Is Shyft Network (SHFT) a good investment?: A Comprehensive Analysis of Risk, Potential, and Market Outlook for 2024

Introduction: Shyft Network (SHFT) Investment Status and Market Outlook

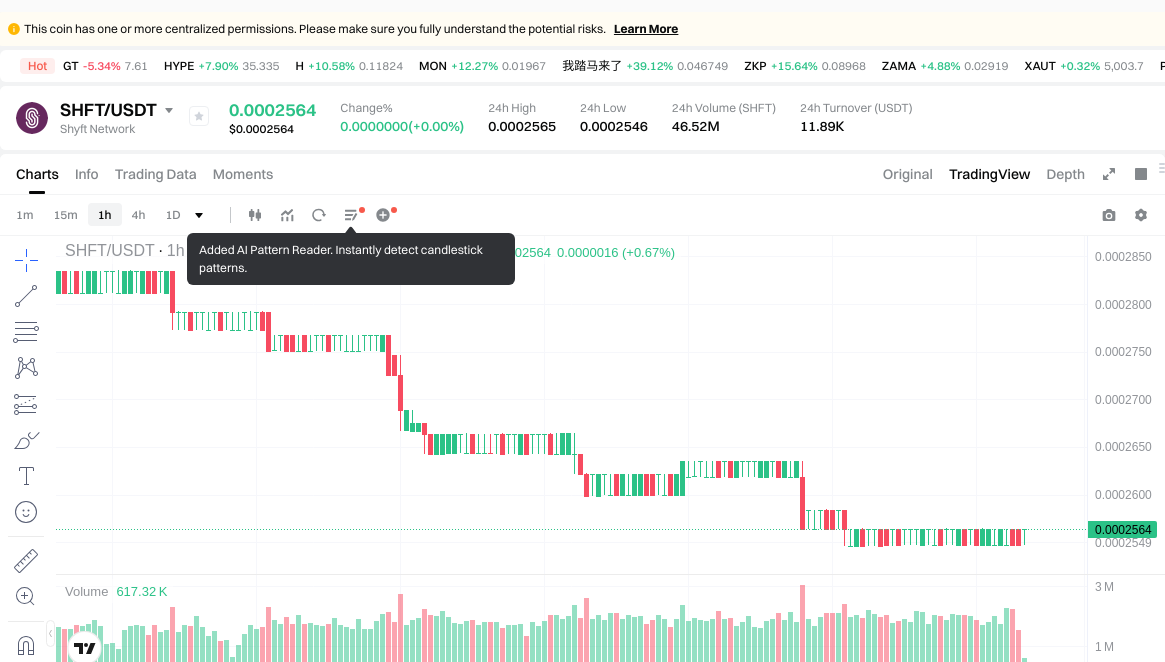

SHFT is a digital asset in the cryptocurrency sector, launched in March 2021, which has been developing within the blockchain data verification and identity framework space. As of February 5, 2026, Shyft Network holds a market capitalization of approximately $598,710, with a circulating supply of about 2.34 billion tokens, and the current price is around $0.0002564. Positioned as a public blockchain protocol for data trust and authentication, SHFT has gradually become a subject of discussion among investors considering "Is Shyft Network (SHFT) a good investment?" This article will comprehensively analyze SHFT's investment characteristics, historical price movements, future price considerations, and investment risks to provide reference information for investors.

I. Shyft Network (SHFT) Price History Review and Investment Value Status

SHFT Historical Price Trends and Investment Performance

- March 2021: SHFT reached a price peak of $6.34 → Investors experienced subsequent value decline

- April 2025: Price fell to $0.0002186 → SHFT showed considerable volatility with price decreasing from earlier levels

- 2021-2026: Market cycle transition → Price declined from $6.34 to current levels around $0.0002564

Current SHFT Investment Market Status (February 2026)

- SHFT current price: $0.0002564

- Market sentiment (Fear & Greed Index): Data not available in reference materials

- 24-hour trading volume: $11,893.54

- Institutional investor holdings: Data regarding major institutional positions is not provided in reference materials

Click to view real-time SHFT market price

II. Core Factors Influencing Whether SHFT is a Good Investment

Supply Mechanism and Scarcity (SHFT Investment Scarcity)

- Supply Structure: Shyft Network (SHFT) has a maximum supply of 2,520,000,000 tokens, with approximately 2,335,062,791 tokens currently in circulation, representing a circulating ratio of 92.66%. This relatively high circulating supply indicates limited future dilution risk.

- Scarcity Impact: With the circulating supply approaching the maximum cap, SHFT exhibits a constrained supply dynamic. According to reference materials, the token's market capitalization stands at approximately $598,710, suggesting a lower market valuation compared to many crypto assets.

- Investment Significance: The limited remaining token supply may contribute to scarcity-driven value support over time, though this depends on sustained demand growth and network adoption.

Institutional Investment and Mainstream Adoption (Institutional Investment in SHFT)

- Compliance Infrastructure: Shyft Network has positioned itself as a compliance-focused protocol, integrating its Veriscope solution with partners such as Fincrypto and Endl to facilitate Travel Rule compliance across digital ecosystems. This focus on regulatory alignment may attract institutional interest seeking compliant blockchain solutions.

- Market Adoption Indicators: Reference materials note Shyft Network's expansion in India, a market ranked #1 in Chainalysis' 2025 Global Crypto Adoption Index, with over 75% of crypto activity originating from non-metro regions. This geographic diversification and regulatory compliance positioning could enhance long-term investment viability.

- Policy Environment: Shyft's emphasis on trust and verification infrastructure positions it within evolving regulatory frameworks, potentially providing a structural advantage as compliance requirements tighten globally.

Macroeconomic Environment's Impact on SHFT Investment

- Market Performance Context: As of February 5, 2026, SHFT has declined 0.66% over 24 hours, 9.46% over 7 days, and 25.36% over 30 days, reflecting broader market volatility. The token has experienced a 43.51% decline over the past year.

- Trading Volume: SHFT's 24-hour trading volume stands at approximately $11,893, indicating relatively limited liquidity compared to larger-cap assets. Lower liquidity may amplify price volatility during macroeconomic shifts.

- Market Correlation: Reference materials indicate the global crypto market declined 11.30% over the same 7-day period when SHFT fell 5.50%, suggesting SHFT demonstrated relative resilience during this specific timeframe.

Technology and Ecosystem Development (Technology & Ecosystem for SHFT Investment)

- Protocol Functionality: Shyft Network operates as a public blockchain protocol designed to aggregate and embed trust and verification into data stored across public, private, permissioned, and permissionless networks. The protocol facilitates bridging isolated datasets to layer context over raw data.

- Use Case Expansion: The SHFT token functions as a payment mechanism for security and operational costs on the Shyft Network, as well as for data market transactions across identity system intermediaries. This utility-driven design supports potential long-term value accrual.

- Compliance Ecosystem Growth: Shyft's 2025 integrations with compliance partners in India's growing crypto market (projected to reach $7.5 billion by 2030 according to Grand View Research) demonstrate ecosystem expansion in a region experiencing strong adoption momentum.

- Technical Infrastructure: The protocol's focus on digital reputation, identity, and trust frameworks positions it within emerging data verification and compliance infrastructure sectors, though broader ecosystem adoption metrics remain limited in available materials.

III. SHFT Future Investment Predictions and Price Outlook (Is Shyft Network(SHFT) worth investing in 2026-2031)

Short-term Investment Prediction (2026, short-term SHFT investment outlook)

Based on available market data, short-term predictions for SHFT in 2026 present varied scenarios. Conservative estimates suggest a price range of $0.00014102 to $0.000328192, reflecting potential volatility in the near term. A neutral forecast indicates an average price around $0.0002564, maintaining relatively stable trading patterns. Optimistic projections may see prices approaching the upper range of $0.000328192, contingent upon favorable market sentiment and broader crypto market conditions.

Mid-term Investment Outlook (2027-2029, mid-term Shyft Network(SHFT) investment forecast)

- Market Stage Expectation: The mid-term period may witness gradual development phases as Shyft Network continues building its identity verification and data trust infrastructure.

- Investment Return Prediction:

- 2027: Price range between $0.00018122352 and $0.00037121592, representing potential growth of approximately 14%

- 2028: Projected range from $0.0002454994104 to $0.000447870546, indicating possible expansion around 29%

- 2029: Anticipated movement between $0.00032354499999 and $0.00045218337348, suggesting growth potential near 52%

- Key Catalysts: Market adoption dynamics, regulatory developments affecting identity verification protocols, and competitive positioning within the blockchain trust infrastructure sector may influence price movements.

Long-term Investment Outlook (Is SHFT a good long-term investment?)

- Baseline Scenario: $0.000265228937341 - $0.000479938077093 (2030-2031 range, assuming steady ecosystem development and moderate market acceptance)

- Optimistic Scenario: $0.000414430739553 - $0.000554075880055 (reflecting enhanced adoption of trust verification solutions and favorable regulatory frameworks)

- Risk Scenario: Prices may experience downward pressure if market conditions deteriorate, competitive alternatives emerge, or broader crypto market sentiment weakens significantly.

Check SHFT long-term investment and price predictions: Price Prediction

2026-2031 Long-term Outlook

- Base Scenario: $0.000265228937341 - $0.000479938077093 (corresponding to steady progress and gradual mainstream application growth)

- Optimistic Scenario: $0.000414430739553 - $0.000554075880055 (corresponding to large-scale adoption and favorable market environment)

- Transformative Scenario: Above $0.000554075880055 (if ecosystem achieves breakthrough developments and mainstream popularization)

- 2031-12-31 Projected High: $0.000554075880055 (based on optimistic development assumptions)

Disclaimer: Price predictions are inherently speculative and subject to numerous variables including market volatility, regulatory changes, technological developments, and macroeconomic factors. Historical price performance reached a high of $6.34 in March 2021 and a low of $0.0002186 in April 2025, demonstrating significant volatility. Current market capitalization stands at approximately $598,710, with circulating supply of 2.34 billion tokens. Predictions should not be construed as investment advice, and investors should conduct thorough research and assess their risk tolerance before making investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.000328192 | 0.0002564 | 0.00014102 | 0 |

| 2027 | 0.00037121592 | 0.000292296 | 0.00018122352 | 14 |

| 2028 | 0.000447870546 | 0.00033175596 | 0.0002454994104 | 29 |

| 2029 | 0.00045218337348 | 0.000389813253 | 0.00032354499999 | 52 |

| 2030 | 0.000479938077093 | 0.00042099831324 | 0.000265228937341 | 64 |

| 2031 | 0.000554075880055 | 0.000450468195166 | 0.000414430739553 | 75 |

IV. SHFT Investment Strategy and Risk Management (How to invest in Shyft Network)

Investment Methodology (SHFT investment strategy)

-

Long-term Holding (HODL SHFT): This approach may suit investors who believe in the protocol's vision of embedding trust and verification across data ecosystems. Given the project's focus on bridging isolated datasets and enabling data marketplaces, long-term holders would need to evaluate whether the network's adoption and utility justify sustained exposure.

-

Active Trading: Traders relying on technical analysis may consider short-term price movements. With a 24-hour trading volume of approximately $11,893 and recent price fluctuations (including a 7-day decline of around 9.46% and a 30-day decline of approximately 25.36%), active trading strategies require careful monitoring of volatility and liquidity conditions.

Risk Management (Risk management for SHFT investment)

-

Asset Allocation Ratios: Conservative investors might limit exposure to a small percentage of their portfolio, while more aggressive participants could consider higher allocations based on their risk tolerance. Professional investors may integrate SHFT into diversified digital asset portfolios, weighing the project's niche focus against broader market conditions.

-

Risk Hedging Strategies: Diversification across multiple digital assets and traditional hedging instruments can help mitigate exposure to SHFT's price volatility. Investors may also consider position sizing and stop-loss mechanisms to manage downside risk.

-

Secure Storage: Cold wallets and hardware wallets are recommended for storing SHFT tokens, particularly given the ERC-20 contract address (0xb17c88bda07d28b3838e0c1de6a30eafbcf52d85) on the Ethereum network. Hot wallets may be used for smaller amounts intended for active trading, while offline storage solutions provide enhanced security for larger holdings.

V. SHFT Investment Risks and Challenges (Risks of investing in Shyft Network)

-

Market Risk: SHFT has experienced notable volatility, with a 1-year decline of approximately 43.51% and a 30-day decline of around 25.36%. The current price of approximately $0.0002564 reflects substantial distance from the historical high of $6.34 recorded on March 28, 2021. Such price fluctuations present both opportunities and challenges for investors.

-

Regulatory Risk: As a protocol designed to aggregate trust and verification across data systems, Shyft Network may face evolving regulatory scrutiny related to data privacy, identity verification, and cross-border data flows. Policy uncertainty in different jurisdictions could impact the network's adoption and operational model.

-

Technical Risk: The protocol's reliance on bridging isolated datasets and enabling data marketplaces introduces technical complexities. Potential challenges include network security vulnerabilities, integration difficulties with external systems, and risks associated with protocol upgrades or governance decisions.

VI. Conclusion: Is Shyft Network a Good Investment?

-

Investment Value Summary: Shyft Network's focus on embedding trust and verification into data ecosystems addresses a specialized niche within the blockchain sector. However, the token has experienced significant price volatility, with current trading levels considerably below historical peaks. The project's long-term potential depends on network adoption, ecosystem growth, and its ability to deliver on its data marketplace vision.

-

Investor Recommendations:

✅ Beginners: Consider dollar-cost averaging and secure wallet storage. Given the token's volatility and niche focus, new investors should approach SHFT with caution and limit exposure accordingly.

✅ Experienced Investors: Evaluate swing trading opportunities based on technical analysis and market conditions. Portfolio diversification remains essential given the token's price history and market dynamics.

✅ Institutional Investors: Assess strategic fit within broader blockchain infrastructure or data management portfolios. Due diligence on network adoption metrics, partnership developments, and competitive positioning is recommended.

⚠️ Disclaimer: Cryptocurrency investments carry high risk. This content is for informational purposes only and does not constitute investment advice.

VII. FAQ

Q1: What is the maximum supply of SHFT tokens, and how much is currently in circulation?

Shyft Network (SHFT) has a maximum supply of 2,520,000,000 tokens, with approximately 2,335,062,791 tokens currently in circulation as of February 2026, representing a circulating ratio of 92.66%. This high circulating supply indicates that most tokens have already entered the market, resulting in limited future dilution risk. The relatively constrained supply dynamic means that value appreciation would primarily depend on demand growth and network adoption rather than supply expansion.

Q2: How has SHFT's price performed historically, and what does this indicate about its volatility?

SHFT reached its historical peak of $6.34 in March 2021, but declined significantly to approximately $0.0002564 by February 2026. The token experienced a 1-year decline of approximately 43.51%, a 30-day decline of around 25.36%, and a 7-day decline of roughly 9.46%. This substantial price contraction from peak levels demonstrates considerable volatility and market risk. Investors should carefully evaluate their risk tolerance before considering SHFT, as historical performance suggests significant price fluctuations that may present both opportunities and challenges.

Q3: What is Shyft Network's primary use case and technological focus?

Shyft Network operates as a public blockchain protocol designed to aggregate and embed trust and verification into data stored across public, private, permissioned, and permissionless networks. The SHFT token serves as a payment mechanism for security and operational costs on the network, as well as for data market transactions across identity system intermediaries. The protocol focuses on bridging isolated datasets to layer context over raw data, positioning itself within the compliance infrastructure, digital identity, and data verification sectors. This utility-driven design supports potential value accrual through network usage and ecosystem expansion.

Q4: What are the projected price ranges for SHFT in the mid-term period (2027-2029)?

Based on available predictions, SHFT may experience gradual development during the mid-term period. For 2027, the projected price range is between $0.00018122352 and $0.00037121592, representing potential growth of approximately 14%. In 2028, estimates suggest a range from $0.0002454994104 to $0.000447870546, indicating possible expansion around 29%. By 2029, anticipated movement falls between $0.00032354499999 and $0.00045218337348, suggesting growth potential near 52%. These projections depend on market adoption dynamics, regulatory developments affecting identity verification protocols, and competitive positioning within the blockchain trust infrastructure sector.

Q5: What are the primary risks associated with investing in SHFT?

SHFT investments carry multiple risk categories. Market risk is evidenced by significant volatility, with the token declining approximately 43.51% over one year and trading substantially below its historical high. Regulatory risk stems from potential scrutiny related to data privacy, identity verification, and cross-border data flows, which could impact adoption. Technical risk involves the protocol's complexity in bridging isolated datasets, potential network security vulnerabilities, integration challenges with external systems, and governance-related uncertainties. Additionally, SHFT's relatively low trading volume of approximately $11,893 over 24 hours indicates limited liquidity, which may amplify price volatility during market shifts.

Q6: Which investment strategies are suitable for different types of SHFT investors?

For beginners, dollar-cost averaging combined with secure cold wallet storage is recommended, with limited portfolio exposure given the token's volatility and niche focus. Experienced investors may evaluate swing trading opportunities based on technical analysis and market conditions, while maintaining portfolio diversification to manage risk. Institutional investors should assess SHFT's strategic fit within broader blockchain infrastructure or data management portfolios, conducting thorough due diligence on network adoption metrics, partnership developments, and competitive positioning. All investor categories should carefully evaluate risk tolerance before making investment decisions.

Q7: How does Shyft Network's compliance focus potentially affect its investment value?

Shyft Network has positioned itself as a compliance-focused protocol, integrating its Veriscope solution with partners such as Fincrypto and Endl to facilitate Travel Rule compliance across digital ecosystems. This regulatory alignment may attract institutional interest seeking compliant blockchain solutions as global regulatory frameworks evolve. The protocol's expansion in India, ranked number one in Chainalysis' 2025 Global Crypto Adoption Index with a projected market size of $7.5 billion by 2030, demonstrates ecosystem growth in a region experiencing strong adoption momentum. This compliance infrastructure positioning could provide structural advantages as regulatory requirements tighten globally, though broader adoption metrics remain limited.

Q8: What storage methods are recommended for securing SHFT tokens?

Cold wallets and hardware wallets are recommended for storing SHFT tokens, particularly given the ERC-20 contract address (0xb17c88bda07d28b3838e0c1de6a30eafbcf52d85) on the Ethereum network. These offline storage solutions provide enhanced security for larger holdings by keeping private keys disconnected from internet-connected devices. Hot wallets may be used for smaller amounts intended for active trading, offering convenient access for transactions while accepting higher security risks. Investors should implement proper backup procedures for recovery phrases and consider multi-signature solutions for institutional-scale holdings to ensure asset security.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What Is a Non-Custodial Wallet? A Step-by-Step Guide to Creating a Non-Custodial Wallet

How to Avoid Slippage in Cryptocurrency Trading

What Is a Blockchain Game Guild? Should You Join a Game Guild?

Free Money for App Registration: Crypto Rewards Guide

Top 4 Cryptocurrency Exchanges for Free Registration Bonuses