2026 SKOP Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: SKOP's Market Position and Investment Value

Skull Of Pepe Token (SKOP), as a community-driven meme token merging rebellious skull imagery with Pepe's iconic charm, has carved out a distinctive niche since its launch in May 2024. Inspired by Trystan's SKULL of Pepe NFT collection and developed by Jaggedsoft, this ERC20 token on the Base blockchain represents a cultural movement aimed at community empowerment. As of February 7, 2026, SKOP maintains a market capitalization of approximately $319,050 with a fully circulating supply of 150 million tokens, trading at around $0.002127. With over 123,000 holders, this asset demonstrates notable grassroots adoption within the meme token ecosystem.

This article will comprehensively analyze SKOP's price trajectory from 2026 through 2031, integrating historical patterns, market supply-demand dynamics, ecosystem developments, and broader macroeconomic conditions to provide investors with professional price forecasting and practical investment strategies. Given SKOP's recent volatility—including a 24-hour gain of 5.79% yet a 30-day decline of 24.31% and annual drop of 83.06% from its July 2025 all-time high of $0.1333—understanding the token's risk-reward profile becomes essential for informed decision-making in this speculative segment of the cryptocurrency market.

I. SKOP Price History Review and Current Market Status

SKOP Historical Price Evolution Trajectory

- May 2024: SKOP token launched on Gate.com with an initial price of $0.00316, marking its entry into the crypto market

- July 2025: Token reached a notable price level of $0.1333, reflecting strong market interest in the SKULL of Pepe NFT-inspired project

- February 2026: Price experienced significant adjustment, declining to $0.001878, representing a substantial correction from previous levels

SKOP Current Market Situation

As of February 7, 2026, SKOP is trading at $0.002127, with a 24-hour trading volume of $19,973.55. The token demonstrates a circulating supply of 150,000,000 SKOP, which represents 100% of its maximum supply. The current market capitalization stands at $319,050, with the fully diluted valuation matching this figure due to complete token circulation.

Recent price movements show mixed signals across different timeframes. Over the past hour, SKOP has gained 0.022%, while the 24-hour period reflects a 5.79% increase. However, broader timeframes indicate downward pressure, with a 7.48% decline over the past week and a 24.31% decrease over the past 30 days. The token's 24-hour price range spans from $0.001955 to $0.002127.

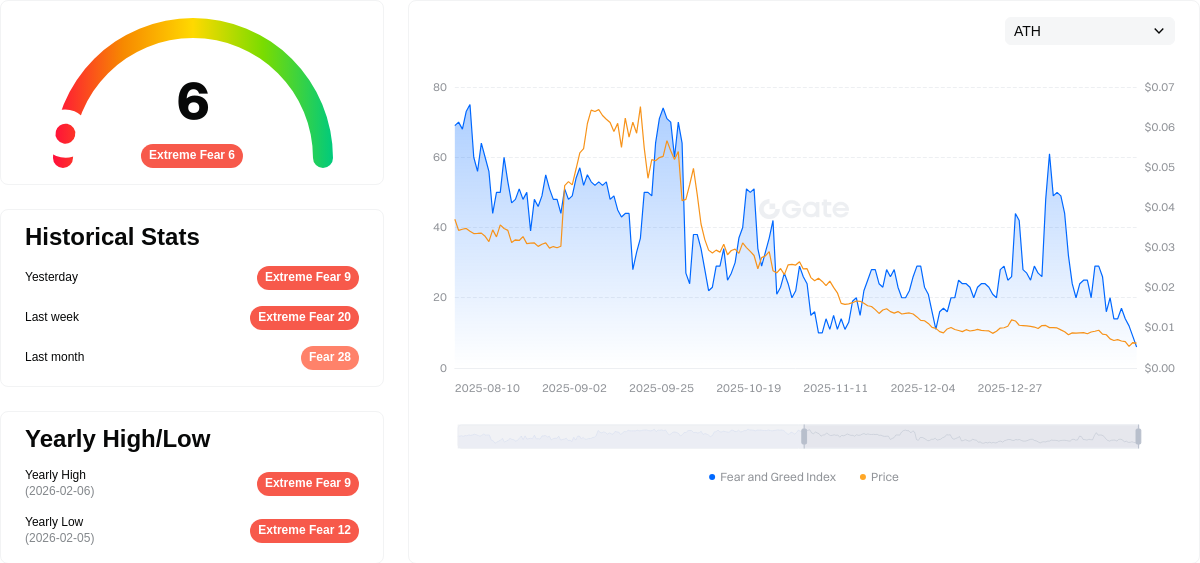

The project maintains an active holder base of 123,523 addresses and operates on the Base blockchain using the ERC20 standard. SKOP's market dominance represents 0.000012% of the total crypto market. The current market sentiment index registers at 6, indicating extreme fear conditions in the broader market environment.

Click to view current SKOP market price

SKOP Market Sentiment Index

02-07-2026 Fear and Greed Index: 6(Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to just 6 points. This indicates widespread investor anxiety and risk aversion across the digital asset sector. Market participants are displaying heightened caution, with sentiment heavily skewed toward pessimism. Such extreme fear levels historically present contrarian opportunities for long-term investors, as markets tend to recover from these psychological extremes. However, traders should exercise prudence and conduct thorough research before making investment decisions during periods of high market uncertainty.

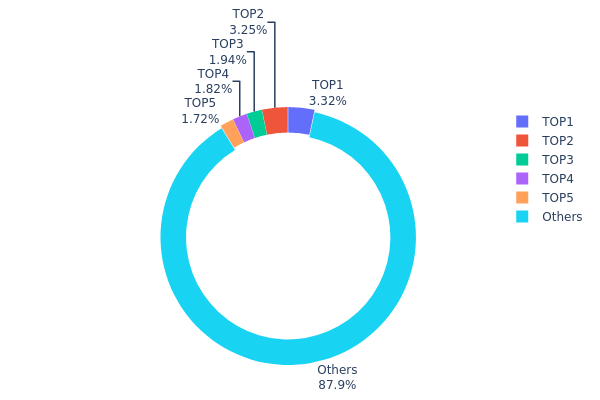

SKOP Holding Distribution

The holding distribution chart visualizes the allocation of SKOP tokens across different wallet addresses, serving as a crucial indicator of token concentration and decentralization levels within the network. By examining the proportion of tokens held by top addresses versus the broader holder base, this metric provides insights into potential centralization risks and market structure dynamics.

According to the latest on-chain data as of February 7, 2026, SKOP demonstrates a relatively decentralized holding pattern. The top five addresses collectively hold approximately 11.03% of the total token supply, with the largest single holder controlling only 3.32% (4,982.71K tokens). The second and third largest addresses hold 3.25% and 1.93% respectively, while the remaining holders outside the top five control a substantial 87.97% of the circulating supply. This distribution suggests a healthy dispersion of tokens across the network, with no single entity possessing dominant control over the asset.

From a market structure perspective, this balanced distribution reduces the risk of price manipulation and supports organic price discovery mechanisms. The absence of whale dominance typically correlates with lower volatility from large sell-offs and fosters greater confidence among retail participants. The relatively even distribution among top holders indicates mature community development and suggests that SKOP has progressed beyond early-stage accumulation phases where tokens might be concentrated among founding teams or early investors. This decentralized structure enhances the protocol's resilience against coordinated market actions and contributes to a more stable on-chain ecosystem.

Click to view current SKOP Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5da3...f4c115 | 4982.71K | 3.32% |

| 2 | 0x0d07...b492fe | 4876.70K | 3.25% |

| 3 | 0xc4cf...007b10 | 2903.40K | 1.93% |

| 4 | 0x8888...8e547c | 2726.22K | 1.81% |

| 5 | 0x5f71...195011 | 2587.46K | 1.72% |

| - | Others | 131923.51K | 87.97% |

II. Core Factors Influencing SKOP's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: The Federal Reserve maintained the federal funds rate at 4.25%-4.5% during its January 2025 meeting, following three consecutive rate cuts since September 2024. This stable monetary stance, combined with ongoing evaluation of economic indicators, creates a backdrop of measured policy adjustment that influences risk asset sentiment, including cryptocurrency markets.

-

Inflation Dynamics: Malaysia's Consumer Price Index (CPI) remained stable at 1.7% year-on-year in January 2025, with core CPI also showing annual consistency. This regional economic stability provides context for market participants assessing broader economic trends.

-

Geopolitical Factors: Recent trade policy announcements involving major economies have introduced elements of market uncertainty. International trade dynamics and evolving policy frameworks continue to shape global market trajectories, creating a complex environment for asset price formation.

Market Sentiment and Global Trends

-

Global Economic Interconnectedness: The interplay between political developments, economic indicators, and currency exchange rate fluctuations adds layers of complexity to asset valuation. Economic globalization means that factors affecting convertible currencies have increasingly intricate implications for digital asset markets.

-

Regional Investment Flows: Service sector investment has shown strength in certain markets, with capital allocation patterns reflecting evolving economic priorities. These broader investment trends can influence overall market liquidity and risk appetite across asset classes.

-

Market Uncertainty Management: The ongoing assessment of multiple economic variables—including policy trajectories, international relations, and sectoral performance—contributes to an environment where market participants continuously recalibrate expectations and positioning.

III. 2026-2031 SKOP Price Prediction

2026 Outlook

- Conservative Forecast: $0.0014 - $0.00213

- Neutral Forecast: $0.00213

- Optimistic Forecast: $0.00317 (requires favorable market conditions)

2027-2029 Outlook

- Market Stage Expectation: Potential gradual recovery phase with increasing adoption

- Price Range Forecast:

- 2027: $0.00138 - $0.00389 (approximately 24% growth anticipated)

- 2028: $0.00222 - $0.00425 (approximately 53% cumulative growth potential)

- 2029: $0.00308 - $0.00444 (approximately 76% cumulative growth potential)

- Key Catalysts: Market maturation, potential ecosystem expansion, and broader crypto market trends

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00271 - $0.0041 (assuming steady market development)

- Optimistic Scenario: $0.00448 - $0.00533 (assuming accelerated adoption and favorable regulatory environment)

- Transformative Scenario: $0.00618 (under exceptionally favorable market conditions with significant ecosystem growth)

- 2026-02-07: SKOP trading within early-stage price discovery range

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00317 | 0.00213 | 0.0014 | 0 |

| 2027 | 0.00389 | 0.00265 | 0.00138 | 24 |

| 2028 | 0.00425 | 0.00327 | 0.00222 | 53 |

| 2029 | 0.00444 | 0.00376 | 0.00308 | 76 |

| 2030 | 0.00533 | 0.0041 | 0.00271 | 92 |

| 2031 | 0.00618 | 0.00471 | 0.00448 | 121 |

IV. SKOP Professional Investment Strategy and Risk Management

SKOP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Community-focused investors who believe in meme token culture and are willing to accept higher volatility

- Operational Recommendations:

- Consider accumulating positions during market corrections, particularly when the token trades near recent support levels

- Monitor community engagement metrics and holder growth (currently at 123,523 holders) as indicators of long-term viability

- Storage Solution: Utilize Gate Web3 Wallet for secure self-custody with convenient access to DeFi opportunities on the Base network

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume (currently $19,973.55) relative to market cap ($319,050) to identify liquidity patterns

- Price Range Monitoring: Track the 24-hour range between $0.001955 (low) and $0.002127 (high) to identify breakout opportunities

- Swing Trading Key Points:

- Consider the token's recent performance showing +5.79% (24H) but -7.48% (7D), indicating short-term volatility suitable for active traders

- Set clear stop-loss levels given the token's distance from its historical high of $0.1333

SKOP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 7-10% within speculative meme token category

(2) Risk Hedging Solutions

- Diversification Strategy: Balance SKOP holdings with established cryptocurrencies and stablecoins to mitigate meme token volatility

- Position Sizing: Never allocate more than you can afford to lose, considering the token's -83.06% decline over the past year

(3) Secure Storage Solutions

- Self-Custody Recommendation: Gate Web3 Wallet provides secure storage for ERC20 tokens on the Base network with user-controlled private keys

- Hardware Wallet Solution: For larger holdings, consider transferring to cold storage while maintaining awareness of Base network compatibility

- Security Precautions: Always verify contract address (0x6d3B8C76c5396642960243Febf736C6BE8b60562) before transactions, enable two-factor authentication, and never share private keys or seed phrases

V. SKOP Potential Risks and Challenges

SKOP Market Risks

- Extreme Volatility: SKOP has demonstrated substantial price fluctuations, declining approximately 83% from its historical high, indicating significant downside potential during unfavorable market conditions

- Limited Liquidity: With daily trading volume of approximately $19,973.55 against a market cap of $319,050, liquidity constraints may impact ability to execute large orders without price slippage

- Meme Token Dependency: As a culture-driven token inspired by the Pepe meme and NFT collection, SKOP's value is heavily dependent on community sentiment and social media trends, which can shift rapidly

SKOP Regulatory Risks

- Meme Token Scrutiny: Regulatory authorities in various jurisdictions have increased focus on meme tokens and community-driven projects, which could impact trading accessibility

- Securities Classification Uncertainty: Potential regulatory changes regarding token classifications could affect SKOP's trading status on certain platforms

- Cross-Border Compliance: As regulatory frameworks evolve globally, compliance requirements for meme tokens may introduce operational challenges

SKOP Technical Risks

- Smart Contract Dependency: As an ERC20 token on the Base network, SKOP relies on the underlying smart contract security and the Base blockchain's operational stability

- Network Congestion: During periods of high Base network activity, transaction costs and confirmation times may increase, affecting trading efficiency

- Limited Exchange Availability: Currently listed on only 1 exchange, which concentrates liquidity risk and limits trading options for investors

VI. Conclusion and Action Recommendations

SKOP Investment Value Assessment

SKOP represents a community-driven meme token that merges cultural elements of the Pepe phenomenon with NFT-inspired artwork. With 123,523 holders and a fully circulating supply of 150 million tokens, the project demonstrates established community engagement. However, investors should carefully consider the token's substantial decline from its historical high and inherent volatility characteristics typical of meme tokens. The long-term value proposition depends heavily on sustained community interest and cultural relevance, while short-term risks include liquidity constraints, market sentiment shifts, and the speculative nature of meme-based cryptocurrencies.

SKOP Investment Recommendations

✅ Beginners: Start with minimal allocation (no more than 1-2% of total crypto portfolio) after thoroughly researching meme token risks. Use Gate Web3 Wallet for secure storage and familiarize yourself with Base network operations before investing.

✅ Experienced Investors: Consider SKOP as a small speculative position within a diversified meme token strategy. Monitor community metrics and trading volume trends, employing disciplined risk management with predetermined exit points.

✅ Institutional Investors: Approach with caution given limited liquidity ($19,973.55 daily volume) and single exchange listing. Conduct comprehensive due diligence on community sustainability and consider SKOP only as a micro-allocation within alternative digital asset portfolios.

SKOP Trading Participation Methods

- Spot Trading: Execute buy and sell orders directly on Gate.com, monitoring the 24-hour price range and volume indicators for optimal entry and exit points

- Self-Custody Management: Transfer tokens to Gate Web3 Wallet after purchase for enhanced security and direct control over your assets on the Base network

- Portfolio Diversification: Combine SKOP holdings with other digital assets to balance risk exposure, maintaining meme tokens as a minority component of overall crypto allocation

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SKOP and what is its current market value?

SKOP (Skulls of Pepe Token) is a cryptocurrency token in the Web3 ecosystem. As of February 2026, its current market value is approximately $0.0030 USD per token, with price subject to market fluctuations.

How can I predict SKOP token price movements in the future?

Analyze historical price data, trading volume trends, and market sentiment. Monitor on-chain metrics, community activity, and project developments. Use technical analysis tools and charts to identify patterns. Consider multiple data sources for informed predictions.

What factors influence SKOP price predictions and market trends?

SKOP price predictions are influenced by market sentiment, trading volume, government policies, and macroeconomic indicators. Supply and demand dynamics, project developments, and crypto market trends also significantly impact price movements and market cycles.

Is SKOP a good investment based on price prediction analysis?

SKOP shows strong potential for trend investors. Recent price momentum indicates positive market sentiment. Current market fundamentals suggest favorable short-term prospects for strategic investors seeking growth opportunities.

What are the risks associated with SKOP price speculation?

SKOP price speculation involves market volatility, uncertain price movements, and potential losses for traders. Price fluctuations can be significant due to market sentiment, liquidity conditions, and speculative trading activities. Participants should understand these inherent market dynamics before engaging.

How does SKOP price compare to other similar cryptocurrency tokens?

SKOP's market cap ranks #4244 on CoinGecko with BTC4.5376 valuation. In the last 7 days, SKOP declined -12.80%, outperforming similar Meme tokens down -20.50% and the broader market down -19.60%. SKOP's price uses volume-weighted average calculation.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Top 5 Meme Coins to Invest in 2025: Risks and Rewards

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Meme Coin Price Predictions for 2025:Factors Influencing Meme Coin Prices

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

MemeBox Price and Airdrop Guide 2025: What You Need to Know

What Is the Wyckoff Method? Crypto Trading Pattern Explained

Cryptocurrency for Beginners: Which Coin Should You Invest In

Comprehensive Guide to IOU Tokens

Comprehensive Guide to Mainnet in Cryptocurrency

What Is a Crypto Scam — Common Fraud Schemes and How to