2026 WNDR Price Prediction: Expert Analysis and Market Forecast for Wonderland Token

Introduction: WNDR's Market Position and Investment Value

Wonderman Nation (WNDR), as a blockchain-based play-to-earn gaming token combining elements from Axie Infinity's ecosystem, Final Fantasy's combat mechanics, and CryptoKitties' breeding system, has been developing its unique position in the GameFi sector since its launch in 2022. As of February 5, 2026, WNDR maintains a market capitalization of approximately $610,300, with a circulating supply of around 46.67 million tokens, and the price hovering near $0.013076. This asset, positioned as an innovative gaming metaverse token, is playing an increasingly important role in the convergence of blockchain technology and interactive entertainment.

This article will comprehensively analyze WNDR's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. WNDR Price History Review and Market Status

WNDR Historical Price Evolution Trajectory

- 2022: Token launched in May with an initial price of $0.099, reaching a peak of $0.327695 on May 9, 2022, representing a significant early-stage surge

- 2023: Market experienced substantial correction, with the price declining to a low of $0.00779408 on October 21, 2023, marking a notable downturn period

- 2025-2026: Price demonstrated recovery momentum, fluctuating within the range of $0.011966 to $0.013076

WNDR Current Market Dynamics

As of February 5, 2026, WNDR is trading at $0.013076, showing a 24-hour increase of 1.74% and a 1-hour gain of 7.04%. The token's 24-hour trading volume stands at $12,347.11, with a market capitalization of approximately $610,300.

The circulating supply represents 46,673,294.97 WNDR tokens, accounting for 9.33% of the maximum supply of 500,000,000 tokens. The fully diluted market cap is valued at $6,538,000, with a market cap to FDV ratio of 9.33%.

Over broader timeframes, WNDR has experienced mixed performance, with a 7-day decline of 20.66%, a 30-day decrease of 31.26%, and a 1-year drop of 12.3%. The token currently holds a market ranking of 2876, with a market dominance of 0.00025%.

The project maintains 1,946 holders and is deployed on the BSC (BNB Smart Chain) network, with the contract address 0xDfd7b0dD7Bf1012DfDf3307a964c36b972300Ac8. Trading is available on Gate.com.

Click to view current WNDR market price

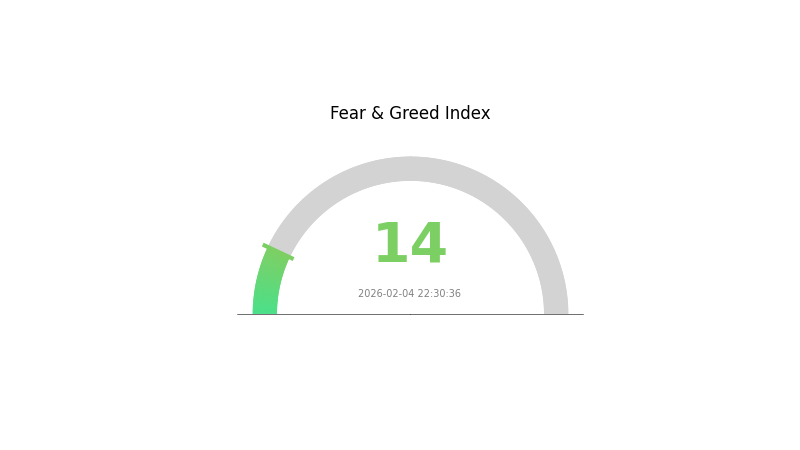

WNDR Market Sentiment Indicator

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 14. This reading indicates significant market pessimism and risk aversion among investors. Such extreme fear conditions often signal potential accumulation opportunities for long-term investors, as panic selling may create attractive entry points. However, caution remains warranted as underlying market conditions may continue to deteriorate. Traders should monitor key support levels closely and manage risk appropriately during this volatile period.

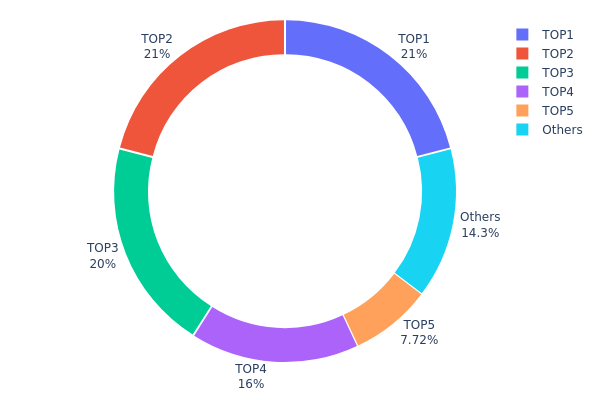

WNDR Holding Distribution

The holding distribution chart reveals the concentration level of token ownership across different wallet addresses, serving as a critical indicator of decentralization and potential market manipulation risks. By analyzing the distribution pattern, investors can assess whether the token's control is concentrated among a few large holders or dispersed across a broader community base.

According to the current data, WNDR exhibits a relatively high concentration pattern. The top five addresses collectively control 485,592.23K tokens, accounting for 85.71% of the total supply. Notably, the top three addresses alone hold 62% of the entire circulation, with each maintaining positions between 100,000K and 105,000K tokens. The fourth-largest holder possesses 80,000K tokens (16%), while the fifth address holds 38,592.23K tokens (7.71%). The remaining 71,407.77K tokens (14.29%) are distributed among other addresses.

This concentration structure presents significant implications for market dynamics. The dominance of top holders suggests limited decentralization, creating potential vulnerabilities for price volatility driven by large-scale transactions from these major addresses. Such distribution patterns typically indicate that a relatively small group of entities maintains substantial influence over token price movements and market liquidity. The current structure may expose the token to heightened risks of coordinated selling pressure or market manipulation, particularly during periods of high volatility. From a risk management perspective, this concentration level warrants careful monitoring, as trading decisions by top holders could trigger cascading effects across the broader market.

Click to view current WNDR Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2ec4...3c2b32 | 105000.00K | 21.00% |

| 2 | 0xb064...f9416f | 105000.00K | 21.00% |

| 3 | 0x3a42...6616c1 | 100000.00K | 20.00% |

| 4 | 0xeb89...9ca7ab | 80000.00K | 16.00% |

| 5 | 0xadcd...c137a0 | 38592.23K | 7.71% |

| - | Others | 71407.77K | 14.29% |

II. Core Factors Influencing WNDR's Future Price

Supply Mechanism

- Supply Volume Adjustment: Changes in supply volume directly impact price volatility. The token's supply dynamics serve as a fundamental driver of its market valuation.

- Market Demand Dynamics: Future price movements are primarily driven by market demand patterns. The balance between circulating supply and user adoption plays a critical role in determining price trajectories.

- Current Impact: Supply adjustments are expected to create notable price fluctuations as the market responds to availability changes and demand shifts.

Institutional and Major Holder Dynamics

- Institutional Activity: Institutional and large holder movements represent a significant factor in WNDR's price formation. The actions of major stakeholders can influence market sentiment and liquidity conditions.

- Market Participant Behavior: The complex structure of market participants, including varying levels of institutional involvement, contributes to price discovery mechanisms.

Macroeconomic Environment

- Regulatory Framework: Policy regulations and compliance requirements affect investor confidence and market accessibility. Regulatory developments can introduce both opportunities and constraints for price movement.

- Market Sentiment Factors: Broader cryptocurrency market conditions, including sentiment shifts related to regulatory announcements and security concerns, influence WNDR's price behavior.

Technical Development and Ecosystem Building

- GameFi Macro Trends: By mid-2025, blockchain gaming trends emphasize product-market fit, sustainable on-chain economies, and enhanced security measures. These developments serve as primary drivers for WNDR's medium-term trajectory.

- Technological Progress: Technical advancements within the ecosystem impact long-term value proposition. Ongoing development efforts contribute to the token's utility and adoption potential.

- Risk Assessment: Given the inherent volatility in digital assets, investors should exercise caution when evaluating WNDR's price prospects. Comprehensive risk assessment and asset allocation strategies are essential for navigating market uncertainties.

III. 2026-2031 WNDR Price Prediction

2026 Outlook

- Conservative prediction: $0.00772 - $0.01265

- Neutral prediction: $0.01265

- Optimistic prediction: $0.01696 (requires favorable market conditions)

Based on the projection data, WNDR may experience a 3% price decline in 2026, with the average price expected to stabilize around $0.01265. The predicted price range suggests potential volatility, with the low end at $0.00772 and the high end reaching $0.01696.

2027-2029 Outlook

- Market stage expectation: Recovery and gradual growth phase

- Price range prediction:

- 2027: $0.01318 - $0.01969 (13% increase)

- 2028: $0.01 - $0.02277 (31% increase)

- 2029: $0.01901 - $0.02681 (52% increase)

- Key catalysts: Market sentiment improvement, potential ecosystem development, and broader adoption of related technologies

The mid-term projection indicates a progressive upward trend, with WNDR potentially transitioning from a recovery phase into a growth phase. The year-over-year increase rates suggest strengthening market confidence, with 2029 showing a notable 52% projected growth compared to the previous year.

2030-2031 Long-term Outlook

- Baseline scenario: $0.02341 (assuming steady market development)

- Optimistic scenario: $0.0316 (assuming strong ecosystem expansion and favorable regulatory environment)

- Transformative scenario: Up to $0.0316 in 2030 (under exceptionally favorable market conditions)

The long-term projections indicate sustained growth momentum, with 2030 potentially marking a significant milestone with a 79% increase. By 2031, the average price could reach $0.0275, representing a 110% cumulative increase from 2026 levels. The predicted range of $0.02008 - $0.03025 suggests WNDR may establish a higher price floor while maintaining upside potential.

- 2026-02-05: WNDR trading within early 2026 projected range, market positioning for potential mid-year price movements

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01696 | 0.01265 | 0.00772 | -3 |

| 2027 | 0.01969 | 0.0148 | 0.01318 | 13 |

| 2028 | 0.02277 | 0.01725 | 0.01 | 31 |

| 2029 | 0.02681 | 0.02001 | 0.01901 | 52 |

| 2030 | 0.0316 | 0.02341 | 0.01943 | 79 |

| 2031 | 0.03025 | 0.0275 | 0.02008 | 110 |

IV. WNDR Professional Investment Strategies and Risk Management

WNDR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Gaming enthusiasts and metaverse believers who understand P2E ecosystems

- Operational Recommendations:

- Consider accumulating positions during market corrections, particularly when price approaches historical support levels

- Monitor the project's ecosystem development, including breeding mechanism updates and tournament participation rates

- Utilize Gate Web3 Wallet for secure token storage with built-in staking capabilities

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Monitor the 50-day and 200-day moving averages to identify trend reversals and momentum shifts

- Volume Analysis: Track the 24-hour trading volume ($12,347.11) relative to market cap to assess liquidity conditions

- Swing Trading Key Points:

- Given the token's volatility (24H: +1.74%, 7D: -20.66%), establish clear entry and exit points with stop-loss orders

- Pay attention to gaming ecosystem announcements and partnership news that may trigger price movements

WNDR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Active Investors: 3-5% of crypto portfolio

- Professional Investors: 5-8% of crypto portfolio with active monitoring

(2) Risk Hedging Solutions

- Diversification Strategy: Combine WNDR with other gaming tokens and established cryptocurrencies to reduce sector-specific risk

- Position Sizing: Given the low circulation ratio (9.33%), limit individual position size to manage liquidity risks

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and ecosystem participation

- Cold Storage Option: Consider hardware wallet solutions for long-term holdings exceeding trading needs

- Security Precautions: Enable two-factor authentication, verify contract addresses (0xDfd7b0dD7Bf1012DfDf3307a964c36b972300Ac8 on BSC), and never share private keys

V. WNDR Potential Risks and Challenges

WNDR Market Risks

- High Volatility: The token experienced a 30-day decline of 31.26%, indicating significant price fluctuations that may challenge risk tolerance

- Limited Liquidity: With only 1 exchange listing and 24-hour volume of $12,347, liquidity constraints may impact large order execution

- Market Cap Positioning: Ranked #2876 with 0.00025% market dominance, the token faces challenges in gaining broader market attention

WNDR Regulatory Risks

- Gaming Token Classification: P2E gaming tokens face evolving regulatory scrutiny in various jurisdictions regarding their classification as securities or gaming assets

- Cross-border Operations: The metaverse and breeding mechanics may encounter different regulatory interpretations across regions

- NFT Regulatory Uncertainty: In-game NFT discoverability features may be subject to emerging NFT-specific regulations

WNDR Technical Risks

- Smart Contract Dependencies: The breeding and staking mechanisms rely on smart contract integrity; vulnerabilities could impact token functionality

- Ecosystem Sustainability: The dual-token economy and reward pool design require ongoing balancing to prevent inflationary pressures

- Limited Holder Base: With 1,946 holders, the project faces concentration risk and potential volatility from large holder movements

VI. Conclusion and Action Recommendations

WNDR Investment Value Assessment

Wonderman Nation (WNDR) represents a niche gaming project that combines established game mechanics from Final Fantasy with blockchain-based P2E elements. The token's current price of $0.013076 sits significantly below its all-time high of $0.327695 (May 2022), suggesting substantial risk for recovery-focused investors. While the breeding mechanics and metaverse exploration offer innovative gameplay elements, the limited exchange presence, declining 30-day performance, and modest holder base indicate early-stage adoption challenges. Long-term value depends heavily on the team's ability to expand the user base, maintain ecosystem sustainability, and execute on the breeding franchise revenue model.

WNDR Investment Recommendations

✅ Beginners: Avoid direct exposure until the project demonstrates sustained user growth and ecosystem maturity; instead, gain experience with more established gaming tokens

✅ Experienced Investors: Consider small speculative positions (1-3% of gaming portfolio) with strict stop-losses, focusing on ecosystem milestone achievements and tournament participation metrics

✅ Institutional Investors: Monitor ecosystem development and partnership announcements; consider pilot allocations only after conducting thorough due diligence on smart contract audits and revenue sustainability

WNDR Trading Participation Methods

- Gate.com Platform: Access WNDR trading pairs with competitive fees and integrated wallet solutions

- Direct Ecosystem Participation: Engage with breeding mechanics and tournaments to earn tokens while understanding the gameplay dynamics

- DeFi Integration: Explore staking opportunities through the project's built-in creature staking mechanisms for passive income generation

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is WNDR? What are its uses and application scenarios?

WNDR is a blockchain-based utility token designed for decentralized applications and ecosystem governance. It enables users to participate in network activities, access premium features, and earn rewards through staking and participation rewards.

What is the historical price trend of WNDR tokens? What are the main factors affecting the price?

WNDR has experienced significant price volatility, primarily driven by market demand, technological developments, and community sentiment. Key factors include ecosystem adoption, trading volume, market conditions, and broader crypto market trends.

How do experts predict WNDR's future price trends? What are the short-term and long-term prospects?

Experts predict WNDR's short-term price may fluctuate with market dynamics, while long-term prospects remain bullish with anticipated significant growth. Key factors include market supply-demand dynamics, ecosystem development, and transaction volume trends.

What are the main risks of investing in WNDR? How to assess its security?

WNDR investment risks include market volatility and regulatory changes. Assess security by monitoring market demand, technology development, and policy trends. Proper risk management and asset allocation are essential for investors.

What are the advantages and disadvantages of WNDR compared to similar tokens?

WNDR offers high liquidity and low management fees with relatively lower risk exposure. However, yields may underperform compared to alternatives, and market volatility can impact token value. Ideal for short-term investors seeking stability over maximum returns.

Where can I buy WNDR? How to trade and store safely?

WNDR is available on major crypto platforms. For secure trading, use reputable exchanges with strong security features. Store WNDR in hardware wallets for maximum protection against cyber threats.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

BUCK vs LTC: A Comprehensive Comparison of Two Leading Stablecoin and Cryptocurrency Solutions

Top AI Stocks for Investment

SHFT vs DOT: A Comprehensive Comparison of Two Leading Blockchain Layer-2 Solutions

What Are Nodes?

Money-Making Games: Top 23 Projects for Earning