MUBI vs LTC: A Comprehensive Comparison of Two Leading Streaming Platforms for Film Enthusiasts

Introduction: MUBI vs LTC Investment Comparison

In the cryptocurrency market, the comparison between MUBI and LTC has been a topic that investors cannot avoid. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in the crypto asset landscape. MUBI (MultiBit): Since its launch in 2023, it has gained market recognition with its positioning as a dual-sided bridge designed for cross-network transfers between BRC20 and ERC20 tokens. LTC (Litecoin): Since its inception in 2011, it has been regarded as digital silver and remains one of the cryptocurrencies with the highest trading volume and market capitalization globally. This article will comprehensively analyze the investment value comparison between MUBI and LTC around historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future predictions, attempting to answer the question that investors care about most:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

MUBI (Coin A) vs LTC (Coin B) Historical Price Trends

- 2023: MUBI reached a notable price level of $0.388 in December, representing an early period of market activity following its launch in November 2023.

- 2021: LTC experienced significant price movement, reaching $410.26 in May during a period of broader market expansion.

- Comparative analysis: During the recent market cycle, MUBI declined from $0.388 to $0.000496, while LTC decreased from $410.26 to its current range around $57.98, showing different volatility patterns across distinct market capitalizations.

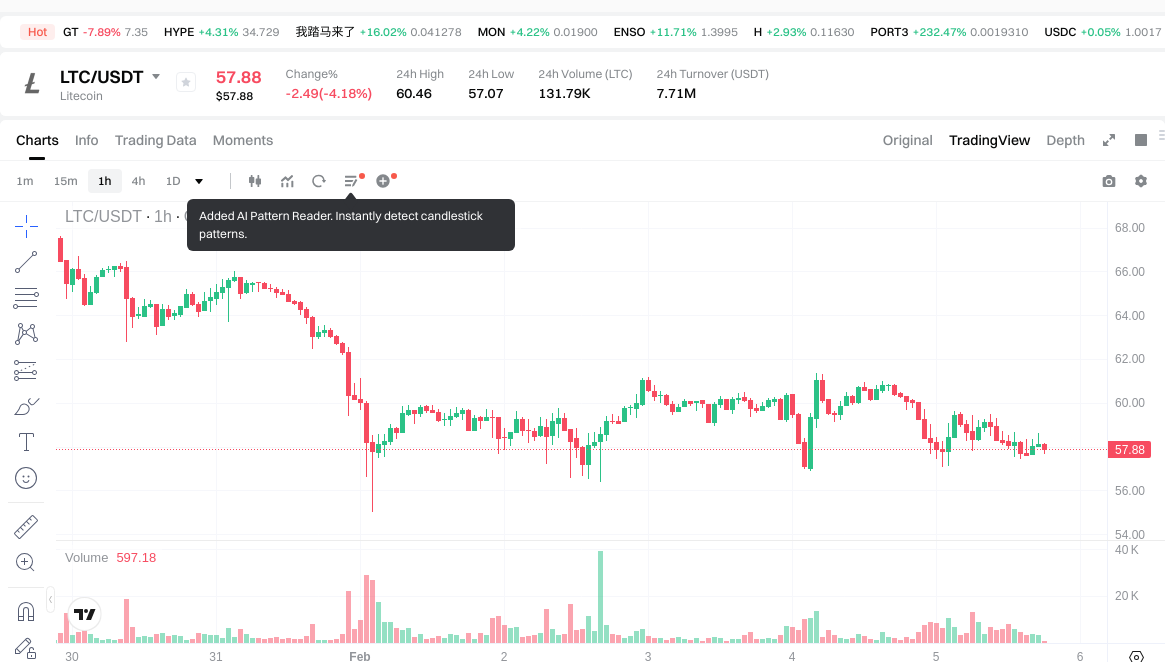

Current Market Status (2026-02-05)

- MUBI current price: $0.0005453

- LTC current price: $57.98

- 24-hour trading volume: MUBI $13,984.91 vs LTC $7,705,870.64

- Market sentiment index (Fear & Greed Index): 12 (Extreme Fear)

View real-time prices:

- Check MUBI current price Market Price

- Check LTC current price Market Price

II. Core Factors Influencing MUBI vs LTC Investment Value

Supply Mechanism Comparison (Tokenomics)

-

MUBI: As part of the Bitcoin ecosystem, MUBI typically follows token economics aligned with Bitcoin-related projects. While specific supply details are not provided in the materials, Bitcoin ecosystem tokens often feature fixed or capped supply models designed to create scarcity value.

-

LTC: Litecoin operates on a capped supply model with a maximum of 84 million coins, four times Bitcoin's supply. It employs a halving mechanism where block rewards reduce by 50% approximately every four years, creating deflationary pressure over time.

-

📌 Historical Pattern: Supply mechanisms drive price cycles through scarcity dynamics. Halving events in proof-of-work cryptocurrencies like LTC have historically preceded price appreciation periods, as reduced new supply meets existing or growing demand.

Institutional Adoption and Market Application

-

Institutional Holdings: Litecoin has established greater institutional recognition due to its longer market presence since 2011. Major financial entities have shown interest in LTC as part of diversified crypto portfolios, though Bitcoin remains the primary institutional focus.

-

Enterprise Adoption:

- MUBI: As a Bitcoin ecosystem project, MUBI may benefit from Bitcoin's expanding infrastructure for payments and settlements, though specific enterprise applications are not detailed in available materials.

- LTC: Litecoin's faster transaction speeds make it suitable for daily transactions and payment scenarios. Some merchants and payment processors have integrated LTC for cross-border remittances and point-of-sale transactions.

-

Regulatory Landscape: Different jurisdictions treat established cryptocurrencies like Litecoin with more regulatory clarity compared to newer ecosystem tokens. LTC benefits from its classification as a commodity in certain markets, while newer projects may face evolving regulatory frameworks.

Technology Development and Ecosystem Building

-

MUBI Technology: Being part of the Bitcoin ecosystem alongside projects like STX, RIF, ORDI, and SATS, MUBI likely focuses on expanding Bitcoin's functionality through layer-2 solutions or Bitcoin-native applications. However, specific technical upgrades are not detailed in the provided materials.

-

LTC Technology: Litecoin positions itself as Bitcoin's "upgraded version" with faster block generation times (2.5 minutes vs Bitcoin's 10 minutes) and lower transaction fees. It has implemented technologies like Segregated Witness (SegWit) and continues exploring Lightning Network integration for scalability.

-

Ecosystem Comparison:

- DeFi Integration: LTC has established presence across decentralized exchanges and lending platforms, though its DeFi ecosystem remains smaller than Ethereum-based alternatives.

- Payment Infrastructure: Litecoin maintains stronger payment network integration with established merchant acceptance.

- Smart Contract Capabilities: Neither MUBI nor LTC prioritizes smart contract functionality, focusing instead on value transfer and store-of-value characteristics.

Macroeconomic Environment and Market Cycles

-

Performance in Inflationary Environments: Both assets may serve as alternative stores of value during currency devaluation periods. LTC's longer track record provides more historical data points across various economic conditions, while MUBI's performance remains less established.

-

Macroeconomic Monetary Policy Impact:

- Interest rates and US dollar strength inversely affect cryptocurrency valuations, as higher yields in traditional assets reduce speculative demand for crypto.

- Both tokens may benefit from accommodative monetary policies that increase liquidity in financial markets.

-

Geopolitical Factors: Cross-border transaction demand during capital controls or currency restrictions can benefit both assets. Litecoin's established network and faster transaction times may provide advantages in urgent remittance scenarios, while Bitcoin ecosystem projects like MUBI could gain traction as Bitcoin adoption expands globally.

III. 2026-2031 Price Forecast: MUBI vs LTC

Short-term Forecast (2026)

- MUBI: Conservative $0.000473019 - $0.0005437 | Optimistic $0.0005437 - $0.00065244

- LTC: Conservative $36.3888 - $57.76 | Optimistic $57.76 - $63.536

Mid-term Forecast (2028-2029)

- MUBI may enter a gradual growth phase, with estimated price range of $0.000530727318 - $0.000896746158 in 2028, potentially reaching $0.00043696549182 - $0.00082119376911 in 2029

- LTC may enter an expansion phase, with estimated price range of $53.006352 - $96.945828 in 2028, potentially reaching $61.67568036 - $95.01388596 in 2029

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Forecast (2030-2031)

- MUBI: Baseline scenario $0.000417264375249 - $0.000787291274055 (2030) | Optimistic scenario $0.000760523370737 - $0.001213215853318 (2031)

- LTC: Baseline scenario $74.0191509834 - $89.17969998 (2030) | Optimistic scenario $89.26887967998 - $106.92646027602 (2031)

Disclaimer

MUBI:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00065244 | 0.0005437 | 0.000473019 | 0 |

| 2027 | 0.0006219928 | 0.00059807 | 0.0004126683 | 9 |

| 2028 | 0.000896746158 | 0.0006100314 | 0.000530727318 | 11 |

| 2029 | 0.00082119376911 | 0.000753388779 | 0.00043696549182 | 38 |

| 2030 | 0.001023478656271 | 0.000787291274055 | 0.000417264375249 | 44 |

| 2031 | 0.001213215853318 | 0.000905384965163 | 0.000760523370737 | 66 |

LTC:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 63.536 | 57.76 | 36.3888 | 0 |

| 2027 | 78.8424 | 60.648 | 43.66656 | 4 |

| 2028 | 96.945828 | 69.7452 | 53.006352 | 20 |

| 2029 | 95.01388596 | 83.345514 | 61.67568036 | 44 |

| 2030 | 107.015639976 | 89.17969998 | 74.0191509834 | 54 |

| 2031 | 106.92646027602 | 98.097669978 | 89.26887967998 | 69 |

IV. Investment Strategy Comparison: MUBI vs LTC

Long-term vs Short-term Investment Strategies

-

MUBI: May appeal to investors focused on Bitcoin ecosystem expansion and early-stage project opportunities. The token's connection to Bitcoin infrastructure development positions it within the broader narrative of Bitcoin's evolving utility beyond simple value transfer.

-

LTC: May suit investors seeking established market presence and payment-oriented use cases. Litecoin's longer operational history and integration into payment networks provide a foundation for those prioritizing transaction utility and market maturity.

Risk Management and Asset Allocation

-

Conservative Investors: A potential allocation framework could consider MUBI 10-20% vs LTC 80-90%, emphasizing the more established asset with greater liquidity and market depth.

-

Aggressive Investors: A potential allocation framework could consider MUBI 40-50% vs LTC 50-60%, allowing for greater exposure to emerging ecosystem projects while maintaining significant allocation to proven assets.

-

Hedging Tools: Stablecoin reserves for market downturns, options strategies for downside protection, and cross-asset diversification across different cryptocurrency categories can help manage portfolio volatility.

V. Potential Risk Comparison

Market Risk

-

MUBI: Lower liquidity with 24-hour trading volume of $13,984.91 may result in higher price volatility and potential execution challenges during market stress. Limited trading history since November 2023 provides less data for pattern analysis.

-

LTC: While more liquid with $7,705,870.64 in 24-hour volume, Litecoin remains subject to broader cryptocurrency market cycles and correlation with Bitcoin price movements. Market capitalization positioning outside the top tier may result in reduced institutional attention compared to dominant assets.

Technical Risk

-

MUBI: As part of the Bitcoin ecosystem, technical development dependencies on Bitcoin infrastructure updates may affect functionality. Limited information about specific technical architecture in available materials suggests investors should conduct thorough technical due diligence.

-

LTC: Network security considerations include mining centralization trends and potential 51% attack vectors, though Litecoin's established hash rate provides substantial security. Legacy codebase maintenance and competition from newer payment-focused protocols represent ongoing technical considerations.

Regulatory Risk

- Global regulatory frameworks continue evolving, with established cryptocurrencies like Litecoin generally receiving clearer treatment in major jurisdictions. Newer ecosystem projects may face uncertainty as regulators develop frameworks for Bitcoin-related tokens. Compliance requirements, tax treatment, and trading restrictions vary significantly across regions, affecting both assets differently based on their classification and market positioning.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

-

MUBI Characteristics: Participation in Bitcoin ecosystem development, early-stage project positioning, and potential alignment with Bitcoin infrastructure expansion. Trading at $0.0005453 with lower market liquidity.

-

LTC Characteristics: Established market presence since 2011, payment network integration, faster transaction processing compared to Bitcoin, and greater institutional recognition. Trading at $57.98 with substantially higher liquidity.

✅ Investment Considerations:

-

New Investors: May consider prioritizing assets with established track records, higher liquidity, and clearer regulatory status. Understanding fundamental differences between ecosystem tokens and standalone blockchains remains essential before allocation decisions.

-

Experienced Investors: May evaluate portfolio positioning based on risk tolerance, market cycle timing, and ecosystem exposure preferences. Diversification across different cryptocurrency categories and thorough research into technical fundamentals and development roadmaps can inform allocation strategies.

-

Institutional Investors: May focus on assets with regulatory clarity, custody solutions, and sufficient liquidity for position management. Established cryptocurrencies with longer operational histories typically align better with institutional risk management frameworks.

⚠️ Risk Disclosure: Cryptocurrency markets demonstrate high volatility characteristics. This content does not constitute investment advice. Investors should conduct independent research and consider their financial circumstances before making investment decisions.

VII. FAQ

Q1: What are the main differences between MUBI and LTC in terms of their fundamental purpose?

MUBI is a Bitcoin ecosystem token focused on cross-network bridge functionality between BRC20 and ERC20 tokens, while LTC operates as an independent blockchain designed for fast, low-cost payments. MUBI's value proposition centers on expanding Bitcoin's utility through infrastructure development, having launched in November 2023 as part of the broader Bitcoin ecosystem alongside projects like STX, ORDI, and SATS. In contrast, Litecoin has functioned since 2011 as "digital silver" with its own blockchain, featuring 2.5-minute block times (four times faster than Bitcoin) and a maximum supply of 84 million coins. LTC emphasizes transaction speed and payment network integration, while MUBI focuses on bridging different token standards within the Bitcoin infrastructure landscape.

Q2: How does the liquidity difference between MUBI and LTC affect investment decisions?

LTC offers significantly higher liquidity with $7,705,870.64 in 24-hour trading volume compared to MUBI's $13,984.91, which directly impacts execution risk and price stability. The substantial liquidity gap means LTC investors can enter and exit positions with minimal price impact, while MUBI traders may experience slippage and difficulty executing large orders during market stress. This liquidity differential particularly matters for risk management strategies—LTC's deeper market allows for easier stop-loss execution and portfolio rebalancing, whereas MUBI's lower volume creates challenges for rapid position adjustments. Conservative allocation frameworks often suggest 80-90% LTC versus 10-20% MUBI precisely because the established asset provides better execution certainty and lower transaction costs during both normal and volatile market conditions.

Q3: What role do supply mechanisms play in the long-term value proposition of MUBI versus LTC?

LTC's deflationary tokenomics feature a fixed maximum supply of 84 million coins with halving events every four years, creating predictable scarcity dynamics that have historically preceded price appreciation periods. This halving mechanism reduces block rewards by 50% approximately every four years, systematically decreasing new supply entering the market while mining continues. MUBI, as part of the Bitcoin ecosystem, typically follows token economics aligned with Bitcoin-related projects featuring fixed or capped supply models designed to create scarcity value, though specific supply details are not provided in available materials. The key distinction lies in LTC's proven track record since 2011 demonstrating how supply reductions interact with demand cycles, while MUBI's supply dynamics remain less established with limited historical data since its November 2023 launch.

Q4: How should investors evaluate regulatory risk differences between these two assets?

LTC benefits from clearer regulatory treatment across major jurisdictions due to its 13-year operational history and classification as a commodity in certain markets, while MUBI faces evolving regulatory frameworks as authorities develop policies for Bitcoin ecosystem tokens. Established cryptocurrencies like Litecoin generally receive more predictable compliance requirements, tax treatment guidance, and trading permissions because regulators have had time to analyze their functionality and market behavior. Newer ecosystem projects like MUBI may encounter uncertainty as global regulatory bodies determine how to classify Bitcoin-related tokens that provide infrastructure services rather than standalone blockchain functionality. This regulatory clarity gap particularly affects institutional investors, who typically require well-defined legal frameworks and custody solutions before allocating significant capital—factors that currently favor LTC's established market positioning.

Q5: What are the key technical development differences that impact investment value?

LTC operates its own blockchain with proven technologies like Segregated Witness (SegWit) and Lightning Network integration for scalability, while MUBI's technical architecture depends on Bitcoin infrastructure development for cross-network bridge functionality. Litecoin's independent blockchain allows for autonomous protocol upgrades and feature implementation without reliance on external development timelines, providing greater technical flexibility. However, MUBI's integration within the Bitcoin ecosystem positions it to benefit from Bitcoin's expanding infrastructure and network effects as Bitcoin adoption grows globally. The technical risk trade-off involves LTC's need to maintain competitive advantages against newer payment-focused protocols versus MUBI's dependency on Bitcoin ecosystem development progress and potential technical vulnerabilities in bridge operations between different token standards.

Q6: How do price forecasts for 2030-2031 reflect different growth trajectories?

LTC's baseline scenario projects prices between $74.02-$89.18 in 2030 and $89.27-$106.93 in 2031, representing a 69% increase from current levels, while MUBI's forecasts show $0.000417-$0.000787 in 2030 and $0.000761-$0.001213 in 2031, representing a 66% increase. Despite similar percentage growth rates, the absolute price difference reflects their distinct market capitalizations and adoption stages—LTC's projections assume continued integration into payment networks and institutional portfolios, while MUBI's estimates depend on Bitcoin ecosystem expansion and successful implementation of cross-network bridge functionality. The convergence in growth percentages suggests both assets may benefit from broader cryptocurrency adoption trends, though they serve different roles within the digital asset landscape: LTC as an established payment medium and MUBI as infrastructure supporting Bitcoin's evolving utility.

Q7: What allocation strategy makes sense for different investor profiles?

Conservative investors may consider 80-90% LTC versus 10-20% MUBI allocation, prioritizing established market presence and higher liquidity, while aggressive investors might allocate 50-60% LTC versus 40-50% MUBI for greater exposure to emerging ecosystem opportunities. This framework reflects risk-return preferences—conservative portfolios emphasize capital preservation through proven assets with regulatory clarity and sufficient trading volume for position management, while aggressive strategies accept higher volatility and execution risk in exchange for potential early-stage project upside. Institutional investors typically focus almost entirely on assets like LTC due to requirements for regulatory clarity, custody solutions, and liquidity depth that align with institutional risk management frameworks. New investors should prioritize understanding fundamental differences between ecosystem tokens and standalone blockchains before determining appropriate allocation percentages based on individual financial circumstances and risk tolerance levels.

Q8: How does the current market sentiment (Extreme Fear at 12) affect investment timing considerations?

The Fear & Greed Index reading of 12 (Extreme Fear) as of February 5, 2026, historically signals potential accumulation opportunities when investor pessimism reaches extremes, though timing market bottoms remains challenging regardless of sentiment indicators. During extreme fear periods, both MUBI (at $0.0005453) and LTC (at $57.98) may trade below intrinsic value as panic selling drives prices downward, creating potential entry points for long-term investors with conviction in underlying fundamentals. However, extreme fear can persist or intensify before reversals occur, meaning investors should combine sentiment analysis with fundamental research, technical chart patterns, and macroeconomic factors rather than relying solely on fear/greed metrics for timing decisions. Dollar-cost averaging strategies may prove more effective than attempting precise bottom-picking during extreme sentiment conditions, allowing investors to build positions gradually while managing execution risk across different market environments.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What is ZOON: A Comprehensive Guide to the Decentralized Social Network Platform

What is BICITY: A Comprehensive Guide to the Revolutionary Blockchain-Based Urban Mobility Platform

What is ASMATCH: A Comprehensive Guide to Autonomous Smart Matching Technology

What is MP: A Comprehensive Guide to Understanding Market Price and Its Impact on Trading

What is EYWA: A Comprehensive Guide to the Advanced AI-Powered Ecosystem Platform