ADAPAD vs XTZ: A Comprehensive Comparison of Two Emerging Blockchain Platforms and Their Investment Potential

Introduction: Investment Comparison Between ADAPAD and XTZ

In the cryptocurrency market, the comparison between ADAPAD vs XTZ continues to be a topic of interest for investors. The two differ notably in market cap ranking, application scenarios, and price performance, representing distinct positioning within the crypto asset landscape.

ADAPAD (ADAPAD): A token launch platform on Cardano featuring a deflationary mechanism, with deflation triggers linked to sales, unlocking events, and IDO participation.

XTZ (XTZ): Launched in 2017, Tezos is a decentralized blockchain that manages itself through a digital federation structure, simplifying formal verification and enhancing smart contract security.

This article will provide a comprehensive analysis of ADAPAD vs XTZ investment value comparison through historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future projections, attempting to address investors' most pressing question:

"Which is the better buy right now?"

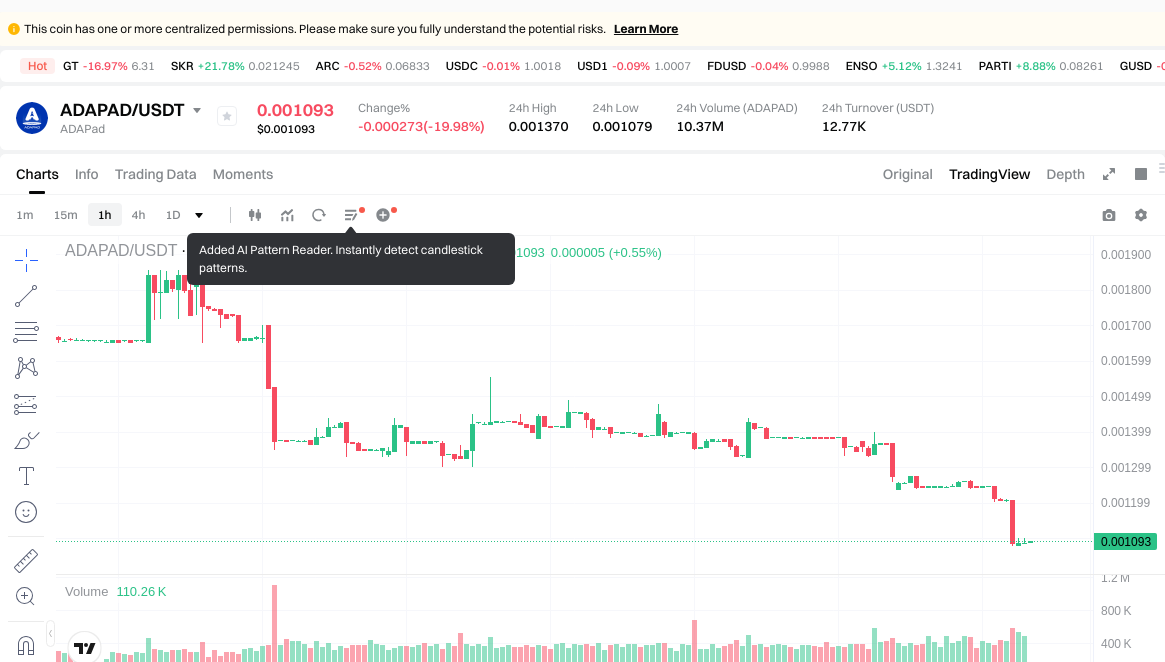

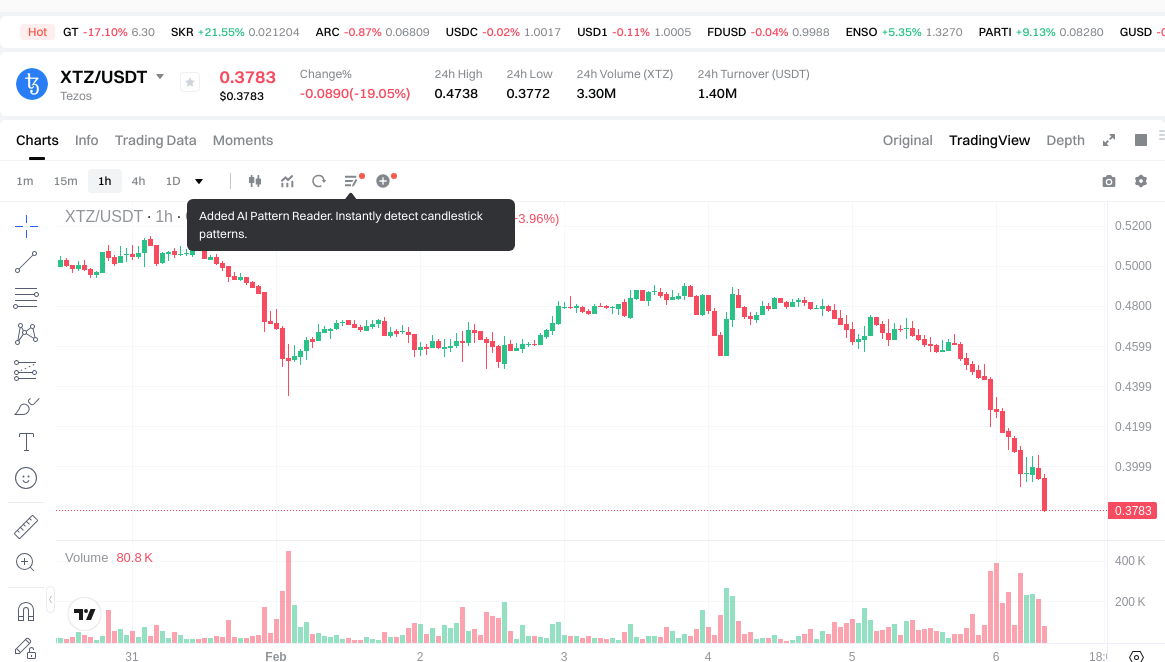

I. Historical Price Comparison and Current Market Status

Historical Price Trends of ADAPAD (Coin A) and XTZ (Coin B)

- 2021: ADAPAD reached a price peak of $1.28 in October, representing its all-time high during the broader cryptocurrency market rally.

- 2018: XTZ experienced a significant decline to $0.350476 in December, marking its historical low during a prolonged bear market period.

- Comparative Analysis: During different market cycles, ADAPAD has declined from its peak of $1.28 to a current low of approximately $0.001097, representing a significant contraction. Meanwhile, XTZ has experienced price fluctuations from its all-time high of $9.12 in October 2021 to a current trading range around $0.3943, showing substantial volatility across market conditions.

Current Market Status (2026-02-06)

- ADAPAD Current Price: $0.001097

- XTZ Current Price: $0.3943

- 24-Hour Trading Volume: ADAPAD $12,740.65 vs XTZ $1,383,744.93

- Market Sentiment Index (Fear & Greed Index): 12 (Extreme Fear)

View real-time prices:

- View ADAPAD current price Market Price

- View XTZ current price Market Price

II. Core Factors Affecting ADAPAD vs XTZ Investment Value

Supply Mechanism Comparison (Tokenomics)

- ADAPAD: The supply mechanism details are subject to market dynamics and token distribution schedules that may influence availability and scarcity over time.

- XTZ: Tezos operates with an inflationary model where new tokens are generated through the baking process, with staking rewards distributed to network participants.

- 📌 Historical Pattern: Supply mechanisms play a role in shaping price cycles, with different models responding variably to market demand and holder behavior.

Institutional Adoption and Market Application

- Institutional Holdings: Market data suggests varying levels of institutional interest in both assets, influenced by factors such as market capitalization, liquidity, and regulatory clarity.

- Enterprise Adoption: Both ADAPAD and XTZ are exploring applications in blockchain infrastructure, though their specific use cases in cross-border payments, settlements, and investment portfolios differ based on their respective technological frameworks.

- National Policy: Regulatory attitudes toward digital assets vary across jurisdictions, affecting the operational environment for both tokens in different markets.

Technology Development and Ecosystem Building

- ADAPAD Technology Development: The platform focuses on innovations related to its launchpad functionality, with potential implications for project incubation and token distribution mechanisms.

- XTZ Technology Development: Tezos continues to develop its on-chain governance and self-amendment capabilities, which may influence its adaptability and long-term sustainability.

- Ecosystem Comparison: Both projects are involved in areas such as DeFi, NFT, payment solutions, and smart contract deployment, though the maturity and scale of these implementations vary.

Macroeconomic Factors and Market Cycles

- Performance in Inflationary Environments: Different digital assets may exhibit varying characteristics during periods of inflation, influenced by their supply models, market positioning, and investor perception.

- Macroeconomic Monetary Policy: Interest rates and dollar index movements can affect capital flows into digital assets, with potential differential impacts on various tokens.

- Geopolitical Factors: Cross-border transaction requirements and international situations may influence demand patterns for blockchain-based assets, though the specific impact varies by use case and regional adoption.

III. 2026-2031 Price Prediction: ADAPAD vs XTZ

Short-term Forecast (2026)

- ADAPAD: Conservative $0.00068607 - $0.001089 | Optimistic $0.001089 - $0.00149193

- XTZ: Conservative $0.349258 - $0.3838 | Optimistic $0.3838 - $0.483588

Mid-term Forecast (2028-2029)

- ADAPAD may enter a gradual growth phase, with estimated price range of $0.00113774 - $0.002051771

- XTZ may enter a moderate expansion phase, with estimated price range of $0.440849952 - $0.66405924

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Forecast (2031)

- ADAPAD: Baseline scenario $0.002161760 - $0.003156170 | Optimistic scenario may approach upper range

- XTZ: Baseline scenario $0.613812093 - $0.757034914 | Optimistic scenario may approach upper range

Disclaimer

ADAPAD:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00149193 | 0.001089 | 0.00068607 | 0 |

| 2027 | 0.00166469985 | 0.001290465 | 0.0009033255 | 17 |

| 2028 | 0.001654892316 | 0.001477582425 | 0.00113773846725 | 34 |

| 2029 | 0.002051770955355 | 0.0015662373705 | 0.000955404796005 | 42 |

| 2030 | 0.002514515786469 | 0.001809004162927 | 0.001411023247083 | 64 |

| 2031 | 0.003156169563059 | 0.002161759974698 | 0.002096907175457 | 97 |

XTZ:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.483588 | 0.3838 | 0.349258 | -2 |

| 2027 | 0.49441116 | 0.433694 | 0.3252705 | 9 |

| 2028 | 0.5197388896 | 0.46405258 | 0.440849951 | 17 |

| 2029 | 0.66405924198 | 0.4918957348 | 0.437787203972 | 24 |

| 2030 | 0.7860493842104 | 0.57797748839 | 0.5548583888544 | 46 |

| 2031 | 0.757034914293222 | 0.6820134363002 | 0.61381209267018 | 72 |

IV. Investment Strategy Comparison: ADAPAD vs XTZ

Long-term vs Short-term Investment Strategies

- ADAPAD: May suit investors focused on launchpad ecosystem development and token distribution mechanisms, with considerations for higher volatility tolerance

- XTZ: May suit investors interested in on-chain governance frameworks and self-amendment protocol features, with focus on established blockchain infrastructure

Risk Management and Asset Allocation

- Conservative Investors: ADAPAD 10-15% vs XTZ 25-30%

- Aggressive Investors: ADAPAD 25-35% vs XTZ 40-50%

- Hedging Tools: Stablecoin allocation, options strategies, cross-asset portfolio diversification

V. Potential Risk Comparison

Market Risk

- ADAPAD: Lower liquidity levels with 24-hour trading volume of $12,740.65 may present challenges during market volatility periods

- XTZ: Moderate liquidity with 24-hour trading volume of $1,383,744.93, though subject to broader market sentiment shifts as indicated by Fear & Greed Index readings

Technical Risk

- ADAPAD: Scalability considerations related to launchpad functionality and network capacity during high-activity periods

- XTZ: Network stability factors related to baking process and validator participation rates

Regulatory Risk

- Global regulatory developments may impact both assets differently based on their functional classifications, with launchpad platforms and smart contract platforms potentially subject to varying compliance frameworks across jurisdictions

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- ADAPAD Advantages: Focus on token launch infrastructure with deflationary mechanism design; potential alignment with project incubation trends

- XTZ Advantages: Established presence since 2017 with self-governance capabilities; formal verification features supporting smart contract security

✅ Investment Recommendations:

- Novice Investors: Consider starting with smaller allocations to understand market dynamics, prioritizing assets with established track records and higher liquidity

- Experienced Investors: Evaluate portfolio diversification opportunities across different blockchain infrastructure types, balancing exposure to launchpad ecosystems and governance-focused protocols

- Institutional Investors: Assess alignment with organizational risk frameworks, regulatory compliance requirements, and strategic positioning within digital asset categories

⚠️ Risk Disclaimer: Cryptocurrency markets exhibit significant volatility. This content does not constitute investment advice.

VII. FAQ

Q1: What are the main differences in supply mechanisms between ADAPAD and XTZ?

ADAPAD features a deflationary mechanism with supply reduction triggered by sales, unlocking events, and IDO participation, while XTZ operates an inflationary model generating new tokens through the baking process with staking rewards. This fundamental difference means ADAPAD aims for scarcity over time through token burns, whereas XTZ continuously creates new supply to incentivize network validators and participants in its proof-of-stake consensus.

Q2: Which asset offers better liquidity for trading?

XTZ provides significantly better liquidity with a 24-hour trading volume of $1,383,744.93 compared to ADAPAD's $12,740.65 as of February 6, 2026. The substantial difference in trading volume means XTZ offers easier entry and exit positions with lower slippage risk, making it more suitable for investors requiring flexibility in position management, while ADAPAD's lower liquidity may present challenges during volatile market conditions.

Q3: How do institutional adoption levels compare between ADAPAD and XTZ?

XTZ demonstrates stronger institutional adoption due to its established presence since 2017, formal verification capabilities, and self-governance framework that appeals to enterprises requiring regulatory clarity and technical stability. ADAPAD, as a launchpad platform, attracts different institutional interest focused on project incubation and token distribution infrastructure, though its institutional footprint remains smaller compared to XTZ's broader enterprise blockchain applications.

Q4: What are the projected price ranges for both assets by 2031?

By 2031, ADAPAD is projected to reach a baseline scenario range of $0.002161760 - $0.003156170, representing potential growth from current levels of $0.001097. XTZ is forecasted to achieve a baseline range of $0.613812093 - $0.757034914 from its current price of $0.3943. These projections suggest XTZ may offer larger absolute price appreciation, while ADAPAD could provide higher percentage gains, though both carry significant uncertainty inherent to long-term cryptocurrency forecasts.

Q5: Which asset is more suitable for risk-averse investors?

XTZ is generally more appropriate for risk-averse investors due to its higher liquidity ($1.38M vs $12.7K daily volume), longer operational history since 2017, and established institutional adoption across various blockchain applications. Conservative allocation recommendations suggest 25-30% portfolio weight for XTZ compared to 10-15% for ADAPAD, reflecting the latter's higher volatility and lower market maturity requiring greater risk tolerance.

Q6: How do technological development paths differ between ADAPAD and XTZ?

ADAPAD focuses its development on launchpad functionality, token distribution mechanisms, and project incubation infrastructure within the Cardano ecosystem. XTZ prioritizes on-chain governance innovations, self-amendment protocol capabilities, and formal verification enhancements for smart contract security. These distinct technological trajectories mean ADAPAD serves the token launch and fundraising sector, while XTZ positions itself as a self-evolving blockchain platform addressing broader decentralized application requirements.

Q7: What macroeconomic factors impact ADAPAD and XTZ differently?

Interest rate changes and dollar index movements affect both assets through capital flow patterns, but XTZ's larger market capitalization and established institutional presence may demonstrate different sensitivity to monetary policy shifts compared to ADAPAD's smaller scale. Additionally, XTZ's applications in enterprise blockchain and cross-border solutions may respond more directly to geopolitical developments affecting international transactions, whereas ADAPAD's launchpad-focused model correlates more closely with broader cryptocurrency fundraising cycles and venture capital availability.

Q8: How should investors approach portfolio allocation between ADAPAD and XTZ?

Portfolio allocation should reflect individual risk tolerance and investment objectives, with conservative investors considering 10-15% ADAPAD and 25-30% XTZ allocations, while aggressive investors might allocate 25-35% to ADAPAD and 40-50% to XTZ within their cryptocurrency holdings. Both allocations should be complemented with stablecoin reserves and diversification across other asset classes, recognizing that the current Fear & Greed Index reading of 12 (Extreme Fear) suggests heightened market volatility requiring careful position sizing and risk management strategies.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What is Dencun? Everything About Ethereum Cancun-Deneb Upgrade

Top 7 Blockchain Game Tokens

Bitcoin Halving Timeline | Has the Price Cycle Run Its Course?

Everything About Asset Tokenization

What Does DYOR Mean in Crypto?