As Metal Markets Enter an Amplified Volatility Phase, Gate’s Metals Zone Offers 24/7 Access for Traders

Global Capital Refocuses on the Metals Market

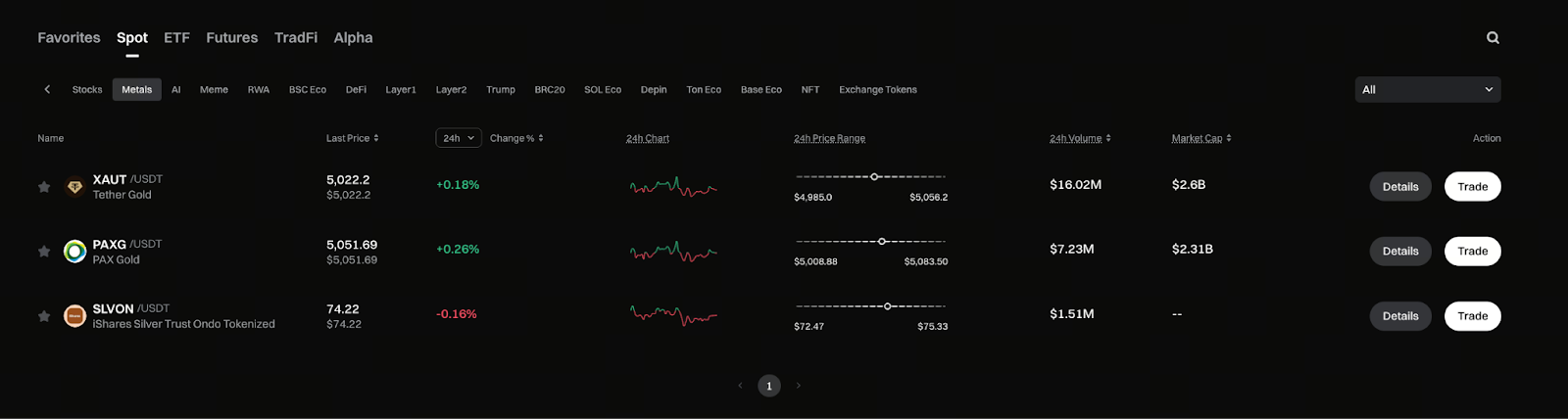

Chart: https://www.gate.com/price/category-metals

Since the start of this year, metal assets have once again become a major focus for global capital. Rising demand for safe-haven assets has driven renewed interest in gold and silver, while expectations for an industrial recovery have spurred active trading in industrial metals. As a result, trading volumes for metals have risen sharply.

Compared with previous periods of relative stability, capital flows in today’s market are more frequent, and price swings have become more pronounced. This shift has transformed metals from a relatively stable asset class into one of the most actively traded markets.

Why Are Metal Prices Experiencing Frequent, Significant Volatility?

Recent volatility in metal prices is primarily driven by a combination of factors.

First, uncertainty around the pace of global economic growth has led markets to continually adjust their expectations for future demand. Some industries are rebounding quickly, while certain regions still face growth pressures, resulting in ongoing shifts in supply and demand expectations.

Second, changes in energy and transportation costs also affect expectations for metal production and supply, which is reflected in price movements.

Additionally, as quantitative funds and institutional investors increase their participation, the market’s reaction to macroeconomic data and policy changes has accelerated. This often results in sharp price surges or pullbacks within short timeframes.

New Trading Dynamics Driven by Amplified Volatility

In the current environment, the metals market displays several new trading dynamics.

First, price trends and reversals are occurring more frequently, with prices often forming short-term, cyclical patterns. Second, capital rotation has accelerated, causing hot assets to shift rapidly. Third, the timing of trades has become more critical, requiring investors to implement their strategies quickly as market conditions change.

These dynamics make the execution efficiency of trading platforms and tools increasingly important.

How Gate’s Metals Section Meets Trading Needs

Gate’s Metals Section offers users a streamlined entry point for metals trading, enabling traders to monitor and participate in relevant markets all within a single platform.

With this integrated section, users can easily track market movements and execute trades, minimizing the inconvenience of switching between multiple platforms or markets. The platform’s robust trading system and risk management mechanisms also help maintain a stable trading experience during periods of rapid market movement.

For users accustomed to digital asset trading, the Metals Section provides a new avenue for asset allocation, further diversifying their portfolios.

The Importance of a 24/7 Trading Environment

Unlike traditional markets with fixed trading hours, digital asset trading environments allow for round-the-clock participation. This flexibility enables investors to adjust their trading strategies to fit personal schedules and market developments.

When unexpected events or rapid market changes occur internationally, 24/7 trading lets traders respond immediately, without waiting for the next trading session to open.

Metals Remain a Key Asset Allocation Option

From a long-term perspective, metal assets remain a crucial component of global investment portfolios. Whether used as a risk-hedging tool or as a cyclical trading asset, metals continue to attract significant market attention.

As traditional assets increasingly integrate with digital trading systems, the ways investors participate in metals trading continue to evolve. For those looking to capitalize on market volatility, choosing stable and convenient trading channels will help them seize opportunities more efficiently.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks