2026 SKEB Price Prediction: Expert Analysis and Market Forecast for the Next Digital Asset Era

Introduction: SKEB's Market Position and Investment Value

Skeb Coin (SKEB), positioned as the native governance token of Japan's premier creator commission platform, has established itself as a unique bridge connecting global art enthusiasts with over 113,000 native Japanese creators since its inception. As of 2026, SKEB maintains a market capitalization of approximately $1.54 million, with a circulating supply of around 9.77 billion tokens, and the price hovering around $0.0001579. This asset, serving as the economic foundation of the Skeb ecosystem, plays an increasingly vital role in facilitating fair compensation for digital creators and enabling community-driven governance.

This article will comprehensively analyze SKEB's price trajectory from 2026 to 2031, incorporating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. SKEB Price History Review and Market Status

SKEB Historical Price Evolution Trajectory

- 2022: SKEB reached a notable price level of $0.01238736 on December 6, marking a significant milestone in its early trading period

- 2024: The token experienced a substantial decline, touching its historical low of $0.0000653 on August 6, reflecting broader market corrections

- 2025-2026: The price demonstrated considerable volatility, with a one-year decline of approximately 67.95%, dropping from higher levels to the current range

SKEB Current Market Situation

As of February 2, 2026, SKEB is trading at $0.0001579, with a 24-hour trading volume of $11,763.91. The token has experienced a 4.75% decrease over the past 24 hours, with intraday price fluctuations between $0.0001442 and $0.0001678.

The current circulating supply stands at 9.766 billion tokens, representing 97.66% of the total supply of 9.979 billion SKEB. The market capitalization is approximately $1.54 million, with the fully diluted valuation closely aligned at $1.58 million. The token maintains a market dominance of 0.000057% and is ranked #2214 in the cryptocurrency market.

SKEB has shown short-term price pressure, with a 4.97% decline over the past hour and a 3.36% decrease over the past week. The 30-day performance indicates a more pronounced downward trend of 29.54%. The token is currently trading significantly below its all-time high, representing a decline of over 98% from the December 2022 peak.

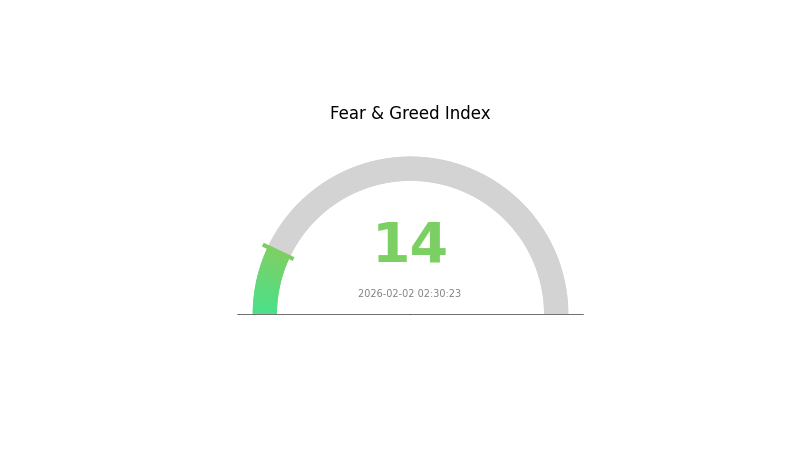

The market sentiment index currently stands at 14, indicating an "Extreme Fear" condition in the broader cryptocurrency market, which may be influencing SKEB's price action. The token is listed on 2 exchanges and has approximately 1,611 token holders.

Click to view current SKEB market price

SKEB Market Sentiment Indicator

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear conditions, with the index dropping to 14. This exceptionally low reading suggests heightened market anxiety and pessimism among investors. During such periods, market participants often demonstrate risk-averse behavior, leading to increased selling pressure and declining asset prices. Extreme fear can present opportunities for contrarian investors seeking favorable entry points. However, it also signals elevated volatility and uncertainty. Traders should exercise caution and implement robust risk management strategies while monitoring market developments closely for potential shifts in sentiment.

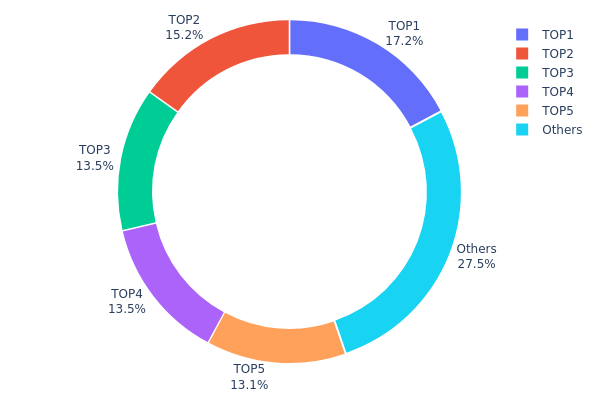

SKEB Holding Distribution

The holding distribution chart reflects the concentration of token holdings across different wallet addresses in the market. It provides insight into whether tokens are dispersed among numerous holders or concentrated in the hands of a few major addresses. This metric is crucial for evaluating the degree of decentralization and potential market manipulation risks within a cryptocurrency ecosystem.

Based on current data, SKEB exhibits a relatively concentrated holding structure. The top five addresses collectively control approximately 72.52% of the total supply, with the largest single address holding 17.24% (1,724,500,000 tokens), followed by four other major addresses each holding between 13.14% and 15.16%. The remaining 27.48% is distributed among other holders, indicating that the majority of tokens are concentrated within a small group of major stakeholders.

This concentration level presents both opportunities and risks for market participants. On one hand, such distribution may suggest strong conviction from early investors or strategic partners, potentially providing price stability during market downturns. On the other hand, the concentrated ownership structure increases the risk of significant price volatility if any major holder decides to liquidate their position. Furthermore, this concentration could limit true decentralization and potentially expose the market to coordinated price manipulation. The current holding pattern suggests that SKEB's market structure remains relatively centralized, with price discovery and trading dynamics heavily influenced by the actions of these top addresses. Investors should carefully monitor any movement from these major holders, as such activity could signal important shifts in market sentiment and trigger substantial price fluctuations.

Click to view current SKEB Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7ce5...2123df | 1724500.00K | 17.24% |

| 2 | 0x46c5...b9b8ef | 1516000.00K | 15.16% |

| 3 | 0x21eb...d98594 | 1352182.43K | 13.52% |

| 4 | 0x09bc...eff74b | 1346689.84K | 13.46% |

| 5 | 0xb743...27c194 | 1314044.17K | 13.14% |

| - | Others | 2746583.56K | 27.48% |

II. Core Factors Influencing SKEB's Future Price

Supply and Demand Dynamics

- Supply-Demand Relationship: The fundamental price driver for SKEB relies on the balance between token supply constraints and market demand growth. When supply remains limited while demand increases, upward price pressure typically emerges.

- Historical Patterns: Market data suggests that supply restrictions combined with rising demand have historically created favorable conditions for price appreciation in similar token environments.

- Current Impact: The interplay between current supply mechanisms and evolving market demand continues to shape SKEB's price trajectory, with supply limitations potentially supporting price levels as market interest develops.

Market Sentiment and Investor Behavior

- Investor Confidence: Market sentiment plays a significant role in SKEB's price movements, with investor confidence levels directly influencing buying and selling pressures.

- Large Transaction Activity: Substantial orders and significant trading volumes can impact short-term price trends, as market makers adjust their positions to accommodate major transactions.

- Behavioral Dynamics: The collective actions of market participants, including both retail and institutional investors, create momentum that influences price discovery mechanisms.

Trading Activity and Liquidity

- Market Maker Operations: To facilitate large order executions, market makers often need to acquire substantial token positions, which can generate upward price momentum during accumulation phases.

- Volume Patterns: Trading volume fluctuations provide insights into market participation levels and can signal shifts in investor interest that may precede price movements.

- Liquidity Considerations: The depth and availability of liquidity in SKEB markets affect price stability and the ease with which positions can be established or liquidated.

III. 2026-2031 SKEB Price Prediction

2026 Outlook

- Conservative Prediction: $0.0001

- Neutral Prediction: $0.00016

- Optimistic Prediction: $0.00017 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: The token may experience gradual growth with moderate volatility as the project develops its ecosystem and expands its user base.

- Price Range Prediction:

- 2027: $0.00012 - $0.00018

- 2028: $0.00017 - $0.00018

- 2029: $0.00014 - $0.00025

- Key Catalysts: Platform development progress, community growth, and broader market sentiment shifts could serve as primary drivers for price movement.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00011 - $0.00026 (assuming steady market conditions and continued project development)

- Optimistic Scenario: $0.00021 - $0.00034 (assuming significant platform adoption and positive market environment)

- Transformative Scenario: Up to $0.00034 (requires exceptional ecosystem expansion and favorable regulatory developments)

- 2026-02-02: SKEB trading around $0.0001 - $0.00017 range (current market positioning)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00017 | 0.00016 | 0.0001 | 0 |

| 2027 | 0.00018 | 0.00017 | 0.00012 | 4 |

| 2028 | 0.00018 | 0.00017 | 0.00017 | 8 |

| 2029 | 0.00025 | 0.00018 | 0.00014 | 11 |

| 2030 | 0.00026 | 0.00021 | 0.00011 | 33 |

| 2031 | 0.00034 | 0.00024 | 0.00021 | 49 |

IV. SKEB Professional Investment Strategies and Risk Management

SKEB Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term development of creator economy and Japanese content markets

- Operational Recommendations:

- Consider accumulating positions during market corrections when trading volume shows relative stability

- Monitor the growth of Skeb platform creator base and transaction volume as fundamental indicators

- Utilize Gate Web3 Wallet for secure storage with private key control

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume trends; current volume of approximately $11,763 suggests relatively low liquidity requiring careful position sizing

- Support and Resistance Levels: Track the 24-hour range between $0.0001442 and $0.0001678 for potential entry and exit points

- Swing Trading Considerations:

- Given the token's high volatility, implement strict stop-loss orders

- Consider the limited exchange availability (currently listed on 2 exchanges) when planning trade execution

SKEB Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Consider position sizing based on liquidity constraints and project development stage

(II) Risk Hedging Approaches

- Portfolio Diversification: Balance SKEB holdings with more established assets to offset volatility

- Position Sizing: Account for the token's relatively low market cap of approximately $1.54 million when determining exposure

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading needs with multi-layer security features

- Cold Storage Approach: Consider hardware wallet solutions for long-term holdings

- Security Precautions: Never share private keys; verify contract address (0x6D614686550B9E1c1DF4b2cD8f91C9D4df66C810 on Ethereum) before transactions; be cautious of phishing attempts

V. SKEB Potential Risks and Challenges

SKEB Market Risks

- High Volatility: Recent performance shows a 29.54% decline over 30 days and 67.95% decline over one year, indicating substantial price fluctuations

- Limited Liquidity: With only 2 exchanges listing the token and daily trading volume around $11,763, executing large orders may face slippage challenges

- Market Concentration: The token's focus on Japanese creator markets may limit global adoption and create regional dependency

SKEB Regulatory Risks

- Platform Compliance: Changes in regulations affecting creator platforms or commission-based services in Japan could impact ecosystem operations

- Token Classification: Evolving regulatory frameworks for utility and governance tokens may affect SKEB's legal status

- Cross-border Restrictions: Potential limitations on international transactions involving creator commissions could affect platform growth

SKEB Technical Risks

- Smart Contract Security: As an ERC-20 token, vulnerabilities in the contract code could pose risks to holders

- Centralization Concerns: The project's governance structure and token distribution mechanisms require ongoing monitoring

- Platform Dependency: Token value is closely tied to the success and adoption of the Skeb commission platform

VI. Conclusion and Action Recommendations

SKEB Investment Value Assessment

SKEB represents a niche opportunity in the creator economy sector, specifically targeting the Japanese art and content commission market with over 113,000 creators on the platform. The token serves as both a governance and utility token within the ecosystem, with mechanisms including transaction fees, staking, and buyback programs. However, investors should weigh the project's specialized market focus against significant challenges including limited liquidity, high volatility, and concentration risk. The substantial distance from its historical high suggests either significant correction or fundamental challenges requiring careful evaluation.

SKEB Investment Recommendations

✅ Beginners: Limit exposure to micro-allocation levels; prioritize education about the creator economy sector before committing capital; start with small test positions to understand volatility patterns ✅ Experienced Investors: Conduct thorough due diligence on platform metrics including creator growth and transaction volumes; consider SKEB as a speculative position within a diversified portfolio; implement strict risk management protocols ✅ Institutional Investors: Evaluate liquidity constraints carefully before position establishment; consider direct engagement with the project team for deeper insights; assess the token's role within broader creator economy investment themes

SKEB Trading Participation Methods

- Spot Trading: Available on Gate.com and one other exchange; verify trading pairs and liquidity before order placement

- Gradual Accumulation: Consider dollar-cost averaging approach to mitigate timing risk given price volatility

- Community Engagement: Monitor project developments through official Twitter channel and platform updates to inform investment decisions

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of SKEB token? How has its historical price trend been?

SKEB is an art commission platform, not a cryptocurrency token with trading markets. There is no token price or historical price data available, as SKEB operates as a service platform rather than a blockchain-based asset.

What will SKEB token price reach in the future? What are the price predictions for 2024-2025?

SKEB token was predicted to reach approximately $0.001451 in 2024 and $0.000411 in 2025 based on historical trend analysis. These projections reflect market dynamics during that period.

What is SKEB? What are its uses and application scenarios?

SKEB is a Japanese online creator commission platform launched in 2018, specializing in custom artwork and voice acting services. It facilitates efficient collaboration between global creators and users, serving as a key marketplace for professional creative work.

What are the main factors affecting SKEB price?

SKEB price is primarily influenced by market sentiment, trading volume, ecosystem development, community engagement, regulatory changes, and overall cryptocurrency market trends. Technology upgrades and adoption metrics also significantly impact price movements.

Is SKEB token investment safe? What risks should I pay attention to?

SKEB token investment carries market volatility risks. Success depends on project fundamentals, adoption rates, and market conditions. Conduct thorough research and assess your risk tolerance before investing. Monitor market trends and project developments regularly.

What advantages does SKEB have compared to other creative platform tokens?

SKEB features a deflationary tokenomics model with up to 50% buyback and burn mechanism, reducing platform fees for creators. Unlike other platforms, SKEB leverages Skeb's 2+ million user base, creating sustainable value growth through transaction volume increases.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Top Staking Coins for Passive Income

Free Money for App Registration 2025

What is crypto? How can you explain digital currencies to a young child?

Top Cold Wallets for Cryptocurrency: Rankings

Everything You Need to Know About Sybil Attacks