2026 SENSO Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: SENSO's Market Position and Investment Value

Sensorium (SENSO), positioned as a global social VR media platform token, has been developing since its launch in 2020 to create immersive entertainment experiences through the Sensorium Galaxy virtual world. As of 2026, SENSO maintains a market capitalization of approximately $210,385, with a circulating supply of around 70.27 million tokens, and the price hovering around $0.002994. This asset, recognized as a pioneer in the VR entertainment ecosystem, is playing an increasingly significant role in bridging virtual reality experiences with blockchain technology.

This article will comprehensively analyze SENSO's price trajectory from 2026 to 2031, examining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. SENSO Price History Review and Market Status

SENSO Historical Price Evolution Trajectory

- 2020: SENSO was launched in May 2020, marking the beginning of its trading journey in the cryptocurrency market

- 2021: The token reached its all-time high of $3.28 on November 21, 2021, reflecting strong market interest during the broader crypto market rally

- 2022-2024: Following the peak, SENSO entered a prolonged correction phase alongside the broader market downturn

- 2025: The token recorded its all-time low of $0.000012 on August 28, 2025, representing a significant decline from its historical peak

SENSO Current Market Status

As of February 8, 2026, SENSO is trading at $0.002994, showing a modest 24-hour increase of 0.33%. The token has experienced a 0.037% gain over the past hour, indicating short-term stability. However, the 7-day performance shows a decline of 4.39%, while the 30-day trend reflects a 3.26% decrease. Over the past year, SENSO has declined by 82.31%, highlighting ongoing challenges in the market.

The current trading volume stands at $15,106.10 over 24 hours, with a circulating supply of 70,269,127 SENSO tokens out of a total supply of 715,280,000. The market capitalization is approximately $210,385.77, representing a 0.000084% share of the overall cryptocurrency market. The token ranks 3876th by market capitalization, with a fully diluted valuation of $2,141,548.32.

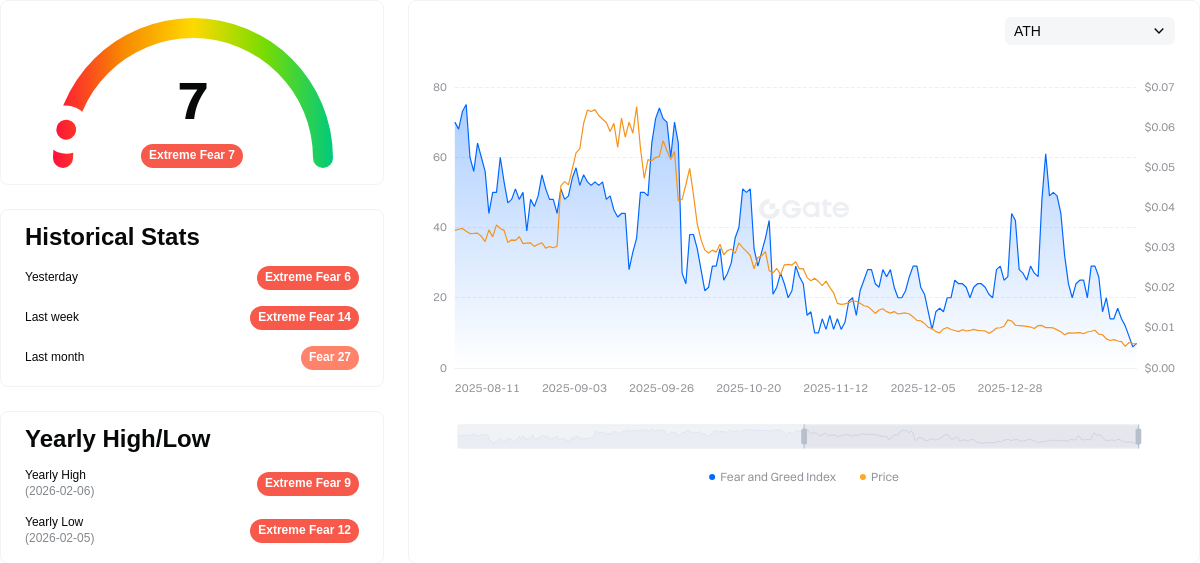

SENSO's market cap to fully diluted valuation ratio stands at 1.19%, suggesting that a relatively small portion of the total supply is currently in circulation. The token is held by 3,571 addresses and is traded on Gate.com. The current Fear and Greed Index reading of 7 indicates "Extreme Fear" in the broader cryptocurrency market, which may be influencing SENSO's price action.

Click to view the current SENSO market price

SENSO Market Sentiment Index

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the SENSO index plummeting to 7. This exceptionally low reading reflects heightened market anxiety and risk aversion among investors. During such periods, extreme fear often presents opportunities for long-term investors seeking discounted entry points. However, caution is warranted as further market volatility may occur. Monitor key support levels closely and consider dollar-cost averaging strategies to navigate this turbulent sentiment environment. Stay informed through Gate.com's market analytics tools for real-time insights into market dynamics.

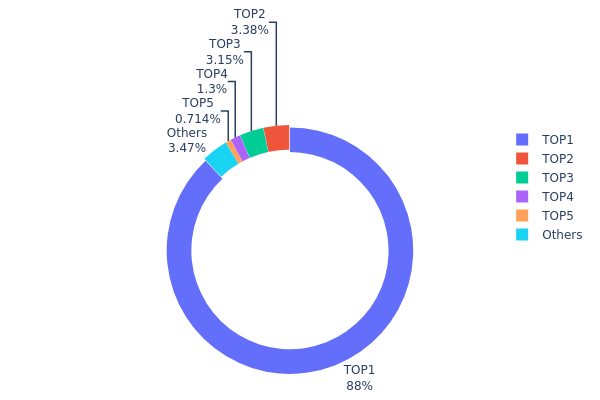

SENSO Holding Distribution

According to the latest on-chain data, SENSO exhibits an extremely high degree of concentration in its holding distribution. The top-ranked address holds 5.205 billion tokens, accounting for 87.99% of the total supply, demonstrating overwhelming dominance. The second and third addresses hold 200 million and 186.396 million tokens respectively, representing 3.38% and 3.15% of the supply. The top five addresses collectively control 96.52% of the circulating supply, while all other addresses combined hold only 3.48%. This extreme concentration pattern indicates that SENSO's on-chain structure is heavily centralized, with a single dominant address controlling nearly 90% of the token supply.

This highly concentrated holding distribution poses significant structural risks to the SENSO market. The dominant address possesses substantial pricing power and could theoretically trigger severe price fluctuations through large-scale sell-offs or transfers. For ordinary investors, this concentration level implies reduced market liquidity and heightened vulnerability to single-entity manipulation. Additionally, if the top address represents project team reserves or early investor holdings without transparent lock-up mechanisms, market confidence may be adversely affected. From a decentralization perspective, SENSO's current distribution structure deviates substantially from the ideal state of distributed holdings across blockchain networks.

Nevertheless, extreme concentration does not necessarily indicate imminent market risk. If the top address belongs to verified project treasury reserves, exchange cold wallets, or staking contract addresses with transparent operational mechanisms, this structure may reflect normal project operational requirements. Investors should conduct thorough due diligence on the nature and historical behavior of these large holding addresses while monitoring any significant changes in the holding distribution to assess potential market impacts.

Click to view current SENSO Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...000001 | 5205000.00K | 87.99% |

| 2 | 0x9c2f...d400fb | 200000.00K | 3.38% |

| 3 | 0x45c3...bf38c9 | 186396.00K | 3.15% |

| 4 | 0xbc68...ce2172 | 76684.80K | 1.29% |

| 5 | 0x8c77...9726c3 | 42207.40K | 0.71% |

| - | Others | 204991.80K | 3.48% |

II. Core Factors Influencing SENSO's Future Price

Supply Mechanism

- Token Supply Dynamics: SENSO operates within a defined token supply framework that directly impacts its market value. Historical patterns suggest that changes in circulating supply can create significant price volatility.

- Historical Pattern: Past supply adjustments have demonstrated correlation with price movements, though specific historical data was not detailed in available materials.

- Current Impact: Supply mechanisms continue to play a foundational role in SENSO's price trajectory, with token distribution patterns potentially affecting market liquidity and investor sentiment.

Macroeconomic Environment

- Monetary Policy Impact: Traditional economic factors including interest rates, inflation, and GDP performance influence broader cryptocurrency market trends. When economic uncertainty rises or monetary policies shift, investors may seek alternative assets like SENSO, potentially increasing demand.

- Inflation Hedge Attribute: During periods of currency weakness due to inflation or policy changes, digital assets including SENSO may attract investors looking for value preservation options.

- Geopolitical Factors: International tensions and political developments create market uncertainty that can drive fluctuations in cryptocurrency valuations, including SENSO.

Technology Development and Ecosystem Building

- Metaverse Integration: SENSO demonstrates strong connection with metaverse technology, positioning it for significant value appreciation as virtual reality applications expand. The convergence of SENSO with metaverse platforms creates substantial potential for future application scenarios.

- VR/AR Technology Progress: Advancements in virtual reality and augmented reality technologies directly benefit SENSO's value proposition. As VR/AR technology matures and adoption increases, SENSO's utility within these ecosystems may expand correspondingly.

- Ecosystem Applications: The development of applications leveraging SENSO within virtual environments and immersive experiences contributes to its fundamental value. Growth in practical use cases within the Sensorium ecosystem supports long-term price potential.

III. 2026-2031 SENSO Price Forecast

2026 Outlook

- Conservative forecast: $0.0018 - $0.0041

- Neutral forecast: Around $0.00299

- Optimistic forecast: Up to $0.0041 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: Potential gradual recovery and consolidation phase

- Price range forecast:

- 2027: $0.00209 - $0.0039

- 2028: $0.0032 - $0.00443

- 2029: $0.00265 - $0.00514

- Key catalysts: Progressive adoption growth, ecosystem development, and broader market sentiment improvements

2030-2031 Long-term Outlook

- Baseline scenario: $0.00235 - $0.00641 (assuming steady market development)

- Optimistic scenario: $0.00463 - $0.0065 (with enhanced adoption and positive regulatory environment)

- Transformative scenario: Approaching $0.0065 (under exceptionally favorable conditions including significant technological breakthroughs and mass adoption)

- 2026-02-08: SENSO trading within initial forecast range ($0.0018 - $0.0041)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0041 | 0.00299 | 0.0018 | 0 |

| 2027 | 0.0039 | 0.00355 | 0.00209 | 18 |

| 2028 | 0.00443 | 0.00373 | 0.0032 | 24 |

| 2029 | 0.00514 | 0.00408 | 0.00265 | 36 |

| 2030 | 0.00641 | 0.00461 | 0.00235 | 53 |

| 2031 | 0.0065 | 0.00551 | 0.00463 | 83 |

IV. SENSO Professional Investment Strategy and Risk Management

SENSO Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Risk-tolerant investors who believe in the long-term potential of VR entertainment and metaverse development

- Operational Recommendations:

- Consider dollar-cost averaging to mitigate price volatility, particularly given the token's high historical fluctuation range

- Monitor Sensorium Galaxy platform development milestones and partnership announcements with major music festivals

- Use secure storage solutions like Gate Web3 Wallet for long-term holdings to maintain full custody control

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Track the 24-hour trading volume ($15,106) relative to market cap to identify potential breakout moments

- Support and Resistance Levels: Monitor the 24-hour range ($0.002974-$0.002999) to identify short-term trading opportunities

- Swing Trading Considerations:

- Given the low liquidity and small market cap, be prepared for potential slippage on larger orders

- Set strict stop-loss levels due to high volatility, as evidenced by the 82.31% annual decline

SENSO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio

- Aggressive Investors: 2-3% of crypto portfolio

- Professional Investors: Up to 5% with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance SENSO exposure with established crypto assets and other metaverse tokens

- Position Sizing: Limit single position size given the token's small market dominance (0.000084%)

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and convenient access to platform features

- Cold Storage Option: Hardware wallets for long-term holdings exceeding short-term trading needs

- Security Precautions: Enable two-factor authentication, never share private keys, and regularly verify contract addresses (0xC19B6A4Ac7C7Cc24459F08984Bbd09664af17bD1 on Ethereum)

V. SENSO Potential Risks and Challenges

SENSO Market Risks

- Extreme Volatility: The token has experienced significant price fluctuations, declining 82.31% over the past year from higher levels

- Limited Liquidity: With only $15,106 in 24-hour trading volume and 0.000084% market dominance, the token faces liquidity constraints

- Low Circulation Rate: Only 1.19% of the fully diluted market cap is currently in circulation, presenting potential dilution risk

SENSO Regulatory Risks

- VR and Metaverse Regulation: Evolving regulatory frameworks for virtual worlds and digital entertainment platforms may impact operations

- Token Classification: Potential regulatory scrutiny regarding the token's utility versus security classification

- Geographic Restrictions: Regulatory differences across jurisdictions may limit platform accessibility and token utility

SENSO Technical Risks

- Smart Contract Vulnerabilities: As an ERC-20 token, SENSO depends on Ethereum network security and the integrity of its smart contract code

- Platform Development Risk: The success of SENSO is closely tied to the Sensorium Galaxy platform's development and user adoption

- Competition: The VR entertainment and metaverse sector faces intense competition from established and emerging platforms

VI. Conclusion and Action Recommendations

SENSO Investment Value Assessment

SENSO represents a high-risk, speculative investment in the VR entertainment and metaverse sector. While the token offers exposure to an innovative concept combining virtual reality with music festivals and social experiences, it faces significant challenges including low liquidity, limited circulation, and substantial price decline over the past year. The project's long-term value proposition depends heavily on the successful execution of the Sensorium Galaxy platform and broader adoption of VR entertainment experiences. Short-term risks include continued price volatility, regulatory uncertainty, and competitive pressures in the rapidly evolving metaverse landscape.

SENSO Investment Recommendations

✅ Beginners: Consider avoiding SENSO until gaining more experience with established cryptocurrencies, or limit exposure to a minimal portion of your portfolio while thoroughly researching the project

✅ Experienced Investors: Only allocate a small speculative position (1-3% of crypto portfolio) with clearly defined risk parameters and exit strategies

✅ Institutional Investors: Conduct comprehensive due diligence on platform development progress, partnership agreements, and user adoption metrics before considering any position

SENSO Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and sale of SENSO tokens with various trading pairs

- Dollar-Cost Averaging: Regular small purchases to mitigate timing risk and build positions gradually

- Limit Orders: Use limit orders rather than market orders to minimize slippage given the token's low liquidity

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the historical price trend of SENSO token?

SENSO reached $3.25 in 2021, declined to $0.1655 in 2024, and further dropped to $0.0556 in 2025. Price continues downward in early 2026 amid market adjustments.

What are the main factors affecting SENSO price?

SENSO price is primarily influenced by supply and demand dynamics, Sensorium Galaxy platform technological advancements, entertainment industry partnerships, overall crypto market trends, and macroeconomic conditions.

What is the price prediction for SENSO in 2024-2025?

Based on available predictions, SENSO is forecasted to reach approximately $0.003077 in November 2025 and $0.003090 in December 2025. Long-term forecasts suggest potential growth trajectory into 2026.

What advantages does SENSO have compared to similar tokens?

SENSO specializes in blockchain data services with enhanced privacy and security features. Its decentralized architecture and unique data collection capabilities provide competitive advantages in market reliability and user protection.

What are the main risks of investing in SENSO?

Main risks include market volatility, price manipulation, regulatory uncertainty, and technical risks from network security and upgrades.

What are the technical foundations and application scenarios of SENSO?

SENSO is built on edge computing and cloning technology for advanced image processing. Its applications include permanent magnet synchronous motor vector control and distributed computing solutions for real-time data processing.

XRP Price Analysis 2025: Market Trends and Investment Outlook

Treasure NFT Marketplace: A 2025 Guide for Web3 Gamers and Investors

Mastering the Crypto Fear and Greed Index: 2025 Trading Strategies

What Is the Best Crypto ETF in 2025: Top Performers and Beginner's Guide

What is SwissCheese (SWCH) and How Does It Democratize Investment?

What Is the Best AI Crypto in 2025?

How do derivatives market signals predict crypto price movements in 2025: funding rates, liquidations, and open interest data explained

How to analyze on-chain data: active addresses, transaction volume, whale distribution, and gas fees explained

How Will Zcash (ZEC) Price Fluctuate Between $49.96 and $1,422.48 by 2028?

What are the key derivative market signals indicating for the crypto derivatives market in 2026?

Rafał Zaorski – Who Is He? What Is His Net Worth?