MINT vs HBAR: A Comprehensive Comparison of Two Leading Blockchain Platforms and Their Market Potential

Introduction: MINT vs HBAR Investment Comparison

In the cryptocurrency market, the comparison between MINT vs HBAR has consistently been a topic of interest for investors. These two assets exhibit notable differences in market cap ranking, application scenarios, and price performance, representing distinct positioning within the crypto asset landscape.

MINT (Mint Blockchain): Launched in 2025, this Ethereum native Layer2 network built on OP Stack technology has gained market recognition through its focus on NFT asset issuance, trading, and settlement. As a core member of Superchain, MINT aims to connect global consumers through NFT infrastructure.

HBAR (Hedera): Since its launch in 2020, Hedera has established itself as a fast, secure public ledger network utilizing hashgraph consensus. With transaction speeds exceeding 10,000 TPS and aBFT security, HBAR supports decentralized applications, peer-to-peer payments, and network security mechanisms.

This article will provide a comprehensive analysis of MINT vs HBAR investment value comparison through historical price trends, supply mechanisms, institutional adoption, technical ecosystem, and future projections, attempting to address investors' most pressing question:

"Which is the better buy right now?"

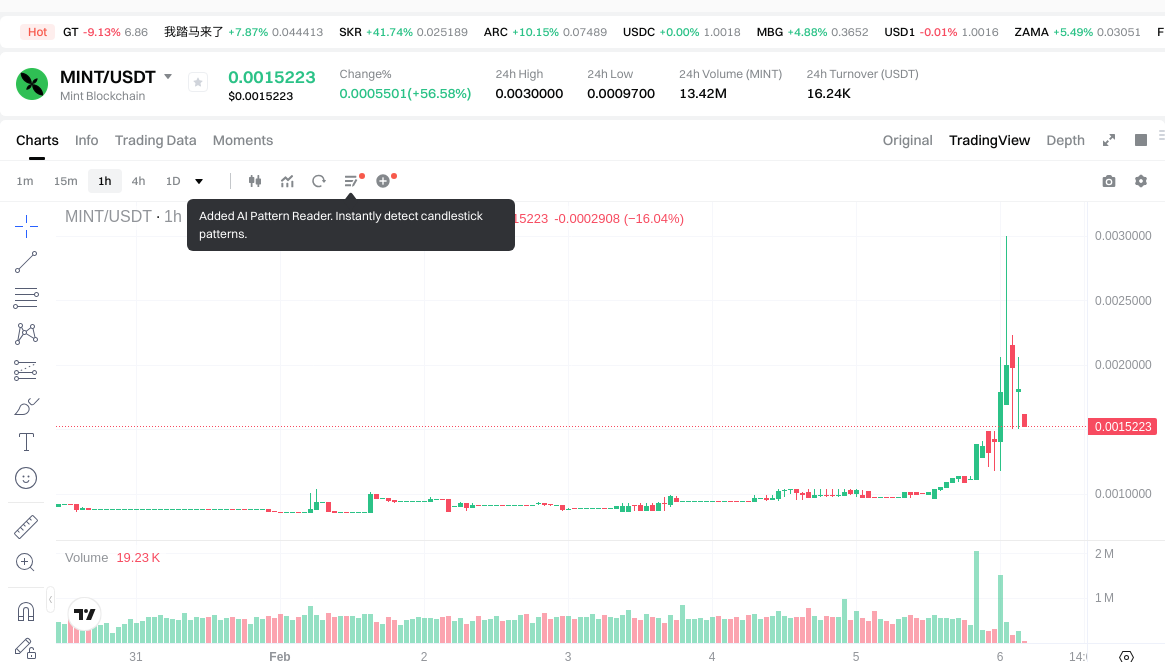

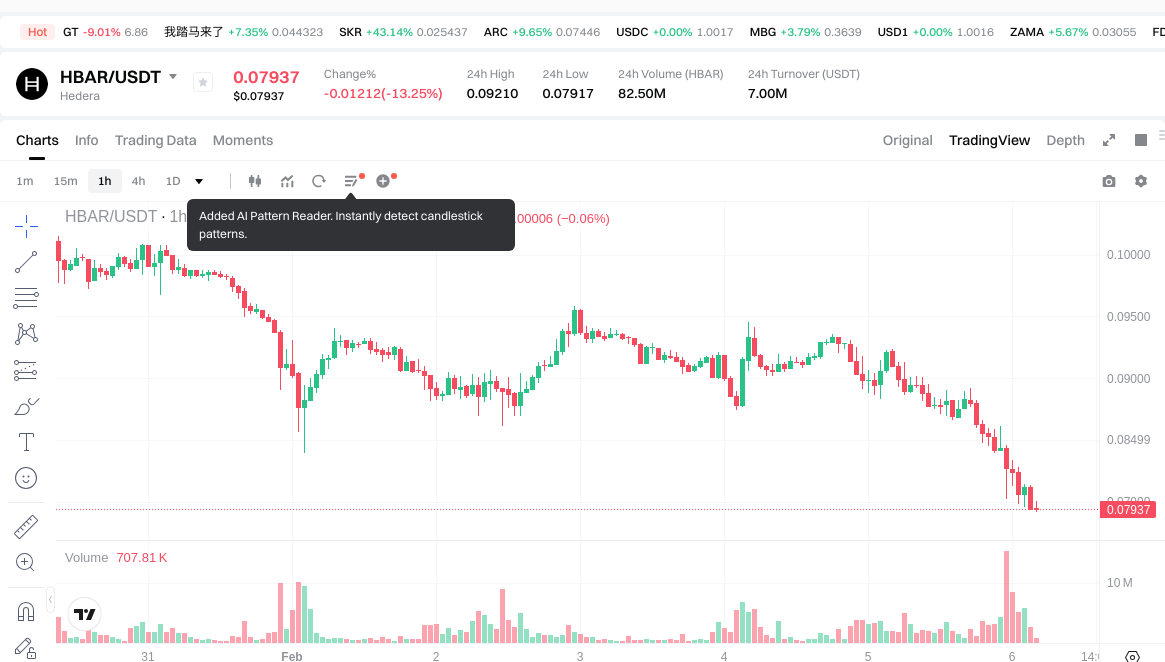

I. Historical Price Comparison and Current Market Status

MINT (Coin A) and HBAR (Coin B) Historical Price Trends

- 2025: MINT experienced initial trading activity following its launch in March 2025, with its price reaching a peak of $0.10503 during early market enthusiasm.

- 2021: HBAR was influenced by the broader cryptocurrency bull market, with its price reaching a notable level of $0.569229 in September 2021.

- Comparative Analysis: During the 2025-2026 market cycle, MINT declined from its high of $0.10503 to a low of $0.0006416, while HBAR experienced a significant correction from its 2021 peak, trading substantially lower by early 2026.

Current Market Status (2026-02-06)

- MINT Current Price: $0.0020575

- HBAR Current Price: $0.07976

- 24-Hour Trading Volume: MINT $16,305.01 vs HBAR $6,997,458.43

- Market Sentiment Index (Fear & Greed Index): 12 (Extreme Fear)

Click to view real-time prices:

- View MINT Current Price Market Price

- View HBAR Current Price Market Price

II. Core Factors Influencing MINT vs HBAR Investment Value

Supply Mechanism Comparison (Tokenomics)

- MINT: The reference materials do not provide specific information regarding MINT's supply mechanism, token issuance model, or whether it employs fixed supply or deflationary mechanisms.

- HBAR: The reference materials do not contain detailed information about HBAR's supply structure, halving mechanisms, or token distribution model.

- 📌 Historical Pattern: Supply mechanisms can influence price cycles through scarcity dynamics and emission schedules, though specific comparative data between these two assets is not available in the provided materials.

Institutional Adoption and Market Application

- Institutional Holdings: The reference materials do not provide comparative data on institutional preference or holdings between MINT and HBAR.

- Enterprise Adoption: Specific information regarding enterprise-level implementation of MINT or HBAR in cross-border payments, settlement systems, or corporate treasury portfolios is not detailed in the available sources.

- Regulatory Environment: The materials mention general regulatory developments in the crypto space but do not specifically address governmental policy stances toward MINT or HBAR across different jurisdictions.

Technical Development and Ecosystem Building

- MINT Technical Progress: The materials reference Mint Blockchain's technical characteristics and ecosystem components including Mint Studio, IP Layer, Mint Liquid, RareShop, and NFT-AI Agent modules, suggesting an NFT-focused infrastructure approach.

- HBAR Technical Evolution: HBAR's scalability advantages and low transaction fee structure are mentioned as factors that may attract user adoption, though detailed technical roadmap information is not provided.

- Ecosystem Comparison: While MINT appears to emphasize NFT and IP-related applications, comparative analysis of DeFi deployment, smart contract implementation, or payment network development between the two platforms is limited in the reference materials.

Macroeconomic Factors and Market Cycles

- Inflation Environment Performance: The materials do not provide empirical data comparing MINT and HBAR performance characteristics under inflationary conditions or their relative properties as inflation hedges.

- Monetary Policy Impact: While references acknowledge that digital assets respond to interest rates, liquidity conditions, and dollar index movements similarly to traditional assets, specific comparative sensitivity analysis between MINT and HBAR is not available.

- Geopolitical Considerations: The materials recognize geopolitical factors and cross-border transaction demand as market influences but do not detail how these specifically differentiate investment cases for MINT versus HBAR.

III. 2026-2031 Price Forecast: MINT vs HBAR

Short-term Forecast (2026)

- MINT: Conservative $0.001035 - $0.0015223 | Optimistic $0.0015223 - $0.00213122

- HBAR: Conservative $0.06996 - $0.0795 | Optimistic $0.0795 - $0.10653

Medium-term Forecast (2028-2029)

- MINT may enter a gradual recovery phase, with projected price range of $0.001797 - $0.003117 in 2028, potentially reaching $0.001954 - $0.00288 in 2029

- HBAR may enter an expansion phase, with projected price range of $0.0965 - $0.1316 in 2028, potentially reaching $0.114 - $0.180 in 2029

- Key drivers: institutional capital inflows, ETF developments, ecosystem growth

Long-term Forecast (2030-2031)

- MINT: Baseline scenario $0.00207 - $0.00276 | Optimistic scenario $0.00276 - $0.00342

- HBAR: Baseline scenario $0.0999 - $0.1514 | Optimistic scenario $0.1514 - $0.212

Disclaimer

MINT:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00213122 | 0.0015223 | 0.001035164 | -26 |

| 2027 | 0.0025026612 | 0.00182676 | 0.0017536896 | -11 |

| 2028 | 0.003117183264 | 0.0021647106 | 0.001796709798 | 5 |

| 2029 | 0.00287863215588 | 0.002640946932 | 0.00195430072968 | 28 |

| 2030 | 0.003422139034485 | 0.00275978954394 | 0.002069842157955 | 34 |

| 2031 | 0.003245512503673 | 0.003090964289212 | 0.001700030359067 | 50 |

HBAR:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.10653 | 0.0795 | 0.06996 | 0 |

| 2027 | 0.1339416 | 0.093015 | 0.06418035 | 16 |

| 2028 | 0.131634828 | 0.1134783 | 0.096456555 | 42 |

| 2029 | 0.18015814908 | 0.122556564 | 0.11397760452 | 53 |

| 2030 | 0.1558980772362 | 0.15135735654 | 0.0998958553164 | 89 |

| 2031 | 0.212006249305578 | 0.1536277168881 | 0.095249184470622 | 92 |

IV. Investment Strategy Comparison: MINT vs HBAR

Long-term vs Short-term Investment Strategies

- MINT: May appeal to investors interested in NFT infrastructure development and emerging Layer2 ecosystems, with focus on longer-term technological maturation rather than immediate price appreciation

- HBAR: May suit investors seeking exposure to established public ledger networks with demonstrated transaction processing capabilities and broader application deployment

Risk Management and Asset Allocation

- Conservative Investors: MINT 20-30% vs HBAR 70-80% allocation approach could balance exposure between emerging and more established network technologies

- Aggressive Investors: MINT 40-50% vs HBAR 50-60% allocation may provide higher risk-reward positioning while maintaining diversification across different technical architectures

- Hedging Instruments: Stablecoin allocations, options contracts where available, and cross-asset combinations can help manage portfolio volatility

V. Potential Risk Comparison

Market Risks

- MINT: Limited trading volume ($16,305.01 as of reference date) may present liquidity constraints and increased price volatility during market stress periods

- HBAR: While trading volume is substantially higher ($6,997,458.43), broader cryptocurrency market sentiment (Fear & Greed Index at 12 - Extreme Fear) affects price stability

Technical Risks

- MINT: As a relatively new Layer2 network launched in 2025, the platform faces typical early-stage challenges including network scalability testing, user adoption rates, and infrastructure stability as ecosystem components develop

- HBAR: Network security considerations and maintaining distributed consensus mechanisms represent ongoing technical priorities for the hashgraph architecture

Regulatory Risks

- Both MINT and HBAR operate within evolving global regulatory frameworks for digital assets. Jurisdiction-specific policy developments regarding Layer2 networks and public ledger systems may create differentiated compliance requirements and market access considerations across various regions

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- MINT Characteristics: NFT-focused infrastructure positioning, Superchain ecosystem participation, and emerging Layer2 technology development pathway

- HBAR Characteristics: Established network with demonstrated transaction processing capacity, broader market recognition, and longer operational track record since 2020

✅ Investment Considerations:

- Beginning Investors: Approach both assets with careful position sizing, prioritizing understanding of underlying technology differences and market dynamics before committing significant capital

- Experienced Investors: May evaluate allocation strategies based on portfolio diversification objectives, risk tolerance levels, and views on NFT infrastructure versus general-purpose ledger network adoption trajectories

- Institutional Investors: Assessment should incorporate liquidity requirements, custody solutions availability, regulatory compliance frameworks, and alignment with broader digital asset investment mandates

⚠️ Risk Disclosure: Cryptocurrency markets demonstrate substantial volatility characteristics. This analysis does not constitute investment advice, and all investment decisions should be made based on individual circumstances, risk tolerance, and thorough due diligence.

VII. FAQ

Q1: What are the main differences between MINT and HBAR in terms of technology and use cases?

MINT is an Ethereum Layer2 network focused on NFT infrastructure, while HBAR operates as a hashgraph-based public ledger for general-purpose applications. MINT, launched in 2025, specializes in NFT asset issuance, trading, and settlement as part of the Superchain ecosystem, utilizing OP Stack technology. In contrast, HBAR (launched in 2020) employs hashgraph consensus to deliver high-speed transactions (10,000+ TPS) with aBFT security, supporting decentralized applications, peer-to-peer payments, and broader network services beyond the NFT sector.

Q2: Why is there such a significant price difference between MINT ($0.0020575) and HBAR ($0.07976)?

The price disparity reflects different market capitalizations, trading histories, and adoption levels. HBAR has been trading since 2020 and reached a peak of $0.569229 in September 2021, establishing broader market recognition and institutional awareness. MINT, launched only in March 2025, represents a newer project with limited trading volume ($16,305.01 vs HBAR's $6,997,458.43) and shorter price discovery period, having declined from its initial high of $0.10503. The price difference indicates HBAR's more mature market position compared to MINT's early-stage development phase.

Q3: Which asset shows better long-term growth potential according to the 2026-2031 forecasts?

Based on projected percentage growth from current levels, HBAR demonstrates stronger absolute price appreciation potential. The 2031 optimistic forecast for HBAR reaches $0.212 (approximately 166% increase from current $0.07976), while MINT's optimistic 2031 projection of $0.00342 represents approximately 66% growth from current $0.0020575. However, investors should note that MINT's lower absolute price and emerging market position may offer different risk-reward characteristics compared to HBAR's more established trajectory, with forecasts subject to significant uncertainty given cryptocurrency market volatility.

Q4: How should investors allocate between MINT and HBAR based on risk tolerance?

Conservative investors may consider a 20-30% MINT / 70-80% HBAR allocation to balance emerging technology exposure with established network stability. This approach prioritizes HBAR's longer operational history, higher liquidity, and broader market recognition while maintaining limited exposure to MINT's NFT infrastructure development potential. Aggressive investors seeking higher risk-reward profiles might adopt a 40-50% MINT / 50-60% HBAR allocation, accepting MINT's lower liquidity and early-stage risks in exchange for possible upside from NFT ecosystem growth. All allocations should incorporate stablecoin reserves and be sized according to individual portfolio constraints and cryptocurrency market volatility tolerance.

Q5: What are the primary risks associated with investing in MINT versus HBAR?

MINT faces liquidity risk due to limited trading volume ($16,305.01 daily), which may cause significant price slippage during entry or exit. As a 2025 launch, MINT also carries early-stage technical risks including unproven network scalability, developing ecosystem infrastructure, and user adoption uncertainty. HBAR, while offering substantially higher liquidity ($6,997,458.43 daily volume), is subject to broader cryptocurrency market sentiment (currently at Extreme Fear levels) and faces ongoing technical priorities related to maintaining distributed consensus and network security. Both assets operate under evolving regulatory frameworks, with jurisdiction-specific policies potentially creating differentiated compliance requirements for Layer2 networks versus hashgraph-based public ledgers.

Q6: Is now a good time to buy MINT or HBAR given the current market sentiment?

The current Fear & Greed Index reading of 12 (Extreme Fear) historically suggests potential buying opportunities for long-term investors, as extreme fear often precedes market recoveries. However, MINT's 24-hour trading volume of only $16,305.01 indicates very limited market activity and potential liquidity challenges, while HBAR's $6,997,458.43 volume provides more reliable price discovery. The decision depends on investment timeframe—short-term traders may face continued volatility during fear periods, while long-term investors with 3-5 year horizons may view current prices as accumulation opportunities. Critical factors include individual risk tolerance, portfolio diversification needs, and ability to withstand further price declines during prolonged market uncertainty.

Q7: How do institutional adoption levels compare between MINT and HBAR?

The reference materials do not provide specific comparative data on institutional holdings or enterprise adoption rates between MINT and HBAR. However, HBAR's longer operational history since 2020 and substantially higher trading volume ($6,997,458.43 vs MINT's $16,305.01) suggest greater institutional awareness and participation. MINT's recent 2025 launch means institutional adoption is still in early stages, though its Superchain ecosystem membership and NFT infrastructure focus may attract specialized institutional interest in digital collectibles and IP-related applications. Investors seeking institutional validation may find HBAR's established track record more reassuring, while those interested in emerging NFT infrastructure opportunities may monitor MINT's institutional adoption trajectory as the ecosystem matures.

Q8: What factors could drive significant price appreciation for MINT versus HBAR through 2031?

For MINT, key growth drivers include successful NFT ecosystem expansion through its Mint Studio, IP Layer, and NFT-AI Agent modules, increased transaction volume on the Layer2 network, and broader Superchain ecosystem development. HBAR's appreciation potential depends on expanded enterprise adoption of its high-speed transaction capabilities, growth in decentralized applications utilizing hashgraph consensus, and institutional recognition of its aBFT security properties. Both assets would benefit from favorable cryptocurrency regulatory developments, increased institutional capital inflows, potential ETF approvals, and broader digital asset market cycles. However, MINT's lower current price and emerging status create higher relative volatility, while HBAR's established position may provide more stable, though potentially lower percentage, appreciation trajectories.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Comprehensive Guide to Investing in AI Tokens

Comprehensive Guide to Altcoin Bull Markets

What is GAMES: A Comprehensive Guide to Understanding Game-Based Learning and Engagement Strategies

What is WEST: A Comprehensive Guide to Understanding the Western Educational Standards and Training Framework

What is ZOON: A Comprehensive Guide to the Next Generation Decentralized Social Platform