2026 SNTR Price Prediction: Expert Analysis and Market Forecast for Sentre Token's Future Value

Introduction: SNTR's Market Position and Investment Value

Sentre (SNTR), as an open liquidity protocol built on the Solana blockchain, has been developing its ecosystem since its launch in 2022. As of February 2026, SNTR maintains a market capitalization of approximately $362,000, with a circulating supply of around 999.94 million tokens, and the price holds at $0.000362. This asset, characterized as an integrated Solana open platform combining DApps Store and liquidity protocol features, is playing an increasingly significant role in the DeFi development and liquidity aggregation space.

This article will comprehensively analyze SNTR's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment factors to provide investors with professional price forecasts and practical investment strategies.

I. SNTR Price History Review and Market Status

SNTR Historical Price Evolution Trajectory

- 2022: SNTR reached its all-time high of $0.053225 on January 8, 2022, marking a significant milestone in its early trading history

- 2025: The token experienced substantial downward pressure, reaching its all-time low of $0.00016367 on December 6, 2025, representing a notable decline from previous levels

SNTR Current Market Situation

As of February 6, 2026, SNTR is trading at $0.000362, with a 24-hour trading volume of $15,658.97. The token has demonstrated mixed short-term performance, with a 1-hour price increase of 0.22% and a 24-hour decline of 1.3%. Over the past week, SNTR has decreased by 2.34%, while showing a 30-day gain of 7.53%.

The current market capitalization stands at approximately $362,000, with a circulating supply of 999,943,579 tokens out of a maximum supply of 1,000,000,000 tokens, representing a circulation ratio of approximately 99.99%. The fully diluted market cap closely aligns with the current market cap at $362,000.

SNTR maintains a presence on the Gate.com exchange, with 2,332 token holders. The 24-hour price range has fluctuated between $0.0003426 and $0.0004992. The market sentiment indicator currently reflects extreme fear conditions, with a value of 9.

Over the past year, SNTR has experienced a decline of 40.30%, indicating challenging market conditions for the token during this period.

Click to view current SNTR market price

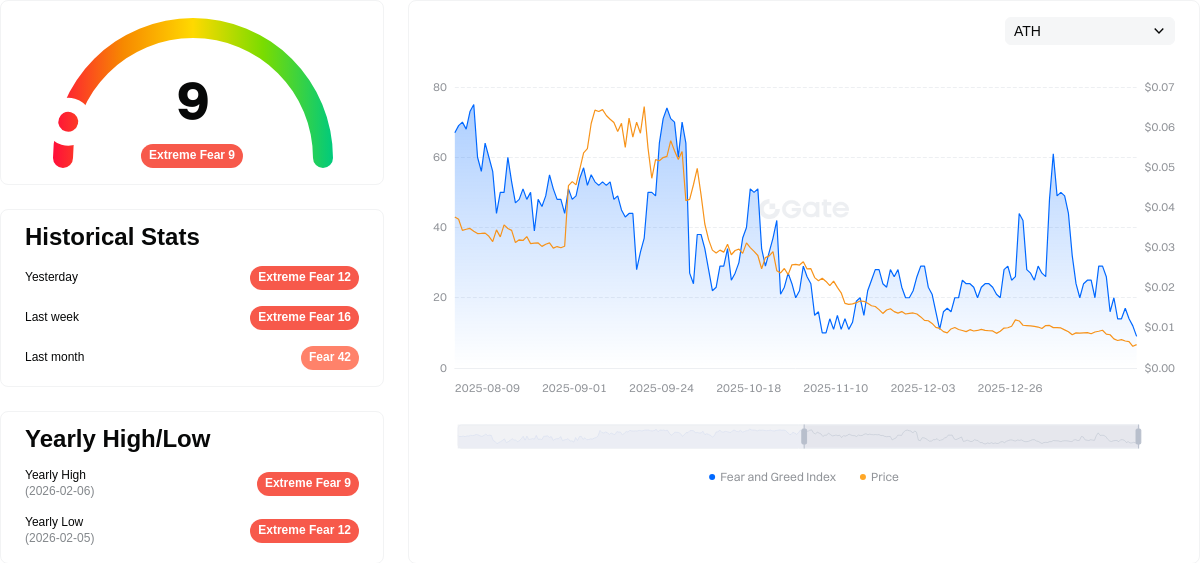

SNTR 市场情绪指标

2026-02-06 恐惧与贪婪指数:9(Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the SNTR index at just 9 points. This exceptionally low reading indicates widespread market pessimism and risk aversion among investors. During such periods of extreme fear, asset prices often reach capitulation levels, potentially creating opportunities for contrarian investors. However, heightened uncertainty and volatility persist. Market participants should exercise caution and avoid making impulsive decisions driven by emotional reactions. This sentiment environment typically reflects significant market corrections or broader economic concerns affecting the crypto sector.

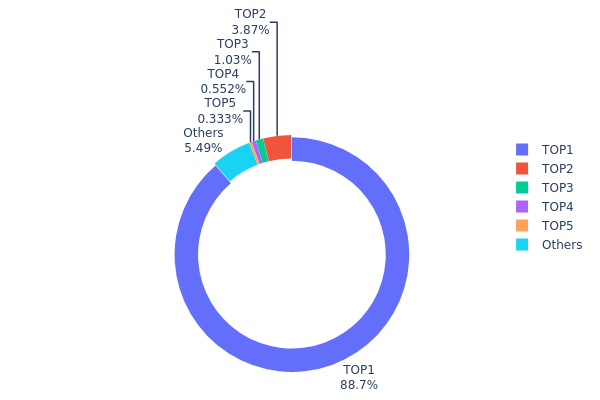

SNTR Holdings Distribution

The holdings distribution chart reveals the concentration of token ownership across different wallet addresses, serving as a critical indicator of decentralization and market structure health. For SNTR, the current distribution data presents a highly concentrated ownership pattern that warrants careful examination.

The top address holds an overwhelming 887,147.90K SNTR tokens, representing 88.72% of the total supply. This extreme concentration in a single wallet is followed by the second-largest holder with 38,690.99K tokens (3.86%), and the third with 10,270.50K tokens (1.02%). The top three addresses collectively control approximately 93.60% of all SNTR tokens, while the remaining addresses, including the fourth and fifth positions, hold less than 1% each. The "Others" category, encompassing all remaining addresses, accounts for merely 5.52% of the total supply.

This distribution pattern indicates an exceptionally high degree of centralization, which introduces significant concerns regarding market manipulation risk and price volatility. The dominant position held by the top address suggests potential control over supply dynamics, creating an asymmetric market structure where liquidity and price discovery mechanisms may be compromised. Such concentration typically correlates with increased susceptibility to sudden price movements, as large holders possess the capacity to influence market conditions through substantial buy or sell orders. From a decentralization perspective, this distribution reflects a weak on-chain governance structure, potentially limiting the project's resilience against single-point failures or coordinated actions by major stakeholders.

Click to view current SNTR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | AynAuE...6jm8of | 887147.90K | 88.72% |

| 2 | u6PJ8D...ynXq2w | 38690.99K | 3.86% |

| 3 | BHxt1d...6pH4vn | 10270.50K | 1.02% |

| 4 | 3oidmq...itc8yy | 5522.09K | 0.55% |

| 5 | 2cgswW...xqGgVQ | 3333.33K | 0.33% |

| - | Others | 54944.75K | 5.52% |

II. Core Factors Influencing SNTR's Future Price

Supply and Demand Dynamics

- Market Sentiment: Investor confidence and sentiment have a direct impact on SNTR price movements. Positive news regarding widespread adoption or significant technological breakthroughs can drive price appreciation.

- Supply-Demand Balance: The fundamental relationship between market supply and available demand plays a crucial role in determining SNTR's price trajectory.

Macroeconomic Environment

- Monetary Policy Impact: Global macroeconomic trends and policy changes from major central banks can influence cryptocurrency markets, including SNTR's performance.

- Regulatory Framework: Policy supervision and regulatory developments in different jurisdictions affect market confidence and trading activity.

- Economic Trends: Broader economic conditions and financial market dynamics contribute to SNTR's price volatility.

Technology and Innovation

- Technical Development: Technological innovations and advancements within the Sentre Protocol ecosystem may impact long-term value proposition.

- Market Positioning: SNTR's unique features and competitive advantages within the cryptocurrency landscape influence investor interest and adoption rates.

III. 2026-2031 SNTR Price Prediction

2026 Outlook

- Conservative Forecast: $0.00028 - $0.00036

- Neutral Forecast: $0.00036

- Optimistic Forecast: $0.00051 (requires favorable market conditions and sustained trading volume)

2027-2029 Outlook

- Market Phase Expectation: Gradual recovery phase with potential consolidation patterns as the token seeks to establish new support levels

- Price Range Forecast:

- 2027: $0.00034 - $0.00045

- 2028: $0.00026 - $0.00062

- 2029: $0.00032 - $0.00065

- Key Catalysts: Progressive year-over-year growth momentum, with projected price changes ranging from 20% to 46%, indicating potential market maturation and increased adoption

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00059 (assuming steady market development and maintained project fundamentals)

- Optimistic Scenario: $0.00074 in 2030 and $0.00091 in 2031 (contingent on sustained ecosystem growth and favorable regulatory environment)

- Transformative Scenario: Potential to reach upper price thresholds with cumulative price changes approaching 84% by 2031 (requires breakthrough partnerships, significant protocol upgrades, or exceptional market conditions)

- February 6, 2026: SNTR trading within the $0.00028 - $0.00051 range (initial phase of the projected multi-year trajectory)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00051 | 0.00036 | 0.00028 | 0 |

| 2027 | 0.00045 | 0.00043 | 0.00034 | 20 |

| 2028 | 0.00062 | 0.00044 | 0.00026 | 21 |

| 2029 | 0.00065 | 0.00053 | 0.00032 | 46 |

| 2030 | 0.00074 | 0.00059 | 0.0003 | 63 |

| 2031 | 0.00091 | 0.00067 | 0.0005 | 84 |

IV. SNTR Professional Investment Strategy and Risk Management

SNTR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to Solana DeFi ecosystem with moderate risk tolerance

- Operational Recommendations:

- Consider accumulating positions during market downturns, particularly when SNTR trades near support levels

- Monitor Solana ecosystem developments and SenSwap protocol updates that may impact long-term value

- Implement a secure storage solution using Gate Web3 Wallet for optimal asset protection

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use 50-day and 200-day moving averages to identify potential trend reversals and entry points

- Volume Analysis: Monitor 24-hour trading volume (currently $15,658.97) to assess market liquidity and participation

- Swing Trading Considerations:

- Observe the 24-hour price range ($0.0003426 - $0.0004992) to identify potential breakout or breakdown levels

- Consider the recent 30-day performance (+7.53%) when evaluating short-term momentum

SNTR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Moderate Investors: 3-5% of crypto portfolio allocation

- Experienced Investors: 5-10% of crypto portfolio allocation

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance SNTR holdings with established Solana ecosystem tokens to mitigate protocol-specific risks

- Position Sizing: Limit individual position size based on market capitalization ($361,979) and liquidity constraints

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and DApp interaction

- Cold Storage Option: Hardware wallet solutions for long-term holdings exceeding trading needs

- Security Precautions: Enable two-factor authentication, maintain private key backups, and avoid sharing sensitive information

V. SNTR Potential Risks and Challenges

SNTR Market Risks

- Liquidity Constraints: With a market cap of approximately $362,000 and limited exchange listings (1 exchange), SNTR faces potential liquidity challenges that may impact price stability

- High Volatility: The token has experienced notable price fluctuations, with a historical range from $0.00016367 to $0.053225, indicating substantial volatility risk

- Market Concentration: Trading primarily on Gate.com may create dependency risks and limit market depth

SNTR Regulatory Risks

- DeFi Protocol Scrutiny: As regulatory frameworks evolve, DeFi protocols like Sentre may face increased compliance requirements

- Jurisdictional Uncertainty: Changes in cryptocurrency regulations across different regions could impact protocol operations and token accessibility

- Liquidity Protocol Oversight: Automated market maker (AMM) mechanisms may attract regulatory attention as authorities develop DeFi-specific guidelines

SNTR Technical Risks

- Smart Contract Vulnerabilities: As with any DeFi protocol, potential security vulnerabilities in smart contracts could expose users to financial risks

- Solana Network Dependency: SNTR's reliance on Solana blockchain means network outages or performance issues could affect token functionality

- Protocol Development Risk: The success of Sentre's vision for an integrated DApps platform depends on continued technical innovation and adoption

VI. Conclusion and Action Recommendations

SNTR Investment Value Assessment

Sentre (SNTR) represents a DeFi infrastructure project within the Solana ecosystem, focusing on open liquidity protocols and DApp distribution. While the project demonstrates technical ambition through Sen OS and SenSwap, investors should carefully weigh the opportunities against notable challenges. The token's limited market capitalization, restricted exchange availability, and recent 1-year performance decline (-40.30%) suggest elevated risk levels. However, the 30-day positive momentum (+7.53%) and nearly complete circulating supply (99.99%) indicate some market stability factors.

SNTR Investment Recommendations

✅ Beginners: Consider observing from the sidelines initially; if interested, allocate only a minimal portion (1-2%) of your crypto portfolio and prioritize learning about DeFi protocols before investing

✅ Experienced Investors: Evaluate SNTR as a speculative position within a diversified Solana ecosystem portfolio; limit exposure to 3-5% and monitor protocol development milestones

✅ Institutional Investors: Conduct thorough due diligence on protocol security, team credentials, and competitive positioning; consider SNTR only as a micro-cap allocation within broader DeFi exposure strategies

SNTR Trading Participation Methods

- Spot Trading: Execute buy and sell orders on Gate.com with attention to liquidity conditions and market depth

- DCA Strategy: Implement dollar-cost averaging to mitigate timing risk, particularly suitable for long-term accumulation approaches

- Portfolio Integration: Incorporate SNTR as part of a diversified Solana DeFi exposure alongside more established protocols

Cryptocurrency investment carries extreme risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SNTR token and what are its uses?

SNTR is a cryptocurrency token issued on the Ethereum platform, designed for communication and data protection. It provides visual protection systems for messages, images, videos, and audio content on mobile devices.

SNTR price historical performance? What were past price movements?

SNTR has experienced significant price volatility. Historical data shows varying performance across different timeframes(1-day, 30-day, 60-day, 90-day, 1-year, and all-time periods). As of February 2026, real-time charts display detailed price action and trend analysis for comprehensive market perspective.

What are the main factors affecting SNTR price?

SNTR price is primarily influenced by market sentiment, adoption rate, regulatory policies, and technological development. Trading volume, investor confidence, and macroeconomic conditions also play significant roles in price movement.

SNTR未来价格可能会涨到多少?

SNTR's future price depends on market conditions and adoption. During bull markets, SNTR could see significant growth potential. However, exact future prices remain unpredictable and vary based on market dynamics.

How to analyze and predict SNTR price trends?

Analyze SNTR price trends using machine learning models, historical market data, and on-chain metrics. Monitor trading volume, market sentiment, and project developments. Consider technical analysis patterns and fundamental factors affecting Silent Notary ecosystem growth for informed price forecasting.

What are the investment risks of SNTR?

SNTR faces market volatility, regulatory changes, and competition risks. Cryptocurrency markets are highly unpredictable with price fluctuations. Project adoption and technological development uncertainty also affect value. Investors should assess their risk tolerance before investing.

What are the advantages of SNTR compared to other similar tokens?

SNTR offers superior traceability and transparency with immutable transaction records, rare among similar tokens. Its distributed ledger technology enhances security and efficiency, while its unique high-performance validation mechanism sets it apart in the market.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

Is Bitcoin Dollar-Cost Averaging a Smart Investment? A Detailed Look at Its Benefits and Drawbacks

How to Buy Solana Meme Coins: A Step-By-Step Guide

Stablecoins: Definition and Mechanism of Operation

Top 10 Best Decentralized Exchanges

What is GameFi? The Difference Between Traditional Gaming Projects and GameFi