2026 WAMPL Price Prediction: Expert Analysis and Market Forecast for Ampleforth Wrapped Token

Introduction: WAMPL's Market Position and Investment Value

Wrapped Ampleforth (WAMPL), serving as a decentralized unit of account and building block for DeFi protocols, has been facilitating ecosystem integrations since its launch in December 2021. As of 2026, WAMPL maintains a market capitalization of approximately $737,560, with a circulating supply of around 634,188 tokens, and its price hovering near $1.163. This asset, designed as a wrapped version of AMPL similar to wrapped ETH, plays an increasingly vital role in both centralized and decentralized platforms as the primary collateral asset in the SPOT protocol.

This article will comprehensively analyze WAMPL's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. WAMPL Price History Review and Market Status

WAMPL Historical Price Evolution Trajectory

- 2021: WAMPL launched on December 24 with a publish price of $28.51, establishing its initial market presence as a wrapped token variant of AMPL

- 2024: In July, the token reached a notable price level of $35 on July 23, representing a significant appreciation from its launch price

- 2024-2026: The market entered a prolonged correction phase, with price declining from the July 2024 peak to $1.145 recorded on February 3, 2026

WAMPL Current Market Status

As of February 4, 2026, WAMPL is trading at $1.163, showing short-term volatility with a 24-hour decline of 4.91%. The current price represents a substantial retracement from previous levels, with the token experiencing a 0.67% decrease over the past hour.

The token's recent performance reflects broader downward pressure, with a 7-day decline of 19.68% and a 30-day decrease of 18.61%. Over the past year, WAMPL has experienced a considerable correction of 91.82%, bringing the price closer to recent lows.

The 24-hour trading volume stands at $45,173.61, while the circulating supply is 634,188 tokens out of a maximum supply of 10,000,000 tokens, resulting in a circulation ratio of approximately 6.34%. The market capitalization is positioned at $737,560.64, with a fully diluted market cap of $11,630,000.

WAMPL's price range over the past 24 hours has fluctuated between $1.145 (24-hour low) and $1.241 (24-hour high). The token currently ranks #2739 in the cryptocurrency market, with a market dominance of 0.00043%. The market cap to fully diluted valuation ratio stands at 6.34%, indicating a relatively low percentage of tokens currently in circulation.

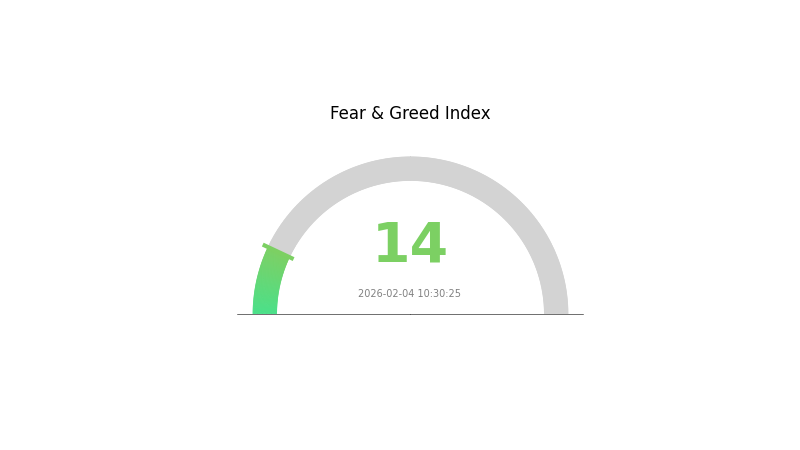

The cryptocurrency is deployed on the Ethereum blockchain as an ERC-20 token, with approximately 4,214 holders. Current market sentiment indicators suggest an environment of extreme fear, with a volatility index reading of 14.

Click to view current WAMPL market price

WAMPL Market Sentiment Indicator

2026-02-04 Fear & Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear & Greed Index plummeting to 14. This historically low reading signals heightened market anxiety and pessimism among investors. Such extreme fear conditions often present contrarian opportunities, as panic selling may have pushed prices below intrinsic value. However, traders should exercise caution and conduct thorough due diligence before making investment decisions. Market volatility remains elevated during periods of extreme fear, requiring careful risk management and disciplined trading strategies.

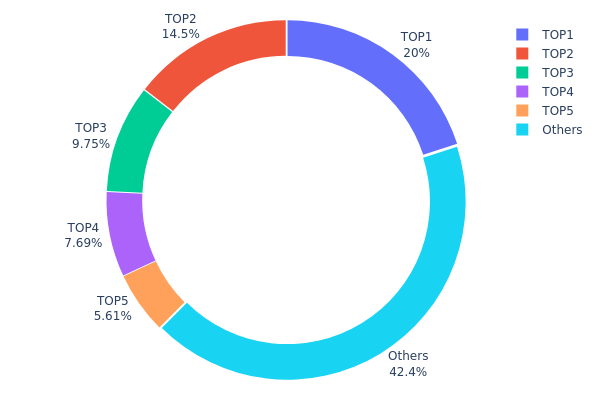

WAMPL Holding Distribution

The holding distribution chart provides a comprehensive view of token ownership across different wallet addresses, revealing the degree of decentralization and concentration risk within the WAMPL ecosystem. This metric serves as a critical indicator for assessing market structure stability and potential vulnerability to large holder influence.

Current data reveals a moderate concentration pattern in WAMPL holdings. The top address controls approximately 20.02% of total supply (285.71K tokens), while the top five addresses collectively hold 57.54% of circulating tokens. This concentration level suggests a semi-centralized ownership structure, though not at alarming levels. The remaining 42.46% distributed among other holders indicates a reasonably broad base of smaller participants, providing some counterbalance to major holder dominance.

From a market dynamics perspective, this distribution pattern presents both opportunities and risks. The significant holdings by top addresses could provide price stability during minor market fluctuations, as these entities typically represent long-term strategic holders rather than short-term speculators. However, the concentration of over half the supply in five addresses creates potential liquidity risks and price volatility if any major holder decides to liquidate positions. The current structure reflects WAMPL's position as an established but niche DeFi asset, where institutional participants and sophisticated investors dominate ownership while maintaining sufficient retail participation to support organic market activity.

Click to view current WAMPL Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xbbe4...9b8a65 | 285.71K | 20.02% |

| 2 | 0x0c2b...530f11 | 206.94K | 14.50% |

| 3 | 0x0d07...b492fe | 139.02K | 9.74% |

| 4 | 0x0600...c7777a | 109.65K | 7.68% |

| 5 | 0x10f6...e30c8a | 80.00K | 5.60% |

| - | Others | 605.14K | 42.46% |

II. Core Factors Influencing WAMPL's Future Price

Supply Mechanism

- Elastic Supply Protocol: WAMPL operates with a rebase mechanism that automatically adjusts token supply based on demand, maintaining its target price through algorithmic expansion and contraction.

- Historical Patterns: Supply adjustments have historically created volatility in token distribution, with price impacts typically stabilizing after each rebase cycle as the market adapts to the new supply levels.

- Current Impact: Market sentiment and trading volume continue to play significant roles in price discovery, with supply adjustments responding to broader market conditions and user adoption trends.

Macroeconomic Environment

- Market Sentiment Influence: WAMPL's price trajectory remains closely tied to overall cryptocurrency market sentiment, with broader risk-on or risk-off trends in digital assets affecting trading patterns and investor confidence.

- Trading Volume Dynamics: Liquidity conditions and trading activity serve as key indicators of market health, with increased volume typically supporting more stable price discovery mechanisms.

- Macroeconomic Conditions: Wider economic factors, including monetary policy expectations and inflation dynamics in traditional markets, continue to influence cryptocurrency valuations, including WAMPL.

Technology Development and Ecosystem Building

- Technical Infrastructure: Ongoing developments in the underlying protocol and smart contract architecture support the token's core functionality and stability mechanisms.

- User Adoption Trends: The growth trajectory of WAMPL depends on expanding user base and increased integration within DeFi ecosystems, with adoption patterns directly impacting long-term value proposition.

- Regulatory Landscape: Evolving regulatory frameworks for digital assets may influence operational parameters and market accessibility, though specific regulatory developments affecting WAMPL remain subject to broader crypto market regulations.

III. 2026-2031 WAMPL Price Prediction

2026 Outlook

- Conservative prediction: $0.99-$1.16

- Neutral prediction: $1.16

- Optimistic prediction: $1.52 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: The token may experience moderate growth with potential volatility as the market matures and establishes broader recognition

- Price range prediction:

- 2027: $1.09-$1.40

- 2028: $1.27-$1.52

- 2029: $0.81-$2.15

- Key catalysts: Market expansion, technological developments, and growing ecosystem participation could serve as primary drivers

2030-2031 Long-term Outlook

- Baseline scenario: $1.71-$1.80 (assuming steady market development and maintained project momentum)

- Optimistic scenario: $2.23-$2.66 (assuming enhanced market adoption and favorable regulatory environment)

- Transformational scenario: $3.12 (requires exceptional market conditions, significant partnerships, and widespread institutional adoption)

- 2026-02-04: WAMPL trading around $1.16 (current baseline reference point)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 1.52353 | 1.163 | 0.98855 | 0 |

| 2027 | 1.397 | 1.34327 | 1.08804 | 15 |

| 2028 | 1.52084 | 1.37013 | 1.27422 | 17 |

| 2029 | 2.15378 | 1.44549 | 0.80947 | 24 |

| 2030 | 2.66346 | 1.79963 | 1.70965 | 54 |

| 2031 | 3.12416 | 2.23154 | 1.62903 | 91 |

IV. WAMPL Professional Investment Strategy and Risk Management

WAMPL Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: DeFi enthusiasts and investors seeking alternative unit-of-account assets with elastic supply mechanisms

- Operational Recommendations:

- Consider WAMPL as a portfolio diversification component within the DeFi ecosystem, particularly for exposure to algorithmic stablecoin alternatives

- Monitor the relationship between WAMPL and the underlying AMPL protocol, as WAMPL's value is tied to AMPL's rebase mechanism

- Storage Solution: Utilize Gate Web3 Wallet for secure storage, which supports ERC-20 tokens on Ethereum mainnet

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price Action Analysis: Track the 24-hour range (Low: $1.145, High: $1.241) to identify support and resistance levels for short-term trading opportunities

- Volume Analysis: Monitor the 24-hour trading volume of approximately $45,173 to assess liquidity conditions before executing larger trades

- Swing Trading Key Points:

- Consider the recent downward trend (24H: -4.91%, 7D: -19.68%, 30D: -18.61%) when planning entry points

- Exercise caution given the limited exchange availability (currently listed on 1 exchange), which may impact liquidity and price stability

WAMPL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of cryptocurrency portfolio

- Aggressive Investors: 2-3% of cryptocurrency portfolio

- Professional Investors: 3-5% of cryptocurrency portfolio, with careful monitoring of AMPL protocol developments

(2) Risk Hedging Solutions

- Diversification Strategy: Balance WAMPL holdings with other DeFi protocol tokens and stablecoin alternatives to mitigate concentration risk

- Position Sizing: Given the relatively low market cap ($737,560) and limited circulating supply (634,188 tokens), limit individual position sizes to manage liquidity risk

(3) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet offers convenient access for ERC-20 tokens with integrated security features

- Hardware Wallet Solution: For larger holdings, consider hardware wallet solutions that support Ethereum-based ERC-20 tokens

- Security Precautions: Always verify the contract address (0xedb171c18ce90b633db442f2a6f72874093b49ef) before transactions, enable two-factor authentication, and maintain private key backups in secure offline locations

V. WAMPL Potential Risks and Challenges

WAMPL Market Risks

- High Volatility: The token has experienced a 91.82% decline over the past year, indicating substantial price volatility that may result in significant capital losses

- Limited Liquidity: With a 24-hour trading volume of approximately $45,173 and availability on only 1 exchange, investors may face challenges executing large orders without impacting market prices

- Low Market Dominance: With a market dominance of 0.00043% and a ranking of #2739, WAMPL represents a micro-cap asset with heightened risk of price manipulation

WAMPL Regulatory Risks

- DeFi Protocol Scrutiny: As regulatory frameworks for decentralized finance continue to evolve globally, protocols like Ampleforth may face increased compliance requirements that could impact WAMPL's utility

- Wrapped Token Classification: Regulatory authorities may develop specific guidelines for wrapped tokens, potentially affecting WAMPL's tradability or requiring additional compliance measures

- Platform Integration Restrictions: Changes in regulatory approaches toward centralized and decentralized platforms could limit WAMPL's ecosystem integration capabilities

WAMPL Technical Risks

- Smart Contract Vulnerability: As an ERC-20 token on Ethereum, WAMPL is subject to potential smart contract bugs or exploits that could compromise user funds

- Dependency on AMPL Protocol: WAMPL's value proposition is directly tied to the underlying AMPL protocol and its rebase mechanism; any technical issues or failures in the AMPL protocol could negatively impact WAMPL

- Limited Supply Constraints: With a maximum supply of 10,000,000 tokens and only 6.34% currently in circulation, future token releases could create downward price pressure

VI. Conclusion and Action Recommendations

WAMPL Investment Value Assessment

WAMPL represents a niche DeFi instrument designed to facilitate ecosystem integration for Ampleforth's algorithmic unit-of-account protocol. While it serves a specific function as a wrapped version of AMPL and acts as collateral in the SPOT protocol, the token faces challenges including limited liquidity, concentrated exchange availability, and a significant year-over-year price decline. The recent downward pressure across multiple timeframes (1H: -0.67%, 24H: -4.91%, 7D: -19.68%, 30D: -18.61%, 1Y: -91.82%) suggests ongoing bearish sentiment. Long-term value proposition depends heavily on broader adoption of the Ampleforth protocol and its ecosystem, while short-term risks include continued volatility, liquidity constraints, and technical dependencies on the underlying AMPL mechanism.

WAMPL Investment Recommendations

✅ Beginners: Avoid or limit exposure to less than 0.5% of total cryptocurrency allocation. Given the complexity of the rebase mechanism, limited liquidity, and high volatility, novice investors should prioritize more established assets while learning about DeFi protocols

✅ Experienced Investors: Consider a small allocation (1-2% of cryptocurrency portfolio) only if familiar with algorithmic stablecoins and elastic supply mechanisms. Monitor AMPL protocol developments and SPOT protocol usage closely

✅ Institutional Investors: Evaluate WAMPL's role in DeFi infrastructure strategies with careful consideration of liquidity limitations and counterparty risks. Position sizing should account for limited market depth and exchange availability

WAMPL Trading Participation Methods

- Spot Trading on Gate.com: Access WAMPL through the Gate.com platform, which currently supports trading pairs for this asset

- DeFi Protocol Integration: Participate in decentralized platforms where WAMPL serves as collateral or liquidity, subject to thorough protocol audit review

- Storage and Management: Utilize Gate Web3 Wallet for secure storage and management of WAMPL tokens, ensuring proper verification of the Ethereum contract address

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is WAMPL and how does it differ from the native AMPL token?

WAMPL is a wrapped version of Ampleforth's AMPL token, designed for cross-chain compatibility and easier trading on decentralized exchanges. Unlike AMPL, which has elastic supply and price volatility, WAMPL maintains a stable peg, making it more suitable for trading and liquidity provision across multiple blockchain networks.

What is the WAMPL price prediction for 2024-2025?

WAMPL price predictions for 2024-2025 have not been officially released. As of February 4, 2026, WAMPL is trading at US$1.44, up 4.10% over the past 7 days.

What are the main factors affecting WAMPL price?

WAMPL price is primarily influenced by market supply and demand, trading volume, overall crypto market trends, project developments, and investor sentiment. These factors collectively drive price movements in the market.

How to predict WAMPL's price trends through technical analysis?

Technical analysis uses historical price trends and real-time technical indicators to forecast WAMPL's movement. Current price is $1.17, with projections suggesting potential rise to $1.4309 next month. Analyze trading volume, support/resistance levels, and chart patterns for informed predictions.

WAMPL作为投资品种有哪些风险需要注意?

WAMPL投资风险包括市场波动性、监管政策变化、技术风险及流动性风险。投资者需充分了解项目基本面、进行风险评估,建议咨询专业投资顾问后谨慎决策。

How does WAMPL compare in investment value to other DeFi tokens?

WAMPL offers superior investment value with 1:1 exchangeability to AMPL and flexible composability. Its non-rebalancing mechanism and floating price provide unique portfolio diversification opportunities compared to traditional DeFi tokens.

WAMPL的历史价格表现和波动率如何?

WAMPL历史最高价为$54.43,最低价为$0.02785184。近24小时价格在$1.43至$1.46之间波动,显示中等波动性。长期来看,WAMPL经历过显著的价格波动,市场波动率较高,适合风险承受度高的投资者。

What are professional analysts' predictions for WAMPL's future price?

Professional analysts project WAMPL could experience significant growth driven by increasing adoption and market demand. While specific targets vary, many expect upward momentum as the ecosystem expands and utility strengthens in the coming years.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

ANI vs LTC: A Comprehensive Comparison of Two Leading Blockchain Technologies and Their Market Impact

EDGEN vs AVAX: Which Layer-1 Blockchain Platform Offers Better Performance and Scalability in 2024?

WSI vs FLOW: Comparing Whole Slide Image Analysis and Real-Time Workflow Optimization in Digital Pathology

Comprehensive Guide to Mining Bitcoin Using GoMining NFTs

Comprehensive Guide to Token Generation Events