2026 TRKX Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: TRKX's Market Position and Investment Value

Trakx (TRKX), as a regulated platform for crypto-index trading, has been offering thematic Crypto Tradable Indices (CTIs) and strategies since its launch in 2024. As of 2026, TRKX maintains a market capitalization of approximately $262,533, with a circulating supply of about 714.38 million tokens, and the price hovering around $0.0003675. This asset, known as a "crypto index trading utility token," is playing an increasingly important role in the diversified crypto investment space.

This article will comprehensively analyze TRKX's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment factors to provide investors with professional price forecasts and practical investment strategies.

I. TRKX Price History Review and Market Status

TRKX Historical Price Evolution Trajectory

- 2024: TRKX launched on Gate.com in October with an initial offering price of $0.025, reaching an all-time high of $0.08408 on October 15, 2024, representing a substantial upward movement in its early trading phase.

- 2025-2026: The token experienced significant downward pressure, declining from its peak of $0.08408 to an all-time low of $0.00033 recorded on February 6, 2026, reflecting a contraction of over 99% from its historical high.

TRKX Current Market Dynamics

As of February 8, 2026, TRKX is trading at $0.0003675, showing a modest 24-hour increase of 0.9%. The token's recent performance indicates continued volatility, with a 1-hour price movement of +0.13%, while experiencing notable declines over longer timeframes: -15.24% over the past 7 days and -24.09% over the past 30 days. The annual performance reflects a decrease of 92.95%.

The market capitalization stands at approximately $262,533, with a circulating supply of 714,375,221 TRKX tokens out of a maximum supply of 1,000,000,000 tokens, representing a circulation ratio of 71.44%. The 24-hour trading volume is recorded at $29,516. The market cap to fully diluted valuation ratio is 71.44%, and TRKX holds a minimal market dominance of 0.000014%.

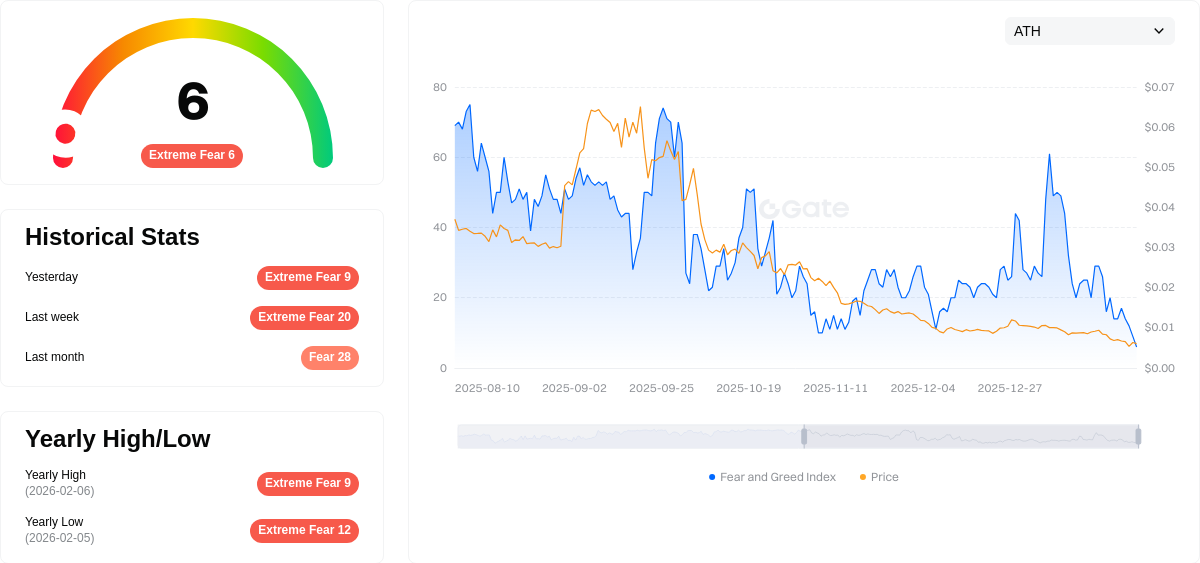

The token's 24-hour price range spans from a low of $0.0003596 to a high of $0.0004001. Current holder count is reported at 1,683 addresses. The cryptocurrency fear and greed index registers at 6, indicating extreme fear sentiment in the broader market environment.

Click to view current TRKX market price

TRKX Market Sentiment Indicator

2026-02-07 Fear and Greed Index: 6 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear with a Fear and Greed Index reading of just 6. This extraordinarily low score indicates severe market pessimism and panic selling pressure among investors. Such extreme readings often signal potential oversold conditions where assets may be trading well below intrinsic value. Historically, these deep fear levels have presented contrarian buying opportunities for long-term investors willing to withstand short-term volatility. However, caution remains essential as markets can remain in distressed conditions longer than anticipated.

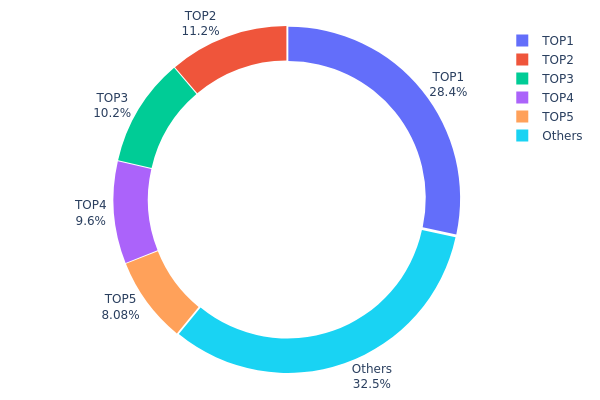

TRKX Holding Distribution

The holding distribution chart illustrates the concentration of TRKX tokens across different wallet addresses, providing insights into the decentralization level and potential market manipulation risks. By analyzing the percentage of tokens held by top addresses versus smaller holders, this metric reveals the underlying power structure within the TRKX ecosystem and its implications for price stability.

Based on current data, TRKX exhibits a highly concentrated holding structure. The top address alone controls 283,652.16K tokens, representing 28.36% of the total supply, while the top five addresses collectively hold 674,551.41K tokens, accounting for 67.43% of the circulating supply. This leaves only 32.57% distributed among other addresses, indicating a significant concentration risk that deviates from ideal decentralization standards typically observed in mature cryptocurrency projects.

This concentration pattern poses several concerns for market dynamics. The dominant position of top holders grants them substantial influence over price movements, as large-scale selling or transfer activities could trigger significant volatility. Additionally, such concentration increases the vulnerability to coordinated manipulation and reduces the resilience of the token economy against external shocks. The limited distribution among smaller holders also suggests weak retail participation, which may impact liquidity depth and organic market development. From a structural perspective, this holding distribution reflects an early-stage or tightly controlled token economy that requires monitoring for potential governance centralization and supply-side risks.

Click to view current TRKX Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xfbdc...9a05c9 | 283652.16K | 28.36% |

| 2 | 0x5711...bf734b | 112305.06K | 11.23% |

| 3 | 0x0d07...b492fe | 101806.75K | 10.18% |

| 4 | 0xd394...7f97f9 | 95991.06K | 9.59% |

| 5 | 0x4858...1a3ccc | 80796.38K | 8.07% |

| - | Others | 325448.59K | 32.57% |

II. Core Factors Influencing TRKX's Future Price

Supply Mechanism

- Token Economics: The supply mechanism plays a fundamental role in determining TRKX's value trajectory. According to market analysis, the token's economic model directly impacts its investment value through carefully designed distribution parameters.

- Historical Patterns: Historical data suggests that supply-side adjustments have been instrumental in shaping price movements across similar digital assets. Understanding these patterns provides insight into potential future scenarios.

- Current Impact: As of February 2026, the supply mechanism continues to be a critical factor that investors monitor when evaluating TRKX's price prospects.

Institutional and Market Adoption

- Institutional Adoption: Market application and institutional involvement represent significant drivers for TRKX's future valuation. The level of institutional participation can provide stability and credibility to the asset.

- Market Application: The extent of TRKX's practical applications within the digital asset ecosystem influences its long-term value proposition and market acceptance.

Macroeconomic Environment

- Market Cycle Impact: TRKX's price movements are closely tied to broader market cycles within the cryptocurrency sector. These cyclical patterns affect investor sentiment and capital flows.

- Economic Factors: Macroeconomic conditions play a crucial role in shaping the investment landscape for digital assets like TRKX. Global economic trends can significantly influence market dynamics and price behavior.

Technology Development and Ecosystem Building

- Technical Upgrades: Ongoing technological development remains central to TRKX's value proposition. Continuous improvement and innovation in the project's technical infrastructure can enhance its competitive position.

- Ecosystem Expansion: The growth and maturation of TRKX's ecosystem, including various applications and use cases, directly contribute to its market acceptance and adoption rates. A robust ecosystem can drive sustained demand and support price appreciation over time.

III. 2026-2031 TRKX Price Forecast

2026 Outlook

- Conservative forecast: $0.0002 - $0.00037

- Neutral forecast: $0.00037

- Optimistic forecast: $0.00044 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: The token may enter a gradual growth phase as the project matures and builds its user base

- Price range forecast:

- 2027: $0.00022 - $0.00046

- 2028: $0.00027 - $0.00054

- 2029: $0.00039 - $0.00053

- Key catalysts: Technological developments, ecosystem expansion, and broader market recovery could serve as primary drivers for price appreciation

2030-2031 Long-term Outlook

- Baseline scenario: $0.00032 - $0.00051 (assuming steady project development and stable market conditions)

- Optimistic scenario: $0.00051 - $0.00064 (assuming accelerated adoption and favorable regulatory environment)

- Transformative scenario: $0.00044 - $0.00059 (under exceptionally favorable conditions including major partnerships and significant technological breakthroughs)

- 2026-02-08: TRKX trading within early-stage price discovery range with potential for gradual appreciation over the forecast period

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00044 | 0.00037 | 0.0002 | 0 |

| 2027 | 0.00046 | 0.0004 | 0.00022 | 9 |

| 2028 | 0.00054 | 0.00043 | 0.00027 | 17 |

| 2029 | 0.00053 | 0.00048 | 0.00039 | 31 |

| 2030 | 0.00064 | 0.00051 | 0.00032 | 37 |

| 2031 | 0.00059 | 0.00057 | 0.00044 | 56 |

IV. TRKX Professional Investment Strategy and Risk Management

TRKX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to regulated crypto index platforms with moderate risk tolerance

- Operational Recommendations:

- Consider accumulating positions during market downturns, particularly when TRKX trades near its historical support levels around $0.00033

- Monitor the platform's CTI product expansion and regulatory compliance developments as key value drivers

- Implement secure storage solutions using Gate Web3 Wallet for enhanced asset protection

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Track the 24-hour trading volume ($29,515.59) relative to market cap to identify accumulation or distribution phases

- Support/Resistance Levels: Current 24-hour range ($0.0003596 - $0.0004001) provides short-term trading boundaries

- Swing Trading Key Points:

- The token has experienced significant volatility with -15.24% weekly and -24.09% monthly changes, creating potential swing opportunities

- Entry points near the lower band of the daily range may offer favorable risk-reward ratios for short-term positions

TRKX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: 5-8% with active position management

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine TRKX with established crypto assets to reduce concentration risk

- Stop-Loss Implementation: Set stop-loss orders 10-15% below entry points to limit downside exposure

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading access

- Multi-Signature Options: Consider multi-signature solutions for larger holdings

- Security Precautions: Enable two-factor authentication, regularly update security protocols, and never share private keys or seed phrases

V. TRKX Potential Risks and Challenges

TRKX Market Risks

- High Volatility: The token has declined 92.95% year-over-year, demonstrating extreme price fluctuation potential

- Low Liquidity: With a 24-hour trading volume of approximately $29,515 and market cap of $262,532, liquidity constraints may impact large position entries or exits

- Limited Exchange Availability: Currently traded on only one exchange, which concentrates trading risk and reduces market depth

TRKX Regulatory Risks

- Regulatory Framework Changes: As a regulated platform, shifts in crypto index product regulations could materially impact business operations

- Compliance Costs: Ongoing regulatory compliance requirements may affect the platform's operational efficiency and profitability

- Jurisdictional Restrictions: Regulatory variations across different regions may limit market expansion opportunities

TRKX Technical Risks

- Smart Contract Vulnerabilities: The token operates on the Polygon network; any protocol-level security issues could affect asset safety

- Platform Dependency: Value proposition relies heavily on the success and adoption of Trakx's CTI products

- Network Risks: Technical issues or congestion on the Polygon blockchain could impact transaction processing and user experience

VI. Conclusion and Action Recommendations

TRKX Investment Value Assessment

TRKX represents a niche investment opportunity in the regulated crypto index space, with a unique value proposition centered on thematic Crypto Tradable Indices. The platform's regulatory compliance provides a differentiated positioning in the market. However, the token faces significant challenges including substantial price depreciation (-92.95% annually), limited liquidity, and concentration risk with single exchange trading. The circulating supply represents 71.44% of total supply, indicating moderate token distribution. Long-term value depends on the platform's ability to expand its CTI product offerings, increase user adoption, and maintain regulatory standing. Short-term risks include continued price volatility, liquidity constraints, and broader market sentiment.

TRKX Investment Recommendations

✅ Beginners: Approach with extreme caution; consider allocating no more than 1% of your crypto portfolio, and only after thoroughly researching the platform's fundamentals and understanding the high-risk nature of low-liquidity tokens

✅ Experienced Investors: May consider speculative positions of 2-3% allocation, employing strict risk management including stop-loss orders and regular portfolio rebalancing based on market conditions and platform development milestones

✅ Institutional Investors: Conduct comprehensive due diligence on Trakx's regulatory status, CTI product performance, and market positioning before considering strategic positions; implement robust risk monitoring frameworks

TRKX Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and sale of TRKX tokens with immediate settlement

- Dollar-Cost Averaging: Systematically accumulate positions over time to reduce timing risk and average entry prices

- Threshold-Based Trading: Set predetermined price levels for entering or exiting positions based on technical analysis and personal risk tolerance

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is TRKX? What are its uses and value?

TRKX is the Trakx token that powers a loyalty program offering trading discounts. It simplifies diversified cryptocurrency portfolio management, enabling users to purchase baskets of crypto assets with a single click for streamlined investing.

What is the historical price trend of TRKX? What is the current price level?

TRKX is currently trading at ¥0.003130, up 0.90%. Market cap stands at ¥2.2254 million with 24H trading volume of ¥91,182. The token has shown modest price movements recently within its trading range.

What is the TRKX price prediction for 2024-2025?

Based on current market analysis, TRKX price predictions for 2024-2025 suggest potential growth of approximately 5% annually. The exact trajectory depends on market adoption, regulatory developments, and broader macroeconomic factors. Long-term projections indicate gradual appreciation as the platform gains traction.

What are the main factors affecting TRKX price?

TRKX price is influenced by supply and demand dynamics, market sentiment driven by news and investor confidence, regulatory developments such as ETF approvals, institutional adoption rates, and broader macroeconomic trends including inflation and interest rates. These factors collectively determine TRKX price movements and market outlook.

What are the advantages and disadvantages of TRKX compared to similar tokens?

TRKX offers high liquidity and lower transaction fees compared to similar tokens, with strong scalability. However, it lacks broader ecosystem integration and may have smaller community support than established competitors.

What are the risks of investing in TRKX? How should I mitigate them?

TRKX investment risks include market volatility and project execution uncertainty. Mitigate by diversifying your portfolio, conducting thorough research, setting stop-loss levels, and only investing capital you can afford to lose.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What Is Ethereum PoW and How Does It Work?

The Ultimate Guide to the Top Crypto SEO Agencies in Recent Years

![Everything About the Ripple vs SEC Lawsuit [2025]](https://gimg.staticimgs.com/learn/b549353d3fafc2e041d8a8101706c83719ec1c1a.png)

Everything About the Ripple vs SEC Lawsuit [2025]

Top 7 Best Stock Investment Apps in Vietnam

Tokenomics in Crypto Assets: A Clear Guide for Beginner Investors