Is PumpBTC (PUMPBTC) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Viability in 2024

Introduction: PumpBTC's Investment Position and Market Prospects

PumpBTC is an AI-driven staking and liquidity operating system built for Modular Chains, designed to enable Bitcoin holders to maximize their returns by seamlessly integrating with the DeFi ecosystem. As of December 22, 2025, PumpBTC maintains a market capitalization of $25,250,000 with a circulating supply of 285,000,000 tokens, currently trading at $0.02525. The platform focuses on providing a highly secure, scalable, and transparent way for Bitcoin holders to participate in decentralized finance while retaining control over their assets. With its distinctive positioning as an AI-driven solution bridging Bitcoin and DeFi opportunities, PumpBTC has become an increasingly discussed asset among investors evaluating potential cryptocurrency investments. This article provides a comprehensive analysis of PumpBTC's investment value, market performance trends, future price projections, and associated investment risks to serve as a reference for prospective investors.

PumpBTC (PUMPBTC) Research Report

I. Project Overview

Project Introduction

PumpBTC is an AI-driven staking and liquidity operating system (OS) built for Modular Chains, designed to enable Bitcoin holders to maximize their returns by seamlessly integrating with the DeFi ecosystem. The platform focuses on providing a highly secure, scalable, and transparent way for Bitcoin holders to participate in decentralized finance (DeFi) while retaining control over their assets.

Core Positioning

- Target Users: Bitcoin holders seeking DeFi yield opportunities

- Key Features: AI-driven staking, liquidity operations, modular chain compatibility

- Core Value Proposition: Maximize returns while maintaining asset security and control

- Technical Standards: BEP-20, ERC-20 compatible

II. Token Economics and Market Data

Fundamental Metrics (As of December 22, 2025)

| Metric | Value |

|---|---|

| Current Price | $0.02525 |

| Market Capitalization | $7,196,250.00 |

| Fully Diluted Valuation | $25,250,000.00 |

| Circulating Supply | 285,000,000 PUMPBTC |

| Total Supply | 1,000,000,000 PUMPBTC |

| Market Dominance | 0.00077% |

| Circulating Supply Ratio | 21.28% |

Price Performance Analysis

Historical Price Levels

| Period | Price Change | Amount Change |

|---|---|---|

| 1 Hour | +1.23% | +$0.000307 |

| 24 Hours | +3.71% | +$0.000903 |

| 7 Days | -2.56% | -$0.000663 |

| 30 Days | -11.95% | -$0.003427 |

| 1 Year | -63.16% | -$0.043290 |

Historical Extremes

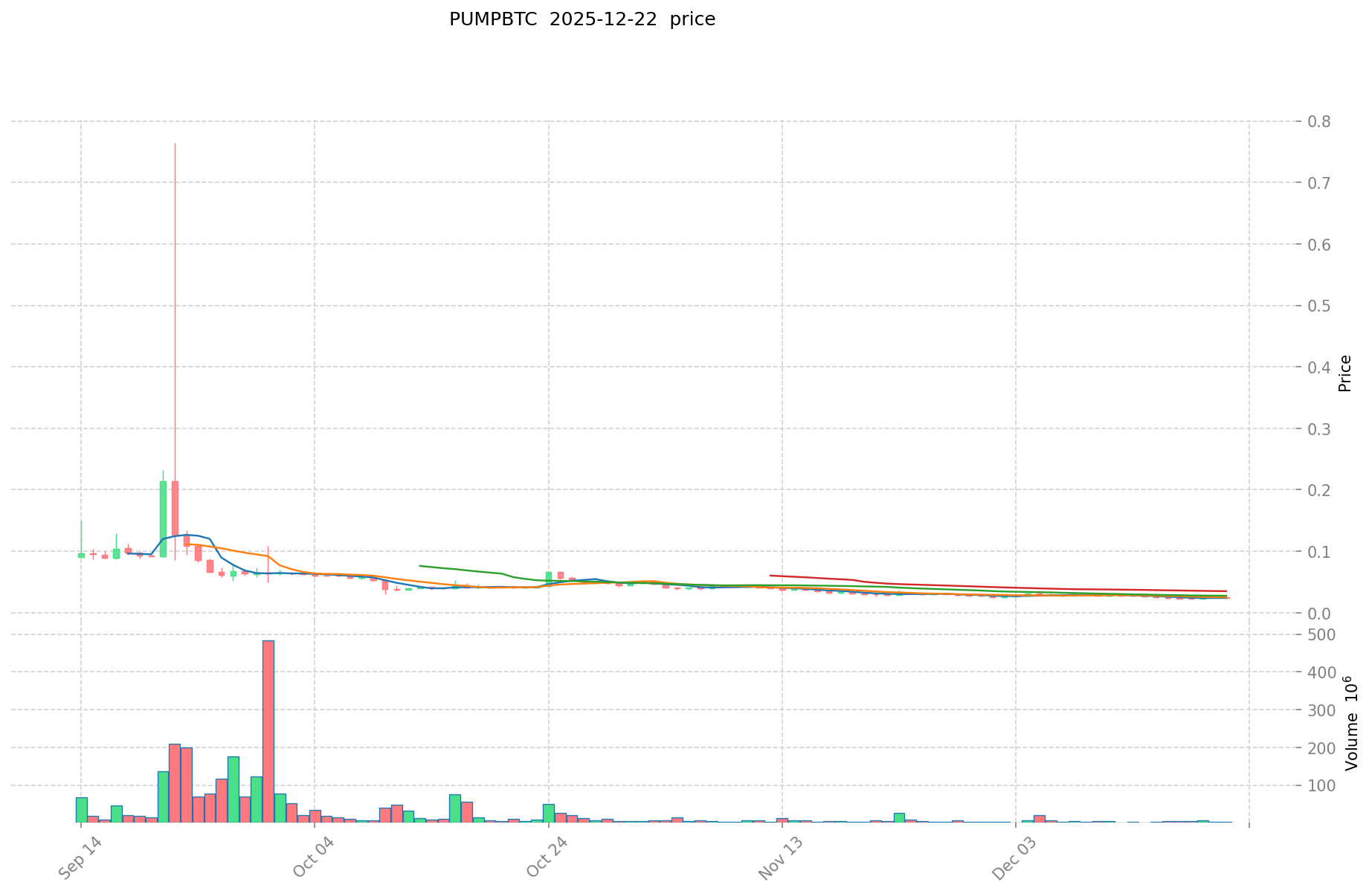

- All-Time High: $0.76464 (September 22, 2025)

- All-Time Low: $0.02217 (December 18, 2025)

- 24-Hour Range: $0.02405 - $0.02541

Market Activity

- 24-Hour Trading Volume: $28,659.43

- Listed on Exchanges: 1 exchange

- Token Holders: 129

- Market Sentiment: Positive (Fear & Greed Index: 1, indicating bullish sentiment)

For real-time PUMPBTC market data, visit Gate Price Page

III. Network and Technical Infrastructure

Smart Contract Information

Ethereum Network (ERC-20)

- Contract Address:

0xb7c0007ab75350c582d5eab1862b872b5cf53f0c - Blockchain Explorer: Etherscan

Cross-Chain Support

The token operates on multiple blockchain standards:

- BEP-20 (Binance Smart Chain)

- ERC-20 (Ethereum)

IV. Official Resources and Community Engagement

Official Channels

- Website: https://pumpbtc.xyz/

- X (Twitter): https://x.com/Pumpbtcxyz

- Whitepaper: Google Drive Link

V. Investment Risk Considerations

Market Volatility

PumpBTC demonstrates significant price volatility, having declined approximately 63.16% over the past year despite recent short-term gains. The token reached its all-time high of $0.76464 in September 2025 but subsequently declined to its all-time low of $0.02217 in December 2025, representing a substantial drawdown.

Liquidity and Exchange Presence

Currently listed on a limited number of exchanges with relatively low trading volumes ($28,659 in 24-hour volume), which may impact market depth and execution efficiency for significant transactions.

Project Stage

With only 129 token holders, the project exhibits a highly concentrated holder distribution, which may present risks related to price volatility and market manipulation.

VI. Key Metrics Summary

- Market Cap Ranking: 1,344

- Launch Date: December 22, 2025 (recent project)

- Market Share: 0.00077% of total crypto market

- Capital Efficiency: Market cap represents 28.5% of fully diluted valuation, indicating significant dilution potential

Disclaimer: This report is for informational purposes only. It does not constitute investment advice, financial recommendations, or solicitation for the purchase or sale of cryptocurrency assets. Cryptocurrency investments carry substantial risks, including potential loss of principal. Investors should conduct thorough due diligence and consult with qualified financial advisors before making investment decisions.

PumpBTC (PUMPBTC) Investment Analysis Report

Report Date: December 22, 2025

I. Executive Summary

PumpBTC is an AI-driven staking and liquidity operating system designed for modular chains, enabling Bitcoin holders to maximize returns through seamless DeFi ecosystem integration. As of December 22, 2025, the token trades at $0.02525 with a market capitalization of $7,196,250 and a fully diluted valuation of $25,250,000. The project ranks 1,344 on the global cryptocurrency market, indicating a relatively niche position within the broader digital asset landscape.

II. Core Factors Influencing Whether PumpBTC is a Good Investment

Supply Mechanism and Scarcity

-

Token Supply Structure: PumpBTC has a total supply of 1,000,000,000 tokens with a circulating supply of 285,000,000 tokens, representing a circulation ratio of 28.5%. The fully diluted market cap stands at $25,250,000, compared to the current market cap of $7,196,250.

-

Market Share Impact: With a market dominance of 0.00077%, PumpBTC represents a micro-cap asset. The gap between current market capitalization and fully diluted valuation suggests additional supply dilution risks for current holders.

-

Investment Implications: The significant difference between circulating and total supply indicates future token release schedules could impact price appreciation potential, requiring careful consideration of tokenomics transparency and unlock schedules.

Technology and Ecosystem Development

-

Core Technology: PumpBTC is specifically engineered for modular chains, providing an AI-driven framework for staking and liquidity operations. This specialization addresses a distinct market segment within the cryptocurrency infrastructure.

-

DeFi Integration: The platform's seamless integration with the DeFi ecosystem enables Bitcoin holders to participate in decentralized finance while maintaining asset control. This use case focuses on yield generation and risk management through composable protocols.

-

Scalability and Security: The platform emphasizes highly secure and scalable infrastructure, critical factors for managing Bitcoin-backed assets in DeFi environments.

III. Market Performance Analysis

Price Trends and Volatility

| Time Period | Price Change | Change Amount |

|---|---|---|

| 1 Hour | +1.23% | +$0.000307 |

| 24 Hours | +3.71% | +$0.000903 |

| 7 Days | -2.56% | -$0.000663 |

| 30 Days | -11.95% | -$0.003427 |

| 1 Year | -63.16% | -$0.043290 |

-

Historical Price Range: PumpBTC reached an all-time high of $0.76464 on September 22, 2025, and an all-time low of $0.02217 on December 18, 2025, representing a 97.1% decline from peak.

-

Current Market Position: The token is trading near its all-time low, having recovered only marginally from its December 18 bottom.

-

Volatility Characteristics: Significant price fluctuations, particularly the severe year-to-date decline of 63.16%, indicate substantial volatility and downside pressure.

IV. Liquidity and Market Participation

-

Trading Volume: 24-hour trading volume stands at 28,659.43 tokens, indicating limited liquidity depth for the asset.

-

Exchange Presence: The token is listed on a limited number of exchanges (1 exchange noted), which may restrict accessibility and liquidity provision.

-

Holder Concentration: With only 129 token holders, PumpBTC exhibits significant concentration risk, suggesting limited retail adoption and potential distribution imbalances.

V. Technical Specifications

-

Blockchain Compatibility: PumpBTC operates on BEP-20 and ERC-20 standards, enabling deployment on both Binance Smart Chain and Ethereum networks.

-

Contract Address (Ethereum): 0xb7c0007ab75350c582d5eab1862b872b5cf53f0c

VI. Project Resources and Transparency

- Official Website: https://pumpbtc.xyz/

- Technical Documentation: Whitepaper available at https://drive.google.com/file/d/1X6LUHklR7wOBx2VAsRhSc--zzFm3SL3C/view?usp=sharing

- Social Media: Twitter presence at https://x.com/Pumpbtcxyz

- Blockchain Explorer: Contract verified on Etherscan

VII. Key Considerations for Investors

Current market conditions reflect bearish technical indicators and significant price depreciation. Multiple technical quantitative indicators suggest caution regarding near-term performance.

-

Risk Factors: Limited exchange presence, concentrated holder base, substantial historical price volatility, and significant year-to-date losses present material risks.

-

Regulatory Considerations: Recent SEC guidance on staking tokens may impact governance and operational compliance frameworks.

-

Market Maturity: As a micro-cap asset with limited adoption, PumpBTC remains in early-stage development with unproven product-market fit.

VIII. Conclusion

PumpBTC presents a specialized infrastructure play focused on Bitcoin DeFi integration through modular chain architecture. However, the project demonstrates characteristics typical of high-risk, early-stage crypto assets: limited market liquidity, concentrated token distribution, severe historical price depreciation, and uncertain mainstream adoption prospects. Prospective participants should conduct independent research and consider their risk tolerance carefully before engagement.

III. PumpBTC Future Investment Predictions and Price Outlook (Is PumpBTC(PUMPBTC) worth investing in 2025-2030)

Short-term Investment Prediction (2025, short-term PUMPBTC investment outlook)

- Conservative forecast: $0.0150 - $0.0255

- Neutral forecast: $0.0255 - $0.0328

- Optimistic forecast: $0.0328 - $0.0400

Mid-term Investment Outlook (2026-2028, mid-term PumpBTC(PUMPBTC) investment forecast)

-

Market stage expectations: PumpBTC demonstrates gradual growth trajectory with increasing adoption of its AI-driven staking and liquidity operating system for modular chains. The ecosystem is expected to mature with enhanced Bitcoin DeFi integration and expanding user base.

-

Investment return projections:

- 2026: $0.0279 - $0.0332

- 2027: $0.0286 - $0.0336

- 2028: $0.0243 - $0.0401

-

Key catalysts: Successful integration with major DeFi protocols, expansion of modular chain partnerships, increased institutional adoption of Bitcoin staking solutions, and improvements in platform security and scalability.

Long-term Investment Outlook (Is PumpBTC a good long-term investment?)

-

Base scenario: $0.0264 - $0.0656 (assuming steady adoption with stable regulatory environment and incremental technological improvements)

-

Optimistic scenario: $0.0312 - $0.0800+ (assuming widespread enterprise adoption, successful scaling solutions, and favorable cryptocurrency market conditions)

-

Risk scenario: $0.0150 - $0.0350 (under adverse conditions including regulatory challenges, competitive pressures, or reduced demand for Bitcoin DeFi products)

Click to view PumpBTC long-term investment and price predictions: Price Prediction

2025-12-31 to 2030 Long-term Outlook

-

Base scenario: $0.0264 - $0.0656 USD (corresponding to steady progress in mainstream adoption and incremental ecosystem development)

-

Optimistic scenario: $0.0312 - $0.0800+ USD (corresponding to large-scale adoption and favorable market environment)

-

Transformative scenario: $0.1000+ USD (should the ecosystem achieve breakthrough progress and mainstream adoption in Bitcoin DeFi infrastructure)

-

2030-12-31 predicted high: $0.0656 USD (based on optimistic development assumptions)

Disclaimer

This analysis is for informational purposes only and does not constitute investment advice. Past performance does not guarantee future results. Cryptocurrency markets are subject to high volatility, regulatory uncertainty, and technical risks. Investors should conduct thorough due diligence and consult with qualified financial advisors before making investment decisions. The predictions presented are based on available data and reasonable assumptions but involve substantial uncertainty and may not materialize as projected.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0327789 | 0.02541 | 0.0149919 | 0 |

| 2026 | 0.033167673 | 0.02909445 | 0.027930672 | 15 |

| 2027 | 0.03362154642 | 0.0311310615 | 0.02864057658 | 23 |

| 2028 | 0.0401466169104 | 0.03237630396 | 0.02428222797 | 28 |

| 2029 | 0.051853888422336 | 0.0362614604352 | 0.031184855974272 | 43 |

| 2030 | 0.065645934898864 | 0.044057674428768 | 0.02643460465726 | 74 |

PumpBTC Investment Analysis Report

I. Project Overview

Basic Information

PumpBTC is an AI-driven staking and liquidity operating system (OS) built for Modular Chains, designed to enable Bitcoin holders to maximize their returns by seamlessly integrating with the DeFi ecosystem. The platform focuses on providing a highly secure, scalable, and transparent way for Bitcoin holders to participate in decentralized finance (DeFi) while retaining control over their assets.

Token Metrics

| Metric | Value |

|---|---|

| Current Price | $0.02525 |

| Market Cap | $7,196,250 |

| Fully Diluted Valuation | $25,250,000 |

| Circulating Supply | 285,000,000 PUMPBTC |

| Total Supply | 1,000,000,000 PUMPBTC |

| Market Dominance | 0.00077% |

| Current Ranking | #1344 |

| Exchange Listings | 1 |

| Token Holders | 129 |

Blockchain Infrastructure

- Supported Networks: BEP-20, ERC-20

- Primary Contract (Ethereum): 0xb7c0007ab75350c582d5eab1862b872b5cf53f0c

- Block Explorer: Etherscan

II. Price Performance & Market Analysis

Recent Price Movements

| Time Period | Change | Amount |

|---|---|---|

| 1 Hour | +1.23% | +$0.000307 |

| 24 Hours | +3.71% | +$0.000903 |

| 7 Days | -2.56% | -$0.000663 |

| 30 Days | -11.95% | -$0.003427 |

| 1 Year | -63.16% | -$0.043290 |

Price Range Analysis

- All-Time High: $0.76464 (September 22, 2025)

- All-Time Low: $0.02217 (December 18, 2025)

- 24-Hour Range: $0.02405 - $0.02541

- Price Decline from ATH: -96.70%

Trading Activity

- 24-Hour Volume: $28,659.43

- Circulating Supply Percentage: 21.28%

- Market Emotion Indicator: Positive (1)

III. Project Fundamentals & Value Proposition

Core Features

PumpBTC distinguishes itself through the following characteristics:

-

AI-Driven Optimization: Leverages artificial intelligence for intelligent staking and liquidity management.

-

Modular Chain Integration: Specifically architected for compatibility with modular blockchain architectures.

-

Bitcoin-Native Focus: Tailored solutions enabling Bitcoin holders to participate in DeFi without asset conversion requirements.

-

Security & Control: Emphasizes user custody and decentralized governance principles.

-

Seamless DeFi Integration: Designed for frictionless interaction with the broader decentralized finance ecosystem.

Market Positioning

PumpBTC operates in the intersection of Bitcoin finance and decentralized applications, targeting the growing segment of Bitcoin holders seeking yield generation opportunities while maintaining asset security and control.

IV. Investment Strategy & Risk Management

Investment Methodology

Long-term Holdings (HODL PumpBTC):

- Suitable for investors with high risk tolerance and long time horizons

- Aligned with belief in platform adoption and DeFi integration maturity

- Mitigates short-term volatility impact

Active Trading:

- Dependent on technical analysis and support/resistance identification

- Requires monitoring of liquidity conditions given current low trading volume

- Suitable for experienced traders comfortable with high volatility

Risk Management Framework

Asset Allocation Recommendations:

| Investor Profile | Allocation Strategy |

|---|---|

| Conservative | 0-2% portfolio allocation maximum |

| Moderate | 2-5% portfolio allocation |

| Aggressive | 5-10% portfolio allocation |

Risk Hedging Approaches:

- Maintain diversified portfolio exposure across multiple asset classes and risk profiles

- Consider complementary positions in established cryptocurrency assets

- Implement stop-loss orders to limit downside exposure

Security Practices:

- Hot Wallets: Use only for active trading amounts with reputable exchange platforms

- Cold Storage: Allocate majority of holdings to offline storage solutions

- Hardware Wallets: Consider hardware wallet options for medium to long-term holdings

V. Investment Risks & Challenges

Market Risks

- Extreme Volatility: Token experienced 96.70% decline from all-time high within three months, indicating extreme price instability

- Low Liquidity: 24-hour trading volume of approximately $28,659 relative to market cap suggests limited market depth

- Limited Trading Venues: Only one exchange listing restricts entry and exit options

- Highly Concentrated Holder Base: 129 total holders indicates significant concentration risk

Regulatory Risks

- Bitcoin-related DeFi protocols face evolving regulatory scrutiny across multiple jurisdictions

- Modular chain ecosystem regulatory classification remains uncertain

- Potential future regulations on AI-driven financial protocols

Technology Risks

- Platform dependency on modular chain infrastructure stability and adoption

- Integration complexity with established DeFi protocols

- Risk of smart contract vulnerabilities or exploits

- Unproven long-term performance of AI-driven staking mechanisms

Project-Specific Risks

- Minimal trading activity suggests limited market confidence

- Recent sharp decline from ATH may indicate reduced investor interest

- Limited public information availability despite published white paper

VI. Conclusion: Is PumpBTC a Good Investment?

Investment Value Summary

PumpBTC presents an early-stage project with innovative positioning at the intersection of Bitcoin finance and decentralized applications. However, the token exhibits characteristics of a highly speculative asset marked by extreme volatility, minimal trading liquidity, and recent significant price deterioration.

Key Considerations:

- The 96.70% decline from ATH within three months presents substantial recovery risk

- Market capitalization of $7.2 million with daily volume under $30,000 indicates early development stage

- Technological proposition shows merit, but market validation remains incomplete

Investor Guidance

✅ For Newcomers:

- Allocate only speculative capital you can afford to lose completely

- If pursuing entry, establish Dollar-Cost Averaging protocol over extended periods

- Utilize secure hardware wallet storage for any holdings

✅ For Experienced Traders:

- Monitor technical indicators and support/resistance levels for tactical opportunities

- Maintain strict position sizing within 2-5% portfolio allocation

- Exercise caution given low liquidity conditions

✅ For Institutional Investors:

- Conduct comprehensive due diligence on platform technology and team

- Evaluate modular chain ecosystem adoption trajectories

- Consider strategic allocation only after demonstrated market validation

⚠️ Critical Disclaimer: Cryptocurrency investments carry substantial risk, including potential total capital loss. This report provides factual analysis only and does not constitute investment advice, recommendation, or endorsement. Investors must conduct independent research and consult qualified financial advisors before making investment decisions.

Report Date: December 22, 2025 Data Source: Gate Market Data

PumpBTC (PUMPBTC) Frequently Asked Questions

I. FAQ

Q1: What is PumpBTC and what problem does it solve?

A: PumpBTC is an AI-driven staking and liquidity operating system built for modular chains, designed to enable Bitcoin holders to maximize their returns by seamlessly integrating with the DeFi ecosystem. It solves the problem of Bitcoin holders being unable to efficiently participate in decentralized finance opportunities while maintaining asset control and security. The platform bridges the gap between Bitcoin's store-of-value characteristics and DeFi's yield-generating opportunities.

Q2: What are the current token metrics and market position of PumpBTC?

A: As of December 22, 2025, PumpBTC trades at $0.02525 with a market capitalization of $7,196,250 and a fully diluted valuation of $25,250,000. The token has a circulating supply of 285,000,000 out of 1,000,000,000 total tokens (28.5% circulation ratio). It ranks #1,344 globally with only 129 token holders and is listed on a single exchange with modest daily trading volume of approximately $28,659.

Q3: Is PumpBTC a good investment for beginners?

A: PumpBTC carries substantial risk and is not recommended as a primary investment for beginners. The token exhibits extreme volatility, having declined 96.70% from its all-time high of $0.76464 reached in September 2025 to $0.02217 in December 2025. Conservative investors should limit exposure to 0-2% of portfolio allocation at maximum, and only with capital they can afford to lose entirely. Beginners should prioritize established cryptocurrencies before considering highly speculative micro-cap assets.

Q4: What are the major risks associated with investing in PumpBTC?

A: Key risks include: extreme price volatility (63.16% year-to-date decline), critically low trading liquidity ($28,659 daily volume), limited exchange listings (single venue), highly concentrated holder base (129 holders), regulatory uncertainty surrounding AI-driven financial protocols, technology execution risks, and unproven market adoption. Additionally, the significant gap between current market cap and fully diluted valuation suggests substantial dilution risk from future token releases.

Q5: What are the price predictions for PumpBTC through 2030?

A: Base scenario projections range from $0.0264 to $0.0656 USD by 2030, assuming steady adoption and incremental ecosystem development. Optimistic scenarios project $0.0312 to $0.0800+ USD with large-scale adoption and favorable market conditions. Conservative near-term projections (2025) estimate $0.0150 to $0.0400. However, these predictions involve substantial uncertainty and may not materialize. Past performance does not guarantee future results, and investors should conduct independent research before making decisions based on price forecasts.

Q6: How should I secure PumpBTC tokens if I choose to invest?

A: For security best practices: limit hot wallet holdings to amounts actively trading on reputable exchanges; store the majority of holdings in cold storage solutions; consider hardware wallets for medium to long-term positions; implement multi-signature security protocols where available; and never store significant amounts on exchange platforms. Given the token's current low liquidity and limited exchange options, ensure you understand withdrawal and transfer procedures before committing funds.

Q7: What blockchain networks does PumpBTC operate on?

A: PumpBTC operates on both BEP-20 (Binance Smart Chain) and ERC-20 (Ethereum) standards, enabling cross-chain functionality. The primary Ethereum contract address is 0xb7c0007ab75350c582d5eab1862b872b5cf53f0c, which is verifiable on Etherscan. This multi-chain deployment approach provides flexibility for users across different blockchain ecosystems, though current trading activity remains concentrated on limited venues.

Q8: What are the key catalysts that could drive PumpBTC's future price performance?

A: Potential positive catalysts include: successful integration with major DeFi protocols, expansion of partnerships with established modular chain projects, increased institutional adoption of Bitcoin staking solutions, demonstrated security improvements and platform scalability enhancements, and favorable regulatory developments for AI-driven financial applications. Conversely, negative catalysts such as regulatory challenges, competitive pressures from established platforms, smart contract vulnerabilities, or reduced demand for Bitcoin DeFi products could negatively impact price performance. Long-term success depends heavily on achieving mainstream ecosystem adoption and validating the AI-driven staking mechanism's effectiveness.

Disclaimer: This FAQ is provided for informational purposes only and does not constitute investment advice, financial recommendations, or endorsement of PumpBTC as an investment. Cryptocurrency investments carry substantial risks, including potential loss of principal capital. Investors should conduct thorough independent research, understand their risk tolerance, and consult with qualified financial advisors before making investment decisions.

# How Much SOL Are Institutions Currently Holding: 2025 Holdings & Fund Flow Analysis

Best BTC Staking Platforms for Passive Income in 2025

Bitcoin Staking Guide 2025: How to Secure High Returns

Best Bitcoin Staking Methods in 2025: Yield Comparison and Security Strategies

On-Chain BTC Staking: A Guide for Bitcoin Investors in 2025

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

Top 5 Best Crypto Mining Apps for Mobile Devices

What is RARI: A Comprehensive Guide to the Decentralized Art NFT Platform

What is BLD: A Comprehensive Guide to Binaural Beat Lucid Dreaming Techniques

Understanding TRC20: The Token Standard on the TRON Blockchain

What is HIFI: A Complete Guide to High-Fidelity Audio Systems and Technology