2026 STBU Price Prediction: Expert Analysis and Future Market Outlook for Status-Based Utility Token

Introduction: STBU's Market Position and Investment Value

Stobox (STBU), as a tokenization platform dedicated to providing technology and consulting services for digital assets and tokenized securities, has been contributing to the creation of regulatory frameworks for virtual assets since its inception. As of 2026, STBU maintains a market capitalization of approximately $239,750, with a circulating supply of about 125 million tokens, and the price hovers around $0.001918. This asset, recognized for its role in tokenization infrastructure, is playing an increasingly significant part in the digital securities and regulatory compliance sectors.

This article will comprehensively analyze STBU's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem developments, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. STBU Price History Review and Current Market Status

STBU Historical Price Evolution Trajectory

- 2021: STBU reached a notable price level of $0.449805 on March 17, representing a significant milestone in the token's early trading history.

- 2022: The token experienced substantial volatility, with the price declining to $0.00045058 on January 23, marking a considerable correction from previous levels.

- 2026: As of February 8, STBU is trading at $0.001918, reflecting an 83.1% decline over the past year.

STBU Current Market Status

As of February 8, 2026, STBU is priced at $0.001918, with a 24-hour trading volume of $28,808.51. The token has experienced a 6.26% decline over the past 24 hours, trading within a daily range of $0.00165 to $0.002142.

Over different timeframes, STBU shows mixed performance: a modest 0.64% increase in the past hour and a 1.28% gain over the past week. However, the 30-day performance reveals a significant decline of 53.66%, while the annual performance shows an 83.1% decrease.

The current market capitalization stands at $239,750, with a fully diluted market cap of $287,700. STBU has a circulating supply of 125,000,000 tokens out of a total supply of 150,000,000, representing a 50% circulation ratio. The maximum supply is capped at 250,000,000 tokens. The token maintains a market dominance of 0.000011% and is held by approximately 1,390 holders.

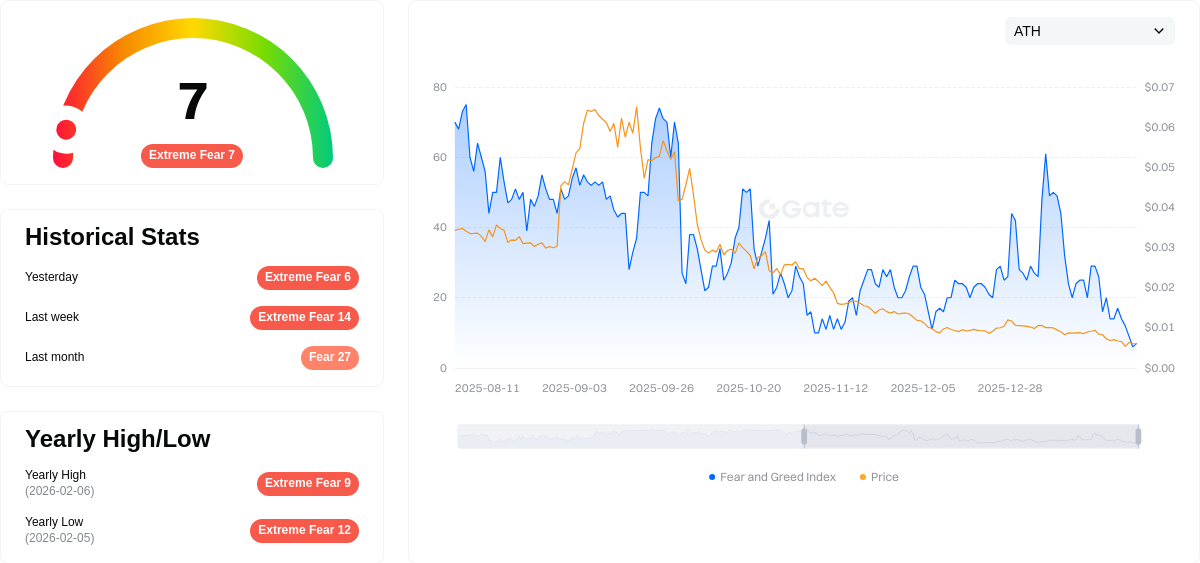

The market sentiment indicator registers at level 7, reflecting an "Extreme Fear" state in the broader cryptocurrency market environment.

Click to view the current STBU market price

STBU Market Sentiment Index

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 7. This indicates significant market pessimism and heightened investor anxiety. During such periods, market volatility typically increases as traders reassess risk positions. Extreme fear often presents both challenges and opportunities for strategic investors. Historical data suggests that markets at this sentiment extreme may be approaching potential inflection points. Investors should exercise caution while considering their long-term investment strategies during this period of market uncertainty.

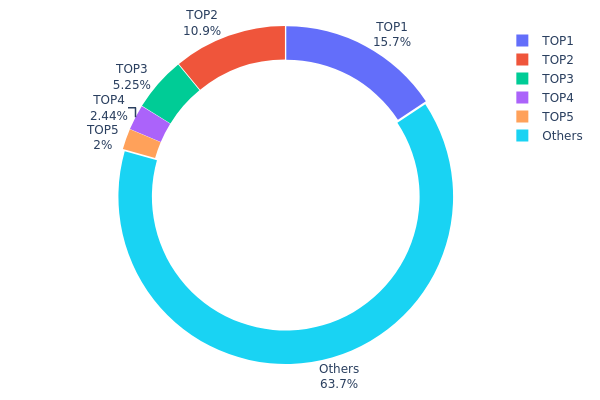

STBU Holdings Distribution

The holdings distribution chart is a key metric for assessing the degree of token concentration across wallet addresses. It reveals whether a cryptocurrency's supply is widely dispersed among numerous holders or concentrated in the hands of a few major addresses, which directly impacts market stability, liquidity depth, and susceptibility to price manipulation.

According to the current data, STBU exhibits a moderate concentration pattern. The top-ranked address holds 15,697.03K tokens (15.69% of total supply), while the burn address at rank 2 contains 10,923.23K tokens (10.92%), effectively removing these tokens from circulation. The third through fifth addresses hold 5,251.79K (5.25%), 2,444.92K (2.44%), and 1,999.70K (1.99%) respectively. Notably, addresses outside the top five collectively control 63,683.32K tokens, representing 63.71% of the total supply. This distribution indicates that while major holders possess significant positions, the majority of tokens remain distributed across a broader holder base.

From a market structure perspective, this distribution pattern presents both opportunities and risks. The relatively high concentration in top addresses, particularly the leading holder controlling over 15% of supply, creates potential for significant market impact if these positions are liquidated. However, the substantial 63.71% held by smaller addresses suggests a reasonably healthy decentralization level that could provide cushioning against single-party manipulation. The presence of over 10% in the burn address is a positive signal, demonstrating a commitment to supply reduction mechanisms that may support long-term value appreciation.

Click to view current STBU Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 15697.03K | 15.69% |

| 2 | 0x0000...00dead | 10923.23K | 10.92% |

| 3 | 0x3cc9...aecf18 | 5251.79K | 5.25% |

| 4 | 0x44e7...d18c74 | 2444.92K | 2.44% |

| 5 | 0xdfb5...2cc218 | 1999.70K | 1.99% |

| - | Others | 63683.32K | 63.71% |

II. Core Factors Influencing STBU's Future Price

Supply Mechanism

- Decentralized Governance: Token holders can participate in the decision-making process, influencing the future direction of the ecosystem. This decentralized approach ensures that the community has a voice in the platform's development.

- Reward System: STBU serves as the core of the reward system, incentivizing participants who contribute significantly to the ecosystem. This mechanism may encourage long-term holding behavior and reduce circulating supply pressure.

Institutional and Major Holder Dynamics

- Community Participation: The level of community engagement plays a significant role in STBU's value proposition. Active community involvement in governance decisions may indicate stronger ecosystem support and potential price stability.

Macroeconomic Environment

- Market Demand: Overall market demand remains a primary driver of price movements. As an emerging market asset, STBU's valuation is sensitive to broader cryptocurrency market trends and investor sentiment.

- Competition Factors: The competitive landscape within the tokenized securities space may influence STBU's market positioning and adoption rate.

Technology Development and Ecosystem Building

- Ecosystem Development: The continuous expansion and maturity of the Stobox ecosystem represents a key factor for long-term value. Platform growth and increased utility of STBU within the ecosystem may contribute to sustained demand.

- Governance Implementation: The practical application of decentralized governance mechanisms allows the community to shape platform evolution, potentially enhancing token utility and ecosystem resilience.

III. 2026-2031 STBU Price Forecast

2026 Outlook

- Conservative prediction: $0.00184 - $0.0019

- Neutral prediction: Around $0.0019

- Optimistic prediction: Up to $0.00233 (requires favorable market conditions)

Based on current market analysis, STBU may experience a slight decline of approximately 1% in 2026, with price movements expected within a relatively narrow range.

2027-2029 Mid-term Outlook

- Market phase expectation: Recovery and gradual growth phase

- Price range forecast:

- 2027: $0.0011 - $0.00315, with potential 10% increase

- 2028: $0.00203 - $0.00372, showing stronger momentum with 37% growth potential

- 2029: $0.00184 - $0.00337, continuing upward trajectory with 65% cumulative gain

- Key catalysts: Market sentiment improvement, ecosystem expansion, and increased adoption of blockchain technology

The mid-term period shows progressive growth potential, with 2028 and 2029 demonstrating significant upward movement as the project matures and market conditions stabilize.

2030-2031 Long-term Outlook

- Baseline scenario: $0.0019 - $0.00327 (assuming steady market development)

- Optimistic scenario: $0.0035 - $0.00338 (with enhanced ecosystem adoption)

- Transformative scenario: Up to $0.00416 (under exceptionally favorable conditions including mainstream adoption and positive regulatory environment)

The long-term forecast suggests STBU could maintain growth momentum into 2031, with potential gains of 70-76% compared to initial projections. Price stability is expected to improve as the token establishes stronger market presence and utility within its ecosystem.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00233 | 0.0019 | 0.00184 | -1 |

| 2027 | 0.00315 | 0.00212 | 0.0011 | 10 |

| 2028 | 0.00372 | 0.00263 | 0.00203 | 37 |

| 2029 | 0.00337 | 0.00317 | 0.00184 | 65 |

| 2030 | 0.0035 | 0.00327 | 0.0019 | 70 |

| 2031 | 0.00416 | 0.00338 | 0.00196 | 76 |

IV. STBU Professional Investment Strategies and Risk Management

STBU Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to tokenization infrastructure and regulatory-compliant digital assets

- Operational Recommendations:

- Consider building positions gradually rather than lump-sum investment given the token's relatively low liquidity (24-hour trading volume of approximately $28,808)

- Monitor Stobox's business development in tokenization consulting and technology services, as these fundamentals may influence long-term value

- Storage Solution: Gate Web3 Wallet offers multi-chain support for STBU tokens deployed on ETH, BSC, and MATIC networks, providing secure custody with user-controlled private keys

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: With limited trading volume, monitor volume spikes that may indicate significant price movements or liquidity events

- Support/Resistance Levels: Recent 24-hour range between $0.00165 (low) and $0.002142 (high) provides reference points for short-term trading

- Swing Trading Considerations:

- The token has experienced significant volatility, with a 53.66% decline over 30 days, suggesting potential opportunities for range-bound trading

- Exercise caution with position sizing due to low market capitalization of approximately $239,750 and limited exchange availability

STBU Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of cryptocurrency portfolio allocation

- Aggressive Investors: 2-3% of cryptocurrency portfolio allocation

- Professional Investors: Up to 5% with active monitoring and risk controls

(2) Risk Hedging Solutions

- Diversification Approach: Balance STBU exposure with established tokenization and blockchain infrastructure projects

- Position Sizing: Limit individual position size to account for low liquidity and 50% circulating supply (125 million of 250 million max supply)

(3) Secure Storage Solutions

- Multi-Chain Wallet Recommendation: Gate Web3 Wallet supports STBU across Ethereum, BSC, and Polygon networks, enabling unified management

- Hardware Wallet Integration: For larger holdings, consider hardware wallet solutions compatible with ERC-20, BEP-20, and Polygon tokens

- Security Precautions: Verify contract addresses (ETH: 0xa6422e3e219ee6d4c1b18895275fe43556fd50ed, BSC: 0xb0c4080a8Fa7afa11a09473f3be14d44AF3f8743, MATIC: 0xcf403036bc139d30080D2Cf0F5b48066F98191bB) before transactions to avoid phishing scams

V. STBU Potential Risks and Challenges

STBU Market Risks

- Liquidity Risk: Daily trading volume of approximately $28,808 indicates limited market depth, which may result in significant price slippage for larger orders

- Price Volatility: The token has declined 83.1% over the past year and 53.66% in the last 30 days, reflecting substantial downward pressure

- Market Capitalization Risk: With a market cap of approximately $239,750 and ranking of 3732, STBU represents a micro-cap asset with elevated volatility exposure

STBU Regulatory Risks

- Tokenization Sector Dependency: As Stobox operates in the regulated tokenization and security token space, changes in securities laws or digital asset regulations may impact business operations

- Compliance Framework Evolution: The company's advisory role in regulatory framework development means shifts in governmental approaches to virtual assets could affect the business model

- Cross-Jurisdictional Challenges: Operating across multiple regulatory environments may create operational complexities or compliance costs

STBU Technical Risks

- Smart Contract Risk: Multi-chain deployment across ETH, BSC, and MATIC networks requires ongoing contract maintenance and security audits

- Concentration Risk: Limited exchange availability (Gate.com) may restrict trading options and price discovery mechanisms

- Supply Inflation Risk: With 50% of max supply currently circulating (125 million out of 250 million), potential token releases could create selling pressure

VI. Conclusion and Action Recommendations

STBU Investment Value Assessment

Stobox (STBU) represents a specialized investment in the tokenization infrastructure sector, with the company providing technology and consulting services for digital asset and tokenized securities deployment. The token's long-term value proposition depends on the growth of the tokenization industry and Stobox's ability to capture market share in regulatory-compliant digital asset solutions. However, short-term risks include limited liquidity, significant recent price declines, and concentration risk from single-exchange trading. The 50% circulating supply suggests potential future dilution concerns.

STBU Investment Recommendations

✅ Beginners: Consider allocating no more than 0.5-1% of cryptocurrency portfolio to STBU, and only after gaining experience with more liquid assets. Focus on understanding tokenization fundamentals before investing

✅ Experienced Investors: May allocate 1-3% with strict risk management protocols, monitoring liquidity conditions and project development milestones. Consider dollar-cost averaging to mitigate volatility

✅ Institutional Investors: Conduct thorough due diligence on Stobox's business model, client portfolio, and competitive positioning. Consider direct engagement with the project team given the token's micro-cap status

STBU Trading Participation Methods

- Spot Trading on Gate.com: Execute market or limit orders with awareness of liquidity constraints and potential slippage

- Multi-Chain Access: Trade or hold STBU on Ethereum, BSC, or Polygon networks based on preferred gas fee structure and ecosystem integration

- Secure Storage via Gate Web3 Wallet: Utilize self-custody solutions for long-term holdings while maintaining flexibility for trading opportunities

Cryptocurrency investments carry extreme risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is STBU token? What are its uses and application scenarios?

STBU token is primarily designed for staking purposes. It serves as a utility token within its ecosystem, enabling users to participate in network validation and governance through staking mechanisms. The token's main application focus is on providing rewards to stakers and supporting blockchain infrastructure operations.

What are the main factors affecting STBU price?

STBU price is influenced by supply and demand dynamics, market sentiment, regulatory developments, institutional adoption rates, and macroeconomic trends. These factors collectively determine STBU's price movements and long-term prospects.

How to conduct STBU price prediction? What are the analysis methods?

STBU price prediction involves two main approaches: technical analysis using indicators like MACD, RSI, and Bollinger Bands to forecast short-term movements; and fundamental analysis evaluating STBU's intrinsic value through project metrics and market trends.

STBU的历史价格走势如何?目前处于什么阶段?

STBU currently trades at ¥0.018536, down 7.09% recently. Market cap stands at ¥1.8257 million with 24-hour trading volume of ¥1.493 million. Price has fluctuated between ¥0.017846 and ¥0.019962, indicating consolidation phase positioning for potential recovery.

What are the risks of investing in STBU? What should I pay attention to?

STBU carries market volatility and price fluctuation risks. Consider your investment experience, financial capacity, and risk tolerance before investing. Understand the project fundamentals and market dynamics to make informed decisions.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Bitcoin Dominance Chart: What Is It and Why Is It Important?

Who Is Charles Hoskinson, the Founder of Cardano?

Bitcoin Dominance: A Comprehensive Guide to Using BTC.D in Trading

7 Ideas for Beginners to Create Digital Art

What is Leverage Trading? A Comprehensive Strategy for Maximizing Cryptocurrency Investment Returns