2026 THINK Price Prediction: Expert Analysis and Market Outlook for the Next Generation Blockchain Token

Introduction: THINK's Market Position and Investment Value

Think Protocol (THINK), positioned as a foundational protocol for the agent-powered internet, has been connecting AI agents to an expanding network of open-source tools, models, and protocols since its inception. As of 2026, THINK maintains a market capitalization of approximately $414,400, with a circulating supply of 700 million tokens and a current price around $0.000592. This protocol, designed for developers, creators, and communities, is playing an increasingly important role in building an ecosystem where intelligence is composable, data remains user-owned, and innovation operates without permission.

This article will comprehensively analyze THINK's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. THINK Price History Review and Market Status

THINK Historical Price Evolution Trajectory

- 2025: THINK reached a notable price level of $0.03576 on July 29, representing a significant milestone in its early trading history

- 2026: The token experienced substantial price volatility, declining from previous levels to $0.0005001 on February 5, marking a considerable correction period

THINK Current Market Situation

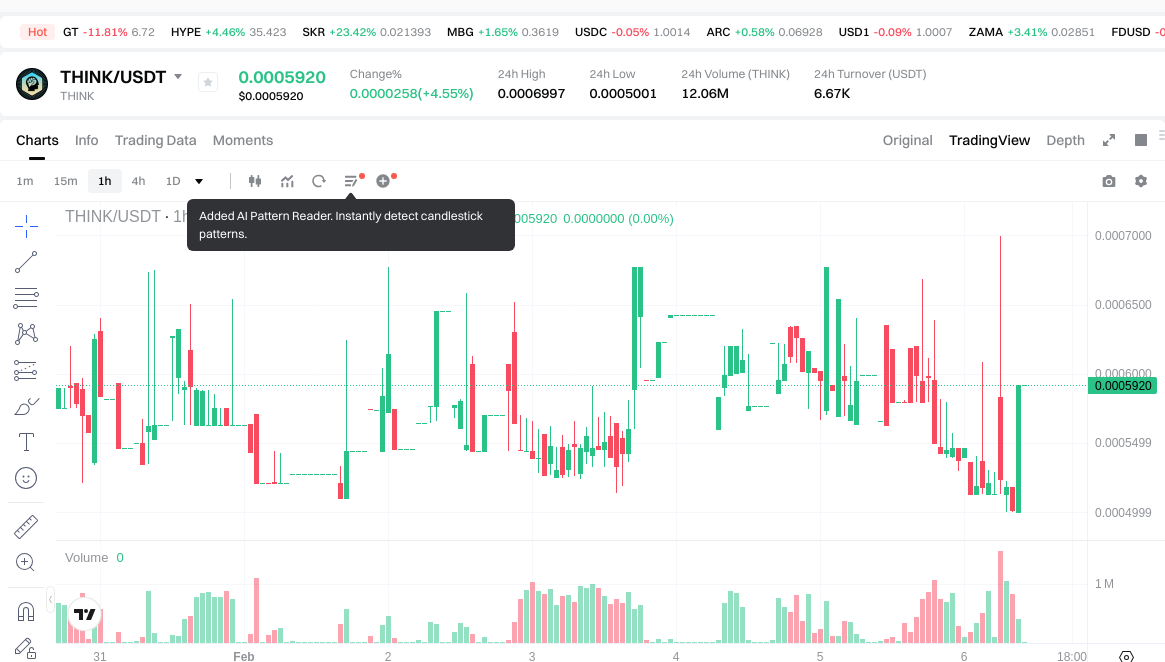

As of February 6, 2026, THINK is trading at $0.000592, showing mixed short-term performance indicators. The token has demonstrated a 16.97% increase over the past hour and a 4.55% gain in the 24-hour period, with trading volume reaching $6,679.49. However, broader timeframe analysis reveals downward pressure, with a 5.45% decline over the past week and a 74.89% decrease over the past 30 days.

The current market capitalization stands at $414,400, with 700 million tokens in circulation out of a maximum supply of 1 billion tokens, representing a 70% circulation ratio. The fully diluted market cap is calculated at $592,000. The token's 24-hour price range fluctuated between $0.0005001 and $0.0006997. Market share remains at 0.000025%, while the token holder base includes 2,173 addresses. Current market sentiment indicators reflect a Fear & Greed Index reading of 9, categorized as Extreme Fear.

Click to view current THINK market price

THINK Market Sentiment Index

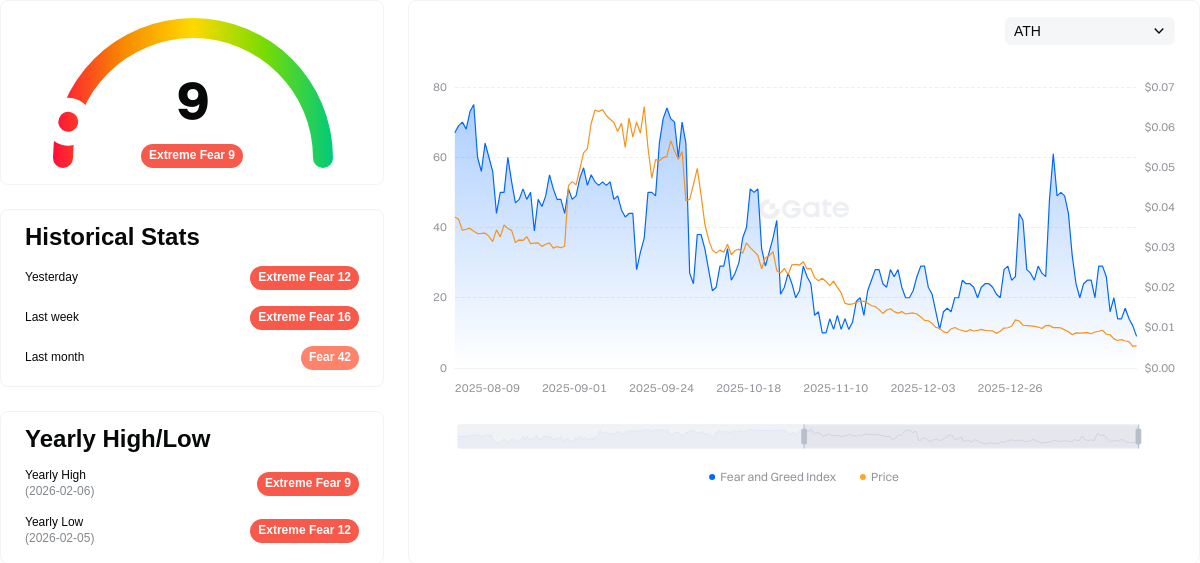

2026-02-06 Fear and Greed Index: 9(Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index hitting a historic low of 9. This indicates severe panic among investors, characterized by significant sell-offs and negative sentiment dominating the market. Such extreme fear levels often present contrarian opportunities for long-term investors, as markets tend to recover from these lows. However, caution is advised, as further volatility and downside risks may persist. Traders should focus on risk management and avoid panic-driven decisions during this period of market distress.

THINK Holding Distribution

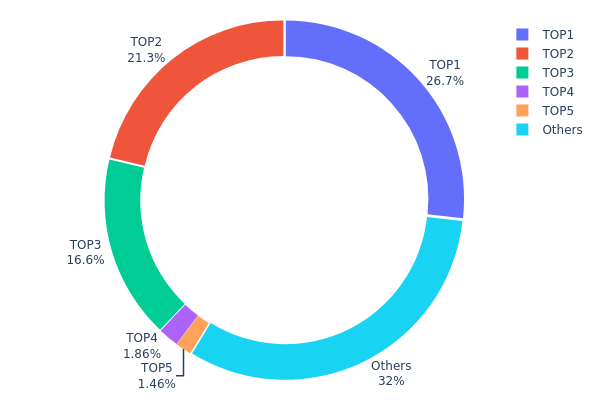

The holding distribution chart reveals the allocation of THINK tokens across different wallet addresses, serving as a critical indicator of token centralization and ecosystem health. Based on current on-chain data, the top three addresses collectively control 267,351.42K, 213,021.88K, and 166,161.11K tokens respectively, representing 26.73%, 21.30%, and 16.61% of total supply. This reveals a highly concentrated ownership structure, with the top three wallets alone holding 64.64% of all circulating THINK tokens.

Such significant concentration presents notable structural risks to the market. When a small number of addresses control nearly two-thirds of the token supply, it creates asymmetric power dynamics that can amplify price volatility during sell-offs or strategic repositioning. The fourth and fifth largest holders possess 1.85% and 1.46% respectively, indicating a substantial gap between major stakeholders and mid-tier participants. The remaining 32.05% distributed among other addresses suggests limited participation from the broader community, which may constrain organic growth and decentralized governance.

From a market structure perspective, this distribution pattern indicates that THINK remains vulnerable to concentrated decision-making and potential large-scale liquidations. The dominance of top addresses could enable coordinated actions that disproportionately influence price discovery mechanisms, potentially deterring institutional participants who prioritize market stability and fair trading conditions.

Click to view current THINK holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x43c3...290343 | 267351.42K | 26.73% |

| 2 | 0x0807...87d101 | 213021.88K | 21.30% |

| 3 | 0xd4a9...d2b8a2 | 166161.11K | 16.61% |

| 4 | 0xfa06...f99d73 | 18586.16K | 1.85% |

| 5 | 0x9642...2f5d4e | 14622.13K | 1.46% |

| - | Others | 320257.30K | 32.05% |

II. Core Factors Influencing THINK's Future Price

Supply Mechanism

- Market Volatility: Volatility remains an indispensable core factor in long-term investment strategies. Price movements reflect all available information in the market, with trends exhibiting persistence until clear reversal signals emerge.

- Historical Pattern: Global development conditions ultimately determine long-term price trends, though short-term movements are influenced by multiple factors. Price changes can continue to rise under certain conditions.

- Current Impact: Local and overall economic environmental changes, supply and demand dynamics, interest rates, and policy adjustments continue to shape market expectations.

Institutional and Major Holder Dynamics

- Institutional Holdings: Private capital markets are expected to play a significant role, demonstrating their ability to offer faster execution, more flexible terms, and greater reliability. The long-term and flexible nature of private capital positions it advantageously in the market.

- Corporate Adoption: The U.S. and China are advancing quickly in related development areas, driven by supportive regulation, substantial private sector investment, and rapid deployment.

- National Policy: Policy changes and regulatory frameworks continue to influence market sentiment and investment patterns. Fiscal balances and sovereign debt concerns may evolve based on policy adjustments and productivity growth trends.

Macroeconomic Environment

- Monetary Policy Impact: Interest rate changes directly affect market valuations. Economic growth patterns and inflation expectations shape policy decisions, which in turn influence pricing dynamics.

- Inflation Hedge Properties: Pricing cycles have changed following recent economic conditions, affecting price rigidity and inflation expectations. Companies frequently adjust prices to maintain profitability amid tight labor markets.

- Geopolitical Factors: International relations and economic dynamics between major economies constitute core factors influencing market trajectories. Global economic outlooks ultimately determine long-term trends, though short-term movements reflect various influencing factors.

Technical Development and Ecosystem Building

- AI Development: AI advancement represents a key factor, with regional leaders driving progress through supportive regulation and significant private sector investment. Private markets are positioned to fund substantial infrastructure buildout in this area.

- Market Infrastructure: The 5-year beta relative to broader market indices indicates that idiosyncratic risk has risen alongside valuations in technology-related segments. Competition is intensifying, leading to widening return dispersions.

- Ecosystem Applications: Private debt markets continue to grow as direct lenders demonstrate capabilities in execution speed and term flexibility. The market expects continued expansion, though competitive pressures may affect performance outcomes.

III. 2026-2031 THINK Price Prediction

2026 Outlook

- Conservative prediction: $0.00039 - $0.00059

- Neutral prediction: $0.00059

- Optimistic prediction: $0.00072 (requires favorable market conditions)

2027-2029 Mid-term Outlook

- Market stage expectation: The token may experience gradual growth as the project develops and market adoption increases

- Price range predictions:

- 2027: $0.00057 - $0.00069, with an expected average of $0.00066

- 2028: $0.00040 - $0.00075, with an expected average of $0.00067

- 2029: $0.00059 - $0.00095, with an expected average of $0.00071

- Key catalysts: Market maturation, technological developments, and increasing adoption could drive price appreciation, with projected changes ranging from 11% to 20% over this period

2030-2031 Long-term Outlook

- Baseline scenario: $0.00078 - $0.00086 (assuming steady market growth and sustained project development)

- Optimistic scenario: $0.00084 - $0.00122 (assuming accelerated adoption and positive market sentiment)

- Transformational scenario: Up to $0.00122 (under exceptionally favorable market conditions with significant ecosystem expansion)

- 2026-02-06: THINK trading within the early prediction range as the project continues its development trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00072 | 0.00059 | 0.00039 | 0 |

| 2027 | 0.00069 | 0.00066 | 0.00057 | 11 |

| 2028 | 0.00075 | 0.00067 | 0.0004 | 13 |

| 2029 | 0.00095 | 0.00071 | 0.00059 | 20 |

| 2030 | 0.00086 | 0.00083 | 0.00078 | 40 |

| 2031 | 0.00122 | 0.00084 | 0.00077 | 42 |

IV. THINK Professional Investment Strategy and Risk Management

THINK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the future development of AI agent infrastructure and are willing to bear medium to long-term volatility

- Operational Recommendations:

- Consider accumulating positions gradually during market corrections rather than investing all at once

- Monitor the progress of THINK's protocol development and ecosystem expansion as key indicators

- Use Gate Web3 Wallet for secure storage, ensuring proper backup of private keys and recovery phrases

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Given THINK's recent volatility, identify key price levels around $0.0005-0.0007 for short-term trading opportunities

- Volume Analysis: Monitor trading volume changes on Gate.com to assess market sentiment and potential trend reversals

- Swing Trading Points:

- Set clear stop-loss levels (typically 5-10% below entry price) to manage downside risk

- Consider taking partial profits during significant upward movements given the token's historical volatility

THINK Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of cryptocurrency portfolio

- Aggressive Investors: 3-5% of cryptocurrency portfolio

- Professional Investors: Up to 10% of cryptocurrency portfolio with active risk management

(2) Risk Hedging Solutions

- Position Sizing: Limit initial exposure and scale in gradually as the project demonstrates progress

- Diversification: Balance THINK holdings with established cryptocurrencies and other AI-related tokens

(3) Security Storage Solutions

- Hot Wallet: Gate Web3 Wallet for active trading and small amounts

- Cold Storage: Hardware wallet solutions for long-term holdings and larger amounts

- Security Precautions: Never share private keys, enable two-factor authentication, and verify all transaction addresses before confirming

V. THINK Potential Risks and Challenges

THINK Market Risks

- High Volatility: THINK has experienced significant price fluctuation, with a 74.89% decline over the past 30 days, indicating substantial volatility risk

- Low Liquidity: With a 24-hour trading volume of approximately $6,679 and limited exchange listings, liquidity constraints may lead to price slippage during large transactions

- Market Sentiment: The AI agent sector is subject to rapid sentiment shifts, which can cause sharp price movements independent of fundamental developments

THINK Regulatory Risks

- AI Regulation Uncertainty: Evolving global regulations around AI technologies could impact the development and adoption of AI agent protocols

- Cryptocurrency Compliance: Changing regulatory frameworks for digital assets in major jurisdictions may affect trading availability and accessibility

- Data Privacy Concerns: As THINK emphasizes user data ownership, regulatory developments in data protection could influence protocol operations

THINK Technical Risks

- Smart Contract Vulnerabilities: As an Ethereum-based protocol, THINK is subject to potential smart contract bugs or security exploits

- Competitive Landscape: The AI agent infrastructure space is rapidly evolving, with numerous projects competing for developer adoption and market share

- Adoption Challenges: The protocol's success depends on attracting developers and building a robust ecosystem, which remains uncertain in the early stages

VI. Conclusion and Action Recommendations

THINK Investment Value Assessment

THINK Protocol presents an interesting opportunity in the emerging AI agent infrastructure space, positioning itself as a foundational layer for connecting AI agents with open-source tools and protocols. The project's emphasis on interoperability, user data ownership, and composable intelligence aligns with growing trends in decentralized AI. However, the token faces significant near-term challenges, including substantial price decline (down 99.35% from its all-time high), limited liquidity, and the need to demonstrate meaningful ecosystem adoption. While the long-term value proposition centers on becoming critical infrastructure for the agent-powered internet, investors should approach with caution given the early-stage nature of the project and high volatility.

THINK Investment Recommendations

✅ Beginners: Start with minimal exposure (under 1% of crypto portfolio) and focus on understanding the AI agent ecosystem before increasing position size ✅ Experienced Investors: Consider a small speculative allocation (2-5% of crypto portfolio) with strict risk management protocols and clear exit strategies ✅ Institutional Investors: Conduct thorough due diligence on protocol architecture, team credentials, and ecosystem development before considering strategic positioning

THINK Trading Participation Methods

- Spot Trading: Purchase THINK directly on Gate.com and hold in Gate Web3 Wallet for medium to long-term exposure

- Dollar-Cost Averaging: Establish regular purchase intervals to smooth out entry price and reduce timing risk

- Active Monitoring: Track protocol development updates, partnership announcements, and ecosystem metrics to inform position adjustments

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is THINK token? What is its purpose?

THINK token is a cryptocurrency that incentivizes ecosystem participants and facilitates platform activities. It serves as a utility token for transactions and rewards within its network, driving user engagement and ecosystem growth.

What is the current price of THINK token? How is the market condition?

THINK token is currently trading at approximately $0.00052926 USD. Market conditions fluctuate in real-time. At current rates, 1 USD equals roughly 341,735.54 THINK tokens. Check real-time data for the latest price updates.

What is the THINK token price prediction for 2024?

Based on market trends and historical halving events, THINK token is projected to reach approximately $55,000 in 2024. However, price predictions may fluctuate based on market conditions and investor sentiment.

What are the main factors affecting THINK token price?

THINK token price is primarily influenced by supply and demand dynamics, market sentiment, trading volume, technology development progress, regulatory policies, and macroeconomic conditions. These factors collectively drive price fluctuations in the market.

What are the advantages and disadvantages of THINK tokens compared to similar tokens?

THINK tokens incentivize community participation and align stakeholder interests through transparent, decentralized mechanisms. Advantages include strong governance alignment and community engagement. Potential disadvantages are liquidity constraints and price volatility inherent in emerging tokens.

What are the risks of investing in THINK tokens and how should they be mitigated?

THINK token investments carry market volatility and liquidity risks. Mitigation strategies include diversifying your portfolio, starting with small amounts to test the market, and avoiding excessive leverage. Conduct thorough research before investing.

What is the technical foundation and team background of THINK token? What are its future prospects?

THINK token is built on blockchain technology to enhance AI agent capabilities. The team comprises tech experts focused on decentralized tools and protocols. With AI and blockchain development accelerating, THINK demonstrates strong growth potential in the emerging infrastructure sector.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

What is a Private Key? How Does It Differ from a Public Key and What Can You Do with It?

Using and Calculating RSI in Cryptocurrency Trading

Cryptocurrency theft topped $2 billion in 2025—it's time to rethink how assets are stored.

What Are RWAs (Real World Assets): A Complete Guide to Tokenizing Real-World Assets

How to Begin Trading NFTs