Is Aki Network (AKI) a good investment?: A Comprehensive Analysis of Market Potential, Tokenomics, and Risk Factors for 2024

Introduction: Aki Network (AKI)'s Investment Position and Market Outlook

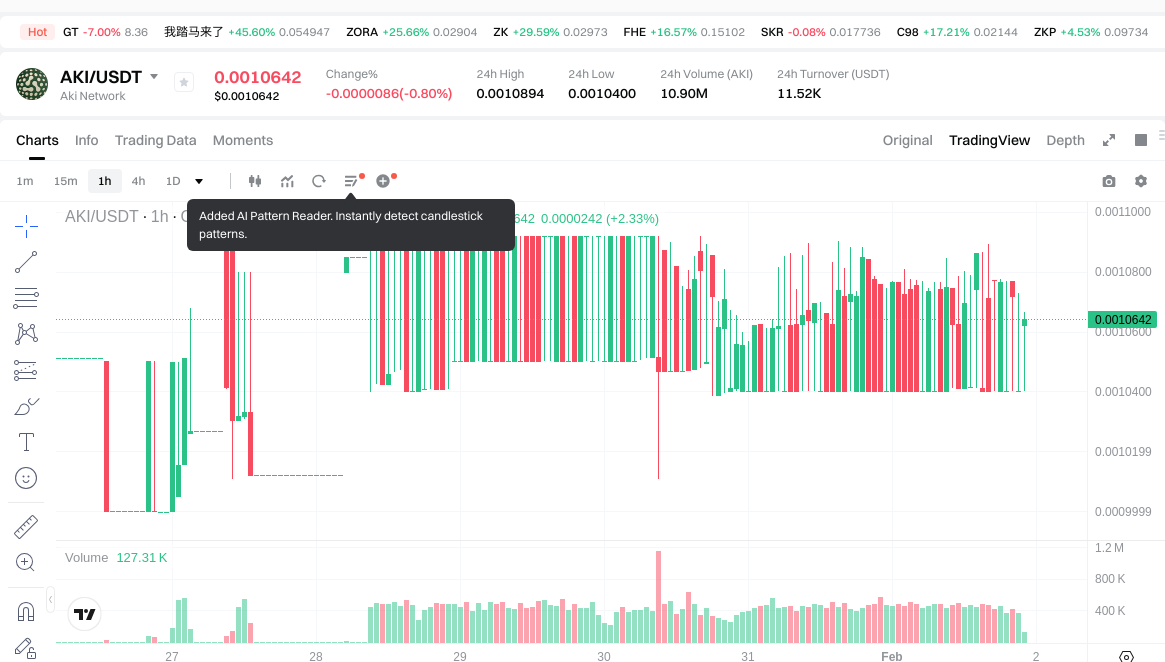

AKI is a notable asset in the cryptocurrency sector, having been launched in 2022 as part of the Web3 data-driven influencer ecosystem. As of February 2026, AKI maintains a market capitalization of approximately $1.79 million, with a circulating supply of around 1.69 billion tokens, and the current price remains around $0.0010636. Positioned as a "Proof of Promotion" platform that tracks on-chain promotional contributions and maps referral-based correlation graphs, AKI has gradually become a focal point when investors discuss "Is Aki Network (AKI) a good investment?" This article comprehensively analyzes AKI's investment value, historical trends, future price projections, and investment risks to provide reference for investors.

With a total supply of 2 billion tokens and approximately 84.33% already in circulation, AKI operates within the Web3 marketing infrastructure space, offering AI-powered tools and resources for identifying and rewarding influencer contributions. The token is deployed on Polygon and currently holds a market ranking of 2121, with a 24-hour trading volume of $11,554.97. While the project has experienced significant price volatility since its all-time high of $0.0825 in December 2023, recent 30-day performance shows a modest increase of 2.36%, contrasting with the 89.95% decline over the past year. This article examines these dynamics alongside AKI's technological framework, tokenomics, and market positioning to help stakeholders evaluate its potential in the evolving Web3 landscape.

I. Aki Network (AKI) Price History Review and Current Investment Value

AKI Historical Price Trends and Investment Performance (Aki Network (AKI) Investment Performance)

- 2023: The token reached a notable price level during December 2023, with market activity reflecting increased attention to the project's data-driven influencer network initiatives.

- 2025: Price movements exhibited volatility throughout the year, with fluctuations influenced by broader market conditions and ecosystem developments related to the Proof of Promotion methodology.

- Recent Period: Price experienced downward pressure from previous levels, reflecting adjustments in market dynamics and trading patterns across exchanges.

Current AKI Investment Market Status (February 2026)

- AKI Current Price: 0.0010636 USD

- Market Sentiment: Data indicates mixed sentiment with limited holder base expansion, as evidenced by approximately 4,831 holders across network addresses.

- 24-Hour Trading Volume: 11,554.97 USD

- Institutional Investor Holdings: Available data does not provide specific institutional investment disclosure for comprehensive analysis.

Click to view real-time AKI market price

II. Core Factors Affecting Whether AKI is a Good Investment

Supply Mechanism and Scarcity (AKI Investment Scarcity)

- Total Supply and Circulation: Aki Network has a maximum supply of 2,000,000,000 AKI tokens, with approximately 1,686,624,980.89 AKI (84.33%) currently in circulation as of February 1, 2026. The fixed supply cap may contribute to potential scarcity dynamics as adoption increases.

- Price Performance Context: AKI has experienced notable price fluctuations, with its price reaching $0.0825 on December 22, 2023, and declining to $0.000627 on September 25, 2025. As of February 1, 2026, the price stands at $0.0010636, representing an 89.95% decline over the past year.

- Investment Consideration: The relationship between the fixed supply mechanism and market demand dynamics represents a factor in evaluating long-term investment positioning, though price volatility remains substantial.

Institutional Investment and Mainstream Adoption (Institutional Investment in AKI)

- Holder Distribution: As of the available data, Aki Network has 4,831 token holders, indicating a relatively limited distribution base compared to more established crypto assets.

- Exchange Availability: AKI is listed on 2 exchanges, with trading available on Gate.com. The limited exchange presence may affect liquidity and accessibility for institutional participants.

- Market Position: With a market capitalization of approximately $1,793,894.33 and a market dominance of 0.000077%, Aki Network represents a micro-cap position within the broader crypto market, suggesting limited institutional adoption at this stage.

Macroeconomic Environment's Impact on AKI Investment

- Market Sentiment: Current market emotion indicators show neutral positioning (value: 1), reflecting uncertain sentiment regarding AKI's investment outlook in the present macroeconomic context.

- Volatility Characteristics: AKI demonstrates high volatility patterns, with 24-hour price fluctuations ranging between $0.00104 and $0.0010894, which may amplify sensitivity to broader market conditions and macroeconomic shifts.

- Risk-On Asset Positioning: As a micro-cap crypto asset, AKI may experience heightened sensitivity to changes in risk appetite driven by monetary policy adjustments, inflation trends, and global economic uncertainty.

Technology and Ecosystem Development (Technology & Ecosystem for AKI Investment)

- Core Technology Framework: Aki Network operates as a data-driven influencer network utilizing a "Proof of Promotion" methodology that tracks on-chain promotional contributions and creates referral-based correlation graphs.

- Blockchain Infrastructure: AKI tokens are deployed on the Polygon network (contract address: 0x1A7e49125a6595588c9556f07a4c006461b24545), which may offer scalability advantages and lower transaction costs compared to alternative networks.

- Ecosystem Focus: The project positions itself as a marketplace for attention within Web3, providing AI-powered tools and resources for influencers while leveraging private domain traffic identification. The development of this niche ecosystem may influence long-term value proposition, though concrete adoption metrics remain limited in available materials.

III. AKI Future Investment Forecast and Price Outlook (Is Aki Network(AKI) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term AKI investment outlook)

- Conservative estimate: $0.00074501 - $0.0010643

- Neutral estimate: $0.0010643

- Optimistic estimate: $0.0010643 - $0.001298446

Mid-term Investment Outlook (2027-2029, mid-term Aki Network(AKI) investment forecast)

-

Market stage expectation: Based on historical price performance models, AKI may experience gradual development during the mid-term period, with price fluctuations reflecting broader market dynamics and project ecosystem progress.

-

Investment return forecast:

- 2027: $0.00111049062 - $0.00164210847

- 2028: $0.0010446881439 - $0.00162350184525

- 2029: $0.001047158690186 - $0.002109493593273

-

Key catalysts: Potential factors may include ecosystem expansion, adoption of the Proof of Promotion methodology, AI-powered tools integration, and developments in the Web3 influencer network.

Long-term Investment Outlook (Is AKI a good long-term investment?)

-

Base scenario: $0.001577794974278 - $0.002067455483537 (assuming steady ecosystem development and moderate market conditions through 2030)

-

Optimistic scenario: $0.001707645687104 - $0.002852544500049 (assuming enhanced adoption of data-driven influencer networks and favorable market environment by 2031)

-

Risk scenario: Below $0.00074501 (under adverse market conditions or slower-than-expected ecosystem growth)

Click to view AKI long-term investment and price forecast: Price Prediction

2026-02-01 - 2031 Long-term Outlook

-

Base scenario: $0.001577794974278 - $0.002067455483537 (corresponding to steady progress and gradual mainstream application improvement)

-

Optimistic scenario: $0.001707645687104 - $0.002852544500049 (corresponding to large-scale adoption and favorable market environment)

-

Transformative scenario: Above $0.002852544500049 (if ecosystem achieves breakthrough progress and mainstream popularization)

-

2031-12-31 forecast high: $0.002852544500049 (based on optimistic development assumptions)

Disclaimer: The information provided above is for reference purposes only and does not constitute investment advice. Cryptocurrency markets are highly volatile and past performance does not guarantee future results. Investors should conduct their own research and assess their risk tolerance before making investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.001298446 | 0.0010643 | 0.00074501 | 0 |

| 2027 | 0.00164210847 | 0.001181373 | 0.00111049062 | 11 |

| 2028 | 0.00162350184525 | 0.001411740735 | 0.0010446881439 | 32 |

| 2029 | 0.002109493593273 | 0.001517621290125 | 0.001047158690186 | 42 |

| 2030 | 0.002067455483537 | 0.001813557441699 | 0.001577794974278 | 70 |

| 2031 | 0.002852544500049 | 0.001940506462618 | 0.001707645687104 | 82 |

IV. AKI Investment Strategy and Risk Management (How to invest in AKI Network)

Investment Methodology (AKI investment strategy)

Long-term Holding (HODL AKI): Suitable for conservative investors

Long-term holding may be considered by investors who believe in the future development of Web3 data-driven influencer networks. This strategy involves purchasing AKI tokens and holding them through market cycles, betting on the potential growth of the Aki Protocol ecosystem and its Proof of Promotion methodology.

Active Trading: Relying on technical analysis and swing operations

Active traders may leverage AKI's price volatility for short-term gains. Given the token's 24-hour trading volume of approximately $11,554.97, traders should be aware of liquidity constraints when executing larger orders. Technical analysis tools can be utilized to identify entry and exit points, though the relatively low trading volume may limit opportunities for frequent position adjustments.

Risk Management (Risk management for AKI investment)

Asset Allocation Ratio: Conservative / Aggressive / Professional investors

- Conservative investors: Consider allocating 1-3% of crypto portfolio to AKI

- Aggressive investors: May allocate 5-10% depending on risk tolerance

- Professional investors: Should conduct thorough due diligence on the project's fundamentals and technological development before determining allocation

Risk Hedging Solutions: Multi-asset portfolio + hedging tools

Investors should maintain a diversified cryptocurrency portfolio to mitigate single-asset risk. Given AKI's market cap dominance of only 0.000077%, it represents a high-risk, small-cap investment that should be balanced with more established crypto assets. Consider hedging strategies through stablecoin reserves or inverse correlation assets.

Secure Storage: Hot and cold wallets + hardware wallet recommendations

AKI tokens are deployed on the Polygon network. Investors should:

- Use hardware wallets (such as Ledger or Trezor) for long-term storage

- Ensure wallet compatibility with Polygon network

- Keep only trading amounts in exchange hot wallets

- Regularly backup wallet recovery phrases in secure, offline locations

V. AKI Investment Risks and Challenges (Risks of investing in AKI Network)

Market Risk: High volatility and price manipulation

AKI has demonstrated significant price volatility. The token reached a price of $0.0825 on December 22, 2023, and declined to $0.000627 on September 25, 2025. As of February 1, 2026, the price stands at $0.0010636, representing an 89.95% decline over the past year. The relatively low trading volume of approximately $11,554.97 per 24 hours may expose investors to liquidity risks and potential price manipulation in low-volume trading environments.

Regulatory Risk: Policy uncertainty across different countries

As a Web3 influencer network project, Aki Protocol operates in an evolving regulatory landscape. Different jurisdictions maintain varying approaches to cryptocurrency regulation, particularly concerning tokens that involve marketing and promotional activities. Changes in regulations regarding data privacy, cryptocurrency marketing, or decentralized networks could impact the project's operations and token value.

Technical Risk: Network security vulnerabilities and upgrade failures

The project relies on blockchain infrastructure and smart contract technology. Potential technical risks include:

- Smart contract vulnerabilities on the Polygon network

- Security risks in the Proof of Promotion mechanism

- Technical challenges in maintaining the referral-based correlation graph system

- Integration risks with AI-powered tools and resources mentioned in the project description

VI. Conclusion: Is AKI Network a Good Investment?

Investment Value Summary: AKI represents a high-risk investment in the Web3 influencer marketing sector with significant price volatility in the short term.

The project addresses the growing need for data-driven influencer networks in Web3, with its Proof of Promotion methodology offering a unique approach to tracking on-chain promotional contributions. However, investors should note the substantial price decline of 89.95% over the past year and the limited trading volume, which may present liquidity challenges.

Investor Recommendations:

✅ Beginners: Consider dollar-cost averaging strategy with secure wallet storage on Polygon-compatible hardware wallets. Start with minimal allocation to understand the project ecosystem.

✅ Experienced Investors: May explore swing trading opportunities while maintaining diversified portfolio allocation. Monitor project development updates and ecosystem growth metrics.

✅ Institutional Investors: Conduct comprehensive due diligence on the project's technology, team, and market positioning before considering strategic long-term allocation.

⚠️ Disclaimer: Cryptocurrency investment carries high risk. This content is for reference only and does not constitute investment advice. Investors should conduct independent research and consider their financial situation before making investment decisions.

VII. FAQ

Q1: What is Aki Network (AKI) and what problem does it solve?

Aki Network is a Web3 data-driven influencer ecosystem launched in 2022 that operates on the Polygon network. The project introduces a "Proof of Promotion" methodology to track on-chain promotional contributions and create referral-based correlation graphs. It addresses the challenge of identifying and rewarding influencer contributions in the Web3 space by providing AI-powered tools and resources that map promotional activities transparently. With a total supply of 2 billion tokens and approximately 84.33% in circulation, AKI positions itself as a marketplace for attention within Web3, leveraging private domain traffic identification to quantify influencer value in decentralized environments.

Q2: What are the main risks of investing in AKI?

The primary risks include extreme price volatility (89.95% decline over the past year), limited liquidity (24-hour trading volume of approximately $11,554.97), and concentration risk due to only 4,831 token holders. Market risks stem from the micro-cap positioning with a market dominance of 0.000077%, making the token susceptible to price manipulation in low-volume environments. Additionally, regulatory uncertainty surrounding Web3 marketing activities across different jurisdictions poses compliance risks. Technical vulnerabilities in smart contracts, the Proof of Promotion mechanism, and AI-powered tools integration represent operational risks that could impact the project's functionality and token value.

Q3: How does AKI's tokenomics affect its investment potential?

AKI's tokenomics feature a fixed maximum supply of 2 billion tokens, with 1.69 billion (84.33%) already in circulation as of February 2026, limiting potential dilution from new token releases. The high circulation rate suggests most tokens are already in the market, which may contribute to supply scarcity if demand increases. However, the relationship between fixed supply and investment potential is complicated by the significant price decline from the all-time high of $0.0825 (December 2023) to the current price of $0.0010636 (February 2026). The token's deployment on Polygon offers advantages in transaction costs and scalability, but the limited exchange presence (2 exchanges) and low trading volume constrain liquidity for larger investors.

Q4: What is the price forecast for AKI through 2031?

Price projections for AKI vary significantly based on market scenarios. For 2026, estimates range from $0.00074501 (conservative) to $0.001298446 (optimistic). Mid-term forecasts suggest potential recovery with 2027 estimates between $0.00111049062 and $0.00164210847, representing an 11% increase. By 2029, projections range from $0.001047158690186 to $0.002109493593273 (42% increase scenario). Long-term forecasts for 2031 reach between $0.001707645687104 (base scenario) and $0.002852544500049 (optimistic scenario), representing an 82% increase from 2026 levels. These projections assume continued ecosystem development, adoption of the Proof of Promotion methodology, and favorable Web3 market conditions, though actual performance may vary substantially.

Q5: What investment strategies are suitable for AKI?

For conservative investors, a long-term holding (HODL) strategy with 1-3% portfolio allocation is appropriate, utilizing hardware wallets compatible with Polygon for secure storage. Aggressive investors may consider 5-10% allocation with active trading strategies, though they should be cautious of the limited liquidity. Dollar-cost averaging is recommended for beginners to mitigate volatility impact while building positions gradually. Professional investors should conduct comprehensive due diligence on the project's technological development and fundamentals before determining strategic allocation. Risk management should include diversification across multiple crypto assets, hedging through stablecoin reserves, and maintaining only trading amounts in exchange hot wallets while storing the majority in cold storage solutions.

Q6: How does AKI compare to other Web3 marketing projects?

AKI distinguishes itself through its Proof of Promotion methodology, which creates on-chain correlation graphs for tracking promotional contributions transparently. However, with a market cap of approximately $1.79 million and ranking of 2121, it represents a micro-cap position significantly smaller than established Web3 infrastructure projects. The limited holder base of 4,831 addresses suggests early-stage adoption compared to more mature protocols. While the AI-powered tools and private domain traffic identification offer technological differentiation, the project faces challenges in achieving mainstream adoption. The 24-hour trading volume of $11,554.97 indicates limited market activity compared to leading Web3 marketing solutions, and the 89.95% price decline over the past year reflects challenges in maintaining investor confidence during market fluctuations.

Q7: What factors could drive AKI's future price appreciation?

Key catalysts for potential price appreciation include successful expansion of the influencer ecosystem, increased adoption of the Proof of Promotion methodology by Web3 projects, and integration of AI-powered tools that demonstrate measurable value for participants. Broader market factors such as general cryptocurrency bull market conditions, institutional interest in Web3 infrastructure, and regulatory clarity for decentralized marketing platforms could provide tailwinds. Technical developments including enhanced smart contract functionality, additional exchange listings to improve liquidity, and partnerships with major Web3 platforms could strengthen the project's market position. However, investors should note that with 84.33% of tokens already in circulation, supply dynamics alone may not drive significant appreciation without corresponding demand growth from ecosystem utility and user adoption.

Q8: What due diligence should investors conduct before investing in AKI?

Investors should thoroughly research the project's technical documentation, including smart contract audits and security assessments for the Polygon-based implementation. Evaluation of the team's background, development roadmap, and milestone achievements provides insight into execution capability. Analysis of on-chain metrics including holder distribution trends, transaction patterns, and actual usage of the Proof of Promotion mechanism helps assess genuine adoption versus speculative interest. Comparing AKI's value proposition against competing Web3 marketing solutions and examining partnership announcements for credibility are essential. Investors should also monitor the project's community engagement across social channels, assess transparency in communication, and verify token contract details on blockchain explorers. Given the high-risk profile, consulting with financial advisors familiar with cryptocurrency investments and allocating only capital that can be lost without financial hardship is prudent before committing to an AKI position.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Ethereum 2.0 in 2025: Staking, Scalability, and Environmental Impact

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

What is BOOP: Understanding the Web3 Token in 2025

Altcoin Season Index 2025: How to Use and Invest in Web3

How Active Is BULLA's Community and Ecosystem in 2026? Twitter, Telegram, and DApp Growth Analysis

What are MERL compliance and regulatory risks in 2026?

Top 4 Coins with the Best Mining Profitability

How does Merlin Chain (MERL) community drive ecosystem growth with 70% activity rate on Twitter, Telegram, and Reddit?

What is the COINX price volatility analysis: historical trends, support resistance levels, and correlation with BTC in 2026?