2026 XCX Price Prediction: Expert Analysis and Market Forecast for the Next Generation Cryptocurrency

Introduction: XCX's Market Position and Investment Value

Xeleb Protocol (XCX), as a decentralized AI agent economy platform focusing on real utility, has been building a new tokenized ecosystem since its launch in 2025. Since its inception, the project has established strategic partnerships with leading institutions including Amber, Mirana, HashKey Capital, and Foresight Ventures. As of 2026, XCX maintains a market capitalization of approximately $1.13 million, with a circulating supply of around 108.3 million tokens, and a price hovering around $0.0104. This asset, recognized as a "Proof-of-Utility (PoU) driven AI agent economy token," is playing an increasingly important role in connecting creators, fans, and investors through transparent and verifiable on-chain mechanisms.

This article will comprehensively analyze XCX's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment factors to provide investors with professional price forecasts and practical investment strategies.

I. XCX Price History Review and Market Status

XCX Historical Price Evolution Trajectory

- 2025: Xeleb Protocol launched in August with an initial price surge, reaching an all-time high of $0.09244 on August 11, 2025, representing significant early market enthusiasm for the AI agent economy platform.

- 2025-2026: Following the peak, XCX experienced a correction phase, with the price declining substantially as the project entered its operational development stage.

- 2026: The token reached its all-time low of $0.010274 on February 1, 2026, marking a notable decrease from historical highs as market conditions adjusted.

XCX Current Market Status

As of February 3, 2026, XCX is trading at $0.010399, showing a modest 24-hour increase of 0.16%. The token demonstrates limited short-term volatility, with a 1-hour change of 0.0036% and a 24-hour trading range between $0.010279 and $0.01046.

The broader market trend reflects challenges, with XCX declining 0.99% over the past 7 days and 10.97% over the past 30 days. The token's circulating market capitalization stands at approximately $1.13 million, with 108.3 million tokens in circulation representing 10.83% of the maximum supply of 1 billion tokens. The fully diluted market cap is calculated at $10.4 million.

XCX maintains a market capitalization ranking of 2,437 and holds a 0.00037% market dominance. The 24-hour trading volume of $21,932 indicates relatively modest trading activity. The token is supported by 34,770 holders and is available on 8 exchanges, operating as a BEP-20 token on the BSC blockchain.

The project is backed by notable investors including Amber, Mirana, HashKey Capital, and Foresight Ventures, providing institutional support for the Xeleb Protocol's AI agent economy ecosystem.

Click to view current XCX market price

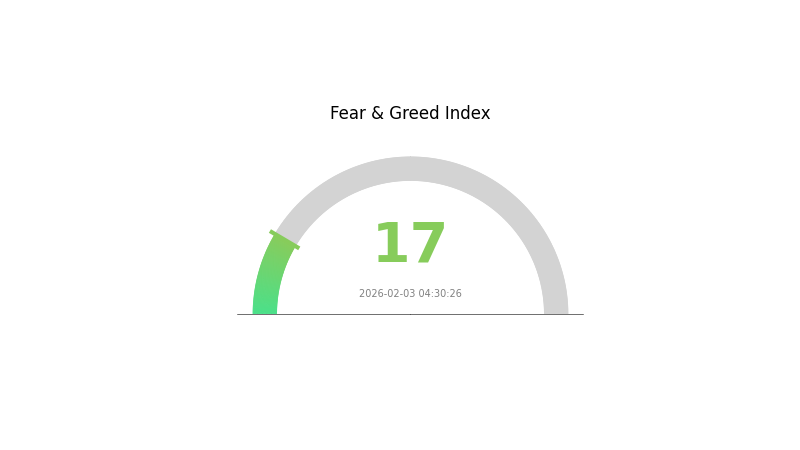

XCX Market Sentiment Indicator

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 17. This historically low reading indicates significant market pessimism and investor anxiety. Such conditions often present contrarian opportunities for long-term investors, as extreme fear typically precedes market reversals. However, traders should remain cautious and conduct thorough research before making investment decisions. Consider monitoring market developments closely and maintaining proper risk management strategies during this volatile period.

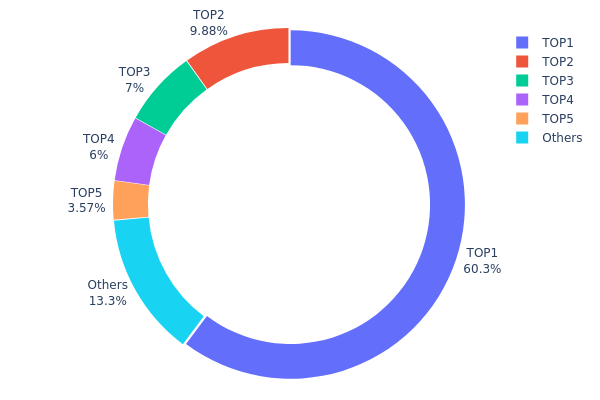

XCX Holdings Distribution

The holdings distribution chart illustrates the allocation of XCX tokens across different wallet addresses, providing crucial insights into token concentration and decentralization levels. This metric serves as a key indicator of market structure health, as excessive concentration in a few addresses may signal potential liquidity risks or vulnerability to single-entity influence.

Based on the current data, XCX exhibits a notably concentrated holdings pattern. The top address holds approximately 602.5 million tokens, accounting for 60.25% of the total supply, while the top 5 addresses collectively control 86.69% of all tokens. The remaining 13.31% is distributed among other holders. This high concentration ratio suggests that a small number of entities maintain substantial control over the token's circulating supply.

Such concentrated holdings distribution presents several implications for market dynamics. The dominant position of the largest holder creates potential price volatility risks, as significant movements from this address could substantially impact market liquidity and price stability. However, if these concentrated holdings belong to project treasury wallets, locked liquidity pools, or strategic reserves with transparent vesting schedules, this concentration may actually contribute to long-term ecosystem stability. The current distribution pattern indicates that XCX maintains a relatively centralized on-chain structure, which warrants continuous monitoring of large holder behavior and their potential market impact.

Click to view current XCX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8a2e...2b35a1 | 602500.00K | 60.25% |

| 2 | 0x5e0c...c14511 | 98799.87K | 9.87% |

| 3 | 0xf338...63920f | 70000.01K | 7.00% |

| 4 | 0xf20c...eb14e9 | 60000.01K | 6.00% |

| 5 | 0xdd74...749a26 | 35730.01K | 3.57% |

| - | Others | 132970.11K | 13.31% |

II. Core Factors Influencing XCX's Future Price

Market Sentiment

Market sentiment plays a significant role in XCX's price dynamics. Investor psychology, shaped by broader cryptocurrency market trends and specific project developments, can drive substantial volatility. When positive news emerges or market conditions improve, investor confidence typically strengthens, potentially supporting upward price movement. Conversely, negative sentiment or market uncertainty may trigger selling pressure.

Macroeconomic Environment

Monetary Policy Impact: Global monetary policies, particularly those from major central banks, influence risk asset appetite. Tightening monetary conditions or higher interest rates generally reduce liquidity in cryptocurrency markets, potentially constraining XCX's price growth. Conversely, accommodative policies may support broader market recovery.

Economic Uncertainty: The current economic landscape, characterized by moderate growth projections and persistent uncertainties, affects investor behavior across all asset classes. Cryptocurrency markets, being relatively high-risk investments, remain sensitive to shifts in economic outlook and consumer confidence.

Regulatory Developments

Policy and regulatory frameworks continue to shape cryptocurrency market dynamics. Changes in regulatory approaches across different jurisdictions can significantly impact market access, institutional participation, and overall investor sentiment toward digital assets like XCX.

Technology and Innovation

Technological advancements within the broader cryptocurrency ecosystem influence market perception. Developments in blockchain infrastructure, security enhancements, and scalability solutions may indirectly affect XCX's competitive positioning and investor interest.

Market Liquidity

Trading activity and liquidity conditions vary across different market periods. During periods of active trading, liquidity tends to be robust, facilitating smoother price discovery. However, during quieter periods, reduced liquidity may amplify price volatility and make the asset more susceptible to sudden movements based on relatively smaller transaction volumes.

III. 2026-2031 XCX Price Prediction

2026 Outlook

- Conservative Prediction: $0.00645 - $0.0104

- Neutral Prediction: Around $0.0104

- Optimistic Prediction: Up to $0.01237 (requires favorable market conditions)

2027-2029 Outlook

- Market Stage Expectation: Gradual recovery and stabilization phase with moderate growth momentum

- Price Range Prediction:

- 2027: $0.00934 - $0.01435

- 2028: $0.00939 - $0.01454

- 2029: $0.01302 - $0.01918

- Key Catalysts: Steady adoption growth, potential ecosystem expansion, and improved market sentiment driving price appreciation

2030-2031 Long-term Outlook

- Baseline Scenario: $0.0102 - $0.02401 (assuming continued ecosystem development and stable market conditions)

- Optimistic Scenario: $0.01644 - $0.02401 (assuming accelerated adoption and positive regulatory developments)

- Transformative Scenario: Approaching $0.02023 - $0.02164 by 2031 (requires significant breakthrough in use cases and widespread market acceptance)

- 2026-02-03: XCX projected average price $0.0104 (early-stage positioning with potential for gradual appreciation)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01237 | 0.0104 | 0.00645 | 0 |

| 2027 | 0.01435 | 0.01139 | 0.00934 | 9 |

| 2028 | 0.01454 | 0.01287 | 0.00939 | 23 |

| 2029 | 0.01918 | 0.0137 | 0.01302 | 31 |

| 2030 | 0.02401 | 0.01644 | 0.0102 | 58 |

| 2031 | 0.02164 | 0.02023 | 0.01861 | 94 |

IV. XCX Professional Investment Strategy and Risk Management

XCX Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term potential of AI agent economy and Proof-of-Utility model

- Operational Recommendations:

- Consider accumulating positions during market downturns, as XCX has experienced an 82.56% decline over the past year

- Monitor the project's development milestones and partnership announcements with backers like Amber, Mirana, HashKey Capital, and Foresight Ventures

- Storage Solution: Use Gate Web3 Wallet for secure storage of XCX tokens on BSC network

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: With 24-hour trading volume at $21,932.39, monitor volume spikes that may indicate trend changes

- Support and Resistance Levels: Current price at $0.010399 is near the all-time low of $0.010274, which may serve as a support level

- Swing Trading Key Points:

- Watch for price movements within the 24-hour range of $0.010279 to $0.01046

- Set stop-loss orders below the all-time low to manage downside risk

XCX Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio

- Professional Investors: Up to 10% with active risk monitoring

(II) Risk Hedging Solutions

- Diversification: Balance XCX holdings with other AI-related tokens and established cryptocurrencies

- Position Sizing: Given the 10.83% market cap to fully diluted valuation ratio, be aware of potential dilution from unlocked tokens

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and staking participation

- Cold Storage Solution: For long-term holdings, consider transferring to hardware wallets after accumulation

- Security Precautions: Always verify the official BSC contract address (0xe32f9e8f7f7222fcd83ee0fc68baf12118448eaf) before transactions, enable two-factor authentication, and never share private keys

V. XCX Potential Risks and Challenges

XCX Market Risks

- High Volatility: XCX has declined 82.56% from its all-time high of $0.09244, indicating significant price volatility

- Low Market Capitalization: With a market cap of approximately $1.13 million and 0.00037% market dominance, XCX is susceptible to large price swings from relatively small trades

- Limited Liquidity: Trading across 8 exchanges with modest daily volume may result in slippage during large transactions

XCX Regulatory Risks

- AI Agent Regulation: As regulatory frameworks for AI-driven economic models are still developing, future regulations could impact the Proof-of-Utility mechanism

- Token Classification: Depending on how regulators classify utility tokens powering AI agent transactions, XCX may face compliance requirements

- Cross-border Operations: The decentralized nature of the AI influencer economy may face regulatory scrutiny in different jurisdictions

XCX Technical Risks

- Smart Contract Vulnerabilities: As a BEP-20 token on BSC, XCX is subject to potential smart contract exploits or bugs

- Proof-of-Utility Implementation: The novel PoU mechanism is unproven at scale and may face technical challenges in verifying and rewarding AI agent actions

- Network Dependency: Reliance on BSC means XCX is affected by any network congestion, security issues, or governance decisions on Binance Smart Chain

VI. Conclusion and Action Recommendations

XCX Investment Value Assessment

Xeleb Protocol presents an innovative approach to the AI agent economy through its Proof-of-Utility model and tokenization of AI influencers. Backed by notable investors including HashKey Capital and Foresight Ventures, the project has institutional support. However, the token has experienced significant price depreciation, declining 82.56% from its all-time high, and currently trades near its all-time low. With a market cap to fully diluted valuation ratio of 10.83%, substantial token unlocks could create selling pressure. The low market capitalization and limited liquidity present both opportunity and risk for investors.

XCX Investment Recommendations

✅ Beginners: Start with a small allocation (0.5-1% of crypto portfolio) and focus on understanding the Proof-of-Utility concept before increasing exposure ✅ Experienced Investors: Consider dollar-cost averaging into positions, monitoring project development milestones and partnership announcements for entry opportunities ✅ Institutional Investors: Conduct thorough due diligence on the PoU mechanism, evaluate the competitive landscape of AI agent platforms, and assess token unlock schedules before taking positions

XCX Trading Participation Methods

- Spot Trading: Purchase XCX on Gate.com and other supporting exchanges with direct fiat or crypto pairs

- Grid Trading: Set up automated grid trading strategies to capitalize on XCX's price fluctuations within established ranges

- Long-term Accumulation: Use Gate.com's recurring buy feature to build positions gradually while managing downside risk

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is XCX and what practical application value does it have?

XCX is the token of Xeleb Protocol, enabling AI agents on the platform to monetize. It powers a next-generation ecosystem where individuals and enterprises create, own, and profit from practical AI agents integrated with Web3 technology.

What is the XCX price prediction for 2024-2025?

Based on market analysis, XCX is projected to experience significant growth momentum through 2024-2025. Driven by increased adoption and ecosystem expansion, price targets suggest potential movement toward higher resistance levels as trading volume grows substantially.

What are the main factors affecting XCX price?

XCX price is primarily influenced by market sentiment and news, as crypto markets are highly sensitive to sentiment shifts. Regulatory environment and legal clarity in major markets also play crucial roles. Additionally, trading volume, adoption trends, and macroeconomic conditions impact price movements.

What are the advantages and disadvantages of XCX compared to other similar tokens?

XCX's advantages include enhanced trading efficiency and innovative transaction solutions leveraging Web3 decentralization principles. Disadvantages may include market competition intensity and technological dependencies. XCX focuses on decentralized infrastructure for the Web3 ecosystem.

What is XCX's historical price performance? What was the highest price it ever reached?

XCX reached an all-time high of HK$0.712747 on August 11, 2025. The token has demonstrated notable price volatility since launch, with current prices subject to continuous market fluctuations based on demand and market conditions.

What is the long-term price outlook for XCX according to professional analysts?

Professional analysts are optimistic about XCX's long-term prospects. The token is expected to experience sustained growth driven by increasing market demand and technological innovation. Strong fundamentals support a positive trajectory for XCX over the coming years.

What are the risks to be aware of when investing in XCX?

XCX investment carries market volatility risk, regulatory policy changes, and company operational risks. Diversify your portfolio and invest only what you can afford to lose.

What is the circulating supply and total supply of XCX? What impact does this have on price?

XCX has a circulating supply of 108.30M tokens. Higher circulating supply typically exerts downward pressure on price. Limited token availability can support price appreciation over time.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Free Money for App Registration: Crypto Platform Bonuses

Top cryptocurrency exchanges that don't require verification: the leading choices right now

What Is CoinList? Key Facts You Need to Know About the CoinList Exchange

Gate Ventures Weekly Crypto Recap (February 2, 2026)

What Is a Cryptocurrency Airdrop: Where to Find Them and How to Earn — An Up-to-Date Guide