2026 VERT Price Prediction: Expert Analysis and Market Forecast for Vertcoin's Future Value

Introduction: VERT's Market Position and Investment Value

Vertus (VERT), as a custodial wallet on the TON blockchain focused on building an extensive DeFi ecosystem accessible through Telegram, has been developing its user-friendly gateway to cryptocurrency since its launch in 2025. As of 2026, VERT maintains a market capitalization of approximately $730,462, with a circulating supply of around 549.84 million tokens, and its price stands at approximately $0.0013285. This asset, designed to bridge traditional users and decentralized financial opportunities, is playing an increasingly important role in simplifying Web3 access and DApp integration.

This article will comprehensively analyze VERT's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

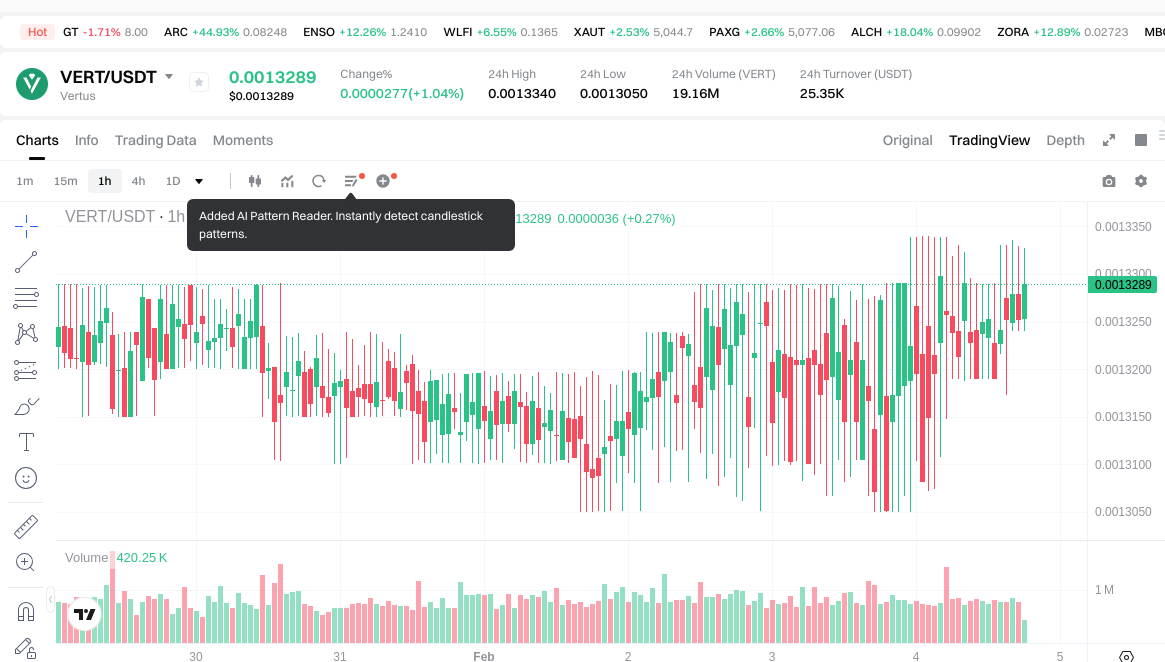

I. VERT Price History Review and Current Market Status

VERT Historical Price Evolution Trajectory

- 2025: VERT token launched on January 16, 2025 with an initial price of $0.025, marking the project's entry into the cryptocurrency market

- 2025: Price reached an all-time high of $0.0295 on January 17, 2025, representing an 18% increase from the launch price within the first day of trading

- 2025: Market experienced significant volatility, with price declining to an all-time low of $0.00045 on February 25, 2025, reflecting an approximate 98.47% decrease from the peak

VERT Current Market Status

As of February 4, 2026, VERT is trading at $0.0013285, representing a recovery from its historical low point. The token demonstrates mixed short-term performance, with a 1.02% increase over the past 24 hours and a 0.79% gain over the past 7 days. However, the 30-day performance shows a slight decline of 0.22%.

The current market capitalization stands at approximately $730,462, with a 24-hour trading volume of $25,336.94. The circulating supply represents 549.84 million tokens, accounting for 45.82% of the total supply of 1.2 billion VERT tokens. The fully diluted market cap is calculated at $1,594,200.

VERT currently ranks at position 2747 in the cryptocurrency market, with a market dominance of 0.000059%. The token's 24-hour price range fluctuates between $0.001305 and $0.001334, indicating relatively stable trading activity. The cryptocurrency market sentiment index stands at 14, classified as "Extreme Fear," which may influence short-term trading behavior.

The project has attracted 143,332 token holders and is listed on 4 exchanges, with Gate.com being one of the trading platforms. The token operates on the TON blockchain, utilizing TON's infrastructure for its custodial wallet and DeFi ecosystem accessible through Telegram.

Click to view the current VERT market price

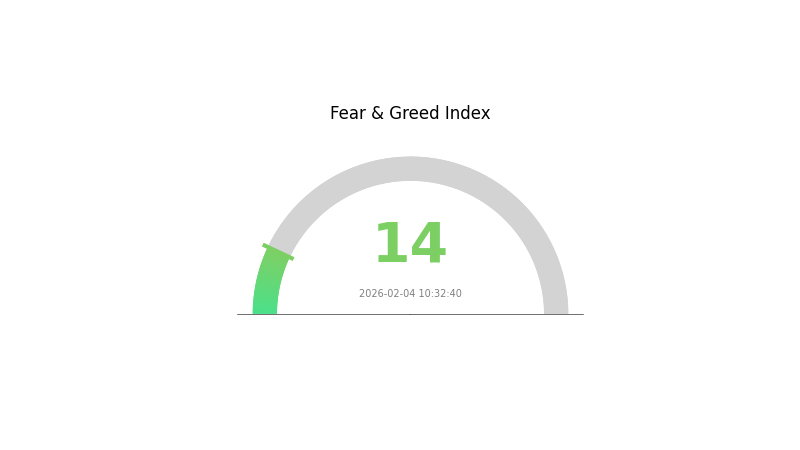

VERT Market Sentiment Index

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index registering at 14. This exceptionally low reading indicates heightened market pessimism and investor anxiety. Such extreme fear conditions typically create significant selling pressure and market volatility. However, history shows that extreme fear can present opportunities for contrarian investors seeking undervalued assets. Market participants should exercise caution while remaining alert to potential entry points. Monitoring on-chain metrics and fundamental developments becomes crucial during these turbulent periods to identify genuine investment opportunities.

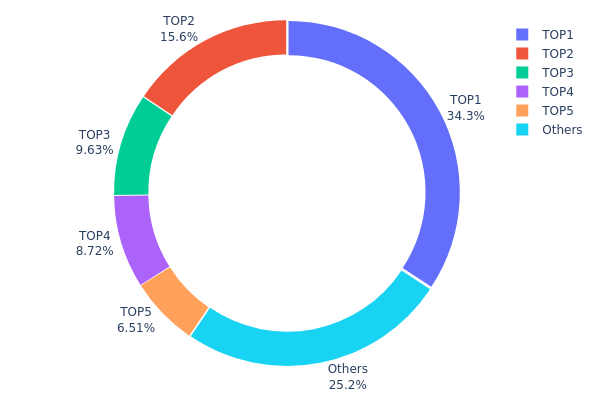

VERT Token Holding Distribution

The token holding distribution chart reflects the allocation of tokens across various on-chain addresses, serving as a key metric for assessing the degree of centralization within a cryptocurrency ecosystem. For VERT, the current distribution data reveals notable concentration characteristics. The top address controls approximately 411.8 million tokens, representing 34.31% of the total supply, while the top five addresses collectively hold 897.4 million tokens, accounting for 74.76% of the circulating supply. This indicates a relatively high concentration level, with the remaining 302.6 million tokens (25.24%) distributed among other addresses.

Such concentration patterns present both opportunities and risks for market participants. On one hand, the substantial holdings by top addresses may suggest strong confidence from early investors or project stakeholders, potentially providing price stability during market downturns. On the other hand, this high degree of centralization creates inherent vulnerabilities regarding price manipulation and liquidity concerns. A coordinated sell-off by major holders could trigger significant price volatility, while the limited distribution among smaller addresses may constrain organic market development and genuine decentralization.

From a market structure perspective, VERT's current distribution profile reflects an early-stage token economy with concentration levels typical of newer projects. The dominance of top addresses suggests the project may still be in its initial distribution phase, with token allocation yet to achieve broader dispersion across the holder base. This structure implies that on-chain stability remains dependent on the behavior of major stakeholders, and achieving greater decentralization will require time and sustained community growth efforts.

Click to view current VERT Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | UQC_3q...0pshwJ | 411802.42K | 34.31% |

| 2 | UQDJlZ...Dv1JNr | 187232.96K | 15.60% |

| 3 | UQAbhM...0d1t87 | 115591.75K | 9.63% |

| 4 | UQDYh9...d344Mm | 104683.36K | 8.72% |

| 5 | UQAqt3...hE7MSp | 78100.00K | 6.50% |

| - | Others | 302589.51K | 25.24% |

II. Core Factors Influencing VERT's Future Price

Supply Mechanism

- Market Supply Dynamics: VERT's price movements reflect the fundamental relationship between supply and demand in the cryptocurrency market. When supply contracts or demand increases, upward price pressure may emerge.

- Historical Patterns: Historical data shows VERT reached a low of $0.00045 on February 25, 2025, demonstrating how supply-demand imbalances can drive significant price volatility during market downturns.

- Current Impact: The token's supply characteristics and distribution patterns continue to play a role in price formation, though specific supply schedule details require further verification from official sources.

Institutional and Major Holder Dynamics

- Market Sentiment: VERT's price trajectory is significantly influenced by overall market sentiment, which drives both institutional and retail participation levels.

- Adoption Trends: User adoption rates serve as a key indicator of VERT's potential value appreciation, as broader acceptance typically correlates with increased demand and price stability.

- External Influence Factors: Regulatory developments, market infrastructure improvements, and integration with trading platforms like Gate.com can materially affect VERT's accessibility and liquidity.

Macroeconomic Environment

- Monetary Policy Considerations: Broader cryptocurrency market trends often correlate with global monetary policy shifts, which can indirectly impact VERT's valuation through changes in risk appetite and capital flows.

- Market Correlation: While VERT operates as an independent asset, it may exhibit correlation with major cryptocurrency market movements during periods of heightened volatility or systemic events.

- Economic Uncertainty: During periods of economic instability, cryptocurrency assets may experience increased volatility as investors reassess risk allocations across different asset classes.

Technical Development and Ecosystem Building

- Technology Evolution: The ongoing development of VERT's underlying technology infrastructure represents a potential catalyst for future price appreciation, though specific upgrade timelines should be verified through official channels.

- Ecosystem Expansion: Growth in practical applications and use cases for VERT could drive fundamental value creation, supporting long-term price stability and appreciation potential.

- Miner Behavior: Mining activity and miner sentiment serve as important indicators of network health and can influence supply-side dynamics that affect price formation.

III. 2026-2031 VERT Price Forecast

2026 Outlook

- Conservative Forecast: $0.0012 - $0.00120

- Neutral Forecast: $0.00133 - $0.00133

- Optimistic Forecast: $0.00138 - $0.00138 (requires favorable market conditions)

2027-2029 Outlook

- Market Phase Expectation: Gradual growth phase with moderate volatility, potential consolidation periods as the token seeks broader market adoption

- Price Range Forecast:

- 2027: $0.00129 - $0.00163

- 2028: $0.00104 - $0.00154

- 2029: $0.00145 - $0.00156

- Key Catalysts: Market adoption expansion, ecosystem development, and broader cryptocurrency market sentiment

2030-2031 Long-term Outlook

- Base Scenario: $0.00129 - $0.00181 (assuming steady ecosystem growth and stable market conditions)

- Optimistic Scenario: $0.00142 - $0.00221 (contingent on significant platform upgrades and increased user engagement)

- Transformative Scenario: Potential upside beyond $0.00221 (under exceptionally favorable conditions including major partnerships and widespread adoption)

- 2026-02-04: VERT trading within established range (current market phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00138 | 0.00133 | 0.0012 | 0 |

| 2027 | 0.00163 | 0.00136 | 0.00129 | 2 |

| 2028 | 0.00154 | 0.00149 | 0.00104 | 12 |

| 2029 | 0.00156 | 0.00151 | 0.00145 | 13 |

| 2030 | 0.00181 | 0.00154 | 0.00129 | 15 |

| 2031 | 0.00221 | 0.00167 | 0.00142 | 26 |

IV. VERT Professional Investment Strategies and Risk Management

VERT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the DeFi ecosystem development on TON blockchain and Telegram integration potential

- Operational Recommendations:

- Consider accumulating positions during market corrections when price approaches support levels

- Monitor Vertus ecosystem development milestones and DApp integration progress

- Store assets in secure custody solutions like Gate Web3 Wallet for enhanced security

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Track the 24-hour trading volume ($25,336.94) relative to market cap to identify liquidity trends

- Price Range Monitoring: Observe the 24-hour range ($0.001305 - $0.001334) for intraday trading opportunities

- Swing Trading Considerations:

- Monitor the token's performance relative to TON blockchain developments

- Be aware of the relatively low circulating supply (45.82% of total supply) which may impact volatility

VERT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Active Investors: 3-5% of crypto portfolio allocation

- Professional Investors: 5-10% of crypto portfolio allocation with hedging strategies

(2) Risk Hedging Approaches

- Diversification: Balance VERT holdings with established TON ecosystem tokens

- Position Sizing: Limit individual position exposure based on market capitalization ($730,462.44) considerations

(3) Security Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet for active trading and DApp interaction

- Security Best Practices: Enable two-factor authentication, maintain secure backup of recovery phrases, and regularly review wallet permissions

V. VERT Potential Risks and Challenges

VERT Market Risks

- Liquidity Risk: With a relatively modest 24-hour trading volume, large orders may experience significant slippage

- Volatility Risk: The token has demonstrated substantial price fluctuations, with a 1-year change of 100.88%

- Market Cap Risk: The current market capitalization represents only 0.000059% of the total crypto market, indicating sensitivity to broader market movements

VERT Regulatory Risks

- Custodial Wallet Regulation: As a custodial solution, Vertus may face evolving regulatory requirements for digital asset custody services

- Telegram Integration Compliance: Regulatory scrutiny of cryptocurrency services integrated with messaging platforms could impact operations

- Cross-border Regulatory Uncertainty: DeFi products operating across multiple jurisdictions may encounter varying compliance requirements

VERT Technical Risks

- Smart Contract Risk: Potential vulnerabilities in the TON blockchain-based smart contracts could affect token security

- Integration Dependency: Heavy reliance on Telegram platform integration creates potential single-point-of-failure concerns

- Scalability Challenges: As the ecosystem grows, the platform must maintain performance and user experience standards

VI. Conclusion and Action Recommendations

VERT Investment Value Assessment

Vertus (VERT) represents an innovative approach to making DeFi accessible through Telegram integration on the TON blockchain. The project addresses a genuine market need by simplifying cryptocurrency entry for traditional users. However, the token's current low market capitalization, limited liquidity, and substantial price volatility present considerable risks. Long-term value depends on successful ecosystem expansion, user adoption growth, and the broader acceptance of TON-based DeFi solutions. Short-term risks include market volatility, regulatory uncertainties, and competitive pressures in the custodial wallet space.

VERT Investment Recommendations

✅ Beginners: Start with minimal allocation (1-2% of crypto portfolio), focus on understanding the Vertus ecosystem through their documentation, and only invest amounts you can afford to lose completely ✅ Experienced Investors: Consider moderate position sizing (3-5% allocation) with disciplined entry strategies, monitor ecosystem development metrics, and implement stop-loss mechanisms ✅ Institutional Investors: Conduct comprehensive due diligence on custody arrangements, assess regulatory compliance frameworks, and evaluate integration risks before considering positions

VERT Trading Participation Methods

- Spot Trading: Purchase VERT tokens through Gate.com spot markets for direct ownership

- DApp Interaction: Participate in the Vertus ecosystem by accessing integrated DeFi products through the platform

- Mining Participation: Engage in the platform's VERT mining features as described in their ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is VERT? What are its main uses and application scenarios?

VERT is a reactive framework for building asynchronous, scalable, and high-concurrency web applications on the JVM. It serves as a Node.js alternative, enabling developers to create efficient server-side applications with superior performance and reliability in modern distributed systems.

How has VERT performed historically? What is the price change over the past year?

VERT has demonstrated strong performance over the past year with a gain of 154.140%. The 52-week price range was between 0.940 and 4.690, reflecting solid upward momentum in the market.

What are the main factors affecting VERT price?

Key factors include market sentiment and news, government regulation and legal clarity, trading volume, project developments, and broader cryptocurrency market trends.

What is the 2024 VERT price prediction? How do professional analysts view it?

Professional analysts predict VERT will stabilize around $0.25 in 2024, driven by community development and early adoption momentum. This projection reflects positive market sentiment for the token's growth trajectory.

What advantages does VERT have compared to mainstream cryptocurrencies like BTC and ETH?

VERT offers lower transaction fees and faster transaction speeds compared to BTC and ETH, making it more efficient for everyday use. It also supports advanced smart contract functionalities.

What are the risks of investing in VERT? How should I evaluate them?

VERT investment carries market volatility, technology, and team execution risks. Evaluate by analyzing project fundamentals, developer activity, trading volume, community strength, and long-term technological roadmap to make informed decisions.

How is VERT's liquidity and trading volume? Which exchanges can trade it?

VERT maintains 12% liquidity allocation to ensure smooth trading and price stability across multiple exchanges. Trading volume is supported by strong market presence, with VERT available on major trading platforms for seamless transactions.

What is the background of VERT's development team? What is the project's technical progress?

VERT's development team comprises experienced technical experts focused on efficient conversion technology. The project has made solid progress, achieving 5-step local high-efficiency conversion with comprehensive deployment solutions in its latest version.

What is VERT's market cap and circulating supply?

VERT has a market cap of approximately $726,613.56 USD with a circulating supply of 54.984 million tokens. The current price stands at $0.0013215 USD as of December 28, 2025.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Comprehensive Guide to Token Generation Events

Comprehensive Guide to Creating and Selling NFTs for Free

How to Profit from Cryptocurrency — Leading Strategies of Recent Years

Best Crypto Trading Bots for Automated Trading

Top 5 Tokens Recommended for DeFi Investment