2026 SPEC Price Prediction: Expert Analysis and Market Forecast for Speculative Assets

Introduction: SPEC's Market Position and Investment Value

Spectral (SPEC), positioning itself as an innovative platform for onchain autonomous agents, has been transforming the blockchain development landscape since its launch in 2024. By converting natural language into Solidity code, Spectral enables individuals and enterprises to deploy production-grade smart contracts, arbitrage agents, NFTs, and rollups. As of 2026, SPEC maintains a market capitalization of approximately $1.45 million, with a circulating supply of around 9 million tokens, trading at approximately $0.16. This asset, recognized for its pioneering role in the Agent Economy within Web3, is playing an increasingly important part in simplifying blockchain development and democratizing smart contract creation.

This article will comprehensively analyze SPEC's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment factors to provide investors with professional price forecasts and practical investment strategies.

I. SPEC Price History Review and Market Status

SPEC Historical Price Evolution Trajectory

- 2024: Token launched in May with an initial price of $2.3, reaching a peak of $18.673 in November, representing substantial growth in the early trading period

- 2024-2025: Following the November peak, price experienced significant volatility and correction phase

- 2026: Price declined to a recorded low of $0.073 in January, marking a considerable downturn from previous levels

SPEC Current Market Situation

As of February 2, 2026, SPEC is trading at $0.16147, showing a 24-hour decrease of 28.38%. The token has demonstrated notable weekly performance with a 111.1% increase over the past 7 days, while maintaining a 22.82% gain over the 30-day period. The annual performance reflects a decline of 96.2% from the previous year's levels.

The current market capitalization stands at approximately $1.45 million, with a circulating supply of 9 million tokens representing 9% of the total supply of 100 million tokens. The fully diluted market cap is calculated at $16.15 million. Trading volume over the past 24 hours reached $176,480, indicating moderate market activity.

The token's price range within the last 24 hours has fluctuated between $0.14947 and $0.22878. Market dominance remains minimal at 0.00060%, positioning SPEC as a smaller-cap asset within the broader cryptocurrency landscape. The project maintains presence across 7 exchanges and has attracted 6,308 token holders.

Market sentiment indicators suggest an environment of extreme caution, with current readings reflecting heightened uncertainty in the trading environment. The token operates on the Ethereum blockchain as an ERC-20 standard token, with its contract address verified and accessible through blockchain explorers.

Click to view current SPEC market price

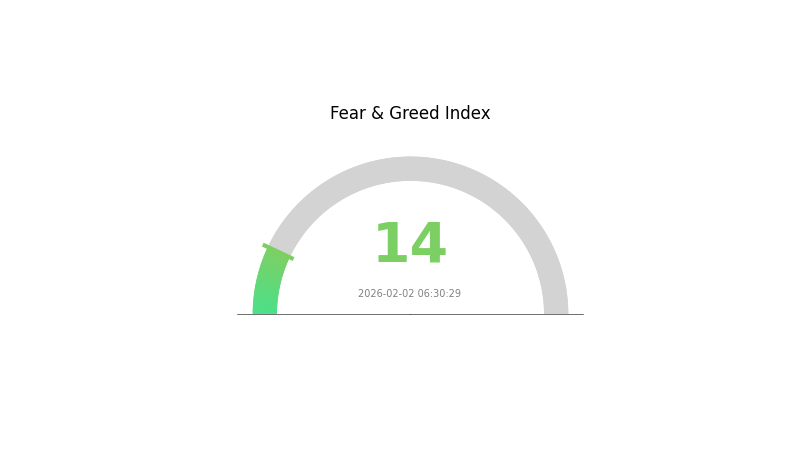

SPEC Market Sentiment Index

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index hitting 14. This indicates investors are heavily risk-averse, showing significant concern about market conditions. Such extreme readings often signal capitulation sentiment, where pessimism reaches peak levels. Historically, these periods can present opportunities for contrarian traders. However, caution remains essential as market volatility may persist. On Gate.com, you can monitor real-time sentiment metrics and market data to make informed trading decisions during these turbulent periods.

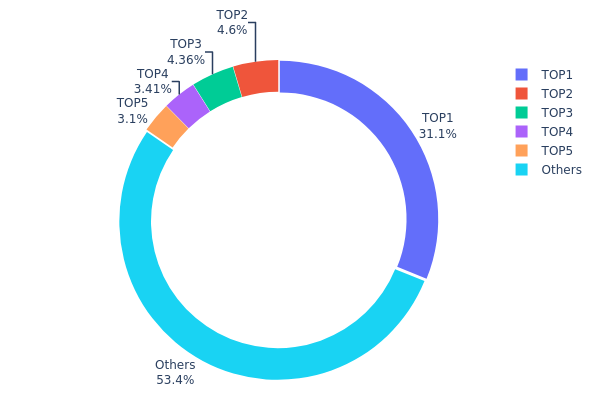

SPEC Holding Distribution

The holding distribution chart reflects the allocation of SPEC tokens across different wallet addresses, revealing the concentration level of token ownership within the ecosystem. By analyzing the proportion held by top addresses versus the broader market, this metric helps assess decentralization levels and potential risks associated with concentrated holdings.

Currently, SPEC exhibits a moderately high concentration pattern. The top address controls 31.14% of the total supply (31.15M tokens), representing nearly one-third of all circulating tokens. The top five addresses collectively hold 46.58% of the supply, while the remaining 53.42% is distributed among other holders. This concentration level suggests that a relatively small number of entities maintain substantial influence over the token's market dynamics.

Such distribution characteristics present both opportunities and risks for market participants. The dominant position of the largest holder could potentially enable significant price manipulation through large-scale buying or selling activities. Additionally, coordinated actions among top holders might amplify volatility during critical market movements. However, the fact that over half of the supply remains distributed among smaller holders indicates a reasonable baseline of decentralization, which provides some buffer against single-entity control and contributes to on-chain structural stability.

Click to view current SPEC Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x42bd...1596a1 | 31148.85K | 31.14% |

| 2 | 0x7c01...b21056 | 4595.02K | 4.59% |

| 3 | 0x1b82...31dc9f | 4358.92K | 4.35% |

| 4 | 0x39ea...331bec | 3406.34K | 3.40% |

| 5 | 0xb7b9...f752b7 | 3100.89K | 3.10% |

| - | Others | 53389.98K | 53.42% |

II. Core Factors Influencing SPEC's Future Price

Market Demand and Adoption Trends

- Market Demand Dynamics: SPEC's price trajectory is significantly shaped by evolving market demand patterns and adoption trends across the cryptocurrency ecosystem.

- Growth Projections: Based on current market analysis, SPEC demonstrates a potential annual growth rate of approximately 5%, reflecting steady adoption momentum.

- Current Impact: The combination of increasing market participation and broader acceptance of SPEC's technology suggests sustained upward pressure on price development.

Institutional Participation and Market Activity

- Institutional Engagement: Institutional involvement plays a crucial role in SPEC's price formation, with growing interest from professional market participants contributing to market depth and liquidity.

- Market Participation: The level and quality of institutional engagement directly correlates with SPEC's price stability and long-term valuation trends.

Macroeconomic Environment

- Economic Factors Impact: Broader economic conditions, including global financial market trends and macroeconomic policy shifts, exert considerable influence on SPEC's price dynamics.

- Market Sentiment: General economic outlook and risk appetite in financial markets continue to shape investor behavior toward digital assets like SPEC.

- Global Economic Conditions: The overall health of the global economy remains a fundamental factor affecting SPEC's price prospects and market positioning.

III. 2026-2031 SPEC Price Forecast

2026 Outlook

- Conservative forecast: $0.15667 - $0.1632

- Neutral forecast: $0.1632 - $0.18

- Optimistic forecast: $0.18 - $0.20237 (requires favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market phase expectation: The token may experience gradual growth as the cryptocurrency market matures and adoption increases across various use cases

- Price range forecast:

- 2027: $0.11881 - $0.24127

- 2028: $0.11026 - $0.31168

- 2029: $0.19116 - $0.31423

- Key catalysts: Market expansion, potential technological developments, and broader cryptocurrency adoption could serve as primary drivers for price appreciation

2030-2031 Long-term Outlook

- Baseline scenario: $0.27076 - $0.31397 (assuming steady market growth and sustained project development)

- Optimistic scenario: $0.28804 - $0.31304 (with enhanced market penetration and favorable regulatory environment)

- Transformational scenario: Approaching $0.301 (under exceptionally favorable conditions including mass adoption and significant market expansion)

- February 2, 2026: SPEC trading within the $0.15667 - $0.20237 range (early-stage price discovery phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.20237 | 0.1632 | 0.15667 | 1 |

| 2027 | 0.24127 | 0.18278 | 0.11881 | 13 |

| 2028 | 0.31168 | 0.21203 | 0.11026 | 31 |

| 2029 | 0.31423 | 0.26186 | 0.19116 | 62 |

| 2030 | 0.31397 | 0.28804 | 0.27076 | 78 |

| 2031 | 0.31304 | 0.301 | 0.23478 | 86 |

IV. SPEC Professional Investment Strategy and Risk Management

SPEC Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors with a long-term vision who believe in the potential of AI-driven smart contract development and the agent economy within Web3

- Operational Recommendations:

- Consider accumulating positions gradually during price corrections, given the current price of $0.16147 represents a significant discount from historical levels

- Monitor the project's development progress in natural language to Solidity code conversion technology

- Implement a cold storage solution using Gate Web3 Wallet for secure long-term holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Track 50-day and 200-day moving averages to identify trend reversals, particularly given the 7-day price increase of 111.1%

- Volume Analysis: Monitor the current 24-hour trading volume of $176,480 for signs of accumulation or distribution patterns

- Key Points for Swing Trading:

- Consider the 24-hour price range between $0.14947 and $0.22878 for identifying potential entry and exit points

- Account for the high volatility, as evidenced by the -28.38% 24-hour change

SPEC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-8% of crypto portfolio allocation

- Professional Investors: Up to 10% with active position management

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine SPEC holdings with established cryptocurrencies to balance risk exposure

- Position Sizing: Limit individual position size based on the token's low market cap of $1.45 million and limited exchange availability (7 exchanges)

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and quick access

- Cold Storage Solution: Consider hardware wallet solutions for long-term holdings exceeding 10% of total SPEC investment

- Security Precautions: Enable two-factor authentication, regularly update wallet software, and never share private keys or seed phrases

V. SPEC Potential Risks and Challenges

SPEC Market Risks

- Extreme Volatility: The -96.2% decline over one year from $4.24 to $0.16147 demonstrates significant price instability

- Low Liquidity: With a market cap of only $1.45 million and trading on just 7 exchanges, large orders may face significant slippage

- Limited Circulation: Only 9% of total supply (9 million out of 100 million tokens) is currently in circulation, creating potential for supply-side pressure

SPEC Regulatory Risks

- AI and Smart Contract Regulation: Evolving regulatory frameworks for AI-generated code and autonomous agents may impact project operations

- Securities Classification: Token classification uncertainty across different jurisdictions could affect trading availability

- Compliance Requirements: Changing regulatory standards for crypto projects may require operational adjustments

SPEC Technical Risks

- Smart Contract Vulnerabilities: AI-generated Solidity code may contain unforeseen security flaws or vulnerabilities

- Technology Adoption: The success of natural language to code conversion depends on user adoption and practical utility demonstration

- Competition: Emerging competitors in the AI-driven smart contract development space may challenge market position

VI. Conclusion and Action Recommendations

SPEC Investment Value Assessment

SPEC presents an innovative approach to blockchain development through its natural language to Solidity conversion technology, targeting the emerging agent economy in Web3. However, the token faces significant challenges, including extreme price volatility (down 96.2% from its all-time high of $18.673), very low market capitalization of $1.45 million, and limited liquidity across only 7 exchanges. While the recent 7-day price surge of 111.1% and 30-day gain of 22.82% suggest renewed interest, investors should carefully weigh the project's technological promise against its current market position and risk profile.

SPEC Investment Recommendations

✅ Beginners: Limit exposure to less than 2% of total crypto portfolio, focus on education about the project's technology, and avoid trading during high volatility periods

✅ Experienced Investors: Consider small speculative positions (3-5% of crypto holdings) with strict stop-loss orders, actively monitor project development updates, and utilize technical analysis for timing entries

✅ Institutional Investors: Conduct thorough due diligence on the project's technology stack and team, evaluate the competitive landscape in AI-driven blockchain development, and consider strategic partnerships or direct engagement with the project team

SPEC Trading Participation Methods

- Spot Trading: Purchase SPEC tokens directly on Gate.com and other supporting exchanges with immediate settlement

- Dollar-Cost Averaging: Implement systematic purchases over time to reduce the impact of price volatility

- Limit Orders: Use limit orders to enter positions at predetermined price levels, particularly given the current price range

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SPEC token and what is its purpose?

SPEC is an ERC-20 token in the Spectral ecosystem used for governance and utility. It enables token holders to participate in protocol decisions, pay agent fees, and access Spectral services on the network.

How to conduct SPEC price prediction? What are the analysis methods?

SPEC price prediction uses technical analysis with moving averages, RSI indicators, and historical price data. Monitor real-time market trends, trading volume, and on-chain metrics. Combine chart patterns with fundamental analysis of project developments for comprehensive forecasting.

What are the risk factors for SPEC price prediction?

SPEC price prediction risks include user activity fluctuations, exchange liquidity changes, ecosystem events, and whale transfers. Market sentiment and trading volume also significantly impact price volatility.

What are the key differences between SPEC and other similar tokens?

SPEC differentiates itself through its advanced Merkle tree architecture, delivering superior efficiency and security compared to similar tokens. This unique technical structure enables faster transaction processing and enhanced reliability across the network.

What is the historical price trend of SPEC?

SPEC has shown steady momentum recently, with a 2.07% increase in the last 24 hours. The current price stands at ¥0.8281, with a 24-hour high of ¥0.8743 and low of ¥0.8029. Trading volume reached ¥940,700 in the past day, reflecting growing market interest.

What are the main factors affecting SPEC price?

SPEC price is primarily influenced by market trading volume, investor sentiment, overall crypto market trends, project development progress, and macroeconomic factors. Positive ecosystem updates and increased adoption typically drive upward price momentum.

SPEC未来的发展前景和价格潜力如何?

SPEC currently has significant growth potential in bull market cycles. With expanding ecosystem adoption and increasing market recognition, SPEC could experience substantial value appreciation. Long-term prospects remain promising for early believers.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Top Staking Coins for Passive Income

Free Money for App Registration 2025

What is crypto? How can you explain digital currencies to a young child?

Top Cold Wallets for Cryptocurrency: Rankings

Everything You Need to Know About Sybil Attacks