Is HARDProtocol (HARD) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Viability in 2024

Introduction: HARD Protocol (HARD) Investment Position and Market Outlook

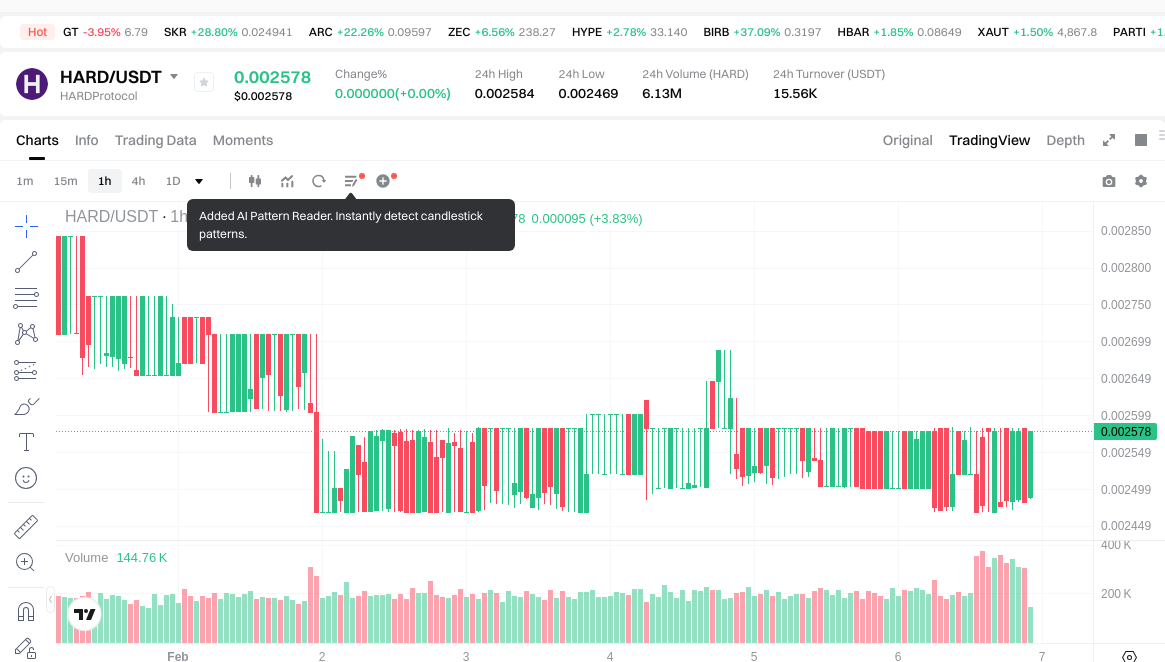

HARD is a notable asset in the cryptocurrency space, having been launched in October 2020 as the native governance token of HARD Protocol, a decentralized money market built on Kava that enables cross-chain asset lending and borrowing. As of February 6, 2026, HARD maintains a market capitalization of approximately $347,492, with a circulating supply of 134,791,668 tokens, and trades at around $0.002578. With its positioning as a governance and liquidity mining reward token within the DeFi ecosystem, HARD has become a subject of interest when investors discuss "Is HARD Protocol (HARD) a good investment?" This article provides a comprehensive analysis of HARD's investment characteristics, historical price movements, future price considerations, and associated risks to serve as a reference for market participants.

The token's utility framework encompasses liquidity mining incentives for platform users engaging in lending and borrowing activities, alongside governance voting rights that enable holders to participate in protocol decision-making. HARD Protocol initially supported deposits of BTC, XRP, BNB, BUSD, and USDX, with plans to expand over-collateralized lending services. The token distribution includes a vesting mechanism where longer lock-up periods result in greater token rewards, with specific parameters subject to governance modifications. Operating within the Kava ecosystem, HARD represents a component of the broader cross-chain DeFi infrastructure development.

From a market performance perspective, HARD has experienced significant price fluctuations since its launch at $0.85. The token reached a notable price level of $2.97 in March 2021, while recording $0.00206758 in September 2025. Recent price trends show a 0.24% change over 1 hour, a decline of 3.49% over 24 hours, 12.49% over 7 days, 24.12% over 30 days, and 97.61% over the past year. With a total supply capped at 200,000,000 tokens and current circulation representing approximately 67.4% of this maximum, the token maintains a fully diluted market cap of $515,600. The 24-hour trading volume stands at $15,500.88, with the asset currently ranking at position 3356 and holding a market share of 0.000021%.

I. HARD Price History Review and Current Investment Value

HARD Historical Price Trends and Investment Performance (HARDProtocol(HARD) investment performance)

- 2021: HARD reached a notable price level of 2.97 USD on March 17, 2021 → Early investors experienced significant gains during this period

- 2025: Market conditions led to considerable price adjustments → HARD price declined to 0.00206758 USD in September 2025

- Recent Period: The token has shown volatility with mixed performance → Price fluctuated between 0.002469 USD and 0.002584 USD in the past 24 hours

Current HARD Investment Market Status (February 2026)

- HARD current price: 0.002578 USD

- 24-hour trading volume: 15,500.88 USD

- Market capitalization: 347,492.92 USD

- Circulating supply: 134,791,668 HARD (67.40% of total supply)

- Price performance: -3.49% (24H), -12.49% (7D), -24.12% (30D), -97.61% (1Y)

Click to view real-time HARD market price

II. Core Factors Affecting Whether HARD is a Good Investment

Supply Mechanism and Scarcity

- Maximum supply capped at 200,000,000 HARD tokens → influences price dynamics and investment value

- Current circulating supply: 134,791,668 HARD (67.4% of total supply)

- Historical context: HARD experienced notable price fluctuations, with price reaching $2.97 on March 17, 2021, compared to current price of $0.002578 as of February 6, 2026

- Investment significance: fixed supply cap provides potential scarcity framework that may support long-term value considerations

Governance and Token Utility

- HARD serves as the native governance token for the platform

- Token holders can participate in platform governance voting and receive HARD token rewards

- Liquidity mining rewards: HARD tokens are distributed to users engaging in lending and borrowing activities on the platform

- Vesting mechanism: distributed HARD token rewards undergo lock-up periods, with longer lock-up durations corresponding to larger token allocations

- Lock-up parameters can be modified through governance voting processes

Technology and Ecosystem Development

- Cross-chain asset lending functionality: built on Kava blockchain, enabling interoperability

- Initial asset support: BTC, XRP, BNB, BUSD, and USDX deposits

- Platform expansion: over-collateralized lending services for supported assets

- DeFi infrastructure: decentralized money market structure provides foundation for broader ecosystem applications

- Investment consideration: technological capabilities and ecosystem expansion efforts represent factors in evaluating long-term platform viability

Market Performance and Liquidity

- Current market indicators (as of February 6, 2026):

- Price: $0.002578

- 24-hour trading volume: $15,500.88

- Market capitalization: $347,492.92

- Exchange availability: listed on 2 exchanges

- Recent price trends:

- 1-hour change: +0.24%

- 24-hour change: -3.49%

- 7-day change: -12.49%

- 30-day change: -24.12%

- 1-year change: -97.61%

- Investment consideration: trading volume and exchange availability reflect current market liquidity conditions

III. HARD Future Investment Forecast and Price Outlook (Is HARDProtocol(HARD) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term HARD investment outlook)

- Conservative Forecast: $0.00172726 - $0.002162

- Neutral Forecast: $0.002578 - $0.003041

- Optimistic Forecast: $0.003041 - $0.007128

Mid-term Investment Outlook (2027-2029, mid-term HARDProtocol(HARD) investment forecast)

- Market Phase Expectation: The mid-term period may reflect a gradual recovery phase following the 2025 market adjustment, with potential stabilization driven by developments in the Kava ecosystem and broader DeFi sector dynamics.

- Investment Return Forecast:

- 2027: $0.0017531689 - $0.0027475035

- 2028: $0.0024406989425 - $0.0031916832325

- 2029: $0.002055819493875 - $0.003700475088975

- Key Catalysts: Cross-chain asset lending expansion, governance mechanism enhancements, and liquidity mining incentives within the HARD Protocol ecosystem.

Long-term Investment Outlook (Is HARD a good long-term investment?)

- Base Scenario: $0.002323076028078 - $0.004314284052146 (under steady ecosystem growth and moderate market conditions)

- Optimistic Scenario: $0.003816482046129 - $0.00503775630089 (assuming accelerated adoption within the Kava platform and favorable DeFi market trends)

- Risk Scenario: Below $0.002137229945832 (in the event of prolonged market downturns or reduced protocol activity)

View HARD long-term investment and price prediction: Price Prediction

2026-2031 Long-term Outlook

- Base Scenario: $0.002323076028078 - $0.004314284052146 (corresponding to steady progress and gradual mainstream application growth)

- Optimistic Scenario: $0.003816482046129 - $0.00503775630089 (corresponding to large-scale adoption and favorable market conditions)

- Transformative Scenario: Above $0.00503775630089 (if ecosystem achieves breakthrough developments and widespread adoption)

- 2031-12-31 Predicted High: $0.00503775630089 (based on optimistic development assumptions)

Disclaimer: Cryptocurrency markets are highly volatile and unpredictable. The forecasts presented are based on historical data, technical analysis, and current market trends, and should not be considered financial advice. Investors should conduct independent research and assess their own risk tolerance before making investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00265534 | 0.002578 | 0.00172726 | 0 |

| 2027 | 0.0027475035 | 0.00261667 | 0.0017531689 | 1 |

| 2028 | 0.0031916832325 | 0.00268208675 | 0.0024406989425 | 4 |

| 2029 | 0.003700475088975 | 0.00293688499125 | 0.002055819493875 | 13 |

| 2030 | 0.004314284052146 | 0.003318680040112 | 0.002323076028078 | 28 |

| 2031 | 0.00503775630089 | 0.003816482046129 | 0.002137229945832 | 48 |

IV. HARD Investment Strategy and Risk Management (How to invest in HARD Protocol)

Investment Methodology (HARD investment strategy)

Long-term Holding (HODL HARD): This approach may suit investors with a stable risk tolerance. Given HARD Protocol's role as a governance token within the Kava-based decentralized money market, long-term holders could potentially benefit from staking rewards and governance participation. However, investors should note the significant price decline of approximately 97.61% over the past year, which suggests considerable volatility and market challenges.

Active Trading: For traders employing technical analysis and swing trading strategies, HARD's price movements present potential opportunities. The token has shown short-term fluctuations, with a 24-hour change of -3.49% and a 7-day change of -12.49%. Active traders should monitor support levels around $0.002469 (24-hour low) and resistance near $0.002584 (24-hour high). The relatively low trading volume of approximately $15,500 over 24 hours indicates lower liquidity, which may impact execution and increase slippage risks.

Risk Management (Risk management for HARD investment)

Asset Allocation Ratio:

- Conservative investors: Consider limiting HARD exposure to less than 1-2% of total crypto portfolio due to high volatility and limited liquidity

- Moderate investors: May allocate 2-5% depending on risk tolerance and belief in DeFi lending protocols

- Experienced investors: Could consider higher allocations while maintaining strict stop-loss disciplines

Risk Hedging Strategies: Investors should consider diversifying across multiple DeFi protocols and different crypto asset categories. Hedging instruments such as stablecoins can help preserve capital during market downturns. Given HARD's focus on cross-chain asset lending, investors might balance exposure with other DeFi governance tokens or layer-1 blockchain assets.

Secure Storage:

- Cold Storage: For long-term holdings, hardware wallets provide enhanced security against online threats

- Hot Wallets: For active trading, use reputable exchanges or non-custodial wallets with strong security features

- Multi-signature Solutions: Institutional or high-value investors should consider multi-signature wallet arrangements

V. HARD Investment Risks and Challenges (Risks of investing in HARD Protocol)

Market Risks: HARD has demonstrated substantial price volatility, with the current price at $0.002578 compared to its all-time high of $2.97 recorded on March 17, 2021. This represents a significant decline from peak levels. The token's 24-hour trading volume of approximately $15,500 suggests relatively limited liquidity, which could amplify price volatility and make large position entries or exits challenging. The circulating supply of approximately 134.79 million tokens represents 67.40% of the maximum supply of 200 million tokens, with potential dilution risks as remaining tokens enter circulation.

Regulatory Risks: As a DeFi lending protocol token, HARD faces uncertain regulatory treatment across different jurisdictions. Governments worldwide are developing frameworks for decentralized finance, which could impact protocol operations, token utility, or accessibility. Cross-border regulatory divergence may affect the protocol's ability to support certain assets or serve users in specific regions. Investors should monitor regulatory developments in major markets that could influence DeFi protocols.

Technical Risks: The HARD Protocol operates on the Kava blockchain and facilitates cross-chain asset lending. This introduces potential technical vulnerabilities including smart contract bugs, oracle manipulation risks, and cross-chain bridge security concerns. Protocol upgrades or changes to supported assets require governance approval, which could face implementation challenges. The lending protocol's dependency on accurate price feeds and collateralization ratios means technical failures could result in liquidation cascades or protocol insolvency. Additionally, the relatively small market capitalization of approximately $347,492 may indicate limited development resources compared to larger DeFi protocols.

VI. Conclusion: Is HARD Protocol a Good Investment?

Investment Value Summary: HARD Protocol serves as a governance token for a cross-chain lending platform built on Kava, offering exposure to the DeFi lending sector. The token's utility includes liquidity mining rewards and governance voting rights, with vesting mechanisms designed to encourage long-term participation. However, the significant price decline of approximately 97.61% over the past year and limited trading volume suggest substantial market challenges. The protocol's focus on supporting assets like BTC, XRP, BNB, BUSD, and USDX provides cross-chain lending functionality, though competition in the DeFi lending space remains intense.

Investor Recommendations:

✅ Newcomers: Consider starting with small allocations through dollar-cost averaging to mitigate timing risks. Prioritize secure storage solutions such as hardware wallets. Thoroughly research DeFi lending mechanics and governance participation before investing.

✅ Experienced Investors: May explore swing trading opportunities based on technical indicators while maintaining strict risk management protocols. Consider HARD as part of a diversified DeFi portfolio rather than a standalone investment. Monitor protocol developments, governance proposals, and supported asset additions.

✅ Institutional Investors: Should conduct comprehensive due diligence on protocol security, governance structure, and competitive positioning. Consider the token's limited liquidity and market capitalization when sizing positions. Evaluate HARD within the broader context of DeFi lending protocol investments.

⚠️ Disclaimer: Cryptocurrency investments carry substantial risks, including potential loss of principal. This content is provided for informational purposes only and does not constitute investment advice. Investors should conduct independent research and consult with qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What is HARD Protocol and what is its primary function?

HARD Protocol is a decentralized money market built on the Kava blockchain that enables cross-chain asset lending and borrowing. Launched in October 2020, HARD serves as the native governance token of the platform, allowing holders to participate in protocol decision-making through governance voting while earning rewards through liquidity mining activities. The protocol initially supported deposits of BTC, XRP, BNB, BUSD, and USDX, with plans to expand over-collateralized lending services across additional assets.

Q2: Why has HARD's price declined significantly from its all-time high?

HARD has experienced a substantial price decline of approximately 97.61% over the past year, falling from its peak of $2.97 in March 2021 to the current price of around $0.002578 as of February 2026. This decline reflects broader market corrections in the DeFi sector, intensified competition among lending protocols, and reduced overall participation in the Kava ecosystem. The token's limited trading volume of approximately $15,500 over 24 hours and market capitalization of $347,492 indicate decreased market interest and liquidity challenges compared to its earlier performance period.

Q3: What are the main risks associated with investing in HARD Protocol?

The primary risks include: (1) Market volatility risk - HARD has demonstrated extreme price fluctuations with limited liquidity that could amplify downside movements; (2) Technical risks - smart contract vulnerabilities, cross-chain bridge security concerns, and potential oracle manipulation affecting the lending protocol's operations; (3) Regulatory uncertainty - evolving DeFi regulations globally may impact protocol accessibility and token utility; (4) Dilution risk - approximately 32.6% of the maximum supply remains to be released into circulation; (5) Competition risk - numerous established DeFi lending platforms compete for market share and user adoption.

Q4: How does HARD's governance and reward mechanism work?

HARD token holders can participate in platform governance by voting on protocol proposals and parameter modifications. The platform distributes HARD tokens as liquidity mining rewards to users who engage in lending and borrowing activities. A vesting mechanism applies to distributed rewards, where longer lock-up periods result in greater token allocations. These lock-up parameters can be adjusted through the governance voting process, allowing the community to adapt reward structures based on protocol needs and market conditions.

Q5: What is the realistic price outlook for HARD in 2026-2031?

Based on current market conditions and historical performance patterns, conservative forecasts suggest HARD could trade between $0.00172726 - $0.007128 in 2026, with potential mid-term ranges of $0.0017531689 - $0.003700475088975 through 2027-2029. Long-term projections estimate a base scenario range of $0.002323076028078 - $0.004314284052146 by 2031, with optimistic scenarios potentially reaching $0.00503775630089 under favorable conditions. However, these forecasts depend heavily on protocol adoption, ecosystem development, and broader DeFi market trends.

Q6: What investment strategies are suitable for different types of HARD investors?

For newcomers, dollar-cost averaging with small allocations (1-2% of portfolio) combined with secure storage practices is recommended. Experienced traders may explore swing trading opportunities while monitoring support around $0.002469 and resistance near $0.002584, maintaining strict stop-loss disciplines due to volatility. Long-term holders should consider staking participation and governance involvement, though the significant historical price decline warrants careful position sizing. All investors should diversify across multiple DeFi protocols and maintain realistic expectations given HARD's current market challenges and limited liquidity environment.

Q7: How does HARD compare to other DeFi lending protocol tokens?

HARD operates within a specialized niche as a cross-chain lending protocol on Kava, differentiating itself through support for assets like BTC, XRP, and BNB. However, its current market capitalization of approximately $347,492 and daily trading volume of $15,500 indicate significantly smaller scale compared to established DeFi lending protocols like Aave or Compound. The token's ranking at position 3356 with a market share of 0.000021% reflects limited mainstream adoption. While HARD offers cross-chain functionality advantages, investors should recognize its early-stage positioning and competitive disadvantages relative to more established platforms with greater liquidity and user bases.

Q8: What factors could potentially improve HARD's investment value?

Potential positive catalysts include: (1) Expansion of supported assets and cross-chain lending capabilities; (2) Successful governance implementations that enhance protocol efficiency and user incentives; (3) Growth in the broader Kava ecosystem driving increased HARD Protocol usage; (4) Strategic partnerships or integrations with major DeFi platforms; (5) Improved market liquidity through additional exchange listings; (6) Favorable DeFi lending sector trends increasing demand for alternative protocols. However, realization of these factors remains uncertain and depends on execution capabilities, market conditions, and competitive dynamics within the evolving DeFi landscape.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Comprehensive Guide to Understanding FUD in Cryptocurrency Markets

Who Are Cameron and Tyler Winklevoss? A Profile on the Twins

Is it too late to become a Bitcoin millionaire? Is now the right time to buy?

Best Web3 Marketing Agencies To Support Your Crypto Project

Tax Strategies for Investors Who Became Billionaires with Bitcoin