Is Archway (ARCH) a good investment? A Comprehensive Analysis of Its Potential, Risks, and Market Position in 2024

Introduction: Archway (ARCH) Investment Position and Market Outlook

ARCH is a notable asset in the cryptocurrency space, representing the Archway protocol—an incentivized smart contract platform designed to reward developers for building scalable cross-chain dApps. As of February 2026, ARCH holds a market capitalization of approximately $1.26 million, with a circulating supply of around 640.03 million tokens, and a current price hovering near $0.001975. With its positioning as a developer-centric protocol aimed at democratizing access to capital and value in the Web 3 ecosystem, ARCH has gradually become a focal point for investors evaluating "Is Archway (ARCH) a good investment?" This article will comprehensively analyze ARCH's investment value, historical performance, future price projections, and associated investment risks to provide a reference for investors.

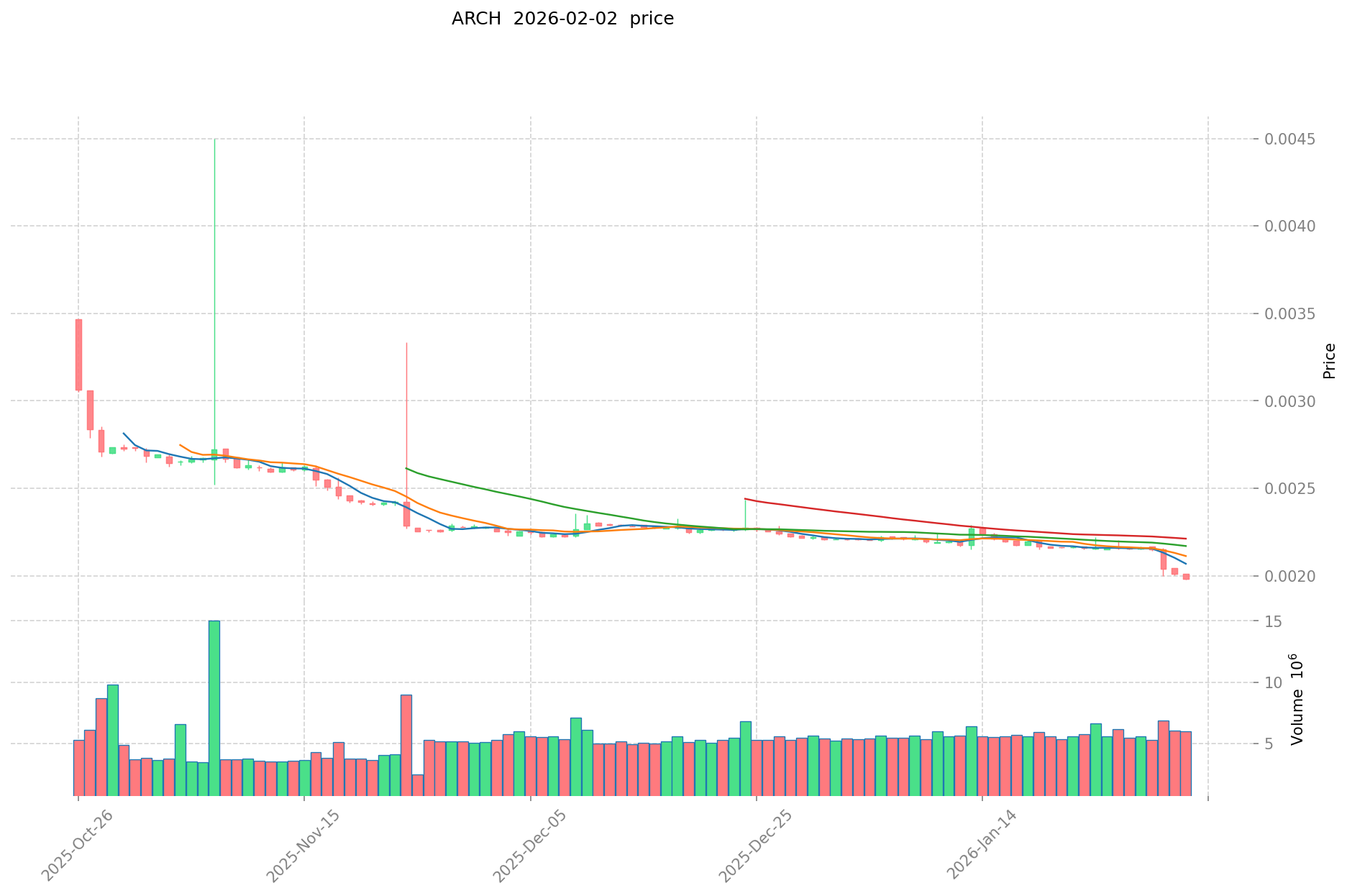

I. Archway (ARCH) Price History Review and Current Investment Value

ARCH Historical Price Trends and Investment Returns (Archway(ARCH) investment performance)

- 2023: ARCH reached a notable price level of $0.28899 on December 24 → Early participants experienced significant nominal gains during this period

- 2024-2025: The token entered a prolonged correction phase → ARCH declined substantially from its previous elevated levels

- 2026: On February 2, ARCH traded at $0.00197 → The price showed considerable depreciation compared to earlier trading ranges

Current ARCH Investment Market Status (February 2026)

- ARCH current price: $0.001975

- 24-hour trading volume: $11,918.10

- Circulating supply: 640,028,533.55 ARCH tokens

- Market capitalization: $1,264,056.35

Click to view real-time ARCH market price

II. Core Factors Influencing Whether ARCH is a Good Investment

Supply Mechanism and Scarcity (ARCH Investment Scarcity)

- Supply Structure: Archway has a maximum supply of 1,000,000,000 ARCH tokens, with a current circulating supply of approximately 640,028,533 ARCH (64% of total supply). The total supply stands at 1,150,198,258 ARCH, indicating that a portion of tokens remains uncirculated, which may influence future supply dynamics.

- Price Performance Context: ARCH has experienced significant price fluctuations since launch. The token reached a notable price level of $0.28899 on December 24, 2023, while the current price stands at $0.001975 as of February 2, 2026. This represents substantial volatility in the token's trading history.

- Investment Consideration: The relationship between circulating supply and maximum supply, along with the fully diluted market cap of approximately $2.27 million, provides context for evaluating potential scarcity dynamics. The circulating supply currently represents 64% of the maximum supply, suggesting a moderate level of token distribution in the market.

Institutional Investment and Mainstream Adoption (Institutional Investment in ARCH)

- Market Positioning: Archway ranks #2351 by market capitalization, with a total market cap of approximately $1.26 million and a market dominance of 0.000082%. The token is listed on 1 exchange, indicating limited trading venue availability.

- Trading Activity: The 24-hour trading volume stands at $11,918.10, reflecting current market activity levels for the token.

- Developer Incentive Model: Archway's protocol incorporates a built-in reward mechanism designed to compensate developers based on the value their dApps contribute to the network. This approach aims to foster sustainable application development and may influence long-term ecosystem adoption.

Macroeconomic Environment's Impact on ARCH Investment

- Market Sentiment: Current market analysis indicates bearish sentiment for ARCH in 2026, with multiple technical indicators suggesting cautious investment outlooks.

- Price Performance: Over the past year, ARCH has experienced a -89.19% change, with additional declines noted across shorter timeframes: -10.74% over 30 days, -8.67% over 7 days, and -0.95% over 24 hours. These figures reflect the token's recent market performance trajectory.

- Volatility Context: The token has shown price movements between a 24-hour high of $0.001994 and a low of $0.00197, demonstrating intraday trading range characteristics.

Technology and Ecosystem Development (Technology & Ecosystem for ARCH Investment)

- Platform Architecture: Archway functions as an incentivized smart contract platform designed to provide developers with tools for building scalable cross-chain decentralized applications (dApps). The protocol aims to facilitate rapid development and deployment of applications within its ecosystem.

- Cross-Chain Functionality: The platform incorporates cross-chain capabilities, which may support interoperability with other blockchain networks and expand potential use cases for applications built on Archway.

- Developer-Centric Model: Archway's protocol includes mechanisms intended to reward developers based on the value their applications generate for the network. This model seeks to create alignment between developer contributions and protocol growth, potentially influencing the long-term sustainability of the ecosystem.

- Governance and Stakeholder Model: The protocol structure aims to distribute governance participation across contributors and stakeholders, including developers and entrepreneurs building on the platform. This approach may impact how the network evolves and responds to ecosystem needs over time.

III. ARCH Future Investment Forecast and Price Outlook (Is Archway(ARCH) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term ARCH investment outlook)

- Conservative forecast: $0.001852 - $0.002227

- Neutral forecast: $0.00197 - $0.002400

- Optimistic forecast: $0.002400 - $0.002837

Mid-term Investment Outlook (2027-2028, mid-term Archway(ARCH) investment forecast)

- Market stage expectation: The token may enter a gradual recovery phase with potential price stabilization as the ecosystem matures and cross-chain functionality develops.

- Investment return forecast:

- 2027: $0.001706 - $0.002812

- 2028: $0.001799 - $0.002816

- Key catalysts: Cross-chain dApp deployment expansion, developer reward mechanism effectiveness, and overall smart contract platform adoption trends.

Long-term Investment Outlook (Is ARCH a good long-term investment?)

- Base scenario: $0.001985 - $0.003771 (assuming steady ecosystem development and moderate market conditions)

- Optimistic scenario: $0.003086 - $0.005098 (assuming accelerated dApp adoption and favorable regulatory environment)

- Risk scenario: Below $0.001800 (under adverse market conditions or limited ecosystem growth)

Click to view ARCH long-term investment and price forecast: Price Prediction

2026-02-02 - 2031 Long-term Outlook

- Base scenario: $0.002400 - $0.003540 (corresponding to steady progress and gradual mainstream application enhancement)

- Optimistic scenario: $0.003771 - $0.005098 (corresponding to large-scale adoption and favorable market environment)

- Transformational scenario: Above $0.006000 (if ecosystem achieves breakthrough development and mainstream penetration)

- 2031-12-31 forecast high: $0.005098 (based on optimistic development assumptions)

Disclaimer: This forecast is based on historical data and market analysis models. Cryptocurrency investments carry significant risks, and actual prices may differ substantially from predictions due to market volatility, regulatory changes, technological developments, and macroeconomic factors. This information does not constitute investment advice, and investors should conduct independent research and risk assessment before making any investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0028368 | 0.00197 | 0.0018518 | 0 |

| 2027 | 0.002811978 | 0.0024034 | 0.001706414 | 21 |

| 2028 | 0.00281630412 | 0.002607689 | 0.00179930541 | 32 |

| 2029 | 0.0039052750464 | 0.00271199656 | 0.0024136769384 | 37 |

| 2030 | 0.003771844815648 | 0.0033086358032 | 0.00198518148192 | 67 |

| 2031 | 0.00509794604557 | 0.003540240309424 | 0.003434033100141 | 79 |

IV. ARCH Investment Strategy and Risk Management (How to invest in ARCH)

Investment Methodology (ARCH investment strategy)

Long-term Holding (HODL ARCH): Suitable for Conservative Investors

For investors seeking a conservative approach, long-term holding may be considered as part of a diversified portfolio strategy. This approach typically involves:

- Accumulating positions during periods of market volatility

- Focusing on the platform's fundamental development and ecosystem growth

- Monitoring the adoption rate of dApps built on the Archway network

- Evaluating the effectiveness of the developer incentive mechanism

Given ARCH's significant price decline of 89.19% over the past year (from historical data through February 2, 2026), conservative investors should carefully assess their risk tolerance before committing capital.

Active Trading: Relying on Technical Analysis and Swing Operations

For more experienced traders, active trading strategies may involve:

- Technical analysis using key support and resistance levels (recent 24-hour range: $0.00197 - $0.001994)

- Volume analysis (24-hour trading volume: $11,918.10)

- Short-term price movements (1-hour change: +0.13%, 24-hour change: -0.95%)

- Swing trading based on weekly and monthly trends (7-day change: -8.67%, 30-day change: -10.74%)

Traders should note the relatively low trading volume and market capitalization ($1,264,056.35), which may result in liquidity constraints during periods of high volatility.

Risk Management (Risk management for ARCH investment)

Asset Allocation Ratio: Conservative / Aggressive / Professional Investors

Conservative Investors:

- Allocation: 0.5-1% of total crypto portfolio

- Focus on established assets with higher market capitalization as primary holdings

- ARCH as a minor speculative allocation

Aggressive Investors:

- Allocation: 2-5% of total crypto portfolio

- Willing to accept higher volatility for potential ecosystem growth returns

- Regular rebalancing based on market conditions

Professional Investors:

- Allocation: Variable based on comprehensive market analysis

- Strategic positioning considering developer activity and dApp deployment metrics

- Sophisticated hedging strategies using derivatives (where available)

Risk Hedging Solutions: Multi-asset Portfolio + Risk Mitigation Tools

Effective risk management for ARCH investment may include:

- Diversification: Combining ARCH with other Layer-1 blockchain tokens and established cryptocurrencies

- Position Sizing: Limiting exposure to no more than an investor's predetermined risk tolerance

- Stop-Loss Orders: Setting predetermined exit points to limit potential losses

- Dollar-Cost Averaging (DCA): Systematic investment approach to mitigate timing risk

- Hedging with Stablecoins: Maintaining liquid positions in stablecoins for market downturns

Secure Storage: Hot and Cold Wallets + Hardware Wallet Recommendations

Storage Solutions:

-

Cold Wallets (Recommended for long-term holdings):

- Hardware wallets compatible with Cosmos-based tokens

- Multi-signature wallets for enhanced security

- Paper wallets for maximum offline security

-

Hot Wallets (For active trading):

- Official Archway-compatible wallets

- Reputable multi-chain wallets with Cosmos ecosystem support

- Exchange wallets for short-term trading (with appropriate security measures)

Security Best Practices:

- Enable two-factor authentication (2FA) on all accounts

- Store recovery phrases securely offline

- Regularly update wallet software

- Use separate devices for large holdings

- Conduct test transactions before large transfers

V. ARCH Investment Risks and Challenges (Risks of investing in ARCH)

Market Risk: High Volatility and Price Manipulation

High Volatility: ARCH has demonstrated significant price volatility, with notable movements including:

- All-time high of $0.28899 on December 24, 2023

- All-time low of $0.00197 on February 2, 2026

- Current price represents a 99.32% decline from all-time high

- Short-term fluctuations ranging from -8.67% (7-day) to -10.74% (30-day)

Liquidity Concerns:

- Relatively low 24-hour trading volume ($11,918.10)

- Market capitalization of approximately $1.26 million

- Limited exchange listings (1 exchange reported)

- Potential for significant slippage on larger orders

Market Manipulation Potential: Low trading volumes and limited liquidity may create conditions where:

- Large orders can significantly impact price

- Lower resistance to coordinated trading activities

- Reduced market depth may amplify price swings

Regulatory Risk: Policy Uncertainty Across Different Countries

Jurisdictional Considerations:

- Varying regulatory frameworks for smart contract platforms globally

- Potential classification changes affecting token status

- Evolving tax treatment of staking rewards and developer incentives

- Cross-border transaction monitoring and compliance requirements

Specific Risk Factors:

- Uncertainty regarding securities classification of incentive mechanisms

- Potential regulatory scrutiny of developer reward structures

- Compliance requirements for dApps built on the platform

- International coordination challenges for decentralized networks

Regional Policy Variations: Investors should monitor regulatory developments in key markets that may affect:

- Token trading and exchange access

- Staking and yield generation activities

- Developer incentive program compliance

- Cross-chain interoperability restrictions

Technical Risk: Network Security Vulnerabilities and Upgrade Failures

Smart Contract Platform Risks:

- Potential vulnerabilities in protocol-level smart contracts

- Risks associated with developer incentive mechanism implementation

- Cross-chain bridge security concerns

- Dependency on Cosmos SDK security updates

Network Upgrade Risks:

- Coordination challenges during protocol upgrades

- Potential consensus failures during network transitions

- Risk of chain splits or temporary network disruptions

- Backward compatibility issues affecting existing dApps

Ecosystem Dependencies:

- Reliance on broader Cosmos ecosystem infrastructure

- Integration risks with cross-chain communication protocols

- Third-party validator reliability and security practices

- Oracle dependencies for external data feeds

Developer Adoption Risks:

- Network value tied to developer activity and dApp deployment

- Competition from established smart contract platforms

- Sustainability of developer incentive model

- Technical barriers to entry for new developers

VI. Conclusion: Is ARCH a Good Investment?

Investment Value Summary

ARCH presents a high-risk investment profile with both potential opportunities and significant challenges. The platform's unique developer incentive mechanism and cross-chain capabilities represent innovative approaches to blockchain development. However, current market performance indicates substantial headwinds:

Key Considerations:

- Price has declined 99.32% from all-time high

- Limited liquidity with low trading volumes

- Small market capitalization ($1.26 million) relative to competing platforms

- Token circulation at 64% of total supply suggests moderate distribution

- Fully diluted market cap to current market cap ratio of 64% indicates potential dilution concerns

Long-term investment potential remains uncertain and highly dependent on:

- Successful developer adoption and dApp ecosystem growth

- Sustained execution of the incentive distribution model

- Competitive positioning against established Layer-1 platforms

- Broader market conditions for smart contract platforms

Short-term price volatility remains pronounced, with recent data showing:

- Weekly decline of 8.67%

- Monthly decline of 10.74%

- Annual decline of 89.19%

Investor Recommendations

✅ Beginners:

- Exercise extreme caution given high volatility and limited liquidity

- If considering investment, allocate only a minimal portion of portfolio (< 1%)

- Implement dollar-cost averaging over extended periods

- Prioritize secure storage using hardware wallets

- Focus primarily on more established cryptocurrencies for core holdings

- Thoroughly research the platform's technology and development roadmap

✅ Experienced Investors:

- Consider ARCH only as a highly speculative allocation (2-5% maximum)

- Employ active monitoring of developer activity and ecosystem metrics

- Utilize technical analysis for swing trading opportunities given price volatility

- Implement strict stop-loss orders to manage downside risk

- Diversify across multiple Layer-1 platforms to reduce concentration risk

- Monitor network upgrade schedules and governance proposals

✅ Institutional Investors:

- Conduct comprehensive due diligence on protocol security and tokenomics

- Evaluate strategic fit within broader blockchain infrastructure thesis

- Assess developer incentive model sustainability through quantitative analysis

- Consider position sizing relative to overall exposure to Cosmos ecosystem

- Implement sophisticated risk management including hedging strategies

- Monitor regulatory developments affecting smart contract platforms

⚠️ Disclaimer: Cryptocurrency investment carries high risk, and market conditions can change rapidly. This analysis is provided for informational purposes only and does not constitute investment advice. Past performance does not guarantee future results. Investors should conduct independent research and consult with qualified financial advisors before making investment decisions. The volatility and risk profile of ARCH may not be suitable for all investors.

VII. FAQ

Q1: Is Archway (ARCH) a good investment for beginners in 2026?

For beginners, ARCH is generally not recommended as a primary investment due to its extremely high volatility and limited liquidity. The token has declined 99.32% from its all-time high and currently has a very small market capitalization of approximately $1.26 million with low trading volumes ($11,918.10 per 24 hours). If beginners wish to explore ARCH, they should allocate no more than 1% of their total crypto portfolio, use dollar-cost averaging to mitigate timing risk, and prioritize secure storage using hardware wallets. New investors should focus on more established cryptocurrencies for their core holdings and thoroughly research Archway's technology, developer incentive mechanism, and cross-chain dApp ecosystem before committing any capital.

Q2: What are the main risks associated with investing in ARCH?

ARCH investment carries three primary risk categories: market risk, regulatory risk, and technical risk. Market risk manifests through extreme price volatility (89.19% decline over the past year), low liquidity that can amplify price swings, and potential for market manipulation due to limited trading volume. Regulatory risk stems from uncertain policy frameworks for smart contract platforms globally, potential changes in token classification, and varying compliance requirements across jurisdictions. Technical risks include potential vulnerabilities in protocol-level smart contracts, network upgrade failures, cross-chain bridge security concerns, and ecosystem dependency on developer adoption rates. The combination of these factors creates a high-risk investment profile that requires careful risk management and position sizing.

Q3: How does ARCH's developer incentive mechanism affect its investment potential?

ARCH's unique developer incentive mechanism represents both an opportunity and a risk factor for investment potential. The protocol incorporates built-in rewards that compensate developers based on the value their dApps contribute to the network, which aims to foster sustainable application development and ecosystem growth. This model could theoretically drive long-term adoption if it successfully attracts talented developers and high-quality dApps. However, the effectiveness of this mechanism remains unproven at scale, and the token's investment value is heavily dependent on actual developer adoption rates and dApp deployment success. The sustainability of this reward structure under various market conditions is also uncertain. Investors should monitor network activity metrics, developer engagement levels, and the quality of applications being built on Archway to assess whether the incentive model is delivering on its promise of ecosystem growth.

Q4: What is the realistic price forecast for ARCH by 2031?

Based on current market analysis and various development scenarios, ARCH price forecasts for 2031 range significantly depending on ecosystem adoption and market conditions. Under a base scenario assuming steady progress, ARCH could reach between $0.002400 and $0.003540 by 2031. An optimistic scenario, which assumes accelerated dApp adoption and favorable market conditions, projects a range of $0.003771 to $0.005098, with the predicted high for 2031 at $0.005098. However, these forecasts carry substantial uncertainty due to the token's extreme volatility, small market size, and dependence on developer ecosystem growth. Investors should note that cryptocurrency price predictions are inherently speculative, and actual performance may differ dramatically from these projections. The forecasts assume continued protocol development, successful cross-chain functionality implementation, and no major security incidents or regulatory setbacks.

Q5: How should investors approach asset allocation for ARCH within their crypto portfolio?

Asset allocation for ARCH should be carefully calibrated to individual risk tolerance and investment experience. Conservative investors should limit ARCH exposure to 0.5-1% of their total crypto portfolio, treating it as a minor speculative allocation while maintaining established assets as primary holdings. Aggressive investors with higher risk tolerance might allocate 2-5% of their portfolio to ARCH, accepting greater volatility for potential ecosystem growth returns and implementing regular rebalancing based on market conditions. Professional investors may use variable allocation based on comprehensive market analysis, strategic positioning considering developer activity metrics, and sophisticated hedging strategies. Regardless of investor type, ARCH should never constitute a core portfolio holding due to its high-risk profile, limited liquidity, and uncertain development trajectory.

Q6: What storage solutions are most appropriate for securing ARCH tokens?

For ARCH token security, investors should utilize different storage solutions based on their investment timeframe and trading frequency. Long-term holders should prioritize cold storage solutions, including hardware wallets compatible with Cosmos-based tokens, multi-signature wallets for enhanced security, or paper wallets for maximum offline protection. Active traders requiring frequent access may use hot wallets, such as official Archway-compatible wallets, reputable multi-chain wallets with Cosmos ecosystem support, or exchange wallets with appropriate security measures for short-term trading. Regardless of storage method, investors should implement security best practices including enabling two-factor authentication (2FA) on all accounts, storing recovery phrases securely offline, regularly updating wallet software, using separate devices for large holdings, and conducting test transactions before large transfers to minimize the risk of loss.

Q7: How does ARCH compare to other Layer-1 smart contract platforms as an investment?

ARCH occupies a distinct but challenging position compared to established Layer-1 smart contract platforms. While its developer incentive mechanism and cross-chain capabilities offer theoretical advantages, ARCH currently ranks #2351 by market capitalization with a total market cap of approximately $1.26 million, representing only 0.000082% market dominance. This contrasts sharply with major competitors that have substantially larger ecosystems, liquidity, and institutional adoption. ARCH's limited exchange listings (1 exchange) and low trading volumes indicate early-stage development status. The platform's investment case depends heavily on successful execution of its unique value proposition—rewarding developers based on dApp value contribution—which remains unproven at scale. Investors comparing ARCH to alternatives should consider that established platforms offer significantly lower risk profiles, though potentially more limited upside potential if ARCH achieves breakthrough adoption.

Q8: What key indicators should investors monitor to evaluate ARCH's investment potential over time?

Investors should track several critical metrics to assess ARCH's evolving investment potential. Primary indicators include developer adoption rates and dApp deployment statistics on the Archway network, trading volume trends across exchanges, token circulation changes relative to maximum supply, and the effectiveness of the developer incentive distribution mechanism. Technical indicators to monitor include network upgrade execution success, cross-chain bridge security performance, validator participation rates, and governance proposal activity. Market metrics such as liquidity depth, exchange listing expansion, price volatility patterns, and correlation with broader crypto market movements provide context for investment decisions. Additionally, investors should track regulatory developments affecting smart contract platforms, competitive positioning versus other Cosmos ecosystem projects, and any significant partnership announcements or ecosystem integrations that could impact long-term value.

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Hedera Hashgraph (HBAR): Founders, Technology, and Price Outlook to 2030

Cardano (ADA) Price Prediction 2025 & 2030 – Is ADA Set to Soar?

2025 SUI coin: price, buying guide, and Staking rewards

Cardano (ADA): A History, Tech Overview, and Price Outlook

Jasmy Coin: A Japanese Crypto Tale of Ambition, Hype, and Hope

Comprehensive Guide to Blockchain-Agnostic Protocols

Comprehensive Guide to Cryptocurrency Trading Platform Registration Bonuses

Isamu Kaneko’s Connection to Bitcoin | The P2P Philosophy Legacy of the Winny Developer

Free Money for Registration in App: Crypto Bonus Guide

How to Create and Profitably Sell NFTs: The Complete Guide