2026 TARA Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: TARA's Market Position and Investment Value

Taraxa (TARA), positioned as a fast and scalable IoT device-friendly public ledger, has been dedicated to enhancing trust, anonymity, and value within the IoT ecosystem since its launch in 2021. As of 2026, TARA maintains a market capitalization of approximately $1.71 million, with a circulating supply of around 6.03 billion tokens and a current price hovering around $0.0002842. This asset, recognized for its innovative Block-DAG topology and VRF-driven PBFT consensus mechanism, is playing an increasingly important role in decentralized IoT infrastructure and device authentication.

This article will comprehensively analyze TARA's price trends from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic environment to provide investors with professional price forecasts and practical investment strategies.

I. TARA Price History Review and Market Status

TARA Historical Price Evolution Trajectory

- 2021: TARA reached its all-time high of $0.07045 on March 22, marking a significant milestone following its initial launch with a publish price of $0.01

- 2025: The token experienced substantial downward pressure throughout the year, with price declining towards lower levels as market conditions shifted

- Recent Period: TARA recorded its all-time low of $0.00019902 on December 23, 2025, reflecting challenging market dynamics

TARA Current Market Status

As of February 2, 2026, TARA is trading at $0.0002842, representing an 8.67% increase over the past 24 hours. The token has shown short-term volatility, with a 6.05% decline in the past hour, while experiencing a 21.16% decrease over the past 7 days.

The 24-hour trading volume stands at $22,591.93, with the price fluctuating between a low of $0.00025 and a high of $0.0003402 during this period. The current market capitalization is approximately $1.71 million, with a circulating supply of 6.03 billion TARA tokens, representing 50.25% of the total supply of 10.96 billion tokens.

The fully diluted market cap is calculated at approximately $3.11 million, based on the maximum supply of 12 billion tokens. TARA maintains a market dominance of 0.00011% and is currently ranked #2150 in the cryptocurrency market. The token is listed on 4 exchanges, with Gate.com being one of the trading platforms.

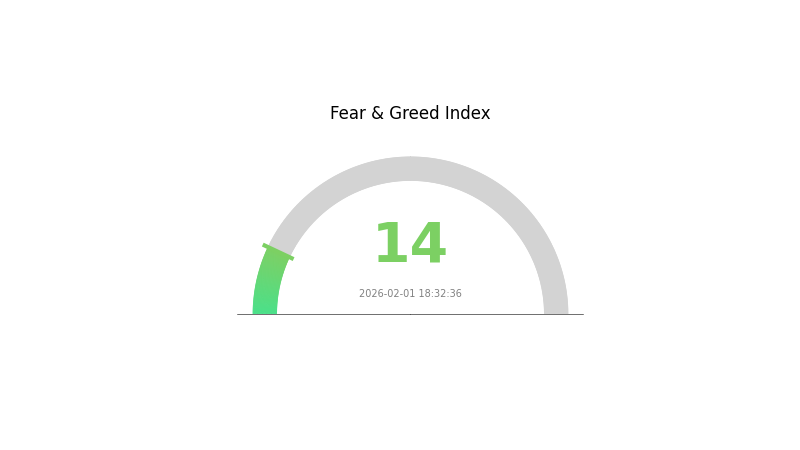

The current market sentiment indicator shows a reading of 14, suggesting an extreme fear environment in the broader crypto market as of February 1, 2026.

Click to view current TARA market price

TARA Market Sentiment Index

2026-02-01 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the index hitting just 14 points. This historically low reading suggests investors are highly pessimistic about near-term price movements. Extreme fear often creates contrarian opportunities, as panic selling can lead to oversold conditions. Market participants should exercise caution while remaining alert to potential buying opportunities during such periods of intense market sentiment. Monitor key support levels and volume indicators closely for signs of stabilization.

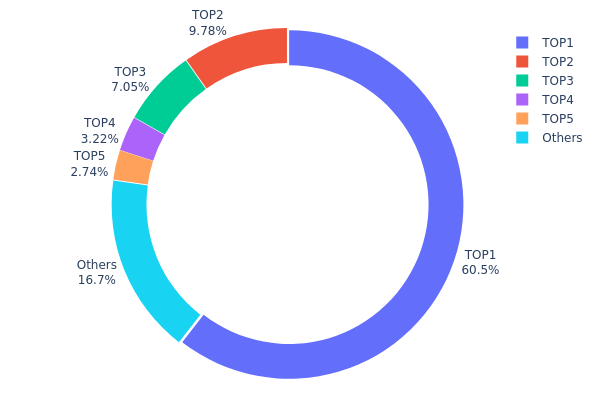

TARA Holding Distribution

Based on the on-chain holding distribution data, TARA exhibits significant concentration characteristics in its token structure. The holding distribution chart reveals the allocation of tokens across different addresses on the blockchain, reflecting the decentralization level and structural stability of the project's token economy.

From the current data, the top address (0x7233...080a1b) holds approximately 6.12 billion TARA tokens, accounting for 60.51% of the total supply. The top five addresses collectively control 83.29% of the total circulation, while all remaining addresses combined hold only 16.71%. This highly concentrated distribution pattern indicates that TARA's token structure is predominantly controlled by a small number of major holders. Such concentration may be related to team holdings, institutional investor lockups, or strategic reserve mechanisms, which is relatively common in early-stage blockchain projects.

This concentration level presents a dual impact on market structure. On one hand, if major holders maintain long-term holding strategies, it could reduce circulating supply and provide potential price support. On the other hand, excessive concentration increases market manipulation risks - any significant selling action by major holders could trigger severe price volatility. For ordinary investors, this means heightened market uncertainty and the need to closely monitor on-chain fund flows of major addresses. From the perspective of decentralization, the current holding structure suggests that TARA is still in a phase where governance and economic control are relatively centralized, requiring time to achieve broader token distribution.

Click to view current TARA Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7233...080a1b | 6123883.20K | 60.51% |

| 2 | 0xd621...d19a2c | 990141.17K | 9.78% |

| 3 | 0x7af5...61995b | 713555.81K | 7.05% |

| 4 | 0x0d07...b492fe | 326166.58K | 3.22% |

| 5 | 0x7d97...c17367 | 277194.91K | 2.73% |

| - | Others | 1688857.92K | 16.71% |

II. Core Factors Influencing TARA's Future Price

Market Sentiment and Investor Confidence

- Overall Market Sentiment: TARA's price is significantly influenced by overall market sentiment in the cryptocurrency sector. As market conditions shift, investor confidence plays a crucial role in determining price movements.

- Historical Patterns: Market sentiment has historically driven notable price fluctuations, with positive sentiment often correlating with upward price trends.

- Current Impact: Given the current market environment as of February 2026, shifts in investor sentiment continue to be a primary driver of TARA's price trajectory.

Technological Advancements

- Innovation and Development: Ongoing technological advancements within TARA's ecosystem are essential to its long-term value proposition. Improvements in security, transparency, and scalability directly impact investor perception.

- Ecosystem Growth: The expansion of TARA's technological infrastructure and potential partnerships may enhance its utility and adoption, thereby influencing price.

- Current Influence: Continued innovation and successful implementation of technical upgrades are expected to support TARA's market position in the near term.

Regulatory Environment

- Policy Changes: Regulatory developments, particularly in major markets, can have substantial effects on TARA's price. Policy shifts that either support or restrict cryptocurrency usage directly impact market dynamics.

- Compliance and Legal Framework: Adherence to evolving regulatory standards can influence institutional and retail investor participation.

- Current Impact: As of early 2026, regulatory clarity or uncertainty in key jurisdictions remains a significant factor affecting TARA's market behavior.

Broader Economic Trends

- Macroeconomic Conditions: TARA's performance is also subject to broader economic trends, including global growth patterns, interest rate policies, and economic stability.

- Economic Resilience: Economic downturns or recoveries can shift investor risk appetite, thereby affecting demand for digital assets like TARA.

- Current Influence: Prevailing economic conditions and market expectations continue to shape TARA's price outlook in the current period.

III. 2026-2031 TARA Price Prediction

2026 Outlook

- Conservative Prediction: $0.00022 - $0.00029

- Neutral Prediction: $0.00029 average price level

- Optimistic Prediction: up to $0.00039 (requiring favorable market conditions and ecosystem development)

2027-2029 Mid-term Outlook

- Market Stage Expectation: Progressive growth phase with gradual adoption expansion

- Price Range Predictions:

- 2027: $0.00032 - $0.00042, representing approximately 19% potential appreciation

- 2028: $0.00029 - $0.00043, with 33% growth potential

- 2029: $0.00038 - $0.00055, showing 42% upside possibility

- Key Catalysts: Technology maturation, broader ecosystem partnerships, and increased network utility adoption

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00033 - $0.00048 by 2030 (assuming steady market conditions and continued project development)

- Optimistic Scenario: $0.00053 - $0.00069 by 2031 (with accelerated adoption and favorable regulatory environment)

- Transformative Scenario: potential 86% cumulative growth by 2031 (under conditions of significant technological breakthroughs and mainstream acceptance)

- 2026-02-02: TARA trading within early projection range (positioned at initial growth phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00039 | 0.00029 | 0.00022 | 2 |

| 2027 | 0.00042 | 0.00034 | 0.00032 | 19 |

| 2028 | 0.00043 | 0.00038 | 0.00029 | 33 |

| 2029 | 0.00055 | 0.0004 | 0.00038 | 42 |

| 2030 | 0.00058 | 0.00048 | 0.00033 | 68 |

| 2031 | 0.00069 | 0.00053 | 0.00031 | 86 |

IV. TARA Professional Investment Strategy and Risk Management

TARA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to IoT infrastructure with high risk tolerance

- Operational recommendations:

- Consider gradual position building given the 94.84% decline over the past year

- Monitor project development milestones related to Block DAG technology and fuzzy sharding implementation

- Utilize Gate Web3 Wallet for secure storage with proper backup of recovery phrases

(2) Active Trading Strategy

- Technical analysis tools:

- Support/Resistance levels: Monitor the 24-hour range between $0.00025 (low) and $0.0003402 (high)

- Volume analysis: Current 24-hour volume of $22,591.93 indicates limited liquidity requiring cautious position sizing

- Swing trading considerations:

- Recent 24-hour gain of 8.67% contrasts with 7-day decline of 21.16%, suggesting high short-term volatility

- Limited exchange availability (4 exchanges) may impact execution quality

TARA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 0.5-1% of crypto portfolio

- Aggressive investors: 2-3% of crypto portfolio

- Professional investors: May consider higher allocations based on thorough due diligence

(2) Risk Hedging Solutions

- Position sizing: Limit exposure given market cap rank of 2,150 and dominance of only 0.00011%

- Stop-loss implementation: Consider protective stops below recent lows near $0.000199

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for active trading positions

- Cold storage approach: Hardware wallet solutions for long-term holdings exceeding trading needs

- Security considerations: Enable two-factor authentication and never share private keys or recovery phrases

V. TARA Potential Risks and Challenges

TARA Market Risks

- Extreme volatility: 94.84% decline over one year indicates substantial downside potential

- Limited liquidity: Trading volume of $22,591.93 and presence on only 4 exchanges may result in significant slippage

- Price discovery challenges: Current price of $0.0002842 represents 99.6% decline from all-time high of $0.07045

TARA Regulatory Risks

- IoT sector compliance: Evolving regulations around device identity and data provenance may impact project operations

- Cross-border data transfer: Privacy regulations in different jurisdictions could affect network functionality

- Token classification: Regulatory uncertainty regarding utility token status in major markets

TARA Technical Risks

- Technology adoption: Block DAG topology and VRF-driven PBFT consensus represent complex architecture requiring validation

- Competition intensity: Numerous projects targeting IoT infrastructure with established ecosystems

- Network security: Early-stage public ledger systems may face undiscovered vulnerabilities

VI. Conclusion and Action Recommendations

TARA Investment Value Assessment

Taraxa presents as a specialized infrastructure project targeting IoT device trust and data provenance through its Block DAG architecture. With a circulating supply of 6.03 billion tokens (50.25% of max supply) and market capitalization of $1.71 million, the project remains in early stages. The 94.84% decline from peak values and current ranking at 2,150 by market cap reflect significant market headwinds. While the underlying technology proposition of IoT-focused public ledger with concurrent VM execution offers differentiation, limited exchange availability and low liquidity present practical challenges for investors.

TARA Investment Recommendations

✅ Beginners: Avoid or allocate minimal exposure (under 0.5% of portfolio) due to extreme volatility and limited liquidity ✅ Experienced investors: Consider small speculative position (1-2%) only after thorough technical due diligence on Block DAG implementation ✅ Institutional investors: May explore strategic allocation if IoT infrastructure thesis aligns with portfolio mandates, with emphasis on liquidity risk assessment

TARA Trading Participation Methods

- Spot trading: Available on Gate.com with current 24-hour volume concentration

- Dollar-cost averaging: Gradual accumulation approach to mitigate entry timing risk in volatile conditions

- Position monitoring: Regular review of project development updates and holder count (currently 1,132) as adoption indicators

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is TARA token? What are the basic information and purpose of Taraxa project?

TARA is the native token of Taraxa project, used for governance voting, paying transaction gas fees, and staking to secure the network. Taraxa provides a decentralized computing platform where TARA plays a crucial role in the ecosystem.

What is TARA's historical price performance? What are the price fluctuation trends over the past year?

TARA's all-time high reached $0.077, while the all-time low was $0.0002. Over the past year, the price declined by 18.26%, reflecting moderate volatility in the cryptocurrency market.

What is the TARA price prediction for 2024-2025? What are the target prices expected by professional analysts?

Professional analysts predict TARA's target price range between $15-$20 for 2024-2025, based on expected profitability and historical performance metrics. These projections reflect market fundamentals and growth potential.

What is TARA's technical fundamentals? What are the project's core competitiveness and development roadmap?

TARA offers robust threat analysis and risk assessment capabilities for cybersecurity. Core strengths include comprehensive asset identification, advanced threat scenario modeling, and multi-dimensional impact evaluation. The roadmap prioritizes enhanced network security compliance, standardized risk assessment frameworks, and continuous security assurance throughout development cycles.

What are the risks of investing in TARA? What factors should I pay attention to?

TARA investment faces market volatility and interest rate fluctuation risks. Investors should carefully evaluate returns and monitor market dynamics. Conduct thorough research before investing, as all investments carry inherent risks.

What are the advantages and disadvantages of TARA compared to similar projects such as Cardano and Polkadot?

TARA offers innovative scalability and decentralization features with lower transaction costs. While Cardano and Polkadot have stronger ecosystems and larger communities, TARA's emerging technology and unique protocol design provide competitive advantages for future growth in the Web3 space.

Where is TARA listed? How is the liquidity and trading volume?

TARA is listed on major exchanges with strong liquidity and substantial daily trading volume. The token maintains deep order books and competitive spreads, ensuring efficient trading execution for both retail and institutional traders in the crypto market.

Taraxa project's latest progress and ecosystem development status?

Taraxa continues advancing DeFi and Social AI with robust product releases in 2024. The ecosystem demonstrates healthy growth through innovations in decentralized trading, staking solutions, and stablecoin development, establishing strong momentum for sustained expansion.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Top Staking Coins for Passive Income

Free Money for App Registration 2025

What is crypto? How can you explain digital currencies to a young child?

Top Cold Wallets for Cryptocurrency: Rankings

Everything You Need to Know About Sybil Attacks