2026 SOPHIA Price Prediction: Expert Analysis and Market Forecast for the Next Generation AI Token

Introduction: SOPHIA's Market Position and Investment Value

SophiaVerse (SOPHIA), positioned as a decentralized and open-source AGI superconscious encryption challenge project at the intersection of gaming and artificial intelligence technology, has been developing its ecosystem since its launch in 2023. As of 2026, SOPHIA maintains a market capitalization of approximately $351,621, with a circulating supply of around 343,750,000 tokens and a current price hovering near $0.0010229. This asset, characterized as a gamified AGI development platform, is playing an increasingly significant role in integrating advanced artificial intelligence systems with blockchain technology.

This article will comprehensively analyze SOPHIA's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development milestones, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. SOPHIA Price History Review and Market Status

SOPHIA Historical Price Evolution Trajectory

- 2023: Token launched in July with initial price of $0.015, reaching peak of $0.2715 on July 28, demonstrating strong early market interest

- 2023-2025: Extended consolidation period with gradual price decline from peak levels

- 2026: Market experienced continued pressure, with price declining to $0.00094 on February 6, marking a new low point

SOPHIA Current Market Status

As of February 7, 2026, SOPHIA is trading at $0.0010229, showing a 5.34% increase over the past 24 hours. The token's 24-hour trading range spans from $0.00094 to $0.0010378, with total trading volume reaching $20,187.18.

The current market capitalization stands at $351,621.88, with a circulating supply of 343.75 million tokens representing 34.38% of the total supply. The fully diluted market cap is calculated at $1,022,900.00, based on a maximum supply of 1 billion tokens. SOPHIA's market dominance is currently 0.000040%.

Recent price trends indicate mixed performance across different timeframes. While the 1-hour movement shows a slight decline of 0.21%, the 24-hour period demonstrates positive momentum with a 5.34% gain. However, longer-term metrics reveal downward pressure, with the 7-day period showing a 13.93% decrease, the 30-day period down 17.26%, and the 1-year performance declining 87.5%.

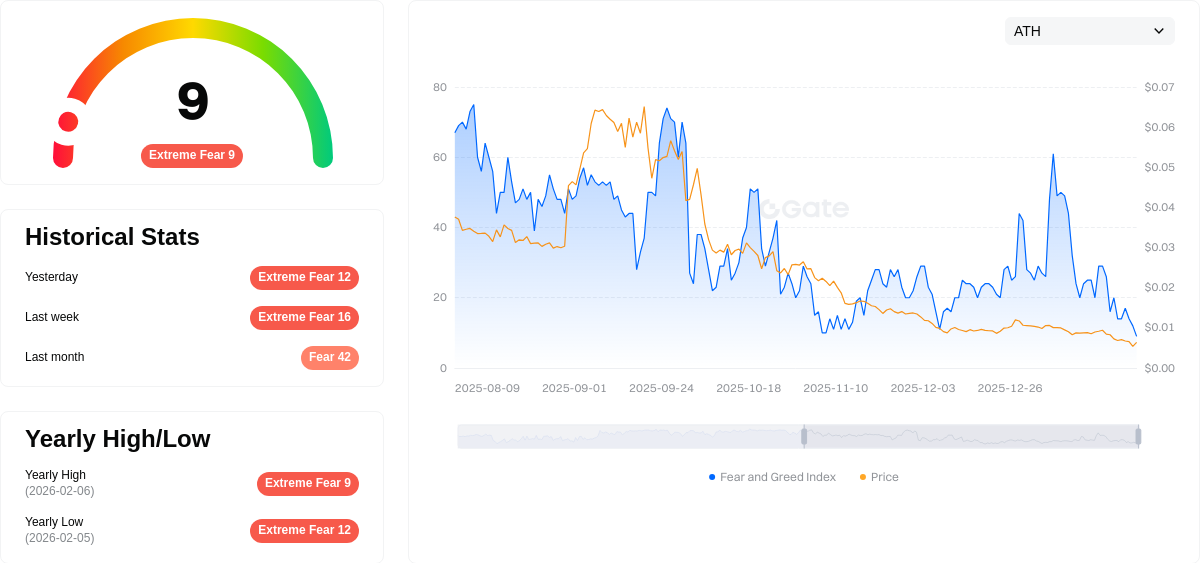

The token is deployed on both Ethereum and BSC networks with the same contract address (0x73fbd93bfda83b111ddc092aa3a4ca77fd30d380), with a holder count of 3,424 addresses. Current market sentiment indicators suggest an "Extreme Fear" environment with a fear and greed index reading of 9.

Click to view current SOPHIA market price

SOPHIA Market Sentiment Index

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index dropping to just 9. This indicates severe market pessimism and heightened anxiety among investors. When sentiment reaches such extreme lows, it often signals potential oversold conditions. Experienced traders typically view extreme fear as a contrarian indicator, suggesting possible market recovery opportunities. However, exercise caution and conduct thorough research before making investment decisions. Stay informed and monitor market developments closely on Gate.com for real-time data and analysis.

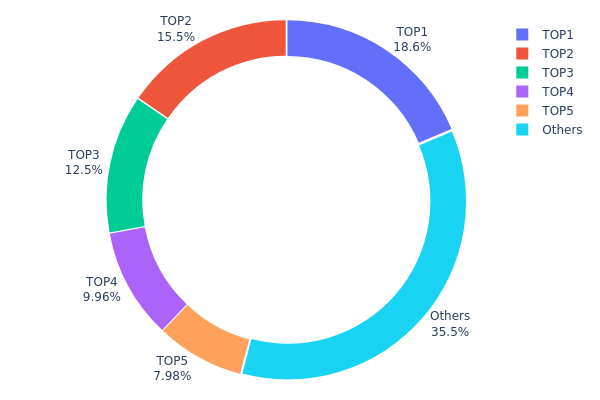

SOPHIA Holder Distribution

The holder distribution chart illustrates the concentration of token ownership across different wallet addresses, providing insights into the decentralization level and potential market control dynamics. By analyzing the distribution of holdings among top addresses versus smaller holders, this metric helps assess the risk of price manipulation and the overall health of the token's ecosystem.

According to the current data, SOPHIA exhibits a highly concentrated ownership structure. The top five addresses collectively hold 64.48% of the total supply, with the largest single address controlling 18.61% (186,140.24K tokens), followed by 15.45% and 12.50% in the second and third positions respectively. This level of concentration indicates that a relatively small number of entities possess significant influence over the token's market dynamics.

Such concentration presents both opportunities and risks for the SOPHIA ecosystem. While large holders may provide stability and long-term commitment to the project, the dominance of top addresses raises concerns about potential price manipulation and vulnerability to coordinated selling pressure. The remaining 35.52% distributed among other addresses suggests limited diversification, which could impact liquidity during volatile market conditions. This distribution pattern reflects a centralized on-chain structure that warrants careful monitoring, particularly regarding the behavior of major holders and their potential impact on market sentiment and price stability.

Click to view current SOPHIA Holder Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf2a3...fcfa3e | 186140.24K | 18.61% |

| 2 | 0x4571...0fdf74 | 154532.40K | 15.45% |

| 3 | 0x7961...1468b4 | 125000.00K | 12.50% |

| 4 | 0x0320...3b6f46 | 99584.29K | 9.95% |

| 5 | 0x3ca8...32307a | 79772.39K | 7.97% |

| - | Others | 354970.67K | 35.52% |

II. Core Factors Influencing SOPHIA's Future Price

Technical Development and Ecosystem Building

- AI Integration: SOPHIA incorporates advanced AI technology and may further enrich its functionality and application scenarios in the future.

- Ecosystem Applications: As an AI-focused project, SOPHIA has potential to expand its presence across various use cases and platforms.

- Technology Progress: Continuous innovation remains essential for maintaining competitiveness in the evolving market landscape.

Macroeconomic Environment

- Macroeconomic Pressures: Inflationary pressures may impact operational costs and market dynamics.

- Market Competition: Intensified competition within the sector could influence growth trajectories and market positioning.

III. 2026-2031 SOPHIA Price Prediction

2026 Outlook

- Conservative forecast: $0.00082 - $0.00102

- Neutral forecast: Around $0.00102

- Optimistic forecast: Up to $0.00121 (subject to favorable market conditions)

2027-2029 Outlook

- Market stage expectation: Gradual growth phase with moderate volatility

- Price range forecast:

- 2027: $0.00074 - $0.00126 (approximately 9% average growth)

- 2028: $0.00101 - $0.00159 (approximately 16% average growth)

- 2029: $0.00111 - $0.00192 (approximately 35% average growth)

- Key catalysts: Ecosystem development, increased adoption rates, and broader market recovery trends

2030-2031 Long-term Outlook

- Baseline scenario: $0.0016 - $0.00193 (assuming steady ecosystem expansion)

- Optimistic scenario: Approaching $0.00193 (with enhanced network utility and partnership developments)

- Transformative scenario: Around $0.00185 in 2031 (contingent on significant technological breakthroughs and mass adoption)

- 2026-02-07: SOPHIA trading within the early-stage prediction range (current market positioning phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00121 | 0.00102 | 0.00082 | 0 |

| 2027 | 0.00126 | 0.00111 | 0.00074 | 9 |

| 2028 | 0.00159 | 0.00119 | 0.00101 | 16 |

| 2029 | 0.00192 | 0.00139 | 0.00111 | 35 |

| 2030 | 0.00193 | 0.00165 | 0.0016 | 61 |

| 2031 | 0.00185 | 0.00179 | 0.00113 | 75 |

IV. SOPHIA Professional Investment Strategy and Risk Management

SOPHIA Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors who believe in the long-term potential of AI and gaming technology integration

- Operational Recommendations:

- Establish position during market corrections when SOPHIA trades near support levels

- Adopt dollar-cost averaging approach to reduce entry price volatility impact

- Store assets in Gate Web3 Wallet for secure long-term custody with full control of private keys

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Monitor 7-day and 30-day moving averages to identify trend reversals, particularly relevant given SOPHIA's recent 13.93% decline over 7 days

- Volume Analysis: Track the current 24-hour trading volume of approximately $20,187 to assess market participation and potential breakout signals

- Swing Trading Key Points:

- Consider entry opportunities when price approaches the recent low of $0.00094

- Set profit targets based on key resistance levels, monitoring the 24-hour high of $0.0010378

SOPHIA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation

- Aggressive Investors: 5-8% portfolio allocation

- Professional Investors: 10-15% portfolio allocation with active risk monitoring

(2) Risk Hedging Solutions

- Diversification Strategy: Balance SOPHIA holdings with established cryptocurrencies and stablecoins to reduce concentration risk

- Stop-Loss Implementation: Set automatic stop-loss orders 10-15% below entry price to limit potential losses

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading access with multi-layer security features

- Cold Storage Solution: Transfer long-term holdings to hardware wallets for maximum security against online threats

- Security Precautions: Never share private keys, enable two-factor authentication, and verify all transaction details before confirming

V. SOPHIA Potential Risks and Challenges

SOPHIA Market Risks

- High Volatility: SOPHIA has experienced an 87.5% decline over the past year, demonstrating significant price volatility that may result in substantial losses

- Low Liquidity: With a market cap of approximately $351,622 and relatively low trading volume, large orders may experience significant slippage

- Market Ranking: Currently ranked #3356 with 0.000040% market dominance, indicating limited market attention and potential delisting risks

SOPHIA Regulatory Risks

- AI Technology Regulation: Increasing regulatory scrutiny on artificial intelligence applications may impact SophiaVerse's operational model

- Gaming Token Classification: Potential regulatory changes regarding gaming tokens and virtual assets could affect SOPHIA's legal status

- Cross-border Compliance: Decentralized AI projects may face varying regulatory requirements across different jurisdictions

SOPHIA Technical Risks

- Smart Contract Vulnerabilities: As SOPHIA operates on both ETH and BSC chains using ERC20 and BEP20 standards, potential smart contract exploits could compromise token security

- Development Progress: Limited recent information about project updates or technological advancements may indicate slower-than-expected development

- Competition Risk: Numerous AI and gaming projects compete for market attention, potentially reducing SOPHIA's competitive advantage

VI. Conclusion and Action Recommendations

SOPHIA Investment Value Assessment

SophiaVerse presents a speculative opportunity in the intersection of AI and gaming technology, positioning itself as a decentralized AGI development platform. The project's long-term value proposition centers on its gamified approach to cognitive AI development. However, investors should carefully consider the substantial short-term risks, including the 87.5% annual decline, low market capitalization, and limited liquidity. The current circulating supply of 343,750,000 tokens represents 34.38% of total supply, suggesting potential future dilution concerns.

SOPHIA Investment Recommendations

✅ Beginners: Avoid allocating significant capital to SOPHIA due to extreme volatility and high risk profile. If interested, limit exposure to less than 1% of portfolio and thoroughly research AI-gaming sector fundamentals

✅ Experienced Investors: Consider small speculative positions during significant price corrections, implementing strict stop-loss orders and position sizing discipline. Monitor project development updates and community engagement metrics

✅ Institutional Investors: Conduct comprehensive due diligence on technical infrastructure, team credentials, and competitive positioning before considering allocation. Evaluate liquidity constraints for institutional-sized positions

SOPHIA Trading Participation Methods

- Spot Trading: Purchase SOPHIA on Gate.com through direct spot markets using USDT or other trading pairs, suitable for investors seeking straightforward exposure

- Limit Orders: Set limit buy orders below current market price to capture potential downside volatility and improve entry pricing

- Portfolio Rebalancing: Periodically adjust SOPHIA allocation based on market performance and changing risk tolerance, maintaining disciplined position management

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of SOPHIA token, and what are its historical highest and lowest prices?

SOPHIA's current price details are unavailable. Historical all-time high reached US$0.0007227, while the all-time low was US$0.00003865.

What are the main factors for SOPHIA price prediction and how should they be analyzed?

SOPHIA price prediction is primarily influenced by supply-demand dynamics, market sentiment, and regulatory developments. Market sentiment driven by news and investor confidence, combined with macroeconomic trends, collectively determines price movements. Analyze these factors together for comprehensive price forecasting.

What is the basic information about SOPHIA project, and how is the team background and technical strength?

SOPHIA is a next-generation AI application designed for complex cross-functional tasks. The team possesses strong AI technical capabilities, having developed multiple successful AI projects. Its innovation strength is widely recognized in the industry.

What are the risks of investing in SOPHIA and how should they be assessed?

SOPHIA investment involves market volatility and technology risks. Assess by evaluating market demand, technical feasibility, project innovation, and competitive advantages. Analyze risk-return potential carefully before investing in this AI-powered metaverse token.

What are the advantages and disadvantages of SOPHIA compared to similar projects?

SOPHIA offers faster optimization speeds than Adam, approximately 2x faster, with superior model performance. It uses gradient curvature for normalization instead of variance. However, it remains less explored and adopted compared to established optimizers like Adam and AdamW in practice.

What is the market liquidity and trading volume of SOPHIA, and on which exchanges can it be traded?

SOPHIA maintains active liquidity primarily on decentralized platforms. The 24-hour trading volume reaches approximately US$6.13, with SPH/WETH being the most active trading pair. The token demonstrates solid market presence and accessibility for traders.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

Comprehensive Guide to Understanding FUD in Cryptocurrency Markets

Who Are Cameron and Tyler Winklevoss? A Profile on the Twins

Is it too late to become a Bitcoin millionaire? Is now the right time to buy?

Best Web3 Marketing Agencies To Support Your Crypto Project

Tax Strategies for Investors Who Became Billionaires with Bitcoin