2026 TRC Price Prediction: Expert Analysis and Market Outlook for TRON's Native Token

Introduction: TRC Market Position and Investment Value

Terrace (TRC), as a next-generation self-custodial crypto trading terminal and broker that aggregates liquidity from CEX, DEX, market makers, and OTC desks, has been actively developing since its launch in 2025. As of 2026, Terrace has achieved a market capitalization of approximately $1.54 million, with a circulating supply of about 180 million tokens, and the price is maintained at around $0.0086. This asset, regarded as an innovative all-in-one trading solution, is playing an increasingly important role in enhancing trading efficiency and liquidity access for crypto investors.

This article will comprehensively analyze the price trends of Terrace from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. TRC Price History Review and Market Status

TRC Historical Price Evolution Trajectory

- 2025: TRC experienced its initial trading phase after launching on Gate.com on January 13, 2025, with price demonstrating considerable volatility during early market formation

- March 2025: The token reached a peak level of $0.03089 on March 12, 2025, representing a notable upward movement during its initial trading months

- April 2025: Following the peak period, TRC entered a corrective phase, recording its lowest level at $0.001399 on April 11, 2025

TRC Current Market Status

As of February 2, 2026, TRC is trading at $0.0085545, with a 24-hour trading volume of $6,793.37. The token has demonstrated positive momentum across multiple timeframes, showing a 7.96% increase over the past hour and a 12.55% gain in the last 24 hours. Over the past week, TRC has experienced significant upward movement with a 76.86% increase, while the 30-day performance indicates a 113.86% gain.

The token currently maintains a market capitalization of approximately $1.54 million, with 180 million tokens in circulation out of a maximum supply of 1 billion tokens, representing an 18% circulation ratio. The fully diluted market capitalization stands at $8.55 million. TRC holds a market dominance of 0.00031% and ranks at position 2,215 in the cryptocurrency market. The token has attracted 708 holders and is available on 2 exchanges, with Gate.com being a primary trading venue.

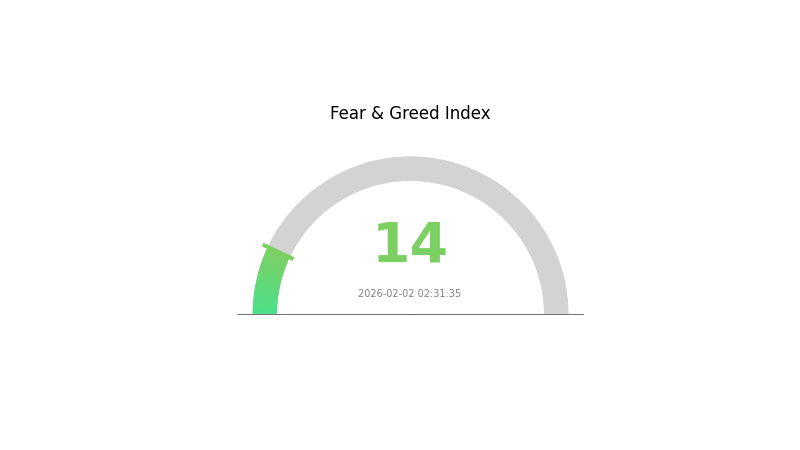

Within the past 24 hours, TRC has traded within a range between $0.0076 and $0.0086425. The current market sentiment index for cryptocurrencies shows an Extreme Fear reading at 14, indicating heightened caution among market participants.

Click to view the current TRC market price

TRC Market Sentiment Indicator

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The TRC market is currently experiencing extreme fear with a fear and greed index of 14. This indicates exceptionally negative market sentiment, with investors showing significant pessimism and risk aversion. Such extreme fear conditions often present contrarian opportunities for long-term investors, as excessive pessimism can precede market reversals. However, caution is still warranted as prices may continue declining in the short term. Monitor key support levels and market developments closely before making investment decisions.

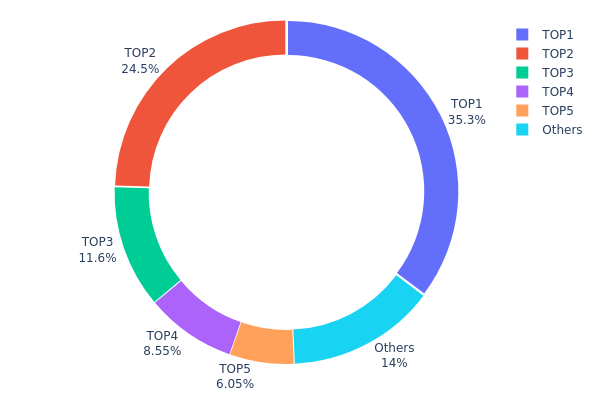

TRC Holdings Distribution

The holdings distribution chart illustrates the concentration of TRC tokens across different wallet addresses, providing insights into the token's decentralization level and potential market control risks. Based on the current data, the top 5 addresses collectively hold 850,551.56K TRC, representing approximately 85.06% of the total supply, while the remaining 14.06% is distributed among other addresses.

The data reveals a significantly high concentration pattern. The largest holder controls 352,500.00K tokens (35.25%), and the second-largest address holds 244,988.08K tokens (24.49%). Combined, just these two addresses account for nearly 60% of the entire token supply. The top 5 addresses' cumulative holding of over 85% indicates an extremely centralized ownership structure. This level of concentration presents substantial risks to market stability, as any selling pressure from these major holders could trigger significant price volatility. Additionally, such concentration patterns may raise concerns about potential market manipulation, as a small number of entities possess sufficient influence to impact price movements and liquidity conditions.

From a market structure perspective, this distribution pattern suggests limited decentralization and potentially fragile on-chain stability. While concentrated holdings might indicate strong confidence from early investors or project stakeholders, it simultaneously creates vulnerability to sudden market shifts. The relatively small proportion held by other addresses (14.06%) suggests limited broad-based community participation, which could affect long-term ecosystem development and trading liquidity depth.

Click to view current TRC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6906...a0c2df | 352500.00K | 35.25% |

| 2 | 0x17a4...5f1242 | 244988.08K | 24.49% |

| 3 | 0xfbb0...f2290b | 116036.85K | 11.60% |

| 4 | 0x0d07...b492fe | 85525.78K | 8.55% |

| 5 | 0x8c6e...e047fa | 60500.85K | 6.05% |

| - | Others | 140448.44K | 14.06% |

II. Core Factors Influencing TRC's Future Price

Supply Mechanism

- DPoS Consensus and Token Distribution: TRC operates on a Delegated Proof of Stake (DPoS) consensus mechanism, which influences token distribution through validator rewards and network participation incentives.

- Historical Patterns: Past supply dynamics have shown that increased network activity and token lock-ups in DeFi protocols tend to create upward pressure on price by reducing circulating supply.

- Current Impact: As more assets become locked in TRON's DeFi ecosystem, particularly in platforms like JustLend, the effective circulating supply may tighten, potentially supporting price stability.

Institutional and Major Holder Dynamics

- Institutional Position: TRON has gained attention from various crypto investment funds, though specific institutional holdings remain relatively dispersed compared to more mainstream assets.

- Enterprise Adoption: The TRON network has seen adoption primarily in the stablecoin transfer space, with TRC-20 USDT becoming one of the most widely used stablecoin standards due to its low transaction fees.

- Regulatory Environment: Ongoing legal developments, including past SEC scrutiny of TRON Foundation and its founder, continue to create regulatory uncertainty that may affect investor confidence and institutional participation.

Macroeconomic Environment

- Monetary Policy Impact: As with other crypto assets, TRC's price tends to be sensitive to global monetary policy shifts, particularly U.S. Federal Reserve actions that influence risk appetite in digital asset markets.

- Inflation Hedge Characteristics: While cryptocurrencies are sometimes positioned as inflation hedges, TRC's performance in inflationary environments has been mixed, with price movements more closely tied to broader crypto market sentiment than macroeconomic fundamentals.

- Geopolitical Factors: International regulatory developments and cross-border payment trends can impact TRON's utility, particularly given its significant role in facilitating low-cost stablecoin transfers.

Technical Development and Ecosystem Building

- DeFi Infrastructure Expansion: The continued development of DeFi protocols on TRON, including decentralized exchanges like SunSwap and lending platforms like JustLend, provides fundamental use cases that drive network activity and token utility.

- NFT and GameFi Integration: TRON's ecosystem includes NFT marketplaces such as APENFT Marketplace and various GameFi projects, though these segments have gained less traction compared to TRON's strength in payment and DeFi applications.

- Ecosystem Applications: The network's low transaction costs and fast settlement times continue to attract developers building payment-focused applications, stablecoin infrastructure, and value transfer solutions, which remain core strengths of the TRON ecosystem.

III. 2026-2031 TRC Price Forecast

2026 Outlook

- Conservative forecast: $0.00796 - $0.00855

- Neutral forecast: $0.00855 (average market conditions)

- Optimistic forecast: $0.01104 (requires favorable market momentum and increased adoption)

2027-2029 Outlook

- Market stage expectation: TRC is anticipated to enter a gradual growth phase, with price movements reflecting broader market sentiment and ecosystem development.

- Price range forecast:

- 2027: $0.00735 - $0.01136 (14% potential increase)

- 2028: $0.00645 - $0.01227 (23% potential increase)

- 2029: $0.00651 - $0.01531 (33% potential increase)

- Key catalysts: Sustained ecosystem expansion, enhanced utility adoption, and positive regulatory developments could drive price appreciation during this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00869 - $0.01337 (assuming steady market conditions and moderate adoption growth)

- Optimistic scenario: $0.01664 - $0.01992 (driven by significant technological upgrades and broader market acceptance)

- Transformational scenario: Up to $0.02147 (contingent upon exceptional market conditions, major partnerships, and widespread utility integration)

- February 2, 2026: TRC trading within early-stage consolidation range

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01104 | 0.00855 | 0.00796 | 0 |

| 2027 | 0.01136 | 0.00979 | 0.00735 | 14 |

| 2028 | 0.01227 | 0.01058 | 0.00645 | 23 |

| 2029 | 0.01531 | 0.01142 | 0.00651 | 33 |

| 2030 | 0.01992 | 0.01337 | 0.00869 | 56 |

| 2031 | 0.02147 | 0.01664 | 0.01015 | 94 |

IV. TRC Professional Investment Strategies and Risk Management

TRC Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Individuals seeking exposure to innovative trading infrastructure and liquidity aggregation technology

- Operational Recommendations:

- Consider gradual accumulation during market corrections to minimize timing risk

- Monitor platform development milestones and user adoption metrics

- Storage Solution: Gate Web3 Wallet for secure self-custody with multi-chain support

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume trends; current volume of approximately 6,793 USDT suggests limited liquidity requiring careful position sizing

- Price Action Analysis: Observe key support levels around 0.0076 USDT (24H low) and resistance near 0.0086 USDT (24H high)

- Swing Trading Considerations:

- Recent 7-day gain of 76.86% indicates elevated short-term volatility

- Set appropriate stop-loss orders given the token's price fluctuation history

TRC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio

- Professional Investors: 5-8% of crypto portfolio

(2) Risk Hedging Strategies

- Position Sizing: Limit exposure based on market capitalization of approximately 1.54 million USDT

- Diversification: Maintain exposure across multiple trading infrastructure tokens

(3) Secure Storage Solutions

- Self-Custody Wallet Recommendation: Gate Web3 Wallet for Base chain and ERC-20 compatible assets

- Cold Storage Option: Consider hardware wallet integration for larger holdings

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (Base: 0xc23e4352cdba6fc951398bf274619c4529eac867)

V. TRC Potential Risks and Challenges

TRC Market Risks

- Liquidity Risk: With only 2 exchanges listing TRC and modest daily volume, exit positions may face slippage

- Volatility Risk: 30-day gain of 113.86% suggests significant price swings that could reverse quickly

- Market Cap Risk: Relatively small market cap of 1.54 million USDT increases susceptibility to large holder movements

TRC Regulatory Risks

- Trading Platform Regulations: Evolving regulatory frameworks for crypto aggregation services may impact platform operations

- Compliance Requirements: Self-custodial platforms face increasing scrutiny regarding KYC/AML implementations

- Jurisdictional Restrictions: Access to certain liquidity sources may become restricted in various regions

TRC Technical Risks

- Smart Contract Risk: ERC-20 and Base chain contract vulnerabilities could expose user funds to exploits

- Integration Risk: Reliance on multiple CEX and DEX integrations creates additional technical dependencies

- Competition Risk: Established trading terminals and aggregators may limit market penetration

VI. Conclusion and Action Recommendations

TRC Investment Value Assessment

TRC represents an emerging solution in the crypto trading infrastructure space, offering liquidity aggregation across centralized and decentralized venues. With 18% of total supply in circulation (180 million of 1 billion tokens) and holder count at 708, the project shows early-stage adoption. However, limited exchange listings and modest market capitalization present significant liquidity constraints. Long-term value depends on platform adoption, successful liquidity partnerships, and competitive differentiation in a crowded market.

TRC Investment Recommendations

✅ Beginners: Allocate minimal exposure (under 2% of crypto holdings) and prioritize learning about the platform's functionality before investing ✅ Experienced Investors: Consider small speculative positions while monitoring adoption metrics, trading volume growth, and platform development updates ✅ Institutional Investors: Conduct thorough due diligence on liquidity partnerships and user acquisition strategy before considering allocation

TRC Trading Participation Methods

- Spot Trading: Available on Gate.com with TRC/USDT trading pairs

- Self-Custody Trading: Acquire tokens through decentralized exchanges on Base chain

- Research Participation: Follow project development through official channels at terrace.fi and Twitter @terrace_fi

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is TRC? What are its basic characteristics and uses?

TRC is a blockchain-based utility token designed for decentralized ecosystem governance and transaction facilitation. It features fast settlement, low fees, and enables smart contract interactions. Primary uses include platform transactions, staking rewards, and decentralized finance participation.

What are the main factors affecting TRC price?

TRC price is primarily influenced by market demand, supply volume, overall economic trends, regulatory policies, technological innovations, and market sentiment. Trading volume and ecosystem development also play significant roles in price movements.

How to conduct TRC price technical analysis and prediction?

Analyze TRC price through chart patterns, moving averages, and RSI indicators. Study historical price data and trading volume to identify trends. Combine support/resistance levels with momentum analysis to forecast future price movements and trading opportunities.

What are the risks and limitations of TRC price prediction?

TRC price prediction faces risks from regulatory uncertainty and market volatility. Limitations include centralization dependency, technical reliance, and data accuracy constraints that may affect prediction precision.

How is the price correlation between TRC and mainstream cryptocurrencies such as BTC and ETH?

TRC shows relatively low price correlation with BTC and ETH due to its smaller market cap and lower trading volume. As an emerging cryptocurrency, TRC's price movements are driven by distinct market factors, operating somewhat independently from mainstream digital assets.

What key information should I understand before investing in TRC?

Before investing in TRC, understand its legitimacy, reputation, and regulatory background. Evaluate the exchange's security, user experience, and compliance status. Research TRC's market fundamentals, transaction volume, and community support to make informed decisions.

TRX Staking Fees on Gate.com and Tron Network Explained

Tron (TRX), BitTorrent (BTT), and Sun Token (SUN): Can Justin Sun’s Crypto Ecosystem Moon in 2025

How to Use TRX Token for Transactions

What is Tron?

SUN Token – Can TRON DeFi Token $SUN Reach The Moon ?

TRON price analysis and market trends for investment in 2025

Top Staking Coins for Passive Income

Free Money for App Registration 2025

What is crypto? How can you explain digital currencies to a young child?

Top Cold Wallets for Cryptocurrency: Rankings

Everything You Need to Know About Sybil Attacks