A Short-Term Yield Option for Fast-Moving Markets: Gate Launches CODEX 7-Day Fixed Earn

Market Capital Flows Shift: Demand for Short-Term Products Emerges

As the crypto market enters a phase of persistent high volatility and liquidity, capital allocation strategies are evolving. Rather than locking up assets for extended periods, more users now favor products with clear terms and predictable redemption timelines. This approach enables capital to move flexibly between opportunities.

In this environment, short-term, clearly structured investment solutions are gaining traction. These products not only boost capital utilization efficiency but also better suit the rapid pace of current market operations.

Gate CODEX 7-Day Fixed-Term Investment: Design Rationale

Gate’s CODEX 7-Day Fixed-Term Investment is built around the principles of short duration and high efficiency. The product features a fixed 7-day lock-up period, allowing users to clearly manage both capital allocation and redemption dates at the time of subscription. This structure helps avoid liquidity pressure from long-term uncertainty.

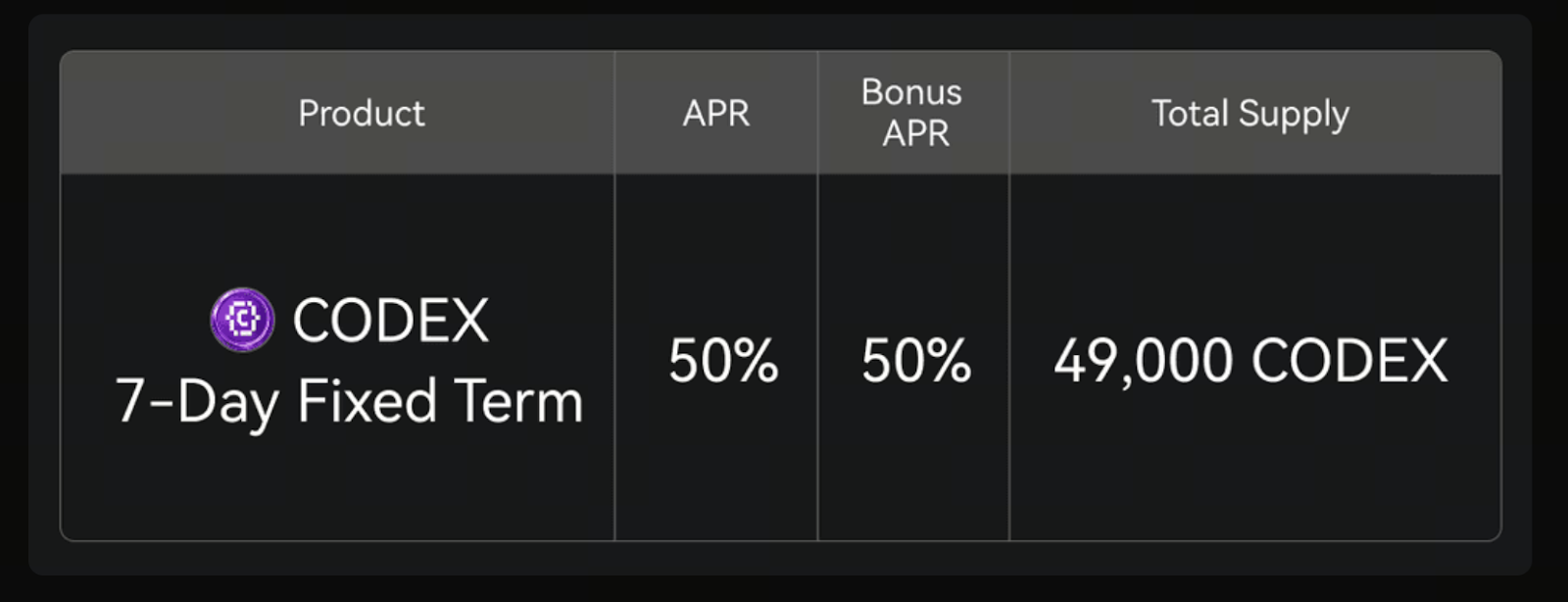

For returns, the product employs a high annualized yield structure, with maximum annualized rewards reaching 100%. A limited quota mechanism ensures controlled and transparent distribution of overall returns.

Dual Yield Structure for Flexible Returns

The CODEX 7-Day Fixed-Term Investment offers returns from two sources:

First, users receive base yields calculated and paid in CODEX tokens. Second, Gate provides an additional USDT reward pool, which supplements the overall annualized reward.

The total USDT reward pool is $15,000, distributed based on actual participation. Once the pool is exhausted, the extra subsidy ends. Users can view all earnings details on the Gate investment records page.

Log in to Gate to subscribe to fixed-term investment products and maximize asset growth efficiency: https://www.gate.com/simple-earn

Quota and Participation Mechanism

The total quota for this CODEX 7-Day Fixed-Term Investment is 49,000 CODEX, available on a first-come, first-served basis. Once fully subscribed, the product will close automatically and will not accept new applications.

This investment plan does not support early redemption. Users must ensure their funds remain locked until maturity. All subscription and redemption processes are governed by the information on Gate’s official page.

CODEX and CodexField: Ecosystem Positioning

CODEX is the core token of the CodexField ecosystem. CodexField specializes in decentralized infrastructure, aiming to transform code, algorithms, and structured digital knowledge into verifiable, tradable on-chain assets.

The protocol is built on BNB Greenfield and BNB Smart Chain. By leveraging decentralized storage and reputation mechanisms, it helps developers establish clear ownership and usage structures, enabling previously hard-to-quantify technical achievements to acquire asset attributes in the Web3 environment.

Risks and Limitations to Consider Before Participating

Before participating in the CODEX 7-Day Fixed-Term Investment, users should carefully assess their capital arrangements and risk tolerance. The crypto asset market is subject to price volatility, and investment returns do not constitute a principal guarantee. Additionally, Gate reserves the right to disqualify participants for any violations or improper actions during the event. Users from the UK and other restricted jurisdictions are not eligible for this product. For specific eligibility, refer to the Gate User Agreement.

Short-Term Investment: A Gateway to Ecosystem Insights

From a broader perspective, the CODEX 7-Day Fixed-Term Investment is not just a yield product—it’s also an ecosystem-oriented allocation tool. Its short-term design enables users to engage with the Web3 infrastructure applications represented by CodexField in a limited timeframe. For Gate, these products enhance asset utilization efficiency; for users, they offer a low time-cost entry point, allowing investment and project observation to proceed in tandem.

User Agreement: https://www.gate.com/legal/user-agreement

Summary

In a market where capital flows are accelerating, investment product value is determined not just by annualized yield, but by how well it matches operational tempo. Gate’s CODEX 7-Day Fixed-Term Investment delivers an efficient short-term allocation option through clear term design, transparent yield structure, and a limited quota mechanism. For investors focused on Web3 infrastructure and technical assetization, these short-term solutions provide a practical entry point for observing project ecosystems and market dynamics.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About