TRA vs KAVA: A Comprehensive Comparison of Two Popular Herbal Beverages and Their Unique Properties

Introduction: Investment Comparison Between TRA and KAVA

In the cryptocurrency market, the comparison between TRA vs KAVA has been a topic that investors cannot avoid. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different crypto asset positioning.

TRA (Trabzonspor Fan Token): Since its launch in 2021, it has gained market recognition by positioning itself as a fan engagement token on the Chiliz platform, representing the Turkish Football Club Trabzonspor and providing holders with multiple rights and privileges.

KAVA: Since its launch in 2019, it has been positioned as a cross-chain decentralized finance platform, serving as a Layer 1 hub that supports DeFi applications and services, connecting users with stablecoins, loans, and interest-bearing accounts.

This article will comprehensively analyze the investment value comparison of TRA vs KAVA from the perspectives of historical price trends, supply mechanisms, technical ecosystem, and future outlook, attempting to answer the question that investors care about most:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

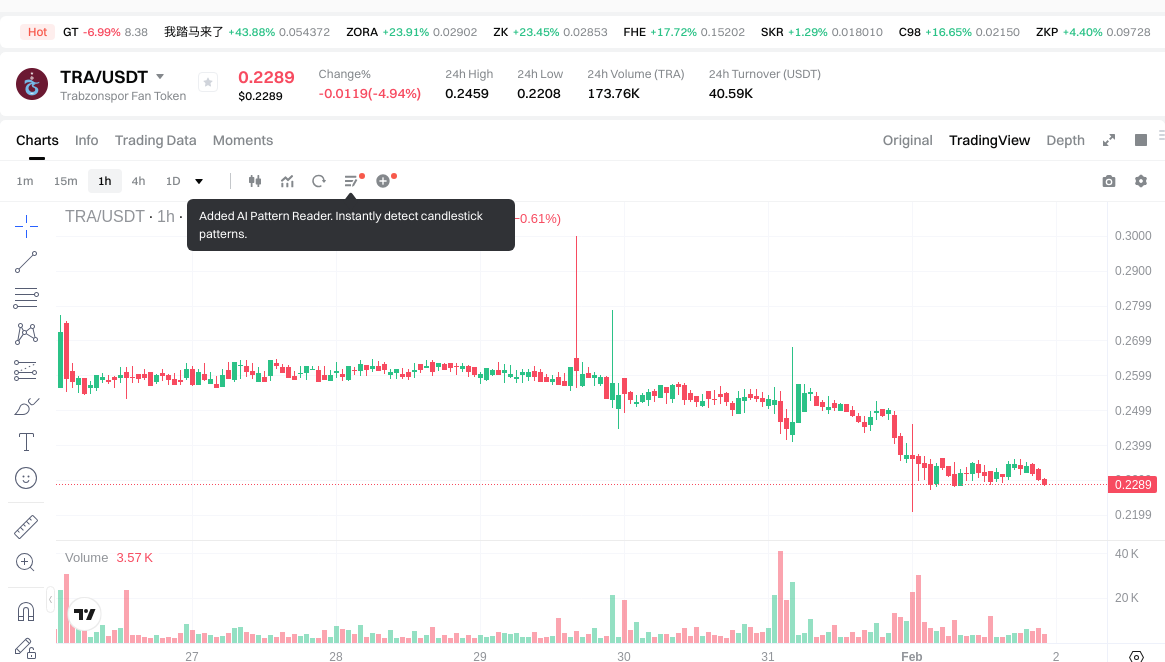

TRA (Coin A) and KAVA (Coin B) Historical Price Trends

- 2022: TRA experienced notable price movement, reaching $9.77 in April 2022 during a period of heightened market activity.

- 2021: KAVA reached its peak at $9.12 in August 2021, reflecting strong market sentiment during the broader crypto market expansion.

- Comparative Analysis: During the market cycle from 2021-2026, TRA declined from its high of $9.77 to $0.230156, while KAVA dropped from $9.12 to $0.059126, with both tokens showing significant downward pressure.

Current Market Status (2026-02-01)

- TRA current price: $0.2304

- KAVA current price: $0.06375

- 24-hour trading volume: TRA $39,872.85 vs KAVA $389,520.78

- Market Sentiment Index (Fear & Greed Index): 14 (Extreme Fear)

View real-time prices:

- View TRA current price Market Price

- View KAVA current price Market Price

II. Core Factors Influencing Investment Value of TRA vs KAVA

Supply Mechanism Comparison (Tokenomics)

- TRA: Supply mechanism details were not available in the provided materials.

- KAVA: The economic model considerations are referenced in available materials, though specific supply mechanism details require comprehensive evaluation of technical fundamentals and economic structure.

- 📌 Historical Pattern: Supply mechanisms can influence price cycles through inflation rates, token release schedules, and scarcity dynamics, though specific historical data for these assets requires further analysis.

Institutional Adoption and Market Applications

- Institutional Holdings: Comparative institutional preference data between TRA and KAVA was not available in the materials.

- Enterprise Adoption: Applications in cross-border payments, settlement, and investment portfolios require evaluation based on each project's technical capabilities and market positioning.

- Regulatory Stance: Different jurisdictions maintain varying regulatory approaches toward crypto assets, with investors needing to assess compliance considerations for both assets.

Technological Development and Ecosystem Building

- TRA Technical Development: Specific technical upgrade information was not provided in the reference materials.

- KAVA Technical Progress: The project involves technical foundations and ecosystem dynamics that require thorough understanding, with materials referencing considerations of technological basis and market dynamics.

- Ecosystem Comparison: DeFi integration, NFT functionality, payment solutions, and smart contract implementations vary across blockchain projects, with evaluation needed based on specific deployment scenarios and adoption metrics.

Macroeconomic Environment and Market Cycles

- Performance in Inflation Environment: Crypto assets may exhibit varying characteristics during inflationary periods, though comparative analysis requires consideration of multiple factors including market demand, technological innovation, and ecosystem development.

- Macroeconomic Monetary Policy: Interest rates, dollar index movements, and monetary policy shifts can influence crypto asset valuations through capital flow dynamics and risk appetite changes.

- Geopolitical Factors: Cross-border transaction demand and international developments may affect adoption patterns, with blockchain technology potentially offering solutions for specific payment and settlement scenarios in various geopolitical contexts.

III. 2026-2031 Price Forecast: TRA vs KAVA

Short-term Forecast (2026)

- TRA: Conservative $0.2209 - $0.2301 | Optimistic $0.2301 - $0.2876

- KAVA: Conservative $0.0572 - $0.0636 | Optimistic $0.0636 - $0.0795

Medium-term Forecast (2028-2029)

- TRA may enter a growth consolidation phase, with projected prices ranging from $0.1763 to $0.4090

- KAVA may enter an expansion phase, with projected prices ranging from $0.0432 to $0.1327

- Key drivers: institutional capital inflows, ETF adoption, ecosystem development

Long-term Forecast (2030-2031)

- TRA: Baseline scenario $0.3641 - $0.4513 | Optimistic scenario $0.4153 - $0.5897

- KAVA: Baseline scenario $0.0652 - $0.1450 | Optimistic scenario $0.1043 - $0.1622

Disclaimer

TRA:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.287625 | 0.2301 | 0.220896 | 0 |

| 2027 | 0.359818875 | 0.2588625 | 0.209678625 | 12 |

| 2028 | 0.38976926625 | 0.3093406875 | 0.176324191875 | 34 |

| 2029 | 0.40897932294375 | 0.349554976875 | 0.2586706828875 | 51 |

| 2030 | 0.451327908392156 | 0.379267149909375 | 0.364096463913 | 64 |

| 2031 | 0.589722491394087 | 0.415297529150765 | 0.382073726818704 | 80 |

KAVA:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0795 | 0.0636 | 0.05724 | 0 |

| 2027 | 0.080136 | 0.07155 | 0.0679725 | 12 |

| 2028 | 0.10845549 | 0.075843 | 0.04323051 | 18 |

| 2029 | 0.1326949128 | 0.092149245 | 0.06911193375 | 44 |

| 2030 | 0.145024481781 | 0.1124220789 | 0.065204805762 | 76 |

| 2031 | 0.16219133322903 | 0.1287232803405 | 0.104265857075805 | 101 |

IV. Investment Strategy Comparison: TRA vs KAVA

Long-term vs Short-term Investment Strategies

- TRA: May appeal to investors interested in fan engagement ecosystems and sports-related blockchain applications, with consideration for its positioning within the Chiliz platform and community-driven utilities.

- KAVA: May appeal to investors focused on decentralized finance infrastructure, cross-chain capabilities, and DeFi service accessibility, given its Layer 1 positioning and financial service orientation.

Risk Management and Asset Allocation

- Conservative Investors: Portfolio considerations might include balanced exposure with diversification across multiple asset classes, though specific allocation percentages depend on individual risk tolerance and market conditions.

- Aggressive Investors: Higher concentration strategies require thorough evaluation of volatility patterns, liquidity conditions, and market cycle positioning for both assets.

- Hedging Tools: Stablecoin reserves, diversified portfolio construction, and regular rebalancing can help manage exposure during market fluctuations.

V. Potential Risk Comparison

Market Risks

- TRA: Price movements may reflect factors including fan token market sentiment, sports industry developments, and platform-specific adoption trends. Trading volume of $39,872.85 suggests liquidity considerations for position management.

- KAVA: Price dynamics may be influenced by DeFi sector performance, cross-chain technology adoption, and competitive positioning within the Layer 1 landscape. Trading volume of $389,520.78 indicates relatively higher liquidity compared to TRA.

Technical Risks

- TRA: Platform dependency and ecosystem development trajectory require monitoring, with technical infrastructure relying on the underlying Chiliz network.

- KAVA: Cross-chain architecture complexity, smart contract security, and network stability considerations are relevant factors for technical risk assessment.

Regulatory Risks

- Regulatory approaches toward fan tokens and DeFi platforms vary across jurisdictions, with evolving frameworks potentially affecting both assets differently. TRA's sports engagement focus and KAVA's financial services orientation may face distinct compliance considerations in different markets.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary

- TRA Characteristics: Positioned within the sports fan engagement sector with community-focused utilities; current price $0.2304 represents significant decline from historical highs, with forecast ranges suggesting potential recovery scenarios depending on market conditions and ecosystem development.

- KAVA Characteristics: Infrastructure-focused DeFi platform with cross-chain capabilities; current price $0.06375 reflects substantial decrease from peak levels, with projection scenarios indicating potential growth trajectories linked to DeFi adoption and technological advancement.

✅ Investment Considerations

- Newer Investors: Both assets exhibit significant historical volatility and require thorough research into underlying technology, use cases, and market dynamics. Diversification across multiple assets and risk management through position sizing are important considerations.

- Experienced Investors: Comparative analysis of sector positioning (fan tokens vs DeFi infrastructure), liquidity profiles, and technological development trajectories can inform strategic allocation decisions based on market cycle assessment and portfolio objectives.

- Institutional Participants: Due diligence on regulatory compliance, custody solutions, liquidity depth, and operational infrastructure is essential for both assets, with sector-specific considerations for sports engagement platforms versus financial service protocols.

⚠️ Risk Disclosure: Cryptocurrency markets demonstrate substantial volatility with potential for significant value fluctuations. This analysis does not constitute investment advice, and individuals should conduct independent research and consult qualified professionals before making investment decisions.

VII. FAQ

Q1: What are the main differences between TRA and KAVA in terms of their core use cases?

TRA is a fan engagement token designed for sports community interaction, while KAVA is a DeFi infrastructure platform for cross-chain financial services. TRA operates on the Chiliz platform to provide Trabzonspor supporters with voting rights and exclusive benefits, focusing on strengthening the connection between fans and their football club. KAVA, launched in 2019, functions as a Layer 1 blockchain hub that enables decentralized finance applications including stablecoins, lending protocols, and interest-bearing accounts across multiple blockchain networks.

Q2: How do the current trading volumes of TRA and KAVA compare, and what does this indicate?

KAVA demonstrates significantly higher trading volume at $389,520.78 compared to TRA's $39,872.85 as of February 1, 2026. This approximately 10x difference in daily trading volume suggests that KAVA maintains greater market liquidity, which typically translates to easier position entry and exit, tighter bid-ask spreads, and reduced slippage for traders. The higher volume may also reflect broader market interest in DeFi infrastructure compared to sports fan tokens, though both assets require careful liquidity assessment for position management.

Q3: Which asset has declined more from its historical peak, and what does this mean for investors?

Both assets have experienced substantial declines from their historical peaks: TRA dropped approximately 97.6% from $9.77 (April 2022) to $0.2304, while KAVA fell approximately 99.3% from $9.12 (August 2021) to $0.06375. These significant drawdowns reflect the broader cryptocurrency market cycle downturn and sector-specific challenges. While neither decline necessarily indicates future performance, investors should recognize that recovery to previous peaks would require extraordinary market conditions and ecosystem developments, with KAVA needing approximately 143x growth and TRA requiring about 42x appreciation.

Q4: What are the primary risk factors that differ between investing in TRA versus KAVA?

TRA's primary risks center on the sports fan token sector dynamics, including dependency on the Chiliz platform infrastructure, engagement levels of the Trabzonspor supporter base, and the overall adoption of fan tokens in sports. KAVA faces distinct risks related to DeFi sector competition, cross-chain technology complexity, smart contract security vulnerabilities, and regulatory scrutiny of decentralized financial services. Additionally, TRA's lower liquidity presents greater market risk for position management, while KAVA's technical architecture introduces complexity-related operational risks that infrastructure projects commonly face.

Q5: According to the price forecasts, which asset shows stronger potential growth through 2031?

Based on the provided forecasts, TRA demonstrates stronger projected percentage growth from current levels through 2031. TRA's optimistic scenario suggests potential appreciation from $0.2304 to $0.5897 (approximately 156% increase), while KAVA's optimistic forecast indicates growth from $0.06375 to $0.1622 (approximately 154% increase). However, these projections depend heavily on factors including institutional adoption, ecosystem development, and macroeconomic conditions. Investors should note that such forecasts carry substantial uncertainty and do not guarantee actual performance.

Q6: What type of investor profile might favor TRA over KAVA, or vice versa?

Investors focused on sports technology integration, community-driven digital assets, and fan engagement innovations might find TRA's positioning more aligned with their thesis, particularly if they believe in the long-term growth of tokenized sports experiences. Conversely, investors prioritizing established DeFi infrastructure, cross-chain interoperability, and broader financial service adoption may favor KAVA's Layer 1 platform positioning. Risk tolerance also matters: KAVA's higher liquidity may suit investors requiring more flexible position management, while TRA's niche focus might appeal to those seeking exposure to emerging sports fan token sectors despite lower trading volumes.

Q7: How does the current market sentiment affect both TRA and KAVA, and should this influence investment decisions?

The current market sentiment index of 14 (Extreme Fear) indicates widespread caution across cryptocurrency markets, which typically affects both assets. During extreme fear periods, crypto assets often experience compressed valuations regardless of fundamental developments, presenting potential accumulation opportunities for long-term investors or heightened risk for short-term traders. Both TRA and KAVA trade at significant discounts from historical peaks during this sentiment phase. Investors should balance current fear-driven pricing against fundamental evaluation of each project's technological progress, adoption metrics, and competitive positioning rather than relying solely on sentiment indicators for investment decisions.

Q8: What are the key monitoring indicators investors should track when holding TRA or KAVA?

For TRA, key indicators include Chiliz platform user growth, Trabzonspor fan engagement metrics, trading volume trends, and broader sports fan token sector developments. For KAVA, important metrics encompass Total Value Locked (TVL) in its DeFi protocols, cross-chain transaction volumes, network activity, development progress on technical upgrades, and competitive positioning versus other Layer 1 DeFi platforms. Both assets require monitoring of regulatory developments in relevant jurisdictions, macroeconomic conditions affecting risk asset appetite, and Bitcoin/Ethereum market cycle positioning given their correlation with broader cryptocurrency markets.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Everything You Need to Know About Sybil Attacks

Games You Can Earn From – TOP 11 Games

Phil Konieczny – Who Is He? What Is His Wealth? Why Does He Wear a Mask?

What is ZULU: A Comprehensive Guide to South Africa's Warrior Culture and Heritage

What is LANDSHARE: A Revolutionary Platform for Sustainable Agriculture and Community Land Access