2026 WBAI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: WBAI's Market Position and Investment Value

WhiteBridge Network (WBAI), as a decentralized AI-powered people data intelligence platform, has been building a global trust layer since its launch in 2025. The project has powered over 3.7 million searches with access to 3.59 billion profiles and serves more than 100,000 users, generating $3 million in annual recurring revenue. As of February 7, 2026, WBAI maintains a market capitalization of approximately $336,978, with a circulating supply of 97 million tokens and a current price of $0.003474. This asset, recognized as a "Web3-powered trust infrastructure," is playing an increasingly vital role in identity verification, compliance solutions, reputation scoring, and cybersecurity protection.

This article will comprehensively analyze WBAI's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. WBAI Price History Review and Current Market Status

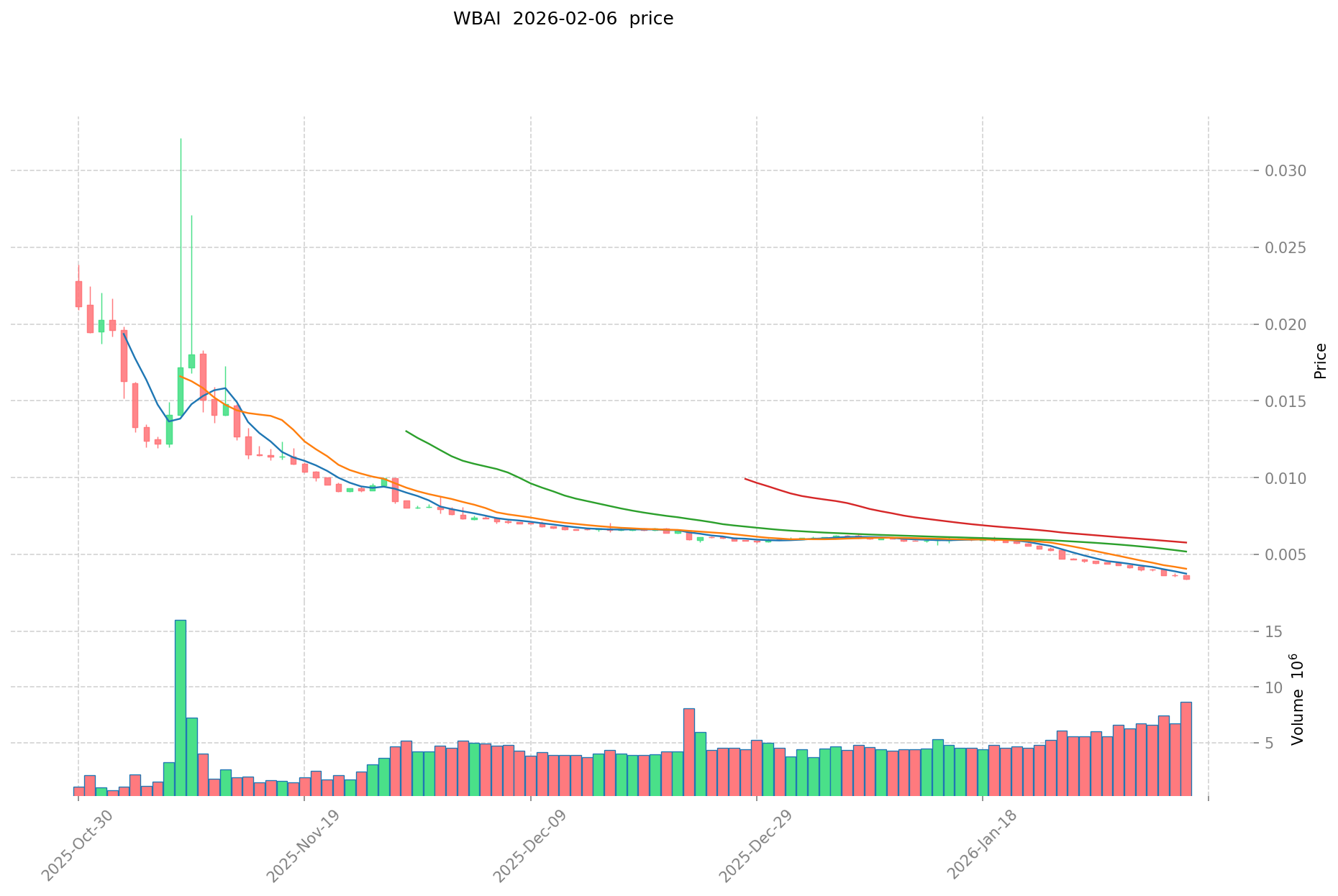

WBAI Historical Price Evolution Trajectory

- October 2025: WBAI reached a notable price level of $0.095546 on October 15, marking a significant milestone since its launch.

- February 2026: The token experienced substantial price adjustment, declining to $0.003345 on February 6.

WBAI Current Market Dynamics

As of February 7, 2026, WBAI is trading at $0.003474, showing a 24-hour increase of 2.7% with a trading volume of $36,150.73. Over the past hour, the token has demonstrated modest growth of 0.35%. However, broader timeframes reveal more significant movement, with a 7-day decline of 20.78% and a 30-day decrease of 42.80%.

The token currently holds a market capitalization of approximately $336,978, with a circulating supply of 97 million WBAI out of a maximum supply of 1 billion tokens, representing 9.7% of the total supply in circulation. The fully diluted market cap stands at $3.47 million. WBAI ranks #3408 in the cryptocurrency market with a dominance of 0.00013%.

WhiteBridge Network has demonstrated operational traction, powering over 3.7 million searches with access to 3.59 billion profiles and serving more than 100,000 users, generating $3 million in annual recurring revenue. The project has attracted 6,451 token holders and is supported by ChainGPT Labs, MVB 10 (BNB Chain, YZi Labs, and CMC Labs). The token operates on the BSC network.

Click to view current WBAI market price

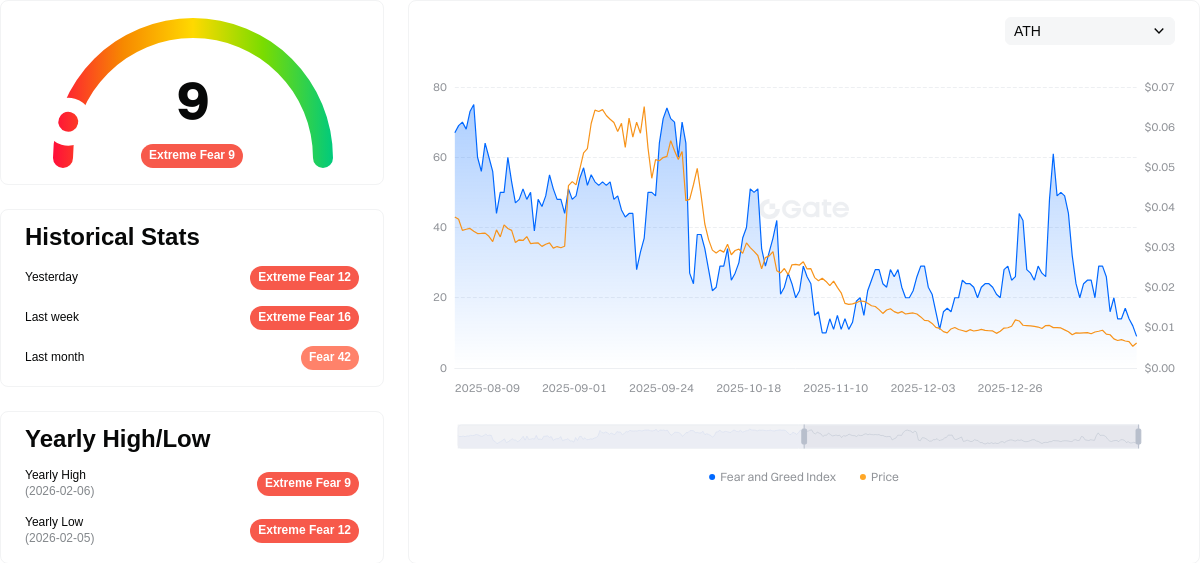

WBAI Market Sentiment Index

02-06-2026 Fear and Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index at a critically low level of 9. This indicates severe market pessimism and panic selling pressure. During such periods, experienced investors often view market downturns as potential buying opportunities, as extreme fear typically precedes market reversals. However, caution is advised, and thorough research is essential before making investment decisions. Monitor market developments closely and consider your risk tolerance carefully during these volatile conditions.

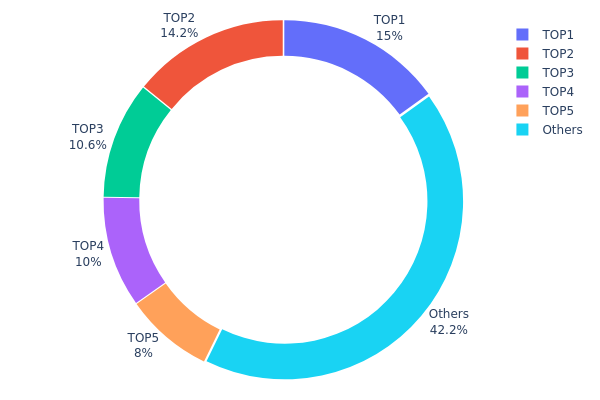

WBAI Holding Distribution

The holding distribution chart illustrates the concentration of token ownership across different wallet addresses, serving as a critical indicator of market structure and decentralization level. For WBAI, the current on-chain data reveals a moderately concentrated distribution pattern. The top five addresses collectively control approximately 57.75% of the total token supply, with the largest single holder possessing 150,000K tokens (15.00%), followed closely by the second-largest holder at 142,041.70K tokens (14.20%). The third through fifth positions hold 10.55%, 10.00%, and 8.00% respectively, while the remaining addresses account for 42.25% of the circulating supply.

This concentration level suggests a relatively balanced yet cautiously centralized ownership structure. While no single entity demonstrates overwhelming dominance, the cumulative holdings of the top five addresses exceeding the halfway mark indicates potential vulnerability to coordinated market movements. Such distribution patterns typically introduce elevated price volatility risks, as large holders possess sufficient token quantities to significantly impact market liquidity through substantial buy or sell orders. Additionally, the 42.25% held by smaller addresses provides a foundation for retail participation, which can serve as a stabilizing mechanism during periods of market turbulence.

From a market structure perspective, WBAI's current holding distribution reflects a transitional phase between centralized control and broader community ownership. The presence of multiple large holders rather than a single dominant entity reduces the risk of unilateral price manipulation, though coordinated actions among top holders remain a theoretical concern. This distribution pattern generally supports moderate liquidity conditions while maintaining reasonable price discovery mechanisms, contributing to a relatively stable on-chain structural framework for the token ecosystem.

Click to view current WBAI Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9b11...497224 | 150000.00K | 15.00% |

| 2 | 0xca22...01ddc8 | 142041.70K | 14.20% |

| 3 | 0x7ae1...ab5296 | 105513.01K | 10.55% |

| 4 | 0x549d...754c40 | 100000.00K | 10.00% |

| 5 | 0x5af9...467eb1 | 80000.00K | 8.00% |

| - | Others | 422445.29K | 42.25% |

II. Core Factors Influencing WBAI's Future Price

Supply Mechanism

- Fixed Total Supply: WhiteBridge Network has established a fixed total supply of 1 billion WBAI tokens, creating a deflationary framework that may support long-term value appreciation as demand increases.

- Historical Pattern: The token's structured distribution approach aims to balance ecosystem growth with supply discipline, though as a newly launched project, historical price impact data remains limited.

- Current Impact: Early-stage liquidity conditions and initial exchange listings are expected to create near-term price volatility, with the token's performance heavily influenced by investor demand and market sentiment during the initial 1-3 month period.

Institutional and Major Holder Dynamics

- Institutional Positioning: WhiteBridge Network launched through ChainGPT Pad and was listed on multiple platforms in October 2025, attracting attention from early-stage crypto investors focused on AI and decentralized infrastructure projects.

- Corporate Adoption: The project positions itself at the intersection of AI, DePIN (Decentralized Physical Infrastructure Networks), and identity verification, targeting enterprise and individual users seeking verifiable, AI-driven data insights in the growing Web3 identity and compliance market.

- Governance Framework: WBAI functions as a governance token, enabling holders to participate in key decision-making processes and ensuring the platform remains responsive to community needs and preferences.

Macroeconomic Environment

- Market Sentiment Impact: Investor sentiment and confidence directly influence WBAI price movements, with positive news regarding widespread adoption or significant technological breakthroughs potentially driving upward momentum.

- Sector Positioning: As part of the emerging AI-driven data economy, WBAI's performance may correlate with broader trends in artificial intelligence, blockchain infrastructure, and data sovereignty sectors.

- Risk Considerations: Early-stage projects typically experience higher volatility, with price action influenced by overall crypto market conditions, regulatory developments, and shifts in investor risk appetite.

Technical Development and Ecosystem Building

- Hybrid Blockchain Architecture: WhiteBridge operates on a custom hybrid blockchain architecture designed to support secure, scalable, and transparent data transactions, providing the technical foundation for its decentralized AI data infrastructure.

- Trust Layer for Personal Data: The platform aggregates fragmented public information from social data, professional networks, and public records, utilizing AI for verification and unification to deliver actionable insights for users and enterprises.

- Ecosystem Incentives: Users can earn WBAI tokens through multiple channels, including operating data nodes, staking, providing liquidity, and participating in community-driven activities such as referral programs, social tasks, and promotional events like airdrops.

- Data Monetization Framework: WhiteBridge enables users to own, protect, and monetize their personal and behavioral data, bridging human data with AI systems through blockchain-based identity and reputation mechanisms.

III. 2026-2031 WBAI Price Prediction

2026 Outlook

- Conservative Forecast: $0.00264 - $0.00348

- Neutral Forecast: $0.00348 (average scenario)

- Optimistic Forecast: Up to $0.00507 (requiring favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with potential for moderate growth as the project establishes its market presence

- Price Range Predictions:

- 2027: $0.00261 - $0.00457

- 2028: $0.00288 - $0.00659

- 2029: $0.00281 - $0.00755

- Key Catalysts: Market maturation, technological developments, and broader ecosystem expansion could drive price appreciation through this period

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00379 - $0.00653 (assuming steady market development and maintained project momentum)

- Optimistic Scenario: $0.00653 - $0.00907 in 2030 (contingent on accelerated adoption and favorable macro conditions)

- Growth Scenario: $0.00507 - $0.01045 by 2031 (under conditions of significant ecosystem expansion and sustained bullish market sentiment)

- February 7, 2026: WBAI trading within the predicted range of $0.00264 - $0.00507 (early-stage price discovery phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00507 | 0.00348 | 0.00264 | 0 |

| 2027 | 0.00457 | 0.00428 | 0.00261 | 23 |

| 2028 | 0.00659 | 0.00443 | 0.00288 | 27 |

| 2029 | 0.00755 | 0.00551 | 0.00281 | 58 |

| 2030 | 0.00907 | 0.00653 | 0.00379 | 87 |

| 2031 | 0.01045 | 0.0078 | 0.00507 | 124 |

IV. WBAI Professional Investment Strategy and Risk Management

WBAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term potential of decentralized people-data intelligence and AI-driven trust layers

- Operational Recommendations:

- Consider accumulating positions during periods of market stabilization, as WBAI has experienced notable volatility with a 30-day decline of approximately 42.80%

- Monitor the project's user growth metrics and recurring revenue performance as key indicators of fundamental value

- Storage Solution: Utilize Gate Web3 Wallet for secure asset management, ensuring private key protection and regular backup procedures

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of approximately $36,150 to identify potential liquidity patterns and entry/exit points

- Price Range Monitoring: Track movements between support levels near $0.003345 and resistance zones approaching recent highs

- Swing Trading Considerations:

- Be aware of short-term volatility, as evidenced by 7-day decline of 20.78%

- Consider the relatively low market capitalization of approximately $336,978, which may contribute to price sensitivity

WBAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-10% of crypto portfolio allocation

- Professional Investors: Up to 15% with active monitoring and hedging strategies

(2) Risk Hedging Approaches

- Portfolio Diversification: Balance WBAI holdings with established cryptocurrencies and stablecoins to manage volatility exposure

- Position Sizing: Implement gradual accumulation strategies rather than concentrated purchases, particularly given the token's circulating supply of 97 million out of 1 billion maximum supply

(3) Secure Storage Solutions

- Primary Recommendation: Gate Web3 Wallet, offering user-friendly interface with robust security features for BEP-20 tokens

- Multi-signature Setup: For larger holdings, consider implementing multi-signature wallet configurations

- Security Precautions: Never share private keys, enable two-factor authentication, and regularly verify wallet addresses before transactions

V. WBAI Potential Risks and Challenges

WBAI Market Risks

- High Volatility: The token has demonstrated considerable price fluctuations, with a 95.53% decline from its peak price of $0.095546 since October 2025

- Low Liquidity: With a market capitalization of approximately $336,978 and ranking at 3408, liquidity may be limited during high-volume trading periods

- Market Sentiment Dependency: Price movements may be heavily influenced by broader market conditions and investor sentiment toward AI and data intelligence projects

WBAI Regulatory Risks

- Data Privacy Regulations: As a people-data intelligence platform, WhiteBridge Network may face evolving regulatory scrutiny regarding data collection, verification, and privacy compliance across different jurisdictions

- Token Classification: Potential regulatory changes in how utility tokens are classified could impact trading availability and compliance requirements

- Cross-border Data Transfer: Operations involving 3.59 billion profiles may encounter regulatory challenges related to international data transfer regulations

WBAI Technical Risks

- Smart Contract Vulnerabilities: As a BEP-20 token on BSC, security depends on the integrity of deployed smart contracts and underlying blockchain infrastructure

- Platform Scalability: Managing over 3.7 million searches and 100,000+ users requires continuous technical infrastructure upgrades

- Integration Dependencies: The platform's effectiveness relies on maintaining connections with global data provider nodes and AI agent functionality

VI. Conclusion and Action Recommendations

WBAI Investment Value Assessment

WhiteBridge Network presents an innovative approach to decentralized people-data intelligence, supported by measurable adoption metrics including 3.7 million searches, 100,000+ users, and $3 million in annual recurring revenue. The project's backing by ChainGPT Labs and MVB 10 participants provides credibility. However, investors should carefully weigh the significant price decline of over 95% from peak levels and the current low market capitalization against the project's long-term vision of creating a global trust layer for data intelligence. The relatively small circulating supply of 9.7% of maximum supply may present both opportunities and risks regarding future token distribution.

WBAI Investment Recommendations

✅ Newcomers: Start with small allocation (1-2% of crypto portfolio), focus on understanding the project's fundamentals and platform utility before increasing exposure ✅ Experienced Investors: Consider strategic accumulation during stabilization periods, monitor user growth metrics and revenue performance as key indicators for position adjustments ✅ Institutional Investors: Conduct thorough due diligence on platform architecture, data provider network quality, and regulatory compliance framework before establishing positions

WBAI Trading Participation Methods

- Spot Trading: WBAI is available for spot trading on Gate.com, providing direct token ownership and participation in the network ecosystem

- Dollar-Cost Averaging: Implement systematic purchase plans to mitigate entry timing risks given current volatility patterns

- Active Monitoring: Track platform development updates, user growth statistics, and partnership announcements that may influence token utility and demand

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is WBAI, and what are its basic purposes and characteristics?

WBAI is the Whole Brain Architecture Initiative, dedicated to advancing whole brain artificial intelligence architecture research. Its core purpose is promoting harmonious coexistence between AI and humanity through integrated development of comprehensive AI systems.

How to analyze WBAI's historical price trends and technical indicators?

Analyze WBAI's historical price data to identify key support/resistance levels and volatility patterns. Use technical tools like moving averages and RSI to evaluate trends. Historical data helps predict future price movements and market direction.

WBAI的价格主要受哪些因素影响?

WBAI price is mainly influenced by three key factors: node growth and data utility, staking dynamics, and strategic partnerships. Strong node expansion and utility growth drive price appreciation, while staking levels need to maintain 10-15% threshold. Major partnership announcements significantly impact market sentiment and price performance.

What are professional analysts' predictions for WBAI's future price?

Professional analysts predict WBAI price growth based on market trends, adoption rates, and tokenomics. With current price at $0.00345, analysts anticipate potential upside driven by increasing demand for decentralized AI solutions and ecosystem expansion. However, predictions vary based on market conditions.

What are the main risks to consider when investing in WBAI?

Key risks include market volatility, price manipulation, regulatory uncertainty across jurisdictions, and technical risks such as network security vulnerabilities or failed upgrades. Conduct thorough research before investing.

What are the advantages and disadvantages of WBAI compared to similar crypto assets?

WBAI offers innovative AI-driven features and strong community support as advantages. However, it faces lower market liquidity and less regulatory clarity compared to established cryptocurrencies, presenting higher volatility and adoption risks.

Top 10 DePIN Crypto Projects to Invest in 2025

How to Participate in a DePIN Project

What is DePIN?How Does DePIN Work?

What Does Onyxcoin's DApp Ecosystem Look Like in 2025?

How to Earn with The RWA DePin Protocol in 2025

TrendX (XTTA): An Innovative Investment Platform Integrating AI and DePIN

What is Inflation? How Does It Affect Our Lives? Understanding Inflation Rates

Rafał Zaorski – Who Is He? Background, Net Worth, and Career Overview

7 Ideas for Beginners to Create Digital Art

What Are Nodes?

Comprehensive Guide to Buying and Trading Cryptocurrencies