What is USD1: Understanding the One Dollar Currency Unit in the United States Financial System

USD1's Positioning and Significance

In 2025, World Liberty Financial (WLFI) launched USD1 (USD1), aiming to address inefficiencies in digital transactions and the need for seamless integration between fiat and digital assets.

As a fiat-backed stablecoin, USD1 plays a crucial role in the digital payment and cross-border transaction sectors.

As of 2025, USD1 has become a significant player in the stablecoin market, with a market cap of $2,149,870,657 and an active user base. This article will analyze its technical architecture, market performance, and future potential.

Origin and Development History

Background of Creation

USD1 was created by World Liberty Financial (WLFI) in April 2025, with the aim of simplifying digital transactions by providing seamless fungibility between fiat currency and digital assets.

It was born in the context of increasing demand for stable digital assets in the crypto ecosystem, targeting to streamline digital transactions and provide a reliable USD-pegged digital asset.

USD1's launch brought new possibilities for users seeking stable value transfer in the digital asset space.

Important Milestones

- April 2025: Launch of USD1, offering a 1:1 USD-pegged stablecoin.

- 2025: Partnership with BitGo Trust Company for issuance and legal management, ensuring full compliance with U.S. regulatory standards.

With the support of World Liberty Financial (WLFI) and BitGo Trust Company, USD1 continues to optimize its stability, security, and real-world applications.

How Does USD1 Work?

No Central Control

USD1 operates on a network of regulated financial institutions, maintaining a balance between decentralization and regulatory compliance.

This structure ensures transparency and security while adhering to legal requirements, providing users with a stable and trustworthy digital asset.

Blockchain Core

USD1 utilizes blockchain technology to record transactions transparently and immutably.

Transactions are grouped into blocks and linked through cryptographic hashes, forming a secure chain.

The system allows for public verification of records while maintaining the stability of the USD peg.

Ensuring Fairness

USD1 employs a regulated issuance and redemption mechanism to maintain its 1:1 peg with the US dollar.

BitGo Trust Company, as the regulated trust entity, manages the issuance and legal aspects of USD1, ensuring compliance and stability.

Its innovative approach combines the benefits of blockchain technology with traditional financial oversight.

Secure Transactions

USD1 uses public-private key encryption to secure transactions:

- Private keys are used to sign transactions

- Public keys are used to verify ownership

This mechanism ensures fund security while transactions remain traceable for regulatory compliance.

Additional security features include the backing of USD1 with real US dollar reserves, providing stability and trustworthiness to the stablecoin.

USD1's Market Performance

Circulation Overview

As of September 12, 2025, USD1's circulating supply is 2,151,591,931 tokens, which is equal to its total supply of 2,151,591,931.

New tokens enter the market through issuance by BitGo Trust Company, influencing its supply and demand dynamics.

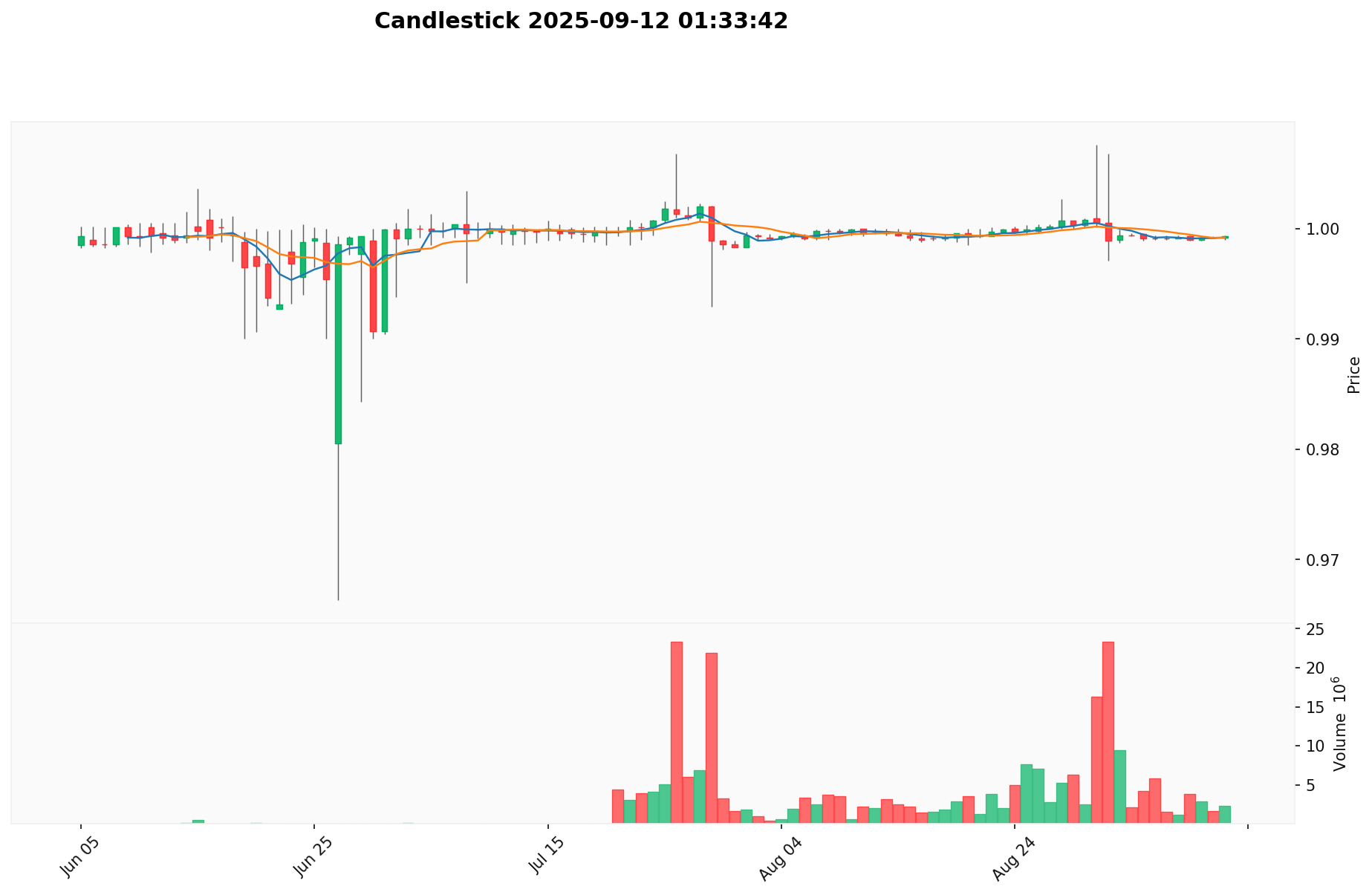

Price Fluctuations

USD1 reached its all-time high of $5000 on June 2, 2025, driven by an apparent system anomaly or data error.

Its lowest price was $0.9663, occurring on June 27, 2025, likely due to temporary market fluctuations.

These fluctuations reflect market sentiment, adoption trends, and external factors, though as a stablecoin, USD1 generally aims to maintain a 1:1 peg with the US dollar.

Click to view the current USD1 market price

On-Chain Metrics

- Daily Transaction Volume: $1,219,115.206716 (indicating network activity)

- Active Addresses: 50,655 (reflecting user engagement)

USD1 Ecosystem Applications and Partnerships

Core Use Cases

USD1's ecosystem supports various applications:

- Digital Payments: Facilitates seamless transactions between fiat and digital assets.

- DeFi: Provides stable value for decentralized finance protocols and applications.

Strategic Partnerships

USD1 has established partnerships with BitGo Trust Company, enhancing its regulatory compliance and security measures. These partnerships provide a solid foundation for USD1's ecosystem expansion.

Controversies and Challenges

USD1 faces the following challenges:

- Regulatory Scrutiny: Potential increased oversight from financial regulators.

- Market Competition: Competition from other stablecoins and central bank digital currencies.

- Trust and Transparency: Maintaining user confidence in the 1:1 backing of USD1 tokens.

These issues have sparked discussions within the community and market, driving continuous innovation for USD1.

USD1 Community and Social Media Atmosphere

Fan Enthusiasm

USD1's community shows steady growth, with 50,655 holders as of September 12, 2025. On X platform, posts and hashtags related to USD1 gain traction, particularly during significant market events. Stability and regulatory compliance fuel community interest.

Social Media Sentiment

Sentiment on X presents a mix of views:

- Supporters praise USD1's regulatory compliance and stability, viewing it as a "bridge between traditional finance and crypto."

- Critics focus on centralization concerns and potential regulatory risks.

Recent trends show generally positive sentiment due to USD1's stability in a volatile market.

Hot Topics

X users discuss USD1's role in DeFi, regulatory developments, and its impact on the broader stablecoin market, highlighting both its potential and the challenges it faces in mainstream adoption.

More Information Sources for USD1

- Official Website: Visit USD1 official website for features, use cases, and latest updates.

- X Updates: On X platform, USD1 uses @worldlibertyfi, as of September 12, 2025, posts cover regulatory compliance, partnerships, and market updates.

USD1 Future Roadmap

- Ecosystem Goals: Expand integration with major DeFi protocols and payment systems

- Long-term Vision: Become a leading regulated stablecoin in the global digital economy

How to Participate in USD1?

- Purchase Channels: Buy USD1 on Gate.com

- Storage Solutions: Use secure wallets supporting BEP-20 and ERC-20 tokens

- Ecosystem Participation: Integrate USD1 into DeFi applications or use it for digital payments

Summary

USD1 redefines digital currency through blockchain technology, offering stability, regulatory compliance, and efficient transactions. Its growing user base, strong regulatory foundation, and market performance set it apart in the cryptocurrency space. Despite facing regulatory scrutiny and market competition, USD1's commitment to compliance and clear vision position it as a significant player in the future of decentralized finance. Whether you're a newcomer or an experienced user, USD1 is worth considering for stable value in the digital asset ecosystem.

FAQ

How does USD1 work?

USD1 is a fiat-backed stablecoin, fully backed 1:1 by US dollars and other assets. It maintains price stability through transparent reserves and aims for broad liquidity across markets.

What is the name of Trump's crypto?

Trump's crypto is called $TRUMP. It's a meme coin on the Solana blockchain associated with Donald Trump.

What is USD1 backed by?

USD1 is backed 1:1 by U.S. dollar deposits and Treasury bills. It's fully collateralized and audited monthly for stability and compliance.

Can you buy USD1?

Yes, you can buy USD1 through various platforms using different payment methods. Simply specify the amount and provide your wallet address to complete the purchase.

Why stablecoin is important: A deep dive into the stable assets of crypto assets

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

Exploring Stablecoins: How They Drive the Development of the Encryption Economy

Stablecoin analysis: Crypto Assets solution to mitigate Fluctuation

How to Buy USDC in 2025: A Complete Guide for Newbie Investors

USDC Price Prediction: Trends and Investment Prospects in the Stablecoin Market for 2025

Top Staking Coins for Passive Income

Free Money for App Registration 2025

What is crypto? How can you explain digital currencies to a young child?

Top Cold Wallets for Cryptocurrency: Rankings

Everything You Need to Know About Sybil Attacks