2026 VGX Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: VGX's Market Position and Investment Value

VGX Token (VGX), positioned as a cross-platform and cross-chain token focused on the gaming space, has been developing since its launch in 2017. As of 2026, VGX maintains a market capitalization of approximately $450,750, with a circulating supply of around 916.73 million tokens, and the price hovering around $0.0004918. This asset, designed as a "gaming-focused cross-chain reward token", is playing an increasingly important role in providing rewards and ownership for players across different blockchain gaming platforms.

This article will comprehensively analyze VGX's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price predictions and practical investment strategies.

I. VGX Price History Review and Market Status

VGX Historical Price Evolution Trajectory

- 2017: VGX token was published with an initial offering price of $0.03, marking the project's entry into the cryptocurrency market

- 2018: The token experienced significant volatility, reaching a historical peak of $12.54 on January 5th

- 2026: The token faced substantial downward pressure, with the price declining to a historical low of $0.0003795 on January 11th

VGX Current Market Situation

As of February 6, 2026, VGX is trading at $0.0004918, reflecting a market capitalization of approximately $450,848. The token demonstrates a circulating supply of 916,730,215 VGX, representing 91.67% of its maximum supply of 1,000,027,215 tokens.

The 24-hour trading volume stands at $33,215, with the price fluctuating between $0.0004317 and $0.0005579 during this period. Short-term performance indicators show a decline of 1.05% over the past hour and 10.18% over the past 24 hours. The 7-day performance reflects a decrease of 5.5%, while the 30-day period shows growth of 10.93%. The annual performance indicates a substantial decline of 94.17%.

The token maintains a market dominance of 0.000019% and is currently listed on 5 cryptocurrency exchanges, with approximately 7,980 holders. The fully diluted valuation aligns closely with the current market cap at 91.67% of the maximum supply in circulation.

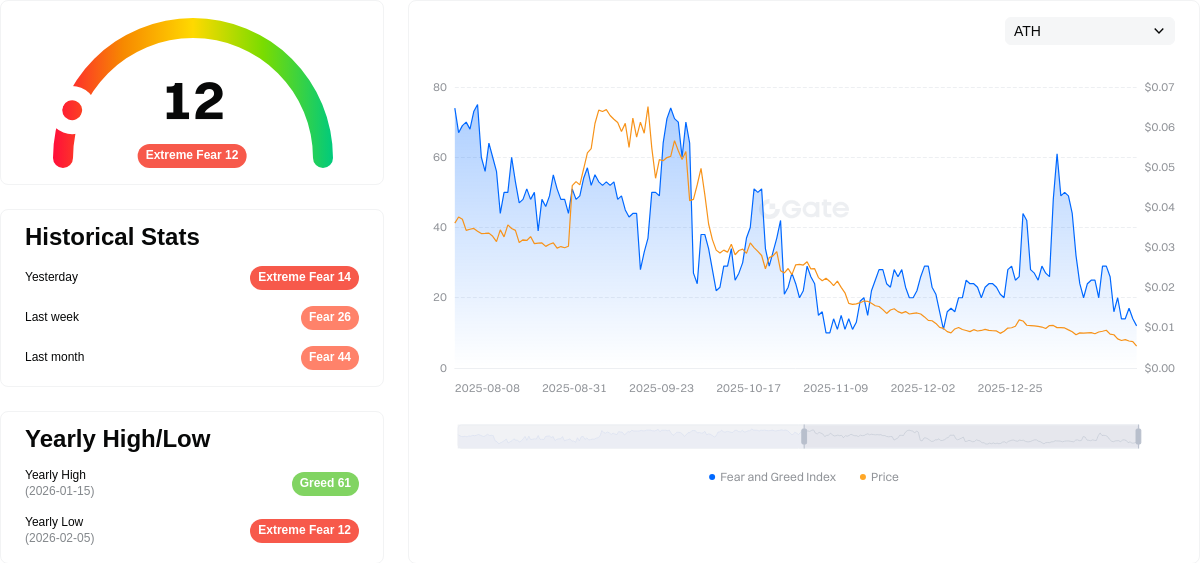

The broader cryptocurrency market sentiment currently registers at 12 on the VIX index, indicating an extreme fear environment among market participants.

Click to view the current VGX market price

VGX Market Sentiment Indicator

02-05-2026 Fear and Greed Index: 12 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index reaching just 12 points. This level typically indicates severe market pessimism and potential capitulation from investors. During such periods, risk assets face significant selling pressure as market participants retreat to safer positions. However, historical data suggests extreme fear often precedes market reversals, creating potential opportunities for contrarian investors. Traders should remain cautious while monitoring for signs of stabilization and accumulation patterns during this heightened fear environment.

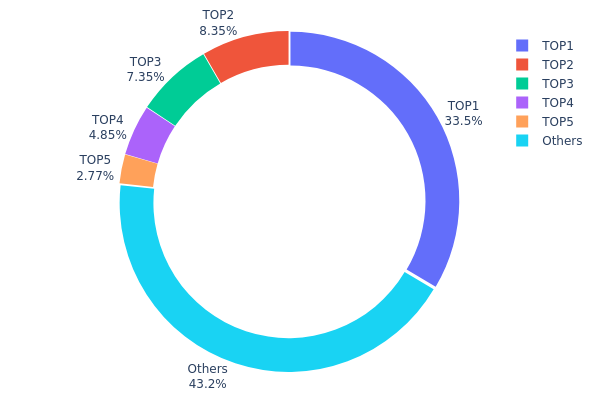

VGX Holding Distribution

The holding distribution chart represents the concentration of token ownership across different wallet addresses, providing insights into how VGX tokens are allocated among major holders and the broader market. This metric is crucial for assessing the degree of decentralization and potential risks associated with concentrated holdings.

Based on the current data, VGX exhibits a moderately high concentration pattern. The top address holds approximately 335.26 million tokens, accounting for 33.51% of the total supply, while the top five addresses collectively control 52.8% of all tokens. Notably, the second-largest address (0x0000...00dead) represents a burn address holding 8.34%, which effectively reduces circulating supply. The remaining 43.2% is distributed among other addresses, suggesting a relatively broad base of smaller holders.

This distribution structure presents a mixed outlook for market dynamics. The significant concentration in the top holder's wallet creates potential vulnerability to large-scale movements, which could trigger substantial price volatility if liquidated or redistributed. However, the presence of a substantial burn address and the meaningful portion held by diverse participants indicates some level of ecosystem maturity. The current structure suggests moderate decentralization, though investors should remain cognizant of the influence that top addresses could exert on market liquidity and price discovery mechanisms.

Click to view current VGX Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 335257.81K | 33.51% |

| 2 | 0x0000...00dead | 83495.60K | 8.34% |

| 3 | 0x3cc9...aecf18 | 73505.99K | 7.34% |

| 4 | 0x9642...2f5d4e | 48465.79K | 4.84% |

| 5 | 0x4c0d...f78e40 | 27753.53K | 2.77% |

| - | Others | 431747.10K | 43.2% |

II. Core Factors Influencing VGX's Future Price

Market Sentiment and Trading Activity

- Overall Market Sentiment: VGX's price is significantly influenced by broader cryptocurrency market sentiment, which can drive investor behavior and trading patterns.

- Trading Volume Dynamics: Higher trading volumes typically correlate with increased price volatility and can indicate growing market interest in the token.

- User Adoption Trends: The rate at which new users adopt and utilize VGX within its ecosystem directly impacts demand and price momentum.

Major Market Events

- Halving Events: Token halving mechanisms, when applicable, can create supply constraints that historically lead to price appreciation.

- Ethereum Network Upgrades: As part of the broader crypto ecosystem, Ethereum upgrades can indirectly affect VGX's market performance and investor sentiment.

- ETF Approvals: Regulatory approvals of cryptocurrency ETFs can trigger significant market movements, influencing prices across various digital assets including VGX.

Macroeconomic Environment

- Whale Activity: Large holders' buying and selling patterns can create substantial price fluctuations in VGX markets.

- Exchange Listings: New listings on major trading platforms typically expand accessibility and can drive price increases.

- Operational Developments: Continued platform operations, potential feature restorations such as staking rewards and cashback programs, affect token utility and investor confidence.

Technical Development and Ecosystem Growth

- Gaming Ecosystem Integration: For certain VGX iterations, the number and quality of Web3 gaming integrations serve as primary price drivers, with each successful integration expanding the token's use case.

- Technology Advancements: Ongoing technical developments and platform improvements enhance the token's functionality and market appeal.

- Ecosystem Expansion: Growth in applications and partnerships within the VGX ecosystem strengthens long-term value proposition.

III. 2026-2031 VGX Price Forecast

2026 Outlook

- Conservative forecast: $0.00044 - $0.00048

- Neutral forecast: Around $0.00048

- Optimistic forecast: Up to $0.0007 (contingent on favorable market conditions and ecosystem developments)

The 2026 projections indicate a relatively flat performance with a projected decline of approximately 1% compared to current levels, suggesting a consolidation phase as the token seeks to establish a stable support base.

2027-2029 Mid-term Outlook

- Market stage expectation: Gradual recovery and accumulation phase, with increasing volatility as market sentiment shifts

- Price range projections:

- 2027: $0.00043 - $0.00061 (approximately 20% potential upside)

- 2028: $0.00057 - $0.00072 (approximately 22% potential growth)

- 2029: $0.0005 - $0.0008 (approximately 34% potential appreciation)

- Key catalysts: Platform adoption metrics, regulatory clarity in digital asset markets, strategic partnerships, and broader crypto market recovery trends

2030-2031 Long-term Outlook

- Baseline scenario: $0.00062 - $0.00073 (assuming steady ecosystem growth and maintained user engagement)

- Optimistic scenario: $0.00074 - $0.00107 (contingent on accelerated platform innovation and expanded utility)

- Transformational scenario: Potential to reach $0.00114 by 2031 (approximately 83% growth, requiring breakthrough adoption milestones and favorable macro conditions)

By 2031, VGX could potentially experience significant appreciation if the platform successfully expands its service offerings and captures greater market share within the competitive crypto exchange landscape. However, these projections remain subject to substantial market risks and regulatory developments.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0007 | 0.00048 | 0.00044 | -1 |

| 2027 | 0.00061 | 0.00059 | 0.00043 | 20 |

| 2028 | 0.00072 | 0.0006 | 0.00057 | 22 |

| 2029 | 0.0008 | 0.00066 | 0.0005 | 34 |

| 2030 | 0.00107 | 0.00073 | 0.00062 | 48 |

| 2031 | 0.00114 | 0.0009 | 0.00074 | 83 |

IV. VGX Professional Investment Strategies and Risk Management

VGX Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors interested in the gaming sector and blockchain gaming ecosystem development

- Operational Recommendations:

- Consider the project's positioning as a cross-platform and cross-chain gaming token when evaluating long-term potential

- Monitor integration partnerships with gaming projects and platforms

- Utilize Gate Web3 Wallet for secure asset storage and management

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Given the 24-hour range of $0.0004317 to $0.0005579, identify key price levels for entry and exit points

- Volume Analysis: Monitor the 24-hour trading volume of $33,215.24 to assess market liquidity

- Swing Trading Considerations:

- Be aware of short-term volatility, as evidenced by the -10.18% change in the last 24 hours

- Consider the 30-day upward trend of 10.93% when planning medium-term positions

VGX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Active Investors: 3-5% of crypto portfolio

- Professional Investors: Up to 8% of crypto portfolio based on risk tolerance

(2) Risk Hedging Approaches

- Diversification: Consider allocating across multiple gaming-related tokens to reduce single-asset exposure

- Position Sizing: Limit individual position size based on the token's market capitalization of approximately $450,750

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and cross-chain functionality

- Cold Storage Approach: Hardware wallet storage for long-term holdings to minimize security risks

- Security Precautions: Verify the official ETH contract address (0x3c4b6e6e1ea3d4863700d7f76b36b7f3d3f13e3d) before any transactions, enable two-factor authentication, and never share private keys

V. VGX Potential Risks and Challenges

VGX Market Risks

- High Volatility: The token has experienced significant price fluctuations, with a 94.17% decline over the past year

- Low Liquidity: With a market capitalization of approximately $450,750 and relatively low trading volume, the token may face liquidity challenges

- Limited Exchange Availability: Currently listed on only 5 exchanges, which may restrict trading opportunities

VGX Regulatory Risks

- Gaming Token Classification: Regulatory treatment of gaming-related tokens remains uncertain in various jurisdictions

- Cross-chain Compliance: Operating across multiple blockchain networks may introduce complex regulatory considerations

- Platform Integration Risk: Changes in gaming platform policies could affect token utility and adoption

VGX Technical Risks

- Smart Contract Risk: As an ERC-20 token on Ethereum, it is subject to potential smart contract vulnerabilities

- Cross-chain Complexity: The cross-platform and cross-chain nature may introduce additional technical challenges

- Network Dependency: Token functionality relies on the underlying Ethereum network's performance and security

VI. Conclusion and Action Recommendations

VGX Investment Value Assessment

VGX positions itself as a cross-platform gaming token aiming to provide rewards and ownership for players across different blockchain ecosystems. While the project's focus on gaming integration presents potential opportunities as the blockchain gaming sector develops, investors should carefully weigh the substantial volatility observed over the past year and the relatively small market capitalization. The token's performance shows mixed signals, with a 30-day gain of 10.93% contrasted by a significant 94.17% decline over the past year. Given these factors, VGX may be suitable for investors with high risk tolerance who believe in the long-term potential of blockchain gaming.

VGX Investment Recommendations

✅ Beginners: Start with minimal allocation (no more than 1% of crypto portfolio) to understand the gaming token sector, and prioritize learning about the project's partnerships and ecosystem development ✅ Experienced Investors: Consider small speculative positions while maintaining strict stop-loss levels, and actively monitor gaming industry trends and VGX integration announcements ✅ Institutional Investors: Conduct thorough due diligence on the project's partnerships, evaluate the gaming token market segment, and assess position sizing in the context of broader gaming sector exposure

VGX Trading Participation Methods

- Spot Trading: Purchase VGX through Gate.com's spot market with various trading pairs

- Dollar-Cost Averaging: Implement systematic investment plans to mitigate volatility impact

- Research-Based Approach: Monitor project developments, gaming industry trends, and community engagement before making investment decisions

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is VGX token and what are its main uses?

VGX is the reward token of Voyager exchange, designed to incentivize user trading activity. VGX holders enjoy reduced trading fees and earn additional rewards when trading on the platform, creating a loyalty-based ecosystem.

What are the main factors affecting VGX price?

VGX price is influenced by market sentiment, trading volume, overall crypto market trends, supply and demand dynamics, and news events related to the Voyager ecosystem.

How to forecast VGX price and what analysis methods are available?

VGX price prediction uses technical analysis and historical trend assessment. Common methods include moving averages, RSI indicators, and trading volume analysis. Predictions vary based on market conditions and real-time data.

What was VGX's past price performance and historical high-low points?

VGX Token reached its all-time high of $12.54. The token has demonstrated significant price volatility throughout its trading history, with substantial fluctuations reflecting market dynamics and investor sentiment in the crypto sector.

What are the main risks of investing in VGX?

VGX investment risks include market volatility, regulatory uncertainties, liquidity fluctuations, and technology development challenges. Price may be affected by crypto market cycles and project execution risks.

What are the differences between VGX and other Layer 2 or DeFi tokens?

VGX is the native token of Volt Protocol, focusing on Layer 2 solutions with built-in governance mechanisms. Unlike other Layer 2 or DeFi tokens, VGX combines governance rights with Layer 2 technology, offering unique utility and ecosystem participation opportunities for token holders.

What are professional analysts' predictions for VGX's future price?

Professional analysts' VGX price predictions vary due to market volatility. Historical peak reached $12.54, with current price fluctuating between $0.0005193 and $0.0005842. Future trends remain uncertain but analysts monitor on-chain metrics and adoption growth for potential upside.

What is the circulating supply and total supply of VGX, and how does this affect the price?

VGX's circulating and total supply directly influence its market dynamics. Lower circulating supply typically supports higher prices through scarcity, while larger supply may create downward pressure. Supply tokenomics are crucial price drivers in crypto markets.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

What Do NGMI and WAGMI Mean in Crypto?

What Is a Physical Bitcoin and What Is Its Worth?

What is crypto scalping and how does it work

Meme coins are making headlines—are you a dog person or a cat person? Which is the better buy?

What is blockchain in simple terms