Is Global Entertainment Token (GET) a good investment?: A Comprehensive Analysis of Tokenomics, Market Performance, and Future Growth Potential

Introduction: Global Entertainment Token (GET) Investment Position and Market Outlook

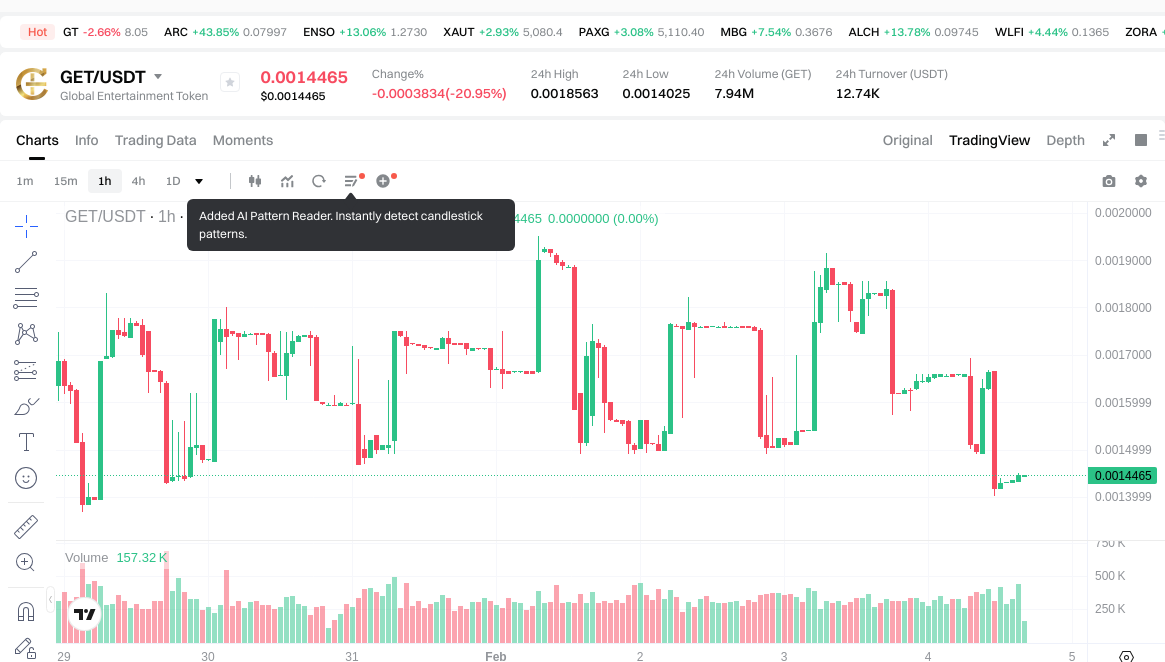

Global Entertainment Token (GET) is a native token issued on the Cardano chain, positioned as a potential common currency for the global entertainment industry. As of February 04, 2026, GET holds a market ranking of 2,751 with a market capitalization of approximately $721,750. The token maintains a current price of $0.0014435, with a circulating supply of 500,000,000 tokens out of a maximum supply of 10,000,000,000. Its 24-hour trading volume stands at $12,714.46, representing a market dominance of 0.00053%. The project aims to facilitate collaboration among companies, artists, and creators within its ecosystem, while enabling users and fans to access content, provide direct support, and participate in decision-making processes for projects they support. With recent price movements showing a 0.89% increase over 1 hour, a decline of 20.79% over 24 hours, and a 9.19% gain over 30 days, GET presents a complex picture for those considering "Is Global Entertainment Token (GET) a good investment?" This article provides a comprehensive analysis of GET's investment value, historical performance, future price projections, and associated investment risks to assist potential investors in making informed decisions.

I. Global Entertainment Token (GET) Price History Review and Current Investment Value

GET Historical Price Performance and Investment Returns (Global Entertainment Token (GET) Investment Performance)

- May 2025: Reached peak price of $0.0336 → Notable price appreciation for early holders

- October 2025: Price declined to $0.000695 → Significant volatility observed during market adjustment

- January 2026 to February 2026: Trading range between $0.0014025 and $0.0018563 → Price consolidation phase with moderate fluctuations

Current GET Investment Market Status (February 2026)

- GET current price: $0.0014435

- 24-hour trading volume: $12,714.46

- Price changes: 1H (+0.89%), 24H (-20.79%), 7D (-22.13%), 30D (+9.19%)

- Market capitalization: $721,750

- Circulating supply: 500,000,000 GET (5% of max supply)

Click to view real-time GET market price

II. Core Factors Influencing Whether GET is a Good Investment

Supply Mechanism and Scarcity (GET Investment Scarcity)

- Supply Distribution Impact → Price and Investment Value Considerations: GET has a maximum supply of 10,000,000,000 tokens, with a current circulating supply of 500,000,000 tokens, representing a 5% circulation ratio. The relatively low circulating supply compared to maximum supply indicates potential future token releases that could affect scarcity dynamics.

- Historical Supply Context: GET reached a trading price of $0.0336 on May 14, 2025, while its lowest recorded price was $0.0005705 on December 5, 2025, demonstrating price volatility influenced by supply and demand dynamics.

- Investment Significance: The current market capitalization stands at $721,750 with a fully diluted valuation of $14,435,000, indicating a substantial gap between current and potential maximum valuation that investors should consider when evaluating scarcity-based investment potential.

Institutional Investment and Mainstream Adoption (Institutional Investment in GET)

- Exchange Availability: GET is currently listed on one exchange, with Gate being the most active trading venue where the GET/USDT pair has recorded a 24-hour trading volume of $12,714.46.

- Market Context for Entertainment Tokenization: According to industry forecasts, tokenized assets could reach $400 billion by the end of 2026, up from $36 billion in early 2026, suggesting growing institutional interest in blockchain-based asset tokenization within which entertainment tokens like GET operate.

- Adoption Framework: GET aims to serve as a universal currency for the global entertainment industry, enabling companies, artists, and creators within its ecosystem to collaborate on its platform, though specific institutional partnerships were not detailed in available materials.

Macroeconomic Environment Impact on GET Investment

- Digital Asset Market Trends: The broader cryptocurrency market in 2026 is experiencing increased institutional adoption and regulatory clarity, which may influence investor sentiment toward smaller-cap tokens like GET.

- Market Positioning: GET holds a market dominance of 0.00053%, ranking at position 2751, positioning it as a micro-cap asset within the entertainment tokenization sector.

- Industry Developments: Real-world asset tokenization is shifting from experimental pilots to active global markets in 2026, with major exchanges like NYSE and Nasdaq proposing blockchain-based trading frameworks, potentially creating favorable conditions for entertainment-focused tokens.

Technology and Ecosystem Development (Technology & Ecosystem for GET Investment)

- Blockchain Infrastructure: GET is issued as a native token on the Cardano chain, utilizing Cardano's blockchain infrastructure for its operations.

- Ecosystem Functionality: The token is designed to allow users and fans to access content, directly support creators, and participate in decision-making processes for projects and creators they support through GET.

- Entertainment Tokenization Applications: According to industry analysis, entertainment tokenization in 2026 enables real-world revenue streams such as streaming and licensing to be tracked and linked with tokens, providing utility-based value propositions for tokens in this sector.

III. GET Future Investment Forecast and Price Outlook (Is Global Entertainment Token(GET) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term GET investment outlook)

- Conservative forecast: $0.00127292 - $0.0014465

- Neutral forecast: $0.0014465 - $0.001515

- Optimistic forecast: $0.001515 - $0.001750265

Mid-term Investment Outlook (2027-2029, mid-term Global Entertainment Token(GET) investment forecast)

-

Market stage expectation: The mid-term period may see gradual price adjustments as the token seeks broader adoption within the global entertainment ecosystem. Price movements could reflect increased collaboration among companies, artists, and creators on the platform.

-

Investment return forecast:

- 2027: $0.0010869001 - $0.00169428545 (approximately 10% annual change)

- 2028: $0.00087255700675 - $0.00182743071225 (approximately 14% annual change)

- 2029: $0.001094235876483 - $0.00180635763737 (approximately 20% annual change)

-

Key catalysts: Potential factors include platform expansion, increased user engagement, strategic partnerships within the entertainment industry, and broader acceptance of GET as a utility token for content access and creator support.

Long-term Investment Outlook (Is GET a good long-term investment?)

- Baseline scenario: $0.001188757013623 - $0.002161376388407 (assuming steady ecosystem growth and moderate adoption rates)

- Optimistic scenario: $0.002161376388407 - $0.00313399576319 (assuming accelerated adoption, successful platform integrations, and favorable market conditions)

- Risk scenario: Below $0.001188757013623 (in cases of limited adoption, intensified competition, or adverse regulatory developments)

For more details on GET long-term investment and price forecast: Price Prediction

2026-2031 Long-term Outlook

- Baseline scenario: $0.00127292 - $0.002161376388407 (corresponding to steady progress and gradual mainstream application growth)

- Optimistic scenario: $0.002161376388407 - $0.00313399576319 (corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $0.00313399576319 (subject to breakthrough ecosystem developments and mainstream penetration)

- 2031-12-31 forecasted high: $0.00313399576319 (based on optimistic development assumptions)

Disclaimer: Price forecasts are for informational purposes only and do not constitute investment advice. Actual market performance may vary significantly due to numerous factors including market volatility, regulatory changes, and technological developments.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.001750265 | 0.0014465 | 0.00127292 | 0 |

| 2027 | 0.00169428545 | 0.0015983825 | 0.0010869001 | 10 |

| 2028 | 0.00182743071225 | 0.001646333975 | 0.00087255700675 | 14 |

| 2029 | 0.00180635763737 | 0.001736882343625 | 0.001094235876483 | 20 |

| 2030 | 0.002551132786316 | 0.001771619990497 | 0.001381863592588 | 22 |

| 2031 | 0.00313399576319 | 0.002161376388407 | 0.001188757013623 | 49 |

IV. GET Investment Strategy and Risk Management (How to invest in GET)

Investment Methodology (GET investment strategy)

Holding Strategy (HODL GET)

For conservative investors seeking long-term exposure to the entertainment token sector, a holding strategy may be considered. This approach involves purchasing GET and maintaining positions over extended periods, potentially benefiting from the project's development within the Cardano ecosystem and adoption in the entertainment industry.

Active Trading Strategy

Active traders may consider technical analysis-based approaches, utilizing price movements and market indicators. Given GET's 24-hour trading volume of approximately $12,714, market participants should note the liquidity considerations when implementing short-term trading strategies.

Risk Management (Risk management for GET investment)

Asset Allocation Considerations

- Conservative approach: Limiting exposure to a small percentage of overall portfolio

- Moderate approach: Balanced allocation within broader cryptocurrency holdings

- Aggressive approach: Higher allocation for experienced traders with appropriate risk tolerance

Risk Mitigation Strategies

Investors may consider diversification across multiple digital assets and traditional hedging instruments. Portfolio construction should account for GET's volatility characteristics and limited exchange availability.

Secure Storage Solutions

- Cold storage: Hardware wallets supporting Cardano native tokens

- Hot wallets: Software wallets with multi-signature capabilities

- Exchange custody: Consideration of security features and insurance coverage

V. GET Investment Risks and Challenges (Risks of investing in GET)

Market Risks

GET exhibits notable price volatility, with recent data showing a 24-hour price fluctuation ranging from $0.0014025 to $0.0018563, representing approximately 32% variance. The relatively modest 24-hour trading volume may contribute to price sensitivity during periods of increased buying or selling activity.

Regulatory Considerations

The regulatory landscape for entertainment-focused tokens varies across jurisdictions. Market participants should monitor regulatory developments in regions where they operate, as policy changes could impact token utility and accessibility.

Technical Considerations

As a Cardano-based native token, GET's functionality depends on the underlying blockchain infrastructure. Considerations include network security, smart contract vulnerabilities, and potential protocol upgrades that could affect token operations.

Liquidity Constraints

With listing on a single exchange platform, liquidity considerations may affect execution for larger transaction sizes. Market participants should evaluate order book depth and potential slippage when planning trading activities.

VI. Conclusion: Is GET a Good Investment?

Investment Value Assessment

GET represents a specialized token targeting the entertainment industry ecosystem within the Cardano blockchain. The project's utility focuses on facilitating collaboration among companies, artists, and creators, while providing fans access to content and decision-making participation.

Market data indicates a circulating supply of 500 million tokens (5% of total supply), with a fully diluted market capitalization of approximately $14.44 million. The token has experienced price movements typical of smaller-cap digital assets.

Considerations for Different Investor Profiles

✅ Newer market participants: Consider systematic accumulation approaches combined with secure storage solutions

✅ Experienced traders: Evaluate technical patterns and market dynamics for potential trading opportunities

✅ Institutional participants: Assess alignment with portfolio objectives and risk parameters

⚠️ Important Notice: Cryptocurrency investments carry substantial risk due to market volatility, regulatory uncertainty, and technological factors. This content is provided for informational purposes only and does not constitute investment advice. Market participants should conduct independent research and consult qualified financial professionals before making investment decisions.

VII. FAQ

Q1: What is the current market position of Global Entertainment Token (GET)?

GET currently ranks at position 2,751 with a market capitalization of approximately $721,750 and a fully diluted valuation of $14,435,000. The token maintains a price of $0.0014435 as of February 2026, with a circulating supply of 500,000,000 tokens representing just 5% of its maximum supply of 10,000,000,000. With a 24-hour trading volume of $12,714.46 and market dominance of 0.00053%, GET operates as a micro-cap asset within the entertainment tokenization sector, indicating limited but developing market presence.

Q2: How volatile has GET's price been historically?

GET has experienced significant price volatility since its market debut. The token reached its peak price of $0.0336 in May 2025, subsequently declining to a low of $0.0005705 in December 2025—representing a decline of approximately 98% from peak to trough. Recent 24-hour price fluctuations have ranged from $0.0014025 to $0.0018563, demonstrating approximately 32% variance. Short-term performance shows mixed signals with a 1-hour gain of 0.89%, a 24-hour decline of 20.79%, and a 30-day gain of 9.19%, reflecting the characteristic volatility of smaller-cap digital assets.

Q3: What is the primary use case for Global Entertainment Token?

GET is designed to serve as a universal currency for the global entertainment industry ecosystem. The token enables collaboration among companies, artists, and creators on the Cardano blockchain platform. For users and fans, GET provides access to content, enables direct financial support to creators, and facilitates participation in decision-making processes for projects they support. This utility-focused approach positions GET as an infrastructure token for entertainment industry transactions rather than purely speculative asset, though practical adoption metrics were not extensively detailed in available materials.

Q4: Which exchanges currently support GET trading?

GET is currently listed on one exchange platform, with Gate serving as the most active trading venue. The GET/USDT trading pair on Gate has recorded a 24-hour trading volume of $12,714.46. This limited exchange availability presents liquidity considerations for investors, particularly those executing larger transactions. Market participants should evaluate order book depth and potential slippage when planning trading activities, as single-exchange listing may contribute to price sensitivity during periods of increased buying or selling pressure.

Q5: What are the projected price ranges for GET through 2031?

Conservative projections suggest GET may trade between $0.00127292 and $0.001750265 in the short term through 2026. Mid-term forecasts for 2027-2029 project ranges from approximately $0.00087 to $0.00183, reflecting potential ecosystem development and adoption patterns. Long-term baseline scenarios for 2031 suggest prices between $0.001189 and $0.002161, while optimistic scenarios project potential highs reaching $0.00313 by year-end 2031. These forecasts assume varying degrees of platform expansion, user engagement growth, and favorable market conditions, though actual performance may differ significantly due to market volatility and technological developments.

Q6: What risks should investors consider when evaluating GET?

Several key risks characterize GET investment considerations. Market risks include substantial price volatility, with recent periods showing up to 32% daily fluctuations, and limited liquidity due to single-exchange availability. Technical risks involve dependency on Cardano blockchain infrastructure, including network security and potential protocol upgrades. The token's 5% circulating supply ratio indicates potential future releases that could affect scarcity dynamics. Regulatory uncertainties surrounding entertainment-focused tokens across different jurisdictions present additional considerations. The project's micro-cap status with $721,750 market capitalization suggests heightened sensitivity to market movements compared to larger digital assets.

Q7: How does GET's supply mechanism impact its investment potential?

GET maintains a maximum supply of 10,000,000,000 tokens with current circulation of 500,000,000 (5%), creating a substantial gap between circulating and maximum supply. This supply structure indicates potential future token releases that could influence scarcity dynamics and price performance. The current market capitalization of $721,750 contrasts with a fully diluted valuation of $14,435,000, representing approximately 20x difference that investors should consider when evaluating long-term valuation potential. Historical price movements from $0.0336 peak to $0.0005705 low demonstrate how supply-demand dynamics have materially impacted token valuation during different market conditions.

Q8: What storage options are available for securing GET tokens?

As a Cardano native token, GET can be stored using various security solutions. Cold storage options include hardware wallets that support Cardano native tokens, providing offline security for long-term holdings. Hot wallet alternatives comprise software wallets with multi-signature capabilities for more frequent access needs. Exchange custody through Gate platform offers convenience for active traders, though investors should evaluate the security features and insurance coverage provided. The choice among storage solutions should reflect individual risk tolerance, transaction frequency requirements, and technical expertise in managing cryptocurrency wallets.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What is NEAR Protocol's current market cap and 24-hour trading volume in 2026?

How active is the Chiliz community and what is the size of its DApp ecosystem?

What are the key derivatives market signals showing about funding rates, open interest, and liquidation data in 2026?

How to Use Technical Indicators (MACD, RSI, KDJ) to Predict Crypto Price Movements in 2026

What is Euler (EUL) DeFi Super App: Whitepaper logic, use cases, and technical innovations explained