SushiSwap Latest Updates and 2026 SUSHI Price Forecast: Full Market Trend Analysis

SushiSwap (SUSHI) Project Overview

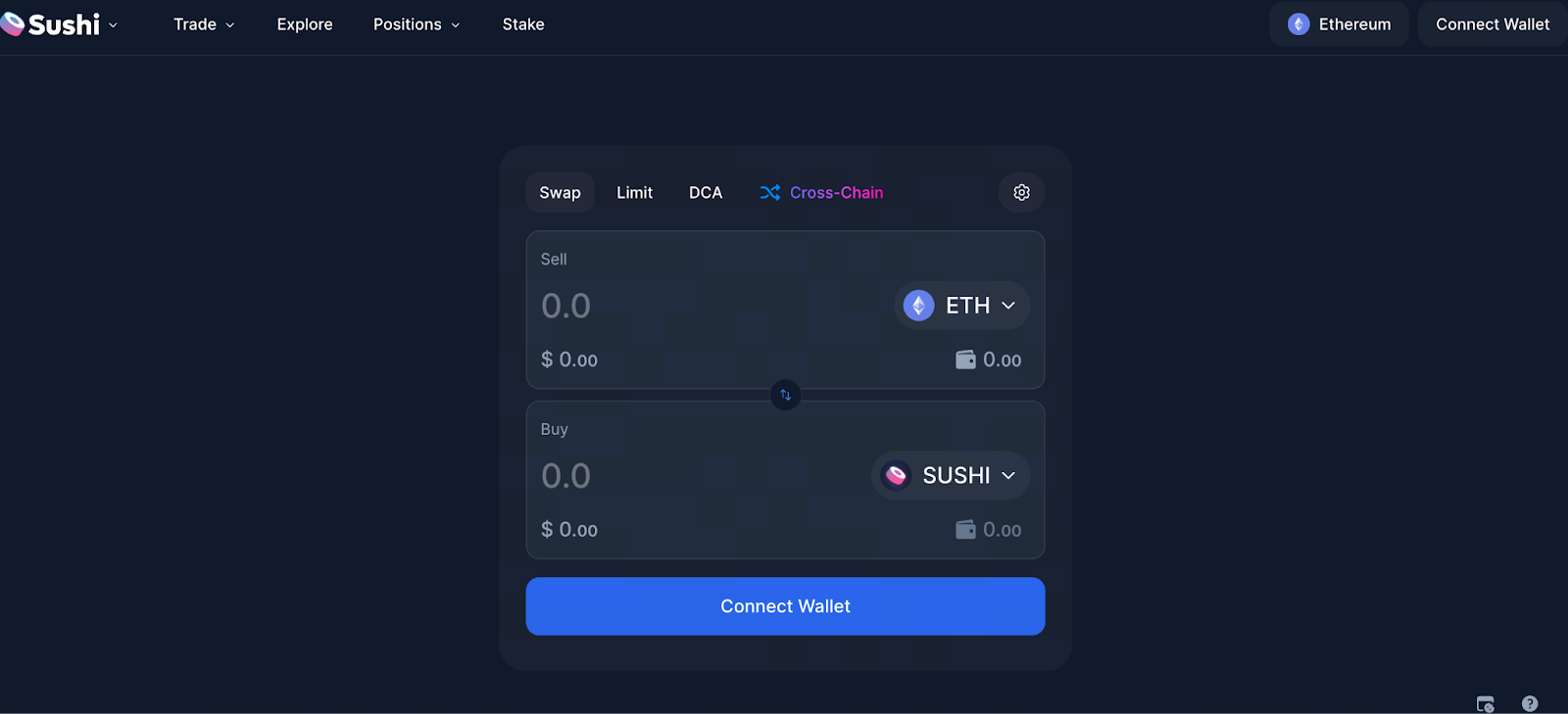

Image: https://www.sushi.com/ethereum/swap

SushiSwap is a decentralized exchange (DEX) built on the Automated Market Maker (AMM) model, enabling permissionless on-chain token swaps. As one of the pioneering projects in DeFi, SushiSwap extended the Uniswap framework with innovations like liquidity mining, protocol revenue sharing, and decentralized governance.

SUSHI is the native token of the SushiSwap protocol, serving three core functions:

1. Protocol governance—token holders can vote on key parameters and upgrade proposals.

2. Protocol incentives and fee distribution—a portion of trading fees is returned to SUSHI holders through staking.

4. Ecosystem incentives—used to drive early liquidity for new features and multi-chain deployments.

Strategically, SushiSwap supports major networks such as Ethereum, Arbitrum, and Polygon, leveraging cross-chain expansion to broaden its user base.

Latest Ecosystem Developments: 2025–2026

Since 2025, the SushiSwap community and ecosystem have seen significant changes, including shifts in core leadership, protocol restructuring, and a focus or consolidation of certain product lines. These moves reflect a strategic pivot to reduce operational complexity and enhance protocol efficiency.

On-chain data shows SushiSwap’s Total Value Locked (TVL) has been volatile. While some new or optimized pools offer higher APRs that attract short-term liquidity, overall TVL remains well below historical highs. This indicates that long-term capital confidence has not yet fully returned.

Within the community, opinions differ on SushiSwap’s future direction: some advocate reinforcing its multi-chain DEX competitive edge, while others favor narrowing the focus to high-efficiency markets and specialized products.

This divergence has contributed to increased market uncertainty regarding SUSHI’s medium- and long-term prospects.

2026 SUSHI Price Forecast: Multi-Model Analysis

Forecast models for SUSHI’s 2026 price show considerable divergence, highlighting a lack of market consensus on its long-term value.

Base-Case Forecasts

Some models, using historical price trends and statistical regression, estimate SUSHI’s average price at the end of 2026 could approach $0.80, with a reasonable range between $0.72 and $0.88. These projections assume a relatively stable market environment without extreme bull markets or systemic shocks.

Optimistic Forecasts

Other analysts believe that if DeFi attracts renewed capital in the next cycle and SushiSwap’s protocol upgrades significantly boost trading volume and user retention, SUSHI could recover above $1.00 in 2026. This outlook depends on crypto market recovery, increased risk appetite, and improved protocol execution.

Conservative / Bearish Forecasts

More cautious models suggest SUSHI may trade in a low range throughout 2026, with potential for periodic declines. These forecasts emphasize current TVL performance, competitive pressures, and the overall contraction in DeFi valuations.

In summary, most models place SUSHI’s 2026 price within a broad range—roughly $0.30 to above $1.00—reflecting very different market scenarios.

Key Factors Impacting SUSHI Price in 2026

Image: https://www.gate.com/trade/SUSHI_USDT

SUSHI’s price is shaped by multiple factors, not a single variable.

Market Sentiment and the Crypto Landscape

Bitcoin and Ethereum trends typically drive DeFi asset performance. When risk appetite rises, capital flows into high-volatility, high-beta DeFi tokens; when sentiment falls, the reverse occurs.

SushiSwap Ecosystem Activity

Key health metrics include user numbers, trading volume, and TVL. If SushiSwap can regain trading depth and capital retention in a competitive DEX market, it will provide medium- to long-term support for SUSHI’s price.

Competitive Positioning and Innovation

The DEX sector is intensely competitive, with leaders like Uniswap and dYdX dominating in brand, liquidity, and user experience. Without differentiated features or cost advantages, SushiSwap’s market share may remain under pressure.

Macroeconomic and Regulatory Factors

Global liquidity, interest rate policy, and crypto regulation can amplify DeFi asset valuations and impact SUSHI’s performance.

Industry Competition and Relative Position

In a cross-industry comparison, SushiSwap still offers advantages in multi-chain support and decentralized governance. However, it now lags leading DEXs in TVL, active addresses, and mainstream user recognition. Fee structure, front-end experience, and product focus are critical areas for ongoing optimization.

Summary: Key Trends and Risk Considerations

Taking into account ecosystem developments, industry competition, and price models, SUSHI’s price in 2026 is likely to be highly volatile and polarized. Both conservative scenarios around $0.30 and more optimistic outcomes above $1.00 have market logic behind them.

For SUSHI investors, it’s crucial to track factors beyond price: clarity of product direction, TVL stabilization and recovery, and improvements in the overall DeFi market structure. In this uncertain environment, risk management remains essential.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About