2026 TRVL Price Prediction: Expert Analysis and Future Outlook for Travel Tokens in the Cryptocurrency Market

Introduction: TRVL's Market Position and Investment Value

Dtravel (TRVL), as a utility token powering a decentralized travel ecosystem, has been addressing key challenges in the travel industry including trust, reputation, distribution, connectivity, and direct bookings since its inception. As of February 2026, TRVL maintains a market capitalization of approximately $524,905, with a circulating supply of around 454.86 million tokens, and trades at approximately $0.001154 per token. This asset, positioned as an enabler of travel ownership, is playing an increasingly meaningful role in transforming the travel experience through its ecosystem products: Dtravel Direct, Dtravel Protocol, and Travel Profile.

This article will comprehensively analyze TRVL's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. TRVL Price History Review and Market Status

TRVL Historical Price Evolution Trajectory

- 2021: TRVL reached a notable price level of $1.56 on November 28, marking a significant milestone in its early trading period

- 2026: The token experienced substantial price compression, with the price declining to $0.00114548 on February 4, representing a significant correction from historical levels

TRVL Current Market Situation

As of February 5, 2026, TRVL is trading at $0.001154, showing price volatility across multiple timeframes. Over the past hour, the token decreased by 0.09%, reflecting short-term market dynamics. The 24-hour trading period recorded a 3.3% decline, with the price fluctuating between a high of $0.001353 and a low of $0.00111.

The 24-hour trading volume stands at $11,247.29, indicating moderate market activity. TRVL's market capitalization is approximately $524,905, with a circulating supply of 454,857,304 tokens, representing 45.49% of the total supply of 1 billion tokens. The fully diluted market cap is calculated at $1,154,000.

Over the past week, TRVL has declined by 25.74%, while the 30-day period shows a 39.09% decrease. The one-year performance indicates a 94.27% decline from previous levels. The token currently holds a market dominance of 0.000045% and ranks at position 2995 in the broader cryptocurrency market.

TRVL is listed on 2 exchanges and has 1,969 token holders. The contract is deployed on the Ethereum network at address 0xd47bdf574b4f76210ed503e0efe81b58aa061f3d. The current market sentiment index registers at 12, indicating extreme fear conditions in the market environment.

Click to view current TRVL market price

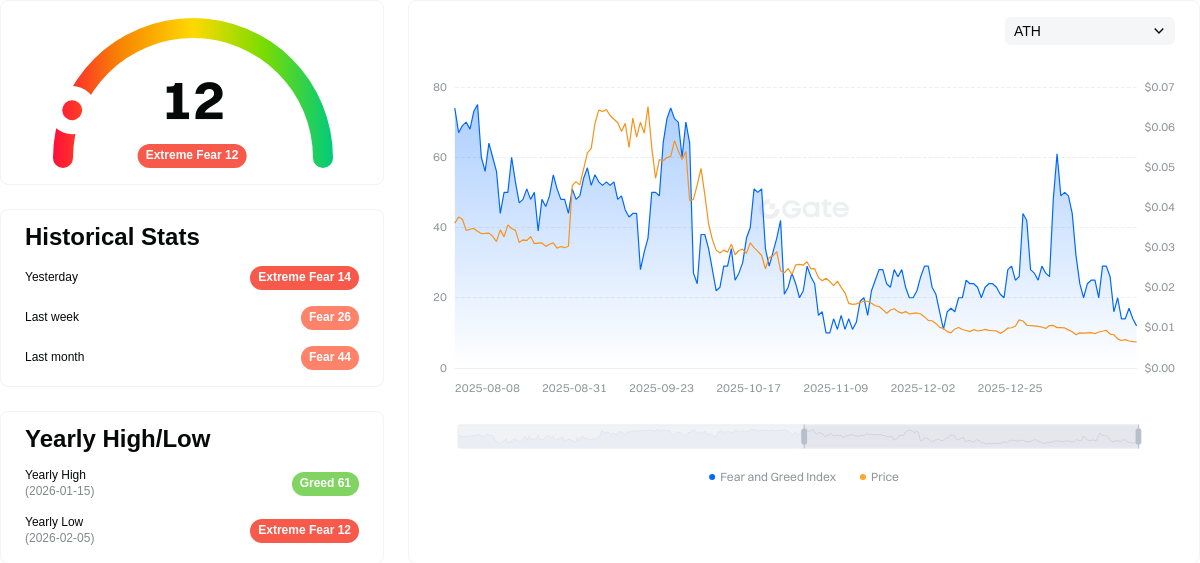

TRVL Market Sentiment Indicator

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The TRVL market is currently experiencing extreme fear, with the Fear and Greed Index at 12. This exceptionally low reading suggests severe market pessimism and heightened risk aversion among investors. During such periods, selling pressure typically intensifies as market participants rush to exit positions. However, extreme fear often creates contrarian opportunities for long-term investors seeking entry points. Traders should exercise caution and consider their risk tolerance carefully. Market recoveries frequently begin when sentiment reaches these extreme lows, making this a critical moment to monitor TRVL's price action closely.

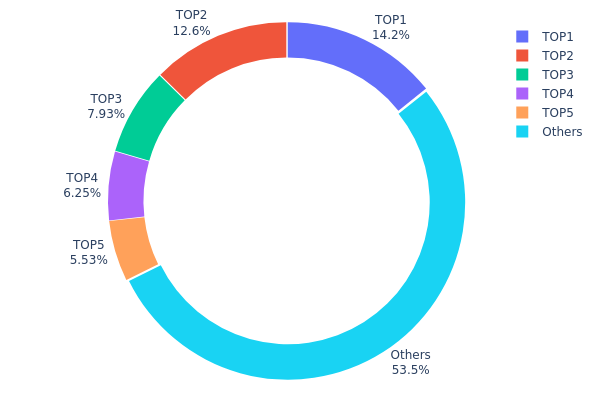

TRVL Holding Distribution

The holding distribution chart reveals the concentration of token ownership across wallet addresses, serving as a critical metric for assessing decentralization levels and potential market manipulation risks. According to the latest data as of February 5, 2026, TRVL exhibits a moderately concentrated holding structure with notable characteristics worth examining.

The top five addresses collectively control approximately 46.52% of the total supply, with the largest single holder (0xc41d...1cf988) accounting for 14.24%, followed by the second-largest at 12.58%. While this concentration level is not extreme compared to some newly launched projects, it nonetheless represents a significant centralization risk. The remaining 53.48% distributed among "Others" suggests a reasonable degree of broader participation, though the relatively high concentration in top addresses could potentially enable coordinated price movements or create liquidity concerns during market stress.

From a market structure perspective, this distribution pattern indicates moderate susceptibility to large-holder influence. The presence of multiple substantial holders rather than a single dominant entity reduces single-point manipulation risk but maintains the potential for coordinated actions. The current holding structure suggests TRVL is transitioning from its initial distribution phase toward a more mature market structure, though further decentralization would strengthen on-chain stability and reduce volatility risks associated with concentrated sell pressure.

Click to view current TRVL Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc41d...1cf988 | 142489.62K | 14.24% |

| 2 | 0x2d73...4a60ba | 125800.63K | 12.58% |

| 3 | 0x723f...a72bae | 79319.23K | 7.93% |

| 4 | 0xa4e8...b50c90 | 62513.92K | 6.25% |

| 5 | 0xf8fb...1edb9a | 55292.37K | 5.52% |

| - | Others | 534584.23K | 53.48% |

II. Core Factors Influencing TRVL's Future Price

Market Sentiment and Investor Behavior

- Market Sentiment: Investor sentiment plays a significant role in TRVL price movements, as collective market psychology can drive short-term volatility and influence trading decisions.

- Trading Activity: Price fluctuations occur frequently due to continuous exposure to global news, supply-demand dynamics, and market activities, with potential changes occurring every few seconds during high volatility periods.

Technological Innovation

- Platform Development: Technological advancements and innovation within the Dtravel ecosystem can impact TRVL's utility and adoption, potentially influencing its market value.

- Ecosystem Integration: The development of applications and services utilizing TRVL tokens may contribute to increased demand and price stability.

Regulatory Environment

- Policy Monitoring: Regulatory developments and policy changes at various governmental levels can significantly affect TRVL's market dynamics and investor confidence.

- Compliance Framework: Adherence to evolving regulatory standards may influence the token's accessibility and adoption across different jurisdictions.

Macroeconomic Trends

- Global Economic Conditions: Overall economic trends, including inflation rates, currency stability, and international trade dynamics, can indirectly impact cryptocurrency valuations including TRVL.

- Market Cycles: Broader cryptocurrency market cycles and trends influence TRVL's price movements as part of the larger digital asset ecosystem.

Market Events

- Exchange Listings: New exchange listings can increase TRVL's liquidity and accessibility to traders, potentially affecting price discovery.

- Partnership Announcements: Strategic partnerships and collaborations may enhance TRVL's utility and market perception.

III. 2026-2031 TRVL Price Prediction

2026 Outlook

- Conservative Forecast: $0.00074 - $0.0012

- Neutral Forecast: $0.0012

- Optimistic Forecast: $0.00164 (contingent on favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: The token may enter a moderate growth phase, with potential volatility as the project develops its ecosystem and user base.

- Price Range Forecast:

- 2027: $0.00078 - $0.00189

- 2028: $0.00124 - $0.00175

- 2029: $0.00124 - $0.00218

- Key Catalysts: Platform expansion, strategic partnerships, broader market recovery, and technological improvements could serve as primary drivers for price appreciation during this period.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00114 - $0.00194 (assuming steady ecosystem development and stable market conditions)

- Optimistic Scenario: $0.00194 - $0.00231 (contingent on significant user growth and enhanced utility)

- Transformational Scenario: $0.00176 - $0.00287 (dependent on breakthrough partnerships, major platform upgrades, and favorable regulatory environment)

- 2026-02-05: TRVL is currently positioned in the early stages of its projected growth trajectory, with the potential for gradual appreciation over the coming years.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00164 | 0.0012 | 0.00074 | 3 |

| 2027 | 0.00189 | 0.00142 | 0.00078 | 22 |

| 2028 | 0.00175 | 0.00165 | 0.00124 | 43 |

| 2029 | 0.00218 | 0.0017 | 0.00124 | 47 |

| 2030 | 0.00231 | 0.00194 | 0.00114 | 68 |

| 2031 | 0.00287 | 0.00212 | 0.00176 | 84 |

IV. TRVL Professional Investment Strategy and Risk Management

TRVL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to the decentralized travel ecosystem with a medium to long-term horizon

- Operational recommendations:

- Consider accumulating positions during market corrections when price volatility increases

- Monitor Dtravel ecosystem developments, including user adoption metrics and partnership announcements

- Store TRVL tokens in secure non-custodial wallets such as Gate Web3 Wallet to maintain full control over assets

(2) Active Trading Strategy

- Technical analysis tools:

- Volume analysis: Monitor the 24-hour trading volume (currently $11,247) to identify liquidity patterns and potential breakout opportunities

- Support and resistance levels: Track the 24-hour range between $0.00111 (low) and $0.001353 (high) to establish key price zones

- Swing trading considerations:

- Given the recent 25.74% decline over 7 days, traders may look for stabilization signals before entering positions

- Set stop-loss orders to manage downside risk, particularly given the token's proximity to its all-time low

TRVL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio allocation

- Moderate investors: 3-5% of crypto portfolio allocation

- Aggressive investors: 5-10% of crypto portfolio allocation, with close monitoring of market conditions

(2) Risk Hedging Approaches

- Diversification strategy: Balance TRVL exposure with established cryptocurrencies and stablecoins to reduce concentration risk

- Position sizing discipline: Avoid overexposure given the token's market cap rank of 2995 and limited liquidity on 2 exchanges

(3) Secure Storage Solutions

- Non-custodial wallet recommendation: Gate Web3 Wallet for self-custody of TRVL tokens on Ethereum network

- Hardware wallet option: Consider cold storage solutions for long-term holdings to minimize online security risks

- Security precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (0xd47bdf574b4f76210ed503e0efe81b58aa061f3d) before transactions

V. TRVL Potential Risks and Challenges

TRVL Market Risks

- Price volatility: The token has experienced a 94.27% decline over the past year and recently approached its all-time low of $0.00114548 on February 4, 2026, indicating substantial downside pressure

- Low liquidity risk: With only $11,247 in 24-hour trading volume across 2 exchanges, large transactions may face slippage and difficulty executing orders

- Limited market capitalization: A circulating market cap of approximately $524,905 places TRVL among lower-tier assets, potentially increasing susceptibility to market manipulation

TRVL Regulatory Risks

- Travel industry compliance: As a token tied to the travel sector, TRVL may face scrutiny from tourism and hospitality regulators in various jurisdictions

- Token classification uncertainty: Regulatory bodies may evaluate whether TRVL's utility functions and governance features trigger securities regulations

- Cross-border transaction complexity: International travel bookings using TRVL could encounter diverse regulatory frameworks affecting adoption

TRVL Technical Risks

- Smart contract dependency: TRVL operates on Ethereum (contract address: 0xd47bdf574b4f76210ed503e0efe81b58aa061f3d), exposing holders to potential smart contract vulnerabilities

- Adoption challenges: The token's utility depends on Dtravel ecosystem growth; limited user adoption could impact demand and token value

- Competition from established platforms: Traditional travel booking platforms and other blockchain-based travel projects may present competitive pressure

VI. Conclusion and Action Recommendations

TRVL Investment Value Assessment

TRVL presents a niche opportunity within the decentralized travel ecosystem, offering utility as a payment method, governance token, and reward mechanism within the Dtravel platform. The token's long-term value proposition depends on successful ecosystem adoption and the ability to address traditional travel industry challenges such as trust, distribution, and direct booking efficiency. However, significant short-term risks exist, including recent substantial price declines, low liquidity, and limited exchange availability. The token currently trades near its all-time low with a circulating supply of approximately 45.49% of total supply, suggesting potential for future token unlocks that could affect price dynamics.

TRVL Investment Recommendations

✅ Beginners: Approach with caution given the token's volatility and limited trading history; consider allocating only a minimal portion of your portfolio after thorough research into Dtravel's ecosystem development ✅ Experienced investors: May consider small speculative positions if bullish on decentralized travel infrastructure; implement strict risk management protocols and monitor ecosystem metrics closely ✅ Institutional investors: Conduct comprehensive due diligence on Dtravel's business model, partnerships, and competitive positioning before considering allocation; assess liquidity constraints for position sizing

TRVL Trading Participation Methods

- Spot trading: Available on Gate.com and one other exchange, allowing direct purchase and sale of TRVL tokens

- Ethereum-based transactions: Interact directly with the TRVL smart contract on Ethereum network for decentralized trading or ecosystem participation

- Ecosystem participation: Hold TRVL to access Dtravel platform features, governance rights, and potential rewards as the ecosystem develops

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is TRVL and what is its positioning in the cryptocurrency market?

TRVL is the native token of Dtravel, a decentralized travel platform built on blockchain technology. It serves as a utility token for the Web3 travel ecosystem, enabling users to participate in governance, access platform services, and benefit from the decentralized travel economy.

What are the main factors affecting TRVL price?

TRVL price is influenced by market demand, overall economic trends, technological innovation, and regulatory policies. Trading volume, platform adoption, and broader cryptocurrency market sentiment also play significant roles in price movements.

How to conduct technical analysis and price prediction for TRVL?

Analyze TRVL price using moving averages and RSI indicators to identify trends. Combine historical data and market sentiment to make accurate predictions. Monitor trading volume and key support/resistance levels for better forecasting accuracy.

What are the advantages and disadvantages of TRVL compared to other tourism-related crypto projects?

TRVL leverages blockchain for transparent, secure, decentralized travel booking. Its AI-driven personalization and strong community differentiate it from competitors. However, it faces adoption challenges against established travel platforms in the broader market.

What are the main risks of TRVL investment?

TRVL investment carries market volatility risk, regulatory policy changes, and unpredictable global events. Investors should conduct thorough research and implement proper risk management strategies before investing.

What are the market prospects and development potential of TRVL in 2024-2025?

TRVL shows strong market prospects with anticipated 7% compound annual growth rate. The cryptocurrency is poised for expansion driven by multiple market factors. Future growth potential remains substantial as adoption accelerates in the Web3 ecosystem.

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Newbie Must Read: How to Formulate Investment Strategies When Nasdaq Turns Positive in 2025

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

How to Mine Ethereum in 2025: A Complete Guide for Beginners

Best Crypto Wallets 2025: How to Choose and Secure Your Digital Assets

TapSwap Listing Date: What Investors Need to Know in 2025

Cryptocurrency for Beginners: Which Coin Should You Invest In

A Comprehensive Overview of the Future Potential and Types of Altcoins

Comprehensive Guide to Decentralized Finance (DeFi)

Mining Calculator: How to Calculate Cryptocurrency Mining Profitability

What is Polygon?