2026 WOD Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: WOD's Market Position and Investment Value

World of Dypians (WOD), positioned as a revolutionary MMORPG token that merges DeFi, NFTs, Gaming, and AI into an immersive experience, has been actively developing since its launch in 2024. As of 2026, WOD maintains a market capitalization of approximately $248,309, with a circulating supply of around 15.1 million tokens, and the price hovering at $0.01644. This asset, characterized as a "next-generation gaming ecosystem token," is playing an increasingly significant role in the blockchain gaming and metaverse sectors.

This article will comprehensively analyze WOD's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. WOD Price History Review and Current Market Status

WOD Historical Price Evolution Trajectory

-

2024: WOD launched on Gate.com on November 26, 2024, with an initial listing price of $0.0425. Following its debut, the token experienced notable volatility. On November 27, 2024, WOD reached its all-time high of $0.31842, representing a significant surge from its launch price.

-

2025: Throughout 2025, WOD entered a prolonged correction phase. The token's price underwent substantial downward pressure, declining from its peak levels. The annual performance showed a contraction as market conditions evolved.

-

2026: On February 4, 2026, WOD recorded its all-time low of $0.01355. As of February 8, 2026, the token trades at $0.01644, reflecting a modest recovery from its recent bottom. Over the past year, WOD has experienced an 85.83% decline from higher valuation levels.

WOD Current Market Conditions

As of February 8, 2026, WOD is trading at $0.01644, representing a 2.83% decrease over the past 24 hours. The token's 24-hour trading range spans from $0.01607 to $0.02241, with a total trading volume of $209,784.46.

In the shorter timeframe, WOD has shown a marginal 0.014% increase over the past hour. However, broader trends indicate continued downward momentum, with a 11.42% decline over the past week and a substantial 59.91% drop over the past 30 days.

The circulating supply stands at 15,103,975 WOD tokens, representing approximately 1.51% of the maximum supply of 1,000,000,000 tokens. The current market capitalization is $248,309, with a fully diluted valuation of $16,440,000. The token holds a market dominance of 0.00065%, with the ratio of market cap to fully diluted valuation at 1.51%.

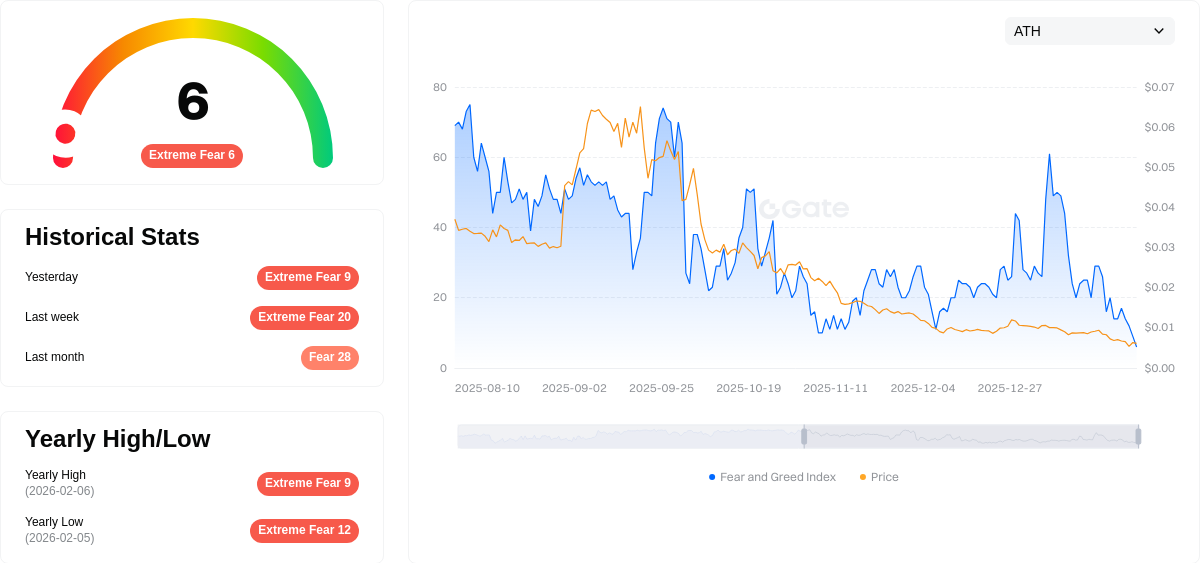

The current market sentiment, as measured by the cryptocurrency fear and greed index, registers at 6, indicating an "Extreme Fear" condition in the broader market environment.

WOD is ranked #3706 across cryptocurrency markets and is available on 10 different exchanges. The token has attracted 198,326 holders and operates on the BSC (BNB Smart Chain) utilizing the BEP20 token standard.

Click to view current WOD market price

WOD Market Sentiment Indicator

2026-02-07 Fear & Greed Index: 6 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear & Greed Index standing at just 6 points. This historically low reading suggests investors are highly pessimistic and risk-averse. Such extreme fear often signals significant market capitulation and potential buying opportunities for contrarian investors. When sentiment reaches these depths, it typically precedes market stabilization or recovery. However, traders should remain cautious and conduct thorough research before entering positions. Monitor market developments closely on Gate.com to stay updated on shifting sentiment and emerging opportunities during this volatile period.

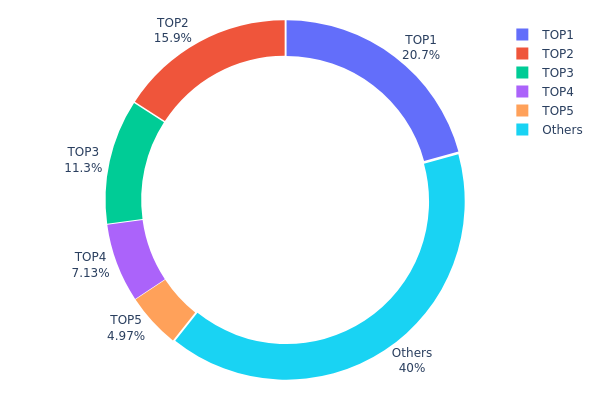

WOD Holding Distribution

The holding distribution chart reveals how WOD tokens are allocated across different wallet addresses, serving as a critical indicator of market concentration and decentralization levels. A highly concentrated distribution, where a few addresses control the majority of tokens, may increase price manipulation risks and liquidity constraints. Conversely, a more dispersed distribution typically reflects better market health and broader community participation.

Based on the current data, WOD exhibits a moderate concentration pattern. The top address holds 207,413.94K tokens (20.74%), while the top five addresses collectively control approximately 59.99% of the total supply. This concentration level suggests that over half of WOD's circulating supply remains in the hands of major holders, which could potentially create short-term price volatility if these addresses initiate significant sell-offs. The "Others" category accounts for 40.01%, indicating that while there is some degree of token distribution among smaller holders, the influence of large addresses remains substantial.

From a market structure perspective, this distribution pattern presents both opportunities and risks. The significant holdings by top addresses may provide price stability during bull markets, as these holders typically demonstrate longer-term holding intentions. However, the relatively high concentration also means that coordinated selling pressure from these major addresses could trigger sharp price corrections. For investors, monitoring on-chain transfer activities of these top addresses becomes crucial for predicting potential market movements and assessing short-term price trends.

Click to view current WOD Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb80e...ec3fe9 | 207413.94K | 20.74% |

| 2 | 0x2827...a602ee | 158774.33K | 15.87% |

| 3 | 0x218b...85c9f2 | 112878.32K | 11.28% |

| 4 | 0x3589...2d3890 | 71300.00K | 7.13% |

| 5 | 0xfdd3...fa18bf | 49747.56K | 4.97% |

| - | Others | 399885.86K | 40.01% |

II. Core Factors Influencing WOD's Future Price

Supply Mechanism

- Token Scarcity: The scarcity of WOD tokens represents a fundamental characteristic affecting its investment value. Limited supply combined with growing demand dynamics can create upward price pressure over time.

- Supply-Demand Dynamics: When market demand exceeds available supply, prices tend to rise; conversely, oversupply conditions may lead to price declines. These dynamics are influenced by industry development trends, regulatory frameworks, and external market conditions.

Institutional and Major Player Dynamics

- Institutional Investment: Institutional participation plays a significant role in WOD's valuation. Growing institutional interest can enhance market confidence and provide price support through sustained capital inflows.

- Mainstream Adoption: The level of mainstream application and acceptance within the blockchain gaming sector influences WOD's long-term value proposition. Broader adoption by users and developers strengthens the token's utility and demand.

Macroeconomic Environment

- Overall Economic Conditions: WOD's investment value is influenced by broader economic factors including growth rates, employment levels, and consumer spending patterns. Economic downturns may reduce discretionary spending on gaming assets, while periods of expansion can boost demand.

- Monetary Policy Impact: Central bank policies, particularly regarding interest rates and liquidity conditions, affect investor risk appetite. Accommodative monetary policies may increase capital flows into digital assets, while tightening conditions could create headwinds.

Technological Development and Ecosystem Building

- Technical Advancements: Ongoing technological improvements within the World of Dypians platform can enhance user experience, attract new participants, and strengthen the token's utility value.

- Ecosystem Applications: The development of diverse applications, gaming features, and community-driven initiatives contributes to WOD's long-term sustainability. A robust ecosystem with active user engagement supports token demand and price stability.

III. 2026-2031 WOD Price Forecast

2026 Outlook

- Conservative forecast: $0.01199 - $0.01642

- Neutral forecast: $0.01642

- Optimistic forecast: $0.01691 (requires favorable market conditions)

2027-2029 Outlook

- Market phase expectation: Gradual recovery and growth phase, with potential volatility reflecting broader crypto market cycles

- Price range forecast:

- 2027: $0.01017 - $0.02433

- 2028: $0.01988 - $0.02562

- 2029: $0.01291 - $0.03413

- Key catalysts: Market adoption expansion, ecosystem development progress, and overall crypto market sentiment improvement

2030-2031 Long-term Outlook

- Baseline scenario: $0.01945 - $0.03174 (assuming steady ecosystem growth and stable market conditions)

- Optimistic scenario: $0.02293 - $0.03922 (assuming accelerated adoption and favorable regulatory environment)

- Transformative scenario: Exceeding $0.03922 (requires breakthrough partnerships, major platform integrations, or significant technological advancements)

- 2026-02-08: WOD trading near historical levels with market participants assessing long-term potential

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01691 | 0.01642 | 0.01199 | 0 |

| 2027 | 0.02433 | 0.01667 | 0.01017 | 1 |

| 2028 | 0.02562 | 0.0205 | 0.01988 | 24 |

| 2029 | 0.03413 | 0.02306 | 0.01291 | 40 |

| 2030 | 0.03174 | 0.0286 | 0.01945 | 73 |

| 2031 | 0.03922 | 0.03017 | 0.02293 | 83 |

IV. WOD Professional Investment Strategies and Risk Management

WOD Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors with multi-year time horizons who believe in the convergence of gaming, DeFi, NFTs, and AI

- Operational Recommendations:

- Consider accumulating positions during periods of market weakness, particularly when WOD trades near technical support levels

- Monitor project milestones including Epic Games platform updates, AI integration advancements, and ecosystem expansion announcements

- Storage Solution: Utilize Gate Web3 Wallet for secure self-custody with support for BSC-based tokens, enabling direct interaction with the World of Dypians ecosystem

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume ($209,784) relative to market capitalization to identify liquidity trends and potential breakout scenarios

- Support/Resistance Levels: Track the 24-hour range ($0.01607 - $0.02241) to establish entry and exit points for swing trades

- Swing Trading Considerations:

- Given the -2.83% 24-hour change and -11.42% weekly decline, traders may look for stabilization signals before establishing long positions

- The significant -59.91% monthly decline suggests elevated volatility; implement strict stop-loss orders to manage downside risk

WOD Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation, prioritizing established cryptocurrency holdings

- Aggressive Investors: 5-10% allocation, accepting higher volatility for potential gaming sector upside

- Professional Investors: Up to 15% allocation with active hedging strategies and diversification across gaming tokens

(II) Risk Hedging Approaches

- Diversification Strategy: Balance WOD exposure with other gaming ecosystem tokens and established cryptocurrencies to reduce sector-specific risk

- Staged Entry Method: Deploy capital in tranches during different market conditions rather than single large positions

(III) Secure Storage Solutions

- Gate Web3 Wallet Recommendation: Non-custodial solution supporting BSC-based tokens with integrated DApp browser for ecosystem interaction

- Hardware Wallet Option: For larger holdings, consider cold storage solutions compatible with BEP20 tokens

- Security Precautions: Never share private keys, verify contract addresses (0xb994882a1b9bd98a71dd6ea5f61577c42848b0e8 on BSC), and enable multi-factor authentication on exchange accounts

V. WOD Potential Risks and Challenges

WOD Market Risks

- High Volatility Profile: The token has experienced an -85.83% decline over one year and -59.91% over 30 days, indicating substantial price instability that may continue

- Limited Liquidity: With a circulating market cap of approximately $248,309 and relatively low 24-hour volume, large orders may significantly impact price discovery

- Low Circulating Supply: Only 1.51% of total supply (15.1 million of 1 billion tokens) is currently circulating, creating potential dilution risk as more tokens enter the market

WOD Regulatory Risks

- Gaming Token Classification: Evolving regulations regarding tokens with gaming utility may affect WOD's operational framework across different jurisdictions

- NFT and DeFi Integration: The project's combination of gaming, NFTs, and DeFi elements may attract regulatory scrutiny as authorities develop frameworks for multi-functional digital assets

- Geographic Restrictions: Access to gaming platforms and token trading may face limitations in certain regions based on local gaming and cryptocurrency regulations

WOD Technical Risks

- Platform Dependency: The project's success is tied to its Epic Games integration and continued platform availability

- Smart Contract Vulnerabilities: As a BEP20 token on BSC with DeFi and NFT integrations, the ecosystem faces potential technical exploits or bugs

- AI Integration Complexity: Advanced AI features require ongoing development and maintenance, with technical challenges potentially impacting user experience

VI. Conclusion and Action Recommendations

WOD Investment Value Assessment

World of Dypians represents an ambitious convergence of gaming, DeFi, NFTs, and AI within a single MMORPG ecosystem available on Epic Games. The project's long-term value proposition centers on its ability to deliver an immersive virtual world experience with advanced technology integration. However, the token currently faces significant headwinds, including substantial price declines across all timeframes, limited liquidity, and a low circulating supply that creates dilution uncertainty. The project's innovation in combining multiple blockchain sectors offers theoretical upside, but investors must weigh this potential against current market weakness and execution risks.

WOD Investment Recommendations

✅ Beginners: Consider observing the project from the sidelines initially. If interested, limit exposure to less than 2% of your cryptocurrency portfolio and prioritize learning about the gaming ecosystem before committing funds. Start with small amounts you can afford to lose entirely.

✅ Experienced Investors: May consider small speculative positions (3-5% of crypto holdings) as a gaming sector play, with staged entry during technical support levels. Maintain strict risk management protocols and monitor project development milestones closely.

✅ Institutional Investors: Conduct thorough due diligence on the project's technology stack, team credentials, and competitive positioning. Consider WOD as part of a diversified gaming token basket rather than a standalone allocation, implementing sophisticated hedging strategies.

WOD Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase of WOD tokens with various trading pairs for immediate ownership

- Dollar-Cost Averaging: Systematic periodic purchases to mitigate timing risk and reduce average entry cost over time

- Gate Web3 Wallet Integration: Self-custody solution enabling direct ecosystem participation while maintaining control of private keys

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the historical price trend of WOD? What are the important price fluctuation events in the past?

WOD has experienced significant volatility, with notable price surges and declines in 2021-2022. A substantial price drop occurred in early 2023. The token shows cyclical patterns typical of emerging crypto assets, with trading volume fluctuations correlating with market sentiment and protocol updates.

What are the main factors affecting WOD price?

WOD price is primarily influenced by supply mechanisms, market demand, scarcity, institutional investment, blockchain technology development, ecosystem growth, and macroeconomic conditions. Trading volume and user adoption also play significant roles in price fluctuation.

What are expert predictions for WOD's future price?

Experts predict WOD may trade between $0.09969 and $0.12185 by end of 2026, with an average forecast of $0.11077. These predictions are based on historical patterns and market analysis trends.

What technical analysis methods are more accurate for WOD price prediction?

XGBoost and Kalman Filters are highly effective for WOD price prediction. XGBoost achieves accuracy rates around 88-90%, while Kalman Filters provide recursive error correction. A hybrid model combining both methods can further enhance prediction accuracy by leveraging machine learning pattern detection with statistical filtering optimization.

How does WOD's price performance compare to other similar assets?

WOD currently offers competitive pricing relative to similar assets in its category. With strong market fundamentals and growing adoption, WOD is positioned for potential upside compared to comparable tokens. Its price reflects genuine utility and ecosystem development.

What are the key risk factors to consider when investing in WOD?

WOD investment risks include market volatility, cryptocurrency price fluctuations, regulatory changes, and liquidity risks. Monitor market trends, project fundamentals, and macroeconomic factors closely before investing.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

Pepe: A Comprehensive Guide to What It Is and How It Works

The 7 Hottest Blockchain Stocks to Watch in the Coming Years

What is the Relative Strength Index? Application in Crypto Trading

Top Cryptocurrency Exchanges for Polish Traders

Master Japanese candlestick analysis like a professional and explore the most well-known patterns with real-world examples