L1 vs ICP: A Comprehensive Comparison of Layer 1 Blockchains and Internet Computer Protocol

Introduction: L1 vs ICP Investment Comparison

In the cryptocurrency market, the comparison between L1 and ICP has been a topic of continuous interest among investors. The two exhibit notable differences in market capitalization ranking, application scenarios, and price performance, representing distinct positions within the crypto asset landscape. L1 (Lamina1): Launched in 2019, L1 positions itself as a creator-owned platform designed for intellectual property incubation, distribution, and monetization, targeting the content creator economy. ICP (Internet Computer): Since its inception in 2019, ICP has been recognized as a decentralized cloud blockchain capable of hosting secure applications, websites, and enterprise systems while enabling trustless multi-chain interactions. This article will provide a comprehensive analysis of the investment value comparison between L1 and ICP, focusing on historical price movements, supply mechanisms, institutional adoption, technological ecosystems, and future projections. We aim to address the question most relevant to investors:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

L1 and ICP Historical Price Performance

- November 2024: L1 experienced notable volatility, with its price reaching a peak of $0.9 during mid-November 2024, marking a significant milestone since its public launch in November 2024 at an initial price of $0.3.

- May 2021: ICP was affected by its mainnet launch event, with price exhibiting substantial fluctuation. The token reached an all-time high of $700.65 shortly after its debut in May 2021.

- October 2025: ICP witnessed a decline, hitting an all-time low of $2.23 in October 2025.

- Comparative analysis: During recent market cycles, L1 declined from its peak of $0.9 to a low of $0.00224 recorded in February 2026, representing a decline of over 99%. Meanwhile, ICP experienced a similar trajectory, falling from $700.65 to $2.23, also reflecting a decline exceeding 99%.

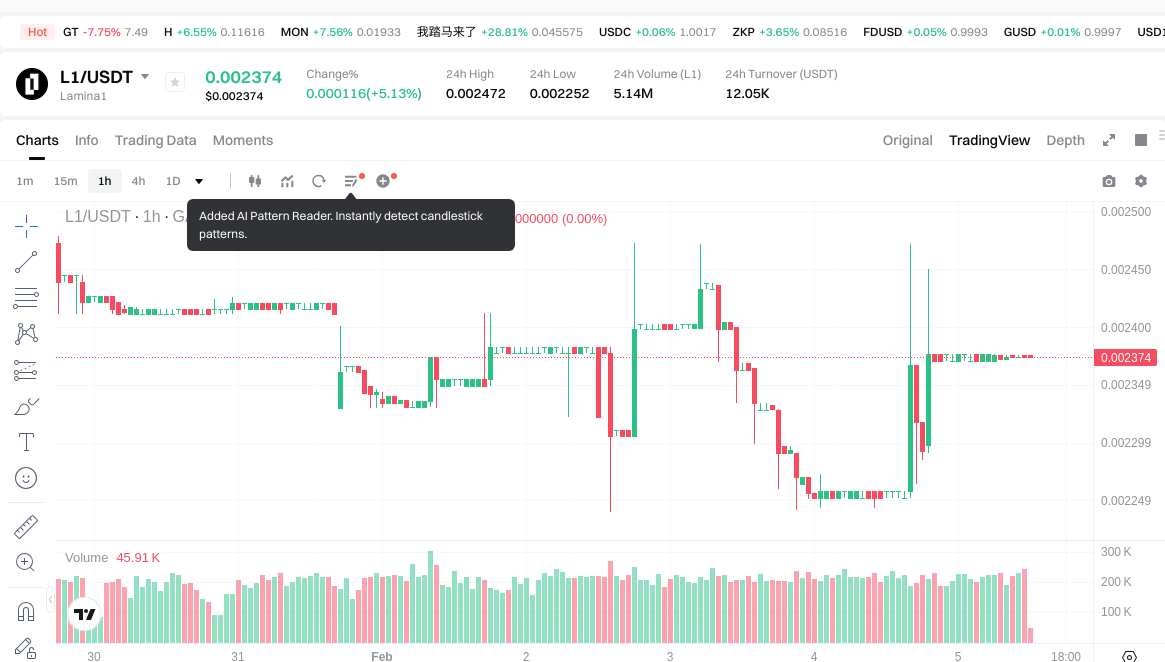

Current Market Situation (February 5, 2026)

- L1 current price: $0.002374

- ICP current price: $2.582

- 24-hour trading volume: L1 recorded $12,039.94 compared to ICP's $2,067,993.16

- Market sentiment index (Fear & Greed Index): 12 (Extreme Fear)

Click to view real-time prices:

- View L1 current price Market Price

- View ICP current price Market Price

II. Core Factors Influencing L1 vs ICP Investment Value

Tokenomics Comparison

-

L1: The core value lies in building an ecosystem that supports its token, including applications, users, throughput, and economic activities. The success of L1 depends on the expansion of its application base and user adoption.

-

ICP: Features a reverse gas mechanism where application developers pre-deposit Cycles to cover costs. ICP positions itself as a high-performance L1 platform within the decentralized cloud computing sector.

-

📌 Historical Pattern: Supply mechanisms and ecosystem utilization patterns drive price cycles. Underutilized L1 networks may experience value erosion over time, while network capacity and user growth alignment affects token performance.

Institutional Adoption and Market Application

-

Institutional Holdings: L1 networks with expanding ecosystems tend to attract institutional attention through their application diversity and user base growth.

-

Enterprise Adoption: ICP's decentralized cloud computing vision targets enterprise-level applications. L1 networks focus on supporting decentralized applications, user activities, and economic transactions.

-

Regulatory Environment: Different jurisdictions maintain varying regulatory attitudes toward blockchain infrastructure and decentralized computing platforms.

Technology Development and Ecosystem Building

-

L1 Technical Upgrades: Network success relies on continuous expansion of applications, user base, throughput capacity, and economic activities within the ecosystem.

-

ICP Technical Development: The Caffeine platform serves as a key driver, aiming to significantly expand network capabilities. The reverse gas mechanism represents a distinctive approach to network economics.

-

Ecosystem Comparison: L1 value accumulation depends on the growth of decentralized applications and user engagement. ICP focuses on decentralized cloud computing services and application development frameworks.

Macroeconomic Environment and Market Cycles

-

Inflation Context: Token economies respond to broader macroeconomic trends and external market shocks.

-

Monetary Policy Impact: Interest rates and currency valuations affect cryptocurrency market sentiment and asset allocation decisions.

-

Geopolitical Factors: Cross-border transaction requirements and international developments influence adoption patterns for blockchain infrastructure and decentralized computing platforms.

III. 2026-2031 Price Forecast: L1 vs ICP

Short-term Forecast (2026)

- L1: Conservative $0.0014-$0.0024 | Optimistic $0.0024-$0.0025

- ICP: Conservative $2.49-$2.57 | Optimistic $2.57-$3.03

Mid-term Forecast (2028-2029)

- L1 may enter a consolidation phase, with projected prices ranging from $0.0021 to $0.0037

- ICP may enter an expansion phase, with projected prices ranging from $2.91 to $5.11

- Key drivers: institutional capital inflows, ETF developments, ecosystem growth

Long-term Forecast (2030-2031)

- L1: Baseline scenario $0.0024-$0.0034 | Optimistic scenario $0.0037-$0.0050

- ICP: Baseline scenario $2.77-$4.27 | Optimistic scenario $4.78-$5.43

Disclaimer

L1:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0024927 | 0.002374 | 0.00140066 | 0 |

| 2027 | 0.003552691 | 0.00243335 | 0.0022630155 | 2 |

| 2028 | 0.003082811115 | 0.0029930205 | 0.002125044555 | 26 |

| 2029 | 0.003736636443225 | 0.0030379158075 | 0.002764503384825 | 27 |

| 2030 | 0.003658258215391 | 0.003387276125362 | 0.002404966049007 | 42 |

| 2031 | 0.004967101710231 | 0.003522767170377 | 0.003064807438227 | 48 |

ICP:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 3.0326 | 2.57 | 2.4929 | 0 |

| 2027 | 3.697716 | 2.8013 | 1.764819 | 8 |

| 2028 | 3.60695388 | 3.249508 | 2.9245572 | 25 |

| 2029 | 5.1080641006 | 3.42823094 | 2.913996299 | 32 |

| 2030 | 4.780325222736 | 4.2681475203 | 2.774295888195 | 65 |

| 2031 | 5.4290836458216 | 4.524236371518 | 3.03123836891706 | 75 |

IV. Investment Strategy Comparison: L1 vs ICP

Long-term vs Short-term Investment Strategies

- L1: May appeal to investors focused on creator economy platforms and content monetization ecosystems, particularly those interested in early-stage network development with substantial risk tolerance

- ICP: May suit investors seeking exposure to decentralized cloud computing infrastructure and enterprise-level blockchain applications, with interest in established technological frameworks

Risk Management and Asset Allocation

- Conservative investors: L1: 10-15% vs ICP: 20-30%

- Aggressive investors: L1: 25-35% vs ICP: 40-50%

- Hedging instruments: stablecoin allocation, options strategies, cross-asset portfolio diversification

V. Potential Risk Comparison

Market Risk

- L1: Exhibits high volatility characteristics with limited trading volume ($12,039.94 in 24-hour period as of February 5, 2026), presenting liquidity challenges and significant price fluctuation exposure

- ICP: Demonstrates volatility patterns common to established blockchain infrastructure projects, with relatively higher trading volume ($2,067,993.16 in 24-hour period) providing improved liquidity conditions

Technology Risk

- L1: Ecosystem development stage presents uncertainties regarding application adoption, user base expansion, and network throughput capacity realization

- ICP: Technical implementation complexity of decentralized cloud computing architecture, network performance validation under scaling conditions, and reverse gas mechanism adoption patterns

Regulatory Risk

- Global regulatory frameworks continue evolving regarding blockchain infrastructure classification, decentralized computing platforms, and creator economy tokenization models, with potential differential impacts on L1's content-focused approach versus ICP's enterprise computing positioning

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- L1 characteristics: Targets the creator economy sector with intellectual property monetization focus, currently in early ecosystem development phase with substantial growth dependency on application adoption and user engagement

- ICP characteristics: Positions within decentralized cloud computing infrastructure with enterprise application targeting, features established technical framework including reverse gas mechanism and multi-chain interaction capabilities

✅ Investment Considerations:

- Novice investors: Consider gradual position building with emphasis on established networks demonstrating clearer adoption metrics and ecosystem development progress, maintaining strict position sizing discipline

- Experienced investors: May explore diversified exposure across both assets based on risk tolerance, with allocation reflecting infrastructure maturity differences and ecosystem development stages

- Institutional investors: Evaluation should incorporate infrastructure scalability assessment, regulatory compliance frameworks, enterprise adoption trajectories, and liquidity profile analysis

⚠️ Risk Notice: Cryptocurrency markets exhibit extreme volatility characteristics. This content does not constitute investment advice.

VII. FAQ

Q1: What is the primary difference between L1 and ICP's value propositions?

L1 focuses on creator economy and intellectual property monetization, while ICP targets decentralized cloud computing infrastructure for enterprise applications. L1 positions itself as a platform for content creators to incubate, distribute, and monetize intellectual property, currently in early ecosystem development phase. ICP, by contrast, functions as a decentralized cloud blockchain capable of hosting secure applications, websites, and enterprise systems with trustless multi-chain interactions, featuring a unique reverse gas mechanism where developers pre-deposit Cycles to cover network costs.

Q2: Why do L1 and ICP have such dramatically different price points despite both launching in 2019?

ICP trades at $2.582 while L1 trades at $0.002374 as of February 5, 2026, primarily reflecting differences in initial launch conditions, market positioning, and ecosystem maturity. ICP launched at a significantly higher valuation with its mainnet reaching an all-time high of $700.65 in May 2021, establishing itself as an enterprise-focused blockchain infrastructure. L1 launched publicly in November 2024 at $0.3, targeting a niche creator economy segment. The price differential also reflects trading volume disparities: ICP maintains $2,067,993.16 in 24-hour volume compared to L1's $12,039.94, indicating substantially different liquidity profiles and market adoption levels.

Q3: Which project offers better risk-adjusted returns for 2026-2031?

ICP presents a more conservative risk profile with established infrastructure and higher liquidity, projecting 2031 prices between $3.03-$5.43. L1 offers higher potential percentage gains but with substantially elevated risk, projecting 2031 prices between $0.003-$0.005 (representing potential 100%+ increase from current levels). Conservative investors might allocate 20-30% to ICP versus 10-15% to L1, while aggressive investors might consider 40-50% ICP versus 25-35% L1 exposure. The choice depends on risk tolerance: ICP suits investors seeking established decentralized computing infrastructure exposure, while L1 appeals to those willing to accept early-stage ecosystem development risks for potential outsized returns in the creator economy sector.

Q4: What are the critical ecosystem development factors that could impact L1 vs ICP investment outcomes?

For L1, success depends on application base expansion, user adoption rates, network throughput capacity, and economic activity growth within its creator-focused ecosystem. For ICP, key factors include the Caffeine platform's development progress, enterprise adoption of decentralized cloud services, reverse gas mechanism acceptance, and multi-chain interaction implementation. Both projects face technological execution risks, but L1's early development stage presents higher uncertainty regarding ecosystem viability, while ICP's complexity lies in enterprise-scale performance validation and developer adoption of its unique economic model.

Q5: How do regulatory considerations differ between L1 and ICP investments?

Regulatory frameworks impact L1 and ICP differently due to their distinct positioning. L1's focus on intellectual property monetization and creator economy may face evolving regulations regarding content tokenization, digital rights management, and creator compensation models across jurisdictions. ICP's enterprise computing infrastructure positioning encounters regulatory considerations around decentralized cloud services, data sovereignty requirements, and enterprise-grade compliance standards. Both face general blockchain infrastructure regulations, but ICP's enterprise focus may require adherence to stricter data protection and service reliability standards, while L1 navigates intellectual property and content-related regulatory frameworks.

Q6: What trading volume and liquidity differences should investors consider?

The liquidity disparity between L1 and ICP is substantial and material to investment decisions. As of February 5, 2026, ICP maintains a 24-hour trading volume of $2,067,993.16 compared to L1's $12,039.94—a difference of over 170x. This volume differential significantly impacts execution quality, price slippage, and exit strategy feasibility. L1's limited liquidity presents challenges for larger position entries and exits, potentially resulting in significant price impact during trades. ICP's higher liquidity provides improved trade execution conditions and reduced slippage risk, making it more suitable for institutional-scale positions and tactical trading strategies.

Q7: How should investors interpret the extreme Fear & Greed Index reading of 12 in current market conditions?

The Fear & Greed Index reading of 12 (Extreme Fear) as of February 5, 2026, indicates severely pessimistic market sentiment across cryptocurrency markets. Historically, extreme fear readings have presented contrarian buying opportunities, though timing recovery remains challenging. For L1 and ICP investments, this context suggests both assets face broader market headwinds beyond project-specific fundamentals. Investors should recognize that sentiment-driven downturns can create accumulation opportunities, but require patience as fear phases may persist. The extreme fear environment reinforces the importance of position sizing discipline, staged entry strategies, and maintaining sufficient capital reserves for potential further downside before sentiment normalizes.

Q8: What position sizing strategy is appropriate given L1 and ICP's different risk profiles?

Position sizing should reflect each asset's distinct risk characteristics and investor risk tolerance. For conservative portfolios, allocating 10-15% to L1 and 20-30% to ICP acknowledges L1's higher execution risk due to early ecosystem stage and limited liquidity, while recognizing ICP's more established infrastructure. Aggressive investors might increase allocations to 25-35% for L1 and 40-50% for ICP, accepting higher volatility for potential returns. Critical considerations include maintaining stablecoin reserves for opportunistic entries during volatility, implementing options strategies for downside protection, and diversifying across complementary blockchain infrastructure assets to mitigate single-project risk concentration.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What is EARNM: A Comprehensive Guide to Earnings Management and Financial Reporting

What is GARI: A Comprehensive Guide to Understanding the AI-Powered Social Platform and Its Revolutionary Features

What is RFC: A Comprehensive Guide to Request for Comments in Internet Standards

What is CBDC, or Central Bank Digital Currency

Top 6 Decentralized Exchanges: Comprehensive Guide to the Best DEX Platforms