What is MTRG: A Comprehensive Guide to Multi-Token Retrieval Generation in Modern AI Systems

Meter's Positioning and Significance

In 2020, the Meter team launched Meter (MTRG) to address challenges in blockchain scalability, stability, and cross-chain interoperability.

As a high-performance EVM-compatible public chain based on the HotStuff2 consensus mechanism, Meter plays a key role in decentralized finance (DeFi) and cross-chain applications.

As of 2026, Meter has established itself within the blockchain ecosystem, featuring its unique dual-token economic model and maintaining an active development community.

This article will provide an in-depth analysis of its technical architecture, market performance, and future potential.

Origin and Development History

Birth Background

Meter was created by the Meter team in 2020 to solve scalability limitations and the lack of stable value measurement units in existing blockchain networks.

It emerged during the rapid expansion of the DeFi ecosystem, aiming to provide a high-performance infrastructure with built-in economic stability through a dual-token system.

The launch of Meter brought new possibilities for developers and users seeking efficient, stable blockchain solutions.

Key Milestones

- 2020: Mainnet launch, implementing HotStuff2 consensus mechanism for high throughput and EVM compatibility.

- The project introduced a unique dual-token model with MTRG for governance and MTR as a semi-stable coin for gas payments.

- Ongoing development: The ecosystem continues to evolve with cross-chain bridge infrastructure and Layer 2 integration capabilities.

With the support of the Meter Foundation and its global community, Meter continues to optimize its technology, security, and real-world applications.

How Does Meter Work?

No Central Control

Meter operates on a decentralized network of computers (nodes) distributed globally, eliminating control by banks or governments.

These nodes collaborate to validate transactions, ensuring system transparency and attack resistance, granting users greater autonomy and enhancing network resilience.

Blockchain Core

Meter's blockchain is a public, immutable digital ledger that records every transaction.

Transactions are grouped into blocks and linked through cryptographic hashing to form a secure chain.

Anyone can view the records, establishing trust without intermediaries.

The system's EVM compatibility enables seamless deployment of Ethereum-based applications while maintaining superior performance.

Ensuring Fairness

Meter employs a hybrid consensus combining Proof of Stake (PoS) through MTRG staking and Proof of Work (PoW) for MTR generation to validate transactions and prevent fraudulent activities such as double spending.

Validators maintain network security through staking MTRG tokens and participating in consensus, earning rewards in the process.

Its innovation includes the separation of governance and gas payment mechanisms, creating a more stable and predictable transaction cost structure.

Secure Transactions

Meter uses public-private key cryptography to protect transactions:

- Private keys (like secret passwords) are used to sign transactions

- Public keys (like account numbers) are used to verify ownership

This mechanism ensures fund security while transactions maintain pseudonymous privacy.

The network implements standard EVM security features along with additional safeguards provided by the HotStuff2 consensus algorithm.

Meter's Market Performance

Circulation Overview

As of February 4, 2026, Meter's circulating supply stands at 32,276,310 MTRG tokens, with a total supply of 48,890,067 tokens and a maximum supply of 43,913,268 tokens. The circulating supply represents approximately 73.5% of the fully diluted market cap, indicating a substantial portion of tokens is already in circulation.

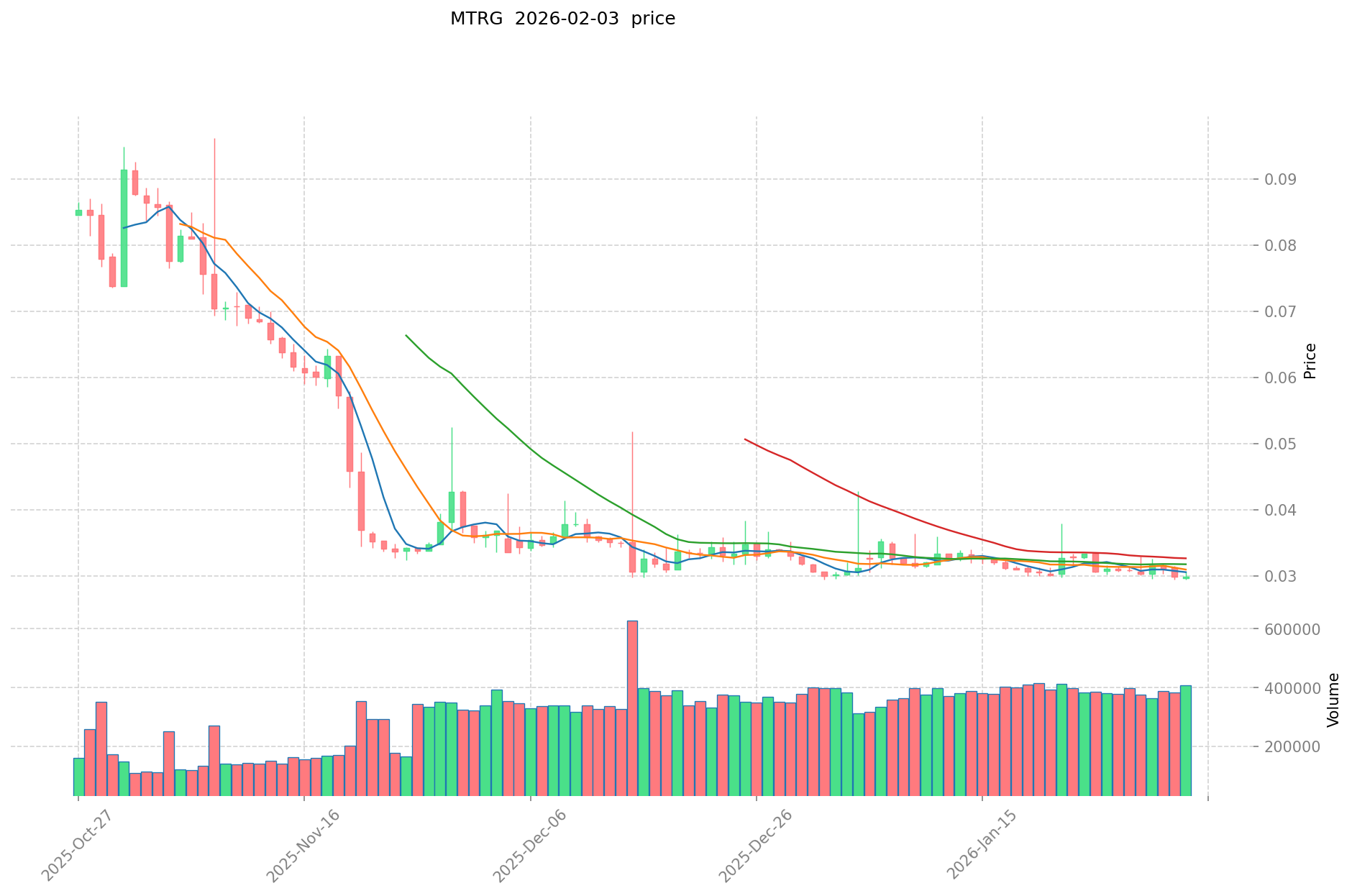

Price Fluctuations

Meter reached its all-time high price of $16.47 on November 3, 2021, reflecting broader cryptocurrency market momentum during that period. The token experienced its lowest price of $0.02804947 on February 3, 2026, demonstrating considerable volatility over its trading history.

Recent price movements show mixed trends across different timeframes. Over the past hour, MTRG registered a gain of 0.63%, while experiencing declines of 4.95% over 24 hours and 8.1% over the past week. The 30-day performance shows a decrease of 14.11%, with the most significant decline observed over the past year at 77.01%. The current trading price stands at approximately $0.02879, with 24-hour trading activity ranging between a high of $0.03052 and a low of $0.02836.

Click to view the current MTRG market price

On-Chain Metrics

- 24-Hour Trading Volume: Approximately $12,418.22 (reflecting current market activity levels)

- Token Holders: 1,785 addresses (indicating the distribution of token ownership)

- Market Capitalization: $929,234.96 (representing the total value of circulating tokens)

Meter Ecosystem Applications and Partners

Core Use Cases

Meter's ecosystem supports multiple applications:

- DeFi: The platform enables decentralized finance activities, providing efficient transaction processing and smart contract execution.

- Cross-chain Infrastructure: Meter facilitates interoperability between different blockchain networks, enhancing connectivity across the crypto ecosystem.

Strategic Cooperation

Meter continues to develop its technical capabilities and expand its market presence through strategic partnerships. These collaborations provide a solid foundation for Meter's ecosystem expansion.

Challenges and Controversies

Meter faces the following challenges:

- Market Volatility: Significant price fluctuations, with recent data showing a 4.95% decline in 24 hours and 77.01% decrease over the past year

- Competitive Pressure: Competition from other blockchain platforms in the high-performance public chain sector

- Market Cap Position: Currently ranked 2558 with a market capitalization of approximately $929,234.96

These issues have sparked discussions within the community and market, while also driving Meter's continuous innovation.

Meter Community and Social Media Atmosphere

Community Engagement

Meter's community shows active participation, with 1,785 token holders as of February 2026. The project maintains presence across multiple social media platforms including X (formerly Twitter), Reddit, Medium, and Facebook. Community enthusiasm is reflected in ongoing discussions about technical developments and ecosystem growth.

Social Media Sentiment

Sentiment on social platforms presents diverse perspectives:

- Supporters praise Meter's high-performance capabilities based on HotStuff2 consensus and innovative dual-token model, viewing it as an efficient blockchain infrastructure solution.

- Critics focus on price volatility and market positioning challenges.

Recent trends indicate cautious sentiment amid broader market fluctuations.

Hot Topics

Community discussions center on Meter's dual-token economic model, network security through PoS consensus, and the role of MTR as a semi-stable coin for gas payments, demonstrating both its innovative potential and the path toward mainstream adoption.

More Information Sources on Meter

- Official Website: Visit Meter Official Website for features, use cases, and latest updates.

- Block Explorer: Meter Scan provides detailed blockchain data and transaction information.

- X Updates: Meter maintains an active presence on X platform at @Meter_IO, sharing updates on technical upgrades, community events, and ecosystem developments.

Meter Future Roadmap

- Ongoing Development: Enhancement of network performance and scalability through continued optimization of the HotStuff2 consensus mechanism

- Ecosystem Goals: Expansion of DApp support and cross-chain functionality

- Long-term Vision: Establishing Meter as a high-performance infrastructure for decentralized applications

How to Participate in Meter?

- Purchase Channels: Acquire MTRG on Gate.com and other supported platforms

- Storage Solutions: Securely store tokens using compatible wallets such as MetaMask or hardware wallets

- Participate in Governance: Engage in community decisions through the PoS staking mechanism

- Build the Ecosystem: Visit Meter GitHub to contribute code or develop DApps

Summary

Meter redefines blockchain infrastructure through its innovative dual-token model and HotStuff2 consensus, offering high performance, security, and efficient gas payment mechanism through MTR. Its active community, comprehensive resources, and technical capabilities distinguish it in the cryptocurrency space. Despite facing market volatility and competitive challenges, Meter's innovative approach and clear development direction position it as a noteworthy player in decentralized technology's future. Whether you are a newcomer or an experienced participant, Meter merits attention and engagement.

FAQ

What is MTRG (Meter Governance) and what is its purpose in the Meter ecosystem?

MTRG is the governance and staking token of the Meter network. It enables users to participate in network governance decisions and validator staking, enhancing security and community involvement in the ecosystem.

How can I buy and store MTRG tokens?

Purchase MTRG tokens on cryptocurrency exchanges that list them. After buying, transfer your tokens to a secure personal wallet with encryption enabled. Always protect your private keys and backup your wallet information.

What are the main use cases and benefits of holding MTRG?

MTRG holders gain governance rights, earn staking rewards, access exclusive features, and participate in protocol decisions. The token provides utility within the ecosystem while offering potential value appreciation through network growth and adoption.

What is the difference between MTRG and MTR tokens on the Meter blockchain?

MTRG is a governance token enabling protocol voting, while MTR is a utility token for transactions and staking. MTRG uses Proof of Work consensus, and MTR serves as the primary transactional currency on the Meter blockchain.

Is MTRG a good investment and what are the potential risks?

MTRG shows strong investment potential through its innovative governance model and real-world utility. While market volatility and speculation present risks, MTRG's ecosystem fundamentals support long-term growth prospects for savvy investors.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Top 14 DeFi Investment Tools for Investors

What is liquidity mining and how can you profit from it

What is a cryptocurrency airdrop: where to find them and how to earn

What is EIP-4844? What Are Its Benefits?

What is a retrodrop and how can you profit from it