Is Trabzonspor Fan Token (TRA) a good investment?: A Comprehensive Analysis of Risk, Utility, and Market Potential for 2024

Introduction: Trabzonspor Fan Token (TRA)'s Investment Position and Market Outlook

TRA is a fan token within the cryptocurrency sector, launched in April 2021 on the Chiliz platform. As a token representing Turkish Football Club Trabzonspor, TRA provides holders with various engagement rights and benefits. As of February 2026, TRA has a market capitalization of approximately $1.79 million, with a circulating supply of around 7.77 million tokens, and the current price is maintained at approximately $0.23. With its positioning as a sports fan engagement token, TRA has gradually become a focal point for investors discussing "Is Trabzonspor Fan Token (TRA) a good investment?" This article will comprehensively analyze TRA's investment value, historical trends, future price predictions, and investment risks to provide reference for investors.

I. Trabzonspor Fan Token (TRA) Price History Review and Current Investment Value

TRA Historical Price Trends and Investment Performance

- 2022: TRA experienced significant price volatility during the broader crypto market correction → The token showed substantial fluctuation from elevated levels

- 2025-2026: Market consolidation period → TRA price stabilized around $0.23-0.26, with the circulating supply maintained at approximately 7.77 million tokens

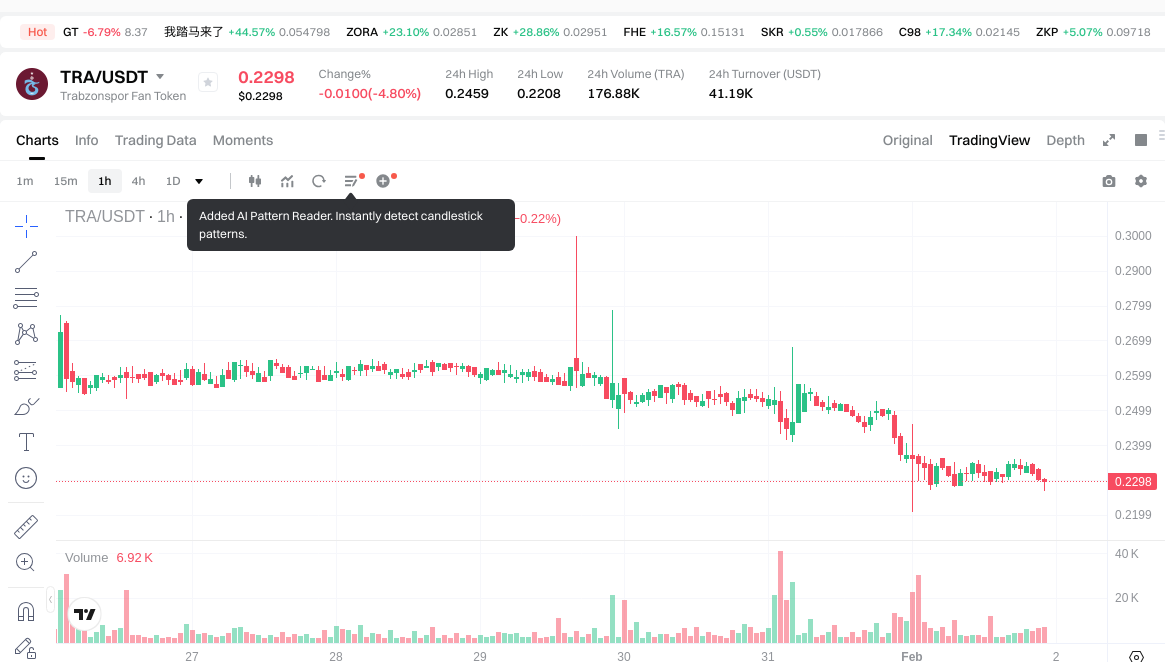

- Recent trend: From $0.2607 level to current $0.2299 → The token demonstrated a decline of approximately 11.4% over the past 7 days

Current TRA Investment Market Status (February 2026)

- TRA current price: $0.2299

- 24-hour trading volume: $40,515.27

- Market capitalization: $1,785,863.2

- Circulating supply: 7,768,000 TRA (77.68% of max supply)

- Trading range (24h): $0.2208 - $0.2459

Click to view real-time TRA market price

II. Core Factors Influencing Whether TRA is a Good Investment (Is Trabzonspor Fan Token(TRA) a Good Investment)

Supply Mechanism and Scarcity (TRA investment scarcity)

- TRA has a fixed maximum supply of 10,000,000 tokens, with 7,768,000 currently in circulation, representing 77.68% of the total supply → This supply structure affects price dynamics and investment considerations

- The circulating supply ratio indicates that a significant portion of tokens is already in the market, which may influence future supply-side price pressure

- Investment significance: The capped supply model provides a degree of scarcity, though the high circulation ratio means limited additional scarcity effects from future supply releases

Institutional Investment and Mainstream Adoption (Institutional investment in TRA)

- TRA is listed on 4 exchanges, indicating a moderate level of platform adoption for trading accessibility

- The token serves as a fan engagement mechanism for Trabzonspor, a Turkish football club, providing utility through fan participation rights rather than traditional institutional investment channels

- The integration with the Chiliz platform connects TRA to a specialized fan token ecosystem, which may influence adoption patterns within the sports entertainment sector

Macroeconomic Environment's Impact on TRA Investment

- As a fan token with relatively small market capitalization ($1.79 million), TRA may exhibit different sensitivity to macroeconomic factors compared to larger crypto assets

- The token's performance appears more closely tied to sports-related engagement and the Chiliz ecosystem dynamics rather than serving as a macroeconomic hedge instrument

- Market sentiment and broader crypto market conditions may still influence TRA's price movements, as evidenced by the 61.47% decline over the past year

Technology and Ecosystem Development (Technology & Ecosystem for TRA investment)

- TRA operates on the Chiliz Chain (CHZ2), utilizing the platform's infrastructure designed specifically for fan token functionality

- The token's utility is centered on providing fan engagement rights for Trabzonspor supporters, creating value through sports-related applications rather than broader DeFi or NFT integration

- The specialized nature of the fan token ecosystem means investment value is supported by the continued engagement of the football club's fan base and the evolution of the Chiliz platform's fan engagement features

III. TRA Future Investment Forecast and Price Outlook (Is Trabzonspor Fan Token(TRA) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term TRA investment outlook)

- Conservative forecast: $0.211 - $0.230

- Neutral forecast: $0.230 - $0.265

- Optimistic forecast: $0.265 - $0.301

Mid-term Investment Outlook (2027-2028, mid-term Trabzonspor Fan Token(TRA) investment forecast)

-

Market stage expectation: TRA may experience gradual growth as fan engagement mechanisms evolve and the sports fan token sector matures. The token's performance could be influenced by Trabzonspor's sporting achievements and broader adoption of fan tokens within the sports industry.

-

Investment return forecast:

- 2027: $0.151 - $0.337

- 2028: $0.196 - $0.443

-

Key catalysts: Enhanced fan participation features, potential partnerships within the sports ecosystem, increased trading volume on additional exchanges, and overall sentiment in the sports fan token market.

Long-term Investment Outlook (Is TRA a good long-term investment?)

- Baseline scenario: $0.267 - $0.513 (assuming steady ecosystem development and maintained fan base engagement)

- Optimistic scenario: $0.407 - $0.594 (assuming expanded utility, increased fan adoption, and favorable market conditions for sports tokens)

- Risk scenario: Below $0.151 (under adverse market conditions, reduced fan engagement, or competitive pressures from alternative fan tokens)

For detailed TRA long-term investment and price predictions: Price Prediction

2026-2031 Long-term Outlook

- Base scenario: $0.211 - $0.433 (corresponding to steady progress and gradual mainstream application improvement)

- Optimistic scenario: $0.407 - $0.594 (corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $0.594 (in case of breakthrough ecosystem developments and mainstream popularization)

- 2031-12-31 predicted high: $0.594 (based on optimistic development assumptions)

Disclaimer: Price predictions are based on historical data and market analysis models and do not constitute investment advice. Cryptocurrency markets are highly volatile and subject to numerous unpredictable factors. Investors should conduct thorough research and consider their risk tolerance before making investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.301038 | 0.2298 | 0.211416 | 0 |

| 2027 | 0.33708213 | 0.265419 | 0.15128883 | 15 |

| 2028 | 0.44283833055 | 0.301250565 | 0.19581286725 | 31 |

| 2029 | 0.49481911554075 | 0.372044447775 | 0.208344890754 | 61 |

| 2030 | 0.593801540871288 | 0.433431781657875 | 0.407425874758402 | 88 |

| 2031 | 0.544433660940456 | 0.513616661264581 | 0.267080663857582 | 123 |

IV. TRA Investment Strategy and Risk Management (How to invest in fan tokens)

Investment Strategy (TRA investment strategy)

Long-term Holding (HODL TRA)

Long-term holding may suit investors who believe in the sustained development of fan token ecosystems and sports-related blockchain applications. This approach focuses on the potential growth of fan engagement platforms and the expansion of utility features for token holders.

Active Trading

Active trading strategies rely on technical analysis and market timing. Given the token's historical price volatility, traders may seek opportunities through:

- Technical indicators and chart patterns

- Market sentiment analysis within the sports fan token sector

- Short-term price movements based on team performance or platform announcements

Risk Management (Risk management for TRA investment)

Asset Allocation Ratio

- Conservative investors: Allocate a small portion (1-3%) of portfolio to speculative assets like fan tokens

- Aggressive investors: May consider higher allocation (5-10%) with careful monitoring

- Professional investors: Implement dynamic allocation based on market conditions and risk parameters

Risk Hedging Solutions

- Diversified portfolio combining multiple asset classes

- Position sizing to limit exposure to individual tokens

- Stop-loss mechanisms for downside protection

- Regular portfolio rebalancing

Secure Storage

- Hot wallets: Convenient for active trading but require strong security practices

- Cold wallets: Recommended for long-term holdings to minimize online exposure

- Hardware wallets: Provide enhanced security for significant holdings

- Multi-signature solutions for institutional-grade security

V. TRA Investment Risks and Challenges (Risks of investing in fan tokens)

Market Risks

- High Volatility: Price fluctuations may be significant due to relatively limited liquidity and market depth

- Price Sensitivity: Fan token prices may respond to factors beyond typical market dynamics, including team performance and fan sentiment

- Liquidity Concerns: Trading volume of 40,515.27 may present challenges for larger position entries or exits

Regulatory Risks

- Jurisdictional Uncertainty: Different countries maintain varying regulatory frameworks for fan tokens and digital assets

- Compliance Evolution: Regulatory requirements for sports-related tokens continue to develop

- Platform Dependencies: Regulations affecting the Chiliz platform could impact token accessibility

Technical Risks

- Network Security: Smart contract vulnerabilities or platform security issues could affect token functionality

- Platform Risk: Token utility depends on the continued operation and development of the underlying platform

- Upgrade Considerations: Platform updates or migrations may introduce technical complexities

Project-Specific Risks

- Team Performance Dependency: Token value perception may correlate with club performance and fan engagement

- Adoption Challenges: Utility depends on sustained fan participation and platform feature adoption

- Competition: Presence of multiple fan tokens may fragment market attention and liquidity

VI. Conclusion: Is Fan Token a Good Investment?

Investment Value Summary

TRA represents a specialized segment within the cryptocurrency market, combining sports fandom with blockchain technology. The token's long-term potential relates to the growth of fan engagement platforms and the evolution of sports-related digital assets. However, investors should note the token's price volatility and the specialized nature of its use case.

Investor Recommendations

✅ Beginners:

- Consider dollar-cost averaging to mitigate entry timing risks

- Use secure wallet solutions with strong security practices

- Start with small allocations to understand market dynamics

- Research the Chiliz platform and fan token ecosystem thoroughly

✅ Experienced Investors:

- Implement technical analysis for timing strategies

- Maintain diversified exposure across multiple asset categories

- Monitor platform developments and team-related events

- Adjust positions based on risk-reward assessments

✅ Institutional Investors:

- Evaluate strategic allocation within alternative asset frameworks

- Consider portfolio diversification benefits and correlation patterns

- Implement comprehensive risk management protocols

- Assess regulatory implications across operating jurisdictions

⚠️ Disclaimer: Cryptocurrency investments carry substantial risks including potential loss of principal. This content provides informational analysis only and does not constitute investment advice. Investors should conduct independent research and consider their financial circumstances before making investment decisions.

VII. FAQ

Q1: What is Trabzonspor Fan Token (TRA) and what makes it different from traditional cryptocurrencies?

TRA is a sports fan engagement token launched on the Chiliz platform in April 2021, specifically designed for supporters of Turkish football club Trabzonspor. Unlike traditional cryptocurrencies that focus on financial transactions or DeFi applications, TRA provides holders with fan engagement rights and participation benefits related to the football club. The token operates on Chiliz Chain (CHZ2) with a fixed maximum supply of 10,000,000 tokens, of which 7,768,000 (77.68%) are currently in circulation. As of February 2026, TRA maintains a market capitalization of approximately $1.79 million and trades around $0.23, with its value primarily driven by fan participation and club-related events rather than traditional investment metrics.

Q2: What are the main risks associated with investing in TRA?

The primary risks include high price volatility (evidenced by a 61.47% decline over the past year and 11.4% drop in the last seven days), limited liquidity with a 24-hour trading volume of only $40,515.27, and dependency on both team performance and sustained fan engagement. TRA faces regulatory uncertainty as different jurisdictions maintain varying frameworks for fan tokens, and its utility entirely depends on the continued operation of the Chiliz platform. Additionally, the token's relatively small market capitalization makes it susceptible to significant price swings, and investors face potential smart contract vulnerabilities or platform security issues that could affect token functionality.

Q3: What is TRA's price forecast for 2026-2031?

For 2026, short-term forecasts range from conservative ($0.211-$0.230), neutral ($0.230-$0.265), to optimistic ($0.265-$0.301) scenarios. Mid-term projections show potential growth to $0.151-$0.337 in 2027 and $0.196-$0.443 in 2028. Long-term outlook for 2031 presents a base scenario of $0.211-$0.433, optimistic scenario of $0.407-$0.594, with the predicted high reaching $0.594. However, these predictions are based on historical data and market analysis models, assuming steady ecosystem development and maintained fan engagement, and do not constitute investment advice given the highly volatile nature of cryptocurrency markets.

Q4: Is TRA suitable for long-term investment?

TRA's suitability for long-term investment depends on individual risk tolerance and belief in the fan token ecosystem's future. The token has a fixed supply structure providing some scarcity value, and its potential growth relates to the evolution of fan engagement platforms and sports-related blockchain applications. However, the 77.68% circulation ratio means limited additional scarcity effects from future supply releases. Long-term holders should be prepared for significant volatility, understand that utility depends on sustained fan participation, and recognize that the token's performance is closely tied to both Trabzonspor's sporting achievements and the broader adoption of fan tokens within the sports industry rather than serving as a traditional investment asset.

Q5: What investment strategies are recommended for TRA?

For conservative investors, allocate only 1-3% of portfolio to speculative assets like TRA, focusing on secure cold wallet storage for long-term holdings. Aggressive investors may consider 5-10% allocation with active monitoring, utilizing technical analysis and market sentiment within the sports fan token sector. Professional investors should implement dynamic allocation based on market conditions, position sizing to limit exposure, stop-loss mechanisms for downside protection, and regular portfolio rebalancing. Dollar-cost averaging is recommended for beginners to mitigate entry timing risks, while experienced investors should monitor platform developments and team-related events to adjust positions based on risk-reward assessments.

Q6: How does TRA generate value for token holders?

TRA generates value primarily through fan engagement rights rather than financial returns. The token provides holders with participation benefits related to Trabzonspor, enabling them to engage with the club through the Chiliz platform's fan engagement features. Unlike traditional cryptocurrencies focused on DeFi applications or NFTs, TRA's utility is centered on sports-related applications and fan participation mechanisms. The token's value proposition depends on the continued engagement of Trabzonspor's fan base, the evolution of the Chiliz platform's features, and the broader adoption of fan tokens within the sports entertainment sector, making it fundamentally different from investment vehicles designed primarily for financial appreciation.

Q7: What factors influence TRA's market performance?

TRA's market performance is influenced by multiple factors including Trabzonspor's sporting achievements, fan engagement levels on the Chiliz platform, and overall sentiment in the sports fan token market. The token's relatively small market capitalization ($1.79 million) makes it sensitive to trading volume changes and market sentiment shifts. Unlike larger cryptocurrencies, TRA shows less correlation with macroeconomic factors and instead responds more closely to sports-related events and the Chiliz ecosystem dynamics. Additional influences include the token's listing on 4 exchanges affecting trading accessibility, platform developments and feature enhancements, competition from alternative fan tokens, and broader cryptocurrency market conditions that may create spillover effects.

Q8: What security measures should investors take when holding TRA?

Investors should implement multi-layered security measures appropriate to their investment size and trading frequency. For active traders, hot wallets provide convenience but require strong security practices including two-factor authentication and regular password updates. Long-term holders should utilize cold wallet storage to minimize online exposure, with hardware wallets recommended for significant holdings to provide enhanced security. Institutional investors should consider multi-signature solutions for institutional-grade security. All investors should verify contract addresses when transacting, use reputable exchanges for trading, maintain backup recovery phrases in secure physical locations, and stay informed about platform security updates and best practices within the Chiliz ecosystem.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

SafeMoon Latest Updates and Price Analysis: What’s Happening with SafeMoon?

What is QuarkChain QKC price today with $25.39M market cap and $545K 24-hour trading volume

Jupiter Integrates Built-In Polymarket Predictions: Powering a New Era of Decentralized Prediction Markets

Is HashPack (PACK) a good investment?: A Comprehensive Analysis of Token Fundamentals, Market Potential, and Risk Factors for 2024

Is The Game Company (GMRT) a good investment?: A Comprehensive Analysis of Financial Performance, Market Position, and Future Growth Potential