2026 TRVL Price Prediction: Expert Analysis and Market Forecast for Travel Token's Future Growth

Introduction: TRVL's Market Position and Investment Value

Dtravel (TRVL), positioned as a utility token powering a decentralized travel ecosystem, has been working to address key challenges in the travel industry including trust, reputation, distribution, and direct bookings since its launch. As of 2026, TRVL maintains a market capitalization of approximately $453,037, with a circulating supply of around 454.86 million tokens, and a current price hovering at $0.000996. This asset, designed to empower ownership in travel through products like Dtravel Direct, Dtravel Protocol, and Travel Profile, is playing an increasingly significant role in connecting travelers, hosts, and travel businesses within its ecosystem.

This article will comprehensively analyze TRVL's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. TRVL Price History Review and Market Status

TRVL Historical Price Evolution Trajectory

- 2021: TRVL reached its all-time high on November 28, with price at $1.56

- 2026: The token experienced significant decline, reaching its all-time low of $0.00098608 on February 6

TRVL Current Market Situation

As of February 6, 2026, TRVL is trading at $0.000996, reflecting a notable decline across multiple timeframes. The token has experienced a decrease of 1.73% over the past hour and 15.52% in the last 24 hours, with the 24-hour trading range fluctuating between $0.000952 and $0.00125.

Looking at broader time periods, TRVL has declined 33.23% over the past week and 49.65% over the past 30 days. The one-year performance shows a decrease of 95.39%, indicating sustained downward pressure.

The token currently holds a market capitalization of approximately $453,037.88, with a circulating supply of 454,857,304.48 TRVL tokens, representing 45.49% of the maximum supply of 1 billion tokens. The 24-hour trading volume stands at $12,223.86. The market capitalization to fully diluted valuation ratio is 45.49%, with the fully diluted market cap at $996,000.

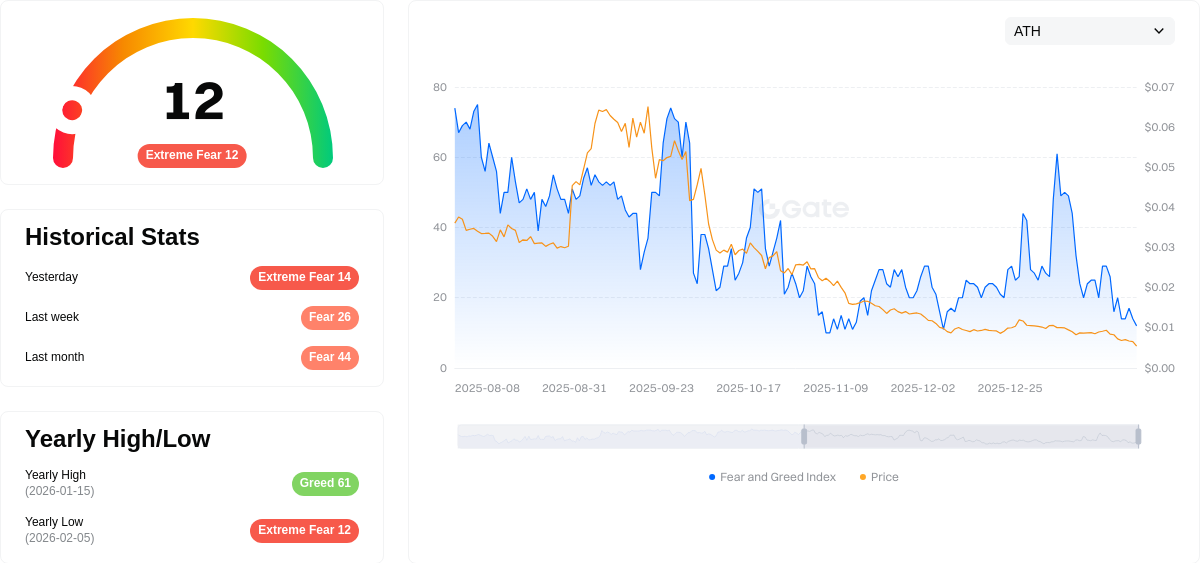

TRVL ranks #3,079 in the cryptocurrency market, with a market dominance of 0.000042%. The current market sentiment index indicates a reading of 12, reflecting an extreme fear sentiment in the broader market.

Click to view the current TRVL market price

Market Sentiment Indicator

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 12. This exceptionally low reading suggests heightened market anxiety and pessimism among investors. When the index reaches such extreme levels, it often indicates potential oversold conditions, which some traders view as contrarian buying opportunities. However, extreme fear can also signal prolonged downward pressure. Investors should exercise caution and conduct thorough research before making trading decisions. Monitor market developments closely as sentiment shifts can significantly impact price movements and trading strategies.

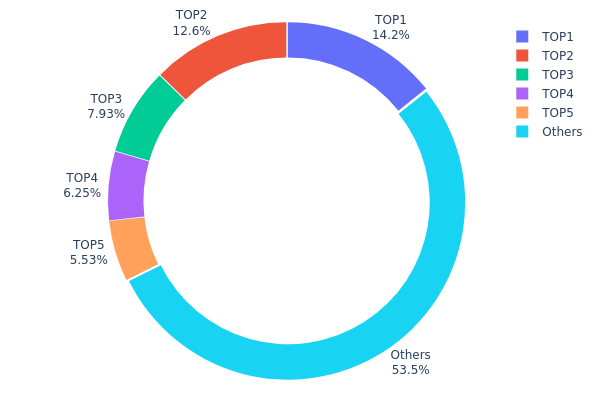

TRVL Holding Distribution

The holding distribution chart illustrates the concentration of TRVL tokens across different wallet addresses, providing insight into the token's ownership structure and potential market dynamics. Based on the latest data as of February 6, 2026, the top five addresses collectively hold 465,415.77K TRVL tokens, representing 46.52% of the total supply, while the remaining 534,584.23K tokens (53.48%) are distributed among other addresses.

The current distribution reveals a moderately concentrated ownership pattern. The largest holder controls 142,489.62K tokens (14.24%), followed by the second-largest address with 125,800.63K tokens (12.58%). The third through fifth positions hold 7.93%, 6.25%, and 5.52% respectively. While the top two addresses combined account for approximately 26.82% of total supply, this concentration level remains within acceptable parameters for many cryptocurrency projects, particularly those in early development stages or with strategic institutional backing.

From a market structure perspective, this distribution pattern suggests several implications. The relatively balanced distribution among the top holders—without any single entity holding an overwhelming majority—reduces the risk of severe price manipulation by a single actor. However, the collective influence of the top five addresses holding nearly half the supply warrants attention, as coordinated actions could significantly impact market liquidity and price stability. The 53.48% held by smaller addresses indicates a reasonably decentralized base, which typically contributes to organic price discovery and community-driven growth, though market participants should remain aware of potential volatility if major holders decide to adjust their positions.

Click to view current TRVL Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc41d...1cf988 | 142489.62K | 14.24% |

| 2 | 0x2d73...4a60ba | 125800.63K | 12.58% |

| 3 | 0x723f...a72bae | 79319.23K | 7.93% |

| 4 | 0xa4e8...b50c90 | 62513.92K | 6.25% |

| 5 | 0xf8fb...1edb9a | 55292.37K | 5.52% |

| - | Others | 534584.23K | 53.48% |

II. Core Factors Influencing TRVL's Future Price

Market Sentiment

- Investor Confidence: The cryptocurrency market is highly sensitive to sentiment shifts. Positive developments, such as strategic partnerships, increased adoption rates, or favorable media coverage, can drive demand and support price appreciation for TRVL.

- Media Impact: Positive press releases and community engagement can enhance market perception, while negative news related to security concerns may trigger sell-offs.

- Current Influence: Market participants closely monitor sentiment indicators, as they provide early signals of potential price movements in the near term.

Regulatory Environment

- Policy Developments: Regulatory actions and announcements from major jurisdictions can significantly impact TRVL's price trajectory. Supportive regulations may boost investor confidence, while restrictive measures could lead to downward pressure.

- Compliance Positioning: Projects that demonstrate proactive compliance with evolving regulatory frameworks tend to attract institutional interest and reduce legal uncertainty.

- Current Influence: As of early 2026, the regulatory landscape continues to evolve, with market participants watching for clarity on digital asset classifications and trading standards.

Partnership and Adoption Dynamics

- Strategic Collaborations: Major partnerships with established platforms or enterprises can expand TRVL's utility and market reach, potentially driving increased demand.

- Adoption Metrics: Growing user bases and real-world applications contribute to the fundamental value proposition, supporting long-term price stability.

- Current Influence: Market observers are tracking announcements of new integrations and partnerships as key indicators of TRVL's market positioning.

Real-Time Market Conditions

- Liquidity and Trading Volume: Market depth and trading activity directly affect price volatility. Higher liquidity generally supports more stable price movements.

- Exchange Listings: Availability on major trading platforms can enhance accessibility and price discovery for TRVL.

- Current Influence: Real-time market data remains essential for understanding short-term price dynamics and identifying potential entry or exit points.

III. 2026-2031 TRVL Price Prediction

2026 Outlook

- Conservative prediction: $0.00062 - $0.001

- Neutral prediction: around $0.001

- Optimistic prediction: up to $0.00129 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: gradual growth phase with potential consolidation periods

- Price range predictions:

- 2027: $0.00079 - $0.00121, average around $0.00115

- 2028: $0.00087 - $0.00147, average around $0.00118

- 2029: $0.00121 - $0.00166, average around $0.00133

- Key catalysts: platform development progress, user base expansion, and broader crypto market recovery trends

2030-2031 Long-term Outlook

- Baseline scenario: $0.00102 - $0.00208 (assuming steady ecosystem development)

- Optimistic scenario: $0.00157 - $0.00225 by 2031 (assuming strong market momentum and enhanced utility)

- Transformative scenario: potential to reach upper bounds if travel industry adoption accelerates significantly

- 2026-02-06: TRVL trading within early-stage price discovery range

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00129 | 0.001 | 0.00062 | 0 |

| 2027 | 0.00121 | 0.00115 | 0.00079 | 15 |

| 2028 | 0.00147 | 0.00118 | 0.00087 | 18 |

| 2029 | 0.00166 | 0.00133 | 0.00121 | 33 |

| 2030 | 0.00208 | 0.00149 | 0.00102 | 49 |

| 2031 | 0.00225 | 0.00178 | 0.00157 | 79 |

IV. TRVL Professional Investment Strategy and Risk Management

TRVL Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors who believe in the long-term potential of decentralized travel ecosystems and are willing to hold through market volatility

- Operational Suggestions:

- Consider accumulating positions during market downturns when TRVL trades near support levels

- Monitor developments in Dtravel's core products (Dtravel Direct, Dtravel Protocol, Travel Profile) as adoption indicators

- Store assets securely using Gate Web3 Wallet for convenient access to ecosystem features and governance participation

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume ($12,223.86) relative to market cap to identify liquidity patterns and potential breakout opportunities

- Support and Resistance Levels: Track the 24-hour range ($0.000952 - $0.00125) to identify potential entry and exit points

- Swing Trading Key Points:

- Given the recent volatility (-15.52% in 24H, -33.23% in 7D), consider setting tight stop-loss orders to manage downside risk

- Watch for volume spikes that may signal trend reversals or continuation patterns

TRVL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation due to high volatility and relatively low market capitalization

- Aggressive Investors: 3-5% allocation with strict position sizing rules

- Professional Investors: Up to 7-10% with hedging strategies and active monitoring

(2) Risk Hedging Solutions

- Position Sizing: Never allocate more than you can afford to lose, especially given TRVL's recent 95.39% decline over one year

- Diversification: Combine TRVL with more established cryptocurrencies to balance portfolio risk

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and ecosystem participation

- Cold Storage Solution: Consider hardware wallet options for long-term holdings exceeding trading needs

- Security Precautions: Enable two-factor authentication, never share private keys, and regularly update wallet software to protect against vulnerabilities

V. TRVL Potential Risks and Challenges

TRVL Market Risks

- High Volatility: TRVL experienced a 15.52% decline in 24 hours and 33.23% over 7 days, indicating significant price instability

- Low Liquidity: With only $12,223.86 in 24-hour trading volume and listing on just 2 exchanges, large trades may face slippage and difficulty executing at desired prices

- Market Cap Concerns: Ranking at #3079 with a market cap of approximately $453,037, TRVL faces sustainability questions and potential delisting risks

TRVL Regulatory Risks

- Travel Industry Regulations: As a blockchain project intersecting with the traditional travel sector, Dtravel may face regulatory scrutiny regarding booking platforms and payment processing

- Token Classification Uncertainty: Evolving cryptocurrency regulations in various jurisdictions may impact TRVL's utility function and trading availability

- Cross-border Transaction Compliance: International travel booking services may trigger complex regulatory requirements across multiple countries

TRVL Technical Risks

- Smart Contract Vulnerabilities: As an ERC-20 token on Ethereum, TRVL depends on smart contract security; any bugs or exploits could impact token value

- Adoption Challenges: The success of TRVL depends heavily on Dtravel ecosystem adoption by travelers and travel businesses, which remains uncertain

- Competition: Established travel platforms and emerging blockchain travel projects may limit Dtravel's market penetration and TRVL token utility

VI. Conclusion and Action Recommendations

TRVL Investment Value Assessment

TRVL presents a high-risk, speculative opportunity in the blockchain-based travel sector. While the Dtravel ecosystem addresses real pain points in the travel industry (trust, reputation, distribution, connectivity, direct bookings), the token's performance metrics raise significant concerns. With a 95.39% decline over one year, current price near all-time low ($0.00098608), and extremely low trading volume, TRVL faces substantial headwinds. The project's long-term value depends on successful adoption of its three core products and meaningful utility generation for token holders. Investors should approach with extreme caution and only with capital they can afford to lose entirely.

TRVL Investment Recommendations

✅ Beginners: Avoid TRVL until you have significant experience with cryptocurrency markets and can thoroughly research the Dtravel ecosystem ✅ Experienced Investors: Consider only micro-position allocation (under 1% of portfolio) as a high-risk speculative bet on decentralized travel adoption ✅ Institutional Investors: Conduct comprehensive due diligence on Dtravel's business model, partnerships, and roadmap execution before considering any position

TRVL Trading Participation Methods

- Spot Trading: Purchase TRVL on Gate.com with limit orders to minimize slippage given low liquidity conditions

- Ecosystem Participation: Hold TRVL to access governance features, payment options within Dtravel, and potential future product unlocks

- Staking and Rewards: Monitor Dtravel announcements for potential staking programs or performance reward mechanisms

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is TRVL token? What practical application value does it have?

TRVL is a digital cryptocurrency enabling peer-to-peer transactions and mining. It applies specialized technology to modern asset management, providing decentralized solutions for travel and commerce ecosystems through blockchain innovation.

What price could TRVL reach in the future? What are the main factors affecting its price?

TRVL price potential depends on market sentiment, trading volume, and adoption trends. Key drivers include ecosystem development, partnership announcements, and overall crypto market conditions. Future price movements remain highly speculative.

How to analyze TRVL's technical and fundamental aspects to predict price movements?

Analyze TRVL's technical face by studying candlestick charts and key indicators. For fundamentals, monitor strategic financing and market sentiment. Combine both analyses to forecast price trends effectively.

What are the main risks of investing in TRVL? How should they be mitigated?

Main risks include market volatility and liquidity constraints. Mitigation strategies: diversify your portfolio, avoid large single transactions, and monitor trading volumes regularly to ensure adequate market depth.

What are the advantages and disadvantages of TRVL compared to other travel tokens?

TRVL offers convenient payment functionality for travelers and seamless transactions. However, it may face challenges with market liquidity and wider adoption compared to established competitors with greater acceptance and trading volume.

How has TRVL performed historically? What are the past price fluctuation patterns?

TRVL has demonstrated moderate price volatility with a 24-hour increase of 0.12%. Historical trends show a generally stable yet volatile pattern. The token maintains consistent trading activity. Monitor real-time price movements for emerging trends and potential opportunities in the market.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What Do NGMI and WAGMI Mean in Crypto?

What Is a Physical Bitcoin and What Is Its Worth?

What is crypto scalping and how does it work

Meme coins are making headlines—are you a dog person or a cat person? Which is the better buy?

What is blockchain in simple terms