Is SCOR (SCOR) a good investment?: A comprehensive analysis of the reinsurance giant's financial performance and future prospects

Introduction: SCOR's Investment Position and Market Prospects

SCOR is an important asset in the cryptocurrency field, establishing itself as a Web3 infrastructure network that connects professional sports intellectual property, fans, and developers in a verified on-chain environment. As of December 23, 2025, SCOR has achieved a market capitalization of $37,016,000 with a circulating supply of 688,000,000 tokens, while the current price is maintained at approximately $0.009254. Built by Sweet, the official Web3 partner of the NHL and MLS, SCOR powers an innovative "fan economy" model where sports organizations can tokenize their intellectual property, distribute it directly to fans, and share value transparently through smart contracts. The network has already integrated with leading leagues, teams, and thousands of athletes across multiple sports disciplines.

Backed by strategic investors including the National Hockey League (NHL), Madison Square Garden (MSG), Animoca Brands, and major venture capital firms such as Orillion Ventures, Pure Ventures, and FBG Capital, SCOR benefits from strong institutional support. The team brings together top-tier technical talent with degrees from MIT and a PhD from Cornell, while the SCOR Foundation is advised by a premier group of industry leaders to ensure ecosystem health, stability, and regulatory compliance.

With the rapid expansion of Web3 applications in sports and entertainment, SCOR has positioned itself at the intersection of two significant market trends: the tokenization of real-world assets and the digitalization of sports fan engagement. Given its institutional backing, experienced development team, and growing integrations with major sports franchises, SCOR merits analysis as a potential investment opportunity. This article will provide a comprehensive analysis of SCOR's investment value, historical price trends, future price forecasts, and associated investment risks to inform investor decision-making.

SCOR Cryptocurrency Research Report

I. SCOR Price History Review and Current Investment Value

SCOR Historical Price Performance and Market Positioning

SCOR is currently ranked #1402 by market capitalization, with the following key metrics as of December 23, 2025:

| Metric | Value |

|---|---|

| Current Price | $0.009254 |

| All-Time High (ATH) | $0.0658 (December 17, 2025) |

| All-Time Low (ATL) | $0.0087 (December 21, 2025) |

| 24-Hour Price Change | +1.65% |

| 1-Hour Price Change | -0.12% |

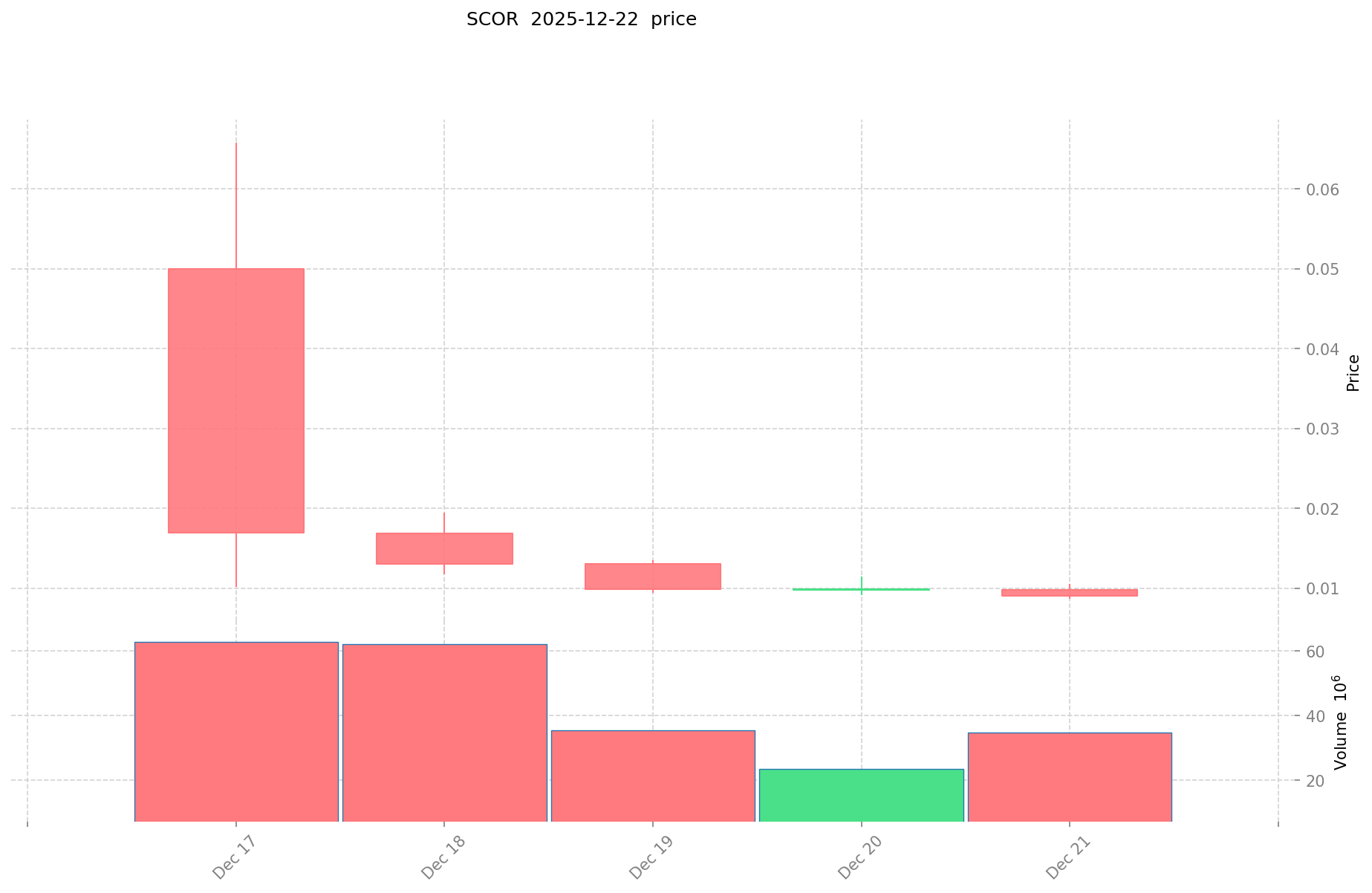

The token has exhibited significant volatility recently, with a notable peak just six days prior to the current reporting date, followed by a sharp correction within four days.

Current Market Status (December 23, 2025)

| Parameter | Value |

|---|---|

| Current Price | $0.009254 |

| 24-Hour Trading Volume | $346,758.41 |

| Total Market Capitalization | $37,016,000.00 |

| Circulating Supply | 688,000,000 SCOR |

| Total Supply | 4,000,000,000 SCOR |

| Market Cap to FDV Ratio | 17.2% |

| Market Dominance | 0.0011% |

| Active Holders | 46 |

Access real-time SCOR market pricing and data on Gate

II. Project Overview and Ecosystem Foundation

Project Core Definition

SCOR is a Web3 infrastructure network that connects professional sports intellectual property (IP), fans, and developers within a verified on-chain environment. The protocol pioneers a new "fan economy" model where sports organizations can tokenize their IP, distribute it directly to fans, and enable transparent value sharing through smart contracts.

Development Background

The network was developed by Sweet, the official Web3 partner of the National Hockey League (NHL) and Major League Soccer (MLS). SCOR has already integrated with multiple leading sports leagues, teams, and thousands of professional athletes across various sports disciplines.

Team and Technical Expertise

The project brings together top-tier technical talent, including specialists with degrees from the Massachusetts Institute of Technology (MIT) and a PhD from Cornell University.

III. Strategic Stakeholders and Investors

Primary Strategic Investors

- Orillion Ventures

- Pure Ventures

- FBG Capital

- National Hockey League (NHL)

- Madison Square Garden (MSG)

- Animoca Brands

- Bolt Ventures (stakeholder in Philadelphia 76ers, New Jersey Devils, and Washington Commanders)

Advisory and Governance Structure

The SCOR Foundation is supported by a premier advisory group of industry leaders ensuring ecosystem health, stability, and compliance operations. Advisory members include:

- Tophash

- FORGD

- Marfire

- HighVern Cayman Limited

- Autonomous

- Carey Olsen (Law Firm)

- McDermott Will & Schulte (Law Firm)

IV. Blockchain Infrastructure and Technical Details

Deployment Chain

SCOR is deployed on BASE EVM (Ethereum Virtual Machine compatible blockchain).

Contract Address: 0xd67ec255100ef200a439d09ff865fbaa2ad9c730

Blockchain Explorer: BaseScan

Tokenomics

- Token Algorithm: BASE

- Circulating Supply: 688,000,000 SCOR

- Total Supply: 4,000,000,000 SCOR

- Maximum Supply: 4,000,000,000 SCOR

- Circulating Supply Ratio: 17.2%

V. Official Resources and Community Channels

Project Links

- Official Website: https://www.scor.io/

- Whitepaper: https://scor.io/whitepaper

- Twitter/X: https://x.com/SCORProtocol

- Discord: https://discord.com/invite/scor

- Block Explorer: https://basescan.org/token/0xd67ec255100ef200a439d09ff865fbaa2ad9c730

Report Date: December 23, 2025

Data Source: Gate Cryptocurrency Market Data

SCOR Investment Analysis Report

Report Date: December 23, 2025

Current Price: USD 0.009254

Market Capitalization: USD 37,016,000

24-Hour Price Change: +1.65%

I. Project Overview

Project Description

SCOR is a Web3 infrastructure network that connects professional sports intellectual property, fans, and developers in a verified on-chain environment. The platform enables a new "fan economy" model where sports organizations can tokenize their intellectual property, distribute it directly to fans, and share value transparently through smart contracts.

The network is developed by Sweet, the official Web3 partner of the National Hockey League (NHL) and Major League Soccer (MLS). SCOR has already integrated with leading leagues, teams, and thousands of athletes across multiple sports.

Development Team

The team comprises top-tier technical talent, including specialists with degrees from Massachusetts Institute of Technology (MIT) and a Ph.D. from Cornell University.

Strategic Investors and Supporters

Strategic investors include:

- Orillion Ventures

- Pure Ventures

- FBG Capital

- National Hockey League (NHL)

- Madison Square Garden (MSG)

- Animoca Brands

- Bolt Ventures (76ers, Devils, and Commanders)

The SCOR Foundation is advised by industry leaders including Tophash, FORGD, Marfire, HighVern Cayman Limited, Autonomous, Carey Olsen, and McDermott Will & Schulte to ensure ecosystem health, stability, and compliance.

II. Core Factors Influencing SCOR Investment Viability

Supply Mechanism and Scarcity

Token Supply Structure:

- Total Supply: 4,000,000,000 SCOR

- Circulating Supply: 688,000,000 SCOR

- Circulating Ratio: 17.2%

- Fully Diluted Valuation: USD 37,016,000

The relatively low circulating supply ratio (17.2%) indicates significant token release potential ahead. This structural characteristic may influence price dynamics as circulating supply increases over time. The substantial difference between current circulating supply and total supply represents an important consideration for long-term valuation assessment.

Blockchain Infrastructure and Technical Foundation

Network and Deployment:

- Blockchain: BASE (BASE EVM)

- Contract Address: 0xd67ec255100ef200a439d09ff865fbaa2ad9c730

- Algorithm: BASE

SCOR operates on the BASE blockchain, a Layer 2 solution, which provides scalability advantages for the platform's infrastructure requirements.

Institutional Integration and Mainstream Adoption

Key Integrations:

- Official Web3 partnership with NHL and MLS

- Integration with leading sports leagues and professional teams

- Connections with thousands of athletes across multiple sports disciplines

- Partnership with established entities including Madison Square Garden and professional sports franchises

The direct integration with major professional sports organizations and leagues represents significant institutional legitimacy and potential for mainstream adoption within the sports industry.

Ecosystem Development and Use Case

Fan Economy Model:

- Intellectual property tokenization for sports organizations

- Direct fan distribution mechanisms

- Smart contract-enabled transparent value sharing

- Multi-sport integration across professional leagues

The platform's focus on tokenizing sports intellectual property addresses a specific market need within the sports and fan engagement sector, creating utility-driven demand for the token.

III. Market Performance Metrics

Current Market Position

| Metric | Value |

|---|---|

| Current Price | USD 0.009254 |

| 24-Hour Volume | USD 346,758.42 |

| Market Cap Ranking | #1,402 |

| Market Share | 0.0011% |

| Total Market Cap | USD 37,016,000 |

Price Performance

Recent Price History:

- All-Time High: USD 0.0658 (December 17, 2025)

- All-Time Low: USD 0.0087 (December 21, 2025)

- 24-Hour High: USD 0.010055

- 24-Hour Low: USD 0.00879

- 1-Hour Price Change: -0.12%

- 24-Hour Price Change: +1.65%

The token has experienced significant volatility since launch, with price movements of approximately 85% between its all-time high and low within a six-day period.

Holder Distribution

The token is held by 46 addresses, indicating concentrated ownership patterns typical of early-stage tokens following launch.

IV. Risk Considerations and Market Dynamics

Price Volatility

The token has experienced extreme price volatility, declining approximately 86% from its all-time high to all-time low within a short timeframe. This volatility reflects typical post-launch token behavior and carries significant investment risk.

Liquidity and Trading Volume

24-hour trading volume of USD 346,758 relative to market capitalization indicates limited liquidity. This liquidity constraint may impact the ability to enter or exit positions at desired price points.

Early-Stage Project Characteristics

As a recently launched token with strong institutional backing but limited trading history, SCOR exhibits characteristics typical of early-stage blockchain projects, including:

- Limited price discovery period

- Concentrated holder distribution

- Significant supply dilution potential

- Evolving market sentiment

V. Resources and Additional Information

Official Channels:

- Website: https://www.scor.io/

- White Paper: https://scor.io/whitepaper

- Twitter: https://x.com/SCORProtocol

- Discord: https://discord.com/invite/scor

- Block Explorer: https://basescan.org/token/0xd67ec255100ef200a439d09ff865fbaa2ad9c730

VI. Conclusion

SCOR represents a Web3 infrastructure project with institutional backing from major sports organizations and experienced investors. The project addresses a specific use case within the sports and fan engagement sector through intellectual property tokenization and fan economy mechanisms.

However, the investment presents significant characteristics requiring careful consideration:

- Early-Stage Risk: Limited price discovery and trading history typical of recently launched tokens

- High Volatility: Extreme price fluctuations from launch indicate elevated risk

- Supply Dilution: Circulating ratio of 17.2% indicates substantial future token supply increases

- Liquidity Constraints: Moderate trading volumes may limit exit flexibility

- Execution Risk: Platform adoption and utility realization remain dependent on ecosystem development

The decision to consider SCOR as an investment should be based on individual risk tolerance, investment horizon, and conviction regarding the platform's ability to achieve mainstream adoption within sports intellectual property tokenization and fan engagement markets.

III. SCOR Future Investment Predictions and Price Outlook (Is SCOR(SCOR) worth investing in 2025-2030)

Short-term Investment Prediction (2025, short-term SCOR investment outlook)

- Conservative Forecast: $0.0061 - $0.0083

- Neutral Forecast: $0.0083 - $0.0107

- Optimistic Forecast: $0.0107 - $0.0125

Mid-term Investment Outlook (2026-2027, mid-term SCOR(SCOR) investment forecast)

-

Market Phase Expectations: SCOR is positioned within the Web3 sports infrastructure sector, with ongoing adoption from major professional sports leagues and integration with leading franchises. The project benefits from established partnerships with NHL, MLS, MSG, and prominent sports teams, potentially supporting gradual market expansion.

-

Investment Return Forecasts:

- 2026: $0.0085 - $0.0125

- 2027: $0.0100 - $0.0125

-

Key Catalysts: Integration of additional sports properties into the SCOR network; expansion of fan engagement through tokenized IP; developments in the broader Web3 sports and entertainment sector; strategic partnerships with additional leagues or franchises.

Long-term Investment Outlook (Is SCOR a good long-term investment?)

- Base Scenario: $0.0118 - $0.0192 (assuming steady ecosystem growth and mainstream adoption of sports IP tokenization)

- Optimistic Scenario: $0.0155 - $0.0242 (assuming accelerated market adoption and increased institutional participation in sports-based Web3 infrastructure)

- Risk Scenario: $0.0062 - $0.0085 (reflecting regulatory challenges, competitive pressures, or limited adoption of tokenized sports IP)

View SCOR long-term investment and price forecasts: Price Prediction

2025-12-23 to 2030 Long-term Outlook

- Base Scenario: $0.0118 - $0.0192 USD (corresponding to steady ecosystem development and mainstream sports partnership integration)

- Optimistic Scenario: $0.0155 - $0.0242 USD (corresponding to widespread adoption and favorable market conditions for Web3 sports infrastructure)

- Transformative Scenario: $0.0242 USD and above (assuming breakthrough ecosystem developments and mainstream sports industry adoption)

- 2030-12-31 Predicted High: $0.0192 USD (based on optimistic development assumptions)

Disclaimer: This analysis is provided for informational purposes only and should not be construed as investment advice. Cryptocurrency markets are highly volatile and subject to regulatory uncertainty. Past performance does not guarantee future results. Investors should conduct thorough due diligence and consult with qualified financial advisors before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0107416 | 0.00926 | 0.0061116 | 0 |

| 2026 | 0.012501 | 0.0100008 | 0.00850068 | 8 |

| 2027 | 0.012488499 | 0.0112509 | 0.010013301 | 21 |

| 2028 | 0.01353145743 | 0.0118696995 | 0.00617224374 | 28 |

| 2029 | 0.0154947057273 | 0.012700578465 | 0.00825537600225 | 37 |

| 2030 | 0.019172793250764 | 0.01409764209615 | 0.013392759991342 | 52 |

SCOR Token Investment Analysis Report

I. Project Overview

Project Introduction

SCOR is a Web3 infrastructure network that connects professional sports intellectual property, fans, and developers in a verified on-chain environment. The protocol powers a new "fan economy" model where sports organizations can tokenize their IP, distribute it directly to fans, and share value transparently through smart contracts.

The network is developed by Sweet, the official Web3 partner of the National Hockey League (NHL) and Major League Soccer (MLS), and already integrates with leading leagues, teams, and thousands of athletes across multiple sports.

Team & Leadership

The project team comprises top-tier technical talent, including specialists with degrees from MIT and a PhD from Cornell University.

Strategic Backers & Advisors

Strategic Investors: Orillion Ventures, Pure Ventures, FBG Capital, National Hockey League (NHL), Madison Square Garden (MSG), Animoca Brands, Bolt Ventures (76ers, Devils, and Commanders).

Advisory Board: The SCOR Foundation is supported by premier industry leaders including Tophash, FORGD, Marfire, HighVern Cayman Limited, Autonomous, Carey Olsen, and McDermott Will & Schulte to ensure ecosystem health, stability, and regulatory compliance.

II. Token Metrics & Market Performance

Current Market Data (As of December 23, 2025)

| Metric | Value |

|---|---|

| Current Price | $0.009254 |

| 24H Change | +1.65% |

| 1H Change | -0.12% |

| Market Cap (Circulating) | $6,366,752 |

| Fully Diluted Valuation (FDV) | $37,016,000 |

| Circulating Supply | 688,000,000 SCOR |

| Total Supply | 4,000,000,000 SCOR |

| 24H Trading Volume | $346,758.42 |

| Market Cap to FDV Ratio | 17.2% |

| Market Dominance | 0.0011% |

| Market Ranking | #1402 |

Price Performance

| Period | High | Low | Status |

|---|---|---|---|

| All-Time High (ATH) | $0.0658 | December 17, 2025 | |

| All-Time Low (ATL) | $0.0087 | December 21, 2025 | |

| 24H Range | $0.010055 | $0.00879 |

III. Technical & Network Information

Blockchain Details

- Blockchain: Base (BASE EVM)

- Contract Address: 0xd67ec255100ef200a439d09ff865fbaa2ad9c730

- Algorithm: BASE

- Token Holders: 46

- Exchange Listings: 1

Official Resources

- Website: https://www.scor.io/

- Whitepaper: https://scor.io/whitepaper

- Block Explorer: https://basescan.org/token/0xd67ec255100ef200a439d09ff865fbaa2ad9c730

- Twitter/X: https://x.com/SCORProtocol

- Discord: https://discord.com/invite/scor

IV. Investment Strategy & Risk Management

Investment Methodology

Long-Term Holding (HODL SCOR): Suitable for conservative investors who believe in the protocol's fundamental value proposition in the sports IP tokenization space and are willing to maintain positions through market cycles.

Active Trading: Dependent on technical analysis and swing trading strategies, monitoring short-term price movements within the volatile crypto markets.

Risk Management

Asset Allocation Proportions:

- Conservative Investors: 1-3% of total crypto portfolio allocation

- Active Investors: 2-5% allocation with defined entry/exit targets

- Institutional Investors: Strategic position sizing based on portfolio objectives and risk tolerance

Risk Hedging Strategies: Multi-asset portfolio diversification combined with stablecoin holdings to manage volatility exposure.

Secure Storage: Utilization of cold wallets for long-term holdings and hardware wallet solutions (Ledger, Trezor) for enhanced security.

V. Investment Risks & Challenges

Market Risk

- High Volatility: Recent price swings from $0.0087 to $0.0658 demonstrate significant intra-period volatility

- Liquidity Concerns: Limited 24-hour trading volume of $346,758 relative to market cap indicates potential liquidity constraints

- Price Manipulation: Low trading volume increases susceptibility to price volatility and potential market manipulation

Regulatory Risk

- Policy Uncertainty: Sports-related tokenization and fan economy models face evolving regulatory frameworks across different jurisdictions

- Compliance Requirements: Integration with official sports leagues (NHL, MLS) subjects the protocol to additional regulatory scrutiny

Technology Risk

- Network Security: As an emerging Web3 infrastructure, potential vulnerabilities in smart contract implementations

- Adoption Risk: Dependency on sports organizations' willingness to adopt and integrate the SCOR protocol

Market Risk Factors

- Early-Stage Liquidity: With only 46 token holders and minimal trading volume, price discovery mechanisms remain underdeveloped

- Concentration Risk: Limited holder distribution increases vulnerability to large position movements

VI. Conclusion: Is SCOR a Good Investment?

Investment Value Summary

SCOR presents a differentiated investment thesis centered on the emerging sports IP tokenization sector, backed by credible strategic partnerships with established sports entities (NHL, MLS, MSG) and experienced venture capital firms. The protocol's focus on the "fan economy" addresses a meaningful market opportunity in connecting athletes, teams, and fans through blockchain infrastructure.

However, the token currently exhibits characteristics typical of early-stage projects: limited liquidity, high volatility, and speculative pricing. The all-time high of $0.0658 (December 17) followed by decline to $0.0087 (December 21) demonstrates substantial short-term price fluctuations.

Investor Recommendations

✅ Newcomers: Consider dollar-cost averaging (DCA) approach with small allocations to reduce entry point risk; maintain holdings in secure, non-custodial wallets with proper backup procedures.

✅ Experienced Investors: Employ swing trading strategies supported by technical analysis; maintain portfolio diversification across multiple asset classes and risk profiles; monitor on-chain metrics and protocol development milestones.

✅ Institutional Investors: Evaluate SCOR as a strategic long-term position within sports-tech themed portfolios; track ecosystem adoption metrics, partnership developments, and regulatory landscape evolution.

⚠️ Disclaimer: Cryptocurrency investment carries substantial risk including potential total loss of capital. This analysis is provided for informational purposes only and does not constitute investment advice, financial recommendation, or endorsement. Investors should conduct independent research, assess personal risk tolerance, and consult with qualified financial advisors before making investment decisions. Past performance does not guarantee future results.

SCOR Cryptocurrency Investment Analysis Report

FAQ

Q1: What is SCOR and what problem does it solve in the cryptocurrency market?

A: SCOR is a Web3 infrastructure network that connects professional sports intellectual property, fans, and developers in a verified on-chain environment. It solves the challenge of tokenizing and distributing sports IP directly to fans through smart contracts. Developed by Sweet, the official Web3 partner of the NHL and MLS, SCOR enables a new "fan economy" model where sports organizations can share value transparently with their fanbase while creating utility-driven demand for blockchain technology in the sports and entertainment sector.

Q2: What are the current market metrics and price performance of SCOR as of December 23, 2025?

A: As of December 23, 2025, SCOR trades at $0.009254 with a market capitalization of $37,016,000 and a 24-hour trading volume of $346,758.42. The token has experienced significant volatility, reaching an all-time high of $0.0658 on December 17, 2025, and an all-time low of $0.0087 on December 21, 2025. The circulating supply is 688,000,000 tokens out of a total supply of 4,000,000,000, representing a 17.2% circulation ratio with 46 active token holders.

Q3: Who are the strategic investors and backers supporting the SCOR project?

A: SCOR is backed by prominent institutional investors including the National Hockey League (NHL), Madison Square Garden (MSG), Animoca Brands, Orillion Ventures, Pure Ventures, FBG Capital, and Bolt Ventures (stakeholder in the Philadelphia 76ers, New Jersey Devils, and Washington Commanders). The SCOR Foundation is advised by industry leaders including Tophash, FORGD, Marfire, Carey Olsen, and McDermott Will & Schulte law firm to ensure ecosystem health, stability, and regulatory compliance.

Q4: What are the short-term and mid-term price predictions for SCOR?

A: Short-term forecasts for 2025 project SCOR trading between $0.0061 and $0.0125 across conservative, neutral, and optimistic scenarios. Mid-term outlooks for 2026-2027 estimate price ranges of $0.0085 to $0.0125. These forecasts assume gradual ecosystem expansion through additional sports property integrations, enhanced fan engagement mechanisms, and continued institutional adoption of Web3 sports infrastructure.

Q5: What are the primary risks associated with investing in SCOR?

A: Key investment risks include extreme price volatility (86% decline from ATH to ATL within six days), limited liquidity with a concentrated holder base of 46 addresses, supply dilution risk as only 17.2% of tokens are currently circulating, regulatory uncertainty surrounding sports-based tokenization and fan economy models, and early-stage technology implementation risks. Additionally, the project's success depends on widespread adoption of tokenized sports IP by professional leagues and organizations, which remains unproven at scale.

Q6: On which blockchain is SCOR deployed and what are its technical specifications?

A: SCOR is deployed on the BASE blockchain, an Ethereum Virtual Machine (EVM) compatible Layer 2 solution that provides scalability advantages for the platform's infrastructure. The contract address is 0xd67ec255100ef200a439d09ff865fbaa2ad9c730. The token uses the BASE algorithm and is accessible through BaseScan blockchain explorer for real-time transaction verification and on-chain analysis.

Q7: What long-term price scenarios are projected for SCOR through 2030?

A: Long-term projections through December 31, 2030 include three scenarios: Base scenario of $0.0118 to $0.0192 USD assuming steady ecosystem growth; optimistic scenario of $0.0155 to $0.0242 USD reflecting accelerated market adoption and increased institutional participation; and transformative scenario exceeding $0.0242 USD in breakthrough adoption scenarios. The predicted high for 2030 is $0.0192 USD based on optimistic development assumptions, representing potential 52% appreciation from current levels.

Q8: What investment strategies are recommended for different investor profiles considering SCOR?

A: Newcomers should employ dollar-cost averaging (DCA) with small allocations to reduce entry point risk, maintaining holdings in non-custodial wallets. Experienced investors should utilize swing trading strategies supported by technical analysis while maintaining portfolio diversification across multiple asset classes. Institutional investors should evaluate SCOR as a strategic long-term position within sports-tech themed portfolios while monitoring ecosystem adoption metrics, partnership developments, and evolving regulatory frameworks. All investors should allocate 1-5% of crypto portfolio exposure based on risk tolerance and conviction regarding sports IP tokenization mainstream adoption potential.

⚠️ Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice, financial recommendation, or endorsement. Cryptocurrency markets carry substantial risk including potential total loss of capital. Investors should conduct independent research, assess personal risk tolerance, and consult with qualified financial advisors before making investment decisions. Past performance does not guarantee future results.

Is PoP Planet (P) a good investment?: Analyzing the Potential Returns and Risks in the Emerging Virtual World Market

Is Eesee (ESE) a good investment?: Analyzing the Potential and Risks of This Emerging Cryptocurrency

Is Alt.town (TOWN) a good investment?: Analyzing the potential and risks of this emerging crypto token

2025 LIY Price Prediction: Analyzing Market Trends and Potential Growth Factors

REX vs CHZ: A Battle of Cryptocurrency Titans in the Digital Arena

Is Bnext (B3X) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

How Volatile Is GIGGLE's Price? A Look at 475% Swings and Support Levels

How to Use Technical Indicators (MACD, RSI, KDJ, Bollinger Bands) for Crypto Trading Signals

What is DEGOD: A Comprehensive Guide to Decentralized Governance and On-Chain Development

How Active is the CSPR Casper Network Community and Ecosystem in 2025?

What is KDA: A Comprehensive Guide to Cardano's Key Decentralized Applications