across commodity markets, driving capital inflows into chemical sectors including rubber products. Accommodative monetary policies in major economies generally support industrial commodity demand through lower financing costs and improved business investment conditions.

-

Infrastructure Investment Support: Accelerated highway and airport construction projects, particularly concentrated in Asia-Pacific regions, drive demand for polymer-modified asphalt applications utilizing SBR. This represents a long-term structural demand factor with multi-year visibility.

-

Geopolitical Considerations: International crude oil price fluctuations stemming from geopolitical tensions directly impact feedstock costs for SBR production. Regional production capacity adjustments, with facility closures in Europe and Japan-Korea due to high energy costs and environmental regulations, are concentrating future capacity additions in China, potentially reshaping global supply dynamics.

Technology Development and Market Evolution

-

Solution SBR (S-SBR) Advancement: S-SBR technology, offering superior performance characteristics for low rolling resistance tires, is recording the fastest growth rate at 4.34% CAGR through 2030. Automotive OEMs are achieving 10% tread weight reductions through functionalized S-SBR applications, driving adoption in premium vehicle segments.

-

Regulatory Standards Enhancement: ASEAN mandatory wet grip labeling requirements are accelerating adoption of high vinyl content S-SBR formulations. EU and Chinese market transitions toward low rolling resistance tire standards create sustained demand for advanced SBR grades.

-

Competitive Material Dynamics: Thermoplastic elastomer (TPE) substitution in footwear applications represents a headwind, particularly in Asia-Pacific markets. However, SBR maintains cost-performance advantages in tire applications where substitution faces technical limitations.

-

Recycling Quota Impacts: China's recycling quota adjustments for conveyor belt applications may modestly reduce virgin SBR demand in industrial segments, though tire sector demand growth substantially offsets this effect.

The convergence of supply-side cost pressures, recovering industrial demand, accommodative macroeconomic conditions, and technological advancement establishes a multi-factor support framework for SBR prices. Short-term dynamics are dominated by butadiene supply tightness and seasonal demand patterns, while medium to long-term trajectories will reflect new energy vehicle market expansion, infrastructure investment cycles, and capacity rationalization across global production networks.

III. 2026-2031 SBR Price Forecast

2026 Outlook

- Conservative forecast: $0.00036 - $0.00052

- Neutral forecast: Around $0.00052

- Optimistic forecast: Up to $0.00057 (subject to favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: Gradual growth phase with moderate volatility as the token seeks broader market recognition

- Price range forecast:

- 2027: $0.0004 - $0.00062 (approximately 4% potential increase)

- 2028: $0.00053 - $0.00084 (approximately 11% potential increase)

- 2029: $0.00043 - $0.0009 (approximately 35% potential increase)

- Key catalysts: Platform development milestones, strategic partnerships, market sentiment shifts, and overall crypto market performance

2030-2031 Long-term Outlook

- Baseline scenario: $0.00055 - $0.00081 (assuming steady ecosystem development and sustained market interest)

- Optimistic scenario: $0.00078 - $0.001 (contingent on significant adoption growth and favorable regulatory environment)

- Transformative scenario: Up to $0.00117 by 2031 (requiring breakthrough developments, mainstream adoption, and exceptionally bullish crypto market conditions with approximately 72% potential growth)

- 2026-02-03: SBR trading within early-stage price discovery range as market participants evaluate long-term value proposition

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00057 | 0.00052 | 0.00036 | 0 |

| 2027 | 0.00062 | 0.00055 | 0.0004 | 4 |

| 2028 | 0.00084 | 0.00058 | 0.00053 | 11 |

| 2029 | 0.0009 | 0.00071 | 0.00043 | 35 |

| 2030 | 0.001 | 0.00081 | 0.00055 | 53 |

| 2031 | 0.00117 | 0.0009 | 0.00078 | 72 |

IV. SBR Professional Investment Strategy and Risk Management

SBR Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors who believe in Solana ecosystem development and cross-chain stablecoin infrastructure

- Operational Recommendations:

- Consider accumulating positions during price dips, as SBR has declined approximately 68% over the past year

- Monitor Saber protocol governance updates and liquidity provider incentive adjustments

- Utilize secure storage solutions such as Gate Web3 Wallet for long-term holdings

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Current 24-hour trading volume stands at approximately $12,385, indicating relatively low liquidity that may impact execution

- Price Range Monitoring: Track the recent 24-hour range between $0.0005209 and $0.0005391 for short-term fluctuations

- Swing Trading Considerations:

- Be aware of the token's high volatility, with a 7-day decline of approximately 7.77%

- Consider the limited exchange availability (currently listed on 2 exchanges) which may affect liquidity

SBR Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: Limit exposure to 1-2% of total portfolio given the token's significant year-over-year decline

- Aggressive Investors: May consider 3-5% allocation while maintaining strict stop-loss disciplines

- Professional Investors: Could allocate up to 5-10% with active hedging strategies and diversified DeFi exposure

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance SBR holdings with other Solana ecosystem tokens and stablecoins

- Position Sizing: Avoid concentrating more than a small percentage in a single DeFi protocol token

(III) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet offers secure storage for Solana-based tokens like SBR

- Cold Storage Option: Consider hardware wallet solutions for large holdings to minimize security risks

- Security Precautions: Never share private keys, enable two-factor authentication, and verify all transaction details before confirmation

V. SBR Potential Risks and Challenges

SBR Market Risks

- Price Volatility: SBR has experienced significant price decline of approximately 68% year-over-year, reflecting broader market challenges

- Limited Liquidity: With trading on only 2 exchanges and relatively low 24-hour volume, large transactions may face slippage

- Market Capitalization: The current market cap of approximately $1.18 million represents a small-cap token with elevated volatility risks

SBR Regulatory Risks

- DeFi Protocol Oversight: Evolving regulatory frameworks for decentralized exchanges and liquidity protocols may impact operations

- Cross-chain Transaction Compliance: Regulatory scrutiny of cross-chain asset transfers could affect Saber's core functionality

- Governance Token Classification: Potential regulatory challenges regarding the classification of governance tokens like SBR

SBR Technical Risks

- Smart Contract Vulnerabilities: As with all DeFi protocols, potential security risks exist in the underlying smart contracts

- Solana Network Dependency: SBR's performance is closely tied to Solana blockchain stability and network congestion issues

- Competition: Other cross-chain stablecoin exchanges and liquidity protocols may challenge Saber's market position

VI. Conclusion and Action Recommendations

SBR Investment Value Assessment

SBR serves as the governance token for Saber, a cross-chain stablecoin exchange on Solana. While the protocol provides critical infrastructure for stablecoin liquidity, the token has faced significant headwinds with substantial price declines over the past year. The limited exchange availability and relatively low trading volume present liquidity challenges. Long-term value depends on Saber protocol adoption, Solana ecosystem growth, and effective governance participation. Short-term risks include continued volatility, regulatory uncertainty, and competitive pressures in the DeFi space.

SBR Investment Recommendations

✅ Beginners: Start with minimal exposure (less than 1% of portfolio) and focus on understanding DeFi protocols and Solana ecosystem before increasing position size ✅ Experienced Investors: Consider small allocations (2-5%) as part of a diversified Solana ecosystem portfolio, with active monitoring of protocol developments ✅ Institutional Investors: Evaluate SBR within a broader DeFi infrastructure thesis, maintaining strict risk controls and liquidity management protocols

SBR Trading Participation Methods

- Spot Trading: Available on Gate.com and one other exchange, suitable for direct token purchases

- Liquidity Provision: Participate in Saber protocol as a liquidity provider to earn fees and potential SBR rewards

- Governance Participation: Hold SBR to engage in protocol governance decisions and parameter adjustments

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SBR token? What are its main uses and value?

SBR is an Ethereum-based meme token that gains value through strategic Bitcoin reserve narratives. Its primary utility lies in investment and trading, with value driven by market demand and community engagement within the web3 ecosystem.

What are the main factors affecting SBR price?

SBR price is primarily influenced by market demand, trading volume, and liquidity. Investor sentiment, market trends, technological innovations, and ecosystem development also significantly impact its price performance.

How to analyze SBR's technical and fundamental aspects to predict price?

Analyze fundamentals including team strength, project utility, and ecosystem adoption. Review technical factors like trading volume, price trends, support/resistance levels, and market momentum indicators to forecast SBR price movements.

What are the advantages and disadvantages of SBR compared to other DeFi governance tokens?

SBR offers low fees and high liquidity on Saber DEX, specializing in stablecoin and asset bundle trading. However, it faces competition from larger platforms like Raydium and Drift Protocol, with a smaller market cap and user base limiting its broader DeFi utility.

What risks exist when investing in SBR and how can they be avoided?

SBR investment risks include price volatility, regulatory uncertainty, and market fluctuations. To mitigate these risks, diversify your portfolio, maintain updated knowledge on regulatory developments, monitor market trends closely, and consider seeking guidance from qualified financial professionals before making investment decisions.

Based on historical data and market trends, what is the future price outlook for SBR?

SBR demonstrates strong fundamentals with steady market expansion. Historical data suggests positive momentum, with growing adoption and increasing trading volume supporting upward price trajectory in the coming years.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

Comprehensive Guide to Blockchain-Agnostic Protocols

Comprehensive Guide to Cryptocurrency Trading Platform Registration Bonuses

Isamu Kaneko’s Connection to Bitcoin | The P2P Philosophy Legacy of the Winny Developer

Free Money for Registration in App: Crypto Bonus Guide

How to Create and Profitably Sell NFTs: The Complete Guide