LBLOCK vs STX: A Comprehensive Comparison of Two Leading Blockchain Tokens in the DeFi Ecosystem

Introduction: LBLOCK Investment Value, Price Prediction, and Risk Analysis

In the cryptocurrency market, LBLOCK represents a distinctive positioning within the NFT competition platform sector. As a digital asset, its investment characteristics and risk profile warrant comprehensive examination.

Lucky Block (LBLOCK): Launched as a market-leading NFT competition platform, it enables players to participate in competitions and receive rewards through NFT holdings. As of February 3, 2026, LBLOCK is ranked 2555 by market capitalization with a circulating supply of 100 billion tokens.

This article will analyze LBLOCK's investment dimensions through historical price movements, supply mechanism, market performance, and technical ecosystem, addressing key questions investors frequently consider:

"What are the fundamental factors influencing LBLOCK's valuation?" "How do market dynamics impact its price volatility?" "What risk factors should be evaluated before allocation?"

By examining data-driven insights and market structure, this analysis aims to provide a framework for understanding LBLOCK's position in the evolving crypto asset landscape.

I. Historical Price Comparison and Current Market Status

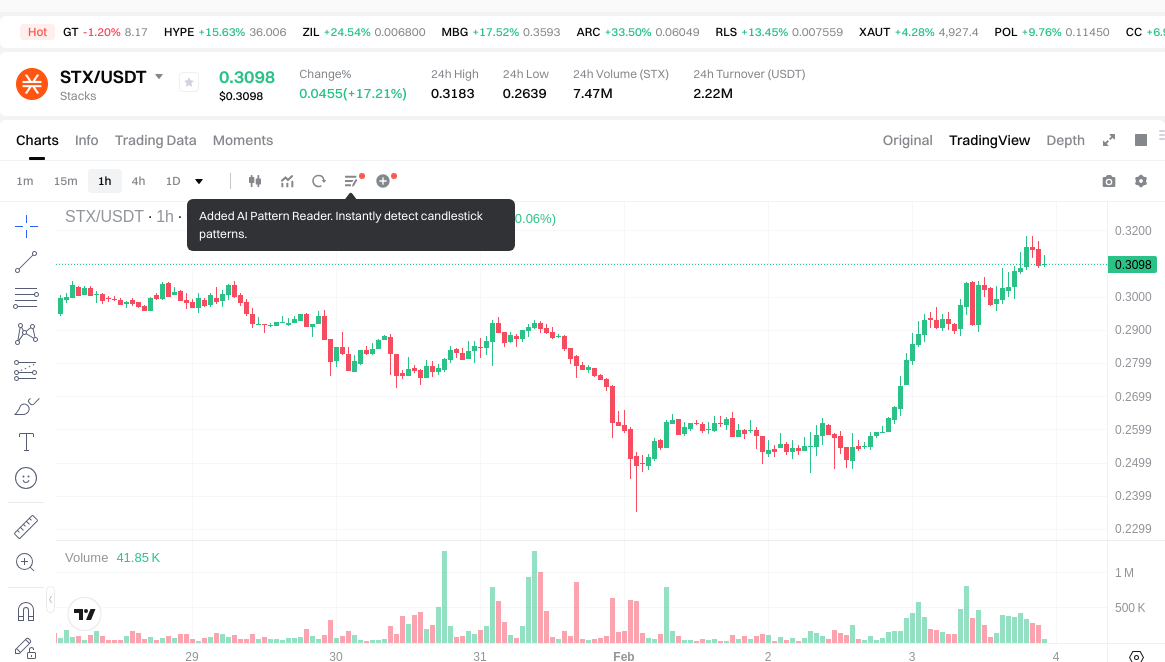

LBLOCK (Lucky Block) and STX (Stacks) Historical Price Trends

- 2022: LBLOCK reached a peak price of $0.00974554 in February, representing a significant milestone during its early market phase.

- 2024: STX experienced notable price action, reaching its all-time high of $3.86 in April, driven by increased activity in Bitcoin-related smart contract platforms.

- 2025: LBLOCK recorded its lowest price of $0.000000067315 in August, while STX saw substantial correction from its peak levels throughout the year.

- Comparative Analysis: During the 2024-2025 market cycle, LBLOCK declined from its historical high of $0.00974554 to current levels near $0.000009362, representing a decline of over 99%. In contrast, STX fell from $3.86 to approximately $0.3107, reflecting a decline of approximately 92% from its peak.

Current Market Status (2026-02-03)

- LBLOCK Current Price: $0.000009362

- STX Current Price: $0.3107

- 24-Hour Trading Volume: LBLOCK $12,309.63 vs STX $2,217,832.10

- Market Sentiment Index (Fear & Greed Index): 17 (Extreme Fear)

- LBLOCK 24-Hour Change: -5.94%

- STX 24-Hour Change: +16.71%

- LBLOCK Market Capitalization: $936,200

- STX Market Capitalization: $551,422,933

View Real-Time Prices:

- Check LBLOCK Current Price Market Price

- Check STX Current Price Market Price

II. Core Factors Influencing LBLOCK vs STX Investment Value

Supply Mechanism Comparison (Tokenomics)

Due to limited available data on the specific supply mechanisms of LBLOCK and STX, a detailed comparison cannot be provided at this time. Investors are encouraged to refer to official project documentation for tokenomics details.

Institutional Adoption and Market Application

Without sufficient data on institutional holdings, enterprise adoption, or regulatory stances toward LBLOCK and STX across different jurisdictions, a comparative analysis of their market applications in cross-border payments, settlement, and investment portfolios cannot be conducted.

Technology Development and Ecosystem Building

Insufficient information is available regarding recent technical upgrades for LBLOCK and STX, as well as their respective ecosystem developments in DeFi, NFT, payments, and smart contract implementations.

Macroeconomic Factors and Market Cycles

A comparison of how LBLOCK and STX perform under inflationary environments, their relationship with macroeconomic monetary policies (interest rates, US Dollar Index), and the impact of geopolitical factors on cross-border transaction demand cannot be established due to lack of relevant data.

III. 2026-2031 Price Prediction: LBLOCK vs STX

Short-term Prediction (2026)

- LBLOCK: Conservative $0.00000777046 - $0.000009362 | Optimistic $0.000009362 - $0.00001160888

- STX: Conservative $0.21679 - $0.3097 | Optimistic $0.3097 - $0.405707

Mid-term Prediction (2028-2029)

- LBLOCK may enter a moderate growth phase, with projected price range of $0.00000856136176 - $0.00001784621888

- STX may enter an expansion phase, with projected price range of $0.239571919125 - $0.664181623153125

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Prediction (2030-2031)

- LBLOCK: Baseline scenario $0.000012813469396 - $0.000016016836745 | Optimistic scenario $0.000016016836745 - $0.000020501551034

- STX: Baseline scenario $0.524104250401372 - $0.61659323576632 | Optimistic scenario $0.61659323576632 - $0.675183543237328

Disclaimer: Price predictions are based on historical data analysis and market trends. Cryptocurrency markets are highly volatile and unpredictable. These projections should not be considered as investment advice or guarantees of future performance.

LBLOCK:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00001160888 | 0.000009362 | 0.00000777046 | 0 |

| 2027 | 0.000013631072 | 0.00001048544 | 0.000008388352 | 12 |

| 2028 | 0.00001784621888 | 0.000012058256 | 0.00000856136176 | 28 |

| 2029 | 0.000016148416435 | 0.00001495223744 | 0.000008971342464 | 59 |

| 2030 | 0.000016483346553 | 0.000015550326937 | 0.000014150797513 | 66 |

| 2031 | 0.000020501551034 | 0.000016016836745 | 0.000012813469396 | 71 |

STX:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.405707 | 0.3097 | 0.21679 | 0 |

| 2027 | 0.482899725 | 0.3577035 | 0.31477908 | 15 |

| 2028 | 0.483346854375 | 0.4203016125 | 0.239571919125 | 35 |

| 2029 | 0.664181623153125 | 0.4518242334375 | 0.384050598421875 | 45 |

| 2030 | 0.675183543237328 | 0.558002928295312 | 0.530102781880546 | 79 |

| 2031 | 0.641256965196973 | 0.61659323576632 | 0.524104250401372 | 98 |

IV. Investment Strategy Comparison: LBLOCK vs STX

Long-term vs Short-term Investment Strategies

- LBLOCK: May appeal to investors with higher risk tolerance seeking exposure to NFT competition platforms and lottery-based reward mechanisms. The token's significant price decline from historical highs suggests a speculative positioning requiring careful consideration of platform adoption and user engagement metrics.

- STX: May suit investors interested in Bitcoin-related smart contract infrastructure and Layer-2 solutions. The token's connection to Bitcoin ecosystem developments positions it for potential growth aligned with Bitcoin network upgrades and institutional interest in Bitcoin-native DeFi applications.

Risk Management and Asset Allocation

- Conservative Investors: LBLOCK 5-10% vs STX 10-20%

- Aggressive Investors: LBLOCK 15-25% vs STX 25-35%

- Hedging Tools: Stablecoin allocations for portfolio balance, options strategies for downside protection, cross-asset diversification across multiple digital assets

V. Potential Risk Comparison

Market Risks

- LBLOCK: Faces substantial volatility with limited trading volume ($12,309.63 daily), creating liquidity constraints. Market capitalization of $936,200 indicates a microcap positioning with elevated price sensitivity to trading activity. The current Extreme Fear sentiment (Fear & Greed Index: 17) may amplify downward pressure.

- STX: Demonstrates higher market liquidity with $2,217,832.10 in daily trading volume and $551,422,933 market capitalization. Price movements may correlate with Bitcoin network developments and broader smart contract platform competition. Market sentiment shifts can create significant price swings, as evidenced by the +16.71% 24-hour change.

Technical Risks

- LBLOCK: Platform-specific risks include user adoption rates for NFT competitions, smart contract functionality for prize distribution, and network infrastructure supporting lottery mechanisms. Limited data availability on technical architecture constrains comprehensive risk assessment.

- STX: Technical considerations include scalability of the Stacks blockchain, integration stability with Bitcoin base layer, smart contract security, and network performance under increased transaction loads. Competition from other Bitcoin Layer-2 solutions presents ongoing technical challenges.

Regulatory Risks

- Regulatory frameworks for lottery-based platforms and NFT competitions vary significantly across jurisdictions, potentially affecting LBLOCK's operational scope. STX may face regulatory scrutiny related to smart contract platforms and DeFi applications, with evolving compliance requirements across different markets impacting development roadmaps and market access.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- LBLOCK Characteristics: Positions within the NFT competition and lottery reward sector with microcap market status. Significant historical price decline reflects early-stage platform risks and limited market adoption. Suitable for highly speculative allocations with understanding of platform-specific execution risks.

- STX Characteristics: Offers exposure to Bitcoin-related smart contract infrastructure with established market presence. Higher liquidity and market capitalization provide relatively improved trading conditions. Ecosystem development tied to Bitcoin network evolution presents both opportunities and dependencies.

✅ Investment Considerations:

- New Investors: Consider starting with established assets demonstrating greater liquidity and market stability. If exploring LBLOCK or STX, limit exposure to small portfolio percentages (under 5%) while building understanding of platform mechanics and market dynamics.

- Experienced Investors: Evaluate LBLOCK for high-risk, speculative positioning with thorough due diligence on platform adoption metrics. Consider STX for exposure to Bitcoin ecosystem development with awareness of technical and competitive landscape factors.

- Institutional Investors: Assess liquidity requirements, custody solutions, and regulatory compliance frameworks before allocation. STX may offer more suitable infrastructure for institutional participation compared to LBLOCK's current market positioning.

⚠️ Risk Disclosure: Cryptocurrency markets exhibit extreme volatility. This analysis does not constitute investment advice. Historical performance does not guarantee future results. Conduct independent research and consult financial advisors before making investment decisions.

VII. FAQ

Q1: What is the current price difference between LBLOCK and STX, and how do their market capitalizations compare?

As of February 3, 2026, LBLOCK trades at $0.000009362 with a market capitalization of $936,200, while STX trades at $0.3107 with a market capitalization of $551,422,933. This represents a substantial disparity in market positioning, with STX demonstrating approximately 589 times greater market capitalization than LBLOCK. The price differential reflects their distinct market segments: LBLOCK operates as a microcap asset within the NFT competition platform sector, whereas STX maintains established positioning in Bitcoin-related smart contract infrastructure. Trading volume further illustrates this contrast, with LBLOCK recording $12,309.63 in 24-hour volume compared to STX's $2,217,832.10, indicating significantly different liquidity profiles and market depth.

Q2: How have LBLOCK and STX performed from their historical peaks, and what does this indicate about their volatility?

LBLOCK has declined over 99% from its February 2022 peak of $0.00974554 to current levels near $0.000009362, while STX has fallen approximately 92% from its April 2024 all-time high of $3.86 to approximately $0.3107. These substantial corrections demonstrate extreme price volatility characteristic of cryptocurrency markets, though the magnitude differs significantly. LBLOCK's more severe decline reflects challenges in platform adoption, user engagement, and market positioning within the competitive NFT sector. STX's correction, while substantial, aligns more closely with broader smart contract platform market cycles and Bitcoin ecosystem developments. Both assets exhibit high-risk profiles, with LBLOCK presenting particularly elevated volatility due to microcap status and limited liquidity.

Q3: What are the primary technological differences between LBLOCK and STX that investors should understand?

LBLOCK functions as an NFT competition platform enabling lottery-based reward mechanisms through NFT holdings, focusing on gaming and prize distribution functionality. STX operates as a Bitcoin Layer-2 smart contract platform, enabling decentralized applications and DeFi protocols while maintaining connection to Bitcoin's base layer security. The technological architectures serve fundamentally different purposes: LBLOCK emphasizes user engagement through competition mechanics and NFT utility, while STX provides infrastructure for developers building Bitcoin-native applications. This distinction affects their respective risk profiles and growth trajectories. LBLOCK's value proposition depends heavily on platform adoption and user retention within a specific use case, whereas STX's positioning relates to broader Bitcoin ecosystem expansion and smart contract platform competition.

Q4: What allocation percentages are suggested for conservative versus aggressive investors considering LBLOCK and STX?

Conservative investors may consider LBLOCK allocation of 5-10% and STX allocation of 10-20% within their cryptocurrency portfolio, emphasizing risk management and diversification. Aggressive investors with higher risk tolerance might allocate 15-25% to LBLOCK and 25-35% to STX, accepting greater volatility for potential upside exposure. These percentages assume allocation within an already diversified investment portfolio and should not represent total portfolio concentration. The lower allocation recommendation for LBLOCK reflects its microcap status, limited liquidity, and platform-specific execution risks. STX receives relatively higher allocation consideration due to greater market capitalization, improved liquidity conditions, and infrastructure positioning within Bitcoin ecosystem development. All investors should implement hedging strategies including stablecoin allocations, cross-asset diversification, and appropriate risk management tools aligned with individual risk tolerance and investment objectives.

Q5: What are the projected price ranges for LBLOCK and STX by 2031, and what factors might influence these projections?

Price predictions for 2031 suggest LBLOCK may range between $0.000012813469396 (baseline low) and $0.000020501551034 (optimistic high), representing potential growth of 71% from current levels under the baseline scenario. STX projections indicate a range of $0.524104250401372 (baseline low) to $0.675183543237328 (optimistic high), suggesting potential growth of 98% under baseline assumptions. These projections incorporate historical trend analysis, market cycle patterns, and ecosystem development trajectories. Key influencing factors include institutional capital flows, regulatory developments, technological advancement, Bitcoin ecosystem evolution (particularly relevant for STX), platform adoption metrics (critical for LBLOCK), competitive landscape shifts, and macroeconomic conditions. However, cryptocurrency markets demonstrate extreme unpredictability, and these projections should not be interpreted as guarantees. Historical performance does not ensure future results, and numerous unforeseen variables can substantially alter actual outcomes.

Q6: What specific regulatory risks should investors consider when evaluating LBLOCK versus STX?

LBLOCK faces regulatory scrutiny related to lottery-based mechanisms and NFT competition platforms, which are subject to varying legal frameworks across jurisdictions. Gaming regulations, gambling laws, and prize distribution requirements may constrain operational scope in certain markets, potentially limiting platform expansion and user accessibility. STX encounters regulatory considerations common to smart contract platforms and DeFi applications, including securities classification questions, DeFi protocol compliance requirements, and evolving regulatory standards for blockchain infrastructure. Both assets operate in regulatory environments that continue developing globally, creating uncertainty regarding future compliance obligations, operational restrictions, and market access limitations. Jurisdictional differences significantly impact how these assets may be utilized, traded, and held, requiring investors to understand applicable regulations in their specific locations. Regulatory developments can materially affect project roadmaps, market valuations, and operational viability.

Q7: How does the current market sentiment (Extreme Fear at 17) affect short-term considerations for LBLOCK and STX investments?

The Fear & Greed Index reading of 17 indicates Extreme Fear sentiment as of February 3, 2026, suggesting widespread market pessimism and risk aversion. Under such conditions, cryptocurrency prices typically face downward pressure as investors reduce exposure and liquidity diminishes. For LBLOCK, this sentiment exacerbates existing liquidity constraints given its limited daily trading volume of $12,309.63, potentially creating difficulty entering or exiting positions at desired price levels. STX, with higher liquidity at $2,217,832.10 daily volume, may demonstrate better price discovery and trading execution despite broader market sentiment. Extreme Fear periods historically present potential accumulation opportunities for long-term investors with sufficient risk tolerance, though timing market bottoms remains challenging. Short-term traders should exercise heightened caution during such sentiment extremes, as volatility often increases and price movements can become erratic. Dollar-cost averaging strategies may help mitigate timing risks during prolonged negative sentiment phases.

Q8: What liquidity considerations distinguish LBLOCK from STX, and why does this matter for different investor types?

LBLOCK demonstrates severely limited liquidity with only $12,309.63 in 24-hour trading volume, creating substantial challenges for position entry and exit, particularly for larger allocations. This low liquidity results in wider bid-ask spreads, increased slippage potential, and difficulty executing orders without material price impact. STX exhibits significantly improved liquidity at $2,217,832.10 daily trading volume, enabling more efficient order execution and better price discovery mechanisms. For retail investors with smaller position sizes, LBLOCK's liquidity constraints may prove manageable, though still requiring careful order execution strategies. Institutional investors or high-net-worth individuals typically require substantially greater liquidity for meaningful allocations, making STX considerably more suitable for larger capital deployments. Liquidity differences directly affect transaction costs, execution quality, portfolio rebalancing capabilities, and risk management effectiveness. Investors must align position sizing with available liquidity to avoid concentration risks and ensure adequate exit options across various market conditions.

Treasure NFT Marketplace: A 2025 Guide for Web3 Gamers and Investors

What are the new trends in the NFT market in 2025?

NFT Treasure Hunting: Top Strategies for Web3 Collectors in 2025

How to Create and Sell NFTs: A Step-by-Step Guide for Beginners

The technical principles and application scenarios of 2025 NFTs

How to Create an NFT in 2025: A Step-by-Step Guide

Comprehensive Guide to Cryptocurrency Trading Platform Registration Bonuses

Isamu Kaneko’s Connection to Bitcoin | The P2P Philosophy Legacy of the Winny Developer

Free Money for Registration in App: Crypto Bonus Guide

How to Create and Profitably Sell NFTs: The Complete Guide

Understanding GameFi: How to Profit from Play-to-Earn