DRAC vs UNI: Comprehensive Comparison of Two Leading DeFi Governance Tokens and Their Ecosystem Impacts

Introduction: DRAC vs UNI Investment Comparison

In the cryptocurrency market, the comparison between DRAC and UNI has been a topic that investors cannot avoid. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different crypto asset positioning. DRAC (DRAC): Since its launch in 2023, it has been positioned as a BRC-20 based crypto inscription. As of February 5, 2026, DRAC is ranked 3011 with a market cap of approximately $517,134 and a circulating supply of 106.82 million tokens. UNI (UNI): Since its launch in 2020, it has been recognized as the first automatic market making protocol on the Ethereum blockchain. As of February 5, 2026, UNI is ranked 40 with a market cap of approximately $2.36 billion and a circulating supply of 634.25 million tokens. This article will comprehensively analyze the investment value comparison between DRAC and UNI around historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question that investors are most concerned about:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

DRAC and UNI Historical Price Trends

- 2022: DRAC experienced significant volatility, with its price reaching a notable level of $0.091844 on November 1, 2022.

- 2021: UNI was influenced by market momentum, with its price reaching $44.92 on May 3, 2021.

- Comparative Analysis: During different market cycles, DRAC declined from its peak of $0.091844 to a low of $0.00005608 recorded on February 16, 2025, while UNI dropped from its high of $44.92 to $1.03 on September 17, 2020.

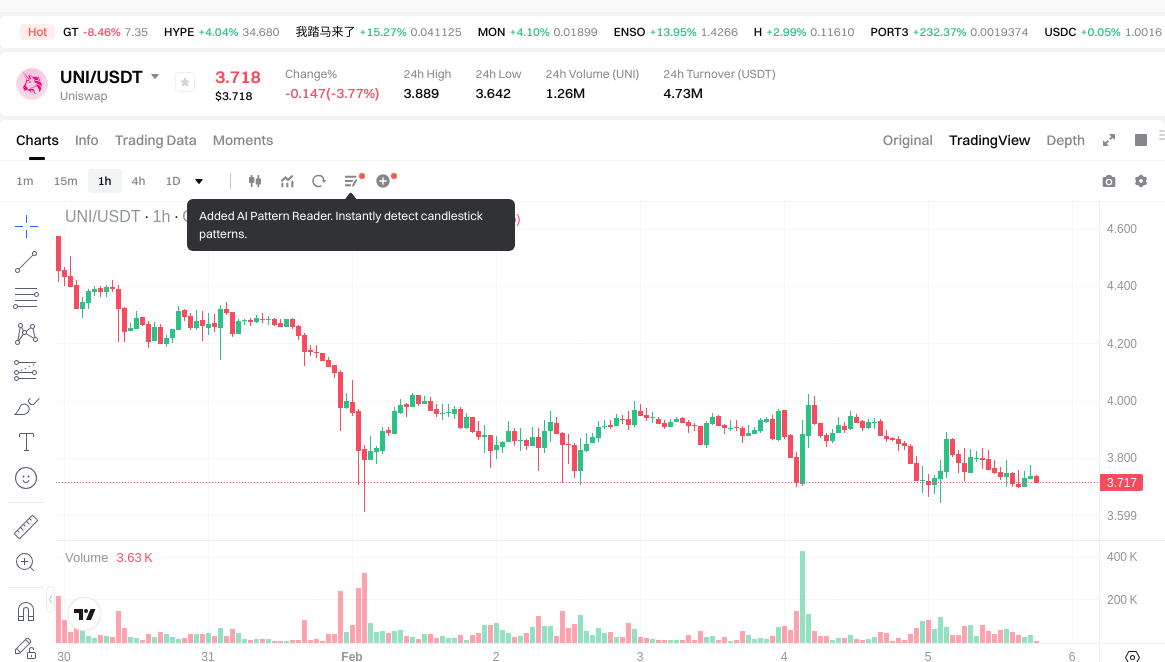

Current Market Conditions (2026-02-05)

- DRAC current price: $0.004841

- UNI current price: $3.716

- 24-hour trading volume: DRAC $16,205.64 vs UNI $4,732,938.10

- Market Sentiment Index (Fear & Greed Index): 12 (Extreme Fear)

View real-time prices:

- View DRAC current price Market Price

- View UNI current price Market Price

II. Core Factors Influencing DRAC vs UNI Investment Value

Supply Mechanism Comparison (Tokenomics)

- DRAC: The materials do not provide specific information regarding DRAC's supply mechanism or tokenomics structure.

- UNI: The materials do not contain detailed information about UNI's supply model, emission schedule, or deflationary mechanisms.

- 📌 Historical Pattern: Supply mechanisms can influence price cycles through scarcity dynamics, emission schedules, and programmed supply adjustments, though specific historical data for these tokens is not available in the reference materials.

Institutional Adoption and Market Applications

- Institutional Holdings: Reference materials do not specify institutional preference between these assets.

- Enterprise Adoption: The materials lack concrete data on DRAC or UNI applications in cross-border payments, settlement systems, or institutional investment portfolios.

- National Policies: Regulatory attitudes toward these specific tokens across different jurisdictions are not detailed in the provided materials.

Technical Development and Ecosystem Construction

- DRAC Technical Upgrades: According to available information, DRAC appears focused on risk management and financial resilience frameworks, though specific technical roadmap details are not provided.

- UNI Technical Development: UNI emphasizes innovation and scalability in blockchain technology, though concrete upgrade timelines and technical specifications are not detailed in the materials.

- Ecosystem Comparison: The materials note both projects may play roles in future financial system evolution, but specific DeFi integration, NFT functionality, payment implementation, or smart contract deployment comparisons are not documented.

Macroeconomic Factors and Market Cycles

- Performance in Inflationary Environments: The materials do not provide comparative data on anti-inflation properties of either asset.

- Macroeconomic Monetary Policy: Specific impacts of interest rates, dollar index movements, or monetary policy changes on DRAC and UNI are not analyzed in the reference materials.

- Geopolitical Factors: While cross-border transaction demand and international circumstances may influence crypto assets generally, specific impacts on these tokens are not documented in the provided sources.

III. 2026-2031 Price Prediction: DRAC vs UNI

Short-term Forecast (2026)

- DRAC: Conservative $0.0046455 - $0.00489 | Optimistic $0.00489 - $0.0060147

- UNI: Conservative $3.56832 - $3.717 | Optimistic $3.717 - $4.34889

Mid-term Forecast (2028-2029)

- DRAC may enter a gradual growth phase, with estimated price range of $0.004537990905 - $0.008469163879837

- UNI may enter a volatility adjustment phase, with estimated price range of $2.46009645 - $6.2998633845

- Key drivers: institutional capital inflows, ETF development, ecosystem expansion

Long-term Forecast (2030-2031)

- DRAC: Baseline scenario $0.006609162107367 - $0.008931300145091 | Optimistic scenario $0.010293701862139 - $0.011610690188619

- UNI: Baseline scenario $2.957540313166425 - $7.132891343519025 | Optimistic scenario $8.416811785352449 - $8.46668403377055

Disclaimer

DRAC:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0060147 | 0.00489 | 0.0046455 | 1 |

| 2027 | 0.0056159205 | 0.00545235 | 0.0046344975 | 12 |

| 2028 | 0.0078031307025 | 0.00553413525 | 0.004537990905 | 14 |

| 2029 | 0.008469163879837 | 0.00666863297625 | 0.0064018876572 | 37 |

| 2030 | 0.010293701862139 | 0.007568898428043 | 0.006812008585239 | 56 |

| 2031 | 0.011610690188619 | 0.008931300145091 | 0.006609162107367 | 84 |

UNI:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 4.34889 | 3.717 | 3.56832 | 0 |

| 2027 | 5.8880997 | 4.032945 | 2.46009645 | 8 |

| 2028 | 6.2998633845 | 4.96052235 | 3.769996986 | 33 |

| 2029 | 5.968004439285 | 5.63019286725 | 2.92770029097 | 51 |

| 2030 | 8.46668403377055 | 5.7990986532675 | 2.957540313166425 | 56 |

| 2031 | 8.416811785352449 | 7.132891343519025 | 4.493721546416985 | 91 |

IV. Investment Strategy Comparison: DRAC vs UNI

Long-term vs Short-term Investment Strategies

- DRAC: May be suitable for investors interested in emerging inscription-based assets and willing to accept higher volatility in exchange for potential growth opportunities in nascent market segments

- UNI: May appeal to investors seeking exposure to established DeFi protocols with demonstrated market presence and liquidity infrastructure

Risk Management and Asset Allocation

- Conservative Investors: DRAC 10-15% vs UNI 85-90%

- Aggressive Investors: DRAC 30-40% vs UNI 60-70%

- Hedging Tools: stablecoin allocation, options strategies, cross-asset portfolio diversification

V. Potential Risk Comparison

Market Risk

- DRAC: Exposure to significant price volatility due to lower market cap ranking (3011) and limited trading volume ($16,205.64 daily), which may result in liquidity constraints and heightened price sensitivity

- UNI: Subject to broader DeFi sector dynamics and correlation with major cryptocurrency market movements, though benefits from higher liquidity with daily trading volume of $4,732,938.10

Technical Risk

- DRAC: Scalability considerations and network stability factors associated with inscription-based architectures may present operational uncertainties

- UNI: Protocol dependency on Ethereum network performance, smart contract security considerations, and evolving competitive landscape in automated market maker space

Regulatory Risk

- Global regulatory developments may impact these assets differently based on their functional classifications, with DeFi protocols potentially facing increased scrutiny regarding securities regulations, while inscription assets may encounter emerging frameworks for digital collectibles and token standards

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- DRAC Advantages: Lower entry price point at $0.004841, potential for growth from current market position, exposure to inscription technology sector

- UNI Advantages: Established market position (rank 40), substantially higher market cap ($2.36 billion), greater liquidity infrastructure, proven protocol utility in DeFi ecosystem

✅ Investment Recommendations:

- Beginner Investors: Consider prioritizing established assets with higher liquidity and market recognition while limiting exposure to lower-cap assets until developing deeper market understanding

- Experienced Investors: May explore diversified allocation strategies incorporating both established protocols and emerging asset classes based on individual risk tolerance and portfolio objectives

- Institutional Investors: Focus on assets with sufficient liquidity depth, regulatory clarity, and established market infrastructure to support position sizing requirements

⚠️ Risk Disclosure: Cryptocurrency markets exhibit extreme volatility. This analysis does not constitute investment advice. Investors should conduct independent research and consult qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What is the current price difference between DRAC and UNI, and how does their market capitalization compare?

As of February 5, 2026, DRAC is priced at $0.004841 with a market cap of approximately $517,134 (ranked 3011), while UNI is priced at $3.716 with a market cap of approximately $2.36 billion (ranked 40). This represents a significant disparity in both price and market positioning. UNI's market cap is approximately 4,565 times larger than DRAC's, reflecting its established position as a leading DeFi protocol on Ethereum since 2020, compared to DRAC's emergence as a BRC-20 inscription token in 2023. The 24-hour trading volume further illustrates this difference, with UNI recording $4,732,938.10 compared to DRAC's $16,205.64, indicating substantially higher liquidity and market participation for UNI.

Q2: Which asset offers better potential returns according to the 2026-2031 price predictions?

Based on the provided forecasts, both assets show growth potential but with different risk-reward profiles. For DRAC, conservative estimates project prices ranging from $0.0046455 in 2026 to $0.006609162107367 in 2031, while optimistic scenarios reach $0.011610690188619 by 2031—representing potential growth of approximately 140% from current levels. For UNI, conservative projections range from $3.56832 in 2026 to $4.493721546416985 in 2031, with optimistic scenarios reaching $8.416811785352449 by 2031—representing potential growth of approximately 126% from current levels. However, it's crucial to note that DRAC's lower market cap and higher volatility mean these projections carry significantly greater uncertainty and risk compared to UNI's more established market position.

Q3: How should investors allocate between DRAC and UNI based on their risk tolerance?

The recommended allocation varies substantially based on investor risk profile. Conservative investors should consider a portfolio weighted heavily toward UNI (85-90%) with minimal DRAC exposure (10-15%), given UNI's established market position, higher liquidity, and proven protocol utility. Aggressive investors with higher risk tolerance might consider increasing DRAC allocation to 30-40% while maintaining 60-70% in UNI, allowing for potential upside from DRAC's emerging market position while retaining substantial exposure to UNI's stability. Beginner investors should prioritize established assets with higher liquidity and market recognition, potentially focusing primarily on UNI until developing deeper market understanding. All allocation strategies should incorporate proper risk management tools including stablecoin reserves, options strategies, and cross-asset diversification.

Q4: What are the primary risks associated with investing in DRAC versus UNI?

DRAC presents higher market risk due to its significantly lower market cap ranking (3011) and limited daily trading volume ($16,205.64), which creates liquidity constraints and heightened price sensitivity to market movements. Additionally, DRAC faces technical risks associated with inscription-based architectures including scalability considerations and network stability uncertainties. UNI, while more established, faces different risks including dependency on Ethereum network performance, smart contract security considerations, and increasing competition in the automated market maker space. Both assets face regulatory uncertainties, though potentially in different ways—DeFi protocols like UNI may encounter increased scrutiny regarding securities regulations, while inscription assets like DRAC may face emerging frameworks for digital collectibles and token standards. The current market sentiment index of 12 (Extreme Fear) suggests heightened overall market risk affecting both assets.

Q5: How do the historical price performances of DRAC and UNI compare?

Historical price data reveals distinct volatility patterns for each asset. DRAC experienced significant fluctuation, reaching a notable peak of $0.091844 on November 1, 2022, before declining to a low of $0.00005608 on February 16, 2025—representing a decline of approximately 99.9% from its high. UNI reached its all-time high of $44.92 on May 3, 2021, before dropping to $1.03 on September 17, 2020—a decline of approximately 97.7% from peak to trough. Both assets demonstrate the extreme volatility characteristic of cryptocurrency markets, though DRAC's shorter market history and lower liquidity have contributed to more dramatic price swings. Current prices represent substantial discounts from historical peaks for both assets, with DRAC trading approximately 94.7% below its 2022 high and UNI trading approximately 91.7% below its 2021 peak.

Q6: What technological and ecosystem factors differentiate DRAC from UNI?

DRAC and UNI represent fundamentally different technological approaches and ecosystem positions. DRAC is positioned as a BRC-20 based crypto inscription with focus on risk management and financial resilience frameworks, representing exposure to the emerging inscription technology sector. UNI operates as the first automatic market making protocol on the Ethereum blockchain, emphasizing innovation and scalability in DeFi infrastructure. While specific technical roadmap details are limited in available materials, UNI benefits from an established ecosystem with proven protocol utility, extensive DeFi integrations, and substantial developer activity. DRAC's inscription-based approach represents a newer paradigm in digital asset architecture. These technological differences translate to distinct use cases—UNI serves as infrastructure for decentralized trading and liquidity provision, while DRAC operates within the inscription asset framework with different functional characteristics and adoption patterns.

Q7: Which asset is more suitable for institutional investors?

UNI appears more suitable for institutional investment based on several key factors. Its market cap of $2.36 billion and daily trading volume of $4,732,938.10 provide sufficient liquidity depth to support institutional position sizing requirements without significant market impact. UNI's rank of 40 in the cryptocurrency market reflects established market recognition and accessibility through major exchanges and custody solutions. The asset benefits from greater regulatory clarity as an established DeFi protocol with years of operational history. In contrast, DRAC's market cap of $517,134 and daily trading volume of $16,205.64 present significant liquidity constraints for institutional-scale positions. Additionally, institutional investors typically prioritize assets with proven market infrastructure, established custody solutions, and clearer regulatory frameworks—characteristics more aligned with UNI's profile. However, some institutional investors with higher risk tolerance and focus on emerging asset classes might consider small allocations to assets like DRAC as part of diversified cryptocurrency portfolio strategies.

Q8: How might macroeconomic factors impact DRAC and UNI differently?

While specific macroeconomic impact data is limited in available materials, general principles suggest differential effects based on asset characteristics. UNI, as an established DeFi protocol with higher market cap and liquidity, may demonstrate greater correlation with broader financial market movements, including responses to interest rate changes, monetary policy adjustments, and traditional market sentiment shifts. Institutional capital flows responding to macroeconomic conditions would likely impact UNI more significantly given its accessibility and market infrastructure. DRAC, with its lower market cap and emerging asset status, may exhibit more idiosyncratic price behavior less directly tied to macroeconomic factors, though still subject to overall cryptocurrency market sentiment. During periods of economic uncertainty or inflationary pressure, investor preference may shift between established assets (favoring UNI) versus speculative emerging assets (potentially favoring DRAC) depending on risk appetite and market cycle positioning. Cross-border transaction demand and geopolitical factors may influence both assets, though specific mechanisms would differ based on their respective use cases and market positions.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Top 10 Forex Brokers for Trading

Cryptocurrency Explained in Simple Terms

7 Leading NFT Artists to Watch in 2025

Ethereum Mining Guide Using NiceHash OS

How to Promote a Crypto Project Through AMA Interviews: Step-by-Step Guide