2026 XELS Price Prediction: Expert Analysis and Market Forecast for Digital Asset Growth

Introduction: XELS Market Position and Investment Value

XELS, an eco-technology platform token, has been operating since 2018 as a decentralized solution addressing climate change through blockchain technology. As of February 2026, XELS maintains a market capitalization of approximately $628,530, with a circulating supply of around 19.59 million tokens, trading at $0.032087. This asset, positioned as "the future of decentralized climate disclosure," is playing an increasingly relevant role in corporate environmental reporting and carbon offset transparency.

This article will comprehensively analyze XELS price movements from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide professional price forecasts and practical investment strategies for market participants.

I. XELS Price History Review and Market Status

XELS Historical Price Evolution Trajectory

- 2021: XELS reached a notable price level during December, with the token trading at higher valuations in the market

- 2021-2026: The token experienced a significant price adjustment period, with valuation declining from elevated levels to lower price ranges

- 2026: In early January, XELS traded near lower price points as market conditions evolved

XELS Current Market Situation

As of February 5, 2026, XELS is trading at $0.032087, showing a slight decrease of 0.17% over the past 24 hours. The token's 24-hour trading range has been between $0.031875 and $0.032101, with a total trading volume of $28,780.46.

The current circulating supply stands at 19,588,304.61 XELS tokens, representing approximately 93.28% of the total supply of 21,000,000 tokens. The market capitalization is $628,529.93, while the fully diluted valuation reaches $673,827.00. XELS holds a market dominance of 0.000025%.

Looking at broader timeframes, the token has declined 2.68% over the past week, while showing a gain of 3.69% over the 30-day period. The one-year performance indicates a decrease of 61.12%. The token was initially offered at $4.50 when it became available for trading in April 2021.

XELS operates as an ERC-20 token on the Ethereum blockchain, with the contract address 0x397Deb686C72384FAd502A81f4d7fDb89e1f1280. The token is currently held by 1,748 addresses and is available for trading on Gate.com.

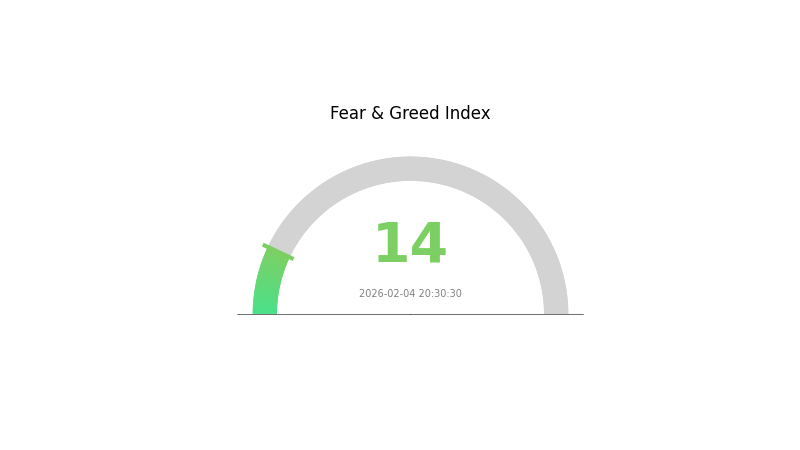

The market sentiment index currently registers at 14, indicating an "Extreme Fear" reading in the broader cryptocurrency market environment.

Click to view current XELS market price

XELS Market Sentiment Indicator

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index standing at 14. This exceptionally low reading indicates significant market pessimism and heightened risk aversion among investors. During periods of extreme fear, assets are typically undervalued, presenting potential opportunities for contrarian investors. However, extreme fear also signals increased volatility and downside risks. Market participants should exercise caution, conduct thorough due diligence, and consider their risk tolerance before making investment decisions in such conditions.

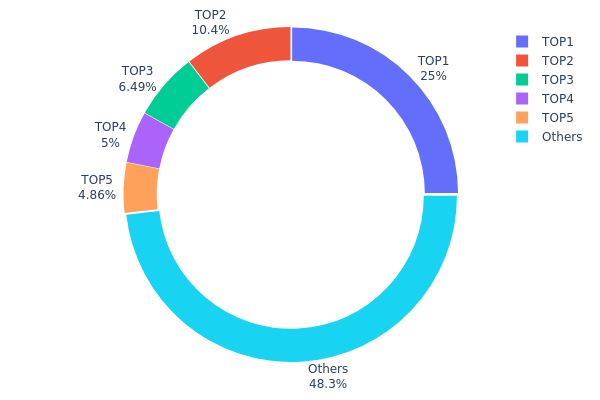

XELS Holding Distribution

According to the on-chain holding distribution data, the XELS token exhibits a notable concentration pattern among major addresses. The holding distribution chart visualizes how token holdings are allocated across different wallet addresses, serving as a key indicator to assess market decentralization and potential manipulation risks.

Data analysis reveals that the top five addresses collectively control approximately 51.71% of the total token supply, with the largest single address holding 5.24 million tokens (24.95%). This concentration level is relatively significant compared to typical cryptocurrency projects, suggesting that XELS maintains a moderately centralized holding structure. The second and third addresses hold 10.43% and 6.48% respectively, indicating a gradual decline in concentration among top holders. Meanwhile, the "Others" category accounts for 48.29%, representing a relatively balanced distribution among smaller holders.

This holding structure presents both opportunities and challenges for market dynamics. The concentrated holdings among top addresses may contribute to increased price volatility, as large-scale transactions by major holders could significantly impact market prices. However, from a project governance perspective, this structure might facilitate more efficient decision-making processes. The current distribution pattern suggests that while XELS maintains reasonable liquidity within the broader market, investors should remain aware of potential price fluctuations driven by whale movements. The balance between major holders and dispersed retail participation indicates a transitional phase in the token's ecosystem maturity.

Click to view current XELS Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9642...2f5d4e | 5241.18K | 24.95% |

| 2 | 0x1e14...5e5a2c | 2191.52K | 10.43% |

| 3 | 0xe7c2...978af2 | 1361.92K | 6.48% |

| 4 | 0xd355...54bd86 | 1050.00K | 5.00% |

| 5 | 0xc873...64e16e | 1020.00K | 4.85% |

| - | Others | 10135.39K | 48.29% |

II. Core Factors Influencing XELS Future Price

Supply Mechanism

Based on available information, specific details regarding XELS supply mechanism are not provided in the reference materials. The token's supply dynamics and their historical impact on price movements require further research for comprehensive analysis.

Institutional and Major Holder Dynamics

The materials do not provide specific information about institutional holdings, major corporate adoption, or national-level policies related to XELS. Market participants should conduct independent research to assess institutional involvement in this asset.

Macroeconomic Environment

- Monetary Policy Impact: The cryptocurrency market remains sensitive to global monetary policy shifts. Major central bank decisions regarding interest rates and quantitative measures continue to influence digital asset valuations.

- Market Sentiment: Positive developments, including strategic partnerships, increased adoption rates, or favorable media coverage, may drive demand and potentially support XELS price levels. Conversely, security concerns or regulatory actions could create downward pressure.

Technology Development and Ecosystem Building

While the reference materials mention XELS in comparison with other blockchain solutions, specific technical upgrades, ecosystem applications, or development roadmap details are not available in the provided documentation. Investors should verify technological progress through official project channels before making investment decisions.

Note: XELS exhibits significant price volatility. The cryptocurrency market involves substantial risk, and investors should exercise caution and conduct thorough due diligence before participating.

III. 2026-2031 XELS Price Prediction

2026 Outlook

- Conservative Prediction: $0.02406 - $0.03209

- Neutral Prediction: Around $0.03209

- Optimistic Prediction: Up to $0.03529 (requires favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market Stage Expectation: Gradual growth phase with potential volatility as the project develops its ecosystem and expands user base

- Price Range Predictions:

- 2027: $0.03167 - $0.04649

- 2028: $0.02606 - $0.0457

- 2029: $0.03689 - $0.0459

- Key Catalysts: Technology improvements, partnership announcements, and broader cryptocurrency market sentiment could drive price movements during this period

2030-2031 Long-term Outlook

- Baseline Scenario: $0.02353 - $0.0444 (assuming steady market conditions and continued project development)

- Optimistic Scenario: $0.04928 - $0.05417 (contingent on successful technology adoption and positive regulatory environment)

- Transformative Scenario: Up to $0.0616 (requires exceptional market conditions, major technological breakthroughs, and widespread institutional adoption)

- 2026-02-05: XELS trading within the range of $0.02406 - $0.03529 (early stage of predicted growth trajectory)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.03529 | 0.03209 | 0.02406 | 0 |

| 2027 | 0.04649 | 0.03369 | 0.03167 | 4 |

| 2028 | 0.0457 | 0.04009 | 0.02606 | 24 |

| 2029 | 0.0459 | 0.0429 | 0.03689 | 33 |

| 2030 | 0.05417 | 0.0444 | 0.02353 | 38 |

| 2031 | 0.0616 | 0.04928 | 0.02661 | 53 |

IV. XELS Professional Investment Strategy and Risk Management

XELS Investment Methodology

(I) Long-Term Holding Strategy

- Target Investors: Environmental-conscious investors and supporters of blockchain-based climate solutions

- Operational Recommendations:

- Consider accumulating positions during market corrections, as XELS has shown resilience with a 30-day price increase of 3.69%

- Monitor the development of carbon credit markets and corporate ESG adoption trends that could drive demand

- Storage Solution: Utilize secure wallet solutions such as Gate Web3 Wallet for asset custody, ensuring private key security

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: With a 24-hour trading volume of approximately $28,780, traders should monitor volume spikes that may indicate significant price movements

- Support and Resistance Levels: Current price at $0.032087 shows a narrow 24-hour range between $0.031875 and $0.032101, suggesting consolidation

- Swing Trading Considerations:

- Short-term traders may capitalize on the token's volatility, though lower liquidity requires careful position sizing

- Set strict stop-loss orders due to the relatively low market capitalization and trading volume

XELS Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio allocation

- Aggressive Investors: 2-3% of crypto portfolio allocation

- Professional Investors: Up to 5% with active management and hedging strategies

(II) Risk Hedging Solutions

- Portfolio Diversification: Combine XELS with established assets to balance exposure to emerging climate-tech tokens

- Position Sizing: Limit single-position exposure given the token's limited exchange availability (currently listed on 1 exchange)

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and convenient access

- Cold Storage Solution: For long-term holdings, consider hardware wallets with multi-signature functionality

- Security Precautions: Never share private keys, enable two-factor authentication, and regularly update wallet software; be cautious of phishing attempts targeting low-liquidity token holders

V. XELS Potential Risks and Challenges

XELS Market Risks

- Liquidity Risk: With only 1,748 holders and listing on a single exchange, XELS faces potential liquidity constraints that could lead to significant price slippage during large transactions

- Volatility Risk: The token has experienced substantial price fluctuations, declining 61.12% over the past year, indicating high volatility that may not suit risk-averse investors

- Market Capitalization Risk: With a market cap of approximately $628,530 and daily trading volume around $28,780, the token remains vulnerable to large sell orders that could impact price stability

XELS Regulatory Risks

- Carbon Credit Regulation: Changes in international carbon credit standards and verification processes could affect the project's business model and token utility

- Environmental Disclosure Requirements: Evolving corporate ESG reporting mandates may either benefit or challenge the platform depending on regulatory frameworks adopted globally

- Securities Classification: Potential regulatory scrutiny regarding token classification could impact trading accessibility and compliance requirements

XELS Technical Risks

- Smart Contract Vulnerability: As an ERC-20 token deployed on Ethereum (contract address: 0x397Deb686C72384FAd502A81f4d7fDb89e1f1280), the project faces inherent smart contract risks

- Platform Development Risk: The success of XELS depends on continued development of its carbon offset NFT platform and enterprise adoption rates

- Competitive Pressure: The emerging blockchain-based climate tech sector may see increased competition from better-funded projects, potentially impacting XELS' market position

VI. Conclusion and Action Recommendations

XELS Investment Value Assessment

XELS represents a specialized investment opportunity in the intersection of blockchain technology and climate action. The project's focus on transparent carbon offset tracking through NFT-based records addresses a genuine market need as enterprises face increasing pressure for environmental accountability. However, the token's current market metrics indicate early-stage development with limited liquidity. The recent 30-day price recovery of 3.69% suggests some market interest, though the one-year decline of 61.12% highlights significant volatility. Long-term value depends heavily on enterprise adoption of the platform and the broader growth of blockchain-based ESG solutions.

XELS Investment Recommendations

✅ Beginners: Approach with caution; if interested in climate-tech exposure, allocate only a minimal portion of your portfolio (under 1%) and focus on learning about carbon credit markets before investing ✅ Experienced Investors: Consider small position sizing (1-3%) as a speculative allocation to the climate-tech sector, with careful attention to liquidity constraints and exit strategy planning ✅ Institutional Investors: Conduct thorough due diligence on the platform's enterprise partnerships and carbon credit verification methodology; consider pilot allocation with active monitoring of adoption metrics

XELS Trading Participation Methods

- Spot Trading: Available on Gate.com for direct token purchase and sale with standard order types

- Dollar-Cost Averaging: Implement systematic purchasing strategy to mitigate volatility risk given the token's price fluctuations

- Gate Web3 Wallet Integration: Utilize Gate Web3 Wallet for secure token storage and seamless trading access between self-custody and exchange accounts

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is XELS? What is its purpose?

XELS is an eco-conscious blockchain platform enabling enterprises and individuals to offset carbon footprints by purchasing tokenized carbon-neutral credits transparently and easily.

What is the current price of XELS? How has its historical price trend been?

XELS current price is 0.03157 CNY as of February 4, 2026. Historically, XELS has shown minimal price fluctuations this year with stable market performance. The token maintains a consistent trading volume and steady market cap of approximately 663K CNY.

What are the main factors affecting XELS price?

XELS price is influenced by supply and demand dynamics, market sentiment, regulatory changes, institutional adoption rates, and overall economic trends. Trading volume and blockchain network activity also play significant roles in price fluctuations.

Will XELS price rise or fall in the future?

XELS is expected to experience upward price movement. With consistent market adoption and positive fundamentals, the token could reach approximately 0.32 MAD by 2027, assuming a 5% annual growth rate. Long-term trends suggest bullish potential.

What are professional analysts' price predictions for XELS?

Professional analysts predict XELS may experience continued volatility based on historical trends. While precise price forecasting remains challenging due to complex market dynamics, analysts suggest monitoring key support and resistance levels, trading volume patterns, and broader market sentiment to gauge future price movements.

What are the advantages of XELS compared to similar cryptocurrencies?

XELS features a patented system recording retired carbon credits on blockchain, ensuring traceability, authenticity, and immutability. This innovation establishes new transparency and trust standards in carbon trading, differentiating it from competitors.

What are the risks of investing in XELS and what should I pay attention to?

XELS price is highly volatile and may fluctuate dramatically. Investors should be prepared for potential losses and understand that market movements are unpredictable. Conduct thorough research before investing and only invest what you can afford to lose.

Where can XELS be traded? How is the liquidity?

XELS is primarily traded on major exchange platforms with XELS/USDT as the main trading pair. The liquidity is relatively strong, with substantial daily trading volume supporting efficient price discovery and smooth transactions for traders.

What is the technical team and project background of XELS?

XELS is developed by an experienced technical team focused on building an environmentally friendly digital ecosystem. The project bridges traditional finance and Web3, combining advanced technology to create sustainable solutions. Backed by major industry players, XELS aims to establish a connected and innovative blockchain platform.

What is the total supply of XELS? What is the inflation situation?

XELS has a total supply of 21 million tokens. The token features a fixed supply model without traditional inflation, designed to maintain scarcity and value stability within the blockchain-based sustainability platform ecosystem.

Hedera Hashgraph (HBAR): Founders, Technology, and Price Outlook to 2030

XRP Price Analysis 2025: Market Trends and Investment Outlook

Toncoin Price Prediction for 2025: Will TON Reach New Heights?

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Cardano (ADA): A History, Tech Overview, and Price Outlook

Jasmy Coin: A Japanese Crypto Tale of Ambition, Hype, and Hope

WRT vs VET: Understanding the Key Differences Between Warrant and Veterinary Education Certifications

WNDR vs ICP: A Comprehensive Comparison of Two Emerging Blockchain Platforms and Their Impact on the Decentralized Internet

Bitcoin Dominance: A Comprehensive Guide to BTC.D in Trading

Top Cold Wallets for Cryptocurrency: Rankings

Who is Satoshi Nakamoto, the Legendary Creator of Bitcoin?