Is GensoKishi Metaverse (MV) a good investment?: A Comprehensive Analysis of Risks, Opportunities, and Potential Returns in the Gaming Metaverse Sector

Introduction: GensoKishi Metaverse (MV) Investment Position and Market Outlook

GensoKishi Metaverse (MV) represents a significant asset within the GameFi sector of the cryptocurrency market. Launched in January 2022, the project has established itself as a blockchain-based iteration of the Element Knights MMORPG game, which has accumulated over 8 million downloads across Nintendo Switch and PS4 platforms over 13 years. As of February 2, 2026, MV maintains a market capitalization of approximately $1.42 million, with a circulating supply of around 380.67 million tokens, and a current price around $0.003735. With its positioning as a governance token within a functional 3D metaverse that connects players across smartphones, PCs, and gaming consoles, MV has become a focal point when investors discuss "Is GensoKishi Metaverse (MV) a good investment?" This article provides a comprehensive analysis of MV's investment value, historical price movements, future price projections, and associated investment risks to serve as a reference for investors.

The token operates within the GameFi ecosystem, enabling holders to participate in governance decisions, craft or enhance in-game items, and earn the in-game currency ROND. Players can create, acquire, and trade game items as NFTs, including character cosmetics, equipment, land properties, and monster-related items. With 12,789 token holders and trading availability on 3 exchanges, MV demonstrates established infrastructure within the blockchain gaming space. The project's foundation on a game with over a decade of operational history provides a unique backdrop for evaluating its position in the evolving metaverse and play-to-earn gaming sectors.

I. Price History and Current Investment Status of MV

Historical Price Trends and Investment Performance of GensoKishi Metaverse (MV)

GensoKishi Metaverse (MV) has experienced notable price fluctuations since its launch. The token reached a price level of $1.66 on February 9, 2022, representing a period of elevated market interest. Subsequently, the token entered a downward trajectory, with prices declining to $0.00252092 on December 4, 2025, reflecting broader market adjustments and evolving demand dynamics.

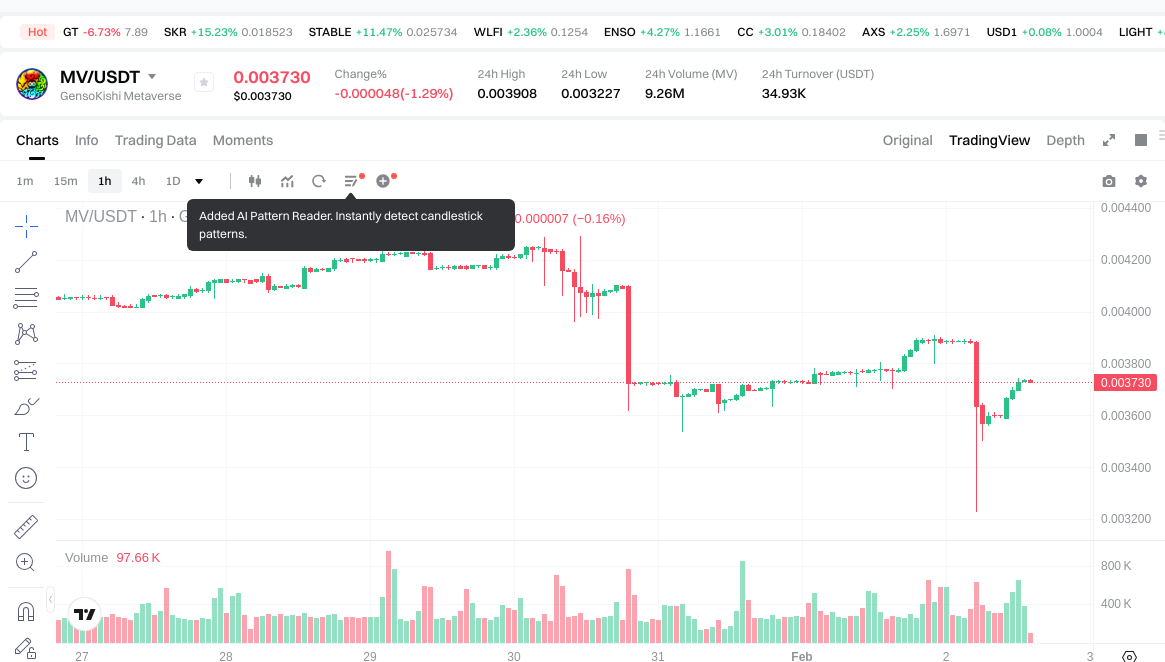

As of February 2, 2026, MV is trading at $0.003735, showing a 24-hour decline of 0.9%. Over different timeframes, the token has recorded a 1-hour change of +0.08%, a 7-day decline of 7.31%, a 30-day decrease of 26.24%, and a 1-year decline of 64.14%. These movements indicate sustained downward pressure on the token's valuation over extended periods.

Current MV Investment Market Status (February 2026)

- Current MV Price: $0.003735

- 24-hour Trading Volume: $34,919.29

- Market Capitalization: Approximately $1.42 million

- Circulating Supply: 380,665,226.68 MV tokens (19.03% of total supply)

- Total Supply: 400,000,000 MV tokens

- Maximum Supply: 2,000,000,000 MV tokens

- Holder Count: 12,789 addresses

- 24-hour Price Range: High $0.003908, Low $0.003227

Click to view real-time MV market price

II. Core Factors Influencing Whether MV is a Good Investment

Supply Mechanism and Scarcity (MV Investment Scarcity)

- Total Supply and Circulation: GensoKishi Metaverse (MV) has a total supply of 400,000,000 tokens, with a maximum supply cap of 2,000,000,000 tokens. As of February 2, 2026, the circulating supply stands at approximately 380,665,226 tokens, representing about 19.03% of the total supply. This relatively low circulation ratio may suggest potential supply expansion in the future, which could impact scarcity considerations.

- Supply Distribution Impact: The current market cap to fully diluted valuation ratio of 19.03% indicates that a significant portion of tokens remains unreleased. Future token releases could influence price dynamics and investment value assessments.

- Investment Significance: The token's scarcity profile, characterized by gradual supply distribution, represents a factor for long-term investment consideration, though the large maximum supply ceiling may moderate scarcity-driven price appreciation potential.

Institutional Investment and Mainstream Adoption (Institutional Investment in MV)

- Holder Distribution: As of the latest data, GensoKishi Metaverse has approximately 12,789 token holders, indicating a relatively modest community base compared to larger cryptocurrency projects.

- Exchange Presence: MV is listed on 3 exchanges, with trading activity recorded on platforms including Gate.com. The limited exchange availability may affect liquidity and institutional access.

- Adoption Indicators: The project positions itself as a GameFi initiative connected to the established "Elemental Knights" MMORPG, which has accumulated 8 million downloads over 13 years. This existing user base represents potential adoption pathways for the token ecosystem.

Macroeconomic Environment's Impact on MV Investment

- Market Position: With a market dominance of 0.000056% and a ranking of 2268, GensoKishi Metaverse represents a micro-cap cryptocurrency investment, which typically exhibits higher sensitivity to broader market conditions and risk sentiment.

- Price Performance Context: The token has experienced significant volatility, with a 1-year decline of approximately 64.14% and a 30-day decline of 26.24% as of February 2, 2026. Such price movements often correlate with broader cryptocurrency market trends and macroeconomic factors affecting risk assets.

- Risk Asset Correlation: As a small-cap GameFi token, MV's investment performance may be influenced by factors including monetary policy shifts, liquidity conditions in cryptocurrency markets, and investor risk appetite for emerging digital asset categories.

Technology and Ecosystem Development (Technology & Ecosystem for MV Investment)

- Platform Foundation: GensoKishi Metaverse operates as a GameFi version of the "Elemental Knights" game, offering a 3D MMORPG metaverse experience across multiple platforms including smartphones, PCs, and gaming consoles.

- NFT Integration: The ecosystem allows players to create, acquire, and trade in-game items as NFTs, including character customizations, equipment, land properties, and monster items. This NFT functionality represents a core component of the project's value proposition.

- Token Utility: MV serves as the governance token within the ecosystem, providing holders with various rights including participation in game policy design, crafting or enhancing certain in-game items, and earning the in-game currency ROND.

- Blockchain Infrastructure: The project operates on the Polygon (MATIC) network, with the contract address verified on Polygonscan, positioning it within the Polygon ecosystem's scalability and cost-efficiency framework.

- Ecosystem Maturity: With a 13-year history of the underlying game and integration of blockchain functionality, the project demonstrates established user engagement, though the relatively recent tokenization (published in January 2022) means the crypto-economic model has a shorter track record for investment evaluation.

III. MV Future Investment Forecast and Price Outlook (Is GensoKishi Metaverse(MV) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term MV investment outlook)

- Conservative forecast: $0.0020548 - $0.003736

- Neutral forecast: $0.003736

- Optimistic forecast: $0.003736 - $0.00388544

Mid-term Investment Outlook (2027-2028, mid-term GensoKishi Metaverse(MV) investment forecast)

- Market stage expectation: Potential entry into a new growth phase driven by ecosystem expansion and technological innovation

- Investment return forecast:

- 2027: $0.00385 - $0.00465

- 2028: $0.00381 - $0.00593

- Key catalysts: Ecosystem expansion and technological innovation

Long-term Investment Outlook (Is MV a good long-term investment?)

- Baseline scenario: $0.002476968 - $0.0056779728 (assuming steady progress and gradual mainstream adoption)

- Optimistic scenario: $0.005397362745625 - $0.009328775115895 (assuming large-scale adoption and favorable market conditions)

- Risk scenario: $0.0020548 - $0.002467060128 (under extreme adverse conditions)

Click to view MV long-term investment and price forecast: Price Prediction

2026-02-02 - 2031 Long-term Outlook

- Baseline scenario: $0.002476968 - $0.007532551335816 (corresponding to steady progress and gradual mainstream application improvement)

- Optimistic scenario: $0.005397362745625 - $0.009328775115895 (corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $0.009328775115895 (in case of breakthrough progress in the ecosystem and mainstream popularization)

- 2031-12-31 predicted high: $0.009328775115895 (based on optimistic development assumptions)

Disclaimer: The above forecasts are for reference only and do not constitute investment advice. Cryptocurrency markets are highly volatile, and actual prices may differ materially from predictions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00388544 | 0.003736 | 0.0020548 | 0 |

| 2027 | 0.0056779728 | 0.00381072 | 0.002476968 | 2 |

| 2028 | 0.005076450648 | 0.0047443464 | 0.002467060128 | 27 |

| 2029 | 0.00667814199264 | 0.004910398524 | 0.0027007191882 | 31 |

| 2030 | 0.007532551335816 | 0.00579427025832 | 0.003070963236909 | 55 |

| 2031 | 0.009328775115895 | 0.006663410797068 | 0.005397362745625 | 78 |

IV. MV Investment Strategy and Risk Management (How to invest in GensoKishi Metaverse)

Investment Methodology (MV investment strategy)

Long-term Holding (HODL MV)

For conservative investors seeking exposure to the GameFi sector, a long-term holding strategy may be considered. This approach involves acquiring MV tokens and maintaining positions through market cycles, focusing on the project's fundamental development rather than short-term price movements. Given MV's role as a governance token within the GensoKishi ecosystem, holders may benefit from potential ecosystem growth and expanded utility over time.

Active Trading

Traders employing technical analysis may consider swing trading strategies based on MV's price patterns. With a 24-hour trading volume of approximately $34,919 and observable price fluctuations (24-hour high: $0.003908, 24-hour low: $0.003227), there may be opportunities for short-term positions. However, the relatively modest trading volume suggests lower liquidity compared to major cryptocurrencies, which could impact execution and slippage.

Risk Management (Risk management for MV investment)

Asset Allocation Ratios

- Conservative Investors: Consider limiting MV exposure to 1-3% of total crypto portfolio, with majority allocation to established assets

- Moderate Investors: May allocate 3-7% to GameFi tokens including MV, balanced with mainstream cryptocurrencies

- Aggressive Investors: Could consider 7-15% allocation to emerging GameFi projects, acknowledging higher risk tolerance

Risk Hedging Approaches

Diversification across multiple asset classes and cryptocurrencies can help mitigate concentration risk. Investors might consider:

- Maintaining positions in both established cryptocurrencies and emerging GameFi tokens

- Balancing exposure across different blockchain ecosystems

- Periodic rebalancing based on performance and risk assessment

Secure Storage

- Hot Wallets: Suitable for active trading amounts, such as MetaMask for Polygon network compatibility

- Cold Storage: Hardware wallets like Ledger or Trezor recommended for long-term holdings

- Best Practice: Store majority of holdings offline, maintaining only trading amounts in exchange or hot wallets

V. MV Investment Risks and Challenges (Risks of investing in GensoKishi Metaverse)

Market Risks

- Price Volatility: MV has experienced significant price fluctuations, with a 1-year decline of 64.14% and 30-day decrease of 26.24%. The token reached a peak of $1.66 in February 2022 but traded at $0.003735 as of February 2, 2026

- Liquidity Concerns: With a daily trading volume of approximately $34,919 and availability on 3 exchanges, liquidity may be limited compared to major cryptocurrencies, potentially affecting trade execution

- Market Capitalization: The relatively modest market cap of approximately $1.42 million and ranking of 2,268 indicates a smaller-scale project with potentially higher price sensitivity

Regulatory Risks

- Jurisdictional Uncertainty: GameFi projects face evolving regulatory frameworks across different countries, particularly regarding NFT classification and gaming token regulations

- Compliance Requirements: Changes in cryptocurrency regulations in Japan or other jurisdictions could impact the project's operations and token utility

- NFT and Gaming Regulations: Emerging policies specific to blockchain gaming and NFT marketplaces may affect the ecosystem's functionality

Technical Risks

- Smart Contract Vulnerabilities: The MV token operates on the Polygon network (contract address: 0xa3c322ad15218fbfaed26ba7f616249f7705d945), and any smart contract vulnerabilities could pose security concerns

- Network Dependencies: The project's reliance on Polygon infrastructure means network-related issues could affect token functionality

- Platform Development Risk: The success of MV is closely tied to the GensoKishi game's development and user adoption, creating project-specific technical dependencies

Additional Considerations

- Token Economics: With a circulating supply of approximately 380.67 million tokens (19.03% of total supply), a total supply of 400 million, and a maximum supply of 2 billion, future token releases could impact supply dynamics

- Competition: The GameFi sector faces intense competition from numerous projects, which may affect market positioning

- Holder Base: Approximately 12,789 holders suggests a relatively concentrated holder distribution

VI. Conclusion: Is GensoKishi Metaverse a Good Investment?

Investment Value Summary

MV represents exposure to the GameFi sector through a project with a 13-year legacy in traditional gaming. The token serves governance functions and enables NFT creation within the GensoKishi ecosystem. However, price performance has shown considerable volatility, with substantial declines over various time periods. The project's relatively modest market presence and trading volume indicate it remains an emerging asset within the broader cryptocurrency market.

Investor Recommendations

✅ Beginners:

- Consider dollar-cost averaging with small allocations

- Prioritize secure wallet storage using hardware wallets

- Thoroughly research GameFi mechanics before investing

- Start with minimal position sizing to understand market dynamics

✅ Experienced Investors:

- May employ swing trading strategies based on technical analysis

- Consider portfolio diversification across multiple GameFi projects

- Monitor game development updates and user adoption metrics

- Implement strict position sizing and stop-loss disciplines

✅ Institutional Investors:

- Conduct comprehensive due diligence on project fundamentals

- Assess liquidity constraints for larger position sizes

- Consider strategic allocation as part of broader GameFi sector exposure

- Evaluate long-term ecosystem development roadmap

⚠️ Important Notice: Cryptocurrency investments carry substantial risk, including potential total loss of capital. Price volatility in crypto assets can be extreme, and past performance does not indicate future results. This content is for informational purposes only and does not constitute financial, investment, or trading advice. Investors should conduct independent research, assess their risk tolerance, and consult qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What is GensoKishi Metaverse (MV) and what makes it different from other GameFi tokens?

GensoKishi Metaverse (MV) is a governance token for a blockchain-based 3D MMORPG metaverse built on the Polygon network, distinguished by its foundation on the 13-year-old "Elemental Knights" game with over 8 million downloads across Nintendo Switch and PS4 platforms. Unlike many new GameFi projects, MV leverages an established gaming community and proven game mechanics, while enabling players to create, trade, and own in-game items as NFTs, including character cosmetics, equipment, land properties, and monster items. The token provides governance rights, allows holders to craft or enhance in-game items, and earn the in-game currency ROND, connecting players across smartphones, PCs, and gaming consoles in a cross-platform metaverse experience.

Q2: What has been the price performance of MV since its launch?

MV has experienced significant volatility since launching in January 2022, reaching a peak of $1.66 in February 2022 before entering a prolonged downward trajectory. As of February 2, 2026, the token trades at $0.003735, representing a 64.14% decline over one year, a 26.24% decrease over 30 days, and a 7.31% drop over seven days. The token hit a low of $0.00252092 on December 4, 2025, reflecting broader market adjustments and evolving demand dynamics. With a 24-hour trading volume of approximately $34,919 and a market capitalization of roughly $1.42 million, MV demonstrates characteristics of a micro-cap cryptocurrency with higher price sensitivity to market conditions.

Q3: What are the key risks associated with investing in MV?

MV investment carries multiple risk categories: market risks include extreme price volatility (64.14% annual decline), limited liquidity with only $34,919 daily trading volume across 3 exchanges, and a small market cap of $1.42 million at rank 2,268. Technical risks involve smart contract vulnerabilities on the Polygon network, dependency on network infrastructure, and development risks tied to the GensoKishi game's adoption. Regulatory risks include evolving GameFi and NFT regulations across jurisdictions, particularly in Japan. Additionally, token economics present supply concerns, with only 19.03% of total supply circulating and a maximum supply of 2 billion tokens potentially impacting future scarcity, while competition from numerous GameFi projects and a relatively concentrated holder base of 12,789 addresses add further considerations.

Q4: What are the price predictions for MV through 2031?

Short-term forecasts for 2026 range from a conservative $0.0020548-$0.003736 to an optimistic $0.003736-$0.00388544. Mid-term projections suggest 2027 prices between $0.00385-$0.00465 and 2028 prices of $0.00381-$0.00593, driven by potential ecosystem expansion. Long-term baseline scenarios predict $0.002476968-$0.007532551335816 by 2031 assuming steady progress, while optimistic scenarios forecast $0.005397362745625-$0.009328775115895 under favorable conditions with large-scale adoption. The predicted 2031 high of $0.009328775115895 assumes breakthrough ecosystem development and mainstream popularization. However, these forecasts carry significant uncertainty given cryptocurrency market volatility, and a risk scenario projects prices could remain as low as $0.0020548-$0.002467060128 under adverse conditions.

Q5: How should different types of investors approach MV investment?

Conservative investors should limit MV exposure to 1-3% of their crypto portfolio, prioritizing established assets and employing dollar-cost averaging strategies while using hardware wallets for secure storage. Moderate investors may allocate 3-7% to GameFi tokens including MV, balanced with mainstream cryptocurrencies and periodic rebalancing based on performance assessments. Aggressive investors could consider 7-15% allocation, acknowledging higher risk tolerance, and may employ swing trading strategies based on technical analysis given the token's price fluctuations between $0.003227-$0.003908 daily. Institutional investors should conduct comprehensive due diligence, assess liquidity constraints for larger positions, and evaluate long-term ecosystem development roadmaps. All investor types should maintain only trading amounts in hot wallets, store majority holdings in cold storage, and implement strict risk management including diversification across multiple blockchain ecosystems.

Q6: What utility does the MV token provide within the GensoKishi ecosystem?

MV functions as the primary governance token enabling holders to participate in game policy design and decision-making processes within the GensoKishi metaverse. Token holders can craft or enhance specific in-game items, providing functional utility beyond governance rights. The token facilitates earning ROND, the in-game currency used for various transactions and activities. Players can create, acquire, and trade diverse in-game assets as NFTs including character cosmetics, equipment, land properties, and monster-related items, with MV serving as a key component in these economic activities. Operating on the Polygon network (contract address: 0xa3c322ad15218fbfaed26ba7f616249f7705d945), the token benefits from the network's scalability and cost-efficiency, while its integration across multiple platforms including smartphones, PCs, and gaming consoles creates cross-platform utility for the gaming community.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

What is QuarkChain QKC price today with $25.39M market cap and $545K 24-hour trading volume

Jupiter Integrates Built-In Polymarket Predictions: Powering a New Era of Decentralized Prediction Markets

Is HashPack (PACK) a good investment?: A Comprehensive Analysis of Token Fundamentals, Market Potential, and Risk Factors for 2024

Is The Game Company (GMRT) a good investment?: A Comprehensive Analysis of Financial Performance, Market Position, and Future Growth Potential

Ethereum Co-Founder Vitalik on the Creator Token Dilemma: Why Non-Tokenized DAOs Are the Key