As Metal Market Volatility Intensifies, Gate’s Metals Zone Offers Traders a New 24/7 Trading Option

I. Metal Markets Enter a High-Volatility Phase

Gold, silver, and other metal assets have recently experienced frequent rapid surges and pullbacks, with trading activity rising sharply.

Driven by shifts in macro policy expectations, changing demand for safe-haven assets, and capital flows, metal markets now display pronounced, short-term volatility rather than just long-term trends.

In this environment, traders are moving their focus from simply holding assets to actively adapting to market swings.

II. Intensified Volatility Challenges Traditional Trading Models

Traditional trading systems for metal assets are often constrained by limited trading hours and rigid market structures, making it difficult for investors to adjust positions when prices move outside standard trading periods.

Additionally, cross-market operations can be complex and fragmented account structures may reduce capital efficiency.

Consequently, more traders are seeking solutions that allow for quick entry and exit and unified management.

III. Gate Metals Section: Platform Solutions

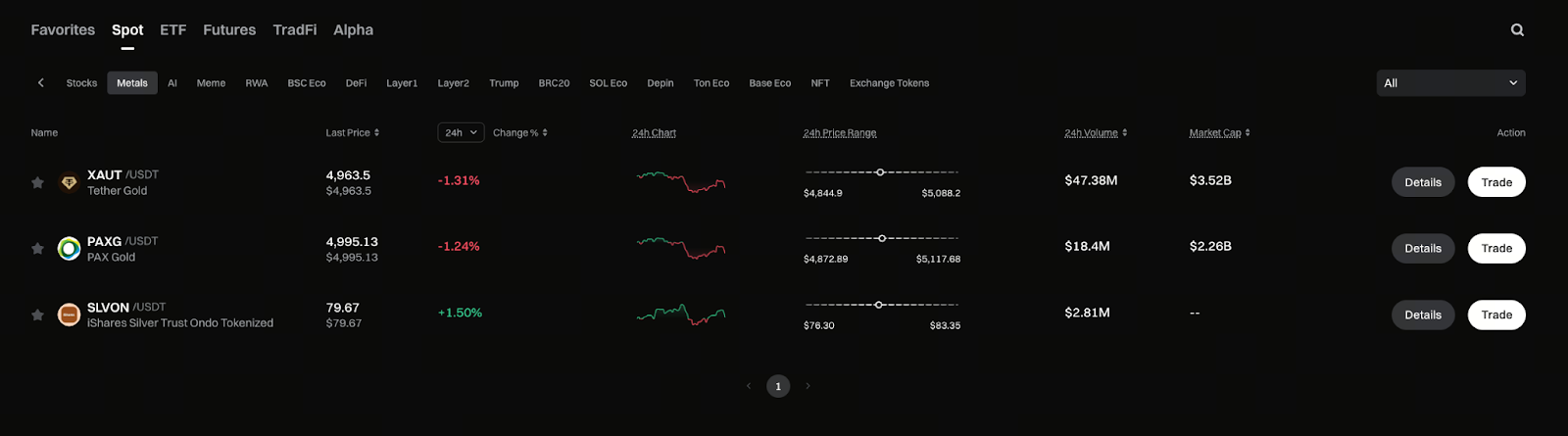

Image: https://www.gate.com/price/category-metals

Gate’s Metals Section brings gold, silver, and other metal assets into its trading system through perpetual contracts, giving users flexible ways to participate.

Key advantages include:

- 24/7 continuous trading

- Unified account and margin system

- No physical delivery required to capture market movements

- Consistent trading experience across Gate’s contract products

These features empower users to make fast trading decisions as markets change, free from time or operational constraints.

IV. Why Metal Assets Belong in Trading Portfolios

For crypto traders, metal assets often have distinct correlations compared to digital assets, making them valuable for portfolio diversification.

During volatile periods, metal assets can help:

- Hedge against overall market risk

- Capture short-term trading opportunities

- Expand tradable asset choices

- Build multi-asset trading strategies

The Gate Metals Section provides a single access point, making it easier to execute these strategies.

V. Gate Is Building a Comprehensive Multi-Asset Trading Ecosystem

The launch of the Metals Section demonstrates Gate’s ongoing expansion of its product offerings.

By integrating traditional assets into its contract system, Gate is establishing a trading environment that spans both crypto and traditional markets.

As trading scenarios continue to evolve, users will gain greater efficiency in both asset trading and risk management—all within a single platform.

VI. Conclusion

As metal markets enter a phase of heightened volatility, the importance of advanced trading methods and tools becomes even more pronounced.

The Gate Metals Section gives users the flexibility to engage with metal markets in a unified trading environment and opens up new opportunities for multi-asset trading.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks